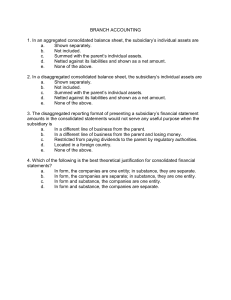

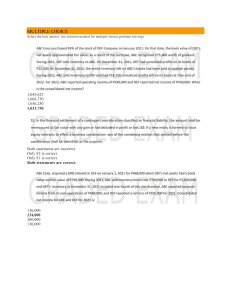

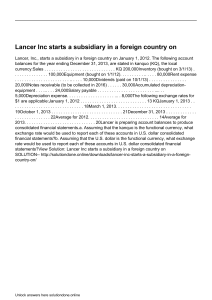

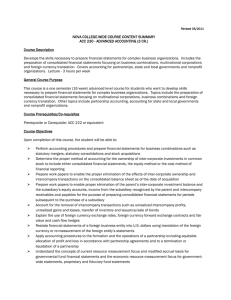

lOMoARcPSD|12076918 Advanced Accounting I Business Combination Subsequent TO DATE OF Acquisition Bachelor of Science in Accountancy (University of Saint Louis) Studocu is not sponsored or endorsed by any college or university Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Disclaimer: This handout is not meant to replace the prescribed book of the college. No part of this handout may be reproduced or sold for personal gain without permission from the preparers but may be reproduced for academic purposes only. Special thanks are dedicated to all of the professors and students, in the UST-AMV College of Accountancy, and to God. Preparers: Edilmar R. Fontanilla, CPA Mark Stephen A. Asido, CPA Sources: IFRS 3 – Business Combination IFRS 10 – Consolidated Financial Statements IAS 39 – Financial Instruments, Recognition and Measurement IFRS 9 – Financial Instruments Intermediate Accounting vol. 2 – Empleo and Robles Advanced Accounting vol. 2 – Dayag Theory of Accounts vol. 2 - Valix UST-AMV College of Accountancy Professors ADVANCED ACCOUNTING I – BUSINESS COMBINATION STOCK ACQUISITION – TRANSACTIONS SUBSEQUENT TO ACQUISITION KEY POINTS TO CONSIDER: The preparation of consolidated financial statements at the date the acquirer company (parent) acquires more than 50% of the stock of the acquired company (subsidiary) is not different when preparing consolidated financial statements subsequent to acquisition, except for the fact that there are transactions between the parent and the subsidiary occurred after the acquisition date, which were already recorded in their books. Transactions between the two entities must eliminated when preparing consolidated financial statements because, although they are legally viewed as separate entities, they are economically viewed as one entity. The transactions between the parent and subsidiary are eliminated only in the working papers for consolidation purposes. Those transactions remain in their respective separate books. The parent’s control of the subsidiary due to the stock acquisition is the main reason why there are items in the separate statement of comprehensive income, which will be shared by both the controlling interest and the non-controlling interest. If the result of the business combination is goodwill and the NCI has its share on the total goodwill (full goodwill approach), the share of the controlling and non-controlling interest for further impairment of goodwill may not be always based on the control percentage acquired by the acquirer (parent). In intercompany profit transactions, there are two types of sale of assets, namely, upstream or downstream sales. In upstream sale, the selling affiliate is the subsidiary, while in downstream sale, the selling affiliate is the parent. It is very important to know what type of intercompany profit transactions occur between the parent and the subsidiary because it will greatly affect the consolidated net income attributable to the controlling and non-controlling interest. If the sale is upstream, the controlling interest will have to share in such adjustment to the subsidiary’s net income equivalent to the control % of the parent because those adjustments will affect the net income of the subsidiary, of which was already shared between the controlling interest and non-controlling interest. Page 1 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination If the sale is downstream, only the consolidated net income attributable to the controlling interest will be affected because those items will only affect the net income of the parent. For the preparation of the consolidated financial statements, in the working paper: The investment in subsidiary account of the parent is eliminated. The equity (ordinary shares, additional paid-in capital, retained earnings, etc) of the subsidiary is eliminated. Assets and liabilities of the subsidiary are updated to their fair values less any subsequent amortization in excess of the fair value over the books, or plus the amortization of excess of book value over the fair value, if any, and if applicable. Non-controlling interest in net assets (NCINAS) of the subsidiary is established representing the percentage of ownership of subsidiary not acquired, if the not whollyowned by parent plus the consolidated net income attributable to subsidiary, less any dividends declared to shareholders other than the parent. All the of the intercompany transactions between the parent and subsidiary are eliminated because in their consolidated financial statements, they are viewed as one economic entity. In business combination problems, the following items must be considered (and mostly asked in the problems) Consolidated sales Consolidated cost of goods sold consolidated Net income of the Consolidated gross profit subsidiary (NCINIS) Consolidated operating expenses Consolidated dividend income Consolidated net income (CNI) Consolidated net Non-controlling interest in the Non-controlling interest in the net assets of the subsidiary income Consolidated stockholder’s equity attributable to parent (CNI-P) THE CONSOLIDATED NET INCOME ATTRIBUTABLE TO PARENT AND NCI The consolidated net income of the parent includes the net income of the parent, the net income of the subsidiary from the date of acquisition, any adjustments to their net income such as adjustment for the depreciation expense previously recognized already in the books of subsidiary, all intercompany transactions that resulted to a gain or loss, or declaration of dividends, profit arising from the intercompany sale of inventories, and the impairment of goodwill that arose only from the business combination, if any. In other words, it is basically the combination of their revenues, expenses, gains, losses, and other income earned and incurred only from the unaffiliated companies and individuals. Table 2.1 –Consolidated net income attributable to controlling and non-controlling interest ITEMS IN THE INCOME STATEMENT PARENT NCI Net income of the parent per books xx Net income of the subsidiary per books xx xx (xx) (xx) liabilities of subsidiary xx xx Intercompany dividends (xx) (xx) Impairment of goodwill** (xx) (xx) Amortization of excess of fair over book value of assets and liabilities of subsidiary Amortization of excess of book over fair value of assets and Page 2 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Gain on acquisition** xx Unrealized (gain) / loss in the sale of plant assets (upstream)* (xx) / xx (xx) / xx Realized gain / (loss) in the sale of plant assets (upstream)* xx / (xx) xx / (xx) Unrealized (gain) / loss in the sale of plant assets (downstream)* (xx) / xx Realized gain / (loss) in the sale of plant assets (downstream)* xx / (xx) Unrealized profit in ending inventory (UPEI) – upstream* (xx) / xx Unrealized profit in ending inventory (UPEI) – downstream* (xx) Realized profit in the beginning inventory (RPBI) – upstream* xx Realized profit in the beginning inventory (RPBI) – downstream* xx Adjusted net income for consolidated income statement (xx) / xx XX xx XX *not included in the quiz 5 for advanced accounting I subject **there can be only one result of the business combination. Gain on acquisition is included only in the consolidated net income in the year of acquisition only. ITEMS IN THE CONSOLIDATED NET INCOME Net income of the parent per books - it is the net income based on the separate financial statements of the parent. Remember that this item is fully attributable to controlling interest only. Net income of the subsidiary per books - it is the net income based on the separate financial statements of the subsidiary. For consolidation purposes, the parent has a share of the of its net income based on the percentage of ownership of stocks owned by the parent and what is attributable to subsidiary is the percentage of ownership attributable to the non-controlling interest. Amortization of excess in fair over book value / book over fair value of assets and liabilities of the subsidiary - these items pertain to the increases or decreases in assets and liabilities of the subsidiary not recorded in the books of the subsidiary but recognized in the working paper for consolidated financial statements at the date of acquisition. In the books of the subsidiary, some of the expenses (CGS, depreciation, amortization, etc.) included in the net income of the subsidiary are based on the book values of subsidiary’s assets and liabilities. Thus, these expenses are either understated or overstated, because for consolidation purposes, these expenses must be based on their fair values relevant to the reporting period. This is the reason why there is an additional amortization for consolidation purposes. The following are the common items that are mostly revalued at the date of acquisition and how are they being amortized for consolidation: Depreciable assets (PPE, intangibles, investment property accounted for at cost model, leased assets) – the difference between the fair value and the book value shall be amortized based on the remaining useful life from the date of acquisition because the excess pertains to the overstatement (book over fair) or understatement (fair over book) of the depreciation expense being included in the net income of the subsidiary. Table 2.2 – amortization of excess – depreciable assets Amortization Working paper entries of excess of depreciable assets Reason for adjustment Year of acquisition Subsequent years Page 3 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination FAIR VALUE > Dep. Expense BOOK VALUE xx Accumulated dep. xx Retained earnings xx Depreciation is Depreciation exp. xx understated because depreciation in Accumulated dep. xx books is the recorded based on the book value of depreciable asset FAIR VALUE < Accumulated dep. BOOK VALUE xx Accumulated dep. Depreciation expense xx xx Depreciation is Depreciation expense xx overstated because Retained earnings depreciation in xx books is the recorded based on the book value of depreciable asset Non-depreciable assets (land, inventories, intangibles with indefinite useful life) – the excess of the fair over book, or book over fair values shall only be amortized if already sold to the outside parties. The excess shall be considered in the consolidated net income, because when those items are already sold to the outside parties, the gain or loss (for non-depreciable non-current assets), or the cost of goods sold pertaining to the inventories revalued at the date of acquisition, are either overstated or understated, thus, amortizing these excess amounts will bring them to their correct amount for consolidated financial statements. If there is a partial sale of those assets mentioned above, the excess to be amortized must be proportionate only to the sold assets (e.g. if 20% of inventories sold during the year, 20% of the total excess must be amortized.) Table 2.3 – amortization of excess – -non-depreciable assets Working paper entries Subsequent years (if there Amortization of excess of inventory Year of acquisition are inventories already Reason for existing at DOA still unsold adjustment as of the end of the year of acquisition FAIR VALUE > CGS BOOK VALUE xx inventory xx CGS (pertains to last pertains to the excess year CGS xx BOOK VALUE xx CGS xx attributable to portion of acquisition inventory existed at (pertains to last the date of acquisition Year CGS xx CGS xx inventory of the NCI, date Inventory FAIR VALUE < inventory is understated, Consolidated RE the which was already sold xx xx CGS is overstated, CGS xx pertains to the excess Consolidated RE xx attributable NCI xx portion to of the the inventory existed at Page 4 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination the date of acquisition which was already sold Intercompany dividends - these arise because when the subsidiary declares a dividend, a major part of it are received by the parent company, or when there are shares of stock of the parent owned by the subsidiary, the latter as well received dividends from the parent. The controlling interest portion of the dividends declared by subsidiary is deducted from the consolidated net income attributable to the controlling interest because it was included as an income of the parent in the books. Also, retained earnings of the subsidiary is credited in the amount of dividends received by the parent from the subsidiary in the working paper because the balance of the retained earnings of the subsidiary was already affected by the subsidiary’s dividend declaration. Dividends declared for subsidiary’s other shareholders (also represented by the non-controlling interest), will be accounted for as a deduction in the NCINAS in the equity portion of the parent in the consolidated financial statements. Table 2.4 – intercompany dividends Dividends Working paper entries Reason for adjustment Dividend income xx Dividend NCI xx recorded by parent at the date of declaration of the declared by subsidiary RE – subsidiary xx income eliminated represents income subsidiary. The portion of NCI represents dividend declared by subsidiary to other shareholders. The effect of dividend declaration to the retained earnings because it must appear that the subsidiary only declares dividends to other shareholders at the date of declaration. Impairment of goodwill - goodwill is not amortized, but is tested for impairment annually. If the parent company determined that the goodwill arising from the business combination is impaired, the impairment shall be allocated proportionately on the basis on the share of the controlling interest and the NCI on the goodwill at the date of acquisition, if the acquisition resulted in goodwill and the fair value of the NCI at the date of acquisition is based only on fair value of the NCI (given or approximated based on the cost of investment of parent), which is higher than proportionate share of NCI in the net assets of the subsidiary (minimum amount of NCI). In short, the subsidiary will only share in the impairment of goodwill if there is a part of goodwill allocated to the NCI at the date of acquisition (full goodwill approach). It must be noted, however, that if the parent already has goodwill before the date of acquisition, then its impairment is already reflected in the separate books in the parent, and is solely attributable to the controlling interest, as it arose from a different transaction before the acquisition. The following table summarizes how the goodwill will be allocated between the CI and NCI. Table 2.5 – summary of allocation of impairment goodwill between CI and NCI How NCI was measured at the date Allocation of goodwill of acquisition Estimated FV Controlling and non-controlling percentage or share of CI and NCI in goodwill Page 5 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Given fair value share of CI and NCI in goodwill Proportionate FV Goodwill impairment is fully attributable to CI To illustrate, PARIS CAT corporation acquired 80% of the stocks of SURFER CAT corporation for 3,500,000 on January 1, 2016. At the date of acquisition, the fair value of the net assets of Surfer cat corporation amounted to 4,000,000. During the year, goodwill is tested for impairment and PARIS CAT corporation determined it has been impaired by 27,000. Case 1: NCI is measure at fair value, no fair value of the non-controlling interest provided. In this case, NCI will be measured at its estimated fair value of 875,000, since it is higher than the proportionate fair value of NCI amounting to 800,000. The business combination resulted to a goodwill of 375,000 ((3,500,000 / 80%)-4,000,000). Also, because the estimated FV of NCI is higher than its proportionate amount, the NCI will share in the subsequent impairment of goodwill. Note that the share of CI and NCI in the goodwill is the same as the percentage of ownership controlled by the parent. Thus, if the fair value of NCI is based on estimated FV, the impairment loss to be attributable to the controlling interest is equal to the percentage of ownership of the parent. Table 2.6 – allocation of the impairment of goodwill to controlling and non-controlling interest Allocation of Goodwill to controlling and non- Working Paper Entries controlling interest DATE OF CI ACQUISITION Cost of assets TOTAL 3,500,000 875,000 4,375,000 (3,200,000) (800,000) (4,000,000) 300,000 75,000 375,000 investment FV of net NCI GOODWILL SUBSEQUENT Share of controlling interest in the goodwill Goodwill 375,000 Investment In subsidiary 300,000 NCI 75,000 Impairment loss 27,000 TO DATE OF impairment Goodwill ACQUISITION Controlling interest: 27,000 27,000 x (300/375) = 21,600 Non-controlling interest 27,000 c (75/375) = 5,400 Case 2: NCI is measure at fair value; the fair value of the non-controlling interest is 750,000. In this case, the fair value of the non-controlling interest is lower than its proportionate fair value, thus, the fair value given cannot be used because the non-controlling interest must be recorded at its proportionate fair value based on the fair value of the net assets of the subsidiary, at a minimum. Thus, the goodwill of 300,000 must be attributable only to the controlling interest because the NCI is recorded at minimum amount. Table 2.7 – goodwill attributable to the controlling interest only Allocation of Goodwill to controlling and non- Working Paper Entries controlling interest DATE OF CI ACQUISITION Cost of investment NCI 3,500,000 TOTAL 800,000 4,300,000 Goodwill 300,000 Investment In subsidiary 300,000 Page 6 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination FV of net assets (3,200,000) (800,000) (4,000,000) 300,000 0 300,000 GOODWILL SUBSEQUENT Share of controlling interest in the goodwill Impairment loss 27,000 TO DATE OF impairment Goodwill ACQUISITION Controlling interest: 27,000 27,000 Non-controlling interest: 0 Case 3: NCI is measure at fair value; the fair value of the non-controlling interest is 860,000. In this case, since the fair value of NCI is higher than the proportionate FV (850,000 > 800,000), the NCI will be recorded at fair value, resulting to goodwill of 350,000, both attributable to controlling and non-controlling interest, since the reflected NCI in the consolidated financial statement is higher that its minimum amount (proportionate FV). Note that the allocation of goodwill to both controlling and non-controlling interest must be based on the goodwill allocated to CI and NCI at the date of acquisition. In contrast to the case 1, The ownership % cannot be used because the fair value of NCI is based on cost of investment of the acquirer (parent) to the acquire (subsidiary). Table 2.8 – allocation of the impairment of goodwill to controlling and non-controlling interest Allocation of Goodwill to controlling and non- Working Paper Entries controlling interest DATE OF CI ACQUISITION Cost of investment FV of net assets GOODWILL NCI TOTAL 3,500,000 860,000 4,360,000 (3,200,000) (800,000) (4,000,000) 300,000 60,000 360,000 SUBSEQUENT Share of controlling interest in the goodwill TO DATE OF impairment Goodwill 360,000 Investment In subsidiary NCI 60,000 Impairment loss 27,000 Goodwill ACQUISITION Controlling interest: 300,000 27,000 27,000 x (300/360) = 22,500 Non-controlling interest 27,000 x (60/360) = 4,500 Intercompany sale of plant assets. Any gain or loss on sale of those assets of the selling affiliate are unrealized until those assets are either depreciated or sold to the outside parties, and must be eliminated in the working paper in the net income of the selling affiliate, and recognized as realized on the consolidated net income of the parent when depreciated or sold to outside parties. The realization of gains and losses depends whether the plant assets are non-depreciable (land), or depreciable (e.g. machinery, equipment). Also, the whether the parent will share in the adjustment to the net income of the subsidiary and such adjustment is fully attributable to parent only will depend if the sale is upstream or downstream sale. In intercompany sale of land, because land is not depreciated over time, any unrealized gains or losses from the intercompany sale of land remains unrealized until sold to outside parties. In intercompany sale of depreciable assets, the unrealized gains and losses are eliminated in the working paper, and such gains or loss is realized in the net income periodically based on Page 7 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination remaining useful life from the date of sale in the form of adjusting depreciation expense and accumulated depreciation in the working paper, in order to bring the depreciation expense and accumulated depreciation to the amount based on the carrying amount of the equipment of the selling affiliate as if no sale was occurred between the two parties, and as if the selling affiliate is still the owner of the said depreciable asset. If the realized gain or losses is not adjusted, the resulting depreciation expenses in the consolidated income statement is either understated (loss on sale) or overstated (gain on sale). Table 2.9 – intercompany sale of plant assets Working paper entries Intercompany Result sale of plant of Year of Subsequent to the assets sale acquisition year of acquisition Unrealized gain xx Land xx Retained earnings xx Land Reason for adjustment Unless sold to unaffiliated parties, there xx should be no gain to be recognized and the working paper entry restores the GAIN land to its carrying value before the sale. LAND Land xx Land Unrealized loss xx xx Retained earnings xx LOSS Accu. Dep. xx Unrealized gain xx Dep. asset GAIN xx Accu dep. Dep. asset Accu. Dep ASSETS xx Either gain or loss, the first entry at the Dep. expense xx year of acquisition restores the carrying Retained earnings xx amount of depreciable asset as if no sale has occurred and as if the selling xx Dep. expense DEPRECIABLE Accu. Dep. Unrealized affiliate is the owner. The second xx xx Dep. expense xx Retained earnings xx gain Accu. Dep. entry adjusts the depreciation expense xx and accumulated depreciation to the xx amount as if no sale has occurred between the affiliates. However, when xx that depreciable asset is already sold to LOSS Dep. expense Accu. Dep. xx unaffiliated companies, the remaining xx unrealized gain or loss must be recognized in the working paper in the year that sale occurred. Intercompany sale of inventories - subsequent to acquisition date, there may be intercompany sale of inventories between the affiliated parties (parent and subsidiary) of which the inventory of the buying affiliate includes profit from sale of the selling affiliate. Those profits must be eliminated for consolidation purposes until the inventory from the selling affiliate is sold to unaffiliated companies and individuals. By eliminating these profits as well as intercompany sale of inventory, in the consolidated financial statements: (1) the consolidated sales and cost of goods sold will include only sales and cost of goods sold to unaffiliated parties; and (2) the inventory balance to be included by the buying affiliate in the consolidated financial statements will include only cost of inventory to the selling affiliate (either parent or subsidiary). Also, like in the intercompany sale of plant assets, any profit recorded in the books Page 8 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination of the selling affiliate will only be realized when the inventory coming from the selling affiliate has been sold to unaffiliated parties. Intercompany Sale of inventories between the affiliated parties may be upstream (subsidiary to parent), downstream (parent to subsidiary), or horizontal sales (subsidiary to another subsidiary). However, for consolidation purposes, only downstream or upstream sales are of concern by the consolidating entity such that the determination of upstream or downstream sale may affect the consolidated net income attributable to the controlling and non-controlling interest. If the sale is upstream Two items are of concern of the consolidating parent in intercompany transactions: Unrealized profit in ending inventory (UPEI) – These are the profits of the selling affiliate included in the unsold inventory of the buying affiliate which previously arose from the intercompany sale. What is eliminated in the working paper is the profit from the inventories coming from the selling affiliate such that those profits are reverted to being unrealized. Because of higher inventory ending balance of the buying affiliate to the unrealized profit, the cost of goods sold in its books is understated. It can be adjusted by debiting CGS and crediting inventory in the working paper. Realized profit in the beginning inventory (RPBI) - These are the profits of the selling affiliate included in the beginning inventory (overstating the total goods available for sale) of the buying affiliate which was previously eliminated in the working paper, because the related inventory was unsold in the year of intercompany sale. Those profits are already recognized in the books of the selling affiliate in the year of intercompany sale, but for consolidation purposes, those profit must be only recognized in the consolidated net income in the year the inventories coming from the selling affiliate are already sold to outside parties. Table 2.9 summarizes the intercompany sale of inventories, their adjustments to consolidated financial statements, and summarized rationale for the accounting treatment for those items. It must be noted that when the sale is upstream sale, both the controlling and non-controlling interest will share in such adjustment because it is the profit of the subsidiary. If such sale is downstream sale, only the controlling interest’s share in the consolidated net income will be adjusted, because it is the profit of the parent. However, whether downstream of upstream sale, there is no need to allocate such adjustment of CNI-P and NCINIS to determine the consolidated net income. Table 2.10 – intercompany sale of inventories Inter- Adjustments of selling affiliate’s profit to comp P/L or to B/S accounts in the working any Working paper sale of entries invent paper CGS CNI -ories To eliminate intercompany Reason for adjustment / Ending Retained inventory earnings the If there is no 1st entry, it has sale still transactions: Sales CGS UPEI explanation no effect consolidated xx net in the income, but both the consolidated xx sales and CGS is overstated To eliminate the profit add Deduct deduct N/A for consolidation purposes included in the ending because at the time of the inventory intercompany buying coming of the selling affiliate from the affiliate the recorded sales and the buying affiliate selling affiliate: CGS sale, recorded xx CGS in their respective books. Page 9 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Ending inventory xx The amount of profit to be eliminated in the 2nd entry is profit the / markup included by the selling affiliate to affiliate the its buying sale of inventories to the latter. To recognize the profit The realized profit must be included in the sold deducted from CGS because inventory in the books of the buying that was eliminated in the year of affiliate, when such inventory intercompany is sold to unaffiliated / transaction: Consolidated RE CGS outside parties, the profit xx has been included in its xx RPBI Deduct add N/A inventory, making the CGS deduct overstated. Consolidated RE is debited to avoid double counting of such realized profit as such profit (form of reduction to consolidated CGS) will eventually be closed to consolidated RE. THE CONSOLIDATED ITEMS IN THE CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED NET INCOME (CNI) ITEMS The following items appear in consolidated net income are revenues, expenses, gains, and losses after the necessary adjustments discussed earlier. In addition, accruals made Consolidated interest income Consolidated Sales Sales of the parent xx Interest Sales of the subsidiary xx parent (xx) Interest Intercompany sale Consolidated sales xx income of the income of the subsidiary Intercompany income Consolidated CGS CGS- parent xx Consolidated CGS - subsidiary xx income Intercompany sale interest interest (xx) xx Consolidated dividend income fair value over the book Dividend income - Parent value / (book value over Dividend xx/(xx) UPEI xx RPBI (xx) Consolidated CGS xx (xx) Amortization of excess of the fair value) of inventory xx xx income xx - subsidiary Intercompany dividends Consolidated income dividend xx (xx) xx Page 10 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Consolidated operating expenses (OPEX) OPEX- parent xx OPEX- subsidiary xx Consolidated loss on sale Amortization of excess of loss on sale of the parent fair value over the book loss value / (book value over subsidiary the fair value) of xx/(xx) depreciable assets Realized loss on the sale of xx depreciable assets Realized gain on the sale (xx) of depreciable assets Consolidated OPEX xx on sale of the Unrealized loss Consolidated gain on sale Gain on sale of xx the xx subsidiary Unrealized gain xx Consolidated interest expenses Interest expense of the parent Interest expense of the Intercompany Gain on sale of the parent xx (xx) subsidiary Consolidated Gain on sale xx interest expense Consolidated interest expense xx xx (xx) xx (xx) Consolidated gain on sale xx CONSOLIDATED BALANCE SHEET ITEMS The items in the consolidated balance sheet of the consolidating entity comprise of the balance sheet items in the books of both the parent and the subsidiary after all the adjustments discussed above which may affect the consolidated asset and liability accounts. Note that the investment in subsidiary account should be eliminated in the working papers, because, again, they are economically viewed as one entity. Aside from the adjustments mentioned above, some items below, if not eliminated in the working paper, may overstate or understate some items in the balance sheet. Intercompany receivables and payables. Intercompany receivables / payables arise when: the sales of the selling affiliate to the buying affiliate are on credit or on account in the ordinary course of business (accounts receivable / accounts payable, notes receivable / payable – trade, advances to suppliers / advances from customers); when either of the affiliate grants a loan to the other affiliate not in the ordinary course of business (notes receivable / payable – non-trade); when there are accrued interest arising from the notes (interest receivable / payable). The intercompany receivable is the amount remained unpaid by the debtor affiliate to the creditor affiliate as of the balance sheet date. It must be also eliminated because if not eliminated, it will overstate both the total assets and liabilities in the consolidated balance sheet. Generally, the entry to eliminate intercompany receivables and payables are as follows: Payables Receivables xx xx Page 11 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Consolidated Cash Consolidated depreciable assets* Cash of the parent xx Depreciable asset, net of Cash of the subsidiary xx the parent Consolidated Cash xx Depreciable asset, net of the subsidiary receivables of the subsidiary Intercompany receivables Intercompany xx xx (xx) book value / (book over fair value) of depreciable asset of subsidiary at the date of acquisition xx / (xx) dividend receivables Consolidated receivables xx Excess of the fair over Consolidated Receivables Receivables of the parent xx (xx) Amortization of excess of xx (fair over book value) / book over fair value of depreciable assets of the Consolidated inventory Inventory of the parent xx subsidiary inventory of the subsidiary xx (Unrealized gain) / (xx) / xx Excess of the fair over unrealized loss book value / (book over Realized gain / (realized fair value) of inventory of loss)** subsidiary at the date of acquisition (xx) / xx xx / (xx) Consolidated depreciable xx / (xx) assets xx Amortization of excess of *applies to building, machinery, equipment, (fair over book value) / intangibles with definite useful life, investment property accounted for at cost model, and other depreciable assets **in the form of lower depreciation expense for realized gain, and higher depreciation expense for the realized loss book over fair value of inventory of subsidiary UPEI Consolidated inventories (xx) / xx (xx) xx Consolidated land land of the parent xx Land of the subsidiary xx Consolidated Goodwill Goodwill of the parent Excess of the fair over before book value / (book over combination fair value) of land of Goodwill arising from the subsidiary at the date of acquisition xx / (xx) the business xx business combination Impairment of goodwill Amortization of excess of arising from the business (fair over book value) / combination book over fair value of Consolidated goodwill land of the subsidiary UPEI Consolidated land (xx) / xx (xx) xx xx (xx) xx Note: goodwill of the subsidiary should be eliminated in the working paper because it is not identifiable unlike other intangible assets of the subsidiary and it does not have fair value. Page 12 of 13 Downloaded by Kilua (amari.lgp@gmail.com) lOMoARcPSD|12076918 Junior Philippine Institute of Accountants Discussion Review in Advanced Accounting Business Combination Consolidated liabilities Consolidated SHE Liabilities of the parent xx Ordinary and preference Liabilities of the subsidiary xx shares of the parent Intercompany payables (xx) Dividend payable to the parent (xx) Consolidated liabilities xx Consolidated RE RE, beginning* xx CNI - Parent xx Dividends declared Consolidated RE, end (xx) xx *if it is the year of acquisition, the consolidated RE after the business combination at the date of acquisition. xx Additional paid-in capital of the parent xx Consolidated RE, end xx NCINAS, end xx Items in OCI of the parent xx Consolidated SHE xx Consolidated Assets Total assets of the parent Total assets of xx the subsidiary xx Investment in subsidiary (xx) Goodwill of the subsidiary (xx) Goodwill arising from the business combination, net Non-controlling interest in the Net Assets of the subsidiary (NCINAS) of accumulated impairment loss, if the result NCINAS, beg* xx goodwill NCINIS xx Unrealized (gain) / loss in Dividends declared the sale of plant assets (excluding dividends to be received by parent) NCINAS, end is xx (xx) / xx Realized gain / (loss) in the (xx) xx *if it is the year of acquisition, the NCINAS after the business combination at the date of acquisition. sale of plant assets xx / (xx) Unrealized profit in ending inventory (UPEI) (xx) Excess of fair over book value / (book over fair value of assets) xx / (xx) Amortization of excess of fair over book value / (book over fair value) of assets of subsidiary Intercompany receivables Consolidated Assets (xx) / xx (xx) xx Page 13 of 13 Downloaded by Kilua (amari.lgp@gmail.com)