Process Costing Sample Problem: Assembly & Finishing

advertisement

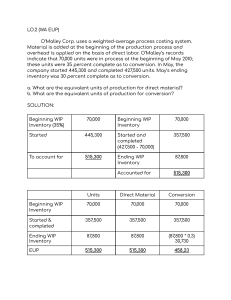

PROCESS COSTING SAMPLE PROBLEM adapted from Cost Accounting Foundations and Evolutions, 8 th edition by Michael R. Kinney and Cecily A. Raiborn Chapter 6 (Process Costing) page 238 Plaid-Clad manufactures golf bags in a two-department process: Assembly and Finishing. The Assembly Department uses weighted average costing; the percentage of completion of overhead in this department is unrelated to direct labor. The Finishing Department adds hardware to the assembled bags and uses FIFO costing; overhead is applied in this department on a direct labor basis. For June, the following production data and costs were gathered: Assembly Department: Units Beginning WIP Inventory (100% complete for DM; 40% complete for DL; 30% complete for OH) Units started Ending WIP Inventory (100% complete for DM; 70% complete for DL; 90% complete for OH) 250 8,800 400 Assembly Department: Costs Beginning WIP Inventory Current period Total costs DM $ 3,755 100,320 $104,075 DL $ 690 63,606 $64,296 OH $ 250 27,681 $27,931 Finishing Department: Units Beginning WIP Inventory (100% complete for transferred in; 15% complete for DM; 40% complete for conversion) Units transferred in Ending WIP Inventory (100% complete for transferred in; 30% complete for DM; 65% complete for conversion) Total $ 4,695 191,607 $196,302 100 8,650 200 Finishing Department: Costs Beginning WIP Inventory Current period Total costs Transferred In $ 2,176 188,570 $190,746 DM $ 30 15,471 $15,501 Conversion $ 95 21,600 $21,695 Total $ 2,301 225,641 $227,942 Required: 1. Prepare a cost of production report for the Assembly Department. 2. Prepare a cost of production report for the Finishing Department. 3. Prepare T-accounts to show the flow of costs through the Assembly and Finishing Departments. 4. Prepare the journal entries for the Finishing Department for June. ___________________________________________________ Adapted from Cost Accounting Foundations and Evolutions, 8 th edition by Michael R. Kinney and Cecily A. Raiborn Chapter 6 (Process Costing) page 238