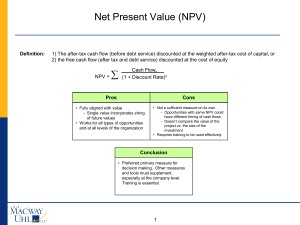

Net Present Value (NPV) Definition: 1 1) The after-tax cash flow (before debt service) discounted at the weighted after-tax cost of capital, or 2) the free cash flow (after tax and debt service) discounted at the cost of equity NPV = Cash Flown (1 + Discount Rate)n Pros Cons • Fully aligned with value - Single value incorporates string of future values • Works for all types of opportunities and at all levels of the organization • Not a sufficient measure on its own - Opportunities with same NPV could have different timing of cash flows - Doesn’t compare the value of the project vs. the size of the investment • Requires training to be used effectively Conclusion • Preferred primary measure for decision making. Other measures and tools must supplement, especially at the company level. Training is essential. Profitability Index Ratio (PI) Definition: PI = Present Value of Cash Inflows Present Value of Cash Outflows Pros Cons • Aligned with value • Single value that incorporates string of future values • Works for all opportunities at all levels • Not sufficient on its own: - Opportunities with same PI could have different timing of cash flows and capital - Cannot determine project scale - Ranking on PI breaks down when more than one resource is rationed or when resources are rationed for multiple yrs • Requires education and experience to use effectively Conclusion • A useful auxiliary measure for prioritizing projects in a capital constrained environment. Requires that NPV be calculated. 2 Internal Rate of Return (IRR) Definition: 3 Discount rate at which an investment’s NPV equals zero. If IRR exceeds the opportunity cost of capital for a company, then an investment should be undertaken. Cash flows are assumed to be reinvested at the rate of return. Pros Cons • Aligned with value • Single value incorporates string of future values • Works for all opportunities at all levels • Doesn’t necessarily have a unique solution • Projects could have the same IRRs but different timings of cash flow • Doesn’t compare the value of the project vs. the size of the investment • Difficult to include risk • Requires education and experience to use effectively Conclusion • Can be used for decisionmaking, but NPV is a superior measure because of the calculational issues associated with IRR Definition: Cash Flow Return on Investment (CFROI) 4 Essentially a form of IRR. CFROI is an efficiency measure that compares cash flows with the total assets employed to generation those flows. CFROI = Cash Flow + Non-Depreciating Assets - Inflation Adjusted Gross Assets where Cash Flow = Net Income + Depreciation/Amortization Expense + Interest Expense + Minority Interest + Rental Expense +/- Holding Gains (Losses) - FIFO Profits Non-Depreciating Assets = Cash + Land + Accounts Receivable + Inventory Inflation Adjusted Gross Assets = Book Assets + Accumulated Depreciation + Gross Plant Inflation Adjustment + Inflation Adjusted LIFO + Operating Leases - Non-Debt Monetary Liabilities Pros Cons • Aligned with value • Single value incorporates string of future values • Works for all opportunities at all levels • Doesn’t necessarily have a unique solution • Projects could have the same CFROIs but different timings of cash flow • Doesn’t compare the value of the project vs. the size of the investment • Difficult to include risk • Requires education and experience to use effectively Conclusion • Can be used for decisionmaking, but NPV is a superior measure because of the calculational issues associated with CFROI Economic Value Added (EVA) Definition: 5 An approximation of value creation over a specified period. The NPV of EVA estimates is the same as the NPV of cash flow. EVA = NOPAT - After-tax Cost of Capital Employed to Produce NOPAT = (Rate of Return - Cost of Capital) * Capital = Operating Profit - (Cost of Capital * Capital) Pros Cons • PV of EVAs is equivalent to NPV • Shows actual $$$ added to company value (vs. % increase) • Not well aligned with long-term value: - Single year measure - Can lead to short-run focus - Does not recognize value of reserves • Can be made complicated with adjustments • Not cash based Conclusion • Could be used as a short-term value indicator. Would be a candidate as a long-term value indicator if measure were modified to include reserves. Return on Assets (ROA) Definition: 6 Rate of return earned on the total capital invested in the firm without regard to whether that capital is called debt or equity. Reflects the fundamental earning power of the company before it is confounded by differences in financing strategies. Measures profit as a percent of total assets. EBIT * (1 - Tax Rate) Total Assets ROA = Pros Cons • Can be tailored for company/ division/business unit levels with some adjustments • Useful for learning purposes • Can be measured “real-time” • Short-term focus only • Does not recognize value of reserves • Return measure, so doesn’t convey $ value of value delivered • Not comparable across assets (different assets will have different ROAs) Conclusion • Useful for learning on mature assets, but not solely appropriate for real-time monitoring of value creation and delivery because it lacks a long-term balance. Return on Equity (ROE) Definition: 7 Estimate of the earnings per dollar of invested equity capital or, alternatively, the percentage return to owners on their investment in the firm. ROE = Net Income - Preferred Dividends Book Value of Shareholder’s Equity Pros Cons • Easy to calculate • Uses book rather than market value of shareholder’s equity, thus is not distorted due to market conditions • Does not work below the corporate level • Backwards looking measure that cannot serve as an indicator of future value creation • Return measure, so doesn’t convey $ value of value delivered • Ignores return on debt capital Conclusion • Not appropriate for decisionmaking because measure does not work below the corporate level Return on Net Assets (RONA) Return on Capital Employed (ROCE) Definition: Measures the efficiency with which a company allocates and manages its resources. RONA/ROCE = EBIT * (1 - Tax Rate) Total Assets - Current Liabilities Pros Cons • Can be tailored for company/ division/business unit levels with some adjustments • Useful for learning purposes • Can be measured “real-time” • Short-term focus only • Does not recognize value of reserves • Return measure, so doesn’t convey $ value of value delivered • Not comparable across assets (different assets will have different RONAs) Conclusion • Useful for learning on mature assets, but not solely appropriate for real-time monitoring of value creation and delivery because it lacks a longterm balance. 8 Total Shareholder Return (TSR) Definition: Annual measure of stock appreciation TSR = Year-end Stock Price - Initial Stock Price + Dividends Initial Stock Price Pros Cons • Aligned with long-term value creation • Easy to measure on a real-time basis if company is public • Can be affected by market conditions not attributable to a company’s performance, particularly in the short term • Only allows for corporate level measurement Conclusion • Not appropriate for business monitoring because market effects can dwarf company effects in the short-term. Measure also does not work below the company level. 9 Market Value Added (MVA) Definition: 10 Measure of the company’s gross market value less the cumulative capital investment made to date. Should be equivalent to NPV. MVA = # Shares Outstanding * Current Share Price + Outstanding Debt - Historical Capital Invested = PV of all Future EVAs (theoretically) Pros Cons • Easy to calculate if company is public • Can be affected by market conditions not attributable to a company’s performance, particularly in the short term • Only allows for corporate level measurement Conclusion • Not appropriate for business monitoring because market effects can cloud performance. • Cannot be used below the company level.