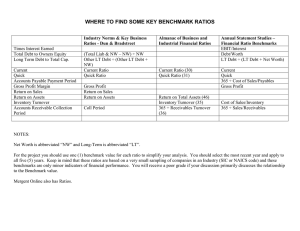

Evaluation of Financial Performance Chapter 2 1 What is Financial Analysis? 1. Assessment of a firm’s past, present and anticipated future performance. 2. Analysis is based on the firm’s financial statements. 3. Focus on historical performance to estimate future performance. 4. Allows comparison of company’s performance over time as well as its performance relative to its competitors. Chapter 2 2 Objectives of Financial Analysis • To identify the firm’s strengths and weaknesses so that the company can capitalize these strengths and take remedial and corrective actions to improve its weaknesses. Chapter 2 3 FINANCIAL RATIOS 1. Mathematical aids for evaluation and comparison of financial performance. 2. Computed based on the firm’s financial statements. 3. Look at the relationship between individual values and relate them to how a company has performed in the past and might perform in the future 4. Standardized financial information to facilitate meaningful comparison. Chapter 2 4 Objectives of Ratio Analysis 1. To standardize financial information for comparison purposes 2. To evaluate the firm’s current operation 3. To compare present performance with past performance 4. To compare the firm’s performance with other firms or industry standards. 5. To assess the efficiency of operations 6. To assess the risk of operations. Chapter 2 5 Types of Comparisons 1. Internal Comparison – analysis based on comparisons of similar ratios for the same firm at different periods. It is also known as time series analysis. 2. External Comparison – involves comparison of ratios of a firm with ratios of other firms in similar industry. This is also known as interfirms comparison or cross-sectional analysis. Chapter 2 6 Users of Financial Statements • Shareholders • Managers • Creditors • Current and future employees • Prospective investors • Customers • Government Chapter 2 7 Types of Ratios 1. 2. 3. 4. 5. Liquidity ratios Efficiency ratios Leverage ratios Profitability ratios Market ratios Chapter 2 8 Liquidity Ratios 1. Show a firm’s ability to meet its shortterm financial obligations. 2. Two commonly used liquidity ratios: a) Current Ratio b) Quick Ratio or Acid Test Ratio 3. CR= CA/CL. It indicates the extent to which current liabilities are covered by current assets Chapter 2 9 Liquidity Ratios 4. A CR of 2X means that the firm has RM2 in current assets for every RM1 in current liabilities. It indicates that the firm has no problem paying its current obligations on time. 5. The ideal ratio of 2 times cannot be applied to all companies because different types of industry have different types of asset requirements, and have different proportion of current assets and current liabilities 6. It is most commonly used as a measure of short-term solvency. Chapter 2 10 Liquidity Ratios 7. One drawback of current ratio is that inventory may include many items that are difficult to liquidate quickly and that have uncertain liquidation values. 8. An alternative measure of liquidity is to use quick ratio or acid test ratio. 9. QR = CA – Inventory – Prepayment CL 10.QR indicates whether a firm has enough CA to cover CL without selling inventory Chapter 2 11 Liquidity Ratios 11. Inventory is deducted because it generally takes longer time to be converted into cash. Prepaid expenses is also deducted because they are expenses that the firm has paid in advance and cannot be used to pay obligations when they come due. 12. Companies with quick ratio of less than 1 will not be able to pay its immediate obligation and therefore should be looked at with caution. Chapter 2 12 Causes for Liquidity Problem 1. Company is holding too much stocks 2. Poor debtors’ collection system 3. Poor cash management 4. Company is using short-term sources of financing to finance the purchase of long-term assets Chapter 2 13 Suggestions to Improve Liquidity Position 1. 2. 3. 4. 5. 6. 7. 8. Promote cash sales Give cash discounts Give discounts to encourage early payments Improve collection system. Adopt effective stock control system Invest in marketable securities to earn income Reduce current liabilities by paying off the existing creditors or use long-term sources of financing Adopt hedging principle in financing the firm’s assets. Chapter 2 14 Efficiency Ratios 1. Also referred as asset management ratios or asset utilization ratios 2. Measure how effectively a firm is managing its assets in generating sales. 3. Also show the firm’s efficiency in collecting debts as well as turning its stocks into sales. 4. Comprised of: 1. Inventory Turnover ratio 2. Average Collection Period 3. Non-Current (Fixed Asset) Turnover 4. Total Asset Turnover Chapter 2 15 Inventory Turnover Ratio 1. 2. 3. 4. 5. ITR = Cost of Goods Sold Average/Closing stocks It indicates how many times the stock is sold and replaced in a year. The higher the ratio, the faster the stock is being sold. ITR can be expressed in terms of number of days, and referred to as the inventory conversion period. This can be calculated by dividing 360 days by the inventory turnover. An ITR of 6 times means an inventory conversion period of 360 days/6 = 60 days. It implies that the firm is able to sell the inventories within 60 days. Chapter 2 16 Possible Causes of Poor Inventory Turnover 1. Holding too much stock, that is overstocking. 2. Large portion of stock consists of old or obsolete stocks, or damaged stocks which may be the result of poor stock control system 3. Lack of sales promotion lead to lower sales 4. The firm do not provide trade discounts to encourage bulk purchase 5. Firm’s pricing policy which affect the demand for the firm’s products. Chapter 2 17 Suggestions for Improving Inventory Turnover 1. If the company is overstocking, evaluate stock control system & introduce a more effective system or change its present method of ordering stocks. 2. Cut down on slow-moving and obsolete stocks by having stock clearance sales 3. Determine degree of competition, whether the product is price elastic or not Chapter 2 18 Average Collection Period 1. Also called “ Days sales outstanding” 2. Indicates the number of days taken by a firm to collect its accounts receivable. 3. Reflects the company’s credit policy whether they are loose or strict. 4. Shows the firm’s effectiveness and efficiency in extending credit and collecting debts. 5. The shorter the ACP, the more efficient the company is in debt collection. It may also indicate that the company is operating on a cash basis. Chapter 2 19 Average Collection Period 6. ACP = Accounts Receivable Annual Credit Sales / 360 • A ACP of 40 days means that the firm took 40 days to collect cash from their debtors. • It can also be expressed as a number of times and referred to as a Receivable Turnover ratio. • Receivables Turnover = 360 ACP 7. A Receivable Turnover of 4 times imply that the firm is able to collect its debt within 90 days. Chapter 2 20 Possible Causes of Poor Average Collection Period 1. 2. 3. 4. Lax or loose credit policy Poor screening No ageing of customers’ accounts No reminders and follow up for late payment 5. Not enough cash discounts given to encourage early payments Chapter 2 21 Suggestions to Shorten Average Collection Period 1. Adopt a tighter collection policy 2. Prepare ageing of debtors’ accounts 3. Screen new customers before allowing them credit sales 4. Offer cash discounts to encourage early payments. Chapter 2 22 Fixed Assets Turnover & Total Asset Turnover 1. FAT = Sales/ Net Fixed Assets 2. TAT = Sales / Total Assets 3. Measures firm’s efficiency in utilizing its property, plant and equipment in generating sales. 4. A higher ratio indicates that a firm is generating a higher volume of sales with the given amount of assets. 5. A lower ratio than the industry indicates that a company should increase its sales or disposed some of its assets. Chapter 2 23 Possible Causes of Low FAT & TAT & Suggestions for Improvement 1. Under utilization of fixed assets which may be due to too much investment in fixed assets and current assets and inefficient use of these assets to produce sales. 2. Insufficient sales Suggestions for improvement: 1. Increase production 2. Dispose of idle fixed assets 3. Review selling price, implement aggressive sales promotion or give trade discounts Chapter 2 24 Leverage Ratios 1. Also referred as Debt Management ratios or Gearing ratios. 2. Leverage refers to the use of borrowed capital or loans. 3. Measures the level of debt or borrowings in a firm. 4. Highlight the ability of the firm to pay its principal and interest charges. 5. Comprised of: 1. Debt ratio 2. Debt-to equity ratio 3. Times interest earned Chapter 2 25 Debt Ratio 1. DR = Total debt Total assets 2. It measures how much debt is used to finance the firm’s assets 3. Total debt comprises both current liabilities and long-term debt. 4. Creditors prefer low debt ratios because it reduces the potential loss that may occur in the event of liquidation. Chapter 2 26 Debt Ratio 5. The owners may want more leverage because it magnifies earnings. 6. A debt ratio of 55% means that the creditors have supplied more than half the firm’s total financing. 7. If a company’s debt ratio is significantly higher than industry ratio, it would experience difficulty in raising additional borrowings. Chapter 2 27 Debt-to-Equity Ratio • Debt/Equity ratio = Total Debt Total Equity • Measures the percentage of borrowing used compared to equity Chapter 2 28 Times Interest Earned (TIE) 1. Also referred as “Interest Coverage” ratio 2. Ratio of EBIT to interest expenses. (EBIT/Interest expense) 3. Measures the ability of the firm to meet its annual interest payments. 4. The higher the ratio, the higher is the firm’s ability to fulfill its interest obligations. Chapter 2 29 Possible Causes of High Leverage & Suggestions for Improvement • Causes: 1. High borrowings due to high dividend policy • Suggestions: 1. Review dividend policy 2. Finance capital investment from retained earnings 3. Have optimum mixture in its sources of financing Chapter 2 30 Profitability Ratios 1. Measures how effective the firm uses its assets to make profit. 2. Shows the combined effects of liquidity, assets management and debt management on operating results. 3. Also indicate the firm’s efficiency in controlling costs and the pricing policy of the firm 4. It shows the profits earned for every RM of sales made or the profits earned per RM of investments in assets. Chapter 2 31 Profitability Ratios 5. Comprised of: 1. Gross Profit Margin 2. Operating Profit Margin 3. Net Profit Margin 4. Return on Assets 5. Return on Equity Chapter 2 32 Gross Profit Margin 1. A measure of the gross profit earned on sales. 2. GPM = Sales – Cost of Goods Sold Sales 3. GPM is the percentage of sales remaining after deducting the cost of sales. 4. A GPM of 30% means that the company is making 30 sen gross profit for every RM1 of sales made. 5. A high GPM reflects good earning potential. It also shows the efficiency of the company in controlling its costs of goods sold and the pricing policy implemented. Chapter 2 33 Possible Causes of Low GPM & Suggestions for Improvement • Causes: – Insufficient sales volume due to high selling price or higher costs of goods sold – Higher costs of goods sold may be due to expensive sources in supply of goods, higher labor costs and high production wastages. • Suggestions: – Review pricing policy – Reduce cost of goods sold by changing supplier – Reduce labor cost and production wastage Chapter 2 34 Operating Profit Margin 1. Operating profit is also referred to Earnings Before Interest and Tax. 2. Percentage of sales remaining after deducting all costs and expenses excluding interest and tax from sales. 3. OPM = EBIT/Sales 4. The higher the operating profit margin, the higher is the profitability of the company. Chapter 2 35 Possible Causes of Lower Operating Margins & Suggestions for Improvement • Causes: 1. Lower gross profit margin 2. High operating expenses. 3. Lower selling price • Suggestions: 1. Reduce cost of goods sold 2. Reduce operating expenses 3. Review selling price Chapter 2 36 Net Profit Margin 1. NPM = Net Income Available to CS Sales 2. Net Income available to common shareholders refers to net profit after tax minus preferred dividend. If there is no preference shares, the net income available to common shareholders is equal to net income after tax. Chapter 2 37 Causes of Low Net Profit Margin & Suggestions for Improvement • Causes: 1. High operating expenses 2. High interest charges • Suggestions: 1. Reduce operating expenses 2. Review financing strategies Chapter 2 38 Return on Assets (ROA) 1. Is also known as Return on Investment (ROI) 2. Indicates management’s ability to make profits from the firm’s investment is assets. 3. ROA = Net Income Available to Common Shareholders Total Assets Chapter 2 39 Return on Equity (ROE) 1. Measures the profit earned by the common shareholders from their investment in the company. 2. The higher the ROE, the better the return for the shareholders. 3. ROE = Net Income Available to Common Shareholders Common Equity Chapter 2 40 Limitations of Financial Ratios 1. Comparison with industry averages is difficult for conglomerates 2. Average performance as shown in the industry averages may not be desirable 3. Seasonal factors can also distort ratios 4. Inflation distorts the firm’s financial statements 5. Different operating and accounting practices make comparison difficult 6. It is sometimes difficult to conclude whether a ratio is good or bad. 7. It is difficult to conclude whether a firm’s overall performance is good or bad. 41