Chronicles of Investment Wisdom from an NITK Alumni idiot - Episode 3

advertisement

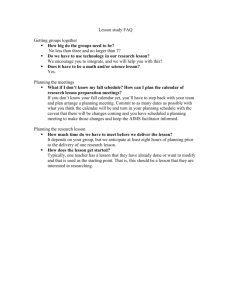

Chronicles of Investment Wisdom from an NITK Alumni idiot not ashamed of his continuing serial failures – Episode 3: Subject: Why I am confident of achieving 50% annual returns in any market – One of the armoury is to leverage event calendar and exploit the collective psychology of the market participants. Context: Investment game is filled with risk and rewards. Good investment game manages risk well and yet optimizes the rewards. Also, it uses a set of proven strategies and tactics. Here I am highlighting one such tactic, which I have benefitted from in the recent past. Since I am approaching the age of 60, conventional wisdom says that I should not put more than (100-60) % in equity. In fact, most of my assets are illiquid in real estate, and my current % of equity over total assets is only 4%, hence I can be bit aggressive within the equity portion, and I hope to bring in more money to equity, may be to the tune of 20% over next 2 years by selling some real estate as now I have become a wise person over serial failures. My current investment strategy from this year onwards is as follows: 1. 70 percent in blue chips (for risk management), achieving 30% average returns annually. 2. 30 percent in short term trading (not day trading, pls. do not do day trading, why I will write a separate note). Short term tends to be anywhere between 3 days to 30 days. I target average 50% annual return here, as the repeated short term plays will bring superior annual return. For example, if you hold a stock for 10 days with 5% return, its effective annual return = 5%*365/10= 163%. Of course, you can not be right in all your games, so key is more churn out, limiting losses and increasing success chances and maximizing return on each success. So, it is fair to assume 50% annual return here. 3. Effective portfolio level return = 30%*70% + 70%*50% = 21%+35% = 56%, higher than the 50% target I have set for me and all others aggressive like me in the equity segment. In this note, I will explain one tactic I successfully used in Q1 (US) for short term plays, I could not use it for Q2 as I got stuck with some investments causing liquidity issues at the cash level. I hope to spring back to this game in Q3 (July onwards), and I hope many of you joining me, we can team up and do more due diligence and share our homework and insights, play together and move towards 100% annualized return. Please note, this is just one of the armouries for the short term play, please alert me to add more armouries here. I have been effective with this game in the US market, I hope to leverage in the Indian market too soon, for which I need to infuse new cash, for which I have to sell some real estate, lockdown has been a dampener here. Concept Summary: Equity space is dominated with quarterly results. There is a pre-published event calendar indicating quarterly result announcements. The stock market operates on projections by professional analysts and the company guidance. But, fuelling this is the greed and fear of market participants. If the projections are bullish, the greed takes over, else the fear takes over. In side way market, the relatable trends influence as it influences in other markets too. For example, let us say the current Indian IT companies now have bullish projections in general. Therefore, one can anticipate some run up on the stocks, days before earning announcement, then depending how far the earnings surprises in which direction, there can be further ramp up or sharp correction against overbought situation. This game works very well with US tech stocks, especially the stocks like FB, AAPL, NVDA etc. So, assuming you are good in technical analysis, knowing the event calendar, you can anticipate the run ups or downs, confirm through tech analysis, and invest a portion of your portfolio, Having invested, you can then track the gains until results date. If the run up is too much and you already have close to 10% gain in a few days, you can even sell off before results and move on to next opportunity. In some cases, additional upto 10% gains happen in one session if the results are bullish. Therefore, you may even choose to wait for the results. It is left to you based on your analysis, intuition and play approach. In a bull run, your projection of gain can be bullish, in side ways situation, you should limit to 5% max as 5% gain in one week is equivalent to 5%*52 = 260% annual gain. In this approach, I take profit even on meagre 2 to 3% gain in 2 to 3 days as the annualized gains is huge even here. In a bear market situation, you should either short the stock if you can (not possible in India or retirement accounts of US) or buy Puts. I limit myself to bullish plays only for now. There is a reasonable projection as to which companies fall in which date range of a quarter when it comes to results announcement date. But, each quarter, actual date may move up or down by couple of days. So, while I have shared a generic calendar here, one should create a quarter specific calendar to exploit the opportunities to maximum. To do this, one needs to do homework at the beginning of each quarter, update calendar as the company announces changes, read market news on a daily basis, and have cash ready to strike, follow the plays for optimal gain and close the trade in time, manage risks and portfolio. This is lot of work, but does not take more than one hour per day. Method to Madness: Now, here is the opportunity for all of us working together. I gave the example of multiple blind people feeling the elephant at different parts, pooling their experience and then building a superior understanding. This is the basic advantage of collaboration. Since there is lot of home work here, there is need for intelligence, projection, anticipation of dates and alerts, need for regular communication etc., we can pool some volunteers including me, who can commit to lead and guide the rest. I can lead the volunteer’s team and manage the work allocation, those of you like to help this pls. ping me. (Nataraja Upadhya, +91 9632824391). Plan is to provide details for both the US and Indian market on a regular basis towards maximum exploitation of event calendar. Once we master this technique, some of us will hit 100% annual returns. We can then foray into many other armouries like this. We can share lot of details regarding this approach which may flood our current investment groups. May be, those of us committed to this play alone can create a separate group to avoid spamming in the current investment groups. But, there is one downside here, which is if the generic investment groups have already became 10+. Due to superior returns of this approach, the new groups may grow beyond 10, then we have a nightmare of managing 20+ groups, different other approaches adding more groups. So, if all agree to learn to ignore flooding of messages not relevant to them, better we stick with these original 10 groups alone. Let us see how the decision emerges. Attachment: I have created a first draft of generic results calendar for the US and Indian market. More scripts need to come into this. I will own this and regularly update it as new versions on the google drive. https://drive.google.com/file/d/1vOb8UzyIJYfyK0yAssA_mxIneueeeKoH/view?usp=sharing Next Steps: 1. Give feedback to me personally to refine the generic calendar. 2. Volunteer registration with me to create a collaborative team to divide tactical work on a regular basis. 3. Volunteer work allocation a. Quarter specific event calendar maintenance for both the US and Indian market b. Analysis of companies and results projection before the greed / fear starts showing in the technical analysis c. Alert on technical analysis confirmation as to window of opportunity opening. d. Alert on event calendar for the next two weeks – this week events is to manage the decisions made in the last week, next week events is to take trade action through this week. e. Post mortem of results based play and key learnings f. Many more assignments as they pop up. We will have a task leader for each task, supported by a set of folks, hence people may come in and go, but the mission remains on for the benefit of all concerned. 4. Separate WhatsApp group dedicated to active volunteers only. When I said we all deserve a minimum of annual 50% return in our meet recent, I was not bullshitting. I already have some success with it, playing alone. I am confident that if we play collaboratively, we will hit 100% annual return by this one approach alone. Better days are ahead. I used Hit and Run approach (need separate note on this) last year to get 25% in the span of 3 months. This year, I made some mistakes due to speculative play in Q2 in a side way market and missed this game for Q2 due to liquidity issues, but I will be back in Q3. Still, I am tracking 20% gain so far towards my target of 40% returns this year. So, I am very hopeful for myself. But, more than that I am more hopeful for all of us together, marching towards 100% annual returns through this approach alone, but this happens only if we learn to work together with voluntary work, sense of adventure and sportsmanship spirit and most importantly generous sharing of experience and insight like this note itself. Namasthe – Nataraja Upadhya 14 June 2021