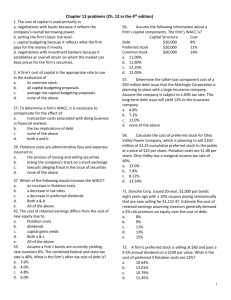

Foundations of Finance, 7e (Keown) Chapter 9 The Cost of Capital 9.1 Learning Objective 1 True or False 1) In order to create value a corporation must earn a rate of return on its invested capital that is higher than the market's required rate of return on that invested capital. Answer: TRUE Diff: 1 Keywords: Required Rate of Return, Invested Capital 2) The cost of capital is the rate that must be earned on an investment project if the project is to increase the value of the common shareholders’ investment. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Shareholder Value 3) The firm’s cost of capital may also be referred to as the firm’s opportunity cost of capital. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Opportunity Cost of Capital 4) The firm’s cost of capital is important when evaluation the firm’s overall value, but should not be used to evaluate individual projects which have their own unique characteristics. Answer: FALSE Diff: 1 Keywords: Cost of Capital 5) The cost of debt increases relative to the investor's required return due to flotation costs, but decreases relative to the investor's required return due to the tax deductibility of interest. Answer: TRUE Diff: 1 Keywords: Cost of Debt, Flotation Costs, Taxes, Interest Multiple Choice 1) Higher flotation costs will result in all of the following except: A) higher after-tax cost of debt B) higher weighted average cost of capital C) higher cost of retained earnings D) higher cost of common equity when new common shares are sold Answer: C Diff: 1 Keywords: Flotation Costs, Cost of Retained Earnings 1 Copyright © 2011 Pearson Education, Inc. 9.2 Learning Objective 2 True or False 1) Flotation costs cause a corporation's cost of capital to be lower than its investors' required returns. Answer: FALSE Diff: 1 Keywords: Flotation Costs, Cost of Capital, Required Returns 2) The cost of a particular source of capital (debt, preferred stock, common stock) is equal to the investor's required rate of return after adjusting for the effects of both flotation costs and corporate taxes. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Flotation Costs, Corporate Taxes 3) The cost of debt capital is obtained by substituting the net proceeds per bond for the bond price in the bond valuation equation and solving for the required return. Answer: TRUE Diff: 2 Keywords: Cost of Debt 4) The cost of preferred stock is equal to the preferred stock dividend divided by the net proceeds per preferred share. Answer: TRUE Diff: 1 Keywords: Cost of Preferred Stock, Net Proceeds, Flotation Costs 5) A corporation's cost of common equity may be estimated using either a dividend valuation model or the capital asset pricing model. Answer: TRUE Diff: 1 Keywords: Cost of Common Equity, Dividend Growth Model, Capital Asset Pricing Model 6) Corporations have two costs of common equity, one for retained earnings and one if the company issues new common stock. Answer: TRUE Diff: 1 Keywords: Cost of Common Equity, Retained Earnings 7) The Capital Asset Pricing Model may be used to estimate the cost of retained earnings. Answer: TRUE Diff: 1 Keywords: Capital Asset Pricing Model, Cost of Retained Earnings 2 Copyright © 2011 Pearson Education, Inc. 8) A reasonable estimate of the market risk premium based on historical data and expert opinion is between 5% and 7%. Answer: TRUE Diff: 1 Keywords: Market Risk Premium, Capital Asset Pricing Model 9) The market risk premium remains constant over time because the risk free rate of return moves inversely with beta. Answer: FALSE Diff: 1 Keywords: Market Risk Premium, Capital Asset Pricing Model 10) A firm's cost of capital is the required rate of return on the firm's average project. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Required Return 11) The firm financed completely with equity capital has a cost of capital equal to the required return on common stock. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Required Return on Common Stock 12) The after-tax cost of equity equals one minus the marginal tax rate times the required rate of return on common stock. Answer: FALSE Diff: 1 Keywords: Cost of Common Equity 13) If preferred stock pays a $5 annual dividend and sells for $50 the cost of preferred stock financing is 10% since dividends are not tax deductible and preferred stock is sold without flotation costs. Answer: FALSE Diff: 1 Keywords: Cost of Preferred Stock, Flotation Costs 14) Other things equal, management should retain profits only if the company's investments within the firm are at least as attractive as the stockholders' other investment opportunities. Answer: TRUE Diff: 1 Keywords: Cost of Retained Earnings, Shareholder Value 15) Financing with new common stock is generally more costly than financing with retained earnings due to increasing tax rates. Answer: FALSE Diff: 1 Keywords: Cost of New Common Stock, Cost of Retained Earnings 3 Copyright © 2011 Pearson Education, Inc. 16) The firm's best financial structure is determined by finding the capital structure that minimizes the firm's cost of capital. Answer: TRUE Diff: 1 Keywords: Capital Structure, Cost of Capital 17) The required return of a preferred stockholder, rps, is higher than the cost of preferred stock for the corporation because stockholder’s must pay federal taxes on their dividend income. Answer: FALSE Diff: 1 Keywords: Required Return on Preferred Stock, Cost of Preferred Stock 18) Investors require higher rates of return to compensate for purchasing power losses resulting from inflation. Answer: TRUE Diff: 1 Keywords: Required Returns, Inflation 19) A security with a reasonably stable price will have a lower required rate of return than a security with an unstable price. Answer: TRUE Diff: 1 Keywords: Required Return, Variability of Returns 20) The cost of internal common equity is already on an after-tax basis since dividends paid to common stockholders are not tax deductible. Answer: TRUE Diff: 1 Keywords: Cost of Retained Earnings 21) A short-term T-bill's rate of return should be used in the CAPM formula to determine the cost of equity capital regardless of the length of the project under consideration. Answer: FALSE Diff: 1 Keywords: Capital Asset Pricing Model, Risk-free Rate of Return 22) The capital asset pricing model uses three variables to evaluate required returns on common equity: the risk free rate, the beta coefficient, and the market risk premium. Answer: TRUE Diff: 1 Keywords: CAPM 4 Copyright © 2011 Pearson Education, Inc. 23) The investor's required rate of return will equal the firm's cost of capital if corporate transactions costs are taken into account. Answer: FALSE Diff: 1 Keywords: Cost of Capital, Required Rate of Return 24) The cost of debt measures the cost of a bank loan, while the cost of preferred stock is used as a proxy for the cost of a new bond issue. Answer: FALSE Diff: 1 Keywords: Cost of Debt, Cost of Preferred Stock, Bonds 25) Preferred dividends are paid with before-tax dollars because the dividend rate is known, whereas common stock dividends are paid with after-tax dollars. Answer: FALSE Diff: 1 Keywords: Preferred Dividends, Common Dividends, Taxes 26) An increase in a corporation's marginal tax rate will cause the corporation's after tax cost of debt to increase, other things remaining the same. Answer: FALSE Diff: 1 Keywords: Cost of Debt, Taxes 27) Because investors like dividends, the higher the company's dividend growth rate, the lower the company's cost of common equity. Answer: FALSE Diff: 2 Keywords: Cost of Common Equity, Dividend Growth Rate 28) An increase in a corporation's marginal tax rate will decrease the corporation's cost of debt, but have no impact on its cost of preferred stock or cost of common equity. Answer: TRUE Diff: 2 Keywords: Cost of Debt, Cost of Preferred Stock, Cost of Common Equity, Marginal Tax Rate Multiple Choice 1) Two factors that cause the investor's required rate of return to differ from the company's cost of capital are: A) taxes and risk. B) transactions costs and risk. C) taxes and transactions costs. D) risk and opportunity cost differences. Answer: B Diff: 1 Keywords: Cost of Capital, Taxes, Transactions Costs 5 Copyright © 2011 Pearson Education, Inc. 2) Two considerations that cause a corporation's cost of capital to be different than its investors' required returns are A) corporate taxes and flotation costs. B) individual taxes and corporate taxes. C) individual taxes and dividends. D) corporate taxes and the earned income tax credit. Answer: A Diff: 1 Keywords: Cost of Capital, Required Rate of Return, Taxes, Flotation Costs 3) Due to changes in regulatory requirements, the transactions costs associated with selling corporate securities increased by $1 per share. This change will A) cause the cost of capital to decrease. B) cause the cost of capital to increase. C) have no effect on the cost of capital because transactions costs are expensed immediately. D) cause the cost of capital to decrease only if investors may be billed for part of the increase in transactions costs. Answer: B Diff: 1 Keywords: Flotation Costs, Cost of Capital 4) Jones Distributing Corp. can sell common stock for $27 per share and its investors require a 17% return. However, the administrative or flotation costs associated with selling the stock amount to $2.70 per share. What is the cost of capital for Jones Distributing if the corporation raises money by selling common stock? A) 27.00% B) 18.89% C) 18.33% D) 17.00% Answer: B Diff: 2 Keywords: Cost of Capital, Flotation Costs 5) A company has preferred stock that can be sold for $21 per share. The preferred stock pays an annual dividend of 3.5% based on a par value of $100. Flotation costs associated with the sale of preferred stock equal $1.25 per share. The company's marginal tax rate is 35%. Therefore, the cost of preferred stock is: A) 18.87%. B) 17.72%. C) 14.26%. D) 12.94%. Answer: B Diff: 2 Keywords: Cost of Preferred Stock, Flotation Costs, Net Proceeds 6 Copyright © 2011 Pearson Education, Inc. 6) Asian Trading Company paid a dividend yesterday of $5 per share (D0 = $4). The dividend is expected to grow at a constant rate of 8% per year. The price of Asian Trading Company's stock today is $29 per share. If Asian Trading Company decides to issue new common stock, flotation costs will equal $2.50 per share. Asian Trading Company's marginal tax rate is 35%. Based on the above information, the cost of retained earnings is: A) 28.38%. B) 24.12%. C) 26.62%. D) 31.40%. Answer: C Diff: 2 Keywords: Cost of Retained Earnings 7) Asian Trading Company paid a dividend yesterday of $5 per share (D0 = $4). The dividend is expected to grow at a constant rate of 8% per year. The price of Asian Trading Company's stock today is $29 per share. If Asian Trading Company decides to issue new common stock, flotation costs will equal $2.50 per share. Asian Trading Company's marginal tax rate is 35%. Based on the above information, the cost of new common stock is: A) 28.38%. B) 24.12%. C) 26.62%. D) 31.40%. Answer: A Diff: 2 Keywords: Cost of New Common Stock 8) In general, which of the following rankings, from highest to lowest cost, is most accurate? A) cost of new common stock, cost of preferred stock, cost of debt, cost of retained earnings B) cost of debt, cost of preferred stock, cost of new common stock, cost of retained earnings C) cost of new common stock, cost of retained earnings, cost of preferred stock, cost of debt D) cost of preferred stock, cost of new common stock, cost of retained earnings, cost of debt Answer: C Diff: 1 Keywords: Cost of New Common Stock, Cost of Retained Earnings, Cost of Preferred Stock, Cost of Debt 9) The risk free rate of return is 2.5% and the market risk premium is 8%. Penn Trucking has a beta of 2.2 and a standard deviation of returns of 28%. Penn Trucking's marginal tax rate is 35%. Analysts expect Penn Trucking's dividends to grow by 6% per year for the foreseeable future. Using the capital asset pricing model, what is Penn Trucking's cost of retained earnings? A) 16.4% B) 17.7% C) 19.6% D) 20.1% Answer: D Diff: 2 Keywords: Capital Asset Pricing Model, Cost of Retained Earnings 7 Copyright © 2011 Pearson Education, Inc. 10) A company has preferred stock with a current market price of $18 per share. The preferred stock pays an annual dividend of 4% based on a par value of $100. Flotation costs associated with the sale of preferred stock equal $1.50 per share. The company's marginal tax rate is 40%. Therefore, the cost of preferred stock is: A) 28.80%. B) 24.24%. C) 22.22%. D) 14.55%. Answer: B Diff: 2 Keywords: Cost of Preferred Stock, Flotation Costs, Net Proceeds 11) KayCee Manufacturing Company paid a dividend yesterday of $3.50 per share. The dividend is expected to grow at a constant rate of 10% per year. The price of KayCee's common stock today is $40 per share. If KayCee decides to issue new common stock, flotation costs will equal $4.00 per share. Kaycee's marginal tax rate is 35%. Based on the above information, the cost of retained earnings is: A) 26.41%. B) 20.09%. C) 19.63%. D) 17.55%. Answer: C Diff: 2 Keywords: Cost of Retained Earnings 12) KayCee Manufacturing Company paid a dividend yesterday of $3.50 per share. The dividend is expected to grow at a constant rate of 10% per year. The price of KayCee's common stock today is $40 per share. If Kaycee decides to issue new common stock, flotation costs will equal $4.00 per share. Kaycee's marginal tax rate is 35%. Based on the above information, the cost of new common stock is: A) 26.41%. B) 20.09%. C) 19.63%. D) 17.55%. Answer: B Diff: 2 Keywords: Cost of New Common Stock, Flotation Costs 8 Copyright © 2011 Pearson Education, Inc. 13) The risk free rate of return is 3% and the expected return on the market portfolio is 14%. Starship Enterprises has a beta of 2.0 and a standard deviation of returns of 26%. Starship's marginal tax rate is 35%. Analysts expect Starship's net income to grow by 12% per year for the next 5 years. Using the capital asset pricing model, what is Starship Enterprises' cost of retained earnings? A) 18.6% B) 21.2% C) 22.8% D) 25.0% Answer: D Diff: 2 Keywords: Capital Asset Pricing Model, Cost of Retained Earnings 14) Jiffy Co. expects to pay a dividend of $3.00 per share in one year. The current price of Jiffy common stock is $60 per share. Flotation costs are $3.00 per share when Jiffy issues new stock. What is the cost of internal common equity (retained earnings) if the long-term growth in dividends is projected to be 8 percent indefinitely? A) 13 percent B) 14 percent C) 15 percent D) 16 percent Answer: A Diff: 1 Keywords: Cost of Retained Earnings 15) The average cost associated with each additional dollar of financing for investment projects is: A) the incremental return. B) the marginal cost of capital. C) CAPM required return. D) the component cost of capital. Answer: B Diff: 1 Keywords: Marginal Cost of Capital 16) A firm's cost of capital is influenced by: A) the current ratio. B) par value of common stock. C) capital structure. D) net income. Answer: C Diff: 1 Keywords: Cost of Capital 9 Copyright © 2011 Pearson Education, Inc. 17) Clanton Company is financed 75 percent by equity and 25 percent by debt. If the firm expects to earn $30 million in net income next year and retain 40% of it, how large can the capital budget be before common stock must be sold? A) $7.5 million B) $12.0 million C) $15.5 million D) $16.0 million Answer: C Diff: 2 Keywords: Capital Structure, Capital Budget 18) The cost of new preferred stock is equal to: A) the preferred stock dividend divided by the market price. B) the preferred stock dividend divided by its par value. C) (1 - tax rate) times the preferred stock dividend divided by net price. D) preferred stock dividend divided by the net selling price of preferred. Answer: D Diff: 2 Keywords: Cost of New Preferred Stock 19) In general, the least expensive source of capital is: A) debt B) new common stock. C) preferred stock D) retained earnings. Answer: A Diff: 2 Keywords: Cost of Capital, Sources of Capital 20) The cost of external equity capital is greater than the cost of retained earnings because of: A) flotation costs on new equity. B) increasing marginal tax rates. C) higher dividends. D) greater risk for shareholders. Answer: A Diff: 2 Keywords: Flotation Costs, Cost of New Common Stock, Cost of Retained Earnings 10 Copyright © 2011 Pearson Education, Inc. 21) Seafood Products Corp. is expected to pay a dividend of $2.60 next year. Dividends are expected to grow at a constant rate of 8% per year, and the stock price is currently $20.00. New stock can be sold at this price subject to flotation costs of 15%. The company's marginal tax rate is 35%. Compute the cost of internal equity (retained earnings) and the cost of external equity (new common stock), respectively. A) 0, 21.00% B) 8.00%, 23.29% C) 21.00%, 23.29% D) 23.00%, 25.48% Answer: C Diff: 2 Keywords: Cost of Retained Earnings, Cost of New Common Stock 22) DEF Company's preferred stock is currently selling for $28.00, and pays a perpetual annual dividend of $2.00 per share. Underwriters of a new issue of preferred stock would charge $3 per share in flotation costs. The firm's tax rate is 40%. Compute the cost of new preferred stock for DEF. A) 4.80% B) 7.14% C) 8.00% D) 9.15% Answer: C Diff: 2 Keywords: Cost of New Preferred Stock, Flotation Costs 23) Atlas Corporation wishes to estimate its cost of retained earnings. The firm's beta is 1.3. The rate on 6-month T-bills is 2%, and the return on the S&P 500 index is 15%. What is the appropriate cost for retained earnings in determining the firm's cost of capital? A) 17.0% B) 19.5% C) 18.9% D) 22.1% Answer: C Diff: 2 Keywords: Capital Asset Pricing Model, Cost of Capital 24) In capital budgeting analysis, when computing the weighted average cost of capital, the CAPM approach is typically used to find which of the following: A) Market value weight of equity B) Pretax component cost of debt C) After-tax component cost of debt D) Component cost of internal equity Answer: D Diff: 1 Keywords: Capital Asset Pricing Model, Cost of Retained Earnings 11 Copyright © 2011 Pearson Education, Inc. 25) The cost of retained earnings is less than the cost of new common stock because: A) marginal tax brackets increase. B) flotation costs are incurred when new stock is issued. C) dividends are not tax deductible. D) accounting rules allow a deduction when using retained earnings. Answer: B Diff: 2 Keywords: Flotation Costs, Cost of Retained Earnings, Cost of New Common Stock 26) Which of the following differentiates the cost of retained earnings from the cost of newlyissued common stock? A) The cost of the pre-emptive rights held by existing shareholders. B) The greater marginal tax rate faced by the now-larger firm. C) The flotation costs incurred when issuing new securities. D) The larger dividends paid to the new common stockholders. Answer: C Diff: 1 Keywords: Flotation Costs, Cost of Retained Earnings, Cost of New Common Stock 27) Five Rivers Casino is undergoing a major expansion. The expansion will be financed by issuing new 15-year, $1,000 par, 9% annual coupon bonds. The market price of the bonds is $1,070 each. Five Rivers flotation expense on the new bonds will be $50 per bond. Five Rivers marginal tax rate is 35%. What is the yield to maturity on the newly-issued bonds? A) 6.95% B) 7.99% C) 8.17% D) 9.82% Answer: C Diff: 2 Keywords: Yield to Maturity 28) Five Rivers Casino is undergoing a major expansion. The expansion will be financed by issuing new 15-year, $1,000 par, 9% annual coupon bonds. The market price of the bonds is $1,070 each. Gamblers flotation expense on the new bonds will be $50 per bond. Gamblers marginal tax rate is 35%. What is the pre-tax cost of debt for the newly-issued bonds? A) 8.76% B) 8.12% C) 7.49% D) 10.25% Answer: A Diff: 2 Keywords: Pre-tax Cost of Debt, Flotation Costs 12 Copyright © 2011 Pearson Education, Inc. 29) General Bill's will issue preferred stock to finance a new artillery line. The firm's existing preferred stock pays a dividend of $4.00 per share and is selling for $40 per share. Investment bankers have advised General Bill that flotation costs on the new preferred issue would be 5% of the selling price. The General's marginal tax rate is 30%. What is the relevant cost of new preferred stock? A) 7.00% B) 7.37% C) 10.00% D) 10.53% E) 15.00% Answer: D Diff: 2 Keywords: Cost of New Preferred Stock, Flotation Costs 30) Kelly Corporation will issue new common stock to finance an expansion. The existing common stock just paid a $1.50 dividend, and dividends are expected to grow at a constant rate 8% indefinitely. The stock sells for $45, and flotation expenses of 5% of the selling price will be incurred on new shares. What is the cost of new common stock be for Kelly Corp.? A) 11.33% B) 11.51% C) 11.60% D) 11.79% E) 12.53% Answer: D Diff: 2 Keywords: Cost of New Common Stock, Flotation Costs 31) Kelly Corporation will issue new common stock to finance an expansion. The existing common stock just paid a $1.50 dividend, and dividends are expected to grow at a constant rate 8% indefinitely. The stock sells for $45, and flotation expenses of 5% of the selling price will be incurred on new shares. What is the cost of retained earnings for Kelly Corp.? A) 11.33% B) 11.51% C) 11.60% D) 11.79% E) 12.53% Answer: C Diff: 2 Keywords: Cost of Retained Earnings 13 Copyright © 2011 Pearson Education, Inc. 32) Which of the following statements is most correct? A) Because the cost of debt is lower than the cost of equity, value-maximizing firms maintain debt ratios of close to 100% B) Corporations that are 100% equity financed will have a much lower weighted average cost of capital because the lack of debt lowers their risk of bankruptcy C) The source of capital with the lowest after-tax cost is preferred stock, because it is a hybrid security, part debt and part equity. D) The cost of a particular source of capital is equal to the investor's required rate of return after adjusting for the effects of both flotation costs and corporate taxes. Answer: D Diff: 1 Keywords: Cost of Capital, Flotation Costs, Transactions Costs 33) All else equal, an increase in beta results in A) an increase in the cost of retained earnings. B) an increase in the cost of newly issued common stock . C) an increase in the after-tax cost of debt. D) an increase in the cost of common equity, whether or not the funds come from retained earnings or newly issued common stock. Answer: D Diff: 1 Keywords: Beta, Cost of Common Equity 34) Royal Mediterranean Cruise Line's common stock is selling for $22 per share. The last dividend was $1.20, and dividends are expected to grow at a 6% annual rate. Flotation costs on new stock sales are 5% of the selling price. What is the cost of Royal's retained earnings? A) 5.73% B) 11.45% C) 11.78% D) 12.09% Answer: C Diff: 2 Keywords: Cost of Retained Earnings 35) Royal Mediterranean Cruise Line's common stock is selling for $22 per share. The last dividend was $1.20, and dividends are expected to grow at a 6% annual rate. Flotation costs on new stock sales are 5% of the selling price. What is the cost of Royal's new common stock? A) 5.73% B) 11.45% C) 11.78% D) 12.09% Answer: D Diff: 2 Keywords: Cost of New Common Stock 14 Copyright © 2011 Pearson Education, Inc. Essay 1) New Jet Airlines plans to issue 14-year bonds with a par value of $1,000 that will pay $60 every six months. The bonds have a market price of $1,220. Flotation costs on new debt will be 4% of the selling price. If the firm has a 35% marginal tax bracket, compute the following: a. Yield to maturity of debt b. After-tax cost of existing debt c. After-tax cost of new debt Answer: a. YTM = 9.18% (Using Yield Function in Excel with rate =.12, Pr = 122, Redemption = 100, Frequency = 2, and Basis = 0) b. After-tax cost of debt = 9.18% × (1-.35) = 5.97% c. After-tax cost of new debt = 9.73% × (1-.35) = 6.33% (The pre-tax cost is determined as in part a, except the Pr is 117.12, based on a net price of $1,220 less flotation costs of $48.80.) Diff: 2 Keywords: Yield to Maturity, After-tax Cost of Existing Debt, After-tax Cost of New Debt, Flotation Costs 2) Alarm Systems Corporation’s preferred stock pays a dividend of $3.60 and sells for $28.00. Alarm Systems Corporation has a marginal tax rate of 35%. What is the cost of preferred financing? Answer: $3.60/$28 = .12857 =12.857%% Diff: 1 Keywords: Cost of Preferred Stock 3) NewLinePhone Corp. is very risky, with a beta equal to 2.8 and a standard deviation of returns of 32%. The risk free rate of return is 3% and the market risk premium is 8%. NewLinePhone’s marginal tax rate is 35%. Use the capital asset pricing model to estimate NewLinePhone’s cost of retained earnings. Answer: 3% + (8%)(2.8) = 25.4% Diff: 2 Keywords: Cost of Retained Earnings, Capital Asset Pricing Model 4) Dickerson Corporation’s common stock is currently selling for $38. Last year's dividend was $4.00 per share. Investors expect dividends to grow at an annual rate of 7 percent indefinitely. Flotation costs of 4% will be incurred when new stock is sold. a. What is the cost of internal common equity? b. What is the cost of new common equity? Answer: a. D1 = $4.00 × 1.07 = $4.28 Cost of internal common equity = $4.28/$38 + .07 = 18.26% b. Cost of new common equity = $4.28/($38 × .96) + .07 = 18.73% Diff: 2 Keywords: Cost of Retained Earnings, Cost of New Common Stock, Flotation Costs 15 Copyright © 2011 Pearson Education, Inc. 5) Last year Gator Getters, Inc. had $50 million in total assets. Management desires to increase its plant and equipment during the coming year by $12 million. The company plans to finance 40 percent of the expansion with debt and the remaining 60 percent with equity capital. Bond financing will be at a 9 percent rate and will be sold at its par value. Common stock is currently selling for $50 per share, and flotation costs for new common stock will amount to $5 per share. The expected dividend next year for Gator is $2.50. Furthermore, dividends are expected to grow at a 6 percent rate far into the future. The marginal corporate tax rate is 34 percent. Internal funding available from additions to retained earnings is $4,000,000. a. What amount of new common stock must be sold if the existing capital structure is to be maintained? b. Calculate the weighted marginal cost of capital at an investment level of $12 million. Answer: a. Equity needed = $12 million × 0.6 = $7.2 million Less additions to R/E 4.0 million New common stock $3.2 million b. Kd = 9(1 - .34) = 5.94% Knc = $2.50/$45 + 0.06 = 11.56% MCC = 0.4 × 5.94% + 0.6 × 11.56% = 9.31% Diff: 2 Keywords: After-tax Cost of Debt, Cost of New Common Stock, Marginal Cost of Capital 6) The common stock for El Viss Company currently sells for $20 per share. The firm just paid a dividend of $1.50, and the dividend three years ago was $1.30. Dividends per share are anticipated to grow at the same rate in the future as they have over the past three years. Flotation costs for new shares will be 6% of the selling price. Calculate the following: a. the cost of retained earnings b. the cost of external equity capital Answer: a. g = 4.89% D1 = $1.50 × 1.049 = $1.57 Cost of retained earnings = $1.57/$20 + .049 = 12.75% b. Cost of external equity = $1.57/($20 × .94) + .049 = 13.25% Diff: 2 Keywords: Cost of Retained Earnings, Cost of New Common Stock 16 Copyright © 2011 Pearson Education, Inc. 7) A company is going to issue a $1,000 par value bond that pays a 7% annual coupon. The company expects investors to pay $942 for the 20-year bond. The expected flotation cost per bond is $42, and the firm is in the 34% tax bracket. Compute the following: a. The yield to maturity on the firm’s bonds b. The firm’s after-tax cost of existing debt c. The firm’s after-tax cost of new debt Answer: a. YTM = 7.57% b. After-tax cost of existing debt = 7.57% × (1 - .34) = 5% c. After-tax cost of new debt = 8.02% × (1 - .34) = 5.29% Diff: 2 Keywords: After-tax Cost of Debt, Yield to Maturity, Flotation Costs 8) Toto and Associates' preferred stock is selling for $27.50 a share. The firm nets $25.60 after issuance costs. The stock pays an annual dividend of $3.00 per share. What is the cost of existing, and new, preferred stock respectively? Answer: Cost of existing preferred stock = $3.00/$27.50 = 10.91% Cost of new preferred stock = $3.00/$25.60 = 11.72% Diff: 2 Keywords: Cost of Existing Preferred Stock, Cost of New Preferred Stock 9) Sutter Corporation's common stock is selling for $16.80 a share. Last year Sutter paid a dividend of $.80. Investors are expecting Sutter's dividends to grow at an annual rate of 5% per year. What is the cost of internal equity? Answer: D1 = $.80 × 1.05 = $.84 Cost of internal equity = $.84/$16.80 + .05 = 10% Diff: 2 Keywords: Cost of Retained Earnings 10) Gibson Industries is issuing a $1,000 par value bond with an 8% annual interest coupon rate that matures in 11 years. Investors are willing to pay $972, and flotation costs will be 9%. Gibson is in the 34% tax bracket. What will be the after-tax cost of new debt for the bond? Answer: 9.76% × (1 - .34) = 6.44% Diff: 2 Keywords: After-tax Cost of Debt, Flotation Costs 11) The preferred stock of Wells Co. sells for $17 and pays a $1.75 dividend. The net price of the stock after issuance costs is $15.30. What is the cost of capital for new preferred stock? Answer: $1.75/$15.30 = 11.44% Diff: 1 Keywords: Cost of Preferred Stock 17 Copyright © 2011 Pearson Education, Inc. 12) Glenna Gayle common stock sells for $55, and dividends paid last year were $1.35. Flotation costs on issuing stock will be 8% of the market price. The dividends are predicted to have a 10% growth rate. What is the cost of internal equity, and new equity, respectively for Glenna Gayle? Answer: D1 = $1.35 × 1.1 = $1.49 Cost of internal equity = $1.49/$55 + .1 = 12.71% Cost of new equity = $1.49/($55 × .92) + .1 = 12.94% Diff: 2 Keywords: Cost of Retained Earnings, Cost of New Common Stock, Flotation Costs 13) Toombes, Inc. is issuing new common stock at a market price of $55. Dividends last year were $3.30 per share and are expected to grow at a rate of 6%. Flotation costs will be 5% of the market price. What is Toombes’ cost of retained earnings, and new equity, respectively? Answer: D1 = $3.30 × 1.06 = $3.50 Cost of retained earnings = $3.50/$55 + .06 = 12.36% Cost of new equity = $3.50/($55 × .95) + .06 = 12.70% Diff: 2 Keywords: Cost of Retained Earnings, Cost of New Common Stock, Flotation Costs 9.3 Learning Objective 3 True or False 1) A company's cost of capital is equal to a weighted average of its investors' required returns. Answer: FALSE Diff: 1 Keywords: Cost of Capital, Investors' Required Returns 2) A corporation may lower its cost of capital by shifting a portion of its total financing from a higher cost source of capital, such as common equity, to a lower cost source of capital, such as debt. Answer: TRUE Diff: 1 Keywords: Weighted Average Cost of Capital 3) The best financial structure is determined by finding the debt and equity mix that maximizes the firm's cost of capital. Answer: FALSE Diff: 1 Keywords: Optimal Capital Structure, Cost of Capital 4) If a firm were to earn exactly its cost of capital, we would expect the price of its common stock to remain unchanged. Answer: TRUE Diff: 1 Keywords: Cost of Capital, Firm Value 18 Copyright © 2011 Pearson Education, Inc. 5) If a firm's tax rate increases then its weighted average cost of capital increases also. Answer: FALSE Diff: 1 Keywords: Cost of Capital, Tax Rate 6) The average cost of capital is the appropriate rate to use when evaluating new investments, even though the new investments may be in a higher risk class. Answer: FALSE Diff: 1 Keywords: Average Cost of Capital, Risk 7) Once the weighted average cost of capital (WACC) is determined then all projects of average risk will be compared to the original WACC regardless of the size of the capital budget. Answer: FALSE Diff: 1 Keywords: Weighted Average Cost of Capital 8) The mixture of financing sources used by a firm will vary from year to year, so many firms use target capital structure proportions when calculating the firm's weighted average cost of capital. Answer: TRUE Diff: 1 Keywords: Weighted Cost of Capital 9) Using the weighted cost of capital as a cutoff rate assumes that the riskiness of the project being evaluated is similar to the riskiness of the company's existing assets. Answer: TRUE Diff: 1 Keywords: Weighted Cost of Capital 10) Using the weighted cost of capital as a cutoff rate assumes that future investments will be financed so as to maintain the firm's target degree of financial leverage. Answer: TRUE Diff: 1 Keywords: Weighted Cost of Capital, Target Capital Structure 11) The market value weights are preferred when calculating a firm's weighted average cost of capital. Answer: TRUE Diff: 1 Keywords: Market Value Weights, Weighted Average Cost of Capital 12) A firm's weighted average cost of capital is a function of (1) the individual costs of capital, (2) the capital structure mix, and (3) the level of financing necessary to make the investment. Answer: TRUE Diff: 1 Keywords: Weighted Average Cost of Capital 19 Copyright © 2011 Pearson Education, Inc. 13) A company's capital structure mix is based on the proportion of fixed versus variable costs in its optimal production process. Answer: FALSE Diff: 1 Keywords: Capital Structure Multiple Choice 1) A firm's weighted average cost of capital is determined using all of the following inputs except: A) the firm's capital structure. B) the amount of capital necessary to make the investment. C) the firm's after tax cost of debt. D) the probability distribution of expected returns. Answer: D Diff: 1 Keywords: Weighted Average Cost of Capital 2) Cost of capital is: A) the coupon rate of debt. B) a hurdle rate set by the board of directors. C) the rate of return that must be earned on additional investment if firm value is to remain unchanged. D) the average cost of the firm's assets. Answer: C Diff: 1 Keywords: Cost of Capital 3) Cost of capital is commonly used interchangeably with all of the following terms except A) the firm's required rate of return. B) the hurdle rate for new investments. C) the internal rate of return for new investments. D) the firm's opportunity cost of funds. Answer: C Diff: 1 Keywords: Cost of Capital, Required Rate of Return, Hurdle Rate, Opportunity Cost of Funds 20 Copyright © 2011 Pearson Education, Inc. 4) Jones Company has a target capital structure of 30% debt, 15% preferred stock, and 55% common equity. The company's after-tax cost of debt is 7%, its cost of preferred stock is 11%, its cost of retained earnings is 15%, and its cost of new common stock is 16%. The company stock has a beta of 1.5 and the company's marginal tax rate is 35%. What is the company's weighted average cost of capital if retained earnings are used to fund the common equity portion? A) 11.20% B) 12.00% C) 13.80% D) 14.45% Answer: B Diff: 2 Keywords: Weighted Average Cost of Capital 5) J & B Corp. is investing in a major capital budgeting project that will require the expenditure of $16 million. The money will be raised by issuing $2 million of bonds, $4 million of preferred stock, and $10 million of new common stock. The company estimates is after-tax cost of debt to be 7%, its cost of preferred stock to be 9%, the cost of retained earnings to be 14%, and the cost of new common stock to be 17%. What is the weighted average cost of capital for this project? A) 12.20% B) 13.12% C) 13.75% D) 14.23% Answer: C Diff: 2 Keywords: Weighted Average Cost of Capital 6) Acme Conglomerate Corporation operates three divisions. One division involves significant research and development, and thus has a high-risk cost of capital of 15%. The second division operates in business segments related to Acme's core business, and this division has a cost of capital of 10% based upon its risk. Acme's core business is the least risky segment, with a cost of capital of 8%. The firm's overall weighted average cost of capital of 11% has been used to evaluate capital budgeting projects for all three divisions. This approach will A) favor projects in the core business division because that division is the least risky. B) favor projects in the related businesses division because the cost of capital for this division is the closest to the firm's weighted average cost of capital. C) favor projects in the research and development division because the higher risk projects look more favorable if a lower cost of capital is used to evaluate them. D) not favor any division over the other because they all use the same company-wide weighted average cost of capital. Answer: C Diff: 1 Keywords: Weighted Average Cost of Capital, Risk-Return Tradeoff 21 Copyright © 2011 Pearson Education, Inc. 7) Joe’s Discount Club currently has a weighted average cost of capital of 12%. Joe’s has been growing rapidly over the past several years, selling common stock in each year to finance its growth. However, due to difficult economic times this year, Joe’s decides to cut its dividend and increase its retained earnings so that the common equity portion of its capital structure will include only retained earnings and no new common stock will be sold. Joe’s weighted average cost of capital this year should be A) zero, since no new stock will be sold. B) less than 12%. C) equal to 12%. D) greater than 12%. Answer: B Diff: 1 Keywords: Weighted Average Cost of Capital 8) Higgins Office Corp. plans to maintain its optimal capital structure of 40 percent debt, 10 percent preferred stock, and 50 percent common equity indefinitely. The required return on each component source of capital is as follows: debt--8 percent; preferred stock--12 percent; common equity--16 percent. Assuming a 40 percent marginal tax rate, what after-tax rate of return must Higgins Office Corp. earn on its investments if the value of the firm is to remain unchanged? A) 12.40 percent B) 12.00 percent C) 11.12 percent D) 10.64 percent Answer: C Diff: 2 Keywords: Weighted Average Cost of Capital 9) SkyHigh Airlines has five possible investment projects for the coming year. Each project is indivisible. They are: Project Investment (million) A $6 B $10 C $9 D $4 E $3 IRR 18% 15% 20% 12% 24% SkyHigh's weighted marginal cost of capital schedule is 12 percent for up to $6 million of investment; 16 percent for between $6 million and $18 million of investment; and above $18 million the weighted cost of capital is 18 percent. The optimal capital budget is: A) $12 million. B) $18 million. C) $23 million. D) $28 million. Answer: B Diff: 2 Keywords: Weighted Average Cost of Capital, Optimal Capital Budget 22 Copyright © 2011 Pearson Education, Inc. 10) The ABC Company is planning a $64 million expansion. The expansion is to be financed by selling $25.6 million in new debt and $38.4 million in new common stock. The before-tax required rate of return on debt is 9 percent and the required rate of return on equity is 14 percent. If the company is in the 35 percent tax bracket, what is the firm's cost of capital? A) 8.92% B) 9.89% C) 11.50% D) 10.74% Answer: D Diff: 2 Keywords: Weighted Average Cost of Capital 11) Burns and Nuble is considering an investment in a project which would require an initial outlay of $350,000 and produce expected cash flows in years 1-5 of $95,450 per year. You have determined that the current after-tax cost of the firm's capital (required rate of return) for each source of financing is as follows: Cost of Long-Term Debt7% Cost of Preferred Stock11% Cost of Common Stock15% Long term debt currently makes up 25% of the capital structure, preferred stock 15%, and common stock 60%. What is the net present value of this project? A) -$9,306 B) $2,149 C) $5,983 D) $11,568 Answer: A Diff: 2 Keywords: Net Present Value, Weighted Average Cost of Capital 12) For a typical corporation, which of the following capital structures will result in the lowest weighted average cost of capital? A) 40% debt, 20% preferred stock, 40% common equity B) 50% debt, 10% preferred stock, 40% common equity C) 60% debt, 10% preferred stock, 30% common equity D) 60% debt, 15% preferred stock, 25% common equity Answer: D Diff: 2 Keywords: Capital Structure, Weighted Average Cost of Capital 23 Copyright © 2011 Pearson Education, Inc. 13) Given the following information on S & G Inc.'s capital structure, compute the company's weighted average cost of capital. Type of Capital Percent of Capital Structure Bonds Preferred Stock Common Stock (Internal Only) 40% 5% 55% Before-Tax Component Cost 7.5% 11% 15% The company's marginal tax rate is 40%. A) 13.3% B) 7.1% C) 10.6% D) 10% Answer: C Diff: 2 Keywords: Weighted Average Cost of Capital 14) Which of the following causes a firm's cost of capital (WACC) to differ from an investor's required rate of return on the company's common stock? A) The fact that the risk free rate of interest has increased. B) The incurrence of flotation costs when new securities are issued. C) The market risk premium exceeds 12%. D) None of the above — the WACC and required return are the same Answer: B Diff: 2 Keywords: Weighted Average Cost of Capital, Taxes, Flotation Costs 15) Which of the following should not be considered when calculating a firm's WACC? A) Cost of preferred stock B) After-tax cost of bonds C) Cost of common stock D) Cost of carrying inventory Answer: D Diff: 1 Keywords: Weighted Average Cost of Capital 16) Which of the following should NOT be considered when calculating a firm's WACC? A) After-tax YTM on a firm's bonds B) After-tax cost of accounts payable C) Cost of newly issued preferred stock D) Cost of newly issued common stock Answer: B Diff: 1 Keywords: Weighted Average Cost of Capital 24 Copyright © 2011 Pearson Education, Inc. 17) Clothier, Inc. has a target capital structure of 40% debt and 60% common equity, and has a 40% marginal tax rate. If Clothier's yield to maturity on bonds is 7.5% and investors require a 15% return on Clothier's common stock, what is the firm's weighted average cost of capital? A) 7.20% B) 10.80% C) 12.00% D) 12.25% Answer: B Diff: 2 Keywords: Weighted Average Cost of Capital 18) Milton Parker has a capital structure that consists of $7 million of debt, $2 million of preferred stock, and $11 million of common equity, based upon current market values. Parker's yield to maturity on its bonds is 7.4%, and investors require an 8% return on Parker's preferred and a 14% return on Parker's common stock. If the tax rate is 35%, what is Parker's WACC? A) 7.21% B) 8.12% C) 10.18% D) 12.25% Answer: C Diff: 2 Keywords: Weighted Average Cost of Capital, Capital Structure 25 Copyright © 2011 Pearson Education, Inc. Essay 1) Meacham Corp. wants to issue bonds with a 9% coupon rate, a face value of $1,000, and 12 years to maturity. Meacham estimates that the bonds will sell for $1,090 and that flotation costs will equal $15 per bond. Meacham Corp. common stock currently sells for $30 per share. Meacham can sell additional shares by incurring flotation costs of $3 per share. Meacham paid a dividend yesterday of $4.00 per share and expects the dividend to grow at a constant rate of 5% per year. Meacham also expects to have $12 million of retained earnings available for use in capital budgeting projects during the coming year. Meacham’s capital structure is 40% debt and 60% common equity. Meacham’s marginal tax rate is 35%. a. Calculate the after-tax cost of debt assuming Meacham’s bonds are its only debt. b. Calculate the cost of retained earnings. c. Calculate the cost of new common stock. d. Calculate the weighted average cost of capital assuming Meacham’s total capital budget is $30 million. Answer: a. YTM with Net Proceeds = $1,075 is 8.0%. After-tax cost of debt = 8.0%(1 - .35) = 5.2% b. (($4.00(1.05))/$30) + 5% = 19% c. (($4.00(1.05))/($30 - $3)) + 5% = 20.56% d. At $30 million, debt = $12 million and common equity = $18 million. Available retained earnings are $12 million, so new common stock will equal $6 million. WACC = (.4)(5.2%) + (.4)(19%) + (.2)(20.56%) = 13.79% Diff: 3 Keywords: Weighted Average Cost of Capital, Cost of Debt, Cost of Retained Earnings, Cost of New Common Stock, Capital Structure 2) Office Clean Corporation has a capital structure consisting of 30 percent debt and 70 percent common equity. Assuming the capital structure is optimal, what amount of total investment can be financed by a $35 million addition to retained earnings without selling new common stock? Answer: Capital budget = $35Million / .7 = $50Million Diff: 2 Keywords: Optimal Capital Structure, Total Capital Budget 9.4 Learning Objective 4 True or False 1) Calculating the cost of capital for divisions within a company is not recommended because the data is too fragmented and all divisions are part of the same company in any case. Answer: FALSE Diff: 1 Keywords: Divisional Costs of Capital 26 Copyright © 2011 Pearson Education, Inc. 2) The after-tax cost of debt is equal to one minus the marginal tax rate times the yield to maturity on the firm's outstanding debt. Answer: TRUE Diff: 1 Keywords: After-tax Cost of Debt, Yield to Maturity 3) If the before-tax cost of debt is 7% and the firm has a 40% marginal tax rate, the after-tax cost of debt is 2.8%. Answer: FALSE Diff: 1 Keywords: After-tax Cost of Debt Multiple Choice 1) A corporate bond has a face value of $1,000 and a coupon rate of 5%. The bond matures in 15 years and has a current market price of $925. If the corporation sells more bonds it will incur flotation costs of $25 per bond. If the corporate tax rate is 35%, what is the after-tax cost of debt capital? A) 3.74% B) 4.45% C) 5.29% D) 6.78% Answer: A Diff: 2 Keywords: After-tax Cost of Debt, Flotation Costs, Bond Valuation 2) A corporate bond has a face value of $1,000 and a coupon rate of 9%. The bond matures in 14 years and has a current market price of $946. If the corporation sells more bonds it will incur flotation costs of $26 per bond. If the corporate tax rate is 35%, what is the after-tax cost of debt capital? A) 5.57% B) 6.56% C) 8.18% D) 7.31% Answer: B Diff: 2 Keywords: After-tax Cost of Debt, Flotation Costs, Bond Valuation 27 Copyright © 2011 Pearson Education, Inc. 3) Kendall, Inc. has $15 million of outstanding bonds with a coupon rate of 10 percent. The yield to maturity on these bonds is 12.5 percent. If the firm's tax rate is 30 percent, what is relevant cost of debt financing to Kendall, Inc.? A) 13.75 percent B) 8.75 percent C) 7.00 percent D) 3.75 percent Answer: B Diff: 2 Keywords: After-tax Cost of Debt, Yield to Maturity 4) Porky Pine Co. is issuing a $1,000 par value bond that pays 8.5% interest annually. Investors are expected to pay $1,100 for the 12-year bond. Porky will pay $50 per bond in flotation costs. What is the after-tax cost of new debt if the firm is in the 35% tax bracket? A) 8.23% B) 4.55% C) 4.70% D) 7.45% Answer: C Diff: 2 Keywords: After-tax Cost of Debt, Flotation Costs 5) All the following variables are used in computing the cost of debt except: A) maturity value of the debt. B) market price of the debt. C) number of years to maturity. D) risk-free rate. Answer: D Diff: 2 Keywords: After-tax Cost of Debt 6) Durocorp has a target capital structure of 30% debt and 70% equity. Durocorp is planning to invest in a project that will necessitate raising new capital. New debt will be issued at a beforetax yield of 14%, with a coupon rate of 10%. The equity will be provided by internally generated funds so no new outside equity will be issued. If the required rate of return on the firm's stock is 22% and its marginal tax rate is 35%, compute the firm's cost of capital. A) 18.00% B) 18.13% C) 19.68% D) 15.55% Answer: B Diff: 2 Keywords: Weighted Average Cost of Capital, After-tax Cost of Debt 28 Copyright © 2011 Pearson Education, Inc. 7) Ewer Firm will finance a proposed investment by issuing new securities while maintaining its optimal capital structure of 60% debt and 40% equity. The firm can issue bonds at a price of $950.00 before $15 flotation costs. The 10-year bonds will have an annual coupon rate of 8% and a face value of $1,000. The company can issue new equity at a before-tax cost of 16% and its marginal tax rate is 34%. What is the appropriate cost of capital to use in analyzing this project? A) 3.63% B) 8.77% C) 9.97% D) 11.81% Answer: C Diff: 2 Keywords: After-tax Cost of Debt, Cost of New Common Stock, Weighted Average Cost of Capital 8) Triplin Corporation's marginal tax rate is 35%. It can issue 10-year bonds with an annual coupon rate of 7% and a par value of $1,000. After $12 per bond flotation costs, new bonds will net the company $966 in proceeds. Determine the appropriate after-tax cost of new debt for Triplin to use in a capital budgeting analysis. A) 2.62% B) 4.87% C) 7.50% D) 7.8% Answer: B Diff: 2 Keywords: After-tax Cost of Debt, Flotation Costs 9) Mars Car Company has a capital structure made up of 40% debt and 60% equity and a tax rate of 30%. A new issue of $1,000 par bonds maturing in 20 years can be issued with a coupon of 9% at a price of $1,098.18 with no flotation costs. The firm has no internal equity available for investment at this time, but can issue new common stock at a price of $45. The next expected dividend on the stock is $2.70. The dividend for Mars Co. is expected to grow at a constant annual rate of 5% per year indefinitely. Flotation costs on new equity will be $7.00 per share. The company has the following independent investment projects available: Project Initial Outlay IRR 1 $100,000 10% 2 $ 10,000 8.5% 3 $ 50,000 12.5% Which of the above projects should the company take on? A) Project 3 only B) Projects 1 and 2 C) Projects 1 and 3 D) Projects 1, 2 and 3 Answer: C Diff: 2 Keywords: Optimal Capital Budget, After-tax Cost of Debt, Cost of New Common Stock 29 Copyright © 2011 Pearson Education, Inc. 10) Five Rivers Casino is undergoing a major expansion. The expansion will be financed by issuing new 15-year, $1,000 par, 9% annual coupon bonds. The market price of the bonds is $1,070 each. Five Rivers flotation expense on the new bonds will be $50 per bond. Five Rivers marginal tax rate is 35%. What is the relevant cost of the new bonds for capital budgeting purposes? A) 5.14% B) 5.69% C) 8.45% D) 4.82% Answer: B Diff: 2 Keywords: After-tax Cost of Debt 9.5 Learning Objective 5 Multiple Choice 1) Using the weighted average cost of capital as the required rate of return for every project will: A) cause a firm to reject projects that should have been accepted. B) cause a firm to accept projects that were too risky. C) result in maximization of shareholder wealth. D) A and B above. Answer: D Diff: 2 Keywords: Weighted Average Cost of Capital, Accept/Reject Decision 2) Why should firms that own and operate multiple businesses that have different risk characteristics use business-specific, or divisional costs of capital? A) Not all divisions have equal risk and the firm might accept projects whose returns are higher than are deemed appropriate. B) Not all business divisions have equal risk and the firm will likely become less risky in the future. C) Not all lines of business have equal risk and it is likely that the firm will accept projects whose returns are unacceptably low in relation to the risk involved. D) Use of the same weighted average cost of capital for all divisions may result in too much money being allocated to the least risky division. Answer: C Diff: 2 Keywords: Divisional Costs of Capital, Weighted Average Cost of Capital 30 Copyright © 2011 Pearson Education, Inc. 9.6 Learning Objective 6 True or False 1) According to interest rate parity theory, differences in observed nominal interest rates in two countries should equal differences in the expected rates of inflation in the two countries. Answer: TRUE Diff: 1 Keywords: Interest Rate Parity Theory, Nominal Interest Rates, Inflation Multiple Choice 1) A U.S. company can borrow 12,000 pounds in Great Britain for 4% interest, paying back 12,480 pounds in one year. Alternatively, the U.S. company can borrow an equivalent amount of U.S dollars in the United States and pay 8% interest. Assuming capital markets are efficient, estimate the expected inflation rate in the United States if inflation in Great Britain is expected to be zero. A) 5.02% B) 4.16% C) 4.00% D) 3.85% Answer: D Diff: 2 Keywords: Interest Rate Parity Theory 2) The interest rate parity theorem suggests that differences in observed nominal rates of interest in two countries should equal A) differences in the expected rates of inflation between the two countries. B) differences in the risk free rates of return between the two countries. C) differences in the federal funds rates between the two countries. D) differences in currency exchange rates between the two countries. Answer: A Diff: 2 Keywords: Interest Rate Parity Theory 3) The interest rate on a one year security in the United States is 3%, while the interest rate on a one year security in German is 8%. If the current exchange rate is 1 EURO = $1.50, then the future exchange rate in one year, according to the international Fisher effect, is: A) $1.431. B) $1.425. C) $1.575. D) $1.385. Answer: A Diff: 2 Keywords: International Fisher Effect 31 Copyright © 2011 Pearson Education, Inc. 4) Interest rate parity exists because A) there are investors who stand ready to engage in arbitrage. B) central banks ensure the relationship holds to protect currency values. C) inflation is the same in all industrialized countries. D) transactions costs and taxes make markets inefficient. Answer: A Diff: 2 Keywords: Interest Rate Parity, Arbitrage 32 Copyright © 2011 Pearson Education, Inc.