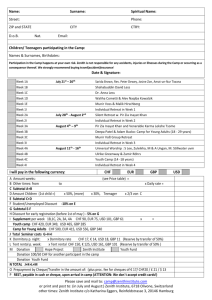

International Finance Dr. Luong Thi Thu Hang Type 1: Cross Exchange Rate Case 1: Given the available rates: USD/CHF = 1,1807/1,1874 USD/HKD = 7,7515/7,7585 Calculate cross rate: CHF/HKD - Exporter from Swiszerland Importer from Hongkong Exporter receives HKD 100,000. He wants to convert HKD into CHF. Which rate is used? Convert HKD into USD Convert USD into CHF - Importer from Swiszerland Exporter from Hongkong Importer has a payable HKD 100,000. He wants to buy HKD by CHF (convert CHF into HKD). Which rate is used? Convert CHF into USD Convert USD into HKD Case 1: Formula: Bid CHF/HKD = Min (USD/HKD : USD/CHF) = Bid USD/HKD : Ask USD/CHF = 7,7515 : 1,1874 = 6,5218 Case 1: Formula: Ask CHF/HKD=Max (USD/HKD : USD/CHF) = Ask USD/HKD : Bid USD/CHF = 7,7585 : 1,1807 = 6,5711 Case 2: Given the available rates: GBP/USD = 2,0345/2,0415 EUR/USD= 1,4052/1,4152 Calculate cross rate: GBP/EUR GBP/EUR = GBP/USD : EUR/USD Case 2: Formula: Bid GBP/EUR = Min (GBP/USD : EUR/USD) = Bid GBP/USD : Ask EUR/USD = 2,0345 : 1,4152 = 1,4376 Case 2: Formula: Ask GBP/EUR=Max (GBP/USD : EUR/USD) = Ask GBP/USD : Bid EUR/USD = 2,0415 : 1,4052 = 1,4528 Case 3: Given the available rates: EUR/USD = 1,4052/1,4140 USD/HKD = 7,7515/7,7585 Calculate cross rate: EUR/HKD EUR/HKD = EUR/USD * USD/HKD Case 3: Formula: Bid EUR/HKD = Min (EUR/USD x USD/HKD) = Bid EUR/USD x Bid USD/HKD = 1,4052 x 7,7515 = Case 3: Formula: Ask EUR/HKD=Max (EUR/USD x USD/HKD) = Ask EUR/USD x Ask USD/HKD = 1,4140 x 7,7585 = Homework Given the available rates : GBP/USD = 2,0345/2,0415 USD/SEK = 6,4205/6,5678 USD/NOK = 5,3833/5,4889 USD/DKK = 5,2367/5,2410 EUR/USD = 1,4052/1,4140 USD/CHF = 1,1807/1,1874 USD/HKD = 7,7515/7,7585 Calculate the cross rate: GBP/NOK; GBP/EUR; EUR/HKD; HKD/SEK; HKD/CHF; CHF/EUR Type 2: ARBITRAGES 2.1 Locational Arbitrage 2.2 Triangle Arbitrage Locational Arbitrage (1) The process of buying a currency at the location where it is priced cheap and immediately selling it at another location where it is priced higher. (2) Condition for the locational Arbitrage The ask price in one location is < the bid price in the other location. (3) Realignment due to locational arbitrage drives prices to adjust in different locations so as to eliminate discrepancies. Local Arbitrage 17 Locational Arbitrage 18 Locational Arbitrage Bank A: GBP/USD = 2.0315/2.0355 GBP/EUR = 1.4388/1.4428 Bank B: USD/GBP = 0.4870/0.4910 USD/EUR = 0.7072/0.7116 Given this information, is locational arbitrage possible for GBP/USD, USD/EUR. Compute the profit from this strategy if you had $1 million to use. Locational Arbitrage Solution: GBP/USD Locational Arbitrage Solution: USD/EUR Bank A: Calculate the cross exchange rate USD/EUR Bid USD/EUR = Bid GBP/EUR : Ask GBP/USD = 1.4388 : 2.0355 = 0.7068 Ask USD/EUR = Ask GBP/EUR : Bid GBP/USD = 1.4428 : 2.0315 = 0.7102 Local Arbitrage Solution: USD/EUR Bank A: USD/EUR = 0.7068/0.7102 Bank B: USD/EUR = 0.7072/0.7116 => Conclusion: No arbitrage Triangle Arbitrage (1) Currency transactions in the spot market to capitalize on discrepancies in the cross exchange rates between two currencies. (2) Realignment due to triangle arbitrage forces exchange rates back into equilibrium. Triangle Arbitrage Example 1: Bank A: EUR/USD = 1.4052/40 Bank B: USD/CHF = 1.1807/74 Bank C: EUR/CHF = 1.6375/49 Given this information, is triangle arbitrage possible? Compute the profit from this strategy if you had $1 million to use. Triangle Arbitrage Solution: From Bank B & Bank C: Calculate cross exchange rate EUR/USD. Bid EUR/USD = Bid EUR/CHF : Ask USD/CHF = 1.6375 : 1.1874 = 1.3790 Ask EUR/USD = Ask EUR/CHF : Bid USD/CHF = 1.6449 : 1.1807 = 1.3931 Triangle Arbitrage Solution: Bank B&C: EUR/USD = 1.3790/1.3931 Bank A: EUR/USD = 1.4052/1.4140 SaskEUR/USD (Bank B&C) < Sbid EUR/USD (Bank A) => Conclusion: Buy EUR/USD from Bank B and C and Sell EUR/USD from Bank A Triangle Arbitrage Solution: 1/ Buy EUR/USD from Bank B and C a/ Convert USD to CHF through Bank B at Sbid USD/CHF = 1.1807 The amount of CHF: 1,000,000 * 1.1807 = CHF1,180,700 b/ Convert CHF to EUR through Bank C at Sbid CHF/EUR = 1/1.6449 = 0.6079 The amount of EUR: 1,180,700 * 0.6079 = EUR717,747.53 2/ Sell EUR/USD from Bank A Convert EUR to USD through Bank A at Sbid EUR/USD = 1.4052 The amount of USD: 717,747.53 * 1.4052 = USD1,008,578.83 Profit: USD8,578.83 Triangle Arbitrage Example 2: Bank A: EUR/USD = 1.4052/40 Bank B: USD/CHF = 1.1807/74 Bank C: EUR/CHF = 1.6375/49 Given this information, is triangle arbitrage possible? Compute the profit from this strategy if you had EUR 150,000 to use. Result: EUR 1,296.7025 Triangle Arbitrage Example 3: Bank A: EUR/USD=1,1255/75 Bank B: USD/CHF=1,5642/42 Bank C: EUR/CHF=1,7890/10 Given this information, is triangle arbitrage possible? Compute the profit from this strategy if you had CHF 500,000 to use. Result: CHF 3,924.5181 Type 3: Hedging Exposure Hedging Exposure to Payables Hedging Exposure to ReceivablesCHF 3,924.5181 Hedging Exposure Payables [1] Forward Hedge on Payables Long in a currency forward contract to purchase the amount of foreign currency needed to cover the payables at a specific exchange rate. Ex: Long position in a forward contract on EUR 100,000. The 1-year forward rate is EUR/USD = 1.2. The USD cost in 1 year: 100,000 * 1.2 = USD120,000 Hedging Exposure Payables [2] Call option Hedge on Payables Long in a currency call option to buy the foreign currency to pay the payables. Call option contract as following: - The size of contract: EUR 100,000 - Premium: EUR/USD = 0.03 - Exercise price: EUR/USD = 1.2 Hedging Exposure Payables [2] Call option Hedge on Payables Cost of call options based on currency forecast. Exercise price: USD1.2/EUR Pro Spot rate at T Premium Exercise Cost/EUR 0.2 EUR/USD=1.16 USD0.03 per EUR No EUR/USD=1.19 USD119,000 0.7 EUR/USD=1.22 USD0.03 per EUR Yes EUR/USD=1.23 USD123,000 0.1 EUR/USD=1.24 USD0.03 per EUR Yes EUR/USD=1.23 USD123,000 Expected total payment at time=T: Total Payment Hedging Exposure Payables [3] No Hedge Pro Spot rate at T Total Payment 0.2 EUR/USD=1.16 USD116,000 0.7 EUR/USD=1.22 USD122,000 0.1 EUR/USD=1.24 USD124,000 Expected total payment at time=T: 0.2*116,000 + 0.7*122,000 + 0,1*124,000 = USD121,000 Hedging Exposure Payables [4] Comparison of Techniques to Hedge Payables The cost of the forward hedge can be determined with certainty The currency call option hedge has different outcomes depending on the future spot rate at the time payables are due (1) Select optimal hedging technique (2) Choose optimal hedge versus no hedge for payables Hedging Exposure Payables Example 1: Assume that Loras Corp (CHF) imported goods from UK and needs GBP500,000 30 days from now. It considers 3 hedging techniques: (1) Long position in a forward contract on GBP500,000. (2) Long position in call option on GBP500,000. (3) No Hedge Given information: Forward rate: GBP/CHF =2.4276 Call options are available for a premium of CHF0.002 per GBP Exercise price: GBP/CHF = 2,4416 The forecasted spot rate GBP/CHF in 30 days follows: Future spot rate Probability GBP/CHF = 2.4400 20% GBP/CHF = 2.4416 50% GBP/CHF = 2.4476 30% Hedging Exposure Payables [1] Long position in a forward contract on GBP 500,000. The 30 days forward rate is GBP/CHF = 2.4276 The CHF cost in 30 days: 500,000 * 2.4276 = CHF 1,213,800 Hedging Exposure Payables [2] Call option Hedge on Payables Exercise price: CHF2.4416/GBP Pro Spot rate at T Premium Exe rcis e Cost/EUR Total Payment 0.2 GBP/CHF=2.4400 CHF0.002 per GBP No GBP/CHF=2.4420 CHF1.221.000 0.5 GBP/CHF=2.4416 CHF0.002 per GBP No GBP/CHF=2.4436 CHF1.221.800 0.3 GBP/CHF=2.4476 CHF0.002 per GBP Yes GBP/CHF=2.4436 CHF1.221.800 Expected total payment at time=T: Hedging Exposure Payables [3] No Hedge Pro Spot rate at T Total Payment 0.2 GBP/CHF=2.4400 CHF1.220.000 0.5 GBP/CHF=2.4416 CHF1.220.800 0.3 GBP/CHF=2.4476 CHF1.223.800 Expected total payment at time=T: 0.2*1.220.000 + 0.5*1.220.800 + 0,3*1.223.800 = CHF1.221.540 Conclusion: Long in position in a forward contract Hedging Exposure Payables Example 2: Assume that Earns Corp (SEK) imported goods from Swizerland and needs CHF500,000 90 days from now. It considers 3 hedging techniques: (1) Long position in a forward contract on CHF500,000. (2) Long position in call option on CHF500,000. (3) No Hedge Given information: Forward rate: CHF/SEK =5.0194 Call options are available for a premium of SEK0.001 per CHF Exercise price: CHF/SEK = 5.0260 The forecasted spot rate GBP/CHF in 90 days follows: Future spot rate Probability CHF/SEK = 4,9860 30% GBP/CHF = 5.0260 40% GBP/CHF = 5.1976 30% Hedging Exposure Receivables [1] Forward Hedge on Receivables Short a currency forward contract to sell the amount of receivables foreign currency at a specific exchange rate. Ex: Short position in a forward contract on CHF200,000. The 6-month forward rate is CHF/USD=0.71 The USD receipt in 6 months: 200,000 * 0.71 = USD142,000 Hedging Exposure Receivables [2] Put option hedge on receivables Long in a currency put option to sell the amount of receivables in foreign currency. Put option contract as following: - The size of contract: CHF200,000 - Premium: USD0.02 per CHF - Exercise price: CHF/USD=0.72 Hedging Exposure Receivables [2] Put option Hedge on Receivables Receipt from put options based on currency forecast: Pro Spot rate at T Premium Exercise Cost/EUR 0.3 CHF/USD=0.71 USD0.02 per CHF Yes CHF/USD=0.70 USD140,000 0.4 CHF/USD=0.74 USD0.02 per CHF No CHF/USD=0.72 USD144,000 0.3 CHF/USD=0.76 USD0.02 per CHF No CHF/USD=0.74 USD148,000 Expected total payment at time=T: 0.3*140,000 + 0.4*144,000 + 0,3*148,000 = USD144,000 Total Receipt Hedging Exposure Receivables [3] No Hedge Pro Spot rate at T Total Payment 0.3 CHF/USD=0.71 USD142,000 0.4 CHF/USD=0.74 USD148,000 0.3 CHF/USD=0.76 USD152,000 Expected total payment at time=T: 0.3*142,000 + 0.4*148,000 + 0.3*152,000 = USD147,400 Conclusion: No Hedge Hedging Exposure Receivables [4] Comparison of Techniques to Hedge Receivables The receipt from the forward hedge can be determined with certainty The currency put option hedge has different outcomes depending on the future spot rate at the time receivables are due (1) Select optimal hedging technique (2) Choose optimal hedge versus no hedge for receivables Hedging Exposure Receivables Example 1: Assume that Lamas Corp (CHF) exported goods to UK and receives GBP500,000 30 days from now. It considers 3 hedging techniques: (1) Short position in a forward contract on GBP500,000. (2) Long position in put option on GBP500,000. (3) No Hedge Given information: Forward rate: GBP/CHF =2.4276 Put options are available for a premium of CHF0.002 per GBP Exercise price: GBP/CHF = 2,4416 The forecasted spot rate GBP/CHF in 30 days follows: Future spot rate Probability GBP/CHF = 2.4400 20% GBP/CHF = 2.4416 50% GBP/CHF = 2.4476 30% Hedging Exposure Receivables [1] Short position in a forward contract on GBP 500,000. The 30 days forward rate is GBP/CHF = 2.4276 The CHF receipt in 30 days: 500,000 * 2.4276 = CHF 1,213,800 Hedging Exposure Receivables [2] Put option Hedge on Receivables Exercise price: CHF2.4416/GBP Pro Spot rate at T Premium Exe rcis e Cost/EUR Total Payment 0.2 GBP/CHF=2.4400 CHF0.002 per GBP Yes GBP/CHF=2.4396 CHF1.219.800 0.5 GBP/CHF=2.4416 CHF0.002 per GBP No GBP/CHF=2.4396 CHF1.219.800 0.3 GBP/CHF=2.4476 CHF0.002 per GBP No GBP/CHF=2.4456 CHF1.222.800 Expected total payment at time=T: Hedging Exposure Receivables [3] No Hedge Pro Spot rate at T Total Payment 0.2 GBP/CHF=2.4400 CHF1.220.000 0.5 GBP/CHF=2.4416 CHF1.220.800 0.3 GBP/CHF=2.4476 CHF1.223.800 Expected total payment at time=T: 0.2*1.220.000 + 0.5*1.220.800 + 0,3*1.223.800 = CHF1.221.540 Conclusion: No Hedge Hedging Exposure Receivables Example 2: Assume that Tucson Corp (USD) exported goods to New Zealand and receives NZD250,000 90 days from now. It considers 3 hedging techniques: (1) Short position in a forward contract on NZD250,000. (2) Long position in put option on NZD250,000. (3) No Hedge Given information: Forward rate: NZD/USD =0.4 Put options are available for a premium of USD0.03 per NZD Exercise price: NZD/USD =0.49 The forecasted spot rate NZD/USD in 90 days follows: Future spot rate Probability NZD/USD =0.44 30% NZD/USD =0.4 50% NZD/USD =0.38 20%