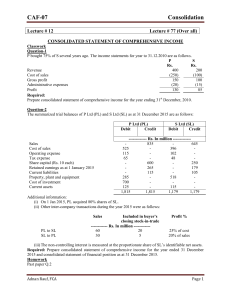

IFRS 10 The objective of the IFRS 10 is the establishment of principles for preparing and presenting financial statements in the context of the control of one or several other entities by an entity. [IFRS 10:1] In these Regulations, Yashili and its subsidiaries are collectively referred to as the “Group”. Recognition Based on IFRS 10, the scope of consolidated financial statements should be recognized on a control basis. Investors determine whether a company is a parent company by evaluating whether it controls one or more investees. From the perspective of control requirements, investors have sufficient power in an investment. The existing rights of investors are directly related to the ability given to their current activities and connections, or the right to receive returns from their investment objects. In addition, the invested entity can use its power to influence investors' returns. From the date when the parent company obtains control over the subsidiary, the parent company must submit consolidated financial statements for investors to evaluate the risk and return situation of the merged entity. The consolidated financial statements must focus on the company as an independent economic entity, rather than the ownership of shareholders. The merging entity itself, the controlling shareholders and non-controlling shareholders are considered as two independent groups, each holding equity in the merging entity. Therefore, the consolidated financial statements need to eliminate the impact of intra group transactions between group entities and be restated annually. In addition, in consolidated financial statements, non-controlling interests (NCI) occurs when one or more subsidiaries are not wholly owned by the parent company. The reporting entity attributes each component of profit or loss and other comprehensive income to the owner and NCI of the parent company. Reporting entities also attribute total comprehensive income to owners and NCI of the parent company. Therefore, the parent company should report NCI in its consolidated statement of financial position in the form of equity, separate from the equity of the parent company's owners. Presentation The consolidated financial statements of the Group treat the assets, liabilities, equity, revenues, expenses and cash flows of the parent company and its subsidiaries as a single economic entity. Consolidated financial statements shall fairly reflect the Group's financial position, operating results, and cash flows. The Group financial statements disclose a consolidated income statement, a consolidated income statement, a consolidated statement of financial position, a consolidated statement of changes in equity and a consolidated statement of cash flows, which include items from subsidiaries and the parent company. Yashili fully complies with the provisions of IFRS 10 regarding subsidiaries. In Note 2, the annual report introduces that Yashili's subsidiary is able to control the group when the group has access to or the right to receive variable returns from its participation in investment activities and has the ability to exercise its power to influence and receive returns. Measurement The entity shall include in the consolidated financial statements the income and expenses of the subsidiary from the date on which it acquires control until the date on which the entity ceases to control the subsidiary. The revenues and expenses of subsidiaries are based on the amounts of assets and liabilities recognized in the consolidated financial statements at the date of acquisition. In addition to being prepared in accordance with IFRS 10, Yashili's consolidated financial statements are adjusted based on historical cost management to better align them with Company policies in Note 2.1. Meanwhile, Yashi uses different measurement methods for different accounting items, such as equity method, amortized cost method, etc. Disclosure The following information shall be disclosed in the notes to the consolidated financial statements: (1) Information of the subsidiaries The name of the subsidiary, the nature of its business, the shareholding ratio of the parent company and the voting rights of the subsidiary become the reasons for the establishment of the subsidiary. According to the information disclosed by the group in Note 1, Yashili holds 100% direct equity in Yashili (BVI) and 100% indirect equity in more than a dozen subsidiaries such as Yashili (HK). Yashili has complete control over these entities. (2) Transactions with Related Parties In Note 35(a), Yashili disclosed transactions with related parties and transactions with significant investors and affiliated companies, namely, purchase and sale of commodities, as well as service fees, leasing income, etc. (3) Balances with Related Parties In Note 35(a), Yashili disclosed the balances of related parties, including accounts receivable, advances, other accounts receivable and other assets, trade payables and notes, and other payables and accrued expenses. (4) NCI In the consolidated statement of comprehensive income (Note 41), NCI is presented separately. In the consolidated statement of comprehensive income, the total comprehensive income is also attributed to the company's owners and NCI, respectively. Comprehensive income is distributed among retained earnings and is a part of equity.