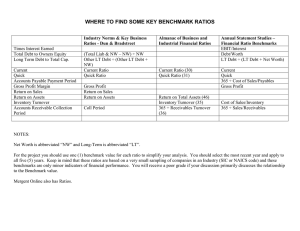

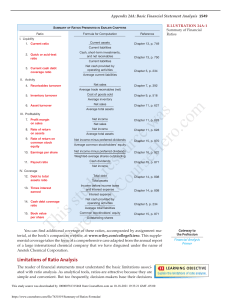

AFS 511: BUSINESS MANAGEMENT FOR FOOD SCIENTISTS IMPORTANCE OF MANAGEMENT IN FOOD BUSINESS Meaning of Management There is no single definition of management. Henry Fayol who is considered as the father of principles of management, - “To manage is to forecast, to plan, to organize, to command coordinate and to control”. Freederick Winslow Taylor, - “Management is knowing exactly what you want men to do and then seeing that they do it in the best and cheapest way”. Mary parker, - “Management is the art of getting things done through people”. Per Drucker, - “Management is a multi-purpose organ that manages a business, manages manager and manages worker and work”. George Terry, - “Management is a distinct process consisting of planning, organizing actuating and controlling performance to determine and accomplish the objectives by the use of people and resources”. Given these definitions of management, now it can be defines as getting things done through others/subordinates. In other words, it is a process of various functions like planning, organizing, leading and controlling the business operations in such a manner as to achieve the objectives set by the business firm. It consists of all activities beginning from business planning to its actual survival. Nature of successful food business The important requisites for success in a modern business are: 1. Clear objectives: Determination of objectives is one of the most essential pre requisite for the success of any food business. The objectives set forth should be realistic and clearly defined. Then, all the business efforts should be geared to achieve the set objectives. 2. Planning: In simple words, planning is a pre-determined line of action. The accomplishment of objectives set, to a great extent, depends upon planning itself. It is said that it does not take time to do thing but it takes time to decide what and how to do. Planning is a proposal based on part experience and present trends for future actions. In other words, it is an analysis of a problem and finding out the solutions to solve them with reference to the objective of the business. 3. Sound organization: An organization is the art or science of building up systematical whole by a number of but related parts. Just as human frame is build up by various parts like heart, lever, brain, legs etc. similarly, organization of business is a harmonies combination of men, machine material, money management etc. so that all these could work jointly as one unit, i.e. “business”. Organization is, thus such a systematic combination of various related parts for achieving a defined objective in an effective manner. 4. Research: These days, food business involves “producing what the consumer want”. Consumers’ behaviour is influenced by variety of factors like cultural, social, personal and psychological factors. The business needs to know and appreciate these factors and then function accordingly. The knowledge of these factors is acquired through market research. Research is a systematic search for new knowledge. Market research enable a business in 1 finding out new methods of production, improving the quality of product and developing new products as per the changing tastes and wants if the consumers. 5. Finance: Finance is said to be the life-blood of business enterprise. It brings together the land, labour, machine and raw materials into production. Food business should estimate its financial requirements adequately so that it may keep the business wheel on moving. Therefore, proper arrangements should be made for securing the required finance for the enterprise. 6. Proper plant location, layout and size: The success of agribusiness depends to a great extent on the location. Where it is set up. Location of the business should be convenient from various points of view such as availability of required infrastructure facilities, availability of inputs like raw materials, skill labour, nearer to the market etc. Hence the business men must take sufficient care in the initial stages to selected suitable location for his business. The sine of the business is also important because the requirement for infrastructural facilities and inputs varies as per the size of the business. The requirement for raw materials, for example, will be less in a smaller sized firm than a larger size firm. 7. Efficient management: One of the reasons for failure of business often attributed to as their poor management or inefficient management. The one man, i.e. the proprietor may not be equally good in all areas of the business. Efficient businessman can make proper use of available resources for achieving the objectives set for the business. 8. Harmonious relations with the workers: In a business organization, the farmer operator occupies a distinct place because he/she is the main living factor among all factors of production. In fact, it is the human factor who makes the use of other non-human factors like land, machine, money etc. Therefore, for successful operation of business, there should be cordial and harmonious relations maintained with the workers/labours to get their full cooperation in achieving business activities. Objectives of Food Business There are several objectives of a food busines. However, this section focuses on the following important ones: (i) Profit objective: The primary objective of a food business is to make profit identifying and effectively serving the needs of consumers. Profit represents a reward for investing in a business. (ii) Growth objective: The growth of a food business is an expansion of the business enterprise. This may be in form of increased sales turnover, market share, number of people employed, capital employed, etc. (iii)Market share objective: This involves building a larger market share, this is usually by winning customers from competitors. (iv) Survival: This entails making the environment. food business thrive, even in unfavourable (v) Employee satisfaction: This involves ensuring that your business brings satisfaction to your employees. This would improve their job performance. 2 (vi) Image and reputation: This means improving the image of the business and developing a good reputation by producing and distributing high quality products. (vii) Social objective: This involves doing the business in a manner that will promote the welfare of the society. It also includes: supply of quality produce/products at fair prices, fair deal to workers, fair deal to investors and fair deal to your suppliers. (viii) National objectives: These involve fulfilling the national goals and aspirations of the country through your business. Some of the national goals are: provision of employment to its citizens, earning revenue from tax, becoming self-sufficient in food production, promoting social justice, etc. (ix) Shareholders’ satisfaction: This is a long-term goal. Business enterprises need to improve the returns to shareholders while at the same time reducing their risks. 3 DATA GATHERING FOR DECISION MAKING IN FOOD BUSINESS Data is a necessary ingredient for decision-making. Planning for the development of a business cannot be adequately done without appropriate data. Any decision maker either on any food business enterprise must be equipped with accurate data in order to make forecasts or plans about the future. Importance of Record Keeping in Food Business Keeping accurate records of your business allows you to i. Prepare your financial statements quickly and accurately. ii. Provide information to enable the control of cash in the business iii. Provide management information to base business decisions on. iv. Contribute promtly to assessing the financial situation of the business at any time v. Keep good track of the cost of staff and their performance vi. Measure the business performance against the projections in the business plan vii. Highligh quickly areas where problems could arise and enable remedies to be put in place viii. Fulfill tax obligations ix. Assist you in calculating how much tax you have to pay x. Assist in providing information required by your bankers xi. Help in detecting theft within the bsuiness itself xii. Provide valuable information and details for the future slae of your business xiii. Increase the chances of the business operating and achieving success xiv. Determine how your financial situation compares with last year or with your budgets xv. Determine how much cash you are owed at any time and how long it has been outstanding xvi. xvii. Determine your actual expenses and overheads compared to your projections Ensure successful planning and implementation of your business xviii. Enjoy the favour of financial institutions xix. Determine the profit or loss of his enterprises. xx. Determine the needed adjustments in terms of input use on the business. xxi. Guide in making production recommendations which are based on costs and returns of production. 4 Classes of Data in Food Business There are basically two sources of data, namely, primary and secondary. Secondary source of data is obtained from various sources other than what the researcher collects by himself. The secondary data might have been collected for a different purpose at same period in the past. Primary data is collected first hand by the person who intends to use it. Primary data can be obtained from farming families whereas secondary data may be obtained from Federal Office of Statistics, Food and Agriculture (FAO), Mistry of Agriculture, NAFDAC, SON, and other external sources. Methods of data gathering Gathering data for an entrepreneurial business may involve the following techniques: i. Tracking your net promoter score – asking your customers (users of your products) how likely they recommend your product(s) to a friend or colleague and getting lots of insights from it. ii. Keeping an updated record of all contact information - maintaining a database of your customers. iii. Collecting user experience data iv. Understanding the purchase decision hierarchy - learning what influences the purchase decisions of current customers –costs, taste, convenience, etc v. Learning how consumers/customers discovered your business. It is a good measure of the effectiveness of your sales and marketing teams. vi. Analyzing customers’ buying behaviour – classifying buyers as ‘active’ or ‘dormant.’ vii. Keeping track of your customers’ physical address. 5 BUSINESS PLANNING Business planning refers to the process of deciding what enterprise to do and how to do it. It involves the establishment of your business objectives and taking all the necessary steps to achieve them. To be successful in any food business, it is important that activities are planned before hand, taking into consideration all related and relevant conditions. No plan or a poor plan is a leading cause of business failure. Why do you need to plan? 1. Food business is a much complex activity. 2. Planning provides a clear understanding of what you need to do in order to achieve your development goals. 3. It guides you in prioritising and making decisions. 4. It allows you to focus possibly limited resources on the actions that will benefit your business the most 5. It keeps you in touch with your context – global, national and local. 6. It provides a tool to help you communicate your intentions to others. 7. It provides a coherent guide for day-to-day implementation. 8. It is is essential for the business survival and development. 9. It reduces risks and safeguards against uncertainty. 10. It necessitates faithfulness to your business objectives. Basic Principles to Guide your Plans Your business planning process should reflect the following principles: i. It should be comprehensive – all significant options and impcts are considered. ii. It should be efficient – the process should not waste time or money. iii. The process should be inclusive – people affected by the plan have opportunities to be involved. iv. Informative – results are understood by stakeholders. v. Integrated – individual short-term decisions should support strategic, long-term goals. vi. Logical – each step leads to the next. vii. Transparent – everybody involved understands how the process operates. 6 Planning for an Entrepreneurial Business An entrepreneurial planning system has a broad coverage. It addresses the resources that are available or not available to an entrebusiness enterprise and its ability to produce products or resources and/or provide services. It also considers those factors that will positively or negatively affect the firm's ability to run these actions. Attention should be given to how to make the business survive, compete and thrive. To achive this, six different factors that may adversely affect the busness should be addressed. These are: political, economic, social, technological, legal and environmental (PESTLE) factors. First, you need to know where you want the business to be in three to five years. Determine where to spend your money and devote your time in order to achive your stated goals. You need to gather detailed information about the strengths and weaknesses of competitors in order to come up with strategies that create a competitive advantage for your business. You also have to have a thorough understanding of the current state of your environment so you can identify emerging opportunities. Market research is also key; understanding your customers will allow you to better attract and serve them. Consumers’ needs change, their tastes change, and what they are willing to pay for products or services changes depending on the economic environment. Your products should match up extremely well with what your customers need. Business Plan A business plan is a document that details the business objective(s) and means of achieving the objective(s). It covers what you intend to do with your business and how it will be done. It seeks to capture the vision, current status, expected needs, defined markets, projected results and financial needs of your business. A business plan is an important tool for managing and growing your business. A welldesigned plan lays out a vision of growth and the steps needed to get there. A plan is also an essential communications tool for attracting financing for your business. Objectives of a Business Plan in Entrepreneurship 1. To give directions to the vision formulated by the entrepreneur. 2. To objectively evaluate the prospects of business. 3. To monitor the progress after implementing the plan. 4. To persuade others to join the business. 5. To seek loans from financial institutions. 6. To visualize the concept in terms of market availability, organizational, operational and financial feasibility. 7. To guide the agripreneur in the actual implementation of the plan. 8. To identify the strengths and weaknesses of the plan. 7 9. To identify challenges in terms of opportunities and threats from the external markets. 10. To clarify ideas and identify gaps in management functions about the business, competitors and the market. 11. To identify the resources that would be required to implement the plan. 12. To document ownership arrangements, future prospects, and projected growths of the business venture. Preparing a Business Plan The various steps involved in preparing a business plan are: (i) Preliminary Investigation: Before preparing the plan, an agripreneur shoild ❖ Review business available plans (if any) ❖ Draw key business assumptions on which the plan will be made (e.g inflation, exchange rate, market growth, compwtitive pressures, etc) ❖ Scan the external and internal environments to assess the strengths, weaknesses, opportunities and threats. ❖ Seek prefessional advice from a friend/relative or a person who is already into similar buisness (if any) (ii) Business Planning Process: This involves laying down the step-by-step that the agriprenur will follow in starting the business. The various steps involved in business planning process are: 1. Idea generation – generating new concepts, ideas, products or services to satisfy the existing demands, latent demands and future demands of the market. The various sources of new ideas are: • Consumers/sutomers • Existing firms/enterprises • Research and development • Employees • Dealers, retailers The various methods of generating new ideas are: brainstorming, reverse brainstorming, brain writing; group discussion; data collection,;invitation of ideas through advertisements, mails and the Internet; value addition ot he current products/services; market research, commercializing inventions. Screening of the new ideas should be done so that promising new ideas are identified and impractical ideas are eliminated. 2. Environmental Scanning: This is carried out to analyze the prospective strengths, weakness, opportunities and threats of the bsuiness enterprise. 8 The different variable to be scanned are in terms of socio-cultural, economic, governmental, technological, demographic changes taking place in the external environment and availability of raw maetrial, machinery, finance, human resources, etc with the agripreneur. The various sources for gathering the information are informal sources (family, friends, colleagues, etc.) and formal sources (bankers, magazines, newspaper, ADPs, seminars, suppliers, dealers, competitors). The more supportive the information, the grater is the confidence regarding the success of the business. 3. Feasibility Analysis:This is done to find whether the proposed agribusiness would be feasible or not. The various variables/dimensions here are: market analysis (demand for the proposed product/service and associated costs), technical/operational analysis (material requirement/availability, plant location/capacity, machinery and equipment, plant layout), financial feasibility (financial issues of the proposed bsuiness venture). 4. Project report prepation 5. Evaluation, control and review. Errors that can undermine business plan Your business may be rejected (if presented for the acquisition of loans or grants) for the following reasons: 1. Submitting a “rough copy”, with stains and typos tells the reader that you don’t take the planning process seriously. 2. Outdated historical financial information or unrealistic comparisons will leave doubts about the agripreneur’s planning abilities. 3. Unsubstantial assumptions – you must explain the “why” of every point in the plan. 4. Too much “blue sky” – a failure to consider prospective pitfalls. 5. Lack of understanding of financial information. 6. Lack of specific, detailed strategies. 7. Not indicating that you have anything at stake – the lender expects you to have some equity capital invested in the business. 8. Starting the plans with unrealistic loan amounts or terms. 9. Too much focus on collateral. 9 PROJECT REPORT PREPARATION A project report helps to understand the opportunities, problems and weaknesses of the business. It guides the agripreneur in actually starting up and running the business venture. It helps him to monitor whether the business is growing as was projected in the business plan or not. It helps in documenting the cost estimates of the business. It can be used to persuade investors and financial institutions to fund the project. It can help in proper utilization of all the resources. It can keep the morale of the employees, owners and investors up. It can finally lead to sustainable development of the organization. Essentials of a project report The project report should (i) be sequentially arranged (ii) be exhaustive (covering all the details about the proposed project) (iii) not be very lenghty and subjective (iv) logically and objectively explain the projections (v) be appropriately be made from two to ten years (vi) be professionally made to demonstarte that the promoters possess enterpreneurial acumen and sound experience. (vii) justify the financial needs and financial projections (viii) justify market prospects and demands (ix) be attratcive to the financial agencies and investors (x) have a high aesthetic value. Preparing a Project Report Essentially, a project report is made up of the following parts: I. Cover Sheet: It is like the cover page of the book. It mentions the name of the project, address of the headquarters (if any) and name and address of the promoters. II. Table of Contents: This is like the table of contents of a book; it guides the person revieving the project report to the desired section quickly. III. Executive Summary: This is the first impression about the business proposal. It should be brief (not more than two or three pages) yet should have all the factual details about the project that can improve its marketability. It should briefly describe the company, mention some financial figures and some salient features of the project. IV. The Business: This will give the business concept. It will discuss the objective of the business, a brif history about the past performance of the company (if it is an old 10 company) what would be the form of ownership, it would also label the address of the proposed headquaters. V. Funding requirements: A careful, well planned funding requirement should be documented. It is also necessary to project how these requirments would be fulfilled. VI. The Product/Services: A brief description of product/service is given in this section. VII. The Plan: Now the functional plans for marketing, finance, human resources and operations are to be drawn. VIII. Critical Risks: The investors are intersted in knowing the tentative risks to evaluate the viability of the project and to measure the risks involved in the business. This can further give confidence to the investors as they can calculate the risks involved in the business from their perspectives as well. IX. Exit Startegy: The exit startegies would provide our the organization would be desolved, what would be the share of each stakeholder in case of winding-up of the organization. It further helps in measuring the risks involved in inesting in the business. X. Appendix: The appendix can provide information about the CV of the owners, Ownership Agreement, Certificate from Pollution Board, Memorandum of Understanding, Articles of Association and all the supporting dosuments that can help in marketing the project viability at large. Format of a Project Report (I) Cover Sheet (name of company, address, promoters) (II) Table of Contents (III) Executive Summary (IV) The Business (a) Objective for setting up business (b) Brief history of past performance (if any) (c) Form of ownership (d) Name, qualification of the owners (e) Proposed/actual headquarters (f) Proposed/actual capital structure (V) The funding requirements (a) Debt (b) Equity (VI) The Product/Service 11 (a) Description of product/service (b) Comparative analysis with similar products/substitute products (c) Patents, tardemarks, copyrights, franchises and licensing arrangements (VII) The Plan (a) Marketing plan ▪ Market demography, like profiles of customers and end-users; preferences and needs ▪ Strenghts and weakness of competitors ▪ SWOT analysis of the market ▪ Market mix strategy • Product mix strategy • Promotion mix strategy • Pricing mix strategy • Distribution mix strategy (b) Operational plan ▪ Plant location ▪ Plan layout ▪ Material requirment ▪ Inventory management ▪ Quality control (c) Organizational plan ▪ Organizational chart ▪ Details about the board of directors ▪ Manpower planning ▪ Legal aspects of labour (d) Finacial plan for two to five years ▪ For existing agribusiness, a summary of existinf financial data ▪ Projected sales ▪ Projected income and expenditure staement ▪ Projected breakeven point 12 ▪ Projected balance sheet ▪ Projected cash flow ▪ Projected fund flow ▪ Project ratios (VIII) Critical risks (IX) Exit strategy (X) Appendix 13 MARKETING PLAN A marketing plan aims at planning the marketing strategies for a business, its products or services. Marketing plan analyzes the market opportunities (through market research), identifies profitable segments and targets them through a compounded marketing mix strategy (which involves strategies for product, price, place and promotion). Marketing Research This is the process of collecting information on any facts relevant to market. It is a systematic collection of information, its analysis and interpretation to strategize some relevant business decisions like whether one should enter new markets, whether one should charge premium prices, what kind of discounts would be more attractive to the customers, etc. Information that can be collected through Market Research i. The total size of the current market ii. The total size of the potential market iii. The growth rate of the market iv. Consumer demography v. Consumer preferences vi. Consumer prefences about product quality, price, brand, etc vii. Consumer satisfaction viii. Product usage rate ix. Consumer buying behaviour x. Current price analysis xi. Current sensitivity analysis xii. Distribution level xiii. Effectiveness of distribution network xiv. Effectiveness of promotional efforts xv. Competitor’s analysis to asssess market share, pricing strategies, distribution and promotional efforts. Steps in Conducting Marketing Research i. Formulate your objectives ii. Design your research iii. Collect your data and tabulate them iv. Analyze your data 14 v. Document your findings vi. Make decisions. What is Market Segmentation? It is the process of dividing the market/customers into similar characteristics or behaviour. The common types are: 1. Demographic Segmentation: This is based on measurable statistics, such as: gender, age, income level, marital status, education, race, religion. Demographic segmentation is usually the most important criteria for identifying target markets, making knowledge of demographic information crucial for many businesses. 2. Geographic Segmentation: It involves segmenting the market based on location e.g home addresses. Depending on the scope of your business this could be done by: neighbourhood, postal/zip code, area code, city, province/state, region, country (if your business is international). Geographic segmentation relies on the notion that groups of consumers in a particular geographic area may have specific product or service needs; for instance, a flour milling enterprise may want to focus their marketing efforts in a particular town/city that has a high percentage of bakeries. 3. Psychographic Segmentation: Psychographic segmentation divides the target market based on socio-economic class, personality, or lifestyle preferences. How to position your Business in the Market 1. Project a good image for your business 2. Develop a good pricing strategy 3. Develop a good packaging system for your product. 4. Determine how your competitors project themselves 5. Let your product meet the needs of your consumers 6. Develop a lasting product lifecycle. Developing Market-mix Strategies Product-mix Strategies ▪ Determine the type of your product(s), the variants and be consistent ▪ Brand your product in order to build, maintain, protect and enhance its identity/image. The advantages of this are: i. It will make it more attractive to customers. ii. High price can be charged iii. You would be able to introduce brand extension 15 iv. It provides defence against price competition. Packaging and Labelling This provides brand image to your product. It creates conveninece and promotional value to your product. Developing an effective packaging requires decisions on: size, shape, material, colour, text, brand marks and statutory text like igredients for food products. Packaging decisions should be made while keeping the following things in mind: i. Convenience of carrying good/handling ii. Price iii. Attractiveness iv. Safety of the product Pricing Mix Pricing is that element of marketing mix that produces revenue. Your pricing decisions should be based on the following: a. Competitor’s price b. Cost of the product/services c. Demand of the product d. Availability of the raw material e. Overall marketing objective of your firm. The different pricing strategies that can be used are: mark-up pricing, target-return pricing, perceived value pricing, value pricing, going-rate pricing, geographical pricing, and skimming pricing. Promotional Mix This is the process of educating customers through various forms of media about the quality, price and the utility of your product. The promotional mix consists of the following decisions: i. Cost decisions ii. Type of media decision The various types of promotional strategies are: advertising, directing marketing, sales promotion, and public relation. Distribution Mix This is the process through which your product is physically delivered to your customers. This could be through merchants, agents, and facilitators. Channel Levels 16 These are all the intermediaries involved in the final delivery of the product to the customers. Some of the channels are distributors, retailers, wholesalers. The common channel levels are: Channel 0 (No intermediary, as in direct marketing): Manufacturer -----------> Customer Channel 1 (involving one intermediary): Manufacturer ----------> Wholesaler -------> Customer Channel 2 (2 intermediaries): Manufacturer ----> Wholesaler -→ Retailer ----→ Customer Channel 3 (3 intermediaries): Manufacturer ----> Wholesaler -→ Distributor --→ Retailer ---→ Customer Budgeting the Marketing Strategies An effective marketing plan must consider the cost in implementing marketing feasibility study and market plan. These should include: i. Cost of marketing research ii. Cost of new product development iii. Cost of sales and promotion iv. Cost of distribution v. Cost of thriving competion The budgeting at this stage would be helpful in drawing up the financial plan. 17 SOURCES OF FINANCE Internal sources of finance This is a situation where fund is raised from within the organization. Internal fund could be ext 1) Owner’s investment (startup or additional capital This is money from owner’s savings. It may be in form of start-up capital used to set up the business or in form of additional capital used to expand the business 2) Retained profit This is undistributed profit coming from the activities of the organization. Assuming no dividend is paid out this profit, the undistributed profit serves as internal source of fund for capital investment. 3) Provision for Taxation Corporate entity are expected to make provision for tax on net profit after a period of time. The provision (money) is not paid until after a financial year of the company. This could serve as internal source of fund for capital investment. However, it is returned back before the end of the financial year of the company. 4) Debt collection A business could raise fund by collecting the money owed them by their debtors. 5) Sale of fixed asset This money comes from selling off fixed assets such as a piece of machinery that is no longer needed 6) Sale of Stock This money comes from selling off unsold stock. It is when the profit made is ploughed back into the business Advantages of internal sources of finance i) No fund repayment to outsider hence no financial risk ii) Interest rate is free which brings about low cost of financing iii) Cost associated with new issues are avoided iv) The liability of the business will not be unnecessarily be inflated v) More revenue will be generated within the organization vi) Rapid growth of the business organization vii) Control of ownership (ownership are not diluted) 18 Disadvantages of internal sources of finance i) It increases tax provision ii) Where retained earnings are used frequently, it reduces the dividend to be given to shareholders which tends to reduce their interest in the company. iii) The funds available from tax provision is tied to the level of profit. Therefore, if profit falls or is not made, the funds available from the source is affected accordingly. iv) The use of provision for depreciation may not be efficient where cash management control is lacking. v) In the case of stock sales, the business will have to take a reduced price for the stock vi) In the debt collection, there is a risk that debts owned the can go bad and not be repaid. External sources of finance External sources of finance could be either short term (less than or equal to one year), medium term (one to seven years) or long term (seven to thirty years) in nature. Short term External sources of finance i) Borrowing from friends This source of finance is unreliable and is risky for the provider of funds because it may be difficult to enforce repayment against a defaulting friend. ii) Borrowing from cooperatives The source is restricted to only members of a cooperative. The amount that could be raised depends on the cooperative. The loan could be interest free or attract a little interest. iii) Trade Credits Trade credit are created when goods are bought on credit terms without signing formal agreement for the liability. However, by accepting the goods, the purchaser agrees to pay the supplier the invoice amount under the terms of the trade required by the supplier. The trade credit is an interest free source of funds for the length of credit period. iv) Bank borrowing 19 Bank loan in money borrowed from the bank for a specific period. Interest paid on the sum of money borrowed during the duration of the loan. v) Factoring of Debts A factor is an agent that manages trade debts. Factoring involves turning over the responsibility for collecting a firm debt to a specialist institution. The factor will charge some fees for this service. He will normally advance about 75 % to 90 % of the book value of the debts, the remaining amount (less the fees) being paid when the debts are collected. vi) Accruals Accruals are amount owed on services rendered to the firm which the payment has not been made. Accruals include wages payable. vii) Acceptance Credits This is a bank bill of exchange drawn on a bank which accepts them. By accepting the bill, the bank undertakes to pay the amount of bill to the holder at maturity. The value of the bank bill might be equal to but more probably less than the value of the trade bill. The date of maturity of the bill must be later than the date of maturity of the underlying bank bill. Medium term External sources of finance i) Term loans This is a negotiated loan between a bank and a company for a period of 4 – 10 years or more. The bank usually charges a fixed rate of interest. ii) Hire purchase agreement A hire purchase agreement is a credit sale agreement by which the owner of the asset or supplier grant the purchaser the right to take possession of the asset but ownership will not be posed until all the hire purchase payments or instalments have been made. The purchaser will pay the hire purchase payment (principal plus interest) over an agreed period iii) Lease agreement A lease is a contract between the owner of an asset and the user of the asset granting the user the exclusive right to use the asset for an agreed period in return for the rental payment. Long term External sources of finance i) Bond 20 A bond represents a method of long-term borrowing by corporation or government agencies. When a corporate bond is issued, it has legal contract that goes with it which contains the provision of loan in terms of its amount, interest and maturity period. ii) Shares A company needs to maintain an equity base large enough to allow it to take advantage of low-cost debt and build an optional capital structure, shares are known as equity. Equity capital can be raised internally through retained earnings or externally by selling preferred or ordinary share/common share/stock. Government Specialialized finance programmes and Schemes in Nigeria These were established by the Nigerian government to provide funds for Agricultural businesses and small and medium enterprises. These include: i) The Agricultural Credit Guarantee Scheme Funds (ACGSF) ii) iii) Small and Medium Enterprises Equity Investment Scheme (SMEEIS) Rural Finance Institution-Building Programme (RUFIN) 21 BUSINESS ACCOUNTING: RATIO ANALYSIS Ratio analysis is a powerful tool of financial analysis. A ratio is defined as the indicated quotient of two mathematical expressions and as the relationship between two or more things. In financial analysis, a ratio is used as bench mark for evaluating the financial position and performance of a firm. Ratio analysis will explain what strength, weakness, pressures and forces are currently at work in your business operation. Farm business managers will need a full time job accountant for the change accruing in his capital structure and net worth as revealed in his balance sheet. Ratio analysis of properly calculated rates can be readily compared with 1. firm’s past ratio in order to show trends 2. ratio of other firms of similar size, large size or of smaller size with which the manager is familiar 3. industrial standards 4. projected goals as reflected in plans for the future. Fundamental difference between ratio analysis and trend is that the ratio analysis measures the movement in absolute terms whereas the trend indicates the relationship. The marginal analysis is used in determining the most profitable combination of resources and products. It is concerned with last added or marginal unit of input and product. Ratio analysis has the following advantages 1. Has no units 2. Compares numerator with respect to denominator 3. Relative and comparable The following are the five important categories of ratios. 1. Liquidity ratios 2. Leverage ratios 3. Coverage ratios 4. Turnover ratios and 5. Profitability ratios Liquidity ratios Liquidity ratios measure the ability of the firm to meet its current obligations. 1. Current Ratio (CR): It is calculated by dividing current assets by current liabilities. Current ratio = Current assets ÷ Current liabilities Current assets include cash, marketable securities, debtors, inventories, prepaid expenses. All those assets which can be converted into cash within a year are included in current assets. 22 Current liabilities include creditors, bills payable, accrued expenses, short term bank loans, income tax liability, long term debt maturing in current year, etc. All obligations maturing within a year are included in current liabilities. Current ratio is a measure of the firm‟s short term solvency. It indicates the availability of current assets in rupees for every one rupee of current liability. A ratio of greater than one indicates that the firm has more current assets than current claims against them. 2. Quick ratio: The ratio establishes a relationship between quick or liquid assets and current liabilities. Quick ratio = (Current assets – inventories) ÷ current liabilities (or) Acid or quick ratio = (Cash + marketable securities + accounts receivable) ÷ current liabilities 3. Cash ratio: Since the cash is the most liquid asset, a financial analyst may examine the ratio of cash and is equivalent to current liabilities. Marketable securities are equivalent cash. Cash ratio = (Cash + marketable securities) ÷ current liabilities 4. Net working capital ratio: The difference between current assets and current liabilities excluding short term borrowings is called net working capital (NWC) or net current assets. NWC ratio = Net working capital ÷ Net assets Leverage Ratios These ratios may be calculated from the balance sheet items to determine the proportion of debt in total financing. 1. Debt-equity ratio: The relationship describing the lender‟s contribution for each rupee of the owner‟s contribution is called debt-equity ratio. Debt-equity ratio = Total debts ÷ Net worth 2. Total debt ratio: In order to know the proportion of the interest-bearing debt (also called funded debt) in the capital structure, debt ratio is computed Debt ratio = Total debts ÷ (Total debt + Net worth) Total debt will include short and long term borrowings from financial institutions, debentures/bonds, deferred payment arrangements for buying capital equipment and bank borrowing, public deposits and any other interest bearing loan. Capital employed will include total debt and net worth. Coverage ratios The interest coverage ratio is one of the most conventional coverage ratio used to test the firm‟s debt servicing capacity. Interest coverage ratio = Earnings before interest and taxes (EBIT) ÷ Interest The interest coverage ratio shows the number of times the interest charges are covered by funds that are available for their payment. Since taxes are computed after interest, interest coverage is calculated in relation to before tax earnings. Depreciation is a non cash item. 23 Therefore, funds equal to depreciation are also available to pay interest charges. We can calculate the interest coverage ratio as earnings before depreciation, interest and taxes (EBDIT) divided by interest. Interest coverage ratio = EBDIT ÷ Interest Activity ratios (or) Turnover ratios These ratios are employed to evaluate the efficiency with which the firm manages and utilizes the assets. They also indicate the speed with which assets are being converted or turned over into sales. Thus activity ratios involve a relationship between sales and assets. 1. Inventory turnover: The ratio indicates the efficiency of the firm in selling its product. Inventory turnover = Cost of goods sold ÷ Average inventory The average inventory is the average of opening and closing balance of inventory. In manufacturing company inventory of finished goods is used to calculate inventory turnover. Inventory turnover can also be calculated by dividing sales with inventory. The inventory turnover shows how rapidly the inventory is turning into receivable through sales. High inventory turnover is indicative of good inventory management. A low inventory turnover implies excessive inventory levels than warranted by production and sales activities or slow moving inventory. 2. Debtors turnover: A firm sells goods for credit or cash. Credit is used as a marketing tool. When the firm extends credit to its customers, book debts (debtors or receivable) are created in the firm‟s records. Book debts are expected to be converted into cash over a short period and therefore included in current assets. Debtors turnover = Sales ÷ Debtors Profitability ratios Profit is the difference between revenue and expenses over a period of time. Profit is the ultimate output of a company and it will have no future if it fails to make sufficient profit. The profitability ratios are calculated to measure the operating efficiency of the company. 1. Gross profit margin: The gross profit margin reflects the efficiency with which management produces each unit of product. A high gross profit margin is a sign of good management. A low ratio reflect higher cost of goods sold due to firm‟s inability to purchase raw materials at favourable terms, inefficient use of fixed and variable resources. Gross profit margin = (Sales – cost of goods sold) ÷ Sales = Gross profit ÷ Sales 2. Net profit margin: Net profit margin is obtained when operating expenses, interest and taxes are subtracted from the gross profit. The net profit margin indicates management‟s efficiency in manufacturing, administering and selling the products. This ratio is the overall measure of the firm‟s ability to turn each rupee sales into profit. It also indicates the firm‟s capacity to withstand adverse economic conditions. Net profit margin = Profit after tax ÷ Sales 24 3. Operating expense ratio (OER): It explains the changes in the profit margin (EBIT to sales) ratio. The ratio is computed by dividing operating expenses viz., cost of goods sold plus selling expenses and general administrative expenses (excluding interest) by sales. Operating expenses ratio = Operating expenses ÷ Sales A higher operating expenses ratio is unfavourable since it will leave small amount of operating income to meet interest, dividends, etc. 4. Return on investment (ROI): The term investment may refer to total assets or net assets. The funds employed in net assets are known as capital employed. Net assets equal fixed assets plus current assets minus current liabilities excluding bank loans. Alternatively capital employed is equal to networth plus total debt. Return on investment (ROI) = Return on total assets (ROTA) = EBIT(IT) ÷ Total assets Return on investment (ROI) = Return on net assets (RONA) = EBIT(IT) ÷ Net assets 5. Return on equity (ROE): This ratio indicates how well the firm has used the resources of owners. It reflects the extent to which the objective of earning a satisfactory return has been accomplished. Return on equity = Profit after tax ÷ Net worth 25 ENTREPRENEURIAL DEVELOPMENT Concept of Entrepreneurship The term refers to perceiving business opportunities and taking advantage of the scarces resources to use them. It is the process of creating something new with value of devoting the necessary time and effort, assuming the accompanying financial, psychic and social risk and receiving the resulting rewards of menetary and personal satisfaction and independence. An entrepreneur, is, therefore, a dynamic business manager performing various business activities using different resources viz. physical resources, financial resources, human resources and information, in order to accomplish a certain goal. He has the foresight, belief and boldness to build something new. He sees an opportunity, seizes it, and creates a new marketable process, or otherwise a marketable contribution to the economy. The Role of Entrepreneurship in Developing Society Entrepreneurship is being seriously advocated, in developing countries in particular because of the following importance: 1. Employment Generation: It helps to provide jobs through the establishment of new businesses, especially small and medium scale enterprises. 2. Productivity through innovations. 3. Facilitate the transfer/adaptation of agricultural technology: It enables entrepreneurs to have the opportunities of developing and adapting appropriate technological methods and provide a veritable avenue for skilled, unskilled and semi-skilled workers. 4. Ensures increased resource utilization: It helps entrepreneurs to put limited resources that might otherwise remain idle into good use. They contribute to the mobilization of domestic savings and utilization of local resources, including human resources. 5. Stimulates growth in those sectors which supplies it with inputs: Entrepreneurship stimulates growth in its agricultural and allied supply markets. 6. Reinvigorates large-scale agricultural enterprises and public enterprises 7. Encourages and sustains economic dynamism that enables an economy to adjust successfully in a rapidly changing global economy: As a result of the dwindling nature of the oil sector, many economies have no other reasonable alternatives than shifting focus to entrepreneurship. 8. Enables individuals to use their potential and energies to create wealth, independence and status for themselves in society. 9. It helps in inducing productivity gains by businessmen and integrating them into local, national and international markets. 26 10. It helps in reducing food costs, supply uncertainties and improving the diets of the rural and urban poor in the country. 11. It also generates growth, increases and diversifies income, and provides entrepreneurial opportunities in rural areas. Functions of an Entrepreneur There are clearly defined activities which an entrepreneur is expected to perform. These are: 1. Perception and identification of business opportunities. This has to do with the recognition and definition of an unsatisfied need of individuals, firms or households which can be satisfied with a product or service at the right price that will guarantee satisfactory profit to the entrepreneur. In other words, business opportunity occurs whenever there is a vacuum in the market place which is not being satisfied by existing organizations or is being inadequately satisfied. 2. Selection of the legal form, location and site of the business. This should depend on the form of the agribusiness to embarked on. 3. Identification, selection and acquisition of key resources: For any business firm to survive and grow depends heavily on the availability of competent manpower who will be able to translate the entrepreneur’s ideas into concrete forms. Thus, key personnel must be sourced and encouraged to contribute their talents and energy during and after the turbulent period of formation and take-off. In addition, the technology that is suitable for the needs of the firm must be identified, evaluated and acquired. Sourcing of funds is one of the major constraints in starting businesses by entrepreneurs, since the organization has no track record to boost of with investors and bankers, a lot depends on the talents and trust of the entrepreneur to develop an attractive project idea, form a credible and resourceful team in order to encourage others to believe in the business. 4. Innovation: This is usually regarded as the height of entrepreneurship. Innovation may be defined as the translation of a new idea into a new enterprise. In other words, innovation simply refers to striving to satisfy your customers better than what competitors are doing/offering. This may take the form of a new product in an old market; old product in a new market; or entirely a new product in a new market. It is important to emphasize that sustaining the patronage of customers depend largely on the ability of the entrepreneur to respond to their needs with new or modified products, new and better techniques of production which reduce cost of production, better methods of distribution, pricing and promotion. 5. Risk bearing: This has been traditionally associated with the entrepreneur. There are various types of risks in agribusiness. The risk of fire, inclement weather, accidents, bad debts, theft etc can be minimized by taking preventive action and by insuring against them. Other risks arise because business decisions are future oriented. Risk of business failure may arise from adverse fluctuation in demand, unfavourable government policies, strong competitive advantage of other firms, obsolete technology and hence high cost of operation etc. These risks cannot usually be insured against and must be borne by the entrepreneur. One way of managing risk is for the entrepreneur to engage actively in monitoring the 27 environment in order to be able to respond and adapt to the dynamic nature of the environment from time to time. 6. Management of the ongoing enterprises: The job of an entrepreneur is not hit and run or one off activity. But rather, it is on a continuous basis (on going activity). To be able to sustain the ongoing nature of the business, the entrepreneur must put in place these activities namely: establishment of goals and targets for the enterprise; determination of the tasks to be undertaken to achieve the goals/targets; efficient and effective allocation of the necessary resources and controlling of the activities involved. This simply implies that the entrepreneur is a planner, organizer, communicator, coordinator, leader, motivation and controller, and most of all, a facilitator. Management of the on-going enterprise also involves the process whereby the entrepreneur monitors and evaluates changes that are continuously taking place in the political, economic, socio-cultural, technological, legal and ecological environment so as to respond appropriately to ensure the survival of the business. Characteristics of an Entrepreneur An entrepreneur must possess, among many others, the following characteristics: a) Be a goal oriented individual b) Possess a keen sense of observation. c) Possess an enquiring mind. d) Have analytical ability e) Be able to take initiatives f) Be a risk taker g) Have a high degree of self-confidence. h) Be able to motivate workers. i) Be an effective communicator. j) Be technically competent, i.e. know what to do and how to do it. k) Be able to manage his time. l) Feels a sense of ownership. m) Sort out problems into big and small, urgent and pending. n) Be able to take corrective steps. o) Be full of vigour, energy and readiness to face risk and uncertainty. p) Be passionate about learning. q) Be a team player r) Be optimistic. s) Be profit-oriented In general, entrepreneurs should be proactive, curious, determined, persistence, visionary, hardworking, honest, integrity with strong management and organizational skills. Entrepreneurial Activities in Agribusiness Agriculture has several areas of entrepreneurship which include the activities like, dairying, sericulture, goat rearing, rabbit rearing, floriculture, fisheries, shrimp farming, sheep rearing, vegetable cultivation, nursery farming, farm forestry, The possible areas of entrepreneurship in agriculture are:- 28 1. Agro-inputs manufacturing units – These units produce goods either for mechanization of food business or for increasing manufacturing plants, e.g.- utensil production units, tools for food tests etc. 2. Agro-produce manufacturing units – These units produce entirely new products based on the agricultural produce as the main raw material. E.g.-sugar factories, bakery, straw board units etc. 3. Agro-produce processing units – There units do not manufacture any new product. They merely process the agriculture produce e.g. rice mills, wheat thressing mills, grinding mills, decorticating mills etc. 4. Food Business Service Centres –These include the workshops and service centres for repairing and serving the agricultural implement used in agriculture. 5. Miscellaneous areas – Besides the above mentioned areas, the following areas may prove to be encouraging to establish agri-enterprises such as setting up of apiaries , feed processing units, seed processing units, mushroom production units, commercial vermin-compose units, goat rearing farmers club, organic vegetable and fruits retail outlet, bamboo plantation and jatropha cultivation. Entrepreneurial Skills Entrepreneurial skills are those competencies required to accomplish tasks and activities related to the farm business. These can be developed by learning and experience. In a dynamic environment with fast technical progress, open minded farm entrepreneurs will recognize more problems than they are able to rationally solve. Entrepreneurial skills can be categorized entrepreneurial competences in six key areas which includes: opportunity recognition skills, relationship building, organizing, strategic competences, conceptual thinking and problem solving skills. These skills involve the following startegies: i. Management and strategic planning, ii. Knowledge of the ecosystem, iii. Capable and professional staff, iv. Understanding of the value chain perspective, v. Craftsmanship, vi. Ability to learn and seek opportunity vii. Enterprising personal characteristics. Thus, management skills are the complete package of skills that a farmer would use in order to develop the farm business. Steps in Setting up an Entrepreneurial Business Basically, there are seven steps in setting up an entrepreneurial business. They are: i. Business idea/objectives ii. Choice of project/scope of business 29 iii. Project feasibility – marketing, technical, commercial viability iv. Company registration/costs requirements of incorporation/compliance with all statutory v. Business funding vi. Project takeoff/implementation. Barriers to Entreprenuership a. Environmental Barriers: These include (i) Non-availability/high cost of raw materials (ii) Dearth/high cost of desired man-power (labour) (iii) High cost of machinery/maintenance (iv) High cost of rent on land and building (v) Other infrastructure requirements – power supply, proper roads, water and drainage facilities, etc. (vi) Financial barriers b. Personal Barriers: These include: (i) Lack of confidence (ii) Lack of dependability on others (iii) Lack of motivation (iv) Lack of patience (v) Inability to dream (vi) Sense of pride and/or embarrassment (vii) Societal barrier 30 PROJECT PLANNING, EVALUATION AND APPRAISAL Meaning and Definition of ‘Project’ • Projects are the building blocks of investment plan. • The whole complex of activities in the undertaking that uses resources to gain benefits constitutes the agricultural project. • A food business project is an investment activity in which financial resources are expended to create capital assets that produce benefits over an extended period of time. • Project is an activity on which money is spent in expectation of returns and which logically seems to lend itself to planning, financing and implementation as a unit. • Project is a specific activity with a specific starting point and a specific ending point intended to accomplish a specific objective. It is something which is measurable both in its major costs and returns. It will have some geographic location or at least a rather clearly understood area of geographic concentration. It will have a specific clientele group which it is intended to reach. It will have a relatively well defined time sequence of investment and production activities. • Sound developmental plans require good projects and good projects require sound planning. Both are interdependent. Project planning seeks to ensure optimization of scarce resources for balanced growth of economy. It should facilitate an analysis in planning, financing, implementation, monitoring, controlling and evaluation. Characteristics of Food Business Projects 1. Project is made up of many sub-projects/investments. Ex: Sericulture, palm oil industry, ice factories for fisheries project, construction of 500 dug wells (each well a sub-project). 2. Project increases capital intensity of food enterprise 3. Investment costs vary according to natural conditions, market conditions and processing conditions. 4. The quantum of incremental benefits (income) depends on benefitting area and the level of benefits depends on stage of development firm. 5. The level of benefits may, however fluctuate from year to year due to weather conditions. The Project Cycle There tends to be a natural sequence in the way projects are planned and carried out, and this sequence is often called the "project cycle." The important phases in project cycle are (1) Conception or Identification (2) Formulation or preparation of the project (3) Appraisal or Analysis (4) Implementation 31 (5) Monitoring (6) Evaluation 1. Conception or identification of the project The first stage in the cycle is to find potential projects. In food buseiness projects, costs are easier to identify than benefits because the expenditure pattern is easily visualized. The various types of costs involved in the project are: • Project costs: These include the value of the resources in maintaining and operating the projects. • Associated costs: Costs that are incurred to produce immediate products and services of the projects for use or sale. • Primary costs or Direct costs: These include costs incurred in construction, maintenance and execution of the projects. • Indirect costs or Secondary costs: Value of goods and services incurred in providing indirect benefits from the projects such as houses, schools, hospitals, etc. • Real costs and nominal costs: Costs at current market prices are nominal costs, whereas if costs are deflated by general price index, these are termed as real costs. • Social costs: These are technological externalities and technological spill-over accrued to the society due to presence of projects, i.e., pollution problems, health hazards, salinity conditions, etc. Next to identifying the costs, the estimation of benefits is imperative to ascertain the impact the projects. This is generally done by taking into account two situations, i.e., „with‟ and „without‟ the projects. The difference is the net additional benefit arising out of the project. Benefits are split into two: tangible and intangible benefits. • Tangible benefits: Incremental income due to the existence of projects is obtained either from an increased value of production or from reduced costs. • Intangible benefits: These include better income distribution, national integration, better standard of living, etc. In identification phase, it is also important to see whether the project is implemented in high priority areas and whether on primafacie grounds the project is economically feasible. It is also imperative to identify problems and objectives of the projects and whether the Government gives sanction for the project implementation or not. The important stages in the process of identification are: 1. Preliminary study. 2. Pre-feasibility study. 3. Project report. In these stages we assess whether the project proposed on the grounds of prima-facie is feasible and the objectives of the project achieved. On this ground, the preliminary study 32 should embody the investment proposals, benefits extended from the projects and method of implementation. Assessment of the demand for the project‟s products, technical feasibility of the project, import and export requirements, marketing aspects, investment prospects, etc., should be exhaustively covered by the feasibility studies, including the analysis of sensitivity. Some of the sources through which the projects identified are: 1. Agricultural and allied programmes proposed in the plans of the country as well as states. 2. Areas identified as potential for further development through Governmental surveys. 3. Special developmental programmes. 4. Irrigation projects which offer scope for development through forward and backward linkages. 5. New projects emerging out of existing projects, etc. 2. Formulation or Preparation of the Project: The following points are considered while formulating the projects. • The location of the project site must be based on technical analysis and technical feasibility of the projects. • The location of the project depends up on available physical resources, market conditions, marketing facilities, alternative investment prospects, administrative experience, farmers‟objective, technical skill, motivations, demand for products, etc. • Technical analysis must make into consideration all aspects of technology to be used in the project and account for all inputs of goods and services. • Assessment of suitability and adequacy of natural resources in advance based on the scientific investigations. • Due consideration to be given to all the organizational, social, economic aspects, etc. • Technical aspects: The issues which need technical examination are thoroughly analysed here. • Financial aspects: The implementing agency should be in a position to estimate financial requirements and anticipated returns, through farm planning and budgeting. Once the incremental income is arrived at, the repayment capacity duly giving allowance for risk and uncertainty can be worked out. Cash flow chart can be profitably used here. • Commercial aspects: The aspects focus on the estimation of effective demand, availability of input supplies and arrangements for the output marketing. Market potentiality for the products needs a careful scrutiny. • Managerial aspects: If we want successful implementation of the project, effective managerial issues are very crucial. The managerial skills can be sharpened. 33 • Organisational aspects: Organisation refers to the process of putting the priorities in an orderly form. For proper administration of the projects, efficient personnel and other requirements are indispensable. • Social aspects: Here customs, culture, traditions and habits etc., of the beneficiaries are considered. The relevant implications like the probable changes in the living standards, material welfare, consumption habits, income distribution effects, etc., fall under this coverage. • Economic aspects: Here we have to examine the benefits, which the project is going to contribute in terms of the utilization of scarce resources of the nation. The indirect effect like, the income distribution, needs to be assessed. 3. Appraisal or Analysis Appraisal should take place before the implementation of the project. It is done independently by specialists. In the appraisal stage it is important to know whether the project is technically feasible according to the data available. The technical data for assessing the feasibility of the project should be consistent with the information available in the office of the sanctioning authority of elsewhere. Managerial aspects play a key role in the project appraisal. Projects become abortive due to the failure to consider managerial aspects, i.e., such as new skills and information gained by the farmers in the project area, including adoption of new technology. The managerial capabilities and capacity of administrative personnel must also be assessed in project appraisal. 4. Implementation This is the most crucial phase of the project cycle. The secret of successful implementation depends up on the extent of realism put into the plans drawn beforehand. It is often not uncommon, to notice our plans getting deviated from the reality. Here the role of prudent decisions by the personnel in charge of implementation to take the situation comes into play. Project implementation can be divided into three different periods, viz., investment period, development period, and full-production period. Investment period may range from few months to few years depending up on the nature of assets to be acquired. Assets proposed should be of superior quality. Development period too consumes time. Implementing agency should make all efforts to reduce the gestation period as per the plan envisaged in the beginning. Full production period is the time during which the beneficiaries start reaping the benefits of the project. 5. Monitoring Monitoring is the timely collection and analysis of data on the progress of a project, with the objective of identifying constraints which impede successful implementation. This is highly desirable, particularly when projects fail, to be completed as per time schedule or in the process of attaining the set goals. It is imperative to get the feedback on the problems faced so that effective measures can be taken up to plug the deficiencies, which hamper the speedy implementation. Monitoring has 34 to be done continuously to offset various shortcomings that crop up from time to time with regard to various aspects of implementation. 6. Evaluation This is the last phase of the project cycle. Evaluation can be done several times during the life of a project. In the evaluation process, it is important to see, how far the objectives set out in the project are achieved. Deficiencies, snags or failures to achieve the objectives may be analysed and appropriate solutions to such failures answered. Evaluation process is to be completed in three phases. They are pre-project evaluation, concurrent evaluation and ex-post evaluation. In the first phase, evaluation is attempted before any change occurs in the existing situation. This is primarily meant to assess economic feasibility of the projects, since it is done at the very beginning. This type of analysis is otherwise called pre-project evaluation. Sometimes it is also important to take up evaluation when the project is in execution, and such evaluation is called concurrent evaluation. This type of evaluation is basically meant for identifying and analyzing the pitfalls in the execution of the project. Evaluation is also resorted to particularly when the project is completed in all its phases, in order to assess the achievement of ends or objectives set out by the projects. Such evaluation is called ex-post evaluation or end-evaluation. 35 PROJECT APPRAISAL AND EVALUATION TECHNIQUES When costs and benefits have been identified, priced, and valued, the analyst is ready to determine which among various projects one is to accept and which to reject. There is no one best technique for estimating project worth (although some are better than others, and some are especially deficient). The techniques of project appraisal can be discussed under two heads viz., (i) Undiscounted and (ii) Discounted. (i) Undiscounted techniques: Include (a) Payback period, (b) Value-added, (c) CapitalOutput Ratio, (d) Proceeds per unit of outlay, and (e) Average annual proceeds per unit of outlay. (ii) Discounted measures: Under this Net Present Worth (NPW), Benefit-Cost Ratio (BCR), Internal Rate of Return (IRR), N/K Ratio and Sensitivity analysis are prominent. UNDISCOUNTED TECHNIQUES Pay Back Period The payback period refers to the length of time required to recover the capital cost of the project. In other words, it is the length of time from the beginning of the project until the net value of the incremental production stream reaches the total amount of capital investment (Net value of incremental production = value of incremental production less O&M, production cost). The formula used to workout the pay back period is P=I÷E P = Payback period of the project in years I = Investment of the project in rupees E = Annual net cash revenue in rupees According to this criterion, the shorter the period for recovery the more profitable is the project. This criterion has two important weaknesses viz., a) It fails to consider earnings after the payback period and b) It does not adequately take into consideration the timing of proceeds. Value-Added It is the amount of economic value generated by the activity carried out within each production unit in the economy. In any production unit, value-added is measured by the difference between the value of the output of the firm and the value of all inputs purchased from outside the firm. The capital and labour attached to each firm are considered internal inputs. Thus, value-added is the value that has been added by the labour and capital of the 36