Chapter 5

Interest Rates

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5.1 How Interest Rates Are Quoted:

Annual and Periodic Interest Rates

Annual percentage rate (APR):

Yearly rate earned by investing in assets or charged

for borrowing (the most commonly quoted rate)

Lenders often charge interest on a non-annual basis.

Periodic interest rate (PIR): r =

[Tab 5.1]

where m = the number of compounding periods

per year (C/Y).

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-2

5.1 How Interest Rates Are Quoted:

Annual and Periodic Interest Rates

The more compounding periods per year,

the more interest earned or paid.

m increases = more compounding -> interest increases (by the interest on interest)

(ex) $500 CD for 1 year with 5% APR

Annual (m=1): PIR = 0.05, Ending balance = $525

*(개인 필기) no difference in APR and PIR

Quarterly (m=4): PIR = 0.0125,

Ending balance = 500(1+PIR)^4

= 525.48

[Tab 5.2]

Conclusion : if the m goes larger, the ending balance becomes larger 5-3

!!

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5.1 How Interest Rates Are Quoted:

Annual and Periodic Interest Rates

Effective(=Actual) annual rate (EAR):

m > 1 => EAR and APR are different from each other.

The interest rate actually paid or earned per year

with compounding

Also known as the annual percentage yield (APY=EAR).

Given APR and m,

The meaning of -1 : ‘net’

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-4

5.1 How Interest Rates Are Quoted:

Annual and Periodic Interest Rates

[Tab 5.2] $500 CD with APR = 0.05. (=PIR)

Monthly ending balance = 500 * (1.004167)

505.58

Quarterly ending balance = 525.47

Annual EAR = 0.05000 = APR

Quarterly EAR = (1+APR / 4)^4 -1=0.05094 (PIR = 0.0125)

Monthly EAR = (1+APR/12)^12 - 1= 0.05116

(farther higher than quarterly EAR)

Daily EAR = (1+APR/365)^365 -1 = 0.05127

Ending balance = PV × ( 1 + EAR ) = PV * (1+APR/m)^m

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

Since EAR = (1+APR/m)^m =1

5-5

5.1 How Interest Rates Are Quoted:

Annual and Periodic Interest Rates

In U.S. -> deposit account, the bank would account EAR

For borrowers, they apply and prefer APR to lower their burden by loan.

Ex1: Calculating an EAR (or APY)

It is different in case of ‘non-annual’ base

The reason why it is different is dependent on its commercial purpose.

----

A bank lends $100,000 for up to 3 years

at an APR of 8.5% (compounded monthly).

Why?

youasborrow

EAR >IfAPR,

m>1

$100,000 for 1 year,

how much interest will you have paid

and what is the bank's APY (=EAR)?

the EAR(APY) for deposits. (savers)

※ Banks quotes

the APR for loans. (borrowers)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-6

5.2 Effect of Compounding Periods

on the TVM Equations

TVM equation requires the periodic rate (r = PIR)

and the number of compounding periods (n),

where n = years × m.

* The interest rate (r) should be consistent

with the frequency of compounding

and the number of payments.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-7

5.2 Effect of Compounding Periods

on the TVM Equations

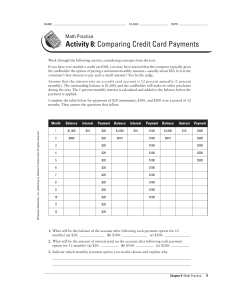

Ex2: Effect of Payment Frequency on Total Payment

Jim needs to borrow $50,000 for a business expansion

project. His bank agrees to lend him the money over a 5year term at an APR of 9% and accepts annual, quarterly, or

monthly payments with no change in the APR. Calculate the

periodic payment under each alternative and compare the

total amount paid each year under each option.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-8

Ex2: Effect of Payment Frequency on Total Payment

Loan = $50,000; Period = 5 years; APR = 9%

PMT = 50,000 * 0.09 / 1- [1/(1.09)^5]

Annual: PV = 50000; n=5; I=9;

CPT PMT = 12,854.62

FV=0; P/Y=1; C/Y=1;

Periodic repayment of amortized loan

Quarterly: PV = 50000; n=20; I=9; FV=0; P/Y=4; C/Y=4;

CPT PMT = 3,132.10 PMT = 50,000 * [ 0.0225 / 1- {1/(1.0225)^20} ]

Total annual payment = 3132.1 * 4 = $12,528.41

Monthly: PV = 50000; n=60; I=9; FV=0; P/Y=12; C/Y=12;

PMT = 50,000 * 0.0075 / 1- [1/(1.0075)^60]

CPT PMT = 1,037.92

Total annual payment=1.0372.92 * 12=12,455.04

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-9

추가 슬라이드

Annual: Annual total = 12,854.62

Quarterly: Annual total = $12,528.41

Monthly: Annual total = $12,455.04

☼ As m increases -> Annual total cash flow goes down.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-10

5.2 Effect of Compounding Periods

on the TVM Equations

Ex3: Comparing Annual and Monthly Deposits

Joshua (currently 25 years old) wants to invest money into a

retirement fund so as to have $2,000,000 saved up when he

retires at age 65.

If he can earn 12% per year in an equity fund, calculate the

amount of money he would have to invest in equal annual

amounts and alternatively, in equal monthly amounts.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-11

Ex3: Comparing Annual and Monthly Deposits

With annual deposits:

With monthly deposits:

FV = $2,000,000

FV = $2,000,000

N = 40 (years)

N = 12 x 40 = 480 (months)

I/Y = APR = 12%

I/Y = APR = 12%

PV = 0

PV = 0

C/Y = 1

C/Y = 12

P/Y = 1

P/Y = 12

PMT = $2,607.25

PMT = $169.99

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

-> $2,039.88 yearly 5-12

5.3 Consumer Loans

and Amortization Schedules

Interest is charged only

on the outstanding balance of a consumer loan.

(remaining)

Increases in 1) frequency and 2) size of payments

-> result in 1) reduced interest charges and

2) a quicker payoff. Over time, outstanding balance 감소

1) interest expense 감소

2) principal repayment 증가

Amortization schedules help in planning and analysis

of consumer loans.

[Tab 5.3] Monthly Amortization Schedule for $25,000 loan

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

(6 years at APR = 8%)

5-13

5.3 Consumer Loans

and Amortization Schedules

Ex4: Paying Off a Loan Early!

Kay has just taken out a $200,000, 30-year, 5% mortgage.

She has heard from friends that if she increases the size of her

monthly payment by one-twelfth of the monthly payment, she

will be able to pay off the loan much earlier and save a

bundle on interest costs.

Use the necessary calculations to help convince her

that this is, in fact, true.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-14

Ex4: Paying Off a Loan Early!

Monthly payment:

PV = $200,000; I/Y = 5; N (= 30 x 12) = 360; FV = 0;

C/Y = 12; P/Y = 12; PMT = PV * r / 1 – [ 1 / (1+r)^n) ]

PIR = r = 0.00416

= 200,000 * 0.004167 / 1- [1 / (1.004167)^360

The monthly payment increased by 1/12

è PMT =

1,073.64 * (13/12) = $1,163.11

PV=$200,000; I/Y=5; C/Y=12; P/Y=12;

N= - [ln (1- {PV * r / PMT } ] / ln (1+r)

N = 303.13 months or 25.26 years.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-15

Ex4: Paying Off a Loan Early!

[Interest saved]

Within the minimum monthly payments:

Total paid = 360 * 1,073.64 = $386,510.40

Amount borrowed = $200,000.00

Interest paid. = $186,510.40

With the higher monthly payments:

Total paid = 303.13 * 1,163.11 = $353,573.53

Amount borrowed = $200,000.00

Interest paid = $153,573.53

Interest saved = $32,936.87

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

It is true!

5-16

5.4 Nominal and Real Interest Rates

The nominal rate is the rate of interest earned

on a investment

such as bank CD or treasury security.

(Compensation paid for giving up of current consumption)

- Nominal rate (r ): the growth rate of actual dollars

- Real rate (r* ): the growth rate of the purchasing power

of the dollars

(adjusted for the erosion of purchasing

power caused by inflation)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-17

5.4 Nominal and Real Interest Rates

The Fisher Effect shows the relationship between

the real rate (r* ), the inflation rate (h ),

and the nominal interest rate (r ).

(1 + r) = (1 + r*) x (1 + h) → r = r* + h + (r* x h)

r* X h = Compensation for inflation erosion of the interest

Approximately, r = r* + h

with r* & h not too high

(그래서 생략 가능)

The nominal interest rate includes the real interest rate

and the inflation premium.

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-18

5.4 Nominal and Real Interest Rates

Ex5: Calculating nominal & real interest rates

Jill has $100 and is tempted to buy 10 T-shirts,

with each one costing $10.

However, she realizes that if she saves the money in a bank

account, she should be able to buy 11 T-shirts.

If the cost of the T-shirt increases by the rate of inflation, i.e.,

by 4%, how much would her nominal and real rates of return

have to be?

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-19

5.4 Nominal and Real Interest Rates

Ex5: Calculating nominal & real interest rates

r* = (FV/PV)1/n – 1 = (11 shirts/10 shirts)1/1 – 1 = 10%

Price of a shirt next year = $10 x (1.04) = $10.4

Cost of 11 shirts next year = 10.4 * 11 = $114.4 (=FV)

PV = $100; n = 1; I/Y = r = (FV/PV) – 1

= (114.4/100) – 1 = 14.4%

r = r* + h + (r* x h) = 0.1 + 0.04 (=Inflation premium)

+ [0.1 * 0.04 ] (=the compensation)

= 14.4%

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-20

5.5 Risk-Free Rate and Premiums

⑴ Default premium (dp): Compensation for the risk

associated with varying types of

collateral & frequency of default

* Risk-free rate on the U.S. Treasury bill

(base rate)

T-bill rate = r(f) = r* + h + 0(=dp).

<- dp가 0이기 때문에 T-bill의 r(f)가 두개로만 구성됨

⑵ Maturity premium (mp): Compensation for additional

waiting time

[Tab 5.4]

Different maturity preferences => Different maturities

Variety of interest rates ⇐

Risk

Length

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

of investment or loan

5-21

Secured

Collateral(resale) value (implies d

of premium..?)

=> dp

ecured

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-22

Waiting time => mp

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-23

5.5 Risk-Free Rate and Premiums

The rate of return on all other riskier investments would

have to include a default

and maturity premium

r = ( r* + h ) + dp + mp + …

(many other things could be contained)

“Term structure of interest rates”

(Ex) 30-year corporate bond yield > 30-year T-bond yield

(due to the higher default risk on corporate bonds)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-24

5.6 A Brief History of Interest Rates

The four components of interest rates vary over time.

(r = r* + h + dp + mp)

[Fig 5.2] Inflation in the U.S. (1950-1999)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-25

5.6 A Brief History of Interest Rates

The four components of interest rates vary over time.

( r = r* + h + dp + mp )

[Fig 5.3] 3-month T-bill rate in the U.S. (1950-1999)

mp = dp = 0,

risk –free

=> r (f)

Fig 5.2 : shows actual inflation rate

While Fig 5.3 shows nominal rate with expected inflation

=> Discrepancy

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-26

5.6 A Brief History of Interest Rates

[Fig 5.3] 3-month T-bill rate in the U.S. (1950-1999)

Data shows the average values over 1950-1999 as:

r = 5.23%, h = 4.05% ⇒ r* = 1.18%

h increases -> h(e) increases

-> Uncertainty increase -> Premiums also increase

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-27

5.6 A Brief History of Interest Rates

[Tab 5.5] Bond yields (1953-1999)

dp(default premium) = 7.13 – 6.64 = 0.49 (=49 basis point)

(for AAA-bond over T-bond)

mp = 6.64 – 5.23 = 1.41%

(for T-bond over T-bill, due to 20-year maturity difference)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-28

5.6 A Brief History of Interest Rates

[Tab 5.5] Bond yields (1953-1999)

Corp-bond yield = 7.13 %

= 1.18 + 4.05 + 0.49 + 1.41

(r= r* + h + dp + mp)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-29

5.6 A Brief History of Interest Rates

The four components of interest rates vary over time.

(r = r* + h + dp + mp)

[Fig 5.2] Inflation in the U.S. (1950-1999)

[Fig 5.3] 3-month T-bill rate in the U.S. (1950-1999)

Data shows the average values over 1950-1999 as:

r = 5.23%, h = 4.05% ⇒ r* =

[Tab 5.5] Bond yields (1953-1999)

Copyright © 2010 Pearson Prentice Hall. All rights reserved.

5-30