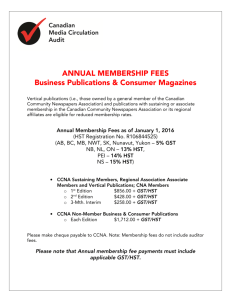

Here is what you need to know about income tax installments as a small business owner Transitioning from a full-time employee to owning a small business or self-employment means you have to cultivate self-discipline. You can no longer rely on your employer to handle business functions unrelated to your job, and you have to take a much more active role in making sure you're on top of your responsibilities, whether it's collecting payments from customers, or paying bills. or make sure you don't run into Revenue Canada. One of these obligations requires you to pay your own income tax, which you must pay when you file your tax return. Additionally, once you exceed a certain income threshold, you must also pay income tax and sales tax installments. Get in touch with accounting firms near me and file corporation tax. What is an installment payment? When you are an employee, your employer is responsible for withholding and paying deductions from your paycheck to the financial agencies. Unincorporated small business owners, such as sole proprietors, must take this responsibility on their own. Since unincorporated small businesses only pay taxes on business profits, which are inconsistent each month, it can be difficult to estimate the taxes that need to be paid (unless, of course, you have a great accounting system, and even then, you don't need to estimate your income and deductions other sources). As such, Revenue Canada requires you to pay tax "charges" to be paid based on the estimate. What are the different types of installments? Owners of unregistered small businesses must make regular payments for: 1. Income taxes 2. GST/HST and QST where applicable How are the fees calculated? Since it's very difficult to accurately estimate your income taxes until you actually prepare your tax return, there are various ways you can pay in installments. The first method is to base payments on taxes due from the previous year. For example, if you owe $10,000 in income taxes for 2019, you'll have to pay $2,500 per quarter in 2020. This is a little more complicated because you don't know the income taxes due until later in the year. The first two installments due on March 15 and June 15 are based on your 2018 income. Alternatively, taking into account the fluctuations between earnings earned in one year versus another, you can estimate your taxes for the current year and remit them based on those amounts. For example, if your average tax rate was 35% in 2019 and you estimate that you will earn $75,000 in the current year after expenses, you can remit $26,250 in four installments, which equals $6,562. Keep in mind that if you think your profit will be higher or lower, your tax bracket may change, resulting in a different average tax rate. I recommend that business owners use a tax calculator to get an idea of their taxes to pay. Quarterly GST/HST and QST payments are simply calculated as 1/4 of what you paid last year (based on your annual returns) Get in touch with accounting firms near me and file corporation tax. What are the fees due date? If you are an unincorporated sole proprietor/entrepreneur, your due dates are as follows: 1. Income tax quotas: March 15, June 15, September 15, and December 15 2. GST/HST and QST charges: April 30, July 31, October 31, and January 31. What happens when you don't do fractions? Revenue Canada charges interest on unpaid installments at prescribed rates, currently around 5%. Revenue Quebec also charges interest at the regular published rate whenever repayments exceed 75% of the amount owed. If your repayment is less than 75% of the required payment, 10% annual interest applies, compounded daily. What else do you need to know about fees? You don't have to pay fees in the first year of business because there is no history to count from. Revenue Canada does not require you to pay fees if your tax liability is estimated to be $3,000 or less. If you live in Quebec, this amount is reduced to $1,800. Quebec residents are also required to pay fees if the estimated Quebec income tax is $1,800 or less. You are only required to make GST/HST and QST payments if the amount payable for GST/HST and QST for the year exceeds $3,000. In this case, payments must be made by the month following the fiscal quarter. Both Revenue Canada and Revenue Quebec will send you a notice of the amount due, along with proof of payment, after reviewing your previous year's tax return. Payment can be made by check or online banking. However, they will not tell you the amount to be paid for GST/HST and QST, which you must calculate yourself. By making your payments on time, you will reduce the number of potential interest costs (which are also not tax deductible for your business), and most importantly, you will reduce the temptation to spend money that you will eventually have to pay to a credit rating agency, which can result in expensive expenses and nasty debts. Get in touch with accounting firms near me and file corporation tax.