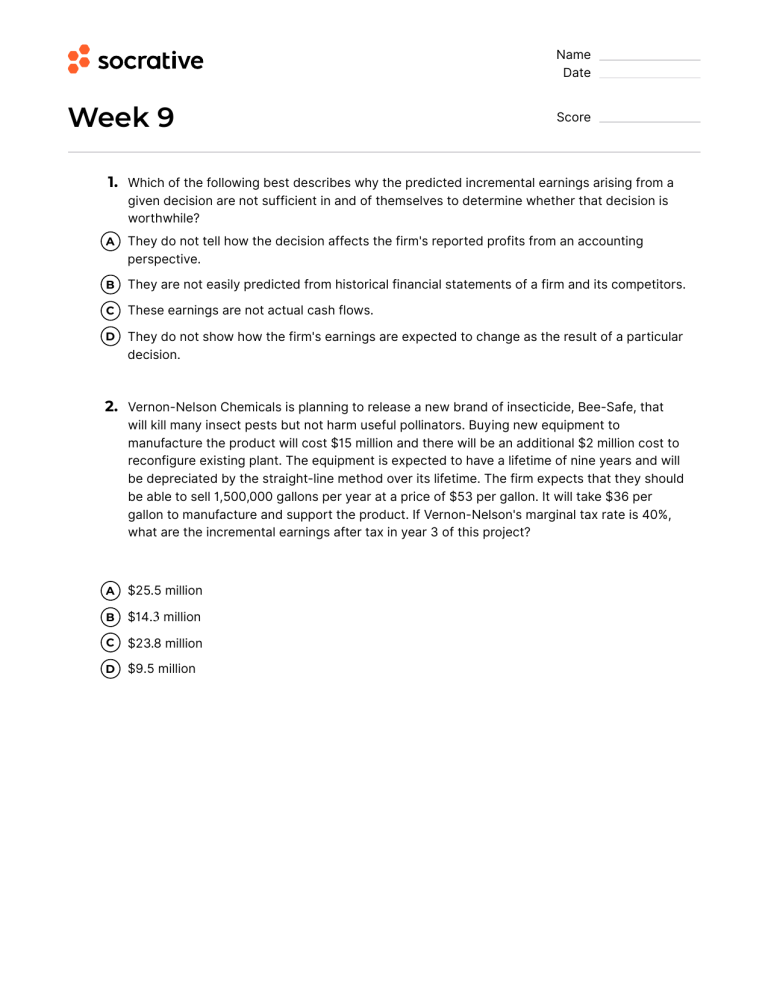

Name Date Week 9 Score 1. Which of the following best desc ibes why the predicted incremental ea nings a ising from a given decision are not sufficient in and of themselves to dete mine whether that decision is wo thwhile? A They do not tell how the decision affects the fi m's repo ted profits from an accounting perspective. B They are not easily predicted from histo ical financial statements of a fi m and its competitors. C These ea nings are not actual cash flows. D They do not show how the fi m's ea nings are expected to change as the result of a pa ticular decision. 2. Ve non-Nelson Chemicals is planning to release a new brand of insecticide, Bee-Safe, that will kill many insect pests but not ha m useful pollinators. Buying new equipment to manufacture the product will cost $15 million and there will be an additional $2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of nine years and will be depreciated by the straight-line method over its lifetime. The fi m expects that they should be able to sell 1,500,000 gallons per year at a p ice of $53 per gallon. It will take $36 per gallon to manufacture and suppo t the product. If Ve non-Nelson's marginal tax rate is 40%, what are the incremental ea nings after tax in year 3 of this project? A $25.5 million B $14.3 million C $23.8 million D $9.5 million 3. Food For Less FFL , a groce y store, is conside ing offe ing one-hour photo developing in their store. The fi m expects that sales from the new one-hour machine will be $175,000 per year. FFL cu rently offers ove night film processing with annual sales of $90,000. While many of the one-hour photo sales will be to new customers, FFL estimates that 40% of their cu rent ove night photo customers will switch and use the one-hour se vice. The level of incremental sales associated with introducing the new one hour photo se vice is closest to ________. A $139,000 B $175,000 C $36,000 D $70,000 4. CathFoods will release a new range of candies which contain antioxidants. New equipment to manufacture the candy will cost $2 million, which will be depreciated by straight-line depreciation over four years. In addition, there will be $5 million spent on promoting the new candy line in the first year. It is expected that the range of candies will b ing in revenues of $4 million per year for four years with production and suppo t costs of $1.5 million per year. If CathFoods' marginal tax rate is 35%, what are the incremental free cash flows in the second year of this project? 1. 2. 3. 4. A $1.800 million B $1.400 million C $2.000 million D $0.700 million C B A A Tips for Q2 Earning (profit) in year 3 = 1,500,000 * ($53 -36) - annual depreciation expense ($15 m / 9) = $23,833,333 Earning (profit) after tax in year 3 = $23,833,333 * (1-40%) = $14,300,000 Tips for Q4 Annual depreciation = $2m /4 = $0.5 m Free Cash flow (in year 2) = ($4 m - $1.5 m - $0.5 m) * (1-35%) + annual depreciation ($0.5 m) = $1.8 m