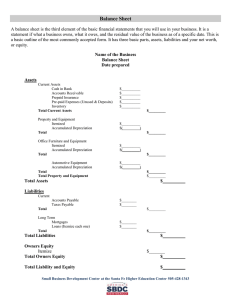

1. Accounting and reporting for tangible non-current assets Long-Term Assets/Non-current assets are assets that have a useful life greater than one year, are acquired for use in the operation of a business, and are not intended for resale to customers (Are reported at carrying value. Information about long-term acquisitions can be found under investing activities in the statement of cash flows) Spread the cost of the services provided by the asset over its useful life As the services benefit the company, the cost of the asset becomes an expense Carrying Value - is the unexpired cost of an asset (Carrying value is reduced if a long-term asset loses some or all of its revenue generating potential before the end of its useful life) To decision to acquire non-current assets - net present value method Discounts cash flows related to the purchase of a long-term asset to their present value As long as the present value of the cash flows is positive, a return on the investment can be expected Financing Long-Term Assets Financing alternatives Use cash flows from operations Take a long-term loan Issue common stock Issue long-term notes Issue bonds Depreciation- is a system of accounting which aims to distribute the cost or other basic value of tangible capital assets, less salvage (if any), over the estimated useful life of the unit in a systematic and rational manner (It is a process of allocation, not of valuation) All tangible assets except land have a limited useful life, because of physical deterioration and obsolescence Physical deterioration - Results from use and exposure to the elements Obsolescence - Process of becoming out of date Depreciation, as used in accounting, means the allocation of the cost of a plant asset to the periods that benefit from the service of that assetm - Does not refer to an asset’s physical deterioration or decrease in market value over time Depreciation is not a process of valuation Four Factors That Affect the Computation of Depreciation: Cost - Net purchase price and All reasonable and necessary expenditures to get the asset in place and ready for use Residual value - An asset’s estimated net scrap, salvage, or trade-in value as of the estimated date of disposal Depreciable cost - Cost less residual value Depreciable cost is allocated over the useful life of an asset Estimated useful life - Total number of service units expected from a long-term asset Depreciation is recorded at the end of the accounting period by an adjusting entry The most common methods include Straight-line method (spreads the depreciable cost of the asset evenly over the estimated useful life of the asset) ; Production method (is based on the assumption that depreciation is solely the result of use and that passage of time plays no role in the depreciation process) ; Declining-balance (reducing-balance) method (computes depreciation by applying a fixed rate to the carrying value (the declining balance) of a tangible, long-lived asset) 2. Accounting for Debtors. Bad and Doubtful Debts. Uncollectible Accounts are accounts owed by customers who will not or cannot pay. Also called bad debts. Represent a loss or an expense of selling on credit Losses may be recognized using the Direct charge-off method Allowance method The Direct Charge-Off Method recognizes the loss at the time the A/R is determined to be uncollectible Reduces A/R and increases - Uncollectible Accounts Expense The Allowance Method matches bad debt losses against the sales they help produce At the time of sale, management cannot identify which customers will not pay To observe the matching rule, losses from uncollectible accounts must be estimated The estimate becomes an expense in the fiscal year in which the sales are made Allowance for Uncollectible Accounts appears on the balance sheet as a contra-asset account that is deducted from Accounts Receivable 3. Accounting for irrecoverable and doubtful debts Uncollectible Accounts are accounts owed by customers who will not or cannot pay. Also called bad debts. Represent a loss or an expense of selling on credit Losses may be recognized using the Direct charge-off method Allowance method The Direct Charge-Off Method recognizes the loss at the time the A/R is determined to be uncollectible Reduces A/R and increases - Uncollectible Accounts Expense The Allowance Method matches bad debt losses against the sales they help produce At the time of sale, management cannot identify which customers will not pay To observe the matching rule, losses from uncollectible accounts must be estimated The estimate becomes an expense in the fiscal year in which the sales are made Allowance for Uncollectible Accounts appears on the balance sheet as a contra-asset account that is deducted from Accounts Receivable 4. Accounting information and its uses Interested parties include Investors - Interested in returns from dividends and the market price of their investment Creditors - Interested in a company’s ability to repay debt Objectives of Accounting Information: To furnish information that is useful in making investment and credit decisions Information that can help present and potential investors and creditors make rational investment and credit decisions To provide information useful in assessing cash flow prospects Information to help users judge the amounts, timing, and risk of expected cash receipts from dividends or interest and the proceeds from the sale, redemption, or maturity of stocks and loans To provide information about business resources, claims to those resources, and changes in them Information about, and the effects of transactions on, the company’s assets, liabilities, and owner's equity Accounting Information Systems summarize financial data about a business and organize the data into useful forms Accomplished by means of data processing Accountants communicate results to management Management uses resulting data to make decisions General Principles of Accounting Information Systems: Cost-benefit principle (Holds that the benefits derived from a system and the information it generates must be equal to or greater than its costs Benefits ≥ Cost; The benefits must be weighed against tangible and intangible costs) Control principle (Requires that an accounting system provide all the features of internal control needed to: Protect the company’s assets and Ensure that data are reliable) Compatibility principle(Holds that the design of an accounting system must be in harmony with the organizational and human factors of a business) Flexibility principle (Holds that an accounting system must be flexible enough to allow The volume of transactions to grow and Organizational changes to be made without having to make major alterations to the accounting system) 5. Accounting Policies Accounting policies are a set of standards that govern how a company prepares its financial statements. These policies are used to deal specifically with complicated accounting practices such as depreciation methods, recognition of goodwill, preparation of research and development (R&D) costs, inventory valuation, and the consolidation of financial accounts. These policies may differ from company to company, but all accounting policies are required to conform to generally accepted accounting principles (GAAP) and/or international financial reporting standards (IFRS). Accounting policies appear in a business when accounting principles allow leeway in how the rules are applied to a situation. Situations that involve management discretion include: Valuation of inventory (Applying the matching rule to inventories; Assessing the impact of inventory decisions; Evaluating the level of inventory) Valuation of investments Valuation of fixed assets (have a useful life greater than one year, are acquired for use in the operation of a business, and. Are not intended for resale to customers. Are reported at carrying value Information about long-term acquisitions can be found under investing activities in the statement of cash flows. Carrying value is reduced if a long-term asset loses some or all of its revenue generating potential before the end of its useful life Depreciation methods (Depreciation is recorded at the end of the accounting period by an adjusting entry The most common methods include Straight-line method (spreads the depreciable cost of the asset evenly over the estimated useful life of the asset) ; Production method (is based on the assumption that depreciation is solely the result of use and that passage of time plays no role in the depreciation process) ; Declining-balance (reducing-balance) method (computes depreciation by applying a fixed rate to the carrying value (the declining balance) of a tangible, long-lived asset) Costs of R&D include the expenses of funding development of new products, testing of existing and proposed products, and pure research. Should be treated as revenue expenditures and charged to expense in the period when incurred. Are continuous and necessary for the success of a business and should be treated as current expenses Do not necessarily result in future benefits (assets) Development Costs may be capitalized if meet certain critirea 6. Translation of foreign currency Recognition of goodwill (Goodwill exists when a purchaser pays more for a business than the fair market value (FMV) of the net assets if purchased separately. It Should not be recorded unless it is paid for inconnection with the purchase of a whole business Accruals basis and cash accounting: uses and differences. The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized. The cash method provides an immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses. Accrual accounting records revenue and expenses when transactions occur but before money is received or dispensed. Cash basis accounting records revenue and expenses when cash related to those transactions actually is received or dispensed. Accrual accounting provides a more accurate view of a company's health by including accounts payable and accounts receivable. The accrual method is the more commonly used method by large companies, especially by publicly-traded companies, as it smooths out earnings over time. The cash basis method typically is used by sole proprietors and smaller businesses. Accrual Accounting Under this method, revenue is accounted for when it is earned. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. In other words, money is accounted for before it's received. Likewise, expenses for goods and services are recorded before any cash is paid out for them. The accrual method is the more commonly used method, particularly by publicly-traded companies. One reason for the accrual method's popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they're generated. The cash basis method records these only when cash changes hands and can present more frequently changing views of profitability. The accrual method doesn't track cash flow. A company might look profitable in the long term but actually have a challenging, major cash shortage in the short term. Another disadvantage of the accrual method is that it can be more complicated to use since it's necessary to account for items like unearned revenue and prepaid expenses. It also may require added staff. Cash Basis Accounting Under this method, revenue is reported on the income statement only when cash is received. Expenses are recorded only when cash is paid out. The cash method is typically used by small businesses and for personal finances. The cash basis method is not acceptable under GAAP. However, the cash basis method might overstate the health of a company that is cash-rich. That's because it doesn't record accounts payables that might exceed the cash on the books and the company's current revenue stream. 7. Allowance for receivables and irrecoverable debts The Allowance Method matches bad debt losses against the sales they help produce At the time of sale, management cannot identify which customers will not pay To observe the matching rule, losses from uncollectible accounts must be estimated The estimate becomes an expense in the fiscal year in which the sales are made Allowance for Uncollectible Accounts appears on the balance sheet as a contra-asset account that is deducted from Accounts Receivable Also called Allowance for Doubtful Accounts Allowance for Bad Debts Uncollectible Accounts Expense appears on the income statement as an operating expense Also called Bad Debts Expense 8. Assets, liabilities and equity as the main elements of financial reports Components of a Balance Sheet Assets Accounts within this segment are listed from top to bottom in order of their liquidity. This is the ease with which they can be converted into cash. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot. Here is the general order of accounts within current assets: Cash and cash equivalents are the most liquid assets and can include Treasury bills and short-term certificates of deposit, as well as hard currency. Marketable securities are equity and debt securities for which there is a liquid market. Accounts receivable (AR) refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe. Inventory refers to any goods available for sale, valued at the lower of the cost or market price. Prepaid expenses represent the value that has already been paid for, such as insurance, advertising contracts, or rent. Long-term assets include the following: Long-term investments are securities that will not or cannot be liquidated in the next year. Fixed assets include land, machinery, equipment, buildings, and other durable, generally capital-intensive assets. Intangible assets include non-physical (but still valuable) assets such as intellectual property and goodwill. These assets are generally only listed on the balance sheet if they are acquired, rather than developed in-house. Their value may thus be wildly understated (by not including a globally recognized logo, for example) or just as wildly overstated. Liabilities A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Longterm liabilities, on the other hand, are due at any point after one year. Current liabilities accounts might include: Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability. Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes. Wages payable is salaries, wages, and benefits to employees, often for the most recent pay period. Customer prepayments is money received by a customer before the service has been provided or product delivered. The company has an obligation to (a) provide that good or service or (b) return the customer's money. Dividends payable is dividends that have been authorized for payment but have not yet been issued. Earned and unearned premiums is similar to prepayments in that a company has received money upfront, has not yet executed on their portion of an agreement, and must return unearned cash if they fail to execute. Accounts payable is often the most common current liability. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt. Long-term liabilities can include: Long-term debt includes any interest and principal on bonds issued Pension fund liability refers to the money a company is required to pay into its employees' retirement accounts Deferred tax liability is the amount of taxes that accrued but will not be paid for another year. Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Shareholder Equity Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends. Treasury stock is the stock a company has repurchased. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. 9. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company's market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. Books of prime entry – definition, purpose, types. Once the source records have been collated, the information contained in them needs to be summarised, so that essential information is recorded for the next step in the accounting process. The following are the six different types of prime entry books: Sales Day Book Sales Returns Book Purchase Day Book Purchases Return Book Cash Book Petty Cash Book 1.1 Sales Day Book The sales day book is a list of credit sales made by a business. It is filled out using copies of sales invoices raised. It also summarises essential information about sales made including invoice date, customer name, sales price and sales tax. 1.2 Sales Returns Book The sales return book is a list of credit notes raised by a business to cancel or reduce the value of sales invoices. 1.3 Purchase Day Book The purchase day book is a list of credit purchases made by a business. It is filled out using copies of purchase invoices received, summarising essential information about purchases made including invoice date, supplier name, total price and sales tax added. 1.4 Purchases Return Book The purchases return book is a list of credit notes received from suppliers in the event that purchase invoices needed to be cancelled or reduced in value. For example, due to errors or problems with products. 1.5 Cash Book The cash book is a record of all the payments and receipts that come in and out of the business bank account, whether that is in the form of bank transfers, standing orders and direct debits. 1.6 Petty Cash Book The petty cash book is a record of cash spent and received. Some businesses keep cash on their premises to pay for small day-today items such as milk or stationery. The petty cash book is a record of this spending and, if necessary, also customers who pay in cash. 10. Cash and credit purchases Managing Cash Needs During Seasonal Cycles Most companies experience seasonal cycles of business activity during the Year. Sales may be weak or strong - Expenditures may be high or low Companies must carefully plan cash inflows, outflows, borrowing, and investing Setting Credit Policies Companies sell on credit to be competitive and increase sales To increase the likelihood of selling to customers who will pay on time, companies develop control procedures and maintain a credit department Cash The most liquid of all assets Readily available to pay debts Includes Currency and coins on hand Checks and money orders from customers Deposits in bank checking and savings accounts Compensating balances (Minimum amount a bank requires to be held in an account; Restrict cash, increase the interest of loans, and reduce a company’s liquidity; Amounts must be reported in notes to financial statements) Cash Equivalents are short-term, highly liquid investments that will revert to cash in 90 days or less from the time of purchase Include Money market accounts Commercial paper U.S. Treasury bills 11. Cash flow from investing activities: main inflows and outflows. The Statement of Cash Flows shows how a company’s operating, investing, and financing activities affected cash (Cash includes cash and cash equivalents during an accounting period) Investing Activities include the cash effects of transactions that affect long-term assets Acquiring and selling long-term assets Acquiring and selling marketable securities other than trading securities or cash equivalents Making and collecting loans Cash inflows Cash receipts from selling long-term assets and marketable securities Collecting loans Cash outflows Cash expended for purchases of long-term assets and marketable securities Cash loaned to borrowers 12. Cash flow from operating activities: main inflows and outflows. The Statement of Cash Flows shows how a company’s operating, investing, and financing activities affected cash during an accounting period. Operating Activities include the cash effects of transactions and other events that affect the income statement. In effect, items on the income statement are changed from an accrual to a cash basis. Cash inflows Cash receipts from customers for goods and services Interest and dividends received on loans and investments Sales of trading securities Cash outflow Cash payments for: Wages Goods and services Expenses Interest Taxes Purchases of trading securities 13. Cash flow statement and its uses The Statement of Cash Flows shows how a company’s operating, investing, and financing activities affected cash during an accounting period. Explains the net increase (or decrease) in cash during the accounting period. Purpose of the Statement of Cash Flows is to provide information about a company’s cash receipts and cash payments during an accounting period Divided into three sections Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Internal Uses of the Statement of Cash Flows. Management uses the statement of cash flows to Asses liquidity Determine if short-term financing is necessary Determine dividend policy Decide whether to raise or lower dividends Evaluate the effects of investment and financing decisions Plan for investing and financing needs External Uses of the Statement of Cash Flows Investors and creditors use the statement of cash flows to assess a company’s ability to Manage cash flows Generate positive future cash flows Pay its liabilities Pay dividends and interest Anticipate its need for additional financing 14. Direct and indirect methods of setting out a cash flow statement ( IAS 7 18.04) Direct: using this method, it's necessary to divide all the activities of the company into 3 groups: operating, investment and financial. Then, one by one, fulfill the Cash Flow Statement, analyzing activities of the organization and directly transferring the necessary amounts. There will be Net cash from operating activities(1), Net cash from investing activities(2), Net cash from financial activities(3) in the end. It's needed to sum these 3 sections,and the amount will be equal to the difference between Cash and cash equivalents at the beginning of the year (4) and Cash and cash equivalents at the end of the year (5) (1+2+3 = 5-4). This amount is Net decrease / increase in cash and cash equivalents. Indirect: using this method, it's necessary to begin with the Profit before taxation and then make some adjustments because not all the transactions that were included in Profit before taxation are conducted by Cash and cash equivalents. For Cash flows from operating activities: 1) to add Depreciation 2) to deduct Investment income 3) to add Interest expense 4) to adjust operating profit before working capital changes: increase in trade and other receivables -> to deduct / decrease in trade and other receivables -> to add (indirect) increase in inventories -> to deduct / decrease in inventories-> to add (indirect) increase in trade payables -> to add / decrease in trade payables -> to deduct (direct) Then there is Cash generated from operations, from which Interest paid and Income taxes paid should be deducted. After that there is Net cash from operating activities(1). Then it's needed to fulfill the section Cash flows from investing activities: to deduct Purchase of PPE and to add Proceeds from sale of equipment, Interest received and Dividends received. There`s Net cash used in investing activities(2) in the end. Then we add the section about Financing activities of the company and receive the line Net cash used in financing activities(3). The last step is to sum up Net cash from operating activities(1), Net cash from investing activities(2), Net cash from financial activities(3) and get Net decrease / increase in cash and cash equivalents for the company. The amount will be equal to the difference between Cash and cash equivalents at the beginning of the year (4) and Cash and cash equivalents at the end of the year (5) (1+2+3 = 5-4) !!! Net decrease / increase in cash and cash equivalents for the same company and period is the same even if the methods are different !!! 15. Double-entry book-keeping principles Book-keeping is the art of recording business transactions in a set of books of accounts. Accounting principles are rules based on assumptions, customs, usages and traditions for recording transactions. Accounting principles may be defined as those rules of action or conduct, which are adopted by the accountants, universally, while recording the transactions. Double-Entry System is based on the principle of duality. Every economic event has two aspects that balance, or offset, each other (The two aspects represent Effort and reward; Sacrifice and benefit; Source and use). Principle of Duality: each transaction recorded with at least one debit and one credit total amount of debits = total amount of credits whole system always in balance 16. Income statement and statement of comprehensive income: components and usage Income statement shows how a company’s net income is derived. It includes all 1) revenues, 2) expenses, 3) gains and losses (except from prior period adjustments) Sections of the Income Statement: 1. Income from continuing operations (May contain gains and losses, write-downs (write-offs), and restructurings (estimated cost associated with a change in a company’s operations) ) 2. Income tax expense (expense recognized in the accounting records on an accrual basis that applies to income from continuing operations) 3. Discontinued operations (non operating item) 4. Effects of accounting changes (non operating item) 5. Earnings per share (non operating item) Comprehensive income is the change in a company’s equity from sources other than owners during a period. It includes 1) net income, 2) changes in unrealized gains and losses, 3) other items affecting equity. It may be reported on income statement or separate statement, but usually reported on statement of stockholders’ equity. The purpose of the Profit or Loss Statement and its explanations is to provide information to users: - about the results of the organization's activities; - about the sources of profit (causes of loss). The data of the Profit or Loss Statement are used to assess the results of the organization's activities for the period and to forecast the future profitability of its activities. For investors, it means the possibility of receiving dividends in the future, and the amount of such a dividend may be crucial when making a decision on investing funds. For the lender, future profitability means the ability of the enterprise, first of all, to pay directly the amount of debt, and in addition, interest on the loan. If the activity is expected to be unprofitable, this situation can be assessed as a threat of non-repayment of debt and the inability to repay interest. 17. International accounting and financial reporting standards and their uses IFRS (International Financial Reporting Standards) is an international regulation for the preparation of financial statements. It is divided into (да, 2 IFRS) IFRS (International Financial Reporting Standards), which are recommendations on methodology used in the European Union, and US GAAP (Generally Accepted Accounting Principles), a set of specific rules used in the United States. Both standards are focused on the consolidated financial statements of the group, that is, on the statements of the parent company and subsidiaries. IFRS (general) describes the procedure for preparing financial statements: what is included in the financial statements, what are the conditions for the recognition and evaluation of various elements of assets, liabilities and capital, what disclosures should be given in the explanatory note. IFRS Standards: Bring transparency, Strengthen accountability, Contribute to economic efficiency. US GAAP standards are based on rules: historically, standard after standard was issued as needed to regulate the accounting of specific business transactions. The IFRS standards are more academic and describe the approach as a whole, without specific references to business operations. This implies greater flexibility for building reporting processes within the company. For the Russian market, IFRS standards are much more common than US GAAP (which are mainly used by divisions of foreign corporations), so they often write IFRS. 18. Inventory valuation methods: FIFO, LIFO, weighted average ( IFF_L13 03.12) - Average-Cost Method (weighted average) computes the average cost of all goods available for sale during the period in order to determine the value of ending inventory - First-In, First-Out (FIFO) Method is based on the assumption that the costs of the first items acquired should be assigned to the first items sold Effect of FIFO Method is to value the ending inventory at the most recent costs and include earlier costs in cost of goods sold. During periods of consistently rising prices FIFO yields the highest possible amount of net income (Cost of goods sold will show earliest, lower costs incurred). This method is best suited to the balance sheet because the ending inventory is closest to current values. During periods of consistently falling prices FIFO yields the lowest possible amount of net income (Cost of goods sold will show most recent, higher costs incurred). A major criticism of FIFO is that it magnifies the effects of the business cycle on income. Last-In, First-Out (LIFO) Method is based on the assumption that the costs of the last items acquired should be assigned to the first items sold. Effect of LIFO Method is to value the ending inventory at the earlier costs and include most recent costs in cost of goods sold. This method is best suited for the income statement because it matches revenues and cost of goods sold This method smoothes out fluctuations in the business cycle: as prices move upward or downward, cost of goods sold will show costs closer to the price level at the time the goods were sold. 19. Non-current assets: depreciation methods Depreciation is a system of accounting which aims to distribute the cost or other basic value of tangible capital assets, less salvage (утиль) (if any), over the estimated useful life of the unit in a systematic and rational manner. The most common methods include straight-line, production and reducing-balance methods. Straight-line method spreads the depreciable cost of the asset evenly over the estimated useful life of the asset. (The amount of depreciation is the same each year) - Production method is based on the assumption that depreciation is solely the result of use and that passage of time plays no role in the depreciation process. (The unit of output or use should be appropriate for that asset) - Reducing-balance method is an accelerated method of depreciation that results in large amounts of depreciation in earlier years of the asset’s life and smaller amounts in later years (fixed rate is always applied to the carrying value* at the end of the previous year; depreciation is greatest in the first year and declines each year after that) * Carrying amount = Cost - Acc. depreciation 20. Qualitative characteristics of financial reports ( Accounting L2 12.09) The qualitative characteristics identify the types of information that are likely to be most useful to the existing and potential investors, lenders and other creditors for making decisions about the reporting entity on the basis of information in its financial report (financial information). 2 main qualitative characteristics of financial statements: Relevance. Neutral information: A neutral depiction is without bias in the selection or presentation of financial information Free from errors information: there are no errors or omissions in the description of the phenomenon, and the process used to produce the reported information has been selected and applied with no errors in the process Relevant financial information is capable of making a difference in the decisions made by users. Information may be capable of making a difference in a decision even if some users choose not to take advantage of it or are already aware of it from other sources. Faithful representation. Complete information: A complete depiction includes all information necessary for a user to understand the phenomenon being depicted, including all necessary descriptions and explanations Financial information must faithfully represent the phenomena that it purports to represent. ( Process for applying the fundamental qualitative characteristics 1. identify an economic phenomenon that has the potential to be useful to users of the reporting entity’s financial information. 2. identify the type of information about that phenomenon that would be most relevant if it is available and can be faithfully represented. 3. determine whether that information is available and can be faithfully represented. ) 21. Statement of Cash Flows: description of tree types of activities Operating activities - include the cash effects of transactions and other events that affect the income statement (Examples: Cash inflow - sale receipts (from sale of goods), Cash outflow - Cash payments (to suppliers, employees) ) Investing activities - include the cash effects of transactions that affect long-term assets (Examples: Cash inflow - payments to acquire / receipts from sale of PPE, Cash outflow - Cash advances / loans (and repayments) to others) Financing activities - include the cash effects of transactions that affect long-term liabilities and stockholders’ equity (Examples: Cash inflow - Cash proceeds from issuing shares, debentures, loans, Cash outflow - Cash paid to purchase own shares, Repayment of borrowings) 22. Statement of financial position (balance sheet): creating and analysis It consists of 3 sections: assets, liabilities and equity (A = L+E) Assets are often divided into four categories (The categories are listed according to how easily they are assumed to be converted into cash) - Current assets (cash and other assets that are reasonably expected to be converted to cash, sold, or consumed within one year or within the normal operating cycle of the business, whichever is longer) Investments (are assets, usually long-term, that are not used in the normal operation of the business and that management does not plan to convert to cash within the next year) Property, plant, and equipment (includes long-term assets used in the continuing operation of the business) Intangible assets (are long-term assets that have no physical substance but have a value based on rights or privileges that belong to their owner) Liabilities are divided into two categories based on when they fall due: Current liabilities (are obligations due to be paid or performed within one year or within the normal operating cycle, whichever is longer) Long-term liabilities (are debts of the business that fall due more than one year in the future or beyond the normal operating cycle, or that are to be paid out of noncurrent assets) Owner's equity represents the owner’s interest in the company. The form of business organization affects the equity section of the balance sheet Sole proprietorship Partnership Corporation Analysis: The balance sheet allows you to analyze the composition, structure and dynamics of current assets, their liquidity, calculate the turnover indicators of current assets, determine the degree of solvency of the enterprise, assess the property stat]f the organization, analyze accounts receivable and accounts payable, the formation of net assets of the organization. With the help of the accounting balance sheet, it is possible to assess the efficiency of the company's capital allocation, its sufficiency for current and prospective activities, and analyze the structure of borrowed funds and the effectiveness of their attraction. With the help of the balance sheet, external users can make decisions on the expediency of mutual relations with this enterprise, on the possibility of acquiring its shares, assess its creditworthiness and the risks of their investments. Based on the results of the analysis of the balance sheet, proposals and recommendations are developed to optimize the structure of equity and debt capital, to accelerate the turnover of assets and strengthen the financial stability of the enterprise. ( камео Иззуки Signs of a ‘good balance’ : 1) Balance sheet at the end of the reporting period should increase compared with the beginning of the period, 2) The growth of rate of current assets should be higher than the growth of non-current assets, 3) Own capital of the company must exceed the borrowed and (or) its growth must be higher than the growth rate of borrowed capital, 4) The growth rates of receivables should be about the same or payable - a little higher, 5) The share of own funds in current assets should be more than 10%, 6) There should be no ‘uncovered loss’ item in the balance sheet. ) 23. Statement of financial position: its preparation and uses. It consists of 3 sections: assets, liabilities and equity (A = L+E) Assets are often divided into four categories (The categories are listed according to how easily they are assumed to be converted into cash) Current assets (cash and other assets that are reasonably expected to be converted to cash, sold, or consumed within one year or within the normal operating cycle of the business, whichever is longer) Investments (are assets, usually long-term, that are not used in the normal operation of the business and that management does not plan to convert to cash within the next year) Property, plant, and equipment (includes long-term assets used in the continuing operation of the business) Intangible assets (are long-term assets that have no physical substance but have a value based on rights or privileges that belong to their owner) Liabilities are divided into two categories based on when they fall due: Current liabilities (are obligations due to be paid or performed within one year or within the normal operating cycle, whichever is longer) Long-term liabilities (are debts of the business that fall due more than one year in the future or beyond the normal operating cycle, or that are to be paid out of noncurrent assets) Owner's equity represents the owner’s interest in the company. The form of business organization affects the equity section of the balance sheet Sole proprietorship Partnership Corporation The balance sheet allows you to analyze the composition, structure and dynamics of current assets, their liquidity, calculate the turnover indicators of current assets, determine the degree of solvency of the enterprise, assess the property status of the organization, analyze accounts receivable and accounts payable, the formation of net assets of the organization. With the help of the accounting balance sheet, it is possible to assess the efficiency of the company's capital allocation, its sufficiency for current and prospective activities, and analyze the structure of borrowed funds and the effectiveness of their attraction. With the help of the balance sheet, external users can make decisions on the expediency of mutual relations with this enterprise, on the possibility of acquiring its shares, assess its creditworthiness and the risks of their investments. Based on the results of the analysis of the balance sheet, proposals and recommendations are developed to optimize the structure of equity and debt capital, to accelerate the turnover of assets and strengthen the financial stability of the enterprise. 24. The main elements of financial statements Statement of Profit or Loss / Income Statement / Statement of Comprehensive Income Income statement shows how a company’s net income is derived. It includes all 1) revenues, 2) expenses, 3) gains and losses (except from prior period adjustments) Sections of the Income Statement: 6. Income from continuing operations (May contain gains and losses, write-downs (write-offs), and restructurings (estimated cost associated with a change in a company’s operations) ) 7. Income tax expense (expense recognized in the accounting records on an accrual basis that applies to income from continuing operations) 8. Discontinued operations (non operating item) 9. Effects of accounting changes (non operating item) 10. Earnings per share (non operating item) Statement of Financial Position / Balance Sheet Assets are often divided into four categories (The categories are listed according to how easily they are assumed to be converted into cash) Current assets (cash and other assets that are reasonably expected to be converted to cash, sold, or consumed within one year or within the normal operating cycle of the business, whichever is longer) Investments (are assets, usually long-term, that are not used in the normal operation of the business and that management does not plan to convert to cash within the next year) Property, plant, and equipment (includes long-term assets used in the continuing operation of the business) Intangible assets (are long-term assets that have no physical substance but have a value based on rights or privileges that belong to their owner) Liabilities are divided into two categories based on when they fall due: Current liabilities (are obligations due to be paid or performed within one year or within the normal operating cycle, whichever is longer) Long-term liabilities (are debts of the business that fall due more than one year in the future or beyond the normal operating cycle, or that are to be paid out of noncurrent assets) Owner's equity represents the owner’s interest in the company. The form of business organization affects the equity section of the balance sheet Sole proprietorship Partnership Corporation Statement of Cash Flows ( Cash (Money on hand and Deposits in company checking accounts) and cash equivalents (Short-term, highly liquid investments (such as Money market accounts, Commercial paper, U.S. Treasury bills) and others combined with the Cash account) ) The statement of cash flows classifies cash receipts and cash payments into categories: 1) Operating activities - include the cash effects of transactions and other events that affect the income statement 2) Investing activities - include the cash effects of transactions that affect long-term assets 3) Financing activities - include the cash effects of transactions that affect long-term liabilities and stockholders’ equity Statement of Owner`s (Shareholder`s) Equity / Statement of Changes in Equity It consists of 1. Balance at the beginning period, 2. Changes in accounting policy, 3. Changes in equity for the year, 4. Issuance of share capital, 5. Dividends (paid and declared), 6. Total comprehensive income for the year, 7. Transfers to retained earnings, 8. Balance at the end period. 25. The main financial reports and their purpose Statement of Profit or Loss / Income Statement / Statement of Comprehensive Income The purpose of the Profit or Loss Statement and its explanations is to provide information to users: - about the results of the organization's activities; - about the sources of profit (causes of loss). The data of the Profit or Loss Statement are used to assess the results of the organization's activities for the period and to forecast the future profitability of its activities. For investors, it means the possibility of receiving dividends in the future, and the amount of such a dividend may be crucial when making a decision on investing funds. For the lender, future profitability means the ability of the enterprise, first of all, to pay directly the amount of debt, and in addition, interest on the loan. If the activity is expected to be unprofitable, this situation can be assessed as a threat of non-repayment of debt and the inability to repay interest. Statement of Financial Position / Balance Sheet The balance sheet allows you to analyze the composition, structure and dynamics of current assets, their liquidity, calculate the turnover indicators of current assets, determine the degree of solvency of the enterprise, assess the property status of the organization, analyze accounts receivable and accounts payable, the formation of net assets of the organization. With the help of the accounting balance sheet, it is possible to assess the efficiency of the company's capital allocation, its sufficiency for current and prospective activities, and analyze the structure of borrowed funds and the effectiveness of their attraction. With the help of the balance sheet, external users can make decisions on the expediency of mutual relations with this enterprise, on the possibility of acquiring its shares, assess its creditworthiness and the risks of their investments. Based on the results of the analysis of the balance sheet, proposals and recommendations are developed to optimize the structure of equity and debt capital, to accelerate the turnover of assets and strengthen the financial stability of the enterprise. Statement of Cash Flows Primary purpose: to provide information about a company’s cash receipts and cash payments during an accounting period. Secondary purpose: to show how a company’s operating, investing, and financing activities affected cash during an accounting period. It also explains the net increase (or decrease) in cash during the accounting period. ( Management uses the Statement of Cash Flows to 1) assess liquidity (determine if short-term financing is necessary), 2) determine dividend policy (decide whether to raise or lower dividends), 3) evaluate the effects of investment and financing decisions (plan for investing and financing needs). Investors and creditors use the statement of cash flows to assess a company’s ability to 1) manage cash flows, 2) generate positive future cash flows, 3) pay its liabilities, 4) pay dividends and interest, 5) anticipate its need for additional financing. ) Statement of Owner`s (Shareholders`) Equity / Statement of Changes in Equity It summarizes the changes in the components of the owner`s (stockholders’) equity section of the balance sheet. The main goal is to provide all users with information about its composition and dynamics, which expresses the effectiveness of the organization's management, as well as the economic rights of users of reporting related to the activities of this organization. In addition, the capital indicator of the organization serves as a link between the balance sheets of the previous and current accounting periods.