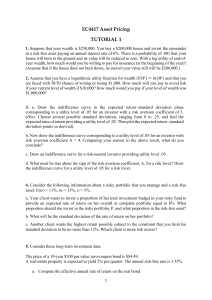

FINS5513 Lecture 2A Risk and Return and Risk Aversion Lecture Outline ❑ 2.1 Constructing An Investment Portfolio ➢ Portfolio Basics ➢ Themes in Portfolio Management (Active/passive, traditional/alternative, growth/value) ❑ 2.2 Measuring Return and Risk ➢ Return Measurement (HPR, APR, EAR) ➢ Measuring Expected Return (ex-ante and ex-post) ➢ Measuring Risk (ex-ante and ex-post) ➢ Sharpe Ratio ❑ 2.3 Risk Aversion and Investor Preference ➢ Distribution of returns ➢ Risk aversion (mean-variance criterion) ➢ Preference and utility (utility functions) ➢ Indifference curves 2 2.1 Constructing An Investment Portfolio FINS5513 Portfolio Basics FINS5513 4 What is a Portfolio? ❑ A combination of multiple assets and/or securities owned by an investor ➢ The aim of owning multiple assets is to achieve diversification ❑ We will be analysing assets/securities both individually as well as in the context of a portfolio ➢ Say an investor owns stocks A and B and wishes to add C • In an isolated approach, an investor would look at the benefits and costs of C individually • In a portfolio approach, an investor would compare the benefits and costs of portfolio A+B to portfolio A+B+C ❑ Investors construct portfolios to achieve diversification and avoid the risks of investing all their capital into a single asset ➢ As we will see, diversification allows investors to reduce risk without reducing the expected rate of return on a portfolio 5 The Investment Process ❑ The process of portfolio construction can be undertaken top-down or bottom-up ❑ Top-down portfolio construction ➢ Asset allocation – choosing between broad asset classes and determining what proportions of the portfolio should be invested in each asset class ➢ Top-down starts with asset allocation, then we decide which securities to hold in each asset class Video 2AV1: “Investopedia: Strategic Asset Allocation” ❑ Bottom-up portfolio construction ➢ Security selection – choosing which individual securities to hold within each asset class ➢ Construct portfolios from securities that are attractively priced with less concern for the resulting asset allocation ➢ May lead to being overweight or underweight certain sectors or security types Further Reading 2AR1: Various studies on asset allocation vs security selection 6 Themes in Portfolio Management FINS5513 7 Key Concepts ❑ Asset/fund managers are called the “buy-side” – they buy the services of sell-side firms such as broker/dealers who sell securities and provide research/recommendations to the buy-side ➢ A number of important buy-side themes will be explored ❑ Efficient markets ➢ Efficient markets price securities quickly and accurately incorporating all relevant information ➢ Are markets efficient in practice? ❑ Risk-return trade-off ➢ In efficient and competitive markets higher expected return should come with higher risk ➢ Does higher return always come with higher risk in practice? ❑ Active vs Passive management 8 Active vs Passive Management ❑ Active vs Passive management ➢ Active management – attempting to improve performance by identifying mispriced securities (through security analysis and security selection) • Active managers attempt to outperform a prescribed market benchmark such as the S&P500 or the ASX200 ➢ Passive management – holding diversified portfolios (little time spent on security selection) • Passive managers attempt to track a prescribed market benchmark such as the S&P500 or the ASX200 ➢ If markets are efficient, why bother with active management? • If an investor were to believe in efficient markets, the only important decision is asset allocation, not security selection ❑ There is a significant evidence that the majority of active fund managers underperform their benchmarks, and overall returns from actively managed funds lag wider stock indices Further Reading 2AR2: “SPIVA 2020 Scorecards” Video 2AV2: “Interview with Andrew Innes S&P on active vs passive performance” 9 Other Key Themes ❑ Traditional vs Alternative ➢ Traditional – long-only, unleveraged funds focused on equity, fixed income and/or balanced (multi-asset) asset classes • Charge management fees based on FUM ➢ Alternative – hedge funds, private equity, venture capital - often leveraged • Charge management fees based on FUM and performance fees (or “carried interest”) ❑ Growth vs Value ➢ Growth – focuses on early stage emerging companies whose growth is expected to significantly outperform wider industry trends. Often follows momentum and trends ➢ Value – concentrates on stocks that appear to be trading for less than their intrinsic value. Focuses on low P/E, low Price/Book, and high free cash flow stocks ➢ Traditionally, value stocks have provided higher returns than growth, however this trend appears to have reversed post GFC Further Reading 2AR3: “Where’s the value in value investing?” Video 2AV3: “Howard Marks’s thoughts on value vs growth investing” 10 Recent Trends ❑ Increase in passive investing due to lower cost and underperformance of active managers ❑ Increased variety and specialisation in ETFs eg thematic and factor based ETFs ❑ Increased use of high frequency trading and other quant methods using advanced statistical and programming based techniques ➢ Attempt to take advantage of very short-term anomalies in the market ❑ Wider use of new data sources such as: social media; imagery and sensor data (customer tracking, carpark monitoring, weather conditions etc); management psychological studies etc to guide investing ❑ Robo-advisors and other algorithm-driven financial planning digital platforms (with no or little human involvement) 11 2.2 Measuring Return and Risk FINS5513 Return Measurement FINS5513 13 Holding Period Return ❑ Investor returns from holding an asset come from two basic sources: ➢ Income received periodically such as interest (debt security) and dividends (equity security) ➢ Capital gains (or losses) from the price of the asset increasing (decreasing) ❑ Holding Period Return (HPR) is the return on an asset during the period it is held ➢ The holding period ends when the asset is sold or matures/expires (for finite life assets) Capital gain component 𝐻𝑃𝑅 = 𝑃𝑇 − 𝑃0 + 𝐼𝑇 𝑃0 Income component 𝑃0 = Price at the beginning of period T 𝑃𝑇 = Price at the end of period T 𝐼𝑇 = Total income received over the holding period T (eg interest, coupons, dividends) ❑ Example 2A1: You buy a share for $75 and sell it 9 months later for $84. It paid a div of $2.25: ➢ P0 = 75 PT = 84 IT = 2.25 𝐻𝑃𝑅 = 84 −75+2.25 75 = 0.15 = 𝟏𝟓% 14 APR and EAR ❑ ❑ The HPR gives the total return over the holding period without regard to the time period We can annualise the HPR in two ways: ➢ Assuming simple interest – we call this the Annualised Percentage Rate (APR) ➢ Assuming compound interest – we call this the Effective Annual Rate (EAR) ❑ Assume: T = holding period expressed in years (eg T=2 for 2-year hold; T=0.25 for 3 months; T=5.5 for 5 years and 6 months) ❑ Annualized percentage rate (APR) 𝐴𝑃𝑅 = ❑ 𝐻𝑃𝑅 𝑇 Effective Annual Rate (EAR) 𝐸𝐴𝑅 = 1 + 𝐻𝑃𝑅 1/T -1 15 APR and EAR ❑ ❑ The EAR accounts for compounding interest, not just simple interest (ie “interest on interest”) ➢ If compounding is annual: EAR = APR (at year end) ➢ If compounding is more frequent then annual: EAR > APR (at year end) The relationship between EAR and APR is given by: 𝐴𝑃𝑅 = 1+𝐸𝐴𝑅 𝑇 𝑇 −1 ❑ Yields are quoted as APRs for short-term bills/bonds (often called the bond equivalent yield) ❑ EAR is used to compare returns on investments with different time horizons ❑ Example 2A2: You invest $10,000 in a fund. With income reinvestment, your investment is worth $16,000 after 4 years. Calculate the HPR and EAR. From your EAR calculate the APR HPR = ➢ ➢ EAR = (1.6)1/4 – 16,000 −10,000+0 10,000 = 0.60 = 60% 1 = .1247 = 12.47% p.a. and APR = 1.1247 4 4 −1 = 15% p.a. = 0.60 / 4 Excel 2AE1: “2A - HPR, APR and EAR Calculations” 16 Other Return Calculations ❑ Gross vs net return – with regard to fund manager returns, refers to whether the fund’s return is before fees and charges (gross return) or after fees and charges (net return) ❑ Real vs nominal return – refers to whether the return is adjusted for inflation (real) or unadjusted for inflation (nominal) ❑ After-tax vs pre-tax return – refers to whether taxes have been deducted from the return (after-tax) or the return is before taxes (pre-tax) ❑ Unleveraged vs leveraged return – where the investor borrows money, unleveraged returns are calculated before deduction of interest expenses while leveraged returns are calculated after deduction of interest expenses ❑ Absolute vs relative return – refers to the raw return of a fund (absolute) or the return compared to the fund’s benchmark index return (relative) 17 Measuring Expected Return FINS5513 18 Expected Return: Ex-Ante ❑ The reward from an investment is its return ➢ Since returns are generally uncertain (or “stochastic”) we deal with expected returns ❑ On a forward-looking basis under uncertainty, we form return expectations. Ex-ante analysis is expectations-based analysis before an event ➢ Ex-ante analysis attempts to place probabilities on possible future scenarios ❑ Expected return 𝐸(𝑟) on an ex-ante basis is given by: 𝐸 𝑟 = σ𝑠 𝑝 𝑠 × 𝑟(𝑠) p(s) = Probability of a scenario r(s) = Return if a scenario (s) occurs ❑ r(s) can be thought of as the expected return if a particular scenario occurs 19 Expected Return: Ex-Ante ❑ Example 2A3: After extensive simulations, Quant Fund has determined that the distribution of returns for Walmart (WMT) in different probability weighted economic future scenarios is given by: Economic Scenario ➢ Scenario Probability Scenario Return Boom 0.25 38.0% Growth 0.50 14.0% Flat 0.20 -7.5% Recession 0.05 -32.0% The expected return 𝐸(𝑟) is the probability weighted return: 𝐸(𝑟) = (.25)(.38) + (.50)(.14) + (.20)(−.075) + (0.05)(−.32) 𝐸(𝑟) = .1340 or 13.40% Excel 2AE2: “2A – Calculating Ex-Ante & Ex-Post ER, Var & SD” 20 Expected Return: Ex-Post ❑ Estimating expected returns by projecting future scenarios can have a high level of forecasting error ❑ Therefore, expected return is often estimated using the average (or mean) historical (backward-looking or ex-post) sample rates of return, denoted 𝒓ത by using the formula: 𝑟ҧ = 1 𝑛 σ𝑛𝑡=1 𝑟𝑡 𝑟𝑡 = Return at time t ❑ Example 2A4: Quant Fund analysed 10-year historical returns for WMT as shown: WMT Returns ➢ 2020 2019 2018 2017 2016 2015 23.3% 30.2% -3.4% 46.5% 16.0% -26.6% 2014 2013 2012 2011 11.9% 18.2% 17.0% 13.9% The expected return can be estimated from the historical average return 𝑟ҧ : 𝑟ҧ = (.233 + .302 −.034 + .465 + .16 − .266 + .119 + .182 + .17 + .139) / 10 𝑟ҧ = .147 or 14.70% 21 Measuring Risk FINS5513 22 What is Risk? ❑ We seek to maximise return because return maximises wealth ➢ However, we seek return in a world of uncertainty ➢ Under uncertainty, we face risk ❑ In finance, risk refers to the possibility that realised outcomes differ (better or worse) from expectation ➢ We seek not to avoid risk, but to incorporate it appropriately into decision making ❑ ❑ Think of return as the “reward” and risk as the “cost” of that reward So, how do we measure risk? ➢ In a quantitative sense, risk is a measure of the volatility of our returns ➢ So, how do we measure volatility? Video 2AV4: RB: “Why is risk - measured by volatility - a problem for fund managers?” 23 Risk: Ex-Ante ❑ Volatility is the sum of total (squared) deviations from our expectations ➢ This is known as the variance which on an ex-ante basis is given by: 𝜎 2 = σ𝑠 𝑝 𝑠 [𝑟 𝑠 − 𝐸 𝑟 ]2 ➢ To return to original units (rather than squares), we use the Standard Deviation: 𝜎= ❑ 𝜎2 Example 2A5: Determine the standard deviation for Quant Fund’s ex-ante analysis of WMT ➢ Step #1 – Derive 𝐸(𝑟) = 13.40% ➢ Step #2 – Take the actual return in each scenario and subtract 𝐸(𝑟) ➢ Step #3 – Square the difference ➢ Step #4 – Multiply each scenario’s squared differences by its probability and sum them: 𝜎 2 = .25(.38 −.134)2 + .50(.14 −.134)2 + .20(− .075 −.134)2 + .05(−.32 −.134)2 = 0.034 ➢ Step #5 – Standard deviation is the square root of the variance: 𝜎 = 0.034 = 𝟏𝟖. 𝟒𝟗% 24 Risk: Ex-Post ❑ We can also use historical (ex-post) data to estimate the risk ❑ When conducting ex-post (backward-looking) analysis, each historical data point is considered equally likely and therefore we do not probability weight them. However, we divide by n – 1 (rather than n) to account for estimation error as 𝒓ത is only an estimation of 𝐸(𝑟) ❑ The unbiased standard deviation estimate 𝜎ො is given by: 𝜎ො = ❑ σ𝑛 𝑡=1 𝑟𝑡 − 𝑟ҧ 2 𝑛−1 Example 2A6: Determine the standard deviation for Quant Fund’s ex-post analysis of WMT ➢ 𝜎 ො 2 = [ (.233 - .147)2 + (.302 - .147)2 + (−.034 - .147)2 + (.465 - .147)2 + (.16 - .147)2 + (−.266 - .147)2 + (.119 - .147)2 + (.182 - .147)2 + (.17 - .147)2 + (.139 - .147)2 ] / 9 = 0.3386 / 9 = 0.0376 ➢ 𝜎ො = 0.0376 = 𝟏𝟗. 𝟒𝟎% Excel 2AE2: “2A – Calculating Ex-Ante & Ex-Post ER, Var & SD” 25 Sharpe Ratio FINS5513 26 Reward to Volatility (Sharpe) Ratio ❑ Now that we have quantified return and risk individually, how do we relate the risk/reward relationship in one measure? ➢ Divide return (the “reward”) by risk (the “cost”) and state it as a ratio ➢ This reward-to-risk ratio is often called the Sharpe ratio ❑ We often look at the “excess return” above the risk-free rate, rather than the total return ➢ This is because part of the return can be earned for no risk by investing in a risk-free asset ➢ On a forward looking basis we often refer to the expected excess return above the risk-free rate for a risky asset as the Risk Premium ❑ The Sharpe Ratio is given by: Sharpe ratio for security i : 𝑆𝑖 = 𝐸 𝑟𝑖 − 𝑟𝑓 𝜎𝑖 𝑟𝑓 = risk-free rate 𝐸 𝑟𝑖 − 𝑟𝑓 = Risk premium for security i 𝜎𝑖 = Standard deviation of excess returns for security i 27 The Importance of the Sharpe Ratio ❑ ❑ The Sharpe ratio measures return per unit of risk. The higher the Sharpe ratio - the higher the incremental return received per unit of risk ➢ In other words, the higher the Sharpe ratio the better (the more attractive the investment) ➢ As the Sharpe ratio is straight forward to calculate and easy to interpret, it is one of the most widely used appraisal measures for assessing risk against reward • However, within a portfolio context it does have limitations which we will explore later Example 2A7: Determine the Sharpe ratio for both Quant Fund’s ex-ante and ex-post analysis of WMT. Assume a risk-free rate of 3.0% ➢ Ex-ante: SWMT = .1340 − .03 = 0.562 .1849 ➢ Ex-post: 𝑆መ WMT = .1470 − .03 = 0.603 .1940 Further Reading 2AR4: “The Sharpe Ratio Broke Investors’ Brains” 28 2.3 Risk Aversion and Investor Preference FINS5513 Distribution of Returns FINS5513 30 Which Fund is Preferred? ❑ Consider two funds: All Weather (AW) and Traditional Portfolio (TP) ➢ AW and TP have the same expected return 𝐸(𝑟) of 10%, but which would you choose? Probab ility 0.2 s AW =5% AW A 0.15 0.1 TPB 0.05 s TP =10% 0 0 5 10 15 20 Retu rn (%) E( r AW) = E (rTP) = 10% ❑ TP has a much wider dispersion of returns - as reflected in the higher 𝜎 31 Which Fund is Preferred? ❑ ❑ ❑ Assume both fund returns are normally distributed Let’s say we are judging both funds by the probability they will make a negative return ➢ Probability AW will return less than 0%: Prob(rAW < 0%) = N[(0% - 10%) / 5%] = N(-2.0) = 2.3% A negative return is 2 standard deviations from the mean which has a probability of 2.3% ➢ Probability TP will return less than 0% Prob(rTP<0%) = N[(0% - 10%) / 10%] = N(-1.0) = 15.9% A negative return is 1 standard deviation from the mean which has a probability of 15.9% TP Fund is riskier - risk averse investors would prefer AW 32 Normal Distributions ❑ ❑ Investment management is simplified when returns (which are uncertain) are approximated as a normal distribution: ➢ Normal distribution assumes returns are symmetric around the mean ➢ Under symmetric returns, standard deviation is an effective measure of risk ➢ Future return probabilities can be estimated using only mean and standard deviation ➢ Interdependence of returns between securities can be estimated by their correlations If returns are not normally distributed, standard deviation is no longer a complete measure of risk and we must also consider skewness and kurtosis Further Reading Skew Kurtosis 2AR5: “How ‘Tail Risk’ changes over the market cycle” Video 2AV5: “Nassim Taleb - What is a "Black Swan?” 33 Risk Aversion FINS5513 34 Mean-Variance Criterion ❑ ❑ Mean-variance analysis requires the mean and standard deviation of returns ➢ We graph expected return (y-axis) against standard deviation (x-axis) The Mean-Variance Criterion states: Portfolio A dominates portfolio B if: E (rA ) E (rB ) and* sA sB * At least one inequality must be strict to rule out indifference Expected Return 2 1 4 3 ➢ 2 dominates 1 - higher return ➢ 2 dominates 3 - lower risk ➢ 4 dominates 3 - higher return Variance or Standard Deviation 35 Risk Aversion ❑ Modern Portfolio Theory rests on the assumption investors are risk averse: ➢ Risk averse investors follow the mean-variance criterion – for the same level of 𝐸(𝑟), they will choose the asset with the lowest risk ➢ Risk neutral investors judge assets solely by their 𝐸 𝑟 and are indifferent to risk ➢ Risk seekers prefer higher levels of risk ❑ Historical market returns show there is a risk premium in the market (indicates risk aversion): ➢ Since 1926, U.S. risk-free assets (1-month T-bills) returned ~3.4% annually while risky assets (US stocks) returned ~11.7% – resulting in a ~8.3% risk premium with 𝜎 = 20.4% ➢ Market takes additional risk only for a commensurate return – indicating risk aversion ❑ What happens when return increases with risk? ➢ Individual investors have different degrees of risk aversion ➢ It will depend on each investor’s individual risk-reward trade-off ➢ Hence the need to understand investor preference and utility Further Reading 2AR6: “Australian Investor Study 2020” Figures 20, 22, 48, 49, 52-55 36 Preference and Utility FINS5513 37 Preference and Utility ❑ Utility is a measure of satisfaction / welfare / happiness of an investor ❑ When an investor prefers Asset A over Asset B, we say that Asset A provides the investor with greater utility ❑ In order to work with preferences mathematically, we use utility functions ➢ A utility function assigns a value to each outcome so that preferred outcomes get higher utility values ❑ For simplicity, the fundamental assumption in finance is that utility is derived from wealth ➢ We assume that the more money an investor has, the better their ability to achieve preferred outcomes ➢ Therefore, in finance: • More is better – maximise return which maximises wealth • More certainty is better – risk aversion 38 Logarithmic Wealth Utility Function ❑ A common specification of the wealth utility function is U(W) = ln(W) The logarithmic expression results in a concave function ➢ The concavity indicates that the incremental utility we gain from increases in wealth is less than the utility we lose from equivalent decreases in wealth ➢ The concavity captures risk aversion – risk averse investors would not take a 50/50 bet 4.5 Utility curve 4 3.5 Wealth level: average of A and B Wealth level B: 41 3 Utility ❑ 2.5 2 Average utility from A and B 1.5 1 0.5 Wealth level A: 1 0 1 11 21 31 41 Wealth 39 Risk-Reward Trade-off ❑ Choosing the preferred asset when one dominates is straight forward ❑ But what about where no asset dominates? Fund Expected Return Risk Premium (rf = 5%) Risk σ Low-Risk 7.0% 2.0% 5.0% Medium-Risk 9.0% 4.0% 10.0% High-Risk 13.0% 8.0% 20.0% ❑ In the example, return increases but so does risk (all funds have the same Sharpe ratio) ❑ Each portfolio receives a utility score indicating the investor’s risk/return trade-off ❑ The portfolio with the highest utility score is preferred 40 Utility Function ❑ What is a reasonable method for determining a utility score? ❑ As wealth is dependent on risk and return, we derive a utility function based on risk and return ❑ For investments, we assume a quadratic utility function: U = E ( r ) − 1 As 2 2 U = Utility A = Coefficient of risk aversion (a constant) ½ = A scaling factor ❑ For a risk-free asset, U = r, as r is a known constant and 𝜎2 = 0 ➢ Therefore, what is the meaning of the utility score U for a risky investment? • It is the risk-free rate which would result in an investor being indifferent between the riskfree asset and a risky investment with the same utility score – often called the certainty equivalent return 41 Estimating Risk Aversion ❑ ❑ ❑ For each individual investor, the unique element in the utility function is the value of A So how do we estimate an individual’s risk aversion coefficient? ➢ Often depends on life cycle and personality type ➢ Questionnaires ➢ Discussion with broker/advisor ➢ Observe how much people are willing to pay to avoid risk ➢ Observe individuals’ decisions when confronted with risk • Would you take $100 for certain or flip of a coin for $200 Note that the higher the risk aversion coefficient A the more risk averse the investor: ➢ ➢ Conservative investors have high risk aversion coefficients Aggressive investors have low risk aversion coefficients Further Reading 2AR7: “Wealth Management Risk Profile Questionnaire” 42 Example: Applying the Utility Function ❑ Example 2A8: Three investors are analysing the Low-Risk, Medium-Risk and High-Risk funds from earlier. For an Aggressive investor, the risk aversion coefficient A = 2.0; Moderate investor A = 3.5; Conservative investor A = 5.0. Which fund would each investor choose? ➢ Replace the risk aversion coefficients and fund return and risk into each utility function. Then rank each fund based on its utility score: Investor ❑ Risk Aversion A Low Risk Fund Utility Score E(r) = 7% σ = 5% Medium-Risk Fund Utility Score E(r) = 9% σ = 10% High-Risk Fund Utility Score E(r) = 13% σ = 20% Aggressive 2.0 .07 – ½ x 2.0 x .052 = .0675 .09 – ½ x 2.0 x .12 = .0800 .13 – ½ x 2.0 x .22 = .090 Moderate 3.5 .07 – ½ x 3.5 x .052 = .0656 .09 – ½ x 3.5 x .12 = .0725 .13 – ½ x 3.5 x .22 = .060 Conservative 5.0 .07 – ½ x 5.0 x .052 = .0638 .09 – ½ x 5.0 x .12 = .0650 .13 – ½ x 5.0 x .22 = .030 Aggressive investor chooses the High-Risk fund, the others choose the Medium-Risk fund ➢ Risk aversion doesn’t mean the investor doesn’t take risk – rather it means the investor puts a higher price (return) on taking risk. For example: even the conservative investor does not pick the Low-Risk fund 43 Indifference Curves FINS5513 44 Indifference Curves ❑ We can illustrate our preferences through indifference curves ➢ Plotted in the risk-return (𝐸 𝑟 − 𝜎) space that connect points giving equal utility ➢ For example, to draw the indifference curve for U = 10%, choose all asset portfolio combinations of E(r) and σ which yield a utility score of 10% ➢ ➢ Graphical representation of the utility function. Called an Indifference “Curve” because the utility function is a quadratic equation Note that two indifference curves with different utility levels never intersect U = 25% ❑ U = 20% E(r) U = 15% U = E(r) – ½* A*σ2 = 10% σ Indifference curves for riskaverse (A > 0) investors are upward sloping 45 How to Plot an Indifference Curve ❑ Each plot point on an indifference curve represents a risk and return combination which provides the same utility score ❑ Example 2A9: For an Aggressive investor with risk aversion coefficient A=2, and a Conservative investor with A=5, plot two indifference curves with U=0.03 and U=0.09 ➢ ➢ Given a specific value of A, indifference curves above and to the left offer higher utility than lower curves and don’t intersect More risk averse investors (A) have steeper indifference curves (higher E(r) for each increase in 𝜎) A=5 is steeper than A=2 Certainty equivalent return. Plot first. Higher Utility Excel 2AE3: “2A – Indifference Curves” Video 2AV5: “How to plot a simple Indifference Curve” 46 Next Lecture ❑ BKM Chapter 6 and 7 ❑ 2.4 Introduction to Modern Portfolio Theory (MPT) ❑ 2.5 Optimal Risky Asset Portfolio Construction 47