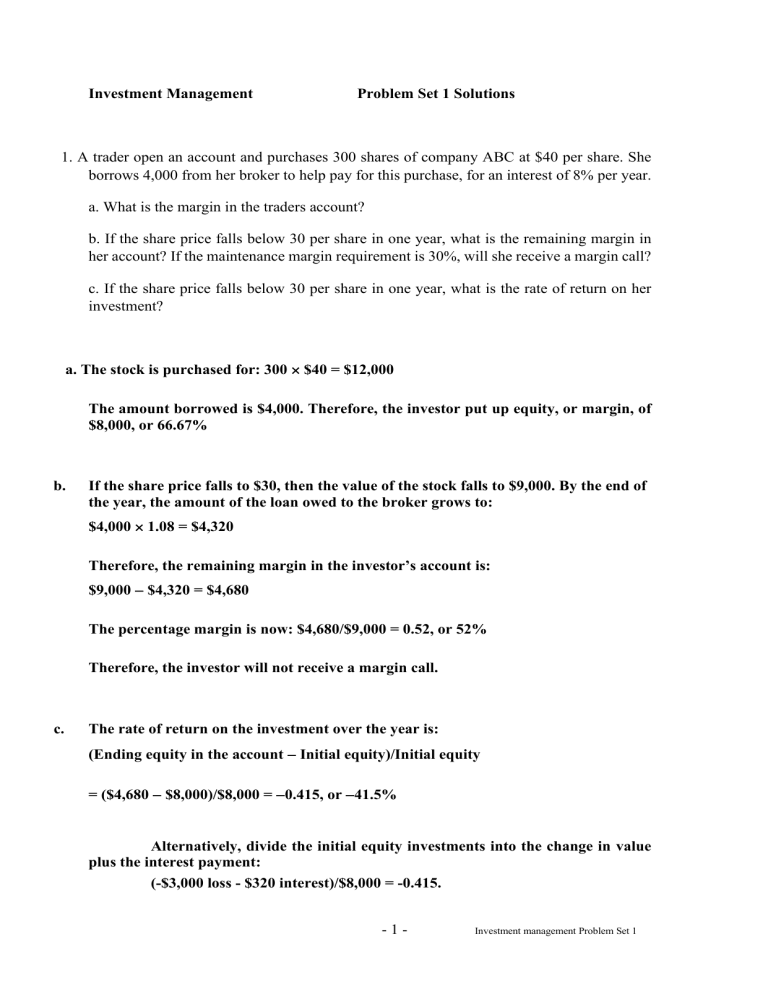

Investment Management Problem Set 1 Solutions 1. A trader open an account and purchases 300 shares of company ABC at $40 per share. She borrows 4,000 from her broker to help pay for this purchase, for an interest of 8% per year. a. What is the margin in the traders account? b. If the share price falls below 30 per share in one year, what is the remaining margin in her account? If the maintenance margin requirement is 30%, will she receive a margin call? c. If the share price falls below 30 per share in one year, what is the rate of return on her investment? a. The stock is purchased for: 300 $40 = $12,000 The amount borrowed is $4,000. Therefore, the investor put up equity, or margin, of $8,000, or 66.67% b. If the share price falls to $30, then the value of the stock falls to $9,000. By the end of the year, the amount of the loan owed to the broker grows to: $4,000 1.08 = $4,320 Therefore, the remaining margin in the investor’s account is: $9,000 − $4,320 = $4,680 The percentage margin is now: $4,680/$9,000 = 0.52, or 52% Therefore, the investor will not receive a margin call. c. The rate of return on the investment over the year is: (Ending equity in the account − Initial equity)/Initial equity = ($4,680 − $8,000)/$8,000 = −0.415, or −41.5% Alternatively, divide the initial equity investments into the change in value plus the interest payment: (-$3,000 loss - $320 interest)/$8,000 = -0.415. -1- Investment management Problem Set 1 2. Suppose that Xtel is currently selling at $20 per share. You buy 1,000 shares using 15,000 of your own account, borrowing the remainder from your broker at a rate of 8% per year. a. What is the percentage change of the net worth of your broker account if the price of XCtel changes immediately to $22, $20 or $18 per share? b. If the maintenance margin is 25%, how low can Xtel’s price fall in one year before you receive a margin call? c. Suppose that after one year that price of Xtel is $22 per share. What is the rate of return on your investment? What is Xtels price after one year was $18 or $20 per share? The total cost of the purchase is: $20 1,000 = $20,000 You borrow $5,000 from your broker and invest $15,000 of your own funds. Your margin account starts out with equity of $15,000. a. Note that because the change of price is immediate, you do not need to pay interest on your loan. (i) Equity increases to: ($22 1,000) – $5,000 = $17,000 Percentage gain = $2,000/$15,000 = 0.1333, or 13.33% (ii) With price unchanged, equity is unchanged. Percentage gain = zero (iii) Equity falls to ($18 1,000) – $5,000 = $13,000 Percentage gain = (–$2,000/$15,000) = –0.1333, or –13.33% The relationship between the percentage return and the percentage change in the price of the stock is given by: % return = % change in price Total investment = % change in price 1.333 Investor' s initial equity For example, when the stock price rises from $20 to $22, the percentage change in price is 10%, while the percentage gain for the investor is: % return = 10% $20,000 = 13.33% $15,000 -2- Investment management Problem Set 1 This of course is due to the amplifying effect of leverage b. The value of the 1000 shares is 1,000P. Equity is (1,000P – $5,400). You will receive a margin call when: 1,000 P − $5,400 = 0.25 when P = $7.20 or lower 1,000 P Note that this calculation is for one year after the investment, where the interest on the loan kicks in and you owe your broker 5000*1.08=5,400. If you want to do the calculation immediately after the investment, you only owe 5000, so the answer is 6.67 or lower. c. By the end of the year, the amount of the loan owed to the broker grows to: $5,000 1.08 = $5,400 The equity in your account is (1,000P – $5,400). Initial equity was $15,000. Therefore, your rate of return after one year is as follows: (i) (1,000 $22) − $5,400 − $15,000 = 0.1067, or 10.67% $15,000 (ii) (1,000 $20) − $5,400 − $15,000 = –0.0267, or –2.67% $15,000 (iii) (1,000 $18) − $5,400 − $15,000 = –0.1600, or –16.00% $15,000 The relationship between the percentage return and the percentage change in the price of Xtel is given by: Funds borrowed Total investment − 8% % return = % change in price Investor' Investor' s initial s initial equity equity For example, when the stock price rises from $40 to $44, the percentage change in price is 10%, while the percentage gain for the investor is: $20,000 $5,000 10% =10.67% − 8% $15,000 $15,000 -3- Investment management Problem Set 1 3. Suppose that the average annual return earned by owing stock ABC over a period of time is 10%. Its market beta is 0.75, and the average annual return on the market index over the same period was 6%. The risk-free rate is 2% per year. What is the “abnormal” return of this company according to the CAPM? According to the CAPM this company should offer an annual return of 𝟐% + 𝟎. 𝟕𝟓 × (𝟔% − 𝟐%) =5%. The actual average return is 10%, so we can estimate the abnormal return as 10%5%=5%. In other words this stock has earned an average return that is by 5% higher according to its systematic risk, as given by the CAPM. 4. Consider the three stocks in the following table. P1 reflects the per unit price of these stocks at time t, and Q1 reflects the shares outstanding for each company at time t. P0 Q0 P1 Q1 A 90 100 95 100 B 50 200 45 200 C 100 200 110 200 (i) Calculate the market value of each company in t=0 and t=1. (ii) Calculate the return earned by these companies from period 0 to 1. (iii) Calculate the equally weighted and value weighted average return earned by these companies from period 0 to period 1. (i) Market value of each company is price per share x shares outstanding. P0 X Q0 P1 X Q1 A 90X100=9,000 95x100=9,500 B 50X200=10,000 45x200=9,000 C 100X200=20,000 110x200=22,000 -4- Investment management Problem Set 1 (ii) Return (assuming no dividends paid) is 𝑷𝟏 𝑷𝟎 − 𝟏, where P0 is the price we paid for the asset and P1 the price we received when we sold it. [If the asset paid dividends equal 𝑷 +𝒅 to d1 per share from time 0 to time 1, then the formula becomes 𝟏𝑷 𝟏 − 𝟏. 𝟎 𝟗𝟓 For asset A: 𝟗𝟎 − 𝟏 = 𝟎. 𝟎𝟓𝟓𝟔 = 𝟓. 𝟓𝟔% 𝟒𝟓 For asset B: 𝟓𝟎 − 𝟏 = −𝟎. 𝟏 = −𝟏𝟎% 𝟏𝟏𝟎 For asset C: 𝟏𝟎𝟎 − 𝟏 = 𝟎. 𝟏 = 𝟏𝟎% (iii) To calculate the equally weighted return we just take a simple average of the returns of the three stocks The equally weighted average is: [0.0556 + (-0.10) + 0.10]/3 = 0.0185 = 1.85% To calculate the value weighted return, we need use as weights the market value of the stocks relative to the total market value at time=0. Total market value at t = 0 is: ($9,000 + $10,000 + $20,000) = $39,000 The weight of each stock in the index is given by market value of stock/total market value Weight of Stock A in index at t=0: 9,000/39,000=0.231 (approximately) Weight0 A 9,000/39,000=0.23 B 10,000/39,000=0.26 C 20,000/39,000=0.51 The market value weighted average return is 𝟎. 𝟐𝟑 × 𝟓. 𝟓𝟔% + 𝟎. 𝟐𝟔 × (−𝟏𝟎%) + 𝟎. 𝟓𝟏 × 𝟏𝟎% = 𝟑. 𝟖% Note that for we calculate the weights using the previous period market values (here t=0) -5- Investment management Problem Set 1 5. Assume that the stock price of stock A in period 2 is 99. What is the buy and hold return an investor would make, had they bought this stock in period 0 and then sold it in period 2? To answer this return we must consider the effect of compounding, i.e., that over time we are earnings returns on previously earned returns. The return from period 1 to period 2 for stock A is 99/95-1=4.21% The buy and hold return is(𝟏 + 𝟎. 𝟎𝟓𝟓𝟔) × (𝟏 + 𝟎. 𝟎𝟒𝟐𝟏) − 𝟏 = 𝟏𝟎%, which is greater than (5.56%+4.21%=9.77%, by the effect of compounding (5.56%x4.21%= 0.23%). 6. Suppose that you sell short 1000 shares of Intel, currently selling at $40 per share, and give your broker $15,000 to put into your margin account. (i) If you earn no interest in the funds in your margin account, what will be your rate of return after 1 year if Intel’s stock is selling at $42, $40 or $38 per share (assuming Intel pays no dividends)? (ii) Assuming that the maintenance margin is 25%, how high can Intel’s price rise before you receive a margin call? (iii) Redo parts a and b, assuming that Intel paid a year-end dividend of $1 per share [assume that the prices in part a are ex-dividend, i.e., prices after the dividend is paid] (i) The gain or loss on the short position is: (–1,000 ΔP) Invested funds = $15,000 Therefore: rate of return = (–1,000 ΔP)/15,000 The rate of return in each of the three scenarios is: Rate of return = (–1,000 $2)/$15,000 = –0.1333, or–13.33% [note that return is calculated as a proportion of the money you have invested in the trade, 15K] Rate of return = (–1,000 $0)/$15,000 = 0% Rate of return = [–1,000 (–$2)]/$15,000 = +0.1333, or+13.33% (ii) Total assets in the margin account equal: $40,000 (from the sale of the stock) + $15,000 (the initial margin) = $55,000 Liabilities since you are in a short position are 1000P. You will receive a margin call when: $𝟓𝟓,𝟎𝟎𝟎−𝟏,𝟎𝟎𝟎𝑷 𝟏,𝟎𝟎𝟎𝑷 = 0.25 when P = $44 or higher -6- Investment management Problem Set 1 Notice here that in this case an increase in price increase your liabilities, since you are in a short position. [Compare this with the example in slide 13 of the pre-recorded material, where the investor had a long position.] (iii) With a $1 dividend, the short position must now pay on the borrowed shares (ie the owner of the stock is still entitled to the dividend): ($1/share 1000 shares) = $1000. Rate of return is now: [(–1,000 ΔP) – 1,000]/15,000 (i) Rate of return = [(–1,000 $2) – $1,000]/$15,000 = –0.2000, or –20.00% (ii) Rate of return = [(–1,000 $0) – $1,000]/$15,000 = –0.0667, or –6.67% (iii) Rate of return = [(–1,000) (–$2) – $1,000]/$15,000 = +0.067, or +6.67% Total assets are $55,000, and liabilities are (1,000P + 1,000). A margin call will be issued when: $𝟓𝟓,𝟎𝟎𝟎−𝟏,𝟎𝟎𝟎𝑷−𝟏,𝟎𝟎𝟎 𝟏,𝟎𝟎𝟎𝑷 = 0.25 when P = $43.2 or higher 7. Suppose you are an invest manager, who actively tries to select stocks. Should you consider the bid-ask spread of different stocks before you include them in your portfolio? If so, how? Will this have implications for overall market efficiency? Yes, definitely you should. High bid-ask spread assets entail larger transaction costs, so when you buy and sell them you will need to transact at more disadvantageous prices. In other words, more of the money you spent will be collected by the market maker as a fee. So in general, you should avoid very illiquid stocks, with very high bidask spreads. Now suppose that all managers do the same, i.e., avoid these stocks. This means that the process of arbitrage will be less effective for high bid-ask spread stocks, and therefore their prices will be set less efficiently.# Which stocks have higher bid-ask spreads? stocks for smaller companies, younger companies, with more volatile returns. In general, stocks with more subjective valuations. 8. In our pre-recorded material we saw that trading volume has gone up and trading costs have gone down. Do these trends have any implications for market efficiency? -7- Investment management Problem Set 1 Probably they do because more people are trying to make money on the stock market, stock prices will reflect the information that all these people have about fundamentals. So it is possible that the stock market is becoming more efficient. A different view is that the stock market now (since it can be accessed more easily) contains more “noise traders”, who are treating the market as a Casino, and are just gambling. The trades of these investors are not based on fundamental information, they are just noise (e.g., rumours, news headlines, etc). Although the trades of these people can temporarily make the market less efficient, this will attract more sophisticated investment managers in the market, who will want to trade to exploit the mispricing. So again, we may end up with a more efficient market. 9. Quiz from pre-recorded lecture: Write out the formulas that were used to produce the ``Your Return" column in the previous slide. Let’s do the first scenario, where the price increases from 100 to 130. Your return is of course equity/initial investment, where equity=assets-liabilities. Assets here is the value of the stock in the account= 26,000. Liability is 10,800 (including the interest for the loan). So equity is 15,200. Your initial investment (from your own money) is 10,000, so your 𝟏𝟓,𝟐𝟎𝟎 return in scenario 1 is 𝟏𝟎,𝟎𝟎𝟎 − 𝟏 = 𝟓𝟐% -8- Investment management Problem Set 1