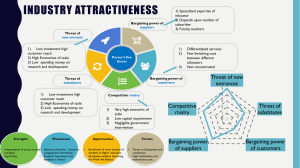

PORTER’S FIVE FORCE ANALYSIS What is Porter’s Five Force Analysis Five forces analysis is a set of ideas, a framework, a tool that states that there are five key competitive forces that serve to minimize the prospects for profitability is a particular industry. It is a method of analyzing the operating environment of competition of a business. BARGAINING POWER OF SUPPLIERS THREAT OF ENTRY INTENSITY OF RIVALRY BARGAINING POWER OF BUYERS THREAT OF SUBSTITU TES THREAT OF ENTRY • Threat of entering is simply the threat of a new business entering your industry. • Potential new entrants might want the threat to entry barriers to be low and therefore the threat of entry to be high, but those already in the industry want the threat to be low. What Can Make Threat of Entry Low? i. High sunk costs: Sunk costs is simply the money that has already been spent and cannot be recovered. If the cost of capital is high, it won’t be much of a problem but if the sunk costs are high, potential new entrants might pause a bit. They represent risks to these potential new entrants that if things don’t work out in their attempt to enter the industry, they are going to have difficulty recovering those costs or investments. THREAT OF ENTRY II. Incumbents have really dominant and competitive advantage: If new entrants are going to be at a competitive disadvantage, compared to existing players, it just might not be profitable to enter. Things like intellectual property, patents, licenses. If to succeed in an industry requires you need a certain license or IP and someone already has it, it would be had for new entrants. Large economies of scale relative to demand is a competitive advantage. Economies of scale is the idea that the more output increases, the average cost per unit will come down. And come down to the point that is called minimum efficient scale(MES). MES is the point you need to achieve to be cost effective in an industry. Different industries have different sort of levels of MES. To the extent the economies of scale don’t matter much, the threat of entry is going to be high. In other words is the company getting better at this? Is it lowering manufacturing cost because they are just doing more of it? Just like the idea that practice makes perfect. THREAT OF ENTRY III. If the new entrants are going to face serious retaliation from incumbent members of the industry. THREAT OF SUBSTITUTES • Substitutes are products that are similar to other products or services, but not exactly the same. But in the eyes of some consumers or buyers, they might under certain conditions substitute in and out for another. The threat of substitute taking away your sales. The threat should be low from the perspective of those in the industry. BARGAINING POWER OF BUYERS • If we are negotiating over a price for our goods or service in the industry, who gets to wield a little more power in negotiation. Do buyers set the price or sellers do? Its better for businesses if the bargaining power is lower. Buyers would have less power if they are less concentrated. If you are selling to a variety of buyers, those buyers won’t have as much power. Many Monopoly Power Competitive Few Mutual Dependence Monopsony Power Buyers Few Suppliers Many BARGAINING POWER OF SUPPLIERS • Supplier bargaining power will be lower when sellers are not concentrated. If the sellers are not concentrated. • If the sellers are few, they have a much greater ability to set price for the goods or services. • If firms have other alternatives, the bargaining power of suppliers will be lower. • If suppliers can’t forward integrate into your business, their bargaining power will be low. INTENSITY OF RIVALRY • This is about how intense is the rivalry among competitors in a particular industry. Those in the industry want the intensity to be low. • How can you tell the intensity? i. Number of competitors: The smaller the number the lesser the rivalry. ii. Opportunities to differentiate in the industry. THANK YOU ANY QUESTIONS?