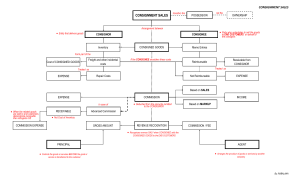

Homework - Consignment Arrangement (due on May 16, 2023) Instructions: Use columnar paper with 2 columns for your answers. Journal entries must be in good form. A. On October 1,2022, Super Trouper Co. shipped 50 cordless phone sets to Contreras on consignment, the sets to be sold at an advertised price of P2,000. The cost of each set to the consignor was P1,000. The cost of shipment paid by the consignor was P750. The consignor agreed to absorb consignee’s expenditures for cartage and also to allow the consignee P100 for delivery and installation of each set. Commission is to be 25% of sales price. On October 31, Contreras submitted the following summary of consignment sales: CONSIGNOR (1) (2) (3) (4) (5) (6) 50 cordless phone sets, costs P1,000 each set = P50,000 Freight P750 Consignor agreed to absorb consignee’s expenditures for cartage P1,000 Also to allow the consignee P100 for delivery and installation of each set P1,600 No entry on sale of goods Commission Expense 25% of P32,000 (16 sets sold x P2,000) = 8,000 Cash = Remittance Enclosed P5,000 Consignee Payable = 2,600 (no. 3+no.4) Consignment Sales revenue = P32,000 CONSIGNEE (1) (2) (3) (4) (5) (6) Memorandum Entry No entry Consignor Receivable, Cash Same as no. 3 Sale of goods for the consignor Dr Cash, Consignor Payable Consignor Payable Commission Revenue Consignor Receivable Cash Sets received Sets sold Sets returned to consignor (defective) Date Oct. 1-31 Particulars Sales: 16 sets @P2,000 Charges: Cartage in Commission Delivery & installation cost Balance 50 16 4 Amount 15,000 P 1,000 8,000 1,600 10,600 P 21,400 Remittance enclosed Balance owed (collections from customers not 5,000 P 16,400 yet made) REQUIRED: 1. Give the journal entries in the books of the consignor assuming profit is determined separately. 2. Give the journal entries in the books of the consignee assuming profit is determined separately. 3. Compute for the following: a. Consignment profit for October. b. Inventory on consignment as of October 31. B. Triumph Co. consigned 8 heavy equipment to Champion Co. Each equipment cost P1,000,000 and has a suggested retail price of P2,100,000. Triumph paid P200,000 in transporting the equipment to the consignee’s place of business. At the end of the period, Champion reported 3 unsold equipment and remitted the collections on sales during the period, after deducting the following: Commission (based on sales net of commission)------------20% Finder’s fee (based on commission)------------------------------5% Delivery, installation and testing (on each unit sold)-----P50,000 Materials generated from the testing were sold for P5,000 and included in the remittance to Triumph Co. REQUIRED: Compute for the following: 1. Consignment profit 2. Net remittance to the consignor 3. Cost of unsold equipment