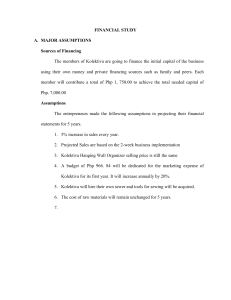

lOMoARcPSD|12553117 Tax 1 Reviewer Atty - Lecture notes 1 Law (University of Nueva Caceres) Studocu is not sponsored or endorsed by any college or university Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 TAX ATI ON I – Re vie w e r ( At t y. Boliva r N ot e s) • [Impt!] TAX ATI ON I N CLUD ES TW O ASPECTS 1. Levying or imposition (by enacting a tax law) of the tax which is a legislative act 2. Collection of the tax levied which is essentially administrative in character (executive dept BIR) The processes together constitute the t ax a t ion syst e m . • [Mem!] BASI C PRI N CI PLES OF A SOUN D TAX SYSTEM 1. Fiscal adequacy , which means that the sources of revenue should be sufficient to meet the demands of public expenditures 2. Equalit y or t heoret ical j ust ice, which means that the tax burden should be proportionate to the taxpayer’s ability to pay – a bilit y t o pa y pr in ciple 3. Adm inist rat ive feasibility , which means that the tax laws should be capable of convenient, just and effective administration • [Mem!] TAX means an enforced and apportioned contribution usually monetary in form, levied by the lawmaking body on persons and property subject to its jurisdiction for the precise purpose of supporting gov’tal needs. • [Mem!] ESSEN TI AL CH ARACTERI STI CS OF TAX 1. Enforced contribution 2. Payable in the form of money 3. Levied by some rule of apportionment usually based on ability to pay (secondarily on the basis of benefits received) 4. Levied on persons, property or business, acts, transactions, right or privileges. 5. Levied by the State which has jurisdiction over the object taxed 6. Levied by the lawmaking body of the State 7. Levied for public purposes • [Mem!] CLASSI FI CATI ON S OF TAX ES 1. N a t ion a l Ta xe s or those imposed by the national gov’t under the NIRC and other laws particularly Tariff and Customs Code 2. Loca l or M u n icipa l Ta xe s or those which LGUs may impose under the LGC • Life Blood D oct r in e states that taxes are the lifeblood of the gov’t and their prompt and certain availability is an imperious need. The following rules or principles or legal provisions are based on lifeblood doctrine: SEC. 1 . Tit le of t h e Code. - This Code shall be known as the N a t ion a l I n te r na l Re ve nu e Code of 1 9 9 7 . (took effect on Jan. 1, 1998) • I N TERN AL REV EN U E TAX – refers to taxes imposed by the legislature other than duties on imports and exports (external revenue tax). • REV EN UE – refers to all funds or income derived by the government, whether from tax or any other source (such as borrowed funds, income from proprietary functions, regulatory fees and proceeds from sale of government properties) • [Impt!] N ATU RE OF I N TERN AL REV EN UE LAW S 1. They are not political in nature 2. Tax laws are civil and not penal in nature although there are penalties (such as imprisonment & fine) provided for their violations. • [Mem!] TAX ATI ON is the act of levying a tax, the process or means by which the sovereign, through its lawmaking body, raises income to defray the necessary expenses of government. As a pow e r , taxation refers to the inherent power of the State (only the gov’t has the inherent power of taxation, LGUs have no inherent power of taxation because their power to tax is granted by the Constitution [Sec. 5, Art. 10] and by the statute or law [LGC of 1991, Book 2]) to demand enforced contributions for public purpose or purposes. Thus, the tem “t ax at ion” may be used to refer to either the power to tax or the act or process by which the power is exercised, or to both. • • • [Mem!] RATI ON ALE OF TAX ATI ON is that gov’t is a necessity and without taxes, the gov’t would be paralyzed for lack of the motive power to activate and operate it. [Mem!] N ATURE OF POW ER OF TAX ATI ON 1. The power of taxation is inherent in sovereignt y (national government) 2. It is essent ially a legislat ive funct ion 3. It is subj ect t o const it ut ional and inherent lim it at ions (due process of law) [Impt!] I N H EREN T LI M I TATI ON S 1. Territoriality, which requires that the person or property taxed must be subject to the jurisdiction of the taxing State 2. International Comity, under which the property of a foreign State may not be taxed by another 3. Exemption of governmental agencies from taxation 4. Prohibition against the delegation of legislative power 5. The levy of tax must be for a public purpose 1. 2. 3. 4. 5. 6. Set-off or compensation is NOT allowed Gov’t is NOT stopped by the mistakes or errors of its agents Courts are NOT allowed to restrain the collection of taxes Summary remedies of distraint and levy Tax exemptions are strictly construed against the person claiming exemption The commissioner or internal revenue is NOT required by law to decide disputed assessments 1 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • TAX I S A LEGAL OBLI GATI ON ! • [VVIP!] Ta x e s n ot ge n er a lly su bj ect t o se t - off – general rule, based on grounds of public policy, is well-settled that no set-off or compensation is admissible against demands for taxes levied for general or local purposes. o The government and taxpayer are not mutually creditors and debtors of each other and a claim for taxes is not such a debt, demand, contract or judgment as is allowed to be set-off • or pr ovision is interpreted strictly against the taxpayer or person claiming the exemption and liberally in favour of the gov’t. 4. W h e r e t a xpa ye r claim s t a x e xe m pt ion – neither does the rule (that the law shall be applied strictly against the gov’t and liberally in favor of the taxpayer) apply where the taxpayer claims exemption from the tax. Tax exemption provisions are construed or interpreted strictly not against the gov’t but against the one who asserts the claim of exemption, strictly against the taxpayer and liberally in favour of the taxing authority. Taxation is a destructive power which interferes with the personal and property rights of the people and takes from them a portion of their property for the support of the gov’t. However, since taxes are what we pay for civilized society or are the lifeblood of the nation, the law frowns against exemptions from taxation. They extend only so far as the language of the law warrants, and all doubts are resolved in favour of taxation. 5. EX EM PTI ON (example is Sec. 30) is an immunity or privilege; it is freedom from a charge or burden to which others are subjected. EX CLUSI ON (example is Section 32B) is the removal of otherwise taxable items from the reach of taxation such as exclusions from gross income and allowable deductions (Section 34). Exclusion is thus also an immunity or privilege which frees a taxpayer from a charge to which others are subjected. Consequently, the rule that the tax exemption should be applied in st rict issim i j uris (strictly) against the taxpayer and liberally in favour of the gov’t applies equally to tax exclusions. W h e n se t - off of t ax e s a llow e d – the exception to the general rule regarding set-off is where both the claims of the gove r n m e n t (local gov’t unit) and the taxpayer against each other have already become due and demandable as well as fully liquidated (ascertain; computer with finality) While the general rule in our jurisdiction is not to allow the set-off of excess taxes paid against other taxes payable to the gov’t, the Commissioner of Internal Revenue may grant the credit of taxes erroneously or illegally paid pursuant to Section 204 (C), second paragraph. • [VIP!] Er r or s of t a x officia ls n ot bindin g on th e gove r n m e n t – errors of tax officers or officials of the gov’t do not bind the gov’t or prejudice its right to collect the taxes legally due from taxpayers. The gov’t is never stopped by the mistakes or errors on the part of its agents. • [Impt!] The errors of certain administrative officers should never be allowed to jeopardize the gov’t’s financial position. Taxes are the lifeblood of the nation through which the gov’t agencies continue to operate and with which the State effects its functions for the welfare of its constituents and so should be collected without unnecessary hindrance or delay. • SOURCES OF TAX LAW 1. Legislation 2. Administrative regulations and rulings or opinions of tax officials 3. Judicial decisions • [VIP!] CON STRUCTI ON OF TAX LAW 1. Deliberation of Congress. Tax statutes are to receive a reasonable construction with a view to carrying out their purpose and intent Tax refunds are also in the nature of tax exemptions (except if the tax refund is the result of excessive payment of tax by reason of error in mathematical computation) and are, therefore, to be construed strictly against the claimant who has the burden of proving the factual basis of his claim for refund. • 2. W h e r e t h e re is dou bt – in every case of doubt, tax statues (such as certain provision of the tax law enumerating who are taxable) are construed strictly against the gov’t and liberally in favour of the taxpayer. Taxes, being burdens, are not to be extended by implication or presumed beyond what the statute expressly declares. 3. The rule of strict construction as against the gov’t is not applicable where the language of the tax statute is plain and there is no doubt as to the legislative intent APPLI CATI ON OF TAX LAW S – the general rule is that tax laws are prospective in operation. The reason is that the nature and amt of the tax could not be foreseen and understood by the taxpayer at the time the transaction, which the law seeks to tax, was completed. o o o While it is not favoured, a statute may nevertheless operate retroactively, pr ovided, it is clearly the legislative intent (it is expressly stated in the effectivity clause of the law; such as the law is made retroactive as provided in the effectivity clause of the law) The application of our tax laws is subject to the provisions of tax treaties (tax laws are subordinated by the tax treaties or tax treaties are superior than tax laws) entered into by the Philippines with foreign countries Ta x la w or t a x pr ovision is interpreted strictly against the gov’t and liberally in favour of the taxpayer while t a x e x e m pt ion la w 2 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Internal Revenue is vested in the Commissioner, subject to the exclusive appellate jurisdiction of the Court of Tax Appeals (NOT the Secretary of Finance). Con st r u ct ion of t h e N I RC 1. 2. A Spe cial La w – the Code being a special law, prevails over a general law like the Civil Code, in case of conflict in their provisions A Ge n e r a l La w – the Tax Code may be considered a general law with respect to other laws. Thus, it has been ruled that Sec 291 did not repeal the tax incentives provisions of RA 7279 (Urban Development and Housing Act of 1992) and RA 6657 (Comprehensive Agrarian Reform Act of 1997) which are special laws in relation to the Tax Code. It is settled that a general law cannot repeal a special law by implication for the legislature is presumed to know all the laws on the subject • Under the NIRC, it is the Secretary of Finance who promulgates rules and regulations to implement the provisions of the NIRC upon the recommendation of the CIR. Under the Tariff and Customs Code, it is the Commissioner of Customs who promulgates rules and regulations to implement the provisions of the TCC (Tariff & Customs Code) • Interpretation of the Laws o The power of the Commissioner of Internal Revenue to interpret tax laws administered by the BIR is exclusive and original but subject to review by the Secretary of Finance. Their interpretations, while entitled to great weight, are not judicially binding o Re ve nu e Re gu la t ions – are issuances signed by the Secretary of Finance upon the recommendation of the Commissioner that specify, prescribe or define rules and regulations for the effective enforcement of the provisions of the Tax Code and relevant laws. 3. D e cision s of Am e r ica n Cou r t s – many provisions of our Tax Code are basically of American origin hence, decisions of American courts have persuasive effect • The general rule is that where a local rule is patterned or copied from that of another country, then the decisions of the courts in such country construing the rule are entitled to great weight in interpreting the local rule. • SEC. 2 . Pow e r s a n d D u t ie s of t h e Bu r ea u of I n t e rn a l Re ve nu e . - The Bureau of Internal Revenue shall be under the supervision and control of the Department of Finance and its powers and duties shall comprehend the assessment and collection of all national internal revenue taxes, fees, and charges, and the enforcement of all forfeitures, penalties, and fines connected therewith, including the execution of judgments in all cases decided in its favor by the Court of Tax Appeals and the ordinary courts. The Bureau shall give effect to and administer the supervisory and police powers conferred to it by this Code or other laws. JURI SD I CTI ON OV ER TAX CASES The power to decide (decisions of the CIR involving disputed assessments, refunds, etc. are NOT subject to review by the Secretary of Finance but are appealable to the CTA) administratively tax cases involving disputed assessments, etc. is vested as well in the Commissioner subject to the exclusive appellate jurisdiction of the CTA. • Ru lin gs of fir st im pre ssion – these refer to the rulings, opinions and interpretations of the CIR with respect to the provisions of the Tax Code and other tax laws without established precedents and which are issued in response to a specific request for ruling field by a taxpayer with the BIR. SEC. 3 . Ch ie f Officials of th e Bur e au of I n te r n al Re ve nu e. - The Bureau of Internal Revenue shall have a chief to be known as Commissioner of Internal Revenue, hereinafter referred to as the Commissioner and four (4) assistant chiefs to be known as Deputy Commissioners. SEC. 5 . Pow e r of t h e Com m ission e r t o Obt a in I n for m a t ion , a n d t o Su m m on , Ex a m in e , a n d Ta ke Te st im on y of Pe r son s. - In ascertaining the correctness of any r e t u rn (or report), or in making a return when none has been made, or in determining the liability of any person for any internal revenue tax, or in collecting any such liability, or in evaluating tax compliance, the Commissioner is authorized: TITLE 1 ORGANIZATION AND FUNCTION OF THE BIR (A) To examine any book, paper, record, or other data which may be relevant or material to such inquiry; [Impt!] SEC. 4 . Pow e r of t h e Com m ission e r t o I n t e r pr e t Ta x La w s an d t o D e cide Ta x Ca se s. - The power to interpret (is this not a violation of the Principle of Separation of Powers? NO, because the interpretations of the commissioner even if reviewed & upheld by the Sec. of Finance are not binding to the courts) the provisions of this Code and other tax laws administered by the BIR shall be under the exclusive and original jurisdiction of the Commissioner, subject to review by the Secretary of Finance. (B) To obtain on a regular basis from any person other than the person whose internal revenue tax liability is subject to audit or investigation, or from any office or officer of the national and local governments, government agencies and instrumentalities, including the Bangko Sentral ng Pilipinas and government-owned or -controlled corporations, any information such as, but not limited to, costs and volume of production, receipts or sales and gross incomes of taxpayers, and the names, addresses, and financial statements of corporations, mutual fund companies, insurance companies, regional operating headquarters of multinational companies, joint accounts, associations, joint ventures of consortia and registered partnerships, and their members; The power to decide disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties imposed in relation thereto, or other matters arising under this Code or other laws or portions thereof administered by the Bureau of 3 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (C) To summon the person liable for tax or required to file a return, or any officer or employee of such person, or any person having possession, custody, or care of the books of accounts and other accounting records containing entries relating to the business of the person liable for tax, or any other person, to appear before the Commissioner or his duly authorized representative at a time and place specified in the summons and to produce such books, papers, records, or other data, and to give testimony; any such report is false, incomplete or erroneous, the Commissioner shall assess the proper tax on the best evidence obtainable. [Impt!] In case a person fails to file a required return or other document at the time prescribed by law, or willfully or otherwise files a false or fraudulent return or other document, the Commissioner shall make or amend the return from his own knowledge and from such information as he can obtain through testimony or otherwise, which shall be prima facie correct and sufficient for all legal purposes. (D) To take such testimony of the person concerned, under oath, as may be relevant or material to such inquiry; and (C) Aut horit y t o Conduct I nv ent ory- t aking, surveillance and t o Prescribe Presum pt iv e Gross Sales and Receipt s. - The Commissioner may, at any time during the taxable year, order inventory-taking of goods of any taxpayer as a basis for determining his internal revenue tax liabilities, or may place the business operations of any person, natural or juridical, under observation or surveillance if there is reason to believe that such person is not declaring his correct income, sales or receipts for internal revenue tax purposes. The findings may be used as the basis for assessing the taxes for the other months or quarters of the same or different taxable years and such assessment shall be deemed prim a facie correct. (E) To cause revenue officers and employees to make a canvass from time to time of any revenue district or region and inquire after and concerning all persons therein who may be liable to pay any internal revenue tax, and all persons owning or having the care, management or possession of any object with respect to which a tax is imposed. [Impt!] The provisions of the foregoing paragraphs especially A notwithstanding, nothing in this Section shall be construed as granting the Commissioner the authority to inquire into bank deposits ot h e r t h an as provided for in Section 6(F) (such as in the case of a decedent to determine his gross estate) of this Code. • When it is found that a person has failed to issue receipts and invoices in violation of the requirements of Sections 113 and 237 of this Code, or when there is reason to believe that the books of accounts or other records do not correctly reflect the declarations made or to be made in a return required to be filed under the provisions of this Code, the Commissioner, after taking into account the sales, receipts, income or other taxable base of other persons engaged in similar businesses under similar situations or circumstances or after considering other relevant information may prescribe a minimum amount of such gross receipts, sales and taxable base, and such amount so prescribed shall be prima facie correct for purposes of determining the internal revenue tax liabilities of such person. GENERAL RULE: Commissioner may not see/examine bank accounts EXCEPTION: Section 6(F) SEC. 6 . Pow e r of t h e Com m ission e r t o M a k e a ssessm en t s a n d Pr e scr ibe a ddit ion a l Re quir e m en t s for Tax Adm in ist r a t ion a n d En for ce m e n t . – (A) Exam inat ion of Ret urns and Det erm inat ion of Tax Due. - After a return has been filed as required under the provisions of this Code, the Commissioner or his duly authorized representative (such as Revenue District Officer or Regional Revenue Director) may authorize (the BIR Examiner) the examination of any taxpayer and the assessment of the correct amount of tax: Pr ovide d, h ow e ve r ; That failure to file a return shall not prevent the Commissioner from authorizing the examination of any taxpayer. Any return, statement of declaration filed in any office authorized to receive the same shall not be withdrawn: Prov ided, That within three (3) years from the date of such filing, the same may be modified, changed, or amended: Provided, furt her, That no notice for audit or investigation of such return, statement or declaration has in the meantime been actually served upon the taxpayer. (D) [Impt!] Au t h or it y t o Te r m in a t e Ta xa ble Pe r iod. - When it shall come to the knowledge of the Commissioner that (1) a taxpayer is retiring from business subject to tax, or (2) is intending to leave the Philippines or to remove his property therefrom or to hide or conceal his property, or (3) is performing any act tending to obstruct the proceedings for the collection of the tax for the past or current quarter or year or to render the same totally or partly ineffective unless such proceedings are begun immediately, the Commissioner shall declare the tax period of such taxpayer terminated at any time and shall send the taxpayer a notice of such decision, together with a demand request for the immediate payment of the tax for the period so declared terminated and the tax for the preceding year or quarter, or such portion thereof as may be unpaid, and said taxes shall be due and payable immediately and shall be subject to all the pe na lt ie s (surcharge and interest) hereafter prescribed, u n le ss (not subject to penalties) paid within the time fixed in the demand made by the Commissioner. (B) Failure t o Subm it Required Ret urns, St at em ent s, Report s and ot her Docum ent s. - When a report required by law as a basis for the assessment of any national internal revenue tax shall not be forthcoming within the time fixed by laws or rules and regulations or when there is reason to believe that (E) [Impt!] Aut horit y of t he Com m issioner t o Prescr ibe Real Propert y Values. The Commissioner is hereby authorized to divide the Philippines into different zones or areas and shall, upon consultation with competent appraisers both from the private and public sectors, determine the fair market value of real The tax or any deficiency tax so assessed shall be paid upon notice and demand from the Commissioner or from his duly authorized representative. 4 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 properties located in each zone or area. For purposes of computing any internal revenue tax (1. Capital Gains Tax; 2. Regular Income Tax on Real Estate Business; 3. VAT; 4. DST; 5. Estate Tax; 6. Donor’s Tax) the value of the real property shall be, whichever is the higher of: (i.) The identity of the person under examination or investigation; (ii.) A statement of the information being sought including its nature and the form in which the said foreign tax authority prefers to receive the information from the Commissioner; (iii.) The tax purpose for which the information is being sought; (iv.) Grounds for believing that the information requested is held in the Philippines or is in the possession or control of a person within the jurisdiction of the Philippines; (v.) To the extent known, the name and address of any person believed to be in possession of the requested information; A Statement that the request is in conformity with the law and administrative practices of the said foreign tax authority, such that if the requested information was within the jurisdiction of the said foreign tax authority then it would be able to obtain the information under its law or in the normal course of administrative practice and that it is conformity with a convention or international agreement; and A statement that the requesting foreign tax authority has exhausted all means available in its own territory to obtain the information, except those that would give rise to disproportionate difficulties. (1) the fair market value as determined by the Commissioner, or (2) the fair market value as shown in the schedule of values of the Provincial or and City Assessors. (F) [VVIP!] Aut horit y of t he Com m issioner t o inquire int o Bank Deposit Account s. - Notwithstanding any contrary provision of Republic Act No. 1 4 0 5 (Bank Secrecy Law), Republic Act No. 6426, otherwise known as the For e ign Cu r r en cy De posit Act of the Philippines and other general or special laws (Central Bank Act & General Banking Law of 2000), the Commissioner is hereby authorized to inquire into the bank deposits of: (vi.) ( 1 ) a decedent to determine his gross estate; a n d (2) any taxpayer who has filed an application for compromise of his tax liability under Sec. 204 (A) (2) of this Code by reason of financial incapacity to pay his tax liability. (vii.) In case a taxpayer files an application to compromise the payment of his tax liabilities on his claim that his financial position demonstrates a clear inability to pay the tax assessed, his application shall not be considered u n le ss and until he waives in writing his privilege under Republic Act No. 1405, Republic Act No. 6426, otherwise known as the Foreign Currency Deposit Act of the Philippines, or under other general or special laws, and such waiver shall constitute the authority of the Commissioner to inquire into the bank deposits of the taxpayer. The Commissioner shall forward the information as promptly as possible to the requesting foreign tax authority. To ensure a prompt response, the Commissioner shall confirm receipt of a request in writing to the requesting tax authority and shall notify the latter of deficiencies in the request, if any, within sixty (60) days from the receipt of the request. (3) A specific taxpayer (such as person who has committed violation of Anti-money Laundering Act or Law of a Foreign Country) or taxpayers subject of a request for the supply of tax information from a foreign tax authority (such as Internal Revenue Services of USA) pursuant to an international convention or agreement on tax matters to which the Philippines is a signatory or a party of: Pr ovide d, That the information obtained from the banks and other financial institutions may be used by the Bureau of Internal Revenue for tax assessment, verification, audit and enforcement purposes. If the Commissioner is unable to obtain and provide the information within ninety (90) days from the receipt of the request, due to obstacles encountered in furnishing the information or when the bank or financial institution refuses to furnish the information, he shall immediately inform the requesting tax authority of the same, explaining the nature of the obstacles encountered or the reasons of refusal. The term 'for e ign t a x au t h or it y', as used herein, shall refer to the tax authority or tax administration of the requesting State under the tax treaty or convention to which the Philippines is a signatory or a party of. In case of request from a foreign tax authority for tax information held by banks and financial institutions, the exchange of information shall be done in a secure manner to ensure confidentiality thereof under such rules and regulations as may be promulgated by the Secretary of Finance, upon recommendation of the Commissioner. (G) Aut horit y t o Accredit and Regist er Tax Agent s. - The Commissioner shall accredit and register, based on their professional competence, integrity and moral fitness, individuals and general professional partnerships and their representatives who prepare and file tax returns, statements, reports, protests, and other papers with or who appear before, the Bureau for taxpayers. Within one hundred twenty (120) days from January 1, 1998, the Commissioner shall create national and regional accreditation boards, the members of which shall serve for three (3) years, and shall designate from among the senior officials of the Bureau, one (1) chairman and two (2) The Commissioner shall provide the tax information obtained from banks and financial institutions pursuant to a convention or agreement upon request of the foreign tax authority when such requesting foreign tax authority has provided the following information to demonstrate the foreseeable relevance of the information to the request: 5 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 members for each board, subject to such rules and regulations as the Secretary of Finance shall promulgate upon the recommendation of the Commissioner. the assessment. Within 60 days from filing of the protest, all relevant supporting documents shall have been submitted (the relevant supporting documents may be submitted together with the protest or within 60 days from the filing of said protest, at the option of the taxpayer); otherwise, the assessment shall become final. Individuals and general professional partnerships and their representatives who are denied accreditation by the Commissioner and/or the national and regional accreditation boards may appeal such denial to the Secretary of Finance, who shall rule on the appeal within sixty (60) days from receipt of such appeal. Failure of the Secretary of Finance to rule on the Appeal within the prescribed period shall be deemed as approval of the application for accreditation of the appellant. • All presumptions are in favour of the correctness of tax assessments: 1. In order to stand the test of judicial scrutiny, the assessment must be based on actual facts 2. The good faith of tax assessors and the validity of their actions are presumed. They will be presumed to have taken into consideration all the facts to which their attention was called 3. The taxpayer shall be informed in writing (in the formal letter of demand and assessment notice) of the law and the facts on which the assessment is made; otherwise, the same shall be void. • [Impt!] Even an assessment based on estimates is prima facie valid and lawful where it does not appear to have been arrived at arbitrarily or capriciously. o The burden of proof is upon the complaining taxpayer to show clearly that the assessment is erroneous in order to relieve himself of it o In the absence of accounting records, the taxpayers’ tax liability may be determined by estimate under the “best evidence rule” based on records of other taxpayers engaged in the same line of business. Under this procedure, the gross profit and net profit ratios of other taxpayers engaged in the same line of business may be used in estimating the taxpayer’s gross profit from sales and net taxable income. o A tax assessment that has become final, executor and enforceable for failure of the taxpayer to assail (or to protest or to contest) the same as provided in Section 228 (within 30 days from receipt of the Official or Final or Faormal Assessment Notice) can no longer be contested • The authority to make assessments of internal revenue taxes is vested in the CIR o The authority may be delegated to subordinate officers (such as BIR examiners). An assessment (preliminary) made by a subordinate officer has the same force and effect as that issued by the Commissioner himself, if not reviewed or revised by the latter. However, the Commissioner cannot delegate the power to make final assessments (THIS IS WRONG! See Section 7 – not included in the exceptions) to his subordinates as he himself is the only one entrusted by law to make final assessments o There must be a grant of authority before any revenue officer can conduct an examination or issue an assessment. He cannot extend his examination or assessment beyond the period covered by the Le t t e r of Au t h or it y (to be issued by the Revenue Regional Director; to be shown as proof) (H) Aut horit y of t he Com m issioner t o Prescribe Addit ional Procedural or Docum ent ary Requirem ent s. - The Commissioner may prescribe the manner of compliance with any documentary or procedural requirement in connection with the submission or preparation of financial statements accompanying the tax returns. • [Mem!] Asse ssm en t is a written notice to a taxpayer to the effect that the amount stated therein is due as a tax, and containing a demand for the payment thereof • [VIP!] A distinction must be made between a pr opose d a ssessm en t (preliminary assessment) and a f or m a l or off icial a sse ssm e n t (final assessment). The first notifies the taxpayer of the findings of the examiner who recommends a deficiency assessment. The taxpayer is usually given 15 days [page 522, Vol. II] from notice within which to explain his side. If the taxpayer fails to respond to the notice or proposed assessment, or his explanation is not satisfactory to the Commissioner, then the BIR issues an official statement. • Je opa r dy Assessm e n t is a delinquency tax assessment made without the benefit of complete or partial audit or investigation by an authorized revenue officer – when it finds itself without enough time to conduct an appropriate or thorough examination in view of the impending expiration of the prescriptive period for assessment (3 years). It is issued only to comply with the period of issuing a valid assessment. • An assessment is not an action (filing a collection case in court) or proceeding (distraint or levy; personal property is seized) for the collection of taxes. o It is merely a written notice to the effect that the amt stated therein is due as a tax and a demand for the payment thereof. It is only a preliminary step but essential to warrant of distraint or levy, if this is feasible, and also to establish a cause for judicial action. Without assessment, there is no obligation on the part of the taxpayer, enforceable in an action, to pay. o [VVIP!] Such a sse ssm e n t (formal or official or final [which is disputable as compared to a prelim assessment where there is only a need for a reply]) may be protested administratively by filing a request (or Motion or Petition) for reconsideration or reinvestigation or recomputation within 30 days from receipt of 6 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • • [Impt!] Necessity of Assessment 1. Taxes are generally self-assessing because they do not need a letter of demand or assessment notice. The taxpayer is supposed to know how much he should pay as tax and when and where he should pay 2. Asse ssm e n t is re quir e d: a. In case of deficiency taxes for failure to file a return or for filing a false or fraudulent return b. When the tax period is terminated 3. [VVIP!] An assessment of a tax deficiency is not necessary to a criminal prosecution for tax evasion (Sec. 222a). the crime is complete when the violator has knowingly and wilfully filed a fraudulent return with intent to evade and defeat the tax [Ungab v Cusi 97 SCRA 877, 1980 (Landmark Case); see, however, Annotation to Secs. 228 and 254 Fortune Tobaco Case] (The penalty for tax evasion is fine from Php 30,000.00 to Php 100,000.00 and imprisonment from 2 to 4 yrs and such penalty does not depend on the amt of tax deficiency) 4. There is no need for precise computation and formal assessment in order for a criminal complaint to be filed in court against taxpayer. Section 222(a) of the Tax Code provides that in the case of a false of fraudulent return with intent to evade tax or a failure to file a return, the tax may be assessed, or a proceeding in court (including criminal action for tax evasion) for the collection of such tax may be begun without assessment, at any time within 10 yrs after the discovery of the falsity, fraud or omission. The perpetration of the crime is grounded upon knowledge on the part of the taxpayer that he has made an inaccurate return, and the gov’t’s failure to discover the error and promptly to assess has no connection with the commission of the crime restrain the collection of any national internal revenue tax, fee or charge [VVIP!] Re con side ra t ion or Re in vest iga t ion or Re com pu t a t ion of dispu t e d a sse ssm e n t 1. 2. A taxpayer’s letter asking for a reconsideration of the questioned assessment cannot be considered as one disputing the assessment where the taxpayer who asked for a period of 30 days within which to submit a position paper failed to substantiate his claim that the deficiency assessment was contrary to law by submitting said position paper. Such a letter (the taxpayer must have filed a motion or petition or request for reconsideration or reinvestigation or recomputation and must have submitted the relevant supporting documents to substantiate his allegation) is nothing but a mere scrap of paper [Mem!] A decision on a request for reconsideration or reinvestigation is not a condition precedent to the filing of an action for collection of taxes already assessed. Nowhere in the Tax Code is the Commissioner of Internal Revenue required to rule (or to decide) first on such a request (Sec. 228, last paragraph). On the contrary, Section 218 withholds from or dina r y cou r ts (only the CTA has authority to enjoin the collection of NIR taxes, in its appellate jurisdiction) the authority to 3. [VVIP!] Here, however, the taxpayer has disputed the tax assessment at the opportune time (within 30 days from receipt of the Official or Formal or Final Assessment notice), the Commissioner cannot ignore the disputed assessment by immediately bringing an action to collect (The implication is that the CIR must first decide the disputed assessment before he can file a collection case in court which is NOT correct because the law does not require him to decide or rule on disputed assessments. Even if the taxpayer has disputed the assessment the CIR may file a collection case before the MTC or RTC or CTA, depending on the amt, without first deciding the protest and the filing o the collection case is deemed a denial of the protest which is appealable to the CTA. The appeal to the CTA must be filed within 30 days from receipt of summons from the court where the collection case was filed and said court loses jurisdiction over the collection case). Payment of taxes being admittedly a burden, taxpayers should not be deprived of the remedy of appeal to the CTA, which right to appeal runs only from the receipt of its decision. 4. A taxpayer’s right to contest assessments, particularly the right to appeal to the CTA, may be waived or lost. The requirement for the Commissioner to rule on disputed assessments (there is NO such requirement under Section 228, last paragraph) before bringing an action for collection is applicable only where the assessment was actually disputed, adducing reasons in support thereto. Where the taxpayer did not actually contest the assessment by stating the basis thereof, the Commissioner need not rule on his request (Dayrit v Cruz, 1998 decision) 5. The filing of a civil suit for collection of the taxes due constitutes a final denial of the taxpayer’s request for reconsideration of the tax assessment (Adamson v CTA, 2009 decision) • If pre-assessment notice is not responded to protested within the prescribed period (15 days), the reviewing office shall then issue a letter of demand and assessment notice (official or formal or final) to the taxpayer • Au t h or it y t o Ca ncel Asse ssm e n t – the Authority to Cancel Assessment (ATCA) shall be issued whenever an assessment is cancelled or when a previously assessed deficiency tax is reduced as a result of a reinvestigation or a reconsideration requested by the taxpayer • Te r m in a t ion Le t t e r – the approving officer shall issue a Termination Letter to the taxpayer in the following cases: 1. Where the deficiency tax is paid immediately after investigation and the review yields no discrepancy 2. Where the deficiency assessment is paid after issuance of the preassessment notice but before issuance of final assessment notice 3. Where the deficiency assessment is paid within 30 days from issuance of assessment notice (official or formal or final) and letter of demand 7 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • SEC. 8 . D u t y of t h e Com m ission e r t o En sur e t h e Pr ovision a n d D ist r ibu t ion of for m s, Re ce ipt s, Ce r t ifica t e s, an d Applia nce s, an d t he Ack n ow le dgm en t of Pa ym e n t of Ta x es.- Gr ou n ds for su spen sion or t e m por a r y closu re of bu sin ess 1. Failure to issue receipts or invoices by a VAT-registered or registerable taxpayer 2. Failure to file VAT return 3. Understatement of taxable sales or receipts by 30% or more of the correct amount 4. Failure to register (A) Provision and Dist ribut ion t o Proper Officials. - It shall be the duty of the Commissioner, among other things, to prescribe, provide, and distribute to the proper officials the requisite licenses internal revenue stamps, labels all other forms, certificates, bonds, records, invoices, books, receipts, instruments, appliances and apparatus used in administering the laws falling within the jurisdiction of the Bureau. For this purpose, internal revenue stamps, strip stamps and labels shall be caused by the Commissioner to be printed with adequate security features. SEC. 7 . Au t h or it y of t h e Com m ission e r t o D e le ga t e Pow e r . - The Commissioner may delegate the powers vested in him under the pertinent provisions of this Code (Sections 4-6, Powers of Commissioner of Internal Revenue) to any or such subordinate officials with the rank equivalent to a division chief or higher, subject to such limitations and restrictions as may be imposed under rules and regulations to be promulgated by the Secretary of finance, upon recommendation of the Commissioner: Pr ovided, h ow e ve r , That the following powers of the Commissioner shall not be delegated: [Mem!] Internal revenue stamps, whether of a bar code or fusion design, shall be firmly and conspicuously affixed on each pack of cigars and cigarettes subject to excise tax in the manner and form as prescribed by the Commissioner, upon approval of the Secretary of Finance. (B) Receipt s for Pay m ent Made. - It shall be the duty of the Commissioner or his duly authorized representative or an authorized agent bank to whom any payment of any tax is made under the provision of this Code to acknowledge the payment of such tax, expressing the amount paid and the particular account for which such payment was made in a form and manner prescribed therefor by the Commissioner. (A) The power to recommend the promulgation of rules and regulations by the Secretary of Finance; (B) The power to issue ru lin gs of fir st im pr e ssion (no established precedent yet) or to reverse, revoke or modify any existing ruling of the Bureau; (C) The power to com pr om ise (to reduce tax liability) or a ba t e (to cancel entirely tax liability) , under Sec. 204 (A) and (B) of this Code, any tax liability: Pr ovide d, h ow e ver , That assessments issued by the regional offices involving basic deficiency taxes of Five hundred thousand pesos (P500,000) or less, and minor criminal violations, as may be determined by rules and regulations to be promulgated by the Secretary of finance, upon recommendation of the Commissioner, discovered by regional and district officials, may be compromised by the a regional evaluation board which shall be composed of the Regional Director as Chairman, the Assistant Regional Director, the heads of the Legal, Assessment and Collection Divisions and the Revenue District Officer having jurisdiction over the taxpayer, as members; and SEC. 9 . I n t e r n al Re ven ue D ist r ict s. - With the approval of the Secretary of Finance, the Commissioner shall divide the Philippines into such number of revenue districts as may form time to time be required for administrative purposes. Each of these districts shall be under the supervision of a Revenue District Officer. SEC. 1 0 . Re ve n ue Re giona l D ir ect or . - Under rules and regulations, policies and standards formulated by the Commissioner, with the approval of the Secretary of Finance, the Revenue Regional director shall, within the region and district offices under his jurisdiction, among others: (A) Implement laws, policies, plans, programs, rules and regulations of the department or agencies in the regional area; (D) The power to assign or reassign internal revenue officers to establishments where articles subject to excise tax (such as Cigars and Cigarettes and Wines and Liquors and Distilled Spirits) are produced or kept. • (B) Administer and enforce internal revenue laws, and rules and regulations, including the assessment and collection of all internal revenue taxes, charges and fees. Aba t e m e n t , can ce lla t ion or com pr om ise of t ax lia bilit y – the power to abate or cancel a tax liability or any portion is exercised exclusively by the Commissioner (EXCEPT if the amt of the basic deficiency tax is Php 500,000.00 or less and minor criminal violations which can be compromised by the regional evaluation board), Internal Revenue Officers may only recommend. (C) [Impt!] [DO NOT READ!] Issue Letters of authority for the examination of taxpayers within the region; (D) Provide economical, efficient and effective service to the people in the area; (E) Coordinate with regional offices or other departments, bureaus and agencies in the area; (F) Coordinate with local government units in the area; 8 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Director, examine taxpayers within the jurisdiction of the district in order to collect the correct amount of tax, or to recommend the assessment of any deficiency tax due in the same manner that the said acts could have been performed by the Revenue Regional Director himself. (G) Exercise control and supervision over the officers and employees within the region; and (H) Perform such other functions as may be provided by law and as may be delegated by the Commissioner. • SEC. 1 4 . Au t h or it y of Office r s t o Adm in ist er Oa t h s a n d Ta ke Test im on y. The Commissioner, Deputy Commissioners, Service Chiefs, Assistant Service Chiefs, Revenue Regional Directors, Assistant Revenue Regional Directors, Chiefs and Assistant Chiefs of Divisions, Revenue District Officers, special deputies of the Commissioner, internal revenue officers and any other employee of the Bureau thereunto especially deputized by the Commissioner shall have the power to administer oaths and to take testimony in any official matter or investigation conducted by them regarding matters within the jurisdiction of the Bureau. Subsection (C) which transfers the power to issue Letters of Authority for the examination of taxpayers from the Revenue District Officer to the Revenue Regional Director. SEC. 1 1 . D u t ie s of Re ve nu e Dist r ict Office rs a n d Ot he r I n t e r na l Re ve nu e Officer s. - It shall be the duty of every Revenue District Officer or other internal revenue officers and employees to ensure that all laws, and rules and regulations affecting national internal revenue are faithfully executed and complied with, and to aid in the prevention, detection and punishment of frauds of delinquencies in connection therewith. [Impt!] SEC. 1 5 . Au t h or it y of I n te r n al Re ve nue Office rs t o M a ke Ar re st s a n d Se iz u re s. - The Commissioner, the Deputy Commissioners, the Revenue Regional Directors, the Revenue District Officers and other internal revenue officers shall have authority to make arrests and seizures for the violation of any penal law, rule or regulation administered by the Bureau of Internal Revenue. Any person so arrested shall be forthwith brought before a court, there to be dealt with according to law. It shall be the duty of every Revenue District Officer to examine the efficiency of all officers and employees of the Bureau of Internal Revenue under his supervision, and to report in writing to the Commissioner, through the Regional Director, any neglect of duty, incompetency, delinquency, or malfeasance in office of any internal revenue officer of which he may obtain knowledge, with a statement of all the facts and any evidence sustaining each case. SEC. 1 2 . Age n t s an d D epu t ie s for Collect ion of N a t iona l I n t e rn a l Re ve nu e Ta x e s. - The following are hereby constituted agents of the Commissioner: (A) The Commissioner of Customs and his subordinates with respect to the collection of national internal revenue taxes on imported goods; [VIP!] The previous issuance of a warrant of arrest or seizure by a court is not required pr ovide d such arrest or and seizure is limited to violations of any penal law or regulation administered by the BIR committed within the view (Plain View Doctrine) of internal revenue officers or employees • Revenue agents have no authority to search, without a warrant, a business establishment for supposedly fraudulent records. But they are empowered to seize said records, discovered in the course of their investigation, pursuant to Section 15 SEC. 1 6 . Assign m e n t of I n te r n al Re ve nu e Officer s I n volve d in Ex cise Ta x Fu n ction s t o Est a blish m en t s W he r e Ar t icle s su bje ct t o Ex cise Ta x ar e Pr odu ce d or Ke pt. - The Commissioner shall employ, assign, or reassign internal revenue officers involved in excise tax functions, as often as the exigencies of the revenue service may require, to establishments or places where articles subject to excise tax are produced or kept: Provided, That an internal revenue officer assigned to any such establishment shall in no case stay in his assignment for more than two (2) years, subject to rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner. (B) The head of the appropriate government office and his subordinates with respect to the collection of energy tax; and (C) Banks duly accredited by the Commissioner with respect to receipt of payments internal revenue taxes authorized to be made thru bank. Any officer or employee of an authorized agent bank assigned to receive internal revenue tax payments and transmit tax returns or documents to the Bureau of Internal Revenue shall be subject to the same sanctions and penalties prescribed in Sections 269 and 270 of this Code. • • SEC. 1 7 . Assign m e n t of I n te r na l Re ve nu e Office rs a nd Ot h e r Em ploye es t o Ot h e r D u t ie s. - The Commissioner may, subject to the provisions of Section 16 and the laws on civil service, as well as the rules and regulations to be prescribed by the Secretary of Finance upon the recommendation of the Commissioner, assign or reassign internal revenue officers and employees of the Bureau of Internal Revenue, without change in their official rank and salary, to other or special duties connected with the enforcement or administration of the revenue laws as the exigencies of the service may require: Prov ided, That internal revenue officers assigned to perform assessment or collection function shall not remain in the same assignment for more than three (3) years; Prov ided, furt her, That assignment of The gov’t may not entrust the collection of unpaid or delinquent taxes which is done by public officers in their official capacities, to private collection agencies (except banks under Sec. 12 (c)) SEC. 1 3 . Au t h or it y of a Re ve n ue Office s. - subject to the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, a Revenue Officer assigned to perform assessment functions in any district may, pursuant to a Letter of Authority issued by the Revenue Regional 9 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 internal revenue officers and employees of the Bureau to special duties shall not exceed one (1) year. (E) Excise taxes; (like wine and liquor) (F) Documentary stamp taxes; and (G) Such other taxes as are or hereafter may be imposed and collected by the Bureau of Internal Revenue. SEC. 1 8 . Re por t s of V iola t ion of La w s. - When an internal revenue officer discovers evidence of a violation of this Code or of any law, rule or regulations administered by the Bureau of Internal Revenue of such character as to warrant the institution of criminal proceedings, he shall immediately report the facts to the Commissioner through his immediate superior, giving the name and address of the offender and the names of the witnesses if possible: Prov ided, That in urgent cases, the Revenue Regional director or Revenue District Officer, as the case may be, may send the report to the corresponding prosecuting officer in the latter case, a copy of his report shall be sent to the Commissioner. SEC. 1 9 . Con t e n t s of Com m ission e r 's An nu al Re por t . - The Annual Report of the Commissioner shall contain detailed statements of the collections of the Bureau with specifications of the sources of revenue by type of tax, by manner of payment, by revenue region and by industry group and its disbursements by classes of expenditures. In case the actual collection exceeds or falls short of target as set in the annual national budget by fifteen percent (15%) or more, the Commissioner shall explain the reason for such excess or shortfall. SEC. 2 0 . Su bm ission Com m ission e r of Re por t a nd Pe r t ine n t I n for m a t ion by t he ( A) Subm ission of Pert inent I nform at ion t o Congress. - The provision of Section 270 of this Code to the contrary notwithstanding, the Commissioner shall, upon request of Congress and in aid of legislation, furnish its appropriate Committee pertinent information including but not limited to: industry audits, collection performance data, status reports in criminal actions initiated against persons and taxpayer's returns: Provided, how ever, That any return or return information which can be associated with, or otherwise identify, directly or indirectly, a particular taxpayer shall be furnished the appropriate Committee of Congress only when sitting in Executive Session Unless such taxpayer otherwise consents in writing to such disclosure. • Custom duties, fees and other charges are governed by the Tariff and Customs Code. They are also national taxes BUT NOT internal revenue taxes • The provisions of any special or general law to the contrary notwithstanding, all tax and duty incentives granted to gov’t and private entities are hereby withdraw EX CEPT: 1. Covered by the non-impairment clause of the Constitution 2. Conferred by effective international agreements 3. Enjoyed by enterprises registered with: (1) the Board of Investments; (2) Export Processing Zone Authority; (3) Philippine Veterans Investment Development Corporation Industrial Authority 4. Copper Mining Industry 5. Conferred by the 3 Basic Codes: (1) Tariff and Customs Code; (2) NIRC and (3) LGC 6. Approved by the President upon the recommendation of the Fiscal Incentives Board *They are still exempted from payment of the tax covered by the nonimpairment clause ( B) Report t o Oversight Com m it t ee. - The Commissioner shall, with reference to Section 204 of this Code, submit to the Oversight Committee referred to in Section 290 hereof, through the Chairmen of the Committee on Ways and Means of the Senate and House of Representatives, a report on the exercise of his powers pursuant to the said section, every six (6) months of each calendar year. [Mem!] SEC. 2 1 . Sou r ce s of Re ve nu e . - The following taxes, fees and charges are deemed to be n a t ion al in t e rn a l r e ve nu e t ax e s: (A) (B) (C) (D) Income tax; Estate and donor's taxes; Value-added tax; (also a percentage tax [12%]) Ot h e r (because VAT is also a percentage tax) percentage taxes; 10 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 TITLE 2 TAX ON INCOME (3) A citizen of the Philippines who works and derives income from abroad and whose employment thereat requires him to be physically present abroad most of the time during the taxable year. Chapter 1 - Definitions (4) A citizen who has been previously considered as nonresident citizen and who arrives in the Philippines at any time during the taxable year to reside permanently in the Philippines shall likewise be treated as a nonresident citizen for the taxable year in which he arrives in the Philippines with respect to his income derived from sources abroad until the date of his arrival in the Philippines. [BAR!] SEC. 2 2 . D e fin it ions - When used in this Title: (A) The term "pe r son " means an individual, a t r u st (is a relationship between a person [trustor] and another person [trustee] whereby the property of the former is conveyed or transferred to the latter with the obligation on the part of the latter to give the former or another person [beneficiary] or BOTH a periodic amt or annuity or pension for a certain period of time or during the lifetime of the trustor or beneficiary or BOTH), estate or corporation • (not included: general/professional partnership because it is not taxable) (5) The taxpayer shall submit proof to the Commissioner to show his intention of leaving the Philippines to reside permanently abroad or to return to and reside in the Philippines as the case may be for purpose of this Section. (F) The term "r e siden t a lie n " means an individual whose residence is within the Philippines and who is not a citizen thereof. (B) The term "cor por a t ion " shall include partnerships (ordinary or business or taxable partnership), no matter how created or organized, joint-stock companies, j oin t a ccoun t s (agreement whereby two or more persons combine their resources to undertake a particular project but there is no agreement or intention to form or create a partnership) (cuentas en participacion) (or joint venture), association, or insurance companies, bu t doe s n ot inclu de (GSP and Joint Venture undertaking construction projects with the gov’t are NOT taxable entities) (1) general professional partnerships and (2) a joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the Government. "Ge n e r a l pr ofe ssion al pa r tn e r sh ips" are partnerships formed by persons for the sole pu r pose of exercising their common profession, no part of the income of which is derived from engaging in any trade or business. (G) The term "n on r esiden t a lie n " means an individual whose residence is not within the Philippines and who is not a citizen thereof. (H) The term "r eside n t for e ign cor por a t ion " applies to a foreign corporation engaged in trade or business within the Philippines. (I) The term 'n on r e side n t for e ign cor por a t ion ' applies to a foreign corporation not engaged in trade or business within the Philippines. (J) The term "fiducia r y" means a guardian, trustee, executor, administrator, receiver, conservator or any person acting in any fiduciary capacity for any person. (K) The term "w it h h oldin g a gen t " means any person required to deduct and withhold any tax under the provisions of Section 57. (C) The term "dom e st ic", when applied to a corporation, means created or organized in the Philippines or under its laws. (Domestic Corporation is a corporation created or organized under Phil laws) (L) [Mem!] The term "sh a re s of st ock " shall include shares of stock of a corporation, stock rights warrants and/or options to purchase shares of stock, a s w e ll a s units of participation in a partnership (ordinary or business or taxable) (except general professional partnerships), joint stock companies, joint accounts, joint ventures taxable as corporations, associations and recreation or amusement clubs (such as golf, polo or similar clubs), and mutual fund certificates. (D) The term "foreign", when applied to a corporation, means a corporation which is not domestic. (Foreign Corporation is a corporation organized, authorized or existing under the laws of any foreign country, Sec. 28 (a)) (E) The term "n on r esiden t cit iz en " means: (1) A citizen of the Philippines who establishes to the satisfaction of the Commissioner the fact of his physical presence abroad with a definite intention to reside therein. (M) The term "shareholder" shall include holders of a share/s of stock, warrant/s and/or option/s to purchase shares of stock of a corporation, as well as a holder of a unit of participation in a partnership (except general professional partnerships) in a joint stock company, a joint account, a taxable joint venture, a member of an association, recreation or amusement club (such as golf, polo or similar clubs) and a holder of a mutual fund certificate, a member in an association, joint-stock company, or insurance company. (2) A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for employment on a permanent basis. 11 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (N) The term "t a x pa ye r " means any person subject to tax imposed by this Title. certificates of assignment or similar instruments, with recourse, or of repurchase agreements for purposes of relending or purchasing receivables and other similar obligations: Provided, however, That commercial, industrial and other non-financial companies, which borrow funds through any of these means for the limited purpose of financing their own needs or the needs of their agents or dealers, shall not be considered as performing quasi-banking functions. (O) The terms "including" and "includes" , when used in a definition contained in this Title, shall not be deemed to exclude other things otherwise within the meaning of the term defined. (P) The term "t a x a ble ye a r " means the calendar year, or the fiscal year ending during such calendar year, upon the basis of which the net income is computed under this Title. 'Taxable year' includes, in the case of a return made for a fractional part of a year under the provisions of this Title or under rules and regulations prescribed by the Secretary of Finance, upon recommendation of the commissioner, the period for which such return is made. (Y) The term "de posit su bst itu t e s" shall mean an alternative from of obtaining funds from the pu blic (the term 'public' means borrowing from twenty (20) or more individual or corporate lenders at any one time) other than deposits, through the issuance, endorsement, or acceptance of debt instruments (such as bonds) for the borrowers own account, for the purpose of relending or purchasing of receivables and other obligations, or financing their own needs or the needs of their agent or dealer. These instruments may include, but need not be limited to bankers' acceptances, promissory notes, repurchase agreements, including reverse repurchase agreements entered into by and between the Bangko Sentral ng Pilipinas (BSP) and any authorized agent bank, certificates of assignment or participation and similar instruments with recourse: Provided, however, That debt instruments issued for interbank call loans with maturity of not more than five (5) days to cover deficiency in reserves against deposit liabilities, including those between or among banks and quasi-banks, shall not be considered as deposit substitute debt instruments. (Q) The term "fisca l ye a r " means an accounting period of twelve (12) months ending on the last day of any month other than December. (R) The terms "paid or incurred" and 'paid or accrued' shall be construed according to the method of accounting upon the basis of which the net income is computed under this Title. (S) The term "t rade or business" includes the performance of the functions of a public office. (T) The term "secu rit ie s" means shares of stock in a corporation and rights to subscribe (stock rights) for or to receive such shares. The term includes bonds, debentures, notes or certificates, or other evidence or indebtedness, issued by any corporation, including those issued by a government or political subdivision thereof, with interest coupons or in registered form. (Z) The term "or dina r y incom e " includes any gain from the sale or exchange of property which is not a capital asset (ordinary asset) or property described in Section 39(A)(1). Any gain from the sale or exchange of property which is treated or considered, under other provisions of this Title, as 'ordinary income' shall be treated as gain from the sale or exchange of property which is not a capital asset as defined in Section 39(A)(1). The term 'or din a r y loss' includes any loss from the sale or exchange of property which is not a capital asset. Any loss from the sale or exchange of property which is treated or considered, under other provisions of this Title, as 'ordinary loss' shall be treated as loss from the sale or exchange of property which is not a capital asset. (U) [Mem!] The term "de a le r in secu rit ie s" means a merchant of stocks or securities, whether an individual, partnership or corporation, with an established place of business, regularly engaged in the purchase of securities and the resale thereof to customers; that is, one who, as a merchant, buys securities and re-sells them to customers with a view to the gains and profits that may be derived therefrom. (AA) The term "r a n k a nd file e m ployee s" shall mean all employees who are holding neither managerial nor supervisory position as defined under existing provisions of the Labor Code of the Philippines, as amended. (V) The term "bank" means every banking institution, as defined in Section 2 of Republic Act No. 337, as amended, otherwise known as the General banking Act. A bank may either be a commercial bank, a thrift bank, a development bank, a rural bank or specialized government bank. (BB) The term "m ut ual fund com pany " shall mean an open-end and close-end investment company as defined under the Investment Company Act. (W) The term "non- bank financial int erm ediary " means a financial intermediary, as defined in Section 2(D)(C) of Republic Act No. 337, as amended, otherwise known as the General Banking Act, authorized by the Bangko Sentral ng Pilipinas (BSP) to perform quasi-banking activities. (CC) The term "t r a de , busin e ss or pr ofession " shall not include performance of services by the taxpayer as an employee. (DD) The term "regional or area headquart ers" shall mean a branch established in the Philippines by multinational companies and which headquarters do not earn or derive income from the Philippines and which act as supervisory, communications and coordinating center for their affiliates, subsidiaries, or branches in the Asia-Pacific Region and other foreign markets. (X) The term "quasi- banking act iv it ies" means borrowing funds from twenty (20) or more personal or corporate lenders at any one time, through the issuance, endorsement, or acceptance of debt instruments of any kind other than deposits for the borrower's own account, or through the issuance of 12 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 The transactions were isolated. The sharing of profits in a common property does not itself establish a partnership in the absence of a clear intent to form the same. The character of habituality peculiar to business transactions for the purpose of gain must be present. (EE) The term "regional operat ing headquart ers" shall mean a branch established in the Philippines by multinational companies which are engaged in any of the following services: general administration and planning; business planning and coordination; sourcing and procurement of raw materials and components; corporate finance advisory services; marketing control and sales promotion; training and personnel management; logistic services; research and development services and product development; technical support and maintenance; data processing and communications; and business development. o Partnerships (ordinary or business or taxable) (ot h e r t h an GPP), whether registered or unregistered, are taxed as corporations o A partnership of architects and engineers engaged in architectural, engineering and other disciplines cannot be said to be a GPP as it cannot be said as one with a commonality of purpose and professional calling as contemplated by law. A firm made up of different and distinct professionals, one that is capable of providing integrated services in the varied disciplines in contrast to a partnership of common profession, such as lawyers, doctors, accountants, etc., is a full service firm (ordinary or business or taxable partnership which is considered by law as corporations) rather than a group of professionals practicing a common profession. (FF) The term "lon g- t e r m de posit or in ve st m en t ce r t ifica t e s" shall refer to certificate of time deposit or investment in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments with a maturity period of not less than five (5) years, the form of which shall be prescribed by the Bangko Sentral ng Pilipinas (BSP) and issued by banks only (not by nonbank financial intermediaries and finance companies) to individuals in denominations of Ten thousand pesos (P10,000) and other denominations as may be prescribed by the BS. • (GG) The term 'st a t u t or y m in im u m w a ge ' shall refer to rate fixed by the Regional Tripartite Wage and Productivity Board, as defined by the Bureau of Labor and Employment Statistics (BLES) of the Department of Labor and Employment (DOLE) (HH) The term 'm in im u m w a ge ea r ne r ' shall refer to a worker in the private sector paid the statutory minimum wage, or to an employee in the public sector with compensation income of not more than the statutory minimum wage in the non-agricultural sector where he/she is assigned • • Join t ve n t u re s – if formed for the purpose mentioned in Section 22 (B), they are not subject to the corporate income tax to enhance the competitive capability of local contractors or operators against foreign investors. Only the entities (or individuals) (co-ventures) composing such joint ventures are separately subject thereto on their respective taxable income. Ot h e r Join t Ve n t u re s although not formally incorporated, are taxable as ordinary corporations Co- ow n e r sh ips (not a taxpayer) are not subject to tax as a corporation if the activitie of the co-owners are limited to the reservation of the property and the collection of the income therefrom in which case each co-owner is taxed individually on his distributive share. Should the co-owners invest the income of the co-ownership in any income producing properties, they would be constituting themselves into a partnership which is consequently subject to tax as a corporation. o A joint venture formed for the purpose of undertaking shipping services or the construction and development of a residential condominium project falls within the purview of a corporation subject to the 30% corporate income tax as contemplated in Section 22(B), in relation to Section 27(A). o [VIP!] The allocation of the condominium units and the issuance of the corresponding Condominium Certificates of Title by the Registry of Deeds to the joint venture partners or co-venturers representing their respective shares or participating interests in the project are not taxable events (because there are no sales yet). The allocation is not subject to income tax because it is merely a return of capital contribution. No income is realized from the allocation. It is only upon the sale or disposition of the units to 3rd parties that the gain realized shall be subject to the regular corporate income tax. [Impt!] Pa r t n e r sh ips – the essential elements of a contract of partnership are 2, namely: (1) an agreement to contribute money, property or industry to a common fund and (2) an intent to divide the profits among the contracting parties. o In a case, the petitioners bought 2 parcels of land in 1965. They did not sell the same nor make any improvements thereon. In 1996, they bought another 3 parcels from one seller. It was only in 1968 when they sold the 2 parcels, after which they did not make any additional orr new purchase. The remaining 3 parcels were sold by them in 1970. • [Impt!] N on - r e siden t citiz en s o It was held that there was no adequate basis to support the proposition that they thereby formed an unregistered partnership. A Filipino citizen who works in Hong Kong from Monday to Friday and spends his weekends and a 6-week vacation leave in the Philippines is considered a non-resident citizen. He is, not subject (income from outside the Phils of non-resident citizens is not 13 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 taxable in the Phils) to income tax on his income as overseas contract worker. But a Filipina who constantly travels around the world with her husband, a US citizen, on a tourist visa without any permanent residence anywhere is not a non-resident citizen (she is a resident citizen, hence, her income from abroad, if any, is taxable in the Phils) within the contemplation of Sections 22(E) (1), (2) of the Tax Code. o • • • Chapter 2- GENERAL PRINCIPLES Ta x Pa ye r For purposes of the income tax exemption, the time spent abroad by the overseas contract worker if not material. All that is required is for the worker’s employment contract to pass through and be registered with the POEA 1. Resident Citizen 2. 3. 4. Non-resident Citizen Resident Alien Non-resident Alien 5. Domestic Corporation 6. [Impt!] Re siden t Alien – an alien may be considered a resident of the Philippines for income tax purposes if: 1. He or she is not a mere transient or sojourner 2. He or she is has no definite intention as to his or her stay 3. His or her purpose is of such a nature that an extended stay may be necessary for its accomplishment and to that end the alien makes his or her home temporarily in the Philippines 7. 8. Resident Foreign Corporation Non-resident Foreign Corporation Estate or Trust Sou r ce s of Ta xa ble I n com e Sources WITHIN and WITHOUT the Phils Sources WITHIN the Phils Sources WITHIN the Phils Sources WITHIN the Phils Sources WITHIN and WITHOUT the Phils Sources WITHIN the Phils Sources WITHIN the Phils Depending on the STATUS of the DECEDENT or TRUSTOR [Mem!] SEC. 2 3 . General Principles of I ncom e Tax at ion in t he Philippines. - Except when otherwise provided in this Code: [VIP!] Sh a r e s of St ock (it also includes units of participation or equity or interest in an ordinary or business or taxable partnership) is expanded to include units of participation in an unincorporated joint venture. (A) A cit iz e n of t he Philippine s r esidin g t he r ein is taxable on all income derived from sources within and without the Philippines; (B) A n on r e siden t cit ize n is taxable only on income derived from sources within the Philippines; Lon g t e r m de posit or in ve st m e n t s – they are exempt from income tax as long as they comply with the requisites of a long term deposit or investment certificate which are: 1. Maturity of not less than 5 years (maturity of 5 yrs or more) 2. In the form of savings, common or individual trust fund, deposit substitutes, investment management accounts or other forms prescribed by the BSP 3. Issued by banks only 4. Issued only to individual citizens (resident or non-resident) or resident aliens or non-resident aliens engaged in trade or business within the Philippines 5. In Php 10,000.00 denominations or other denominations prescribed by the BSP 6. Not preterminated (the deposit is not withdrawn before the end of the 5th year) by the holder before the 5th year o The withdrawal of the principal deposit/investment before the 5th year will subject the entire earnings (interest) to a final WT depending on the holding period of the instrument in accordance with the period specified under Sections 24 (B,1) and 25 (A,2) (C) An individual citizen of the Philippines who is working and deriving income from abroad as an ove r se a s con t r a ct w or k e r is taxable only on income derived from sources within the Philippines: Provided, That a se a m an who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract worker; if the vessel is engaged both in coastwise and in international trade the seaman is considered residential citizen o OCWs and OFWs and Seaman are considered non-resident citizens (D) An a lie n individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines; (E) A dom e st ic cor por a t ion is taxable on all income derived from sources within and without the Philippines; and (F) A for e ign cor por a t ion , whether engaged or not in trade or business in the Philippines, is taxable only on income derived from sources within the Philippines. • [Impt!] (1)RESI D EN T CI TI ZEN and (2)D OM ESTI C CORPORATI ON are taxable on all income derived from sources WITHIN and WITHOUT the Philippines (3) o Estate or Trust where the decedent was or the trustor is a resident citizen 14 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Ex e m pt ion fr om incom e t a x of n on - r e siden t cit izen s (their income from outside the Phils): 1. Income earned or derived from abroad by non-resident citizens, overseas contract workers (OCWs) and Filipino seamen are n ow (Prior to Jan. 1, 1998 income of NRC from sources without the Phils was taxable in the Phils) exempt from income tax 2. All e m ploye es (employed in the Phils) whose services are rendered abroad for being assigned (by their Ers) for a t le a st 1 8 3 da ys may fall under the first category (NRC) and are, therefore, exempt from payment of Philippine income tax. The phrase “most of the time” means that the said citizen shall have stayed abroad for at least 183 days (need not be consecutive or continuous) in a taxable year The same exemption applies to an overseas contract worker but as such worker, the time spent abroad is not material for tax exemption purposes. All that is required is for the worker’s employment contract to pass through and be registered with the POEA. • [VIP!] An alien individual, whether resident or non-resident, and a foreign corporation, whether resident or non-resident, are taxable only on income derived from sources within the Philippines. The taxability of income of an alien individual or a foreign corporation derived from Philippine sources is subject to tax treaty (international agreement such as tax treaty to which the Phils is a party is superior than our law, such as the NIRC) to which the Philippines is a signatory • [Mem!] I ncom e means all wealth (or property such as cash) which flows into the taxpayer ot h e r th a n (or except) mere return of capital (even mere return of capital may be subject to income tax such as presumed capital gain on sale of real property classified as capital asset located in the Phils). An example of mere return of capital is the collection of loans receivable. Income is received not only when it is actually handed to a person but also when it is merely constructively received by him. o This is known as “The Principle or Doctrine of Constructive Receipt of Income” Ex a m ple s: Examples are: 1. Share of a partner in the net income after tax of a business partnership not yet distributed to the partners 2. Dividend declared by a true corporation not yet received by the stockholders 3. Interest on the bank deposit not withdrawn by the depositor A, a resident citizen, is employed as supervising engineer in Corp. X, a domestic corportaion, engaged in construction business. Corp. X normally enters into construction contracts in the Middle East. In 2013, A was assigned by Corp. X in the Middle East to supervise the construction projects there and he spent 7 months during that year. Ex a m ple : The salaries of A during the period of 7 months, while he was in the Middle East are not taxable in the Phils., because during that period, he is classified as NRC. His salaries, however, during the period of 5 months are taxable in the Philippines. 3. • • B, an RC, went to Singapore on Sept. 27, 2013 to work in the country as an OFW. In 2013 he worked in Singapore only for a period of 3 months from Oct. 1 to Dec. 31, 2013. The salaries of B for said 3 months are not taxable in the Phils. although his stay in Singapore is less than 183 days. Regular employees of a domestic corporation sent abroad as “nonresident citizens” for income tax purposes if their employment requires them to stay abroad for most of the time (at least 183 days) during the taxable year. The fact that their salaries and other benefits paid in the Philippines is immaterial as the situs (place) of compensation income is the place where the services are rendered [Impt!] If an OCW or OFC has income/earnings from business activities or properties within the Philippines, such earnings are subject to Philippine income tax • An alien actually present in the Philippines who is not a mere transient or sojourner is a resident of the Philippines for purposes of income tax A and B are boyfriend and girlfriend, respectively. On July 1, 2014, B celebrated her 27th birthday and A gave her in the form of gift a Rolex watch worth Php 2M. o Did B earn income when she received the watch worth Php 2M? ANS: YES, because income means all wealth which flows into the taxpayer other than mere return of capital. o Is B subject to income tax when she received the watch worth Php 2M? ANS: NO, gift or donation is excluded from gross income, hence, the gift or donation is not subject to income tax (Sec 32 B (3)) o Is the transaction (giving of watch to B) not subject to any tax? ANS: YES, the donation is subject to donor’s tax but the one liable is A, the donor [Mem!] I ncom e Ta x – tax on all yearly profits arising from property, professions, trades or businesses or a tax on a person’s income, emoluments, profits and the like. 15 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Ex a m ple : A engaged in merchandising business, purchased a residential house and lot at a price of Php 3M. Six months later, A sustained losses from his business and in order to infuse additional capital to his business, he was forced to sell the said residential houses and lot at a price of Php 2,800,000.00 although the FMV thereof is Php 3,500,000.00. A is subject to capital gains tax of 6% of Php 3,500,000.00. [VIP!] Ta x Be n e fit Ru le – as a rule, an item (e.g. bad debt) previously deducted in 1 taxable year from gross income must be included as taxable income in the year it is received. However, under the rule, the recovery or refund of a prior deduction is excluded from income if the deduction did not reduce the taxpayer’s liability. Ex a m ple s: o Income tax is generally regarded as a privilege (or excise) tax and not a tax on property (such as real property tax). It is really a tax on the right or privilege to earn income by an individual or entity. • [Mem!] For income to be taxable, re quisit es: 1. There must be gain or profit 2. The gain must be realized or received, actually or constructively 3. Gain must not be excluded by law (Section 32B) or treaty from taxation • I n cre a se in va lu e of pr ope r t y – a mere increase in the value of property is not income but merely an unrealized (because the property is not yet sold) increase in capital. Under the r e a liz a t ion pr inciple , no income is derived by the owner from an increase in value of property until after the actual sale or other disposition of the property in excess of its original cost (if the property is ordinary asset because is the property is real property classified as capital asset and is located in the Phils., the taxable amt is the gross selling price or FMV as determined by the CIR or FMV appearing in the schedule of values in the provincial or city assessor’s office, whichever is highest). On March 1, 2014 B miraculously paid A the Php 50,000.00 because B won in lotto. The Php 50,000.00 received by A in 2014 is called “Recovery of Account Previously Written Off” or “Bad Debt Recovery” and A will report as part of his gross income in 2014 the amount of Php 16,000.00. If in 2013 A sustained a loss from his business and he still deducted the Php 50,000.00 bad debt said deduction did not benefit A because whether he deducted it or not he did not pay income tax in 2013, hence, no income tax benefit has been derived by A. When A recovered the Php 50,000.00 in 2014 he will not report any income from said recovery. The only exception is that even without sale or other disposition, if by reason of appraisal, the cost basis of property is increased and the resultant basis is used as the new tax base for purposes of computing the allowable depreciation expense, the net difference between the original cost basis and new basis due to appraisal is taxable under the econ om icbe n efit pr in ciple . The income tax if the bad debt is not deducted is: First Php 500,000.00 Php 125,000.00 Excess (Php 550,000.00 – Php 500,000.00 x 32%) 16,000.00 INCOME TAX Php 141,000.00 The same conclusion obtains as to loss. The mere decrease in the value of property is not normally allowable as a deductible loss. To be allowable, the loss must be realized. • (Debt - Php 50,000.00) A is engaged in merchandising business. On March 1, 2013, A sold merchandise to B on account collectible on June 1, 2013. On June 1, 2013 B failed to pay A because on that day B was already bankrupt. During the year 2013 the taxable income of A was Php 550,000.00 but because A was certain that B can no longer pay his indebtedness of Php 50,000.00 A decided to treat said indebtedness as bad debt and he deducted the Php 50,000.00 from the taxable income of Php 550,000.00 thereby leaving Php 500,000.00 as net taxable income. Therefore, instead of paying income tax in 2013 based on Php 550,000.00, A actually paid income tax based on Php 500,000.00 which resulted to a lower income tax. If the bad debt is deducted the taxable income is Php 500,000.00 ad the income tax is Php 125,000.00. Con st r u ct ive r e ce ipt doct r ine – ordinarily, a cash-basis taxpayer (a taxpayer who adopts the cash-basis method of accounting where he records the income when cash is actually received and records expenses when cash is paid) does not recognize income until it has actually been received. Under the doctrine, an item of income must be included in gross income if it is credited to the account of or set apart for the taxpayer, or otherwise made available to the taxpayer, although not yet physically received or placed to his actual possession. The doctrine prevents taxpayers from manipulating the amount of their reportable gross income by delaying the report of an item of doctrine. The income tax benefit derived by A in deducting the bad debt of Php 50,000.00 is (Php 141,000.00 – Php 125,000.00) Php 16,000.00. The same facts above except that the bad debt recovery or recovery of account previously written off in 2014 is Php 10,000.00 instead of Php 50,000.00, how much will A report as part of his gross income in 2014? 16 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 ANS: A will report as part of his gross income in 2014 the actual amount recovered which is Php 10,000.00. In other words, the amt to be reported as part of gross income is the income tax benefit or actual amt recovered, whichever is lower. • ANS: 1. 2. [Impt!] Award of Damages 1. Act u a l D a m a ge s – the award is not subject to income tax since actual damages constitute return of capital or investment, or a substitution of money value for something permanently lost. 2. M or a l a n d Ex e m pla r y D a m a ge s – such damages awarded on account of personal physical injuries or sickness are excluded from gross income under Section 32(B)(4). However, since there is no provision which exempts from income tax moral and exemplary damages arising from a breach of contract, they are subject to income tax 3. Atty’s fees and costs – when awarded to the winning party-litigant, they are not subject to income tax only to the extent of actual expenses. Any amt in excess of the actual expenses shall be taxable o Damages awarded constitute taxable income to the recipient thereof in the year received only to the extent that such damages constitute loss of anticipated profits or lost salaries and nontaxable to the extent that the same represents a return of capital or investment 3. 4. • [ SECTI ON S 2 4 t o 3 9 a r e I M PORTAN T PROV I SI ON S!] A, an RC and a junior executive in a Corp., while he was crossing a street was bumped from behind by an automobile owned and driven by B. At that time, A was carrying a laptop computer which he purchased from Manila at a cost of Php 20,000.00 to be delivered to his buyer C at a selling price of Php 24,000.00. said computer was totally destroyed by the accident and A was hospitalized for a period of 2 months and by reason thereof, A was not compensated by his employer for the said 2 months. The salary of A is Php 40,000.00. The hospital bills of A amounted to Php 100,000.00. A demanded from B damages but the latter refused to pay, hence, A filed a case in court for recovery of damages. The court awarded in favour of A the ff: 1. 2. 3. 4. [Impt!] Income tax is self-asssessing or self-computed. Under the pay-asyou-file system, the taxpayer himself, in the first instance, computes the tax in the manner indicated in the return and pays the tax at the time of filing the return. Since the rates of tax are fixed by law, the role of the tax official is purely to determine the accuracy of the taxpayer’s assessment of his tax liability Ex a m ple s: Actual damages representing lost salaries in the amt of Php 80,000.00 are taxable, because damages awarded which constitute lost salaries are taxable Actual damages representing the hospital bills in the amt of Php 100,000.00 are no taxable, because they constitute return of capital Actual damages representing the selling price of the computer in the amt of Php 24,000.00, Php 20,000.00 of which is not taxable, because it is a return of capital. While, the anticipated profit of Php 4,000.00 is taxable because damages which constitute loss of anticipated or expected profit are taxable Moral damages in the amt of Php 30,000.00 are not taxable because damages awarded on account of physical injuries are excluded from gross income, hence, they are not taxable Chapter 3 – TAX ON INDIVIDUALS [Impt!] [BAR!] SEC. 2 4 . I ncom e Tax Rat es. (A) Rates of Income Tax on Individual Cit iz en (resident & non-resident) and Individual Re siden t Alie n of the Philippines. (1) An income tax is hereby imposed: (a) [ RESI D EN T CI TI ZEN ] On the taxable income (gross income – allowable deductions as a rule) defined in Section 31 of this Code, other than income subject to tax under Subsections (B), (C) and (D) of this Section, derived for each taxable year from all sources within and without the Philippines by every individual citizen of the Philippines residing therein; Actual damages representing last salaries in the amt of Php 80,000.00 Actual damages representing the hospital bills in the amt of Php 100,000.00 Actual damages representing the selling price of the computer in the amt of Php 24,000.00; and Moral damages, on account of physical injuries in the amt of Php 30,000.00 (b) [ N ON - RESI D EN T CI TI ZEN ] On the taxable income defined in Section 31 of this Code, other than income subject to tax under Subsections (B), (C) and (D) of this Section, derived for each taxable year from all sources within the Philippines by an individual citizen of the Philippines who is residing outside of the Of the above damages awarded to A, which of them are taxable and which of them are not taxable? 17 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Philippines including overseas contract workers referred to in Subsection(C) of Section 23 hereof; and (c) [ RESI D EN T ALI EN ] On the taxable income defined in Section 31 of this Code, other than income subject to tax under Subsections (B), (C) and (D) of this Section, derived for each taxable year from all sources within the Philippines by an individual alien who is a resident of the Philippines. First Php 500,000.00 Excess (Php 1.2M – Php 500,000.00 x 32%) INCOME TAX 5% Over P10,000 but not over P30,000 P500+10% of the excess over P10,000 Over P30,000 but not over P70,000 P2,500+15% of the excess over P30,000 Over P70,000 but not over P140,000 P8,500+20% of the excess over P70,000 Over P140,000 but not over P250,000 P22,500+25% of the excess over P140,000 Over P250,000 but not over P500,000 P50,000+30% of the excess over P250,000 Over P500,000 P125,000+34% of the excess over P500,000 in 1998. For married individuals, the hu sban d a n d w ife , subject to the provision of Section 51 (D) hereof, shall compute separately (but only 1 income tax return) their individual income tax based on their respective total taxable income: Provided, That if any income cannot be definitely attributed to or identified as income exclusively earned or realized by either of the spouses, the same shall be divided equally between the spouses for the purpose of determining their respective taxable income. (B) [Impt!] Rate of Tax on Certain Pa ssive I n com e . (1) (1)I n t e r e st s, (2)Roya lt ie s, (3)Pr iz e s, and (4)Ot h e r W inn in gs. - A fin al t a x (tax on certain items of passive income which is withheld by the payer and remitted to the BIR, hence, the passive income is no longer included in the ITS of the recipient of the passive income) at the rate of twenty percent ( 2 0 % ) is hereby imposed upon the amount of interest from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements; royalties, except on books, as well as other literary works and musical compositions, which shall be imposed a final tax of ten percent ( 1 0 % ) ; prizes (except prizes amounting to Ten thousand pesos ( P1 0 ,0 0 0 ) or le ss which shall be subject to tax under Subsection (A) of Section 24); and other winnings (except Philippine Charity Sweepstakes and Lotto winnings (exempt from income tax)), derived from sources within the Philippines (When is a passive income considered derived from sources within the Phils? ANS: The passive income is from sources within if the payer is a resident of the Philippines): Pr ovide d, h ow e ve r, That interest income received by an individual taxpayer (RC or RA) (except a nonresident individual (exempt from income tax under Section 27D(3),2nd paragraph)) from a depository bank under the expanded foreign currency deposit system shall be subject to a final income tax at the rate of seven and one-half percent ( 7 1 / 2 % ) of such interest income: Pr ovide d, fu r t he r , That interest income from long-term deposit (Philippine currency) or investment in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments evidenced by certificates in such form prescribed by the Ex a m ple s: If the taxable income of A, a resident citizen, is Php 100,000.00, how much is the income tax? First Php 70,000.00 Excess (Php 100,000.00 – Php 70,000.00 x 20%) INCOME TAX Php 8,500.00 6,000.00 Php 14,000.00 If the taxable income of A, an RC, is Php 400,000.00, how much is the income tax? First Php 250,000.00 Excess (Php 400,000.00 – Php 250,000.00 x 30%) INCOME TAX Php 125,000.00 224,000.00 Php 349,000.00 Pr ovide d, That minimum wage earners as defined in Section 22 (HH) of this Code shall be exempt from the payment of income tax on their taxable income: Pr ovide d, fu r t h e r , That the holiday pay, overtime pay, night shift differential pay and hazard pay received by such minimum wage earners shall likewise be exempt from income tax even if said additional benefits will exceed the minimum wage. (2) Ra t e s of Ta x on Taxable Income of I n dividu a ls (RC, NRC, NRA). - The tax shall be computed in accordance with and at the rates established in the following schedule: Not over P10,000 If the taxable income of A, an RC, is Php 1.2M, how much is the income tax? Php 50,000.00 45,000.00 Php 95,000.00 18 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Bangko Sentral ng Pilipinas (BSP) shall be exempt from the tax (20% final tax) imposed under this Subsection: Pr ovide d, fin a lly, That should the holder of the certificate (depositor) pre-terminate the deposit or investment before the fifth (5th) year, a final tax shall be imposed on the entire income and shall be deducted and withheld by the depository bank from the proceeds of the long-term deposit or investment certificate based on the holding period remaining maturity thereof: (b) Jan. 2, 2012 – the final tax is (Php 1M x 10% x 20%) Php 40,000.00 (c) Jan. 2, 2013 – the final tax is (Php 1M x 10% x 12%) Php 36,000.00 (d) Jan. 2, 2014 – the final tax is (Php 1M x 10% x 5%) Php 20,000.00 (e) Jan. 2, 2015 – the entire interest income of 500,000.00 is exempt from income tax 2 x 3 x 4 x Php Four (4) years to less than five (5) years - 5%; (2) Cash and/or Property (5)D ivide n ds - A fin al t a x (Dividend is the distribution by a corporation to its stockholders of the accumulated net income after tax of the corporation in the form of case or property or stock. The accumulated net income after tax of a corporation is entered in the account called Unrestricted Retained Earnings and this URE is the only source of dividends) at the following rates shall be imposed upon the cash and/or property dividends actually or constructively received by an individual from a domestic corporation or from a joint stock company, insurance or mutual fund companies and regional operating headquarters of multinational companies, or on the share of an individual in the distributable net income after tax of a partnership (business or ordinary or taxable partnership which is considered by law as corporation) (except a general professional partnership) of which he is a partner, or on the share of an individual in the net income after tax of an association, a joint account, or a joint venture or consortium taxable as a corporation of which he is a member or co-venturer: Three (3) years to less than (4) years - 12%; and Less than three (3) years - 20% If the items of passive income are derived from outside the Philippines (Payer is not a resident) they are not subject to final tax but they are taxable under subsection A is the recipient is a resident citizen. If the recipient is NRC or RA or NRA, the passive income is not taxable because he is taxable only on income from sources within the Philippines. o Ex a m ple s: A borrowed Php 1M from his brother B payable in 1 year at a minimal interest f 6% per annum. On due date A offered to pay B the principal of Php 1M plus interest of Php 60,000.00 – final tax of Php 12,000.00 or a total of Php 1,048.00. B refused to accept the Php 1,048,000.00 because according to him the interest of Php 60,000.00 is not subject to final tax of 20%. 1. Who is correct? ANS: B is correct, the Php 60,000.00 interest is not subject to 20% final tax because said interest is not from currency bank deposit rather it is from personal loan. A will report as part of his gross income the interest of Php 60,000.00 taxable under Section 24(A). 2. 3. Six percent (6%) beginning January 1, 1998; Eight percent (8%) beginning January 1, 1999; Ten percent ( 1 0 % ) beginning January 1, 2000. Provided, however, That the tax on dividends shall apply only on income earned on or after January 1, 1998. Income forming part of retained earnings as of December 31, 1997 shall not, even if declared or distributed on or after January 1, 1998, be subject to this tax. Is the interest expense of A in the amt of Php 60,000.00 an allowable deduction from the gross income of A? ANS: NO, if the interest expense is paid by the borrower to the lender who are members of a family, the interest, income is not an allowable deduction under Sec. 34 B (2)b in relation to Section 36B o A, an RC, made a time deposit of Php 1M with Bank X at 10% interest per annum on Jan. 2, 2010 for a period of 5 years. The deposit may be pre-terminated on or after Jan. 2, 2011. How much is the final tax if A withdraws the deposit on: (a) Jan. 2, 2011 – the final tax is (Php 1M x 10% x 20%) Php 20,000.00 D I V I D EN D S 1. Received 2. Received 3. Received 4. Received 5. Received 6. Received 19 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) by by by by by by RC, NRC or RA NRA engaged NRA not engaged DC RFC NRFC – 10% FT – 20% FT (Section 25A,2) – 25% FT (Section 25B) – exempt (Section 27D,4) – exempt (Section 28A,7d) – 15% FT subject to certain conditions (Section 28B,5b) lOMoARcPSD|12553117 (C) Ca pit a l Ga in s from Sale of Shares of Stock not Traded (if the shares of stock are traded in stock exchange, the sale is subject to ½ of 1% percentage tax on gross selling price or gross value in money) in the Stock Exchange. - The provisions of Section 39(B) notwithstanding, a fin al t a x at the rates prescribed below is hereby imposed upon the net capital gains realized during the taxable year from the sale, barter, exchange or other disposition of shares of stock in a domestic corporation, except shares sold, or disposed of through the stock exchange. Ex a m ple : Corp. A was organized on Jan. 2, 2011 with an Authorized Capital Stock of 10,000 common shares with par value per share of Php 10,000.00 or Php 100M. 5 years later the corporation already sold 8,000 shares out of the 10,000 shares authorized. At this stage the number of issued shares is 2,000 shares. If the corporation will declare stock dividend it will distribute shares of stock to the stockholders, hence, if the corporation will declare 10% stock dividend it will distribute 1,000 shares to its stockholders. The number of shares received by the stockholders is called stock dividend which is not taxable because the stockholders did not receive something of value because such dividend is referred to sometimes as paper dividend. o Not over P100,000 5% On any amount in excess of P100,000 10% [ Th is pr ovision does n ot a pply t o de ale r s in se cu r it ie s be cau se a s t o t h e m t h e sh a r es of st ock a r e or din ar y a sse t s. There is exception to the rule that stock dividend is not taxable and this is when subsequent to the declaration and distribution of the stock dividend the corporation purchases from the stockholders the stock dividend previously distributed. When the corporation pays the stockholders the purchase price of the shares of stock the corporation shall withhold the final tax of 10% and will remit the same to the BIR. Ex a m ple : E, an RC engaged in real estate business, had the following sales of shares of stock in DC during the first quarter of 2014: 1) Jan. 15 – 1,000 shares costing Php 1M sold at Php 1.2M 2) Feb. 10 – 2,000 shares costing Php 800,000.00 sold at Php 750,000.00 3) Mar. 21 – 500 shares costing Php 1.5M sold at Php 1,650,000.00 On Jan. 2, 2014, Corp. A, a DC purchased from Corp. B also a DC, 1,000 common shares at a cost of Php 1,000 per share. On Jan. 2, 2014, when the FMV of the common shares of Corp. B was Php 1,200 per share Corp. A declared and distributed as dividend the said 1,000 shares to its 10 stockholders at 100 shares per stockholder. The treasurer of Corp. A surrendered for cancellation the certificate of stock covering the said 1,000 shares to Corp. B and the latter cancelled it and issued in lieu thereof 10 separate certificates of stock in the names of the 10 stockholders of Corp. A. Before actually distributing the 10 certificates of stock to the 10 stockholders of Corp. A the treasurer demanded the payment of the final tax on dividend in the amt of (100 shares x Php 1,200.00 x 10%) Php 12,000.00 from each of the 10 stockholders but the latter refused to pay contending that stock dividend is not taxable. Who is or are correct? Compute the Capital Gains Tax Jan. 15 sale (Php1.2M – Php 1M) Php 200,000.00 Feb. 10 sale (Php 750,00.00 – Php 800,000.00) (50,000.00) Mar. 21 sale (Php 1,650,000.00 – Php 1.5M) 150,000.00 NET CAPITAL GAINS Php 300,000.00 1st Php 100,000.00 (Php 100,000.00 x 5%) Excess over Php 100,000.00 Php 005,000.00 (Php 300,000.00 – Php 100,000.00 x 10%) CAPITAL GAINS TAX Php 20,000.00 25,000.00 (D) Ca pit a l Gain s from Sale of Real Property. – [ Th is pr ovision does n ot a pply t o r ea l e st a t e de a le r s or re a l e st a te br ok e r s becau se a s t o t h e m re a l pr ope r t ies ar e or dina r y asse t s] ANS: The treasurer is correct because what has been declared and distributed as dividend is a property not stock dividend. When a corporation purchases shares of stock in another corporation the cost of Php 1M is considered investment, more particularly, investment in stock and investment in property. Stock dividend comes from the unissued shares of the declaring corporation which is not obtaining in this case. Therefore, the dividend is subject to 10% final tax. (1) I n General. - The provisions of Section 39(B) notwithstanding, a fin a l t a x of six percent ( 6 % ) based on the gross selling price or current fair market value as determined in accordance with Section 6(E) (FMV determined by the CIR or FMV appearing in the schedule of values of the assessor’s office, whichever is higher) of this Code, whichever is higher, is hereby imposed upon ca pit a l ga in s presumed (even if the sale results to a loss said sale is subject to 6% CGT) to have been 20 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 realized from the sale, exchange, or other disposition of real property located in the Philippines, classified as capital assets ((1)If the real property is located in the Phils. but is not a Capital Asset, the sale is not subject to 6% CGT but may be subject to VAT and income tax under Sec. 24A; (2)If the real property is located outside the Phils., whether it is Capital or Ordinary Asset, the sale is not subject to 6% CGT but is subject to income tax under Sec. 24A if the seller is RC. If the seller is NRC or RA, the income or gain is not taxable because he is taxable only on income from within the Phils.), including pacto de retro sales and other forms of conditional sales, by individuals, including estates and trusts: Pr ovide d, That the tax liability, if an y (it is possible that there is no tax liability if the selling price is lower than the cost thereby resulting to a loss if the seller chooses Sec. 24A), on gains from sales or other dispositions of real property to the government or any of its political subdivisions or agencies or to government-owned or controlled corporations shall be determined either under Section 24 (A) or under this Subsection, at the option of the taxpayer. (a) Tax under Section 24A: FMV per Assessor’s Office LESS GAIN First Php 500,000.00 Excess Php 5,500,000.00 (4,500,000.00) 1,000,000.00 Php 125,000.00 Php 160,000.00 285,000.00 (Php 1M – Php 500,000.00 x 32%) INCOME TAX (b) Tax under Section 24D: (Php 5.5M x 6%) Php 330,000.00 I will advise C that he should treat the sale of his commercial lot under Section 24A because the tax is lower by (Php 330,000.00 – Php 285,000.00) Php 45,000.00. (2) Except ion. - The provisions of paragraph (1) of this Subsection to the contrary notwithstanding, ca pit a l ga in s presumed to have been realized from the sale or disposition of their principal residence by natural persons, the proceeds of which is fully utilized in acquiring or constructing a new principal residence within eighteen (18) calendar months from the date of sale or disposition, shall be e x e m pt from the capital gains tax imposed under this Subsection: Provided, That the historical cost or adjusted basis of the real property sold or disposed shall be carried over to the new principal residence built or acquired: Pr ovide d, fu r t h e r , That the Commissioner shall have been duly notified by the taxpayer within thirty (30) days from the date of sale or disposition through a prescribed return of his intention to avail of the tax exemption herein mentioned: Pr ovide d, st ill fu r t h er , That the said tax exemption can only be availed of once every ten (10) years: Pr ovide d, fin a lly, that if there is no full utilization of the proceeds of sale or disposition, the unutilized portion of the gain presumed to have been realized from the sale or disposition shall be subject to capital gains tax. For this purpose, the gross selling price or fair market value at the time of sale, whichever is higher, shall be multiplied by a fraction which the unutilized amount bears to the gross selling price in order to determine the taxable portion and the tax prescribed under paragraph (1) of this Subsection shall be imposed thereon. • Section 24(A) imposes progressive rates of income taxes on citizens (residents and non-residents) and resident aliens. The progressive scheme of income taxation has been introduced in our tax system as a measure of raising more revenues to meet adequately the increasing needs of the gov’t and at the same time to correct inequalities in taxation by equitably distributing the tax burden based upon the principle of ability to pay. • I n dividu al in com e t a x pa ye rs 1. Citizens, either resident or non-resident 2. Aliens, either resident or non-resident. Non-resident aliens may either be those engaged or those not so engaged • [Impt!] Ta x a t ion of Alien s 1. Re siden t Alien s are taxable as citizens of the Philippines, but only on income derived from sources within the Philippines. 2. N on - r e side n t Alie ns are likewise taxable only on income derived from sources within the Philippines a. N on - r e side n t Alie n s En ga ge d are subject to tax in the same manner (the same rates of tax prescribed in Section 24A and same manner of computation [Gross Income – Allowable Deductions and Exemptions] except that they are entitled only to personal exemption on a reciprocity basis but not entitled to additional exemption) as citizens and resident aliens on taxable income received from Philippine sources. b. N on - r e side n t Alien s N ot En ga ge d are subject to a flat tax rate of 25% or 15% on their gross income (passive income; NRA not engaged is not entitled to deduct allowable deductions and exemptions because he is taxable at gross income) • I n com e Ta x Syst e m – present method of taxation under the Tax Code is partly global and partly scheduler Ex a m ple : Php C, an RC and engaged in merchandising business, is the owner of a vacant commercial lot with FMV as determined by the CIR of Php 5M and with FMV as shown in the schedule of value of the City Assessor of Php 5.5M. C purchased the said lot 1 year ago at Php 4.5M. The said lot was purchased by the city gov’t of Naga at a price of Php 5.2M. C seeks your legal advice as to his taxability of this sale, what will be your advice? 21 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 1. 2. Globa l Tr e a t m e n t is a system where the tax treatment views indifferently the tax base and generally treats in common all categories of taxable income of the taxpayer. An example is an individual whose income is from compensation and from business which are taxable at the same rates under Sec. 24A. Sch e du la r Appr oa ch is a system employed where the income tax treatment varies and is made to depend on the kind or category of taxable income of the taxpayer. Examples are passive incomes where the tax rates are different. • Every employer making payment of compensation income shall deduct and withhold a tax in an amt equal to the tax due on the employee’s (except Minimum Wage Earners [Sec. 79A]) compensation income for the entire year in accordance with Section 24A. • Before, the former provision (Sec. 21a) allowed the separate computation of the respective income taxes of husband and wife. Married individuals had the option either to compute separately their individual income tax or to consolidate their respective aggregate taxable income and deduct the personal and additional exemptions. o Now, husband and wife are treated as separate taxable units; they have no more option to compute their income tax separately or jointly. It is mandatory that they compute separately the tax due on their respective incomes (but only 1 ITR). o Each spouse is entitled to the personal exemption of Php 50,000.00 u n le ss only one of the spouses is deriving taxable income, in which case only said spouse shall be allowed to avail of the Php 50,000.00 basic personal exemption. o The husband is deemed the proper claimant of the additional exemption in respect of any dependent children, u nle ss he explicitly waives his right in favour of his wife in the withholding exemption certificate o The respective aggregate taxable income of each shall be taxed at the graduated rates of 5% up to the top marginal rate of 32% and their total income tax payable is the sum of their individual income tax determined separately. Both, however, should file only 1 consolidated return. • I n com e t a x for m u la for r esiden t cit iz en s Gross income from all sources (within and/or outside the Philippines) LESS: Allowable deductions (Section 34; Itemized [there should be • [Impt!] Application of deductions and exemptions 1. If the income of the individual taxpayer is purely compensation income arising from personal services rendered under an employer-employee relationship, itemized deductions are not allowed ot h e r t h an premium payments on health and/or hospitalization insurance (subject to certain conditions) not can he avail of the 40% optional standard deduction. Only personal and additional exemptions can be deducted (and premium payments). 2. If his income is mixed, he is receiving a combination of compensation and business/professional income, he shall first deduct the allowable personal and additional exemptions from compensation income; only the excess therefrom can be deducted from business/professional income. 3. In the case of husband and wife, the husband shall be the proper claimant of the exemptions (additional) u n le ss he waives in favour of the wife. The taxable income will be the sum of the compensation income (after deducting personal and/or additional exemptions) and the net income from business/profession. • I n com e t a x for m ula for n on - re side n t cit ize ns a n d re side n t a lie n s – they are now (Prior to Jan. 1, 1998 non-resident citizens and resident aliens were taxable on income from sources within and without the Philippines just like resident citizens) taxed only on their income derived from sources within the Philippines at the same rate as for resident citizens e x ce pt that the gross income is limited to those derived from Philippine sources. • Pa ssive I n com e s are subject to a separate and final tax at fixed rates with a maximum of 20% and a minimum of 5%, such a s: interest from bank deposits, royalties, prizes, and other winnings earnings, dividends and capital gains from sales of shares of stock in a domestic corporation not traded in stock exchange and from sales of real property located in the Phils. and classified as capital assets. They are not (they are not included in the ITR of the taxpayer) added to other income in the determination of ordinary income tax liability. • [VIP!] Interest income from currency bank deposit, etc. arising from the excess contributions to the company’s retirement plan is exempt from the 20% final withholding tax. Section 60(B) specifically exempts employees’ trust (or pension trust or pension fund) from income tax. • [VIP!] Fin a l Ta x on interest from any currency (Philippine or foreign) bank deposit is 2 0 % except: supporting documents] or Optional Standard Deduction [no need for supporting documents] NET I NCOME from all sources LESS: Personal and additional exemptions TAXABLE I NCOME/TAX BASE Multiplied by: Tax rate in Section 24A Am ount of incom e t ax due • (a) Fin a l t ax is 7 ½ % if the interest income is received by an individual taxpayer who is a resident (RC or RA), from a depository bank under the Expanded Foreign Currency Deposit System (ECFDs) (allowed by BSP to transact foreign currency deposits). Any income of non-residents, whether individuals or From the tax due, deduct tax withheld or tax credit and add penalties such as surcharge, interest, or compromise. Ta x cr e dit s refer to amounts allowed as deductions from the tax due in the form of withholding tax on wages, on rents, and other creditable withholding taxes and foreign income tax paid or accrued. 22 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 corporations, from transactions with foreign currency deposit units (FCDUs) (banks who accept foreign currency deposit) are exempt from income tax. convenience, hence, it is believed that the entire interest income is exempt. 4. (b) The interest income (on Phil. currency bank deposit) is exempt from the final tax if derived from long-term deposit or investment e x ce pt that in case of pre-termination the income is subject to a graduated tax of 5%/12%/20% based on the remaining maturity thereof. However, as the law is worded, in case of pretermination, the shorter the remaining maturity, the higher the tax rate. The tax rate should instead be lower. (a) an immigration visa issued by the foreign government in the country where he is a resident of; or (b) a certificate of residency which is issued by the Philippine Embassy or Consulate in the foreign country of his residence; or (c) [VIP!] The graduated rates must be based not on the remaining maturity but on the periods (holding period) that have elapsed before pre-termination. (c) a certificate of the contract of employment of an overseas contract worker which is duly registered with the Philippine Overseas Employment Agency (POEA); or a Seaman's Certificate, in the case of a Filipino seaman; or (d) When an investor places fund in a bank for a period of n ot le ss t h a n 5 ye a rs (or 5 years or more) in the form of common or individual trust fund or individual management account, it is already considered a long-term investment under Section 24(B)(1), the interest income of which is exempt from the 20% final tax. The interest income of the t r u st (employees’ trust or pension trust or pension fund) is exempt (Sec. 60B) regardless of the term (even if less than 5 yrs) of the investment or maturity of the instrument in which it is subsequently invested. • The tax on interest income from foreign currency deposit shall be imposed un less the depositor who is a non-resident citizen or a nonresident alien can present a documentary evidence that he is not a resident of the Phils. Such evidence shall consist of the original or certified copy of any of the following: (d) a certification from the Bureau of Immigration of the Philippines that a non-resident alien is not a resident of the Philippines; or (e) a certification from the Department of Foreign Affairs (DFA) of the Philippines that the individual is a regular member of the diplomatic corps of a foreign government and is entitled to income tax exemption under an international agreement to which the Philippines is a signatory. Individual income on interest from a depository bank under the Expanded Foreign Currency Deposit System (FCDS) 5. To be entitled to an exemption from the tax on interest income on foreign currency deposit, the Foreign Currency Bank Account shall be in the name of the non-resident individual or non-resident corporation. Otherwise, the interest income therefrom shall be considered as subject to the tax imposed. 1. If the interest income is received by a non-resident (NRC or NRA), the income is exempt from the 7.5% final income tax (see Rev. Regs. No. 10-98 [Section 27D,3,2nd paragraph]) 2. Interest income which is actually or constructively received by a resident citizen of the Phils. or by a resident alien from a foreign currency bank deposit shall be subject to a final tax of 7.5%. The depository bank shall withhold and remit the tax pursuant to Sections 57 and 58 of the Tax Code. • There is nothing which prohibits the holder of the certificates to preterminate the deposit or of investment or withdraw the income earned before the 5th year period. The withdrawal of the principal, however, would subject the interest income to a final tax depending on the holding period of the instrument as stated in said provisions. 3. If a bank account is jointly in the name of a non-resident citizen such as an overseas contract worker, or a Filipino seaman, and his spouse or dependent who is a resident, 50% of the interest income from such bank deposit shall be treated as exempt while the other 50% shall be subject to a final tax of 7.5% • [Impt!] Roya lt ie s mean payments of any kind received as a consideration for the use of, or the right to use, any copyright of literary, artistic or scientific work including cinematograph films or tapes used for radio or television broadcasting, any patent, trademark, design or model, plan, secret formula or process or other like right or property (such as the right to use the trade name of another company). Royalties on books, literary works and musical compositions are subject to a final tax of 10%; other royalties, 20%. o This could not have been the legislative intent because coownership here is more of a fiction than fact, the actual depositor is the NRC and the joint account is merely for 23 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Pr ize s amounting to more than P 10,000 and other winnings (except PCSO and lotto winnings [exempt]) are subject to 20% final tax; if the prizes amt to P 10,000 or less, they should be reported (as part of the gross income of the recipient) as income subject to regular income tax under Section 24(A). or current FMV, as determined in accordance with Section 6(E) (FMV as determined by the CIR or FMV appearing in the schedule of values in the assessor’s office) whichever is higher. The 20% tax is imposed on the winner although the responsibilities for the withholding of the tax are entrusted by law upon the payer/payor. The fact that the raffle is a gov’t sponsored project does not constitute a valid ground to exempt the individual recipient of the prize from the tax. There is no provision in the Tax Code exempting the gov’t in general, from the responsibilities of withholding the tax. • [Impt!] Cash prizes won by local (how about non-resident foreign players – subject to final tax of 25% under Sec. 25B) players/participants in gold tournaments are not passive incomes inasmuch as participating in golf tournaments is their profession and/or occupation. Such being the case, the cash prizes of said local participants/players are subject to the rates prescribed under Section 24A and not to 20% final tax. • D ivide n ds comprise any distribution, whether in cash or other property, in the ordinary course of business, even though extraordinary in amt, made by a domestic or resident foreign corporation to the stockholders out of its e a r nin gs (unrestricted retained earnings) or profits. 1. Dividends paid in securities or other property (other than its own stock [stock dividend] are income to the recipients to the amt of the FMV of such property when received by individual stockholders) 2. Dividend income, cash and/or property, from a corporation, etc. and share of an individual in a (business) partnership or an association taxable as a corporation received by a cit izen (resident or nonresident) or resident alien are now taxable at 10% • b) If a stockholder who received shares of stock as property dividend sells the shares, the stockholder shall be subjected t percentage tax at ½ of 1% based on the GSP or gross value in money f the shares of stock if said shares of stock are listed and traded through a local stock exchange c) If the shares are not traded through a local stock exchange, then the capital gain of the stockholder which is not over P 100,000.00, shall be subject to final income tax at 5% and any amount in excess of P100,000.00, at 10%. To arrive at the net capital gain, the cost of the stock shall be determined in the manner as provided in Section 6 of Revenue Regulations No. 2-82. o If the sale is subject to CGT of 6% the taxable amt is GSP or FMV or FMV whichever is highest and the cose thereof is not deducted. If the sale is subject to VAT of 12% the amt subject to VAT is the GSP or FMV or FMV whichever is highest and the cost thereof is not deducted. The same sale will also be subject to ordinary income tax under Section 24A and the taxable amt is GSP or FMV or FMV whichever is highest minus the cost thereof. If the sale is subject to VAT of 12% the seller did not pay 2 taxes for the same sale because the VAT of 12% as added to the GSP or FMX or FMV whichever is highest and was actually paid by the buyer to be remitted by the seller to the BIR. The only tax which is actually paid by the seller is the ordinary income tax under Section 24A. Shares of stocks in the hands of the taxpayer, whether individual or corporate e x ce pt a dealer in securities are capital assets 1. • 3. The tax is 20% if the recipient of the dividend is a non-resident alien engaged and 25% if not so engaged; domestic corporation – exempt; RFC – exempt and NRFC – 15% final tax subject to certain conditions 4. Property dividends should be recorded in the books of the declaring corporation and should be received by the stockholder at its FMV. Thus, if property with an acquisition cost of P100,000 (book value) is declared as property dividend and the market value at the time of declaration is P200,000, the tax would be computed on P200,000. a) The capital gains tax which is a final tax, imposed upon the net capital gains realized from the sale or exchange of shares of stock not traded through a local stock exchange, is in lieu of the income tax; hence, the capital gains shall not be included in the gross income of the seller (or in his ITR) in computing his/its income tax liability. In the absence of a realized net capital gains (capital losses are ether equal to capital gains or capital losses exceed capital gains) there is no tax liability. b) What is being taxed is only the “net capital gains” not “capital gains”. Hence, in determining the CGT due on the sale of the shares of stock, prior capital gains/losses realized/incurred during the year are to be taken into account. In other words, capital losses sustained during a taxable year may be deducted from and to the extent of the capital gains derived during the same taxable year Sa le of pr ope r t y dividen d a) The individual stockholder (if he is not engaged in real estate business if the individual stockholder is also engaged in real estate business the sale is not subject to CGT of 6% but subject to VAT of 12% and subsequently to the regular income tax under Section 34A) selling the r e a l pr ope r t y dividen d (the declaring corporation of which the stockholder previously received the property dividend is engaged in real estate business) shall be subject to the 6% CGT based on the GSP 2. If the shares sold are listed and traded through the local stock exchange or through initial public offering, the percentage tax (½ of 1% of gross selling price or gross value in money of the shares) shall be imposed under Section 127. The tax is not deductible for income 24 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 purposes. In such case, the gain realized is immaterial since the tax is based on the GSP or t r a n sa ct ion va lu e (or gross value in money) of the shares. The tax is known as stock transaction tax. 3. • without acquiring a better right than the assignor. The ownership shall remain with the seller (developer). However, the gain realized by the assignor from the assignment is subject to income tax and the deed of assignment, to DST. If the seller is a dealer in securities, the shares of stock are treated as ordinary assets and, therefore, subject to the regular income tax. This rule applies whether or not the shares sold and listed and traded through a local stock exchange. The applicable tax rates depend on whether or not the shares are so listed and traded as indicated above is the seller is not a dealer in securities. o [Mem!] Transactions under RA No. 6657 (Comprehensive Agrarian Reform Law) involving a transfer of ownership, whether from natural or juridical persons, shall be exempt from taxes arising from capital gains and the payment of registration fees, and all other taxes and fees for the conveyance or transfer thereof. [VVIP!] Ca pit a l ga in s fr om sa les, e t c. of r e a l pr ope r t y classified as capital assets located in the Philippines – Subsection (D, 1) applies only to individual taxpayers who are not real estate dealers or brokers, including estates and trusts. The final CGT is 6 % . The corresponding provision on capital gains from sale of on real property by a domestic corporation is Section 27 (D, 5). o CGT paid on the sale of real property which was subsequently rescinded (by reason of lesion) can be credited on the new deed of sale involving the same property but the DST paid cannot be credited to the new deed of sale, nor refunded considering that there has been a valid sale although it was subsequently rescinded. o The reckoning date for the payment of the CGT on the onerous sale, exchange or other disposition (such as execution sale and foreclosure sale) of real property located in the Phils. classified as capital asset is 30 days from the date of notarization of the deed of sale or transfer document. o Only sale of real property classified as Capital Asset located in the Phils. is subject to CGT. The sale of rights over real property although classified as real property under the Civil Code is not subject to CGT for the reason that the sit u s (or place) of these rights follow their owner (Doctrine of Mobilia Sequuntor Personam) who may not be located in the Philippines. o If the r e a l pr ope r t y (ordinary asset) is other than capital asset, a creditable withholding tax shall be imposed upon the withholding agent/buyer. o o o o • The transfer of title to real property from the trustee to the beneficiary without monetary consideration under and by virtue of the Deed of Acknowledgment of Implied Trust and Waiver of Rights and Interest to Real Estate Properties is not subject to CGT because there is in fact and in law no transfer of the beneficial ownership since the naked ownership of the trustee and the beneficial ownership of the beneficiary are consolidated in the latter. [VIP!] Accordingly, since in a pa ct o de r e t r o sa le the owner-vendor transfers his/her ownership of a realty to another for a consideration, the gain (GSP or FMV or FMV whichever is highest) presumed to be realized by the former in the said transaction shall be subject to CGT, which shall be paid before registration of the deed of sale with right to repurchase with the Register of Deeds. On the other hand, if the owner-vendor exercises his/her right to repurchase the property subject of a pacto de retro sale, the reconveyance of said realty by the vendee a retro to the owner-vendor shall not be subject to CGT, as the same is without any consideration and is made only for the purpose of restoring the rights of the parties to the status quo. The dissolution by the co-owners of the co-ownership by an agreement to divide among the co-owners the properties of the co-ownership is not subject to CGT. The transfer of title to the coowners is not a sale, barter, exchange or other disposition contemplated by law subject to the imposition of the tax. The act of partitioning a commonly owned property to each co-owner should not be treated a taxable event as it is nothing more than terminating the co-ownership by making each co-owner of specific identifiable portion or unit of the property. Section 24 (D, 1) is comprehensive enough to cover not only voluntary but also involuntary sales, like execution sale and expropriation. • [VIP!] Cor p or a t ion s a n d pa r t ne r sh ips are now subject to the final CGT of 6% on the gain presumed to have been realized (GSP or FMV or FMV whichever is highest) from the sale of land and/or buildings (machineries and equipment are not included even if they are classified as real property) which are not actually used (Capital Asset) in the business of the corporation. If the property is actually used in business (Ordinary Asset), the corporation is subject to the 30% corporate income tax based on the gain or profit or income which is GSP or FMV or FMV whichever is highest minus cost. • [Impt!] Ex e cu t ion Sa le – the payment of CGT and DST is not required in the registration of a Sheriff’s Certificate of Sale (provisional) in the Office of the Register of Deeds. Assignment of rights in real property is not subject to CGT because the assignee merely steps into the shoes of the assignor 25 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 The transfer of ownership of a property at an execution sale under Rule 39 of the Rules of Court is not perfected until the execution and delivery of the sheriff’s final deed of sale after the expiration of the 1 year redemption period. A certificate of sale (provisional) given to the purchaser at the time the sa le (Public Auction Sale) is made is different and distinct from the final deed, which is delivered at the expiration of the period of redemption, since the former is not intended to operate as an absolute transfer of the property, but merely to identify the property, price paid, and the date when the right of redemption expires. The registration of the certificate of sale (provisional) is a mere ministerial act by which an instrument is sought to be inscribed in the records of the Office of the Registry of Deeds and annotated at the back of the certificate of title covering the land subject of the instrument. should be paid and the CGT return filed within 30 days from the date of the expiration o the 1 year redemption period. o o Therefore, the sale of the property at an execution sale under Rule 39 of the Rules of Court and the corresponding registration of the certificate of sale in the Office of the Registry of Deeds are not subject to the CGT and DST. o • • • In Execution Sale and Foreclosure Sale the real property is subject to CGT of 6% only if the debtor or mortgagor did not redeem the real property. If the debtor or mortgagor redeemed the real property within the redemption period the execution sale or foreclosure sale is not subject to CGT of 6%. X acquired a real property in his capacity as the highest winning bidder in a Sheriff’s Sale. Y purchased from X the said property. At the time of the execution of the Deed of Sale, there was no Owner’s Duplicate of the TCT. Y was not able to pay the CGT because the RDO required the TCT which was destroyed in the Quezon City Hall fire. Moreover, the filing of various cases in court led to the delay and the failure to pay the CGT on time. The request for waiver of payment of penalty charges on the sale of said real property was denied for lack of legal basis. Being the seller, X is the party liable to pay the CGT. Y is not the proper party in interest. [Impt!] For e closu r e Sa le – the CGT paid (because the redemption period has already expired) in a foreclosure sale cannot be deducted from the CGT on the sale of the property where the mortgagor failed to exercise his right of redemption. There being no timely redemption, the reconveyance (the mortgagor purchased the property from the buyer/mortgagee at foreclosure sale after the expiration of the redemption period) of the subject property from the buyer (usually the mortgagee) to the seller (mortgagor) is another sale subject to CGT under Section 24(D)(1). • In case of non-redemption, the CGT on the foreclosure sale imposed under Secs. 24(D)(1) and 27(D)(5) shall become due based on the bid price (or FMV or FMV whichever is highest) but only within 30 days from the expiration of the 1 year redemption period In case the mortgagor exercises his right of redemption within 1 year from the issuance of the certificate of sale, no CGT shall be imposed because no capital gain has been derived by the mortgagor and no sale or transfer of real property occurred. A certification to that effect or the deed of redemption shall be filed with the Revenue District Office having jurisdiction over the place where the property is located which certification or deed shall likewise be filed with the Register of Deeds and a brief memorandum thereof shall be made by the Register of Deeds on the Certificate of Title of the mortgagor. [VIP!] Where right of redemption exists – where the right of redemption exists, the certificate of title of the mortgagor shall not be cancelled yet even if the property had already been subjected to foreclosure. Instead, only a brief memorandum shall be annotated on the back of the certificate of title. The cancellation of the title and the subsequent issuance of a new title in favour of the purchaser/highest bidder, therefore, depend on whether or not the mortgagor redeems the mortgaged property within 1 year from the issuance of the certificate of sale. Thus, no transfer of title to the highest bidder can be effected until after the lapse of the 1 year period from the issuance of the said certificate of sale. o The sale of the property at an e x t r a j u dicia l for eclosu re (See Section 6, Act No. 3135 and Section 47, 2nd paragraph, RA 8791) which is similar to an execution sale and the corresponding registration of the certificate of sale (provisional). Section 28 of Rule 39 of the Rules of Court allows the judgment obligor, or redemptioner, a period of 1 year from the date of the registration of the certificate of sale (provisional) to redeem the property from the purchaser. The CGT on a foreclosure sale is due within 30 days from the expiration of the 1 year redemption period. The 1 year redemption period of a mortgaged property cannot be extended by the mortgageebank, finance or insurance companies nor by the parties in an extrajudicial foreclosure. In case of non-redemption, a tax clearance certificate (TCL) or Certificate Authorizing Registration (CAR) in favour of the purchaser/highest bidder shall only be issued upon presentation of the capital gains and DSTs returns duly validated by an authorized agent bank evidencing full payment of the capital gains and documentary stamp taxes due on the sale of the property classified as capital asset. Accordingly, the taxes on the sale shall be due only after the lapse of the 1 year redemption period. In a case, considering that the 1 year period within which to redeem the property had lapsed, the CGT 26 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • • • [VIP!] Ba sis of t h e 6 % CGT – the tax is based on the GSP or the FMV (zonal value) as determined by the CIR or as shown in the schedule of values in the Provincial or City Assessor, whichever is higher. o An exception is provided in the case of the sale by an individual of his principal residence o In case of exchange, the 6% CGT payable by the transferor under subsection (D) is based on the FMV of his property o In case of expropriation by the gov’t, the actual consideration (fixed by the court) may be used as basis in determining the CGT. The “just compensation” paid by the gov’t to the owner of the property is the equivalent for the value of the property at the time of its taking. It is the fair and full equivalent for the loss sustained by the transferor which is the measure of indemnity. Such being the case, the amt approved by the court as fair compensation must be used as the tax base for computing the gains derived out of such transaction. o The redemption of realty under a pacto de retro sale is not subject to CGT only pacto de retro sale is subject. o Where the purchaser is the gov’t or any of its political subdivisions or agencies or a gov’t-owned or –controlled corporation, the taxpayer (seller) has the option to have his tax liability determined under Section 24(A) as ordinary income tax. • He must file a Sworn Statement on or before January 31 of every year that his annual taxable income for the previous year does not exceed the poverty level as determined by the NEDA thru the NSCB c) If qualified, his name shall be recorded by the RDO in the Master List of Tax-Exempt Senior Citizens for that particular year, which the RDO is mandatorily required to keep. However, a Senior Citizen who is a compensation income earner deriving from only one employer an annual taxable income exceeding the poverty level or the amt determined by the NEDA thru the NSCB on a particular year, but whose income had been subjected to the withholding tax on compensation, shall, although not exempt from income tax, be entitled to the substituted filing of income tax return The 20% final tax on interest, royalties, prizes and other winnings b) The 10% final tax in Section 24 (B,2) (Dividends [cash and property] c) Capital gains t a x (5% and 10%) from sales of shares of stock in a domestic corporation not traded in the stock exchange d) 6% final tax on presumed capital gains from sale of real property classified as capital asset located in the Phils. e xce pt gains presumed to have been realized from the sale or disposition of principal residence A benefactor refers to any person whether related or not to the senior citizen who provides care or who gives any form of assistance to him/her, and on whom the senior citizen is dependent on for primary care and material support, as certified by the City or Municipal Social Welfare and Development Officer SEC 2 5 . Tax on Nonresident Alien I ndiv idual. - A Senior Citizen must first be qualified as such by the CIR or his duly authorized representative b) a) A Senior Citizen who is not gainfully employed, living with and dependent upon his benefactor for chief support, although treated as dependent under the Act, will not entitle the benefactor to claim the additional exemption of P 25,000.00. The entitlement to claim the additional exemption per dependent (not exceeding 4) is allowable only to individual taxpayers with a qualified dependent child or children subject to the conditions set forth under Section 35(B). A Senior Citizen who is a minimum wage earner or whose taxable income during the year does not exceed his personal and additional exemptions, will be exempt from income tax upon compliance with the following requirements: a) [Impt!] The exemption of Senior Citizens from income tax granted in the Act will not extend to all types of income earned during the taxable year. Hence, he can still be liable for other taxes such as: (A) N on r e side n t Alien En ga ge d in trade or Business Within the Philippines. – (1) I n General. - A nonresident alien individual engaged in trade or business in the Philippines shall be subject to an income tax in the same manner (same rates prescribed in Section 24A and same manner of computing [Gross Income LESS allowable deductions LESS exemptions]) as an individual citizen and a resident alien individual, on taxable income received from all sources within the Philippines. A nonresident alien individual who shall come to the Philippines and stay therein for an aggregate period of more than one hundred eighty (180) days during any calendar year shall be deemed a 'nonresident alien doing business in the Philippines'. Section 22 (G) of this Code notwithstanding. (2) Cash and/ or Propert y Dividends from a Dom est ic Corporat ion or Joint St ock Com pany , or I nsurance or Mut ual Fund Com pany or Regional Operat ing Headquart er or Mult inat ional Com pany , or Share in t he Dist ribut able Net I ncom e of a Part nership ( Ex cept a General Professional Part nership) , Joint Account , Joint Vent ure Tax able as a Corporat ion or Associat ion., I nt erests, Roy alt ies, Prizes, and Ot her Winnings. - Cash 27 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Same as RC, NRC and RA and/or property (1)dividends from a domestic corporation, or from a joint stock company, or from an insurance or mutual fund company or from a regional operating headquarter of multinational company, or the share of a nonresident alien individual in the distributable net income after tax of a partnership (except a general professional partnership) of which he is a partner, or the share of a nonresident alien individual in the net income after tax of an association, a joint account, or a joint venture taxable as a corporation of which he is a member or a co-venturer; (2) interests (whether from bank deposit or not); (3)royalties (in any form); and (4)prizes (except prizes amounting to Ten thousand pesos (P10,000) or less which shall be subject to tax under Subsection (A)(1) of Section 24) and (5)other winnings (except Philippine Charity Sweepstakes and Lotto winnings); shall be subject to an final income tax of twenty percent ( 2 0 % ) on the total amount thereof: Provided, however, that royalties on books as well as other literary works, and royalties on musical compositions shall be subject to a final tax of ten percent ( 1 0 % ) on the total amount thereof: Prov ided, furt her, That cinematographic films and similar works shall be subject to the tax provided under Section 28 of this Code: Prov ided, furt herm ore, That interest income from long-term deposit or investment in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments evidenced by certificates in such form prescribed by the Bangko Sentral ng Pilipinas (BSP) shall be exempt from the tax imposed under this Subsection: Provided, finally, that should the holder of the certificate pre-terminate the deposit or investment before the fifth (5th) year, a final tax shall be imposed on the entire income and shall be deducted and withheld by the depository bank from the proceeds of the long-term deposit or investment certificate based on the re m a in ing m a t u r it y (holding period) thereof: Four (4) years to less than five (5) years - 5%; Three (3) years to less than four (4) years - 12%; and Less than three (3) years - 20%. from the sale of shares of stock in any domestic corporation and real property shall be subject to the income tax prescribed under Subsections (C) and (D) of Section 24. [ Su bsect ion s C, D & E r e fe r t o spe cial N RA n ot e n ga ge d beca use t he y e n j oy pr e fe re n t ia l t ax r a t e of 1 5 % in ste a d of 2 5 % ] (C) Alien Individual Employed by Regional or Area Headquarters and Regional Operating Headquarters of Multinational Companies. - There shall be levied, and collected and paid for each taxable year upon the gross income received by every alien individual employed by regional or area headquarters and regional operating headquarters established in the Philippines by multinational companies as salaries, wages, annuities, compensation, remuneration and other emoluments, such as honoraria and allowances, from such regional or area headquarters and regional operating headquarters, a (final) tax equal to fifteen percent ( 1 5 % ) of such gross income: Pr ovide d, h ow e ve r , That the same tax treatment shall apply to Filipinos employed and occupying the same position as those of aliens employed by these multinational companies. For purposes of this Chapter, the term 'm u ltin a t iona l com pa n y' means a foreign firm or entity engaged in international trade with affiliates or subsidiaries or branch offices in the Asia-Pacific Region and other foreign markets. (D) Alien Individual Employed by Offshore Banking Units. - There shall be levied, and collected and paid for each taxable year upon the gross income received by every alien individual employed by offshore banking units established in the Philippines as salaries, wages, annuities, compensation, remuneration and other emoluments, such as honoraria and allowances, from such off-shore banking units, a tax equal to fifteen percent ( 1 5 % ) of such gross income: Pr ovide d, h ow e ve r , That the same tax treatment shall apply to Filipinos employed and occupying the same positions as those of aliens employed by these offshore banking units. (E) Alien Individual Employed by Petroleum Service Contractor and Subcontractor. - An Alien individual who is a permanent resident of a foreign country but who is employed and assigned in the Philippines by a foreign service contractor or by a foreign service subcontractor engaged in petroleum operations in the Philippines shall be liable to a tax of fifteen percent ( 1 5 % ) of the salaries, wages, annuities, compensation, remuneration and other emoluments, such as honoraria and allowances, received from such contractor or subcontractor: Pr ovide d, h ow e ve r , That the same tax treatment shall apply to a Filipino employed and occupying the same position as an alien employed by petroleum service contractor and subcontractor. Same as RC, NRC, RA and NRA engaged (3) Capit al Gains. - Capital gains realized from sale, barter or exchange of shares of stock in domestic corporations not traded through the local Same as RC, stock exchange, and real properties shall be subject to the tax NRC and RA prescribed under Subsections (C) and (D) of Section 24. (B) N on r e side n t Alien I n dividu al N ot En ga ge d in Trade or Business Within the Philippines. - There shall be levied and collected and paid for each taxable year upon the entire income (or gross income) received from all sources within the Philippines by every nonresident alien individual not engaged in trade or business within the Philippines as interest, cash and/or property dividends, rents, salaries, wages, premiums, annuities, compensation, remuneration, emoluments, or other fixed or determinable annual or periodic or casual gains, profits, and income, and capital gains, a tax equal to twentyfive percent ( 2 5 % ) (final tax) of such income. Capital gains realized by a nonresident alien individual not engaged in trade or business in the Philippines Any income earned from all other sources within the Philippines by the alien employees referred to under Subsections (C), (D) and (E) hereof shall be subject to the pertinent income tax, as the case may be, imposed under this Code. • N on - r e side n t alie n in dividua ls are divided into two classes: 1. Engaged in trade or business within the Phils. 2. NOT engaged in trade or business within the Phils. 28 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Income tax formula for n on - r e siden t a lien en gage d For purposes of computing the distributive share of the partners, the net income of the partnership shall be computed in the same manner (gross income LESS allowable deductions) as a corporation. Gross income within the Philippines LESS: Allowable itemized deductions (or 40% optional standard deduction) NET I NCOME LESS: Personal exemption (if entitled) (or reciprocity basis) TAXABLE I NCOME/TAX BASE Multiplied by: Tax rate in Section 24A Am ount of incom e t ax due o They are taxed in the same manner as non-resident citizens and resident aliens only with respect to income from Philippine sources o They are not entitled to additional exemption for dependents but may be entitled to personal exemptions under certain conditions o They are subject to the same rates of tax as citizens and resident aliens on capital gains from sales of shares of stock in a domestic corporation and real property classified as CA and located in the Phils. and percentage tax in case the shares are listed and traded through a local stock exchange o • Each partner shall report as gross income (because from there the partner can deduct personal and additional exemptions) his distributive share, actually or constructively received, in the net income of the partnership. • Partnerships are either “t a x a ble (ordinary or business) partnerships” or “exempt partnerships (GPP)” • GPP whether registered or not are not subject to income tax and consequently, exempt from withholding tax Unlike an ordinary or business partnership which is treated as a corporation for income tax purposes and, therefore, subject to corporate income tax of 30%, a GPP is not in itself an income taxpayer. • The income tax is imposed on the partners themselves in their separate and individual capacity on their separate and respective distributive shares of the net income of the partnership computed (gross income LESS allowable deductions) in the same manner as a corporation Dividends, etc., received by a non-resident alien are subject to 2 0 % final tax if the alien is engaged otherwise, he is taxable under Subsection (B) at 2 5 % Th e y (GPP) are, however, required to file information returns for the purpose of furnishing information as to share in the net gains or profits which each partner shall include in his individual return mainly for administration and data purposes 2. The distributive share of the individual partner in the net income of a GPP, whether actually or constructively received, is subject to tax under Section 24(A) to be reported as gross (the partner may deduct therefrom personal and additional exemptions) income I n com e t a x for m u la for n on - re side n t a lie n s not e n ga ge d Gross income within the Philippines Multiplied by: 25% Am ount of incom e t ax due 1. 2. • 1. As used in Subsection (B): a. Income is fixed when it is to be paid in amts definitely pre-determined b. Determinable, whenever there is a basis of calculation by which the amt to be paid may be ascertained c. Annual or periodical, when it is paid from time to time, whether or not at regular intervals The income need not be paid annually if it is paid periodically Regular Filipino employees of an ROHQ who are assigned abroad for most of the time during the taxable year qualify as non-resident citizens and are, therefore, exempt from tax on compensation for services rendered abroad. SEC. 2 6 . Tax Liabilit y of Mem bers of General Professional Part nerships. - A gen e ra l pr ofe ssion al par t n e rship (non-taxable entity) as such shall not be subject to the income tax imposed under this Chapter. Persons engaging in business (“exercising their common profession”) as partners in a general professional partnership shall be liable for income tax only in their separate and individual capacities. • Ta x a t ion of bu sin e ss par t n e rsh ips – A partnership whether registered or not, other than a GPP, is considered for tax purposes a corporation and the partners are considered stockholders • The taxable income declared by a partnership for a taxable year is subject to corporate income tax (30%) under Section 27 (A). 1. After deducting such tax imposed therein, such income shall be deemed to have been actually or constructively received by the partners (as dividend) in the same taxable year. 2. The share of an individual partner in a partnership subject to corporate tax under Section 27(A) is subject to a final tax 1 0 % (if the partner is RC, NRC or RA); 2 0 % (if the partner is NRA engaged); 2 5 % (if the partner is NRA not engaged) o There is no inconsistency between a business partnership which is necessarily engaged in business in the Phils and the partners thereof 29 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 who are NRA not engaged in business in the Phils. because the business partnership is a judicial person which is a separate and distinct from the partners of the said partnership For purposes of this Section, the term 'gr oss in com e ' derived from business shall be equivalent to gross sales less sales returns, discounts and allowances and 'cost of goods sold’ (or cost of sale). ‘Cost of goods sold' shall include all business expenses directly incurred to produce the merchandise to bring them to their present location and use. Chapter 4 – TAX ON CORPORATIONS For a trading or merchandising concern, 'cost of goods sold' shall include the invoice cost of the goods sold, plus import duties, freight in transporting the goods to the place where the goods are actually sold, including insurance while the goods are in transit. Se ct ion 2 7 . Rat es of I ncom e t ax on D om e st ic Cor por a t ion s. (A) In General. - Except as otherwise provided in this Code, an income tax of thirty-five percent (35%) is hereby imposed upon the taxable income derived during each taxable year from all sources within and without the Philippines by every corporation, as defined in Section 22(B) of this Code and taxable under this Title as a corporation, organized in, or existing under the laws of the Philippines: Provided, That effective January 1, 2009, the rate of income tax shall be thirty percent ( 3 0 % ) . For a manufacturing concern, 'cost of goods m a n u fact u re d an d sold' shall include all costs of production of finished goods, such as raw materials used, direct labor and manufacturing overhead, freight cost, insurance premiums and other costs incurred to bring the raw materials to the factory or warehouse. In the case of domestic corporation taxpayers engaged in the sale of service, 'gr oss incom e ' means gross receipts less sales returns, allowances and discounts. NO COST OF SALES [Read!] In the case of corporations adopting the fiscal-year accounting period, the taxable income shall be computed without regard to the specific date when specific sales, purchases and other transactions occur. Their income and expenses for the fiscal year shall be deemed to have been earned and spent equally for each month of the period. Ex a m ple : A & B who share profits and losses equally and are RCs, are partners in AB partnership which is a GPP and whose income statement for the year ended Dec. 31, 2013 appears below: The corporate income tax rate shall be applied on the amount computed by multiplying the number of months covered by the new rate within the fiscal year by the taxable income of the corporation for the period, divided by twelve. Gross Income from Profession LESS: Expenses, Losses, etc. (Sec. 34) NET INCOME Provided, furt her, That the President, upon the recommendation of the Secretary of Finance, may, effective January 1, 2000, allow corporations the option to be taxed at fifteen percent (15%) of gross income as defined herein, after the following conditions have been satisfied: (1) A tax effort ratio of twenty percent (20%) of Gross National Product (GNP); (2) A ratio of forty percent (40%) of income tax collection to total tax revenues; (3) A VAT tax effort of four percent (4%) of GNP; and (4) A 0.9 percent (0.9%) ratio of the Consolidated Public Sector Financial Position (CPSFP) to GNP. The option to be taxed based on gross income shall be available only to firms whose ratio of cost of sales to gross sales or receipts from all sources does not exceed fifty-five percent (55%). The election of the gross income tax option by the corporation shall be irrevocable for three (3) consecutive taxable years during which the corporation is qualified under the scheme. 30 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) Php 1,200,000.00 300,000.00 Php 900,000.00 a) Is AB partnership subject to income tax? ANS: NO, a GPP is NOT subject to income tax under Section 26 b) Is AB partnership required to file a return? ANS: YES, a GPP is required by law to file information return c) Is A taxable on his distributive share in the net income of AB partnership? ANS: YES, A should report as gross income or part of his gross income his share in the net income of AB partnership in the amt of (Php 900,000.00 ÷ 2) Php 450,000.00 which shall be taxable under Section 24 A. A & B, who share profits and losses equally, are partners in AB partnership which is engaged in hotel business and whose income statement for the year ended Dec. 31, 2013 appears below: lOMoARcPSD|12553117 Gross Income from Profession LESS: Expenses, Losses, ets. (Sec. 34) NET INCOME before Income Tax LESS: Income Tax (Php 4M x 30%) NET INCOME after Income Tax a) b) c) Php 12,000,000.00 8,000,000.00 Php 4,000,000.00 1,200,000.00 Php 2,800,000.00 educational institution or hospital of its primary purpose or function. A 'Pr opr ie t a r y e duca t ion al inst it u t ion ' is any private school maintained and administered by private individuals or groups with an issued permit to operate from the Department of Education, Culture and Sports (DECS), or the Commission on Higher Education (CHED), or the Technical Education and Skills Development Authority (TESDA), as the case may be, in accordance with existing laws and regulations. Is AB partnership subject to income tax? ANS: YES, a business partnership is taxable at 30% as a corporation under Section 27 Is AB partnership required to file a return? ANS: YES, a business partnership like a corporation is required by la to file quarterly income tax returns Is A taxable on his distributive share in the net income after tax of AB partnership? ANS: 1. If A is RC or NRC or RA, he is taxable at 10% final tax on dividend in the amount of (Php 2.8M ÷ 2 x 10%) Php 140,000.00 which is to be withheld and paid by AB partnership to the BIR o Non-stock, Non-profit educational institutions are exempt from all kinds of taxes, internal or external national or local (Article XIV, Section 4, Constitution) o If the school or hospital is a single proprietorship, the owner thereof is taxable under Section 24A. If it is a partnership or corporation it is subject to corporate income tax of 10%. Proprietary hospital which is a partnership or corporation is taxable at 30%. Ex a m ple : S Gross Income LESS: allowable deductions 2. 3. Tuit ion Unrelat ed Php 20M Php 30M Php 50M 12M 18M Php 12M 30M Php 20M TAXABLE INCOME Php 18M If A is NRA engaged, he is taxable at 20% final tax on dividend or in the amt of (Php 2.8M ÷ 2 x 20%) Php 280,000.00 to be withheld and paid by AB partnership to the BIR Tot al The ratio of unrelated income to total income is (Php 30M ÷ Php 50M) 60% which exceeds 50%, hence, the income tax is (Php 20M x 30%) Php 6M. If A is NRA not engaged, he is taxable at 25% final tax on dividend or in the amt of (Php 2.8M ÷ 2 x 25%) Php 350,000.00 to be withheld and pid by AB partnership to the BIR (C) [Mem!] Government-owned or Controlled-Corporations, Agencies or Instrumentalities. - The provisions of existing special or general laws to the contrary notwithstanding, all corporations, agencies, or instrumentalities owned or controlled by the Government, e x ce pt the (1)Government Service Insurance System (GSIS), the (2)Social Security System (SSS), the (3) Philippine Health Insurance Corporation (PHIC), and the (4)Philippine Charity Sweepstakes Office (PCSO), shall pay such rate of tax (30%) upon their taxable income as are imposed by this Section upon corporations or associations engaged in a similar business, industry, or activity. (as amended by RA 9337) ((5)PDIC or Phil Deposit Insurance Corporation is also exempt from Income tax under RA9576) In either of the 3 cases above, A is taxable and AB partnership must withhold and pay the dividend tax to the BIR even if the partnership did not distribute the net income after the tax of the partnership (B) [Mem!] [BAR!] Pr opr ie t a r y (or for profit) Edu ca t ion al I nst it u t ion s a n d H ospit a ls. - Proprietary educational institutions and h ospit a ls w h ich a r e n on pr ofit (no part of the income of which enures to the benefit of any individual or group of individuals) shall pay a tax of ten percent ( 1 0 % ) on their taxable income except those covered by Subsection (D) hereof: Pr ovide d, that if the gross income from unrelated trade, business or other activity exceeds fifty percent ( 5 0 % ) of the total gross income derived by such educational institutions or hospitals from all sources, the tax (30%) prescribed in Subsection (A) hereof shall be imposed on the entire taxable income. For purposes of this Subsection, the term 'unrelated trade, business or other activity' means any trade, business or other activity, the conduct of which is not substantially related to the exercise or performance by such (D) Rates of Tax on Ce r t a in Pa ssive I ncom e s. – (1) Interest from Deposits and Yield or any other Monetary Benefit from Deposit Substitutes and from Trust Funds and Similar Arrangements, and Royalties. - A fin al t a x at the rate of twenty percent ( 2 0 % ) is hereby imposed upon the amount of (1)interest on currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements received by domestic corporations, and (2)royalties, derived from sources within the 31 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Philippines (if the interest and royalties are derived from outside the Phils., the same RPGI taxable at 30%): Pr ovide d, h ow e ve r , That interest income derived by a dom e st ic cor por a t ion (depositor of foreign currency) from a depository bank under the expanded foreign currency deposit system shall be subject to a fina l in com e t a x at the rate of seven and one-half percent ( 7 ½ % ) (same as RC and RC) of such interest income. o o (4) I n t e r cor por a t e D ivide n ds. - Dividends received by a domestic corporation from another domestic corporation shall not be subject to tax. Prizes and Other Winnings are not mentioned if the taxpayer is a DC probably because a corporation does not participate in any contest or it does not engage in gambling activities. In case a DC receives a prize the same is not subject to final tax of 20% but it is part of the gross income of the corporation taxable at 30% (5) Capital Gains Realized from the Sale, Exchange or Disposition of Lands and/or Buildings. - A fina l t ax of six percent ( 6 % ) is hereby imposed on the gain presumed to have been realized on the sale, exchange or disposition of lands and/or buildings located in the Phils. which are not actually used in the business of a corporation and are treated as capital assets, based on the gross selling price of fair market value as determined in accordance with Section 6(E) of this Code, whichever is higher, of such lands and/or buildings. (2) Capital Gains from the Sale of Shares of Stock Not Traded in the Stock Exchange. - A final tax at the rates prescribed below shall be imposed on net capital gains realized during the taxable year from the sale, exchange or other disposition of shares of stock in a domestic corporation except shares sold or disposed of through the stock exchange: [ sa m e a s RC, N RC, RA, N RA e n ga ge d a n d N RA n ot e n ga ge d] Not over P100,000 5% Amount in excess of P100,000 10% Offshore banking unit is a branch, subsidiary or affiliate of a foreign banking corporation which is duly authorized by BSP to ttransact offshore banking business in the Phils. (3) (Domestic Corporation in a bank) Tax on Income Derived under the Expanded Foreign Currency Deposit System. - I ncom e (interest income on foreign currency loans granted by the domestic corporation to the borrowers) derived by a depository bank (domestic corporation which is the lender bank) under the expanded foreign currency deposit system from foreign currency transactions with nonresidents, offshore banking units in the Philippines, local commercial banks including branches of foreign banks that may be authorized by the Bangko Sentral ng Pilipinas (BSP) to transact business with foreign currency deposit system units a n d other depository banks under the expanded foreign currency deposit system shall be exempt from all taxes, except net income from such transactions as may be specified by the Secretary of Finance, upon recommendation by the Monetary Board to be subject to the regular income tax payable by banks: Pr ovide d, h ow e ve r , That interest income from foreign currency loans granted by such depository banks under said expanded system to residents other than offshore banking units in the Philippines or other depository banks under the expanded system shall be subject to a fina l t ax at the rate of ten percent ( 1 0 % ) . o If the lands and/or buildings are sold to the gov’t, the sale is always subject to CGT of 6% and the Domestic Corporation has no option to treat it as ordinary gain subject to 30% corporate income tax. o In Section 27D (1), the DC is the depositor of foreign currency the interest income of which is subject to final tax of 7½%. In Section 27D(3), 1st paragraph, the DC is a lender or depository bank which grants foreign currency loans to borrowers the interest income of which is either exempt or subject to final tax of 10% instead of corporate income tax of 30%. (E) Minimum Corporate Income Tax on Domestic Corporations. – (1) Imposition of Tax. - A m in im u m cor por a t e in com e t a x of two percent ( 2 % ) of the gross income as of the end of the taxable year, as defined herein, is hereby imposed on a corporation (domestic) taxable under this Title, beginning on the fourth taxable year immediately following the year in which such corporation commenced its business operations, when the minimum income tax is greater than the tax computed under Subsection (A) of this Section for the taxable year (Gross income LESS allowable deductions x 30%). (2) Carry Forward of Excess Minimum Tax. - Any excess of the minimum corporate income tax over the normal income tax as computed under Subsection (A) of this Section shall be carried forward and credited against the normal income tax for the three (3) immediately succeeding taxable years. Ex a m ple : Corporation C, a DC, was organized, commenced business operations and registered with the BIR on Han. 2, 2006. For the taxable year 2009, its gross income was Php 20M and the allowable deductions were Php 19M. For the taxable year 22010, its gross income was Php 25M and the allowable deductions were Php 20M. [Mem!] Any interest income of non-residents (depositors), whether individuals or corporations, from transactions with depository banks under the expanded system shall be exempt from income tax. 32 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 1. 2. Compute the tax due of Corporation X in 2009. Compute the tax due of Corporation X in 2010. For a manufacturing concern, cost of 'goods manufactured and sold' shall include all costs of production of finished goods, such as raw materials used, direct labor and manufacturing overhead, freight cost, insurance premiums and other costs incurred to bring the raw materials to the factory or warehouse. Solution: 1. 2009 Gross Income LESS: allowable deductions TAXABLE INCOME Normal Income Tax (Php 1M x 30%) Php 20,000,000.00 19,000,000.00 Php 1,000,000.00 In the case of taxpayers engaged in the sale of service, 'gross income' means gross receipts less sales returns, allowances, discounts and cost of services. 'Cost of services' shall mean all direct costs and expenses necessarily incurred to provide the services required by the customers and clients including (A) salaries and employee benefits of personnel, consultants and specialists directly rendering the service and (B) cost of facilities directly utilized in providing the service such as depreciation or rental of equipment used and cost of supplies: Provided, however, That in the case of banks, 'cost of services' shall include interest expense. 300,000.00 Minimum Corporate Income Tax (Php 20M x 2%) TAX DUE 2. 400,000.00 400,000.00 2010 Gross Income LESS: allowable deductions TAXABLE INCOME Normal Income Tax (Php 5M x 30%) Php 25,000,000.00 20,000,000.00 Php 5,000,000.00 • Cla ssifica t ion of cor por a t ion s – corporations may be either domestic or foreign and the latter may either be resident foreign (engaged) or nonresident foreign (not engaged). • Cor por a t ion does not include a GPP and a joint venture or consortium “formed for the purpose of undertaking construction projects under a service contract with the Gov’t” 1,500,000.00 Minimum Corporate Income Tax (Php 25M x 2%) TAX DUE 500,000.00 1. Pa r t n e r sh ips (ordinary or business or taxable), e x ce pt GPPs, whether registered or unregisteres, are treated as corporations and subject to tax as such in line with the separate juridical personality doctrine. The partners are considered as stockholders and, therefore, profits distributed to them actually or constructively by the partnership are considered as dividends. 2. Section 27A excluding GPPs from the payment of corporate income tax is not an exemption clause (examples of exemption clauses or exemption provisions are Section 30 of the NIRC and ArticleXIV, Sec. 4, Constitution) but a classification clause, which must be construed liberally in favour of the taxpayer. A classification statute is one which specifies the persons or property subject to tax 1,400,000.00 (3) Relief from the Minimum Corporate Income Tax Under Certain Conditions. - The Secretary of Finance is hereby authorized to suspend the imposition of the minimum corporate income tax on any corporation which suffers losses on account of prolonged labor dispute, or because of force majeure, or because of legitimate business reverses. The Secretary of Finance is hereby authorized to promulgate, upon recommendation of the Commissioner, the necessary rules and regulation that shall define the terms and conditions under which he may suspend the imposition of the minimum corporate income tax in a meritorious case. (4) Gross Income Defined. - For purposes of applying the minimum corporate income tax provided under Subsection (E) hereof, the term 'gross income' shall mean gross sales less sales returns, discounts and allowances and cost of goods sold. "Cost of goods sold' shall include all business expenses directly incurred to produce the merchandise to bring them to their present location and use. For a trading or merchandising concern, 'cost of goods sold' shall include the invoice cost of the goods sold, plus import duties, freight in transporting the goods to the place where the goods are actually sold including insurance while the goods are in transit. • Any corporation, domestic or foreign not otherwise ex e m pt (Section 20 and GSIS, SSS, PHIC and PCSO. PDIC is also exempt), is liable to tax. o A DC is taxed on its income from sources within and outside the Phils. but a foreign corporation is taxed only on its income from sources within the Phils. • The 20% final tax for prizes and winnings (payable by individuals) [Section 24 (B,1)] is not applicable to corporations since this is not included among the income of a corporation subject to the 20% final tax under Section 27(D,1). However, in the hands of a corporate winner, the prize or winning shall, instead, be subject to 30% corporate income tax under Section 27 (A) or Section 28 (A,1) in the case of a foreign corporation. 33 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Income tax formula for proprietary educational institutions and non-profit hospitals: o The new income tax rate of 10% is subject to certain conditions. Section 27B introduces the pr e dom in an ce t e st otherwise, it will be taxed at 3 0 % on its entire taxable educational/non-educational or hospital/non-hospital income It shall, however, be subject to internal revenue taxes on income (BUT if said income is ADE used for educational purposes the same is exempt) from trade, business or other activity, the conduct of which is not related to the exercise or performance by such educational institution of its educational purpose or function. o • [Mem!] All r e ve nu es (incomes or gains or profits) and assets of non-stock, non-profit educational institutions used actually, directly, and exclusively for educational purposes shall be exempt from taxes and duties. o A non-stock, non-profit educational institution is exempt from taxes, 10% tax on its income as an educational institution; 20% withholding tax on its interest income on its savings and time deposits; customs duties and VAT on its importation or purchase sale of books and other educational materials and equipment to be actually, directly and exclusively used for educational purpose. o [VIP!] H ow e ve r , earnings realized from its passive investments (the asset such as cash is no longer used A,D,E for educational purpose) arising from deposit substitute instruments, money market placements, treasury bills, etc. Not derived in pursuance of its purpose as an educational institution, are subject to 2 0 % final tax. Bu t if the earnings from such passive investments are to be used directly, exclusively, and actually for its educational purpose or function, then such earnings are exempt from the 20% withholding tax imposed by Section 27D, pursuant to Section 4(3), Article XIV of the Constitution. o [VIP!] Moreover, revenues derived from and assets used in the operation of cafeterias/canteens, dormitories, hospitals and bookstores are e x e m pt from taxation, provided they are owned and operated by the educational institution as ancillary activities and the same are located within the school premises. Accordingly, the tax exemption does not include the canteen owned by the school operated by a con cessiona ir e (or lessee is the one taxable on income from the canteen; the rent collected by the school is exempt provided it is ADE used for educational purposes). The income from miscellaneous school-related operations like car stickers is, likewise, exempt from income tax. o Revenues derived from and assets used in the operation of hospitals are exempt from taxation, pr ovide d they are owned and operated by the educational institution as an indispensable requirement in the operation and maintenance of its medical school or college o A non-stock, non-profit educational institution is exempt from tax on all revenues derived in pursuance of its purpose as an educational institution and used actually, directly, and exclusively for educational purposes. The exemption contemplated refers to internal revenue taxes and custom duties as well as local taxes under the LGC of 1991. The educational institution must not only be a non-stock corporation. There must be a showing that it is a non-profit corporation, which means that no part of its income inures directly or indirectly to any individual or member. • [Impt!] Gove r n m e n t - ow n e d or – con t r olle d cor por a t ion s – except on ly (PDIC is also exempt from Income Tax under RA 9576) for the GSIS, SSS, PHIC, and PCSO, all such corporations are taxable as privately-owned corporations engaged in a similar business, industry, or activity. RA No. 9337 withdraws PAGCOR’s income tax exemption beginning Nov. 1, 2005, when it removed it from the list of tax-exempt GOCC’s in Section 27C. • Compared to Section 24(B,1) on the taxation on interest, etc., Section 27D and 28(A,7,a) do not include prizes and other winnings (PGI [Part of Gross Income]). Individuals, whether citizens or liens, resident or non-resident, and corporations, whether domestic or foreign and in the latter case, if received by DC or RFC taxable at 30%, whether resident or non-resident are subject to the same rates of tax on capital gains (this is the only item of income the provisions of which are equally applicable to all kinds of tax payers) from sales of shares of stock (in a domestic corporation) not traded through a local stock exchange. • [Impt!] The same is true with respect to capital gains realized from the sale or disposition of real property (located in Phils.) (lands and/or buildings which are not actually used in the business of the corporation and are treated as capital assets) by a DC, e xce pt that in the case of foreign corporations, resident or non-resident, they are subject to the regular corporate income tax of 30% based on gain (GSP or FMX or FMV whichever is highest – cost). o • If the seller of the land and/or building which is located in the Phils. and classified as Capital Asset is a DC the sale is subject to 6% CGT based on GSP or FMV or FMV whichever is highest. If the seller is a foreign corporation whether resident or non-resident, the sale is subject to 30% corporate income tax based on gain (GSP or FMW or FMW whichever is highest – cost). Roya lt ie s to be subject to 20% final tax, the royalties must be in the nature of passive income. 1. Income derived by the t a x pa ye r (DC) from the distribution of the licensed computer systems to Philippine banks and the performance of support services is income generated in the active pursuit and performace of its primary purpose and the same is not passive income 34 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 subject to the 20% final tax but to 30% corporate income tax subject to 15% creditable withholding tax 2. • [Mem!] Under the 2nd paragraph of Section27, Subsection (D,3), any income is exempt from income tax if derived by non-residents (depositors of foreign currency), whether individual or corporations, from transactions with depository banks (or borrowers) under the expanded system Similarly, royalty payments by franchisees to a com pa n y (franchisor) whose primary purpose is to engage in the busness of acquiring, developing, managing, and utilizing franchises, licenses and other intellectual property are not passive income but are in the nature of active income from the active pursuit of its business. The payments received by a taxpayer (franchisor) from the active conduct of trade or business is considered ordinary business income subject to the regular corporate income tax (30%). I n t e r est I ncom e is taxed at 20% final tax whether or not the bank deposit is of Phil. currency. H ow e ve r, interest income derived by a domestic corporation (depositor of foreign currency) from a depository bank under the Expanded Foreign Currency Deposit System is subject to 7½% final tax, the same rate payable by an resident individual citizen and resident alien the same rate of tax is payable by an RFC (Section 28A, 7a). If the depositor of the foreign currency is NRC or NRA or NRFC the interest income is exempt (Section 27D,3, 2nd paragraph). o A DC is subject to a final tax of 10% on interest earned from deposits and similar arrangements other than interest frm a depository bank under the EFCDS which is subject to 7½% FT. o Interests paid by the BSP on deposit of banks required to be maintained as part of legal reserve are not subject to the final tax of 10% imposed under Section 27(D) Although said reserves ordinarily take the form of deposits with the BSP, they are not considered bank deposits. o [VIP!] Corporations, unlike individuals, are not granted tax exemption for long-term deposits Interest income received or earned on long term deposits by: 1. RC, NRC, RA & NRA engaged - exempt 2. NRA not engaged - 25% FT 3. DC & RFC - 20% FT 4. NRFC - 30% FT • • Provincial, city, municipality and barangay gov’ts are liable for 20% final tax on interest on their bank deposits because the tax exemption privileges, including preferential tax treatment of all gov’t units, were withdrawn by PD No. 1931 and EO No. 93. Under the EFCDS from foreign currency transactions with non-residents, offshore banking units in the Philippines (see Section 27 [D,3,1st paragraph]0, and local commercial banks, including authorized branches of foreign banks and other depository banks under the system (see Section 27 [D,3,1st paragraph]), are now again “exempt from all taxes” interest income from foreign currency loans granted by such depository bank to residents other than OBUs or other depository banks under the EFCDS shall be subject to final tax of 10% instead of 30% • Interest income actually or constructively received by a dom e st ic cor por a t ion or a r eside n t for eign cor por a t ion (depositor) from a foreign currency bank deposit shall be subject to a final tax at the rate of 7.5% based on the gross amt of such interest income. • [Mem!] Intercorporate dividends are not subject to income tax (Section 27 [D,4]), withholding tax, or CGT. o Dividends received by a DC from another DC or received by a DC from an RFC is exempt from income tax; dividend received by a NRFC from a DC is subject to final tax of 15% subject to certain conditions • [VIP!] Ca pit a l ga in s t a x on sa le of la n ds a n d/ or bu ildin gs – the final CGT of 6% is imposed only if the land or building sold is not located in the Phils. and is not treated as Capital Asset; ot h e rw ise (if the land and/or building is an Ordinary asset), the gain is subject to the regular corporate income tax (30%) as ordinary income and the GSP or FMX or FMV whichever is the highest is subject to VAT of 12%. • Filing r e tu r ns an d pa ym en t of ca pit a l ga in s t a x o Within 30 days following each sale of lands and/or building located in the Phils. and are treated as Capital Assets, the Capital Gains Tax Return shall be filed by the seller or the buyer and payment of taxes made to an AAB (Authorized Agent Bank) located within the RDO having jurisdiction over the place where the property being transferred is located based on the GSP or FMV as determined in accordance with Section 6E, whichever is higher. • Pursuant to the “Comprehensive Agrarian Reform Law of 1988”, transactions involving transfer of ownership, whether from natural or juridical persons, are exempt from taxes and all other fees for the conveyance thereof. Furthermore, all arrearages in real property taxes, without penalty and interest, shall be deductible from the compensation to which the owner may be entitled. • Ex e m pt ion of PEZA (Phil. Economic Zone Act) re gist e re d com pa n y – A PEZA registered company is subject to the 5% preferential tax based on gross income earned, and since the said 5% tax is in lieu of all national and local taxes, it is exempt from income tax and consequently, from CWT (Creditable Withholding Tax) pursuant to Section 2.57.5(B). • D om e st ic cor por a t ion s t o w h ich M CI T (Min. Corporate Income Tax) doe s n ot a pply – the MCIT shall apply only to DCs subject to the normal corporate income tax. Accordingly, the minimum corporate income tax shall not be imposed upon any of the following: 35 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 1. Domestic corporations operating as proprietary educational institutions subject to tax at 10% on their taxable income 2. DCs engaged in hospital operations which are non-profit subject to tax at 10% on their taxable income 3. DCs engaged in business as depository banks under the expanded foreign currency deposit system, otherwise known as Foreign Currency Deposit Units (FCDUs), on their income from foreign currency transactions with local commercial banks, including branches of foreign banks, authorized by the BSP to transact business with foreign currency deposit system units and other depository banks under the foreign currency deposit system, including their interest income from foreign currency loans granted to residents of the Philippines under the expanded foreign currency deposit system, subject to final income tax 10% of such income. 4. Prov ided, how ev er, That a resident foreign corporation shall be granted the option to be taxed at fifteen percent (15%) on gross income under the same conditions, as provided in Section 27(A). (2) Minim um Corporat e I ncom e Tax on Resident For eign Corporat ions. - A minimum corporate income tax of two percent (2%) of gross income, as prescribed under Section 27(E) of this Code, shall be imposed, under the same conditions, on a resident foreign, corporation taxable under, paragraph (1) of this Subsection. [ N u m be r s 3 , 4 & 6 b a re Specia l Re siden t For e ign Cor por a t ion s] (3) I n t e rn a t ion al Ca r r ie r (The Resident Foreign Corporation). - An international carrier doing business in the Philippines shall pay a tax (with landing or docking rights within the Phils) of two and one-half percent ( 2 1 / 2 % ) (NOT final tax) on its 'Gross Philippine Billings' as defined hereunder: (a) I n t e rn a t ion al Air Ca r r ie r. - 'Gr oss Ph ilippin e Billin gs' refers to the amount of gross revenue derived from carriage of persons, excess baggage, cargo and mail originating from the Philippines in a continuous (there is no transhipment although there may be stopovers) and uninterrupted flight, irrespective of the place of sale or issue and the place of payment of the ticket or passage document: Provided, That tickets revalidated, exchanged and/or indorsed to another international airline form part of the Gross Philippine Billings if the passenger boards a plane in a port or point in the Philippines: Pr ovide d, fu r t he r , That for a flight which originates from the Philippines, but transshipment of passenger takes place at any port outside the Philippines on a n ot h e r a irline (another international carrier not on another plane of the same international carrier), only the aliquot portion of the cost of the ticket corresponding to the leg flown from the Philippines to the point of transshipment shall form part of Gross Philippine Billings. Firms that are taxed under a special income tax regime such as those in accordance with RA No. 7916 and No. 7227, the PEZA and the Bases Conversion Development Act, respectively. SEC. 28. Rat es of I ncom e Tax on Foreign Corporat ions. (A) Tax on Re siden t For e ign Cor por a t ion s. – (1) I n General. - Except as otherwise provided in this Code, a corporation organized, authorized, or existing under the laws of any foreign country, engaged in trade or business within the Philippines, shall be subject to an income tax equivalent to thirty-five percent (35%) of the taxable income derived in the preceding taxable year from all sources within the Philippines: Provided, That effective January 1, 2009, the rate of income tax shall be thirty percent ( 3 0 % ) . (b) I n t e rn a t ion al Sh ippin g. - 'Gr oss Ph ilippine Billin gs' means gross revenue whether for passenger, cargo or mail originating from the Philippines up to final destination (whether there is transhipment or not), regardless of the place of sale or payments of the passage or freight documents. In the case of corporations adopting the fiscal-year accounting period, the taxable income shall be computed without regard to the specific date when sales, purchases and other transactions occur. Their income and expenses for tbe fiscal year shall be deemed to have been earned and spent equdly for each month of the period. (4) Offshore Banking Unit s. - The provisions of any law to the contrary notwithstanding, interest in com e derived by offshore banking units (resident foreign corporations or lender banks) authorized by the Bangko Sentral ng Pilipinas (BSP), from foreign currency transactions with nonresidents, other offshore banking units in the Phils., local commercial banks, including branches of foreign banks that may be authorized by the Bangko Sentral ng Pilipinas (BSP) to transact business with offshore banking units shall be e xe m pt from all taxes except net income from such transactions as may be specified by the Secretary of Finance, upon recommendation of the Monetary Board which shall be The corporate income tax rate shall be applied on the amount computed by multiplying the number of months covered by the new rate within the fiscal year by the taxable income of the corporation for the period, divided by twelve. 36 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 subject to the regular income tax payable by banks: Pr ovide d, h ow e ve r , That any interest income derived from foreign currency loans granted to residents (such as resident citizen and resident alien), other than offshore banking units or local commercial banks, including local branches of foreign banks that may be authorized by the BSP to transact business with offshore banking units, shall be subject only to a final tax at the rate of ten percent ( 1 0 % ) instead of 30%. (the payor of the interest and royalty is a resident of the Phils.) from sources within the Philippines shall be subject to a fin a l in com e t a x at the rate of twenty percent ( 2 0 % ) of such interest and royalties: Pr ovide d, h ow e ve r, That interest income derived by a resident foreign corporation (depositor of foreign currency) from a depository bank under the expanded foreign currency deposit system shall be subject to a fin al in com e t a x at the rate of seven and one-half percent ( 7 1 / 2 % ) of such interest income. Any income of non-residents (depositors of foreign currency), whether individuals or corporations, from transactions with said offshore banking units (resident foreign corporations/borrowers) shall be exempt from income tax. o (5) [Mem!] Ta x on Br a n ch Pr ofit s Re m it t a n ce s. - any profit remitted by a branch (resident foreign corporation) to its head office shall be subject to a t a x (this tax is an example of a direct double taxation which is valid because there is no constitutional or legal prohibition on direct double taxation) of fifteen percent ( 1 5 % ) (final tax) which shall be based on the total profits applied (with the BSP) or earmarked for remittance without any deduction for the tax component thereof (except those activities which are registered with the Philippine Economic Zone Authority). The tax shall be collected and paid in the same manner as provided in Sections 57 and 58 of this Code: Pr ovide d, That interests, dividends, rents, royalties, including renumeration for technical services, salaries, wages, premiums, annuities, emoluments or other fixed or determinable annual, periodic or casual gains, profits, income and capital gains received by a foreign corporation during each taxable year from all sources within the Philippines shall not be treated as branch profits (if remitted to the home office the same are not subject to 15% BPRT) unless the same are effectively connected with the conduct of its trade or business in the Philippines. Prizes and other winnings from sources within the Philippines derived by RFC, if any are part of gross income taxable at 30%. ( b) I n com e D e rive d u n de r t h e Ex pa n de d For e ign Cu r re ncy D e posit Syst e m . (In Section 28A4 the RFC is an OBU/Lender bank whereas in Sec. 28A7b the RFC is FCDU/Lender Bank. The only difference between the OBU and an FCU is that the former is always a resident foreign corporation while the latter may be a DC or RFC) - Income (Interest income of RFC/lender bank which grants loans of foreign currency) derived by a depository bank under the expanded foreign currency deposit system from foreign currency transactions with nonresidents, offshore banking units in the Philippines, local commercial banks including branches of foreign banks that may be authorized by the Bangko Sentral ng Pilipinas (BSP) to transact business with foreign currency deposit system units and other depository banks under the expanded foreign currency deposit system shall be e x e m pt from all taxes, except net income from such transactions as may be specified by the Secretary of Finance, upon recommendation by the Monetary Board to be subject to the regular income tax payable by banks: Pr ovide d, h ow e ve r, That interest income from foreign currency loans granted by such depository banks under said expanded system to residents other than depository banks under the expanded system shall be subject to a fin a l t a x at the rate of ten percent ( 1 0 % ) (instead of 30%). (as amended by RA No. 9294) (6) Regional or Area Headquart ers and Regional Operat ing Headquart ers of Mult inat ional Com panies. – (a) Re gion a l or a r ea h ea dqu ar t e r s (A branch established in the Phils. by a multinational companies which does not earn or derive income in the Phils. but merely acts as supervisory, communications and coordinating center for their affiliates, subsidiaries or branches in the Asia Pacific Region and other foreign markets) as defined in Section 22(DD) shall not be subject to income tax. (b) Re gion a l ope ra t in g h e a dqu a r te r s as defined in Section 22(EE) shall pay a tax of ten percent ( 1 0 % ) of their taxable income. Any income of non-residents (depositors of foreign currency), whether individuals or corporations, from transactions with depository banks (RFCs/borrowers) under the expanded system shall be exempt from income tax. ( c) [Same as other taxpayers] Capit al Gains from Sale of Shares of St ock Not Traded in t he St ock Ex change. - A final tax at the rates prescribed below is hereby imposed upon the net capital gains realized during the taxable year from the sale, barter, exchange or other disposition of shares of stock in a domestic corporation except shares sold or disposed of through the stock exchange: (7) Tax on Cert ain Passive I ncom es Receiv ed by a Resident Foreign Corporat ion. ( a) I nt erest from Deposit s and Yield or any ot her Monet ary Benefit from Deposit Subst it ut es, Trust Funds and Sim ilar Arrangem ent s and Roy alt ies. – (1)Interest from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements and (2)royalties derived Not over P100,000 ................................... 5% On any amount in excess of P100,000 ....... 10% 37 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o Capital Gain from sale of Real Property located in the Phils. classified as Capital Asset of RFC or NRFC is not provided for by law probably because RFC or NRFC does not own said property, hence, should it have said real property the sale thereof is subject to 30% corporate income tax based on gain and not 6% CGT. corporation, which shall be collected and paid as provided in Section 57(A) of this Code, subject to the condition that the country in which the nonresident foreign corporation is domiciled, shall allow a credit against the tax due from the nonresident foreign corporation taxes deemed to have been paid in the Philippines equivalent to (15%) twenty percent (20%), which represents the difference between the regular income tax of (30%) thirty-five percent (35%) and the fifteen percent (15%) tax on dividends as provided in this subparagraph: Provided, That effective January 1, 2009, the credit against the tax due shall be equivalent to fifteen percent (15%), which represents the difference between the regular income tax of thirty percent (30%) and the fifteen percent (15%) tax on dividends; (d) I nt ercorporat e Div idends. - Dividends received by a resident foreign corporation from a domestic corporation liable to tax under this Code shall not be subject to tax under this Title. (B) Tax on Nonresident Foreign Corporat ion. – (C) Capit al Gains from Sale of Shares of St ock not Traded in t he St ock Ex change. - A final tax at the rates prescribed below is hereby imposed upon the net capital gains realized during the taxable year from the sale, barter, exchange or other disposition of shares of stock in a domestic corporation, except shares sold, or disposed of through the stock exchange: (1) I n General. - Except as otherwise provided in this Code, a foreign corporation not engaged in trade or business in the Philippines shall pay a tax equal to thirty-five percent ( 3 5 % ) of the gross income received during each taxable year from all sources within the Philippines, such as interests, dividends, rents, royalties, salaries, premiums (except reinsurance premiums), annuities, emoluments or other fixed or determinable annual, periodic or casual gains, profits and income, and capital gains, ex ce pt capital gains subject to tax under subparagraph 5(c): Provided, That effective January 1, 2009, the rate of income tax shall be thirty percent (30%). Special NonResident Foreign Corp. Not over P100,000 .................................... 5% On any amount in excess of P100,000............... 10%" Ex a m ple : Same as other taxpayers “Tax-Sparing Scheme” Proctor & Gamble USA organized a DC in the Phils. known as Proctor & Gamble Phils., Inc. (a domestic corporation) is Php 1B while the allowable deductions amt to Php 800M, hence, the taxable income is Php 200M. The corporate income tax of said DC is Php 60M. The amt available for declaration for cash dividend is Php 140M. Said DC declared as cash dividend the entire Php 140M as cash dividend to be remitted to the home office or mother corporation in USA. The said Php 140M to be remitted to the USA is subject to divided tax of 15% or Php 21M, hence, the net amt remitted to the USA is Php 119M. This 15% dividend tax is subject to the condition tjat USA should grant a tax credit of 15% in favour of Proctor & Gamble USA so that the amt of tax that will be collected by the gov’t of USA is (Php 140M x 30% - Php 21M) Php 21M. In other words, the amt of tax to be collected by USA must be the same amt collected by the Phil. Gov’t. This is also true if USA does not impose dividend tax on dividend received by DCs in USA derived from foreign countries. If USA shall impose a dividend tax of 30% the Phils. will also impose dividend tax of 30%. (2) Nonresident Cinem at ographic Film Ow ner, Lessor or Dist ribut or. - A cinematographic film owner, lessor, or distributor shall pay a tax of twenty-five percent ( 2 5 % ) (FT) of its gross income from all sources within the Philippines. (3) Nonresident Ow ner or Lessor of Vessels Chart ered by Philippine Nat ionals. - A nonresident owner or lessor of vessels shall be subject to a tax of four and one-half percent ( 4 1 / 2 % ) (FT) of gross rentals, lease or charter fees from leases or charters to Filipino citizens or corporations, as approved by the Maritime Industry Authority. (4) Nonresident Ow ner or Lessor of Aircraft , Machineries and Ot her Equipm ent . - Rentals, charters and other fees derived by a nonresident lessor of aircraft, machineries and other equipment shall be subject to a tax of seven and one-half percent (7 1/2%) of gross rentals or fees. (5) Tax on Certain Incomes Received by a Nonresident Foreign Corporation. – (A) I nt erest on Foreign Loans. - A final withholding tax at the rate of twenty percent (20%) is hereby imposed on the amount of interest on foreign loans contracted on or after August 1, 1986; • (B) I n t e r cor por a t e D ivide n ds. - A final withholding tax at the rate of fifteen percent ( 1 5 % ) is hereby imposed on the amount of cash and/or property dividends received from a domestic I n com e t a x for m u la for r esiden t for e ign cor por a t ion s 1. Resident foreign corporations are taxed in the same manner as domestic corporations but only with respect to their Philippine source income. 38 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Except Capital Gain on sale of land and/or building located in the Phils. classified as Capital Asset: 1. Domestic Corporation - 6% FT based on GSP or FMV or FMV whichever is highest 2. Resident Foreign Corporation - part of gross income taxable at 30% based on gain or profit or income (GSP or FMX or FMS whichever is highest) • An international air carrier having flights origination from any port or point in the Philippines, irrespective of the place where passage documents are sold or issued, is subject to the Gross Philippine Billings Tax of 2 ½ % imposed under Subsection (A,3,a) u n le ss subject to a different tax rate under the applicable tax treaty to which the Philippines is a signatory. • A domestic corporation (such as PAL) is not subject to the 2½% tax on their gross Philippine billings imposed by Section 28 (A,3), but to the regular corporate income t a x (30%) under Section 27A. o Which airline company is liable? The one which lifts the passengers or the one that issues or sells the tickets? The airline company that lifts the passengers. • Revenue derived from interline transactions whereby an airline lifts passengers whose tickets were issued by other carriers in the Phils. are subject to the 2½% tax on gross Philippine billings. • In case transhipment of passenger takes place outside the Philippines, only the aliquot portion of the cost of the ticket corresponding to the leg flown from the Phils. to the point of transhipment shall form part of the gross Phil. billings although the flight originated from the Phils. • Con t in u ous a n d un in te r r u pte d fligh t – it shall refer to a flight in the carrier of the same airline company from the moment a passenger, excess baggage, cargo and/or mail is lifted from the Philippines up to the point of final destination of the passenger, excess baggage, cargo and/or mail. The flight is not considered continuous and uninterrupted if transhipment of passenger, excess baggage, cargo and/or mail takes place at any port outside the Philippines on another aircraft belonging to a different airline company. • Offsh or e ban k in g syst e m shall refer to the conduct of banking transactions in foreign currencies involving the receipt of funds principally from external and internal sources and the utilization of such fund • Offsh or e ba n kin g un it shall mean a branch (RFC) subsidiary or affiliate of a foreign banking corporation which is duly authorized by the BSP to transact offshore banking business in the Phils. • [VIP!] Br a n ch pr ofit s re m it t a n ce t a x – the remittance tax was conceived in an attempt to equalize the income tax burden on foreign corporations maintaining, on the one hand, local branch offices and organizing, on the other hand, subsidiary domestic corporations where at least a majority of all the latter’s shares are owned by such foreign corporations. • • For e ign cu r r en cy de posit u n it shall refer to that unit of a local bank (DC) or of a local branch of a foreign bank (RFC) authorized by the BSP to engage in foreign currency-denominated transactions o The 15% profit remittance tax is in addition to the r e gu la r t a x (of 30%) imposed under Subsection A of Section 28 o Under Subsection (A,5), it is now provided that the 15% remittance tax “shall be based on the total profits applied or earmarked for remittance without any deduction for the tax component thereof.” o Non-resident foreign corporations are not subject to branch profit remittance tax Tax on regional or area headquarters and regional operating headquarters of m u lt in a t ion al com pa nie s – the first, r e gional or a r e a he a dqua r t e r s ( RH Qs) are exempt from tax, re gion al ope r a t ing he a dqu a r t e rs ( ROH Qs) are subject to income tax of 10% of their taxable income o M u lt in a t ion al com pa n y – foreign company or group of foreign companies with business establishment in 2 or more countries o Re gion a l or a r ea he a dqua r t e r s – shall mean an office whose purpose is to act as an administrative branch of a multinational company engaged in international trade which principally serve as a supervision, communications and coordination center for its subsidiaries, branches or affiliates in the Asia Pacific Region and other foreign markets and which does not earn or derive income in the Philippines o RAHQs which do not earn or derive income from the Philippines and which act as supervisory, communications and coordinating centers for their affiliates, subsidiaries or branches in the Asia Pacific Region and other foreign markets are not subject to income tax 39 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 a. o • ROHQs are subject to a tax rate of 10% of their taxable income, provided that any income derived from Philippine sources when remitted to the parent company is subject to the 15% branch profits remittance tax under Section 28 (A,5) of the Tax Code 2. Interest from Philippine Currency bank deposits and royalties (are subject to 20% FT), income derived under the expanded foreign currency deposit system from foreign currency transactions is subjected to 7½% and net capital gains from sale of shares of stock not traded in stock exchange are taxed in the same manner and at the same rates (1st 100,000 – 5% FT; excess – 10%) as in the case of a DC SEC. 2 9 . I m posit ion of I m pr ope r ly Accu m u la t ed Ea r n in gs Tax . – [ Th e pu r pose of t h is t a x , w hich is r ea lly a pen a lt y t a x , is t o for ce t he cor por a t ion t o de cla r e divide n ds an d for t he gov’t t o colle ct divide n d t a ] Intercorporate dividends received from a DC are also exempt from income tax 1) Interest & Royalties a) DC & RFC – 20% FT b) NRFC – 30% FT 2) Dividends a) DC & RFC – exempt b) NRFC – 15% FT subject to certain conditions • I n com e t a x for m u la for n on - re side n t for eign cor por a t ion s o Generally, non-resident foreign corporations are taxed at the same rate as domestic and resident foreign corporations e xce pt that the tax is based on the gross income from Philippine sources • [VVIP!] Tax on dividends received by a non-resident foreign corporation from a DC – the tax on intercorporate dividends is reduced by 20%, from (former) 35% to 1 5 % FT subject to the condition mentioned o the 15% tax on dividends is applicable where the recipient nonresident foreign corporation is exempt from tax on dividends in its home country • • DCs are taxed on sources of income from within and outside the Phils b. Foreign corporations, whether resident or non-resident, are taxed only on income from sources within the Phils As t o k in d of incom e su bj e ct t o t a x a. Domestic and resident foreign corporations are taxed on their net income inasmuch as they are allowed deductions b. NRFCs are taxed on their gross income. They are not allowed deductions. (A) I n General. - In addition to other t a x e s (such as income tax) imposed by this Title, there is hereby imposed for each taxable year (until the corporation declares dividend) on the improperly accumulated taxable income of each cor por a t ion (ordinary/business/taxable partnership is not included because the partnership therein are liable to pay dividend tax even if the net income after tax of said partnership is not distributed to the partners under the doctrine of constructive receipt of of income which doctrine does not apply to a true corporation or corporation organized under BP68 or corporation created by law such as GOCCs. In a true corporation the stockholders are not liable to pay dividend unless the BOD of said corporation declares and distributes dividend) described in Subsection B hereof, an improperly accumulated earnings tax equal to ten percent ( 1 0 % ) of the improperly accumulated taxable income. (B) Tax on Corporat ions Subj ect t o I m properly Accum ulat ed Earnings Tax. (1) I n General. - The improperly accumulated earnings tax imposed in the preceding Sub-Section shall apply to every corporation formed or availed (holding corporation or investment corporation) for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation, by permitting earnings and profits to accumulate instead of being divided or distributed. [Impt!] Pr e fe r en t ia l 1 5 % t a x on Tax-Sparing Scheme – conditions necessary for availment of the preferential 15% tax: 1. To show the actual amount credited by foreign gov’t against the income tax due from the NRFC on the dividend received 2. To present the income tax return of its mother company for the year when the dividends were received 3. To submit any authenticated document showing that the Foreign gov’t credited 1 5 % of the tax deemed paid in the Phils. on the foreign gov’t did not impose any dividend tax at all. (2) Ex cept ions. - The improperly accumulated earnings tax as provided for under this Section shall not apply to: a) b) c) Publicly-held corporations; or widely-held corporations Banks and other nonbank financial intermediaries; and Insurance companies. (C) Ev idence of Purpose t o Av oid I ncom e Tax . (1) Prim a Facie Evidence. - the fact that any corporation is a mere holding company or investment company shall be prima facie evidence of a purpose to avoid the tax upon its shareholders or members. D ist in ction s as to the taxability of domestic and foreign corporations 1 . As t o sou r ce s of in com e 40 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o (2) Evidence Determ inat ive of Purpose. - The fact that the earnings or profits of a corporation are permitted to accumulate beyond the reasonable needs of the business shall be determinative of the purpose to avoid the tax upon its shareholders or members unless the corporation, by the clear preponderance of evidence, shall prove to the contrary. [ ( B) & ( C) – t h e re a son th e y a r e n ot su bj ect t o im pr ope r ly a ccu m u la t e d e a r nin gs t a x is t o e n cou ra ge th e m t o a ccu m u la te t h eir e a r nin gs or incom e in or de r t o in cre a se t h e ir re ser ve s, w h ich is r e qu ire d by la w .] • For e ign Cor por a t ion s – they are not included among those exempted. The tax is applicable to any foreign corporation, whether resident or nonresident, with respect to any income derived from sources within the Philippines. • [VIP!] Close ly- h e ld/ Pu blicly- h eld (or widely-held corporations) Cor por a t ion s – close ly- he ld cor por a t ion s are those corporations at least 50% in value of the outstanding capital stock or at least 50% of the total combined voting power of all classes of stock entitled to vote is owned directly or indirectly by or for not more than 2 0 in dividua ls. Domestic corporations not falling under this definition are, therefore, publicly-held corporations. • H oldin g a n d in ve st m en t com pa nie s 1. A corporation having practically no activities except holding property, and collecting income therefrom or investing therein, h oldin g com pa n y 2. If the activities further include, or consist substantially of, buying and selling stocks, securities, real estate, or other investment property so that the income is derived not only from the investment yield but also from profits upon market fluctuations, the corporation shall be considered an in ve st m en t com pa n y (D) I m pr ope r ly Accu m u la t e d Ta x a ble I n com e . - For purposes of this Section, the term 'improperly accumulated taxable income' means taxable income increased adjusted by: (1) Income exempt from tax; such as Intercorporate dividend (2) Income excluded from gross income; such as Life Insurance proceeds (3) Income subject to final tax; and such as interest o currency bank deposits (4) The amount of net operating loss carry-over deducted; And reduced by the sum of: (1) Dividends actually or constructively paid; and (2) Income tax paid for the taxable year. Provided, however, That for corporations using the calendar year basis, the accumulated earnings under tax shall not apply on improperly accumulated income as of December 31, 1997. In the case of corporations adopting the fiscal year accounting period, the improperly accumulated income not subject to this tax, shall be reckoned, as of the end of the month comprising the twelve (12)-month period of fiscal year 1997-1998. (E) Reasonable Needs of the Business. - For purposes of this Section, the term 'reasonable needs of the business' includes the reasonably anticipated needs of the business. • [VIP!] The tax shall not apply to the 3 kinds of corporations (1Publicly-held corporations, 2Banks, 3Insurance Companies) enumerated in Section 29(B-2) a n d also to the following: taxable partnerships, GPPs; non-taxable joint ventures; and enterprise duly registered with the PEZA and enterprises registered pursuat to the Bases Conversion and Development Act, as well as other enterprises duly registered under special economic zones declared by law which enjoy payment of special tax rate on their registered operations or activities in lieu of other taxes, national or local. [VIP!] SEC. 3 0 . Exem pt ions from Tax on Corporat ions. - The following organizations shall not be taxed under this Title in respect to income received by them as such: [ * An e xa m ple of EX EM PTI ON PROV I SI ON ( str ict ly a ga in st pe r son claim in g e x e m pt ion ; in fa vou r of gov’t ) ] Cor por a t ion s su bj ect / n ot su bje ct t o t h e t ax – The 10% improperly accumulated earnings tax is imposed on every corporation, not specifically excepted, which is formed or availed for the purpose of avoiding the imposition of the individual income tax (on dividends) upon its stockholders or the stockholders of any other corporation by permitting earnings or profits to accumulate, instead of dividing or distributing them. Under Rev. Regs. No. 2-2001, the tax is imposed on improperly accumulated taxable income starting January 1, 1998 by DCs which are classified as closely-held corporations (or close corporations or family corporations where the number of stockholders does not exceed 20). (A) Labor, agricultural or horticultural organization not organized principally for profit; (B) Mutual savings bank not having a capital stock represented by shares, an d cooperative bank without capital stock organized and operated for mutual purposes and non- without profit; 41 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o Under Section 8 of RA 8791 all banks in the Phils. must be stock corporations Ex a m ple : Corp. A is a religious corporation and it has Phil. currency deposit on Bank X amounting to Php 10M under savings account at an annual interest rate of 10%. The annual interest income is (Php 10Mx 10%) Php 1M. This interest income is subject to final tax of 20% or Php 200,000.00, regardless of the disposition made of the net interest income of Php 800,000.00 which means that even if the Php 800,000.00 is actually, directly and exclusively used for religious purposes (C) A beneficiary society, order or association, operating fort he exclusive benefit of the members such as a fraternal organization operating under the lodge system, or mutual aid association or a nonstock corporation organized by employees providing for the payment of life, sickness, accident, or other benefits exclusively to the members of such society, order, or association, or nonstock corporation or their dependents; (D) Cemetery company owned and operated exclusively for the benefit of its members; (E) Nonstock corporation or association organized and operated exclusively for religious, charitable, scientific, athletic, or cultural purposes, or for the rehabilitation of veterans, no part of its net income or asset shall belong to or inures to the benefit of any member, organizer, officer or any specific person; • (F) Business league chamber of commerce, or board of trade, not organized for profit and no part of the net income of which inures to the benefit of any private stock-holder, or individual; (G) Civic league or organization not organized for profit but operated exclusively for the promotion of social welfare; (H) A nonstock and nonprofit educational institution; (I) Government educational institution; NOT included under the old law (J) Farmers' or other mutual typhoon or fire insurance company, mutual ditch or irrigation company, mutual or cooperative telephone company, or like organization of a purely local character, the income of which consists solely of assessments, dues, and fees collected from members for the sole purpose of meeting its expenses; and Ex e m pt ion fr om t a x a t ion is the grant of immunity to particular persons or corporations or to corporations or persons of a particular class from a tax which persons and corporations generally within the same state or taxing district are obliged to pay o A tax exemption represents a loss of revenue to the State. For this reason, tax exemptions are not favoured. They must be clearly expressed and cannot be established by implications. Life-Blood Doctrine o Exemptions are held strictly against the taxpayer and if not expressly mentioned in the law, must at least be within its purview by clear legislative intent. The burden of proof rests upon the party claiming exemption to prove that it is in fact covered by the exemption being claimed o [VVIP!] Neither (Liberal construction is applied) does the rule of strict construction apply where the exemption is in favour of (1) government or any of its political subdivisions or instrumentalities; (2)religious; (3)charitable and (4)educational in st it u tion s These 4 are known as Traditional Exemptees the provisions of which are liberally construed in their favour. o There is no vested right in a tax exemption – especially when the latest expression of legislative intent renders its continuance doubtful. Being a mere statutory privilege, a tax exemption may be modified or withdrawn at will by the granting authority. To state otherwise is to limit the taxing power of the State which is unlimited, plenary comprehensive and supreme. (K) Farmers', fruit growers', or like association organized and operated as a sales agent for the purpose of marketing the products of its members and turning back to them the proceeds of sales, less the necessary selling expenses on the basis of the quantity of produce finished by them; [Mem!] Notwithstanding the provisions in the preceding paragraphs, the income of whatever kind and character of the foregoing organizations (1)from any of their properties, real or personal, or (2)from any of their activities conducted for profit regardless of the disposition made of such income, shall be subject to tax (30% corporate income tax) imposed under this Code. [ Th is 2 n d pa r a gr a ph doe s n ot a pply t o Su bse ct ions H & I ] The same facts above except that Corporation A is a charitable institution, is the Php 1M interest income subject to final tax of 20% ANS: YES, regardless of the disposition made of the net interest income of Php 800,000.00 which means that even if said amount is used actually, directly and exclusively for charitable purposes 42 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) If an exemption law or provision is subsequently repealed, those previously enjoying the exemption will now be taxable and they cannot assert that their right having been vested is violated. lOMoARcPSD|12553117 2. • Exemption of corporations or associations from tax o The tax exemption of a non-stock corporation under Section 30 covers only income tax for which it is directly liable. The exemption of corporations or associations from tax does not extend to the shareholders or members. An exemption from taxation is a personal privilege o The income derived by a charitable organization from any of its charitable operations is exempt from income tax but the re n t a ls (because they are not income of the charitable organization as such and this is true even if said rentals are ADE used for charitable purposes) derived from the leasing of its building are subject to income tax o Con dom in iu m du es (they do not pertain or belong to the CC) received from the unit owners, which are merely held in trust and which are used by the Condominium Corporation (CC) solely for administrative expenses, utilities, and maintenance of the common areas for the benefit of the unit owners and from which the CC could not realize any gain or profit are not subject to income and consequently to withholding tax o • • All of them are taxable except dividends received from a DC Under the constitution, “no law granting any tax exemption shall be passed without the concurrence of a majority of a ll (not merely majority of those present with quorum) the members of the Congress.” or personal, are income from the fees received for attending burials, In this case of an an educational fair However, if such exempt income is invested by the corporation, the income from such investment, as interest from the capital where the capital has been loaned or dividen ds (exempt) on stock where the capital has been invested in shares of stock will constitute taxable income. Donations and other similar contributions received by such corporation from other persons are exempt (Section 32, B-3) 3. This is inconsistent with the the 2nd par. Of Section 30; in Short, This Ruling is WRONG, As usual. Any cemetery corporation cha r t e r e d (or incorporated exclusively for the benefit of its members) solely for burial purposes and not permitted by its charter to engage in any business not necessarily incident to that purpose, is exempt from income tax, provided that no part of its net earnings inures to the benefit of any private shareholder or individual. A cemetery company having a capital stock represented by shares or which is operated for profit or for the benefit of persons other than its members, does not come within the exempted class. (Section 30) [VVIP!] The gain to be realized by a non-stock and non-profit religious corporation from the sale of real property is exempt from income tax and consequently, from the expanded withholding tax, where the proceeds of such sale would be used exclusively in the purchase of another property in the pursuance of the religious purpose (but the law says “regardless of the disposition made of such income”) for which the corporation was organized – the purchase of a property with a building thereon for the use of its member or for the redevelopment and general improvement of its remaining property, as such proceeds are not income from the productive use of the property (the law does not use these words). A taxpayer’s isolated sale of property, with the proceeds used for the furtherance of the purposes for which it was organized is a single transaction of incidental character and does not constitute engaging in business. (Last sentence) this statement is CORRECT but it does not mean that the income is exempt because No. 1 of the 2nd paragraph of Section 30 does not require that the income must be derived from business • [VVIP!] A religious, charitable, scientific, athletic or cultural corporation or corporation for the rehabilitation of veterans is exempt from tax in its income (ot h e r t ha n income of whatever kind and character from its properties, real or personal) if such corporation meets two tests: (a) it must be non-stock and organized and operated for one or more of the specified purposes; and (b) no part of its net income or asset shall belong to or inure to the benefit of any member, etc. 1. Income not derived from their properties, real exempt. In the case of a religious corporation, conduct of strictly religious activities, such as administering baptismal, solemnizing marriages, holding masses, and other like income, is exempt. educational corporation, income from the holding of or exhibit is exempt The income of such corporation which is considered as income from their properties, real or personal, generally consists of income from corporate dividends, rentals received from their properties, interests received from capital loaned to other persons, income from agricultural lands owned by such corporations, profits from the sale of property, real or personal, and other similar income Educational corporations 1. Paragraph 3, Section 4, Article XIV of the Constitution categorically exempts from taxes and duties all revenues and assets of non-stock, non-profit educational institutions, which are actually, directly and exclusively used for educational purposes. The exemption is limited to a non-stock, non-profit educational institution only. 2. As a non-stock, non-profit government educational institution, U.P. falls squarely within the purview of the above constitutional provision; hence, it is eligible to avail of the tax exemption granted thereat with respect to its revenues derived in pursuance of its educational purpose and when such revenues are actually, directly and exclusively used therefor. Conversely, the revenue or income from trade, business or other activity, the conduct of which is not related to the exercise or performance by such educational institutions of their educational 43 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 purposes or functions shall be subject to internal revenue taxes when the same (revenue or income from trade, business or other activity) is (when the revenue or income from trade, business or other activity [not for educational purposes] is used ADE for educational purposes the revenue or income is exempt from income tax) not actually, directly or exclusively used for the intended purpose. 3. • • The tax exemption created in Article VI, Section 28, paragraph 3 of the Constitution covers property taxes only (Real Property Tax) • [VIP!] N on - st ock , N on - pr ofit e du ca t ion a l in stit u t ion s – to be granted the exemption under Article XIV, Section 4, paragraph 3 of the Constitution, an entity must prove with substantial evidence that: (1) it falls under the classification of non-stock, non-profit educational institution (the Capital of the Corporation or institution is not in the form of shares and stock and the income or profit of such institution does not inure to the benefit of any member of such institution) a n d (2) the income it seeks to be exempted from taxation is used actually, directly and exclusively for educational purposes. The last paragraph is a “catch-all provision” applicable to all income tax exempt organizations, etc. Thus, even corporations granted exemptions from tax pursuant to Section 30 can still be subject to income tax under this provision except Paragraphs H & I. o • The law does not make any distinction. The rental income is taxable regardless of w h e n ce (from where or from what source) such income is derived and how it is used or disposed of. The tax exemption granted to a non-stock, nonprofit educational institution under Section 30(H) covers only income taxes for which it is directly liable. Such exemption does nor cover indirect taxes such as VAT (such as VAT on the NSNPEI’s local purchases of school equipment and supplies but if the NSNPEI imports school equipment and supplies it is exempt from VAT on importation because it is a direct tax to the importer) which may be passed on to buyers of goods or services. o • income derived by them as such”, the exemption does not apply to income derived “from any of their properties, real or personal, or from any of their activities conducted for profit regardless of the disposition made of such income except Paragraphs H & I. Interest income earned by a r e ligiou s cor por a t ion on its bank deposits is subject to income tax of 20% or 7½% regardless of the disposition made of such income. The bank deposits of taxexempt corporations enumerated in Section 30 are, in effect, personal property of said corporations. Chapter 5 – COMPUTATION OF TAXABLE INCOME SEC. 3 1 . Ta x a ble I n com e Defined. - The term taxable income means the pertinent items of gross income (Section 32) specified in this Code, less the deductions (Section 34) and/or personal and additional exemptions (Section 35), if any, authorized for such types of income by this Code or other special laws. It has been ruled, however, that the excess of the selling price over the original cost of the land and the church building sold by the non-stock, non-profit r e ligiou s cor por a t ion is exempt from the ordinary corporate income tax, where the net proceeds from the sale would be used exclusively for the purchase of a new church site and the construction thereon of a church building (THIS IS NOT CORRECT! Because the law says “regardless of the disposition made of such income”). Secretary of Justice (he has NO authority to interpret the provisions of the NIRC because it is the CIR who has the exclusive and original jurisdiction to interpret the provisions of the NIRC subject to review by the Secretary of Finance [Section 4]) In the case of the income of whatever kinds and character of the foregoing organizations from any of its properties, real or personal, which apparently is the basis of the above ruling subjecting the gains in question to income tax, the opinion of the Secretary of Justice states that the same refers only to the income realized “from the pr odu ct ive u se (THIS IS NOT CORRECT! Because these words are not mentioned in the provision, even the courts are prohibited from putting words unto the mouth of the legislature because it will result to judicial legislation which is a violation of the Principle of Separation of Powers) of their real and personal properties” e.g. rents, dividends or interests. • Taxable income may be classified into passive income (subject to final tax), compensation income, and non-compensation or business income • [Mem!] I n com e means all wealth which flows into the taxpayer ot h e r t h a n a s a m e r e re t u rn of ca pit a l (even mere return of capital may constitute taxable income such as sale of real property located in the Phils. and classified as Capital Asset o [INCREASE IN VALUE OF REAL PROEPRTY] The difference between the assessed value of a property and the actual cost of such property does not constitute taxable income un less there has been a sale or exchange of such property in which case, the gain, if any, constitutes taxable income. Chapter 6 – COMPUTATION OF GROSS INCOME [VIP!] SEC. 3 2 . Gross I ncom e. (A) General Definit ion. - Ex ce pt (Subsection B) as when otherwise provided in this Title, gr oss incom e means all income derived from whatever (legal or illegal) source, including ( bu t n ot lim it e d t o) (there are items of gross [VIP!] While the income received by the organizations enumerated in Section 30 is, as a rule, exempted from the payment of tax “in respect to 44 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 income which are not included in Section 32A such as informer’s reward and damges awarded for loss of expected profit) the following items: of premiums on property insurance is taxable if the premium paid was previously deducted from gross income under the tax benefit rule or “economic benefit principle”), endowment, or annuity contracts, either during the term or at the maturity of the term mentioned in the contract or upon surrender of the contract. (1) Compensation for services in whatever form paid, including, but not limited to fees, salaries, wages, commissions, and similar items (such as bonuses); (3) Gift s, Be qu e st s, a n d D e vise s. _ The value of property acquired by gift (or donation), bequest (or legacy), devise, or de sce n t (legitime or intestate share or simply inheritance): Provided, however, That income from such property, as well as gift, bequest, devise or descent of income from any property, in cases of transfers of divided interest, shall be included in gross income. (2) Gross income derived from the conduct of trade or business or the exercise of a profession; (3) Gains derived from dealings in property; (4) Interests; (4) Com pe n sa t ion for I n j u rie s or Sick ne ss. - amounts received, through Accident or Health Insurance or under Workmen's Compensation Acts, as compensation for personal injuries or sickness, plu s the amounts of any damages received (damages awarded for lost salaries and loss of expected profit are taxable), whether by suit or agreement, on account of such injuries or sickness. (5) Rents; (6) Royalties; (7) Dividends; (8) Annuities; (5) I n com e Ex e m pt u n de r Tr e a t y. - Income of any kind, to the extent required by any treaty obligation binding upon the Government of the Philippines. (9) Prizes and winnings; [VIP!] [BAR!] (6) Re t ir e m e n t Be n efit s, Pe nsions, Gr a t u it ies, etc.(a) Retirement benefits received under Re pu blic Act N o. 7 6 4 1 (Labor Code) and those received by officials and employees of private firms, whether individual or corporate, 1 in accordance with a reasonable pr iva t e be n efit plan (or pension plan) maintained by the employer: Provided, That the 2 retiring official or employee has been in the service of the same employer for a t lea st t e n ( 1 0 ) ye a r s and is 3 not less than fifty (50) years of age at the time of his retirement: Provided, further, That the benefits granted under this subparagraph shall be 4 availed of by an official or employee only once. For purposes of this Subsection, the term 'r ea son a ble pr iva t e be n efit pla n ' means a pension, gratuity, stock bonus or profit-sharing plan maintained by an employer for the benefit of some or all of his officials or employees, wherein con t r ibu t ion s (or capital or principal or corpus or pension fund or pension trust) are made by such employer for the officials or employees, or both, for the purpose of distributing to such officials and employees the e ar n in gs (or interest) and pr in cipal of the fun d thus accumulated, and wherein its is provided in said plan that at no time shall any part of the cor pu s or income of the fund be used for, or be diverted to, any purpose other than for the exclusive benefit of the said officials and employees. (10) Pensions; and (11) Partner's distributive share from the net income of the general professional partnership. o Is the partner’s distributive share in the net income of an ordinary or business or taxable partnership included in Section 32A? ANS: YES, under dividends or #7. [BAR!] [MEM!] (B) Ex clu sions fr om Gr oss I n com e . - The following items shall not be included in gross income and shall be exempt from taxation under this title: (1) Life I n su ra n ce . - The proceeds of life insurance policies paid to the heirs or beneficiaries upon the death of the insured, whether in a single sum or otherwise, but if such amounts are held by the insurer under an agreement to pay interest thereon, the in te r e st (not subject to 20% FT but PGI) payments shall be included in gross income. (2) Amount Received by Insured as Re t u r n of Pr e m iu m (such as CSLVI or Cash Surrender Value of Life Insurance). - The amount received by the insured, as a return of premiums paid by him under life in su r an ce (return 45 Separation Pay on account of resignation is taxable (b) Any amount received by an official or employee or by his heirs from the employer as a consequence of separation of such official or employee from the service of the employer because of death sickness Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 or other physical disability or for any cause beyond the control (such as retrenchment or closure of business of the employer) of the said official or employee. (d) Prizes and Awards in sports Competition. - All prizes and awards granted to athletes in local and international sports competitions and tournaments whether held in the Philippines or abroad and sanctioned by their national sports associations. (c) The provisions of any existing law to the contrary notwithstanding, social security benefits, retirement gratuities, pensions and other similar benefits received by resident or nonresident citizens of the Philippines or aliens who come to reside permanently in the Philippines from foreign government agencies and other institutions, private or public. o (d) Payments of benefits due or to become due to any person residing in the Philippines under the laws of the United States administered by the United States Veterans Administration. Amounts received by professional athletes such as PBA players, Professional Boxers and Billiard Players from professional tournaments are taxable as income from profession. But prizes received by them in international competitions such as Olympics, Asian Games and South East Asian Games are exempt. (e) 1 3 t h M on t h Pa y a n d Ot h e r Be ne fit s. - Gross benefits received by officials and employees of public and private entities: Pr ovide d, however, That the total exclusion under this subparagraph shall not exceed Thirty thousand pesos ( P3 0 ,0 0 0 ) (there is a pending bill increasing this amount to Php 78,000.00) which shall cover: (e) Benefits (such as monthly pension) received from or enjoyed under the Social Security System in accordance with the provisions of Republic Act No. 8282. (i) Benefits received by officials and employees of the national and local government pursuant to Republic Act No. 6686; (f) Benefits received from the GSIS under Republic Act No. 8291, including retirement gratuity received by government officials and employees. (ii) Benefits received by employees pursuant to Presidential Decree No. 851, as amended by Memorandum Order No. 28, dated August 13, 1986; (7) M isce lla ne ou s I te m s. - (iii) Benefits received by officials and employees not covered by Presidential decree No. 851, as amended by Memorandum Order No. 28, dated August 13, 1986; and (a) I n com e D e r ive d by Foreign Government. - Income derived from investments in the Philippines in loans, stocks, bonds or other domestic securities, or from interest on deposits in banks in the Philippines by (i) 1 foreign governments, (ii) 2 financing institutions owned, controlled, or enjoying refinancing from foreign governments, and (iii) 3 international or regional financial institutions (such as ADB [Asian Development Bank], IMF [International Monetary Fund] and World Bank) established by foreign governments. (iv) Other benefits such as productivity incentives and Christmas bonus: Provided, further, That the ceiling of Thirty thousand pesos (P30,000) may be increased through rules and regulations issued by the Secretary of Finance, upon recommendation of the Commissioner, after considering among others, the effect on the same of the inflation rate at the end of the taxable year. (b) Income Derived by the Government or its Political Subdivisions. Income derived from any public utility or from the exercise of any essential governmental function accruing to the Government of the Philippines or to any political subdivision thereof. (f) GSIS, SSS, Medicare and Other Contributions. - GSIS, SSS, Medicare and Pag-ibig contributions, and union dues of individuals. (c) Prizes and Awards. - Pr iz e s (such as Nobel Peace Prize) and awards made primarily in recognition of religious, charitable, scientific, educational, artistic, literary, or civic achievement but only if: o (i) The recipient was selected without any action on his part to enter the contest or proceeding; and There items are deducted from monthly salary to determine Gross Compensation Income, hence, the taxable compensation income is reduced. (g) Gains from the Sale of Bonds, Debentures or other Certificate of Indebtedness. - Ga in s realized from the same or exchange or retirement of bonds, debentures or other certificate of indebtedness with a maturity of more than five (5) years. (ii) The recipient is not required to render substantial future services as a condition to receiving the prize or award. 46 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 property (except if covered by CARL [Comprehensive Agrarian Reform Law]) and from gambling is taxable. Ex a m ple : A is a resident citizen, purchased a Php 10M face-value bond from Corp X on January 2, 2008 with maturity period of 10 years, hence, the bond will mature on January 2, 2018. Corp X is required to pay A an annual interest of 8%. The annual interest of (Php10M x 8%) Php 800,000.00 is part of the gross income of A taxable under Section 24A. Assuming that A sold the bond to B on January 2, 2014 at a price of Php 10,500,000.00 the gain of Php 500,000.00 realized by A is NOT taxable. o The law’s definition of gross income is rather broad so the courts have established the re a liz a t ion pr in ciple that for income to be recognized for tax purposes, it must be realized or earned. Therefore, mere increase in the value of property would not be taxed as income until the property is sold in excess of its original cost (except if the property sold is Real Property located in the Philippines classified as Capital Asset). o Econ om ic Be n e fit Con ce pt income may include the receipt of any item that confers economic benefit regardless of whether any cash or property was directly received (e.g. fair rental value of house offered free by the employer; fair market value of property received in exchange of services rendered). o Re cove r y of Ca pit al D oct r ine the proceeds from the sale or other disposition of property are reduced by the basis or adjusted basis of the property to determine gross income. Thus, income is not taxed until the capital or cost invested is recovered. (h) Gains from Redemption of Shares in Mutual Fund. - Ga in s realized by the investor upon redemption of shares of stock in a mutual fund company as defined in Section 22 (BB) of this Code • Interest upon the obligations of the Government of the Republic of the Philippines or any political subdivisions thereof, interest income received by bond holders from government bonds was formerly excluded from gross income but is now taxable as follows: 1. 2. 3. 4. 5. RC, NRC & RA NRA engaged NRA not engaged DC & RFC NRFC - • PGI taxable at 5% - 32% 20% FT 25% FT PGI taxable at 30% 30% FT Com pe n sa t ion I ncom e is income arising out of Er-Ee relationship. Compensation income includes all remuneration for service performed by an employee for his employer whether paid in cash or in kind. o Thus, wages, salaries, emoluments and honoraria, bonuses, allowances (such as transportation, representation, entertainment and the like), fringe benefits (monetary and non-monetary fees, including director’s fees, whether or not an Er-Ee relationship exists), taxable pensions and retirement pay, and other income of a similar nature constitute compensation income. o Examples of ot her incom e of a sim ilar nat ure are: proceeds from profit-sharing (given to officers or employees of a corporation or partnership as part of their compensation), allowances for costsof-living, housing, children, medical, grocery, etc., overtime pay, accumulated sick and vacation leaves, terminal leave pay, commissions, 13th month pay, emergency pay, hazard pay, bonus, rice, and clothing allowances, commissions on sales or on insurance premiums, etc., and other benefits paid to an employee, in cash or in kind. The name by which the compensation is designated is immaterial. All of such income must be included in the computation of the gross compensation income. o [Impt!] The prem ium paym ent s made by a corporation on a life insurance policy covering the life of a key officer, the beneficiary being the immediate family of the keyman, constitutes additional salary or compensation to the key officer under Section 32(A), #1 taxable under Section 24(A). NOTE: if the above government bonds qualify as deposit substitutes the interest income in Nos. 1 & 4 is subject to 20% FT. I n for m e r ’s r e w a r d is now subject to 10% FT under Section 282. I n t e r est incom e s (taxable at 7½% FT or exempt) under the expanded foreign currency deposit system (EFCDS) are consequently no longer excluded from gross income. • [Impt!] Gr oss in com e consists of all the gains, profits, and income of a taxpayer during a taxable year of whatever kind and in whatever form derived from any source, whether legal or illegal, e xce pt items of gross income subject to final tax and income exempt from taxation (exclusions [Section 32b]) under the law. The definition of gross income in Subsection (A) is broad enough to include all passive income subject to specific tax rates or final taxes. However, since there passive incomes are already subject to different rates and taxed finally at source (the tax was already deducted by the payer or the source of income), they are no longer included in the computation of gross income to determine taxable income. The phrase “all income derived” from whatever source covers all other forms of income not falling under any of the items of income enumerated in Subsection (B). Thus, income derived from expropriation of one’s 47 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o o Every form of compensation for personal services is taxable, regardless of how it is earned, by whom it is paid, the label by which it is designated, the basis upon which it is determined, or the form by which it is received. Accordingly, “ lov e gift s” receiv ed by past ors from their pastoral ministry are considered compensation income subject to income tax. o o • o M e diu m of pa ym e n t o director and the corporation has an employer-employee relationship (i.e. President of a corporation sitting as a member of the Board of Directors) If services are paid for in a medium other than money, the fair market value of the thing taken in payment is the amount to be included as compensation subject to withholding. [BAR!] [Mem!] If a person receives as remuneration for services rendered a salary and in addition thereto, free living quarters and/or meals, the value to such person of the quarters and/or meals so furnished shall be added to the remuneration otherwise paid for the purpose of determining the amount of compensation subject to withholding. If, however, free living quarters and/or meals are furnished to an employee for the convenience of the employer (such as when the purpose why the employee or officer is furnished free living quarters and/or meals is in order for him to be on call 24/7), the value thereof need not be included as compensation subject to withholding. • H ow e ve r , if these fees are paid t a director who is not an employee of the corporation paying such fee (i.e. whose duties are confined to the attendance of and participation in the meetings of the board of directors), such fees are not treated as compensation income because of the absence of employeremployee relationship, but rather, the same should squarely fall under Section 32(A)(2) under the caption “Gross income derived from the conduct of trade or business or exercise of a profession”. I m pr ove m e n t s m a de by le sse e on le a se d prem ise s o A building constructed or improvements made by the lessee on the leased premises are t a x a ble (to the lessor) only if the same are made pursuant to an agreement with the lessor and the same are not subject to removal by the lessee. The lessor has an option to 1report as income, at the time when such buildings or improvements are completed, the fair market value (normally the cost of building/improvement) of the same, or to 2spread over the life of the lease the estimated depreciated value of such buildings or improvements at the termination of the lease and to report as income for the year of the lease an aliquot part thereof. Ex a m ple : A leased to B his industrial lot for 20 years at Php 2,000,000.00 rental per annum. A & B agreed that the latter will construct a factory building on the said lot and after the expiration of the lease the factory building will be owned by A. The cost of the factory building is Php 50,000,000.00 ad the estimate use life of said building is 50 years. Tips or gr a t u itie s – if paid directly to an employee by a customer of an employer, and not accounted (or not reported and remitted) by the employee to the employer, they are taxable as compensation income but are not subject to withholding. A has the option either to report as income the Php 50,000,000.00 in the year of completion of the said building or to spread over the life of the lease the estimated depreciated value of the building at the termination of the lease which is [Php 50,000,000 – (Php 50,000,000 ÷ 50 years x 20 years)] Php 30,000,000.00, estimated depreciated value, which he will report as income within the period of 20 years at (Php 30,000,000 ÷ 20 years) Php 1,500,000.00. Tr a n spor t a t ion an d ot he r e x pen se s – amounts received by an employee, either as advances or reimbursement for transportation, representation and other bona fide ordinary and necessary expenses incurred or reasonably expected to be incurred by the employee in the performance of his duties in the business of the employer are not compensation. H ow e ve r , if the reimbursement exceeds the actual expenses, the excess if not returned to the employer constitutes taxable income. • V a ca tion a nd sick le a ve a llow a nces – they constitute compensation income. Thus, the salary of an employee on vacation, or on sick leave, paid notwithstanding his absence from work, constitutes compensation. Ta x t r e a t m en t of dire ct or ’s fe e s – director’s fees are subject to tax on wages. The said tax treatment applies whenever it is established that the All interest income is subject to tax including interest on government securities e xce pt where the recipient of such interest is exempt (such as NSNPEI, GSIS, SSS, PHIC and PCSO; there are interest incomes which are exempt if received by particular tax payers such as interest from depository banks under the EFCDS received by non-residents; interests received by foreign governments; interests on CTD of Philippines currency received by RC, NRC, RA and NRA engaged; And interest received by Employees’ trust fund) 48 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • [VIP!] Ta x a ble incom e fr om bu sin ess or pr ofession The taxable income (amount multiplies by the tax rate to arrive at the tax due) may refer to: 1. 2. 3. 4. • The only items that can be deducted from Gross Compensation Income are: 1. Premium Payments 2. Personal Exemptions 3. Additional Exemptions, if any Net income arrived at after subtracting the allowable deductions of the individual taxpayer, including personal exemption or both personal and additional exemptions, as in the case of: a. A resident citizen as to income from all sources b. A non-resident citizen and resident alien as to income from sources within • Ex clu sion s refer to items of income received or earned but are not taxable as income because exempt by law or by treaty due to social, economic, equity, and other considerations. Such tax-free income is not to be included in the tax return. The exclusion of income should not be confused with the reduction of gross income by the application of allowable deductions. While exclusions are simply not taken into account in determining gross income, deductions are subtracted from gross income to arrive at taxable income. Net income within the Philippines arrived at after subtracting the allowable deductions of the individual taxpayer, including personal exemption, as in the case of a non-resident alien (is not allowed additional exemptions by law) engaged in trade or business in the Philippines when he is allowed, under certain conditions (his country grants personal exemption to Filipinos not residing but engaged in trade or business in said country and the amount of personal exemption is that provided in Section 35 (Php 50,000) or the amount granted in said country, whichever is lower), personal exemption; or o • Net income arrived at after subtracting the allowable deductions of the taxpayer, w it h ou t personal and additional exemptions, as in the case of: a. A non-resident alien engaged in trade or business in the Philippines (when he is not allowed personal exemption [because his country does not grant personal exemption to Filipinos not residing but engaged in business in said country]) as to income from within the Philippines b. A domestic corporation as to income from all sources c. A resident foreign corporation as to income from within the Philippines; or Gross income without deductions, as in the case of: a. Non-resident alien not engaged in trade or business in the Philippines as to income received within the Philippines b. A non-resident foreign corporation as to income received within the Philippines [Impt!] Compensation for personal injuries or sickness is compensatory as it adds nothing to the individual, hence, not taxable. But compensation for damages is taxable if it represents payment for loss of expected profits and/or lost salaries. [VVIP!] Pr iva t e r e t ir e m e n t t r ust pla n (or reasonable private benefit plan) 1. There are 3 parties in an employees’ trust which has qualified as a reasonable private retirement trust plan under Subsection (B, 6, a), namely: the 1trustor-employer, 2the trustee of the fund and the 3 beneficiary or employee-members. 2. The t r u st fu n d (or pension fund or pension trust) while the trustee is exempt from income tax on income from investment of said fund, e x ce pt , of course on interest income and continues to be so exempt when paid or distributed to the employee-members upon retirement. Conversely, if such earnings are paid or distributed to the employeemembers withdrawing their personal contributions to the fund befor e their retirement date or age, the same are taxable to them (the earnings and contributions of the Er are taxable but the contributions of the Ee are not taxable being mere return of capital) in the year in which so paid or distributed, such distribution having been effected before their retirement from the employer-company **De Leon opines that when the trust fund is used by the trustee to purchase shares of stock or bonds in corporations the dividend income or the interest income received by the trustee from said corporations is exempt from income tax which is CORRECT. BUT if the trust fund is deposited by the trustee in a bank that interest income is subject to income tax which is WRONG (See Page 649, Annotation #2 in relation to Section 60,B). Ta x a ble in com e fr om e m ploym e n t – in the case of a citizen (resident or non-resident although ordinarily only resident citizens have compensation income in the Philippines) or resident alien with compensation income only within the Philippines, the taxable income is the gross compensation income less the personal and additional exemptions. No other deductions are allowed e x ce pt premium payments on health and/or hospitalization insurance. 49 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 trust fund from its investments is exempt from income tax e xce pt , however, the interest income from bank deposits of the trust fund which is subject to the 20% final tax (THIS IS WRONG AGAIN!!!) Ex a m ple : In 1988, when A was 20 years old he was employed by Corporation X and in 2013 when A was 45 years old he retired. His personal contributions to the pension fund during the period of 25 years amount to Php 300,000.00 and Corporation X’s counterpart is also Php 300,000.00. The interest income for 25 years on the Php 600,000.00 amounts to Php 900,000.00. Upon retirement A received from the trustee Php 1,500,000.00. The personal contributions of A of Php 300,000 are not taxable being mere return of capital while the remaining Php 1,200,000.00 is taxable because it was received by A before his retirement age, hence, this will not qualify as retirement benefit. 3. 4. 5. It has been ruled, however, that since the final tax and the withholding thereof are embraced within the title on “Income Tax,” it follows that such trust must be deemed exempt thereon; otherwise, the exemption becomes meaningless. Accordingly, the interest income from currency bank deposits is exempt from income tax. 7. Employees’ contributions together with the earnings thereof can be returned to the employees if for any reason (such as resignation of the Ee or closure of business of the Er) their retirement plan is terminated. Any and all amounts which represent a re t u r n of pe r son al con t r ibu t ions are not subject to income tax but the earnings are subject to income tax and are taxable to the employee-recipient to the extent of the entire amount thereof in the year in which paid or distributed at the rates prescribed by Section 24(A) The retirement benefits to be received by private sector employees under Section 32(B)(6)(a) are exempt from income tax provided their employers maintain a qualified retirement benefit plan duly approved by the BIR. • One of the under Subsection (B,6,a), as implemented by Rev. Regs. No. 1-68, as amended, in order to avail of the exemption with respect to retirement benefits is that the retiring official or employee shall not have previously availed of the privilege under a retirement benefit plan of “the same or another employer,” which means that the retiring official or employee must not have previously received retirement benefits from the same or another employer who has a qualified retirement plan under said subsection. Benefits received from the GSIS are not from “the same or another employer.” (BIR Ruling No. 125-98, September 4, 1998) 8. In a retirement plan under RA No. 4917, the employer, or officials and employees or both, contribute to a atrust fund for the purpose of distributing to such officials and employees or their beneficiaries, the corpus and income accumulated by the trust in accordance with the plan. • The total benefits which the employees shall receive consisting of their personal contributions, counterpart contributions of the employer and the income of the Fund to which the employees are entitled, shall be exempt from income tax if they are distributed only upon retirement 6. The portion of the retirement fund determined to be in excess of actuarially determined amount to cover the benefits of all the employees may be r e ve r te d (or returned) to the participating/contributing companies without terminating the fund. However, said companies should declare as income the said excess amount and pay the corresponding income tax thereon as prescribed under Section 27 (A). Although this is mere return of capital it is taxable because contributions to pension fund by the employer are allowable deduction, hence, if returned they are taxable under the “Tax Benefit Rule” or “Economic Benefit Rule” The sale of a parcel of land by the in ve st m e n t m a n a ge r (trustee of the pension fund) of a qualified reasonable retirement benefit plan established for the exclusive benefit of all the employees of a bank and the cor pu s (or contributions or capital or principal) or income of the fund is not used for or diverted to purposes other than for exclusive benefit of the members and their beneficiaries is exempt from CGT. Pr ie st s ca nn ot be r e gar de d as e m ployee s – to qualify as a “reasonable private benefit plan” under Section 32(B)(6)(a) of the Tax Code, the retirement plan must be maintained by an employer for the benefit of employees. Thus, any retirement benefits received by officials and employees in accordance with a reasonable private benefit plan maintained by the employer shall be excluded from gross income, and shall be exempt from income tax and withholding tax. In general, the relationship of the employer and employee exists (1) when there is compensation; (2) when the person for whom services are performed has the right to control and direct the individual who performs the services, not only on the result to be accomplished by the work but also on the details and means by which the result is accomplished; and (3) when the person for whom services are performed has the right to dismiss the individual performing the service. Subsection (B, 6, a) of Section 32 of the Tax Code makes no mention of exemption from income tax of the earnings or income of the retirement plan trust fund (or employees’ trust fund or employees’ pension fund or employees’ pension trust). Exemption from income tax of the earnings derived from investments of the employees’ retirement fund is governed by Section 60 (B) which specifically exempts employee’s trust from income tax. Under said section, income of the Pr ie st s (their income is income from the practice of profession) cannot be regarded employees since two essential requirements are absent. There 50 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 are (a) control over the payment of compensation a n d (b) right to dismiss the priests. The fact that the corporation sole actually directs or controls the manner in which the services should be performed will not alter the fact that the priests are not employees of the corporation sole. • employer pays benefits to the official or employee or his heirs as a consequence of such separation. Se pa r a t ion fr om t h e ser vice – the phrase “for any cause beyond the control of said official or employee” connotes involuntariness on the part of the official or employee. The separation from the service must not be asked for or initiated by him. It must not be of his own making or choice. Thus, the separation benefits of an employee whose service with a company was terminated “on the ground of insubordination” are subject to income tax. o o • [Impt!] Un u se d sick an d vaca t ion le a ve cr e dit s – separation benefits received by an official or employee, regardless of age or length of service, separated from service due to death, sickness, or other physical disability or for causes beyond his or her control, shall be exempt from taxes. H ow e ve r , the payment of employees’ 13th month pay and other benefits in excess of the Php 30,000.00 threshold, plus their salaries are subject to income tax. On the other hand, the commutation and payment of unused sick leave and vacation leave credits are not subject to income tax. • Te r m in a l le a ve pa y (is in the nature of retirement benefit, hence, is exempt from income tax) received by a government official or employee is not subject to tax. The rationale behind the exemption has been explained as follows: The laying-off of officials or employees as a result of a reorganization, redundancy, or change in ownership falls within the purview of said phrase. The separation gratuity as well as loyalty cash gifts granted by a corporation to its laid off officials and employees as a result of its reorganization or change in ownership are exempt from income tax. “… commutation of leave credits more commonly known as terminal leave, is applied for by an officer or employee who retires, resigns, or is separated from the service through no fault of his own. In the exercise of sound personnel policy, the Government encourages unused leaves to be accumulated. The government recognizes that for most public servants, retirement pay is always less than generous if not meager and scrimpy. Terminal leave payments are given not only at the same time but also for the same policy considerations governing retirement benefits” Pr e viou s r ulin gs hold that the money value of terminal leave credits granted to said officials and employees are subject to income tax. The tax exemption does not include the commutation or employer’s payment for salary and cash equivalent of accumulated vacation and sick leaves, if any. Likewise, amounts granted to officials and employees who voluntarily resigned from the service before the reorganization are subject to income tax. Su bse que n t ru lin gs hold that separation and/or retirement benefits received by employees for health reasons as well as cash equivalent of accumulated vacation and sick leave credits are exempt from income tax. o o They represent the cash value of an employee’s accumulated leave. In fine, not being part of the gross salary or income of a government official or employee for services rendered but a retirement benefit given to an officer or employee who had already severed his connection with the government, terminal leave pay is not subject to income tax. Ba ck w a ge s (not considered Separation Pay) of Php 1,760,000.00 plus 10% as attorney’s fees awarded to an employee of ColgatePalmolive Phils. for illegal dismissal are considered as compensation for services rendered and, as such, they form part of gross income pursuant to Subsection (A,1). Therefore, the backwages for a period not to exceed 3 years as mandated by the Labor Arbiter and affirmed by the NLRC and the Supreme Court, reckoned from the date of dismissal are subject to income tax. On the other hand, under Subsection (B,6,b), any amount received as a consequence of separation due to any cause beyond the control of the official or employee if exempt from taxes regardless of age or length of service. • GSI S a n d Pa g- ibig con t r ibu t ion s – they are excluded from gross income of the taxpayer and, thus, exempt from income tax. o Subsection (B,6,b) requires the presence of 2 conditions in order that the employee benefits may be granted tax exemption. (a) the employee is separated from the service of the employer due to death, sickness or other physical disability or for any cause beyond the control of the said official or employee; and (b) GSIS, SSS, Medicare and Pag-ibig contributions, and union dues of individual employees are exempted from the requirement of withholding tax on compensation; hence, the basic salary to be subjected to withholding tax on compensation should be net of the said deductions. • Cash dividend received by a financial institution owned or controlled by a foreign government from investments in Philippine corporations are exempt from final withholding tax on dividends. • Pr ize s a n d a w a rds in spor t s com pe t it ion – the national sports association shall refer only to those sports associations duly accredited by the Philippines Olympic Committee (POC). Hence, if the sports association 51 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 which organized and sanctioned a sports event is not duly accredited by the POC, the exemption granted by the subsection does not apply. • • Ex a m ple : Benefits received by officials and employees: o Ch r ist m a s bonu s, e t c. – under Subsection (B,7,e), there is no more limits as long as the total exclusion (benefits) shall not exceed Php 30,000.00 which ceiling may be increased by the Secretary of Finance upon recommendation of the Commissioner of Internal Revenue. o 1 3 t h m on t h pa y – if the taxpayer gets a Christmas bonus of Php 12,000.00 and 13th month pay of Php 25,000.00 or a total of Php 37,000.00, the excess Php 7,000.00 is subject to withholding tax. o [VVIP!] Ga in s (NOT taxable) from sale, etc. of bonds, debentures or other certificates of indebtedness with maturity of more than 5 years. o In connection with the controversial issuance by the government of the so-called “PEACE Bonds”, the BIR made the following ruling: “At the time of issuance or origination of the PEACE bonds, there is no borrowing from the public, since the bonds are being issued only to one entity, that is, RCBC. It has been the practice of the BSP to issue debt instruments and certificates only to banks and/or financial institutions. The required issuance to more than 20 individual or corporate lenders in order that the transaction be considered a borrowing from the ‘public’ is not present in the instant case. At any one time covers only the origination or original issuance of the bonds regardless or whether sale or trading is made in the secondary market. Thus, in the case of PEACE Bonds, the determining factor in ascertaining whether such bonds are ‘deposit substitutes’ is the fact of their original issuance to a single entity, RCBC. Under these circumstances, it is clear that the bonds are issued to a single entity, whether such entity be RCBC, CODE-NGO or RCC Capital. In this regard, a representation or warranty should be made to the effect that the bonds are acquired upon their original issuance by the original purchaser thereof, for and on its own behalf, or on behalf of a single purchaser only, and in the latter case, that the purchaser is acquiring such bonds for its own account and not for the account of other entities On Jan. 2, 2004 A purchased a Php 10M face value bond from Corp. X with a maturity period of 10 years. The bond provides that Corp. X will pay the bond holder 8% interest per annum. On Jan. 2, 2010 A sold the bond to B for Php 9.5M. On Jan. 2, 2014 the bond was surrendered by B to Copr. X for retirement and Corp. X paid B the face value of the bond of Php 10M. B realized a gain from retirement of bond in the amount of Php 500,000.00 which is exempt from income tax. BIR Ruling exempts the income or earning from such long-term instruments from paying the 2 0 % fin a l (this alone is WRONG because this is NOT an interest from Philippine Currency Bank Deposit but interest from Long Term Bond except if the Long Term Instrument or Bond qualifiers as deposit substitute) tax on interest income. “Since the law speaks of the exclusion from gross income of all gains derived from lone-term investments, it follows that embraced thereunder are income, yield, or interest, which are all synonymous with gains.” The exemption is given by law, according to the BIR, “as an incentive to encourage cash savings in such securities and to develop the capital market for these investments.” The Department of Finance nullified this ruling holding that the exemption refers only to gains arising from the sale, exchange or retirement of bonds, debentures and other certificates of indebtedness but not to interest income which has always been subject to tax. The Court of Tax Appeals has held that only the gain from the sale, as distinguished from interest, of bonds, debentures or other certificates of indebtedness with maturity of more than 5 years shall be exempt from income tax; hence, interest income earned from investments in long term fixed rate government treasury notes are subject to 20% withholding tax. o Ga in – the term, however, does not include “interest” which is subject to income (either 20% FT or PGI) tax. The idea is still to treat bonds, etc. as “deposit substitutes” but exclude the interest income (this could have been the idea or intent of the lawmaker which was unfortunately not expressed in words and the law as well as the latest jurisprudence does not exclude interest income from income tax) from gross income if they have maturities of more than 5 years. In this particular case, the term ‘gain’ in Section 32(B)(7)(g) refers to the gain, if any, from secondary trading (sale by the original bond holder to a third person), which is the difference between the selling price of the bonds in the secondary market and the price at which such bonds were purchased by the seller. The term ‘gain’ likewise includes the gain (that is, the difference between the proceeds from the retirement of the bonds and the price at which such last holder acquired the bonds) realized by the last holder of the bonds when such bonds are surrendered for retirement upon their maturity. Since the law exempts interest on long term deposits and similar investments from the final withholding tax, there seems to be no reason why interest income on long-term securities should be subject to tax if the intent of the law were to support capital 52 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 market development. The exemption of interest income on longterm securities would level the playing field between the deposit market and the securities or bond market. A legislative definition or clarification of “gains” in Section 32(B,7,g) is needed. • • Note: EO 93 (Dec. 17, 1986) withdraws, subject to certain exceptions, the duty and tax incentives previously granted to government and private entities. SEC. 3 3 . Special Treat m ent of Fringe Benefit .- [Impt!] Any gain derived from the redemption of u n it s (shares of stock) of a mutual fund company from gross income for income tax purposes and is exempt from CGT pursuant to Section 32(B)(7)(h). Under said section, gains realized by the investor upon redemption of shares of stock in a mutual fund company are excluded from gross income for income tax purposes. “ M u tu a l Fu n d Com pa n y” – an open-end and close-end investment company as defined under the Investment Company Act (ICA). (A) I m posit ion of Tax . - A fin a l t a x of thirty-four percent (34%) effective January 1, 1998; thirty-three percent (33%) effective January 1, 1999; and thirty-two percent ( 3 2 % ) effective January 1, 2000 and thereafter, is hereby imposed on the grossed-up monetary value of fringe benefit furnished or granted to the e m ploye e (managerial or supervisor) (except rank and file employees as defined herein) by the employer, whether an individual or a corporation (u n le ss (not taxable) 1the fringe benefit is required by the nature of, or necessary to the trade, business or profession of the employer, or 2when the fringe benefit is for the convenience or advantage of the employer). The tax herein imposed is payable by the employer which tax shall be paid in the same manner as provided for under Section 57 (A) of this Code. The grossed-up monetary value of the fringe benefit shall be determined by dividing the actual monetary value of the fringe benefit by sixty-six percent (66%) effective January 1, 1998; sixtyseven percent (67%) effective January 1, 1999; and sixty-eight percent ( 6 8 % ) effective January 1, 2000 and thereafter: Prov ided, how ev er, That fringe benefit furnished to employees and taxable under Subsections (B), (C), (D) and (E) of Section 25 shall be taxed at the applicable rates imposed thereat: Prov ided, furt her, That the grossed -Up value of the fringe benefit shall be determined by dividing the actual monetary value of the fringe benefit by the difference between one hundred percent (100%) and the applicable rates of income tax under Subsections (B), (C), (D), and (E) of Section 25. [VIP!] The term “gain,” as used in Section 32(B)(7)(g) does not include interest. Gains from sale or exchange or retirement of bonds, debentures, or other certificates of indebtedness fall within the general category of “gains derived from dealings in property” under Section 32(A)(3), while interest from bonds, debentures or other certificates of indebtedness falls within the category of “interests” under Section 32(A)(4). Said gains and interests are separate and distinct from each other. Only gains realized from the sale or exchange or retirement of bonds, debentures or other certificates of indebtedness with a maturity of more than 5 years are excluded from gross income. The fact that Congress used the term “gains from sale” in the said section, knowing fully well the reference to interest under Sections 24, 25, 26, 27, and 28, shows that it did not intend to exempt such interest. • Other examples of exclusions from income tax under special laws: o Income of the Export Development Corporation of the Philippines (PD 1074), Technology Resource Center (PD 1097) and Philippine Institute for Development Studies (PD 1201) o Income derived by domestic corporations and partnerships and landowners from the instalment sales of houses to their employees and workers as well as to low income groups in housing projects, or income derived from rentals thereof (PDs 745 and 217) o Prizes received by winners in charity horse race sweepstakes from the PCSO (RA 1169) and lotto winnings (Sec. 24 [B,1], 25 [A,2]) o Income from bonds and securities for sale in the international market (PD 81) o Bonds and other instruments of indebtedness which the Export Processing Zone Authority (EPZA) is authorized to issue (PD 66) o See PD 66, 85, 87, 175, 218, 246, 265, 485, 535, 564, 667 and 764 (B) Fringe Benefit defined. - For purposes of this Section, the term 'fr in ge be n efit ' means any good merchandise, service or other benefit (such as property rights and privileges) furnished or granted in cash or in kind by an employer to an individual employee (except rank and file employees as defined herein) such as, but not limited to, the following: (1) Housing; (2) Expense account; (reimbursable expenses or refundable expenses for local travel) (3) Vehicle of any kind; (4) Household personnel, such as maid, driver and others; (5) Interest on loan at less than market rate to the extent of the difference between the market rate and actual rate granted charged; (6) Membership fees, dues and other expenses borne by the employer for the employee in social and athletic clubs or other similar organizations; (7) Expenses for foreign travel; (8) Holiday and vacation expenses; (9) Educational assistance to the employee or his dependents; and (10) Life or health insurance and other non-life insurance premiums or similar amounts in excess of what the law allows. 53 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (C) Fr in ge Be ne fit s N ot Ta x a ble. - The following fringe benefits are not taxable under this Section: medical and dental services; or the so-called courtesy discount on purchases) furnished or offered by an employer to his employees, provided such facilities or privileges are of relatively small value and are offered or furnished by the employer merely as a means of promoting the health, goodwill, contentment, or efficiency of his employees. (1) Fringe benefits which are authorized and exempted from tax under special laws; (2) Contributions of the employer for the benefit of the employee to retirement, insurance and hospitalization benefit plans; • Ba sis – it is imposed on the grossed-up monetary value (GMV) of the fringe benefit furnished or granted to a managerial or supervisory employee. • [Impt!] The GMV of the fringe benefit granted or furnished the employee on which the final tax is paid is now deductible on the part of the employer falling under the (ordinary and necessary business) expense category, pursuant to Section 34(A,1,a,i). (3) Benefits given to the rank and file employees, whether granted under a collective bargaining agreement or not; and (4) D e m in im is (relatively small) benefits as defined in the rules and regulations to be promulgated by the Secretary of Finance, upon recommendation of the Commissioner. [De minimis non curiae lex – the law does not care for or take notice of very small or trifling or trivial or insignificant matter.] The FBT is actually due from the employee (because he is the income recipient) but paid by the employer for and on behalf of the employee. The tax is additional cost to the employer. When the employer pays the FBT on behalf of the employee, the tax becomes an additional benefit of the employee subject thereto. Thus, the need to gross up the monetary value of the fringe benefit received in computing the FBT due thereon. The Secretary of Finance is hereby authorized to promulgate, upon recommendation of the Commissioner, such rules and regulations as are necessary to carry out efficiently and fairly the provisions of this Section, taking into account the peculiar nature and special need of the trade, business or profession of the employer. • The employer may be an individual, professional partnership, or a corporation, regardless of whether the corporation is taxable or not, or the government and its instrumentalities. Taxability of fringe benefits o o The FBT is imposed by Subsection (A) on the grossed-up monetary value of fringe benefit given to employees, e xce pt rank and file employees. If the fringe benefit given is necessary to the trade, business or profession of the employer, or for the convenience or advantage of the employer, then it is not subject to the FBT, • It has been administratively ruled that meal coupons worth Php 330.00 a month given by a bank need not be concluded as compensation subject to withholding since they are given for the convenience of the employer. Likewise, the subsidized cost of 1 sack of rice a month need not be included as compensation subject to withholding. The GMV of the fringe benefit is determined by dividing the monetary value of the fringe benefit by 68%. However, uniforms of employees at an average of Php 2,000.00 for females and Php 1,000.00 for males once every 2 years; a n d the medical cash allowance for dependents of Php 1,500.00 per annum are considered compensation income subject to withholding. N ot e : they may be considered now of relatively small value with the increase in wages and rise in prices of basic commodities. o Subsection (C) says that fringe benefits given to the rank and file employees “are not taxable under this Section.” This means that they are taxable (this could not have been the legislative intent because this clearly violates the constitutional provision that taxation must be equitable) as compensation income of the employees subject to withholding from the employee’s salary and to the graduated tax rates under Section 24(A). On the other hand, since the tax on fringe benefit granted to managerial and supervisory employees is paid by the employer, they get the fringe benefit in full. This difference in treatment may be viewed as anti-poor. • D e M inim is Ben e fit which is exempt from the FBT shall, in general, be limited to facilities or privileges (such as entertainment, Christmas party and other cases similar thereto, Ex pe n se a ccou n t – the following shall be treated as taxable fringe benefits: o Personal expenses incurred by an employee but are paid by his employer; o Personal expenses paid for by an employee but reimbursed by an employer; 54 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 The expenses in letters (a) and (b) shall be treated as fringe benefits e x ce pt when the expenditures are duly receipted for and in the name of the employer and the expenditures do not partake of the nature of a personal expense attributable to the employee. • • rendered under an employer-employee relationship where no deductions shall be allowed under this Section other than under Su bse ct ion ( M ) (premiums payments on health and/or hospitalization insurance) hereof, in computing taxable income subject to income tax under Sections 2 4 ( A) (RC, NRC and RA); 2 5 ( A) (NRA engaged); 2 6 (GPP); 2 7 ( A) (DC), ( B) (proprietary educational institution and nonprofit hospital) and ( C) (GOCC); and 2 8 ( A) ( 1 ) (RFC), there shall be allowed the following deductions from gross income: D e M inim is Be ne fit s – these benefits which are exempt from the fringe benefit tax and compensation income tax and are, therefore, not subject to withholding tax as well, shall, in general, be limited to facilities or privileges furnished or offered by an employer to his employees that are of relatively small value and are offered or furnished by the employer merely as a means of promoting the health, contentment or efficiency of his employees o The following shall be considered as de minimis benefits not subject to income tax as well as withholding tax on compensation income to both managerial and rank and file employees Monetized unused vacation leave credits of private employees not exceeding 10 days during the year Monetized value of vacation and sick leave credits paid to government officials and employees Medical cash allowance to dependents of employees not exceeding Php 750.00 per semester or Php 125.00 per month Rice subsidy of Php 1,500.00 or 1 sack of 50 kg. rice per month amounting to not more than Php 1,500.00 Uniform and clothing allowance not exceeding Php 4,000.00 per annum. Actual medical assistance Laundry allowance not exceeding Php 300.00 per month Employee achievement awards Gifts given during Christmas and major anniversary celebrations not exceeding Php 3,000.00 per employee per annum Daily meal allowance for overtime work and right/graveyard shift not exceeding 25% of the basic minimum wage on a per region basis (A) Ex pe n se s. – (1) Ordinary and Necessary Trade, Business or Professional Ex penses. (a) I n General. - There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or in cu r r ed (or accrued expenses not yet paid at the end of the tax period, EXAMPLE: A is leasing a commercial building at an annual rent of Php 240,000.00. Per agreement with the lessor the Php 240,000.00 shall be payable semi-annually every July 2 and January 2 of the following year. Hence, the Php 240,000.00 rent in 2014 shall be payable on July 2, 2014 in the amount of Php 120,000.00 and on January 2, 2015 in the amount of Php 120,000.00. The Php 120,000.00 paid on July 2, 2014 is an expense paid while the Php 120,000.00 payable on January 2, 2015 is an expense incurred or accrued as of December 31, 2014. The allowable deduction is Php 240,000.00) during the taxable year in carrying on or which are directly attributable to, the development, management, operation and/or conduct of the trade, business or exercise of a profession, in clu din g: (i) The amount of t a x a ble fr in ge ben efit (or GMV) and the frin ge be ne fit s t a x (the FBT is not an allowable deduction because it is already included in or is a component of the taxable fringe benefit or grossed-up monetary value, hence, if the TFB or GMV and FBT are allowed deductions there will be duplication of allowable deduction) shall constitute allowable deductions from gross income of the employer. A reasonable allowance for salaries, wages, and other forms of compensation (such as allowances, bonuses, honoraria, etc.) for personal services actually rendered, including the grossed- up monetary value of fringe benefit furnished or granted by the employer to the employee: Pr ovide d, That the final tax on the fringe benefit imposed under Section 33 hereof has been paid; (ii) A reasonable allowance for travel expenses, here and abroad, while away from home in the pursuit of trade, business or profession; [NRA not engaged and Non-Resident Foreign Corporation are not included because they are taxable at gross income] (iii) A reasonable allowance for rentals and/or other payments which are required as a condition for the continued use or possession, for purposes of the trade, business or profession, of property to which the taxpayer has not taken or is not taking title or in which he has no equity other than that of a lessee, user or possessor; SEC. 3 4 . Deduct ions from Gross I ncom e. - Ex ce pt (if the only income of the individual taxpayer is from compensation the only allowable deduction is Subsection M) for taxpayers earning compensation income arising from personal services (iv) A reasonable allowance for entertainment, amusement and recreation expenses during the taxable year, that are directly connected to the development, Chapter 7 – ALLOWABLE DEDUCTIONS 55 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 management and operation of the trade, business or profession of the taxpayer, or that are directly related to or in furtherance of the conduct of his or its trade, business or exercise of a profession not to exceed such ceilings as the Secretary of Finance may, by rules and regulations prescribe, upon recommendation of the Commissioner, taking into account the needs as well as the special circumstances, nature and character of the industry, trade, business, or profession of the taxpayer: Pr ovide d, That any expense incurred for entertainment, amusement or recreation that is contrary to law, morals, public policy or public order shall in no case be allowed as a deduction. (B) I n t e r est . – (1) I n General. - The amount of interest paid or incurred within a taxable year on indebtedness in connection with the taxpayer's profession, trade or business shall be allowed as deduction from gross income: Provided, however, That the taxpayer's otherwise allowable deduction for interest expense shall be reduced by fortytwo percent (42%) of the interest income subjected to final tax: Provided, That effective January 1, 2009, the percentage shall be thirty-three percent (33%). (2) [Mem!] Ex ce pt ions. - No deduction shall be allowed in respect of interest under the succeeding subparagraphs: (b) Subst ant iat ion Requirem ent s. - No deduction from gross income shall be allowed under Subsection (A) hereof unless the taxpayer shall substantiate with sufficient evidence, such as official receipts or other adequate records: (i) the amount of the expense being deducted, and (ii) the direct connection or relation of the expense being deducted to the development, management, operation and/or conduct of the trade, business or profession of the taxpayer. (a) If within the taxable year an individual taxpayer reporting income on the cash basis incurs an indebtedness on which an interest is paid in advance through discount or otherwise: Pr ovide d, That such interest shall be allowed a deduction in the year the indebtedness is paid: Prov ided, furt her, That if the indebtedness is payable in periodic amortizations, the amount of interest which corresponds to the amount of the principal amortized or paid during the year shall be allowed as deduction in such taxable year; (c) Bribes, Kickbacks and Ot her Sim ilar Pay m ent s. - No deduction from gross income shall be allowed under Subsection (A) hereof for any payment made, directly or indirectly, to an official or employee of the national government, or to an official or employee of any local government unit, or to an official or employee of a government-owned or-controlled corporation, or to an official or employee or representative of a foreign government, or to a private corporation, general professional partnership, or a similar entity, if the payment constitutes a bribe or k ick ba ck (rebate). [Cash-Basis of Accounting means that income is recognized or recorded when cash is received while expenses are recognized or recorded when paid. Hence, cash basis accounting does not record accrued income or accrued expenses] (b) [BAR!] If both the taxpayer (debtor) and the person (creditor) to whom the payment has been made or is to be made are persons specified under Section 36 (B) (such as members of a family [brothers & sisters, spouses, ancestors and descendants] and between individual and corporation more than 50% of the outstanding capital stock of the latter is owned by the former); or (2) Expenses Allow able t o Privat e Propriet ary Educat ional I nst it ut ions. In addition to the expenses allowable as deductions under this Chapter, a private proprietary educational institution; referred to under Section 27(B) of this Code, may at its option elect either: (a) to deduct expenditures otherwise considered as capital outlays of depreciable assets (such as construction cost of school building and acquisition cost of school equipment) incurred during the taxable year for the expansion of school facilities, or (b) to deduct allowance for depreciation thereof under Subsection (F) hereof. Ex a m ple : Ex a m ple : University X, a Proprietary Educational Institution constructed a school building at a cost of Php 50M which was completed on December 31, 2013. The estimated life of the building is 50 years without scrap value. The university can either deduct the said Php 50M from its gross income in 2013 or depreciate the building at Php 1M per annum beginning 2014 up to 2063. 56 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) A borrowed from B Php 1M on July 1, 2013 at an interest of 10% per annum or Php 100,000.00. The loan is payable on June 30, 2014 but the interest of Php 100,000.00 was deducted in advance by the lender/creditor. The interest expense from July 1, 2013 to December 31, 2013 in the amount of Php 50,000.00 is not an allowable deduction in 2013 if A is using Cash Basis of Accounting. The interest expense of Php 100,000.00 is deductible in 2014 when the indebtedness is paid. If A is using the Accrual Method of Accounting he will report interest expense of Php 50,000.00 in 2013 and Php 50,000.00 in 2014. lOMoARcPSD|12553117 (c) If the indebtedness exploration. is incurred to finance petroleum (c) Estate and donor's taxes; and (d) Ta x e s (special levy or special assessment under LGC of 1991) assessed against local benefits of a kind tending to increase the value of the property assessed. (3) Optional Treatment of Interest Expense. - At the option of the taxpayer, interest incurred to acquire property used in trade business or exercise of a profession may be allowed as a deduction or treated as a capital expenditure (the interest paid is added to the cost of the property acquired and said property together with the interest is depreciated over the life of said property). Pr ovide d, That taxes allowed under this Subsection, when refunded or credited, shall be included as part of gross income in the year of receipt to the extent of the income tax benefit of said deduction. [The interest expense paid by the taxpayer-debtor to the creditor is not an allowable deduction but the interest income received by the creditor/lender is taxable as PGI under Section 24A if he is RC, NRC or RA] [ Example – “to the extent of the income benefit…” Taxes paid by Corp. A, a DC, in 2013 amounted to Php 1M, which amount was deducted from the gross income of Corp. A in 2013. The income tax benefit of this deduction is (Php 1M x 30%) Php 300,000.00. Ex a m ple : (a) If the tax refund in 2014 is Php 200,000.00, the corporation will report as PGI Php 200,000.00 A purchased a machinery at a cost of Php 10M but he borrowed said Php 10M with an interest of Php 1M. 1. A may deduct as interest expense the Php 1M; or 2. The Php 1M interest shall be added to the cost of the machinery of Php 10M or a total of Php 11M. If the life of the machinery if 10 years A will deduct a depreciation of (Php 11M ÷ 10) Php 1.1 M for a period of 10 years (b) If the tax refund in 2014 is Php 400,000.00, the corporation will report as PGI Php 300,000.00. In other words, what is to be reported as PGI is the amount of tax refund or the income tax benefit whichever is lower ] (2) Lim it at ions on Deduct ions. - In the case of a nonresident alien individual engaged in trade or business in the Philippines and a resident foreign corporation, the deductions for taxes provided in paragraph (1) of this Subsection (C) shall be allowed only if and to the extent that they are connected with income from sources within the Philippines. (C) Ta x e s.(1) I n General. - Ta xe s (such as VAT, other percentage taxes excise taxes, documentary stamp tax, customs duties, local taxes, real property tax and community tax) paid or incurred within the taxable year in connection with the taxpayer's profession, trade or business, shall be allowed as deduction, ex ce pt : (3) Credit Against Tax for Tax es of Foreign Count ries. - If the taxpayer signifies in his return his desire to have the benefits of this paragraph, the t a x (income tax on the taxable income of the taxpayer from sources within and without the Philippines) imposed by this Title shall be cr e dit e d w ith (or reduced by): (a) Cit iz en (resident) and Domestic Corporation. - In the case of a citizen (resident) of the Philippines and of a domestic corporation, the amount of income taxes paid or incurred during the taxable year to any foreign country; and (a) The income tax provided for under this Title; (b) Income taxes imposed by authority of any foreign country; but this deduction shall be allowed in the case of a t a x pa ye r (resident citizen or domestic corporation) who does not signify in his return his desire to have to any extent the benefits of paragraph (3) of this Subsection (Income tax paid in foreign country is not allowable deduction except if the taxpayer does not signify in his/its return that he shall treat said income tax as tax credit. If the taxpayer signifies in his/its return that he shall treat the income tax paid in foreign country as tax credit then said income tax is not an allowable deduction from his gross income in the Philippines as well as from outside the Philippines. If the taxpayer will treat said income tax as tax credit, he/it shall deduct it from the income tax due in the Philippines to arrive at the income tax still due in the Philippines. Therefore, the tax credit is deducted from income tax) (relating to credits for taxes of foreign countries); (b) Pa r t n e r sh ips (GPP whose partner/s are resident citizens) and Est a t e s (the trustor thereof is a Resident Citizen). - In the case of any such individual (Resident Citizen) who is a member of a general professional partnership or a beneficiary of an estate or trust, his proportionate share of such taxes of the general professional partnership or the estate or trust paid or incurred during the taxable year to a foreign country, if his distributive share of the income of such partnership or trust is reported for taxation under this Title. 57 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 An alien (Resident or Non-Resident) individual non-resident citizen and a foreign corporation (Resident or Non-Resident) shall not be allowed the credits against the t a x (income tax payable in the Philippines or income from sources within the Philippines) for the taxes paid in foreign countries (because their income outside the Philippines is not taxable in the Philippines) allowed under this paragraph. taxpayer, or if any tax paid is refunded in whole or in part, the taxpayer shall notify the Commissioner; who shall redetermine the amount of the tax for the year or years affected, and the amount of tax due upon such redetermination, if any, shall be paid by the taxpayer upon notice and demand by the Commissioner, or the amount of tax overpaid, if any, shall be credited or refunded to the taxpayer. In the case of such a tax incurred but not paid, the Commissioner as a condition precedent to the allowance of this credit may require the taxpayer to give a bond with sureties satisfactory to and to be approved by the Commissioner in such sum as he may require, conditioned upon the payment by the taxpayer of any amount of tax found due upon any such redetermination. The bond herein prescribed shall contain such further conditions as the Commissioner may require. (4) Lim it a t ion s on Cr e dit . - The amount of the credit taken under this Section shall be subject to each of the following limitations: (a) The amount of the credit in respect to the tax paid or incurred to any foreign country shall not exceed the same proportion of the tax against which such credit is taken, which the taxpayer's taxable income from sources within such country under this Title bears to his entire taxable income for the same taxable year; and (6) Year in Which Credit Taken. - The credits provided for in Subsection (C)(3) of this Section may, at the option of the taxpayer and irrespective of the method of accounting employed in keeping his books, be taken in the year which the taxes of the foreign country were incurred, subject, however, to the conditions prescribed in Subsection (C)(5) of this Section. If the taxpayer elects to take such credits in the year in which the taxes of the foreign country accrued, the credits for all subsequent years shall be taken upon the same basis and no portion of any such taxes shall be allowed as a deduction in the same or any succeeding year. Ex a m ple : The following information pertains to Corp A, a DC, for the calendar year 2013: Taxable Income Germany Php 2,000,000.00 Philippines 8,000,000.00 TOTAL Php 10,000,000.00 Philippine Income Tax (Php 10M x 30%) 3,000,000.00 (7) Pr oof of Cr e dit s. - The credits provided in Subsection (C)(3) hereof shall be allowed only if the taxpayer establishes to the satisfaction of the Commissioner the following: Income Tax Paid Php 800,000.00 Germany Tax Credit Limit = Phil Income Tax × (a) The total amount of income derived from sources without the Philippines; ������� �������������� ������ ������� ���������� ������� � = Php 3,000,000.00 × = Php 600,000.00 �� (b) The amount of income derived from each country, the tax paid or incurred to which is claimed as a credit under said paragraph, such amount to be determined under rules and regulations prescribed by the Secretary of Finance; and Tax Credit (lower between increase tax paid in foreign country and tax credit limit) Php 600,000.00 Income Tax still due or payable in the Philippines is (Php 3M – Php 600,000.00) Php 2,400,000.00 (c) All other information necessary computation of such credits. NOTE: If Corporation A does not signify in its return that it will treat the income tax paid in Germany as tax credit, it can deduct from its gross income said income tax paid in Germany of Php 800,000.00 for the verification and (D) Losse s. – (1) I n General. - Losse s (ordinary) actually sustained during the taxable year and not compensated for by insurance or other forms of indemnity shall be allowed as deductions: (b) The total amount of the credit shall not exceed the same proportion of the tax against which such credit is taken, which the taxpayer's taxable income from sources without the Philippines taxable under this Title bears to his entire taxable income for the same taxable year. (a) If incurred in trade, profession or business; (b) Of property connected with the trade, business or profession, if the loss (or destruction) arises from fires, storms, shipwreck, or other casualties, or from robbery, theft or embezzlement. (5) Adj ust m ent s on Paym ent of I ncurred Tax es. - If accrued taxes when paid differ from the amounts claimed as credits by the 58 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 The Secretary of Finance, upon recommendation of the Commissioner, is hereby authorized to promulgate rules and regulations prescribing, among other things, the time and manner by which the taxpayer shall submit a declaration of loss sustained from casualty or from robbery, theft or embezzlement during the taxable year: Pr ovide d, h ow e ve r, That the t im e lim it (90 days from discovery under R.R. No. 12-77) to be so prescribed in the rules and regulations shall not be less than thirty (30) days nor more than ninety (90) days from the date of discovery of the casualty or robbery, theft or embezzlement giving rise to the loss. For purposes of this subsection, the term [Mem!] “n e t ope r a t in g loss” shall mean the excess of allowable deduction over gross income of the business in a taxable year. Provided, That for mines other than oil and gas wells, a net operating loss without the benefit of incentives provided for under Executive Order No. 226, as amended, otherwise known as the Omnibus Investments Code of 1987, incurred in any of the first ten (10) years of operation may be carried over as a deduction from taxable income for the next five (5) years immediately following the year of such loss. The entire amount of the loss shall be carried over to the first of the five (5) taxable years following the loss, and any portion of such loss which exceeds, the taxable income of such first year shall be deducted in like manner form the taxable income of the next remaining four (4) years. (c) No loss shall be allowed as a deduction under this Subsection if at the time of the filing of the return, such loss has been claimed as a deduction for estate tax purposes in the estate tax return. (4) [VVIP!] Ca pit a l Losse s. – (2) Proof of Loss. - In the case of a nonresident alien individual or foreign corporation, the losses deductible shall be those actually sustained during the year incurred in business, trade or exercise of a profession conducted within the Philippines, when such losses are not compensated for by insurance or other forms of indemnity. The secretary of Finance, upon recommendation of the Commissioner, is hereby authorized to promulgate rules and regulations prescribing, among other things, the time and manner by which the taxpayer shall submit a declaration of loss sustained from casualty or from robbery, theft or embezzlement during the taxable year: Provided, That the time to be so prescribed in the rules and regulations shall not be less than thirty (30) days nor more than ninety (90) days from the date of discovery of the casualty or robbery, theft or embezzlement giving rise to the loss; and (a) Lim it at ion. - Loss from sales or Exchanges of ca pit a l a sse t s (except real property located in the Philippines classified as Capital Asset because the sale thereof will never result to Capital loss since what is taxable is the GSP or FMV or FMV, whichever is highest which is the presumed capital gain) shall be allowed only to the extent of the gains from such sales or exchanges. This means that if the Capital losses amount to Php 1M while the capital gains amount to Php 800,000.00, the net capital loss of Php 200,000.00 cannot be deducted from the gross income of the taxpayer from trades business provided in Section 39. (b) Securit ies Becom ing w ort hless. - If securities (such as shares of stock or bonds or profession. On the other hand, if the Capital Gains amount to Php 1M while the capital losses amount to Php 800,000.00 the net capital gain of Php 200,000.00 shall be added to the gross income of the taxpayer from trade, business or profession) as defined in Section 22 (T) become w or t h le ss (the issuing corporation is already insolvent or bankrupt) during the taxable year and are capital assets (the taxpayer or holder is not a dealer in securities), the loss resulting therefrom shall, for purposes of this Title, be considered as a loss from the sale or exchange, on the last day of such taxable year, of capital assets. (3) N e t Ope ra t in g Loss Ca r r y- Ove r . - The net operating loss of the business or enterprise for any taxable year immediately preceding the current taxable year, which had not been previously offset as deduction from gross income shall be carried over as a deduction from gross income for the next three (3) consecutive taxable years immediately following the year of such loss: Prov ided, how ev er, That any net loss incurred in a taxable year during which the taxpayer was exempt from income tax shall not be allowed as a deduction under this Subsection: Provided, further, That a net operating loss carry-over shall be allowed only if there has been no substantial change in the ownership of the business or enterprise in that – (i) (5) Losses From Wash Sales of Stock or Securities. - Losses from 'wash sales' of stock or other securities are not deductible at all as provided in Section 38. Not less than seventy-five percent (75%) in nominal value of outstanding issued shares., if the business is in the name of a corporation, is held by or on behalf of the same persons; or (6) Wagering Losses. - Losses from wagering transactions shall b allowed only to the extent of the gains from such transactions. (ii) Not less than seventy-five percent (75%) of the paid up capital of the corporation, if the business is in the name of a corporation, is held by or on behalf of the same persons. (7) Abandonment Losses. – (a) In the event a contract area where petroleum operations are undertaken is partially or wholly abandoned, all accumulated 59 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 exploration and development expenditures pertaining thereto shall be allowed as a deduction: Prov ided, That accumulated expenditures incurred in that area prior to January 1, 1979 shall be allowed as a deduction only from any income derived from the same contract area. In all cases, notices of abandonment shall be filed with the Commissioner. property held in trust, the allowable deduction shall be apportioned between the income beneficiaries and the trustees in accordance with the pertinent provisions of the instrument creating the trust, or in the absence of such provisions, on the basis of the trust income allowable to each. [Fixed assets such as building, machinery and equipment are subject to depreciation. Intangible assets such as patent, franchise and copyright are subject to authorization. Wasting assets such as mining property are subject to depletion. Depreciation and amortization are covered by Subsection F while depletion is covered by Subsection G.] (b) In case a producing well is subsequently abandoned, the unamortized costs thereof, as well as the undepreciated costs of equipment directly used therein , shall be allowed as a deduction in the year such well, equipment or facility is abandoned by the contractor: Provided, That if such abandoned well is re-entered and production is resumed, or if such equipment or facility is restored into service, the said costs shall be included as part of gross income in the year of resumption or restoration and shall be amortized or depreciated, as the case may be. Ex a m ple : The taxpayer purchased a machinery at a cost of Php12M. The estimated scrap or residual value of the machinery of Php2M, while the estimated useful life of said machinery is 10 years. (E) Ba d D e bt s (or uncollectible accounts).(1) In General. - Debts due to the taxpayer actually ascertained to be worthless (the debtor can no longer pay) and ch a r ge d off (removed from the accounting records of the taxpayer) within the taxable year e x ce pt those not connected with profession, trade or business and those sustained in a transaction entered into between parties mentioned under Section 36 (B) of this Code: Pr ovide d, That recovery of bad debts previously allowed as deduction in the preceding years shall be included as part of the gross income in the year of recovery to the extent of the income tax benefit of said deduction. Compute the annual depreciation of the machinery. Solution: Annual depreciation is cost MINUS scrap value divided by useful life or Php 12M – Php 2M ÷ 10 or Php 1M. (2) Use of Cert ain Met hods and Rat es. - The term 'reasonable allowance' as used in the preceding paragraph shall include, but not limited to, an allowance computed in accordance with rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner, under any of the following m e t h ods: (2) Securities Becoming Worthless. - If securities, as defined in Section 22 (T), are ascertained to be worthless and charged off within the taxable year and are capital assets, the loss resulting therefrom shall, in the case of a taxpayer other than a bank or trust company incorporated under the laws of the Philippines a substantial part of whose business is the receipt of deposits, for the purpose of this Title, be considered as a loss from (deductible as capital loss not as bed debts) the sale or exchange, on the last day of such taxable year, of capital assets. (a) The straight-line method; (b) Declining-balance method, using a rate not exceeding twice the rate which would have been used had the annual allowance been computed under the method described in Subsection (F) (1); (3) Wagering Loss – Net wagering loss by the taxpayer from his income from trade, business or profession. (c) The sum-of-the-years-digit method; and (d) Any other method (such as working hours or production method) which may be prescribed by the Secretary of Finance upon recommendation of the Commissioner. (F) D e pr e cia t ion (this term includes amortization of intangible assets). – (1) General Rule. - There shall be allowed as a depreciation deduction a reasonable allowance for the exhaustion, wear and tear (including reasonable allowance for obsolescence) of property used in the trade or business. In the case of property held by one person for life with remainder to another person, the deduction shall be computed as if the life tenant were the absolute owner of the property and shall be allowed to the life tenant. In the case of (3) Agreem ent as t o Useful Life on Which Depreciat ion Rat e is Based. Where under rules and regulations prescribed by the Secretary of Finance upon recommendation of the Commissioner, the taxpayer and the Commissioner have entered into an agreement in writing specifically dealing with the useful life and rate of depreciation of any property, the rate so agreed upon shall be binding on both the 60 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 taxpayer and the national Government in the absence of facts and circumstances not taken into consideration during the adoption of such agreement. The responsibility of establishing the existence of such facts and circumstances shall rest with the party initiating the modification. Any change in the agreed rate and useful life of the depreciable property as specified in the agreement shall not be effective for taxable years prior to the taxable year in which notice in writing by certified mail or registered mail is served by the party initiating such change to the other party to the agreement: Provided, how ever, that where the taxpayer has adopted such useful life and depreciation rate for any depreciable and claimed the depreciation expenses as deduction from his gross income, without any written objection on the part of the Commissioner or his duly authorized representatives, the aforesaid useful life and depreciation rate so adopted by the taxpayer for the aforesaid depreciable asset shall be considered binding for purposes of this Subsection. (6) Depreciat ion Deduct ible by Nonresident Aliens Engaged in Trade or Business or Resident Foreign Corporat ions. - In the case of a nonresident alien individual engaged in trade or business or resident foreign corporation, a reasonable allowance for the deterioration of Property arising out of its use or employment or its non-use in the business trade or profession shall be permitted only when such property is located in the Philippines. (G) D e ple t ion of Oil and Gas Wells and M ine s (known as Wasting Assets). – (1) I n General. - In the case of oil and gas wells or mines, a reasonable allowance for depletion or amortization computed in accordance with the cost-depletion method (or Production Method) shall be gr a n t e d (or allowed as deduction) under rules and regulations to be prescribed by the Secretary of finance, upon recommendation of the Commissioner. Provided, That when the allowance for depletion shall equal the capital invested no further allowance shall be granted: Prov ided, furt her, That after production in commercial quantities has commenced, certain intangible exploration and development drilling costs: (a) shall be deductible in the year incurred if such expenditures are incurred for non-producing wells and/or mines, or (b) shall be deductible in full in the year paid or incurred or at the election of the taxpayer, may be capitalized and amortized if such expenditures incurred are for producing wells and/or mines in the same contract area. (4) Depreciat ion of Propert ies Used in Pet roleum Operat ions. - An allowance for depreciation in respect of all properties directly related to production of petroleum initially placed in service in a taxable year shall be allowed under the straight-line or decliningbalance method of depreciation at the option of the service contractor. However, if the service contractor initially elects the decliningbalance method, it may at any subsequent date, shift to the straight-line method. Ex a m ple : (of PRODUCTION METHOD) The cost of mining property is Php 5B. the estimated content of the mine is 10,000 tons, this means that the depletion rate per ton is (Php 5B ÷ 10,000) Php 500,000.00. If during the first year of the mining operation, 2,000 tons were extracted, the depletion for that year is (Php 500,000.00 x 2,000) Php 1,000,000,000.00. The useful life of properties used in or related to production of petroleum shall be ten (10) years of such shorter life as may be permitted by the Commissioner. Properties not used directly in the production of petroleum shall be depreciated under the straight-line method on the basis of an estimated useful life of five (5) years. “I nt angible cost s in pet roleum operat ions” refers to any cost incurred in petroleum operations which in itself has no salvage value and which is incidental to and necessary for the drilling of wells and preparation of wells for the production of petroleum: Provided, That said costs shall not pertain to the acquisition or improvement of property of a character subject to the allowance for depreciation except that the allowances for depreciation on such property shall be deductible under this Subsection. Any intangible exploration, drilling and development expenses allowed as a deduction in computing taxable income during the year shall not be taken into consideration in computing the adjusted cost basis for the purpose of computing allowable cost depletion. (5) Depreciat ion of Propert ies Used in Mining Operat ions. - an allowance for depreciation in respect of all properties used in mining operations other than petroleum operations, shall be computed as follows: (a) At the normal rate of depreciation if the expected life is ten (10) years or less; or (b) Depreciated over any number of years between five (5) years and the expected life if the latter is more than ten (10) years, and the depreciation thereon allowed as deduction from taxable income: Prov ided, That the contractor notifies the Commissioner at the beginning of the depreciation period which depreciation rate allowed by this Section will be used. (2) Elect ion t o Deduct Ex plorat ion and Dev elopm ent Ex pendit ures. - In computing taxable income from mining operations, the taxpayer may at his option, deduct exploration and development expenditures accumulated as cost or adjusted basis for cost 61 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 purposes, or 2to accredited domestic corporation or associations organized and operated exclusively for religious, charitable, scientific, youth and sports development, cultural or educational purposes or for the rehabilitation of veterans, or to 3social welfare institutions, or 4to non-government organizations, in accordance with rules and regulations promulgated by the Secretary of finance, upon recommendation of the Commissioner, no part of the net income of which inures to the benefit of any private stockholder or individual in an amount not in excess of ten percent ( 1 0 % ) in the case of an individual, and five percent ( 5 % ) in the case of a corporation, of the taxpayer's taxable income derived from trade, business or profession as computed without the benefit of this and the following subparagraphs. depletion as of date of prospecting, as well as exploration and development expenditures paid or incurred during the taxable year: Provided, That the amount deductible for exploration and development expenditures shall not exceed twenty-five percent (25%) of the net income from mining operations computed without the benefit of any tax incentives under existing laws. The actual exploration and development expenditures minus twenty-five percent (25%) of the net income from mining shall be carried forward to the succeeding years until fully deducted. The election by the taxpayer to deduct the exploration and development expenditures is irrevocable and shall be binding in succeeding taxable years. “Net incom e from m ining operat ions”, as used in this Subsection, shall mean gross income from operations less 'allowable deductions' which are necessary or related to mining operations. “Allow able deduct ions” shall include mining, milling and marketing expenses, and depreciation of properties directly used in the mining operations. This paragraph shall not apply to expenditures for the acquisition or improvement of property of a character which is subject to the allowance for depreciation. (2) Con t r ibu t ion s D e duct ible in Fu ll. - Notwithstanding provisions of the preceding subparagraph, donations to following institutions or entities shall be deductible in full: the the (a) Donat ions t o t he Gov ernm ent . - Donations to the Government of the Philippines or to any of its agencies or political subdivisions, including fully-owned government corporations, exclusively to finance, to provide for, or to be used in undertaking priority activities in education, health, youth and sports development, human settlements, science and culture, and in economic development according to a National Priority Plan determined by the National Economic and Development Authority (NEDA), In consultation with appropriate government agencies, including its regional development councils and private philantrophic persons and institutions: Provided, That any donation which is made to the Government or to any of its agencies or political subdivisions not in accordance with the said annual priority plan shall be subject to the limitations prescribed in paragraph (1) of this Subsection; In no case shall this paragraph apply with respect to amounts paid or incurred for the exploration and development of oil and gas. The term “explorat ion expendit ures” means expenditures paid or incurred for the purpose of ascertaining the existence, location, extent or quality of any deposit of ore or other mineral, and paid or incurred before the beginning of the development stage of the mine or deposit. The term “developm ent expendit ures” means expenditures paid or incurred during the development stage of the mine or other natural deposits. The development stage of a mine or other natural deposit shall begin at the time when deposits of ore or other minerals are shown to exist in sufficient commercial quantity and quality and shall end upon commencement of actual commercial extraction. (b) Donat ions t o Cert ain Foreign I nst it ut ions or I nt ernat ional Organizat ions. - donations to foreign institutions or international organizations which are fully deductible in pursuance of or in compliance with agreements, treaties, or commitments entered into by the Government of the Philippines and the foreign institutions or international organizations or in pursuance of special laws; (3) Deplet ion of Oil and Gas Wells and Mines Deduct ible by a Nonresident Alien indiv idual or Foreign Corporat ion. - In the case of a nonresident alien individual engaged in trade or business in the Philippines or a resident foreign corporation, allowance for depletion of oil and gas wells or mines under paragraph (1) of this Subsection shall be authorized only in respect to oil and gas wells or mines located within the Philippines. (c) Donat ions t o Accredit ed Nongov ernm ent Organizat ions. - the term “nongov ernm ent organizat ion” means a non profit domestic corporation: (1) Organized and operated exclusively for scientific, research, educational, character-building and youth and sports development, health, social welfare, cultural or charitable purposes, or a combination thereof, no part of the net income of which inures to the benefit of any private individual; (H) Ch a r it a ble a n d Ot h e r Con t r ibu t ion s. – (1) I n General. - Contributions or gifts actually paid or m a de (the contribution is property other than money) within the taxable year 1 to, or for the use of the Government of the Philippines or any of its agencies or any political subdivision thereof exclusively for public 62 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (2) Which, not later than the 15th day of the third month after the close of the accredited nongovernment organizations taxable year in which contributions are received, makes utilization directly for the active conduct of the activities constituting the purpose or function for which it is organized and operated, unless an extended period is granted by the Secretary of Finance in accordance with the rules and regulations to be promulgated, upon recommendation of the Commissioner; (4) Proof of Deductions. - Contributions or gifts shall be allowable as deductions only if verified under the rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. (I) Re se a rch a n d D e velopm e n t .[The taxpayer may, at his option, treat the research and development expenditures either: (3) The level of administrative expense of which shall, on an annual basis, conform with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, but in no case to exceed thirty percent (30%) of the total expenses; and (4) The assets of which, in the even of dissolution, would be distributed to another nonprofit domestic corporation organized for similar purpose or purposes, or to the state for public purpose, or would be distributed by a court to another organization to be used in such manner as in the judgment of said court shall best accomplish the general purpose for which the dissolved organization was organized. (ii) As outright expense to be included in ordinary and necessary expenses under Subsection A in the year paid 2. As deferred expense to be amortized over a period of not less than 5 years as research and development under this subsection] (1) I n General. - a taxpayer may treat research or development expenditures which are paid or incurred by him during the taxable year in connection with his trade, business or profession as ordinary and necessary expenses which are not chargeable to capital account. The expenditures so treated shall be allowed as deduction during the taxable year when paid or incurred. (2) Am ort izat ion of Cert ain Research and Developm ent Expendit ures. At the election of the taxpayer and in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, the following research and development expenditures may be treated as deferred expenses: Subject to such terms and conditions as may be prescribed by the Secretary of Finance, the term “ut ilizat ion” means: (i) 1. Any amount in cash or in kind (including administrative expenses) paid or utilized to accomplish one or more purposes for which the accredited nongovernment organization was created or organized. (a) Paid or incurred by the taxpayer in connection with his trade, business or profession; (b) Not treated as expenses under paragraph 91) hereof; and Any amount paid to acquire an asset used (or held for use) directly in carrying out one or more purposes for which the accredited nongovernment organization was created or organized. (c) Chargeable to capital account but not chargeable to property of a character which is subject to depreciation or depletion. In computing taxable income, such deferred expenses shall be allowed as deduction ratably distributed over a period of not less than sixty (60) months as may be elected by the taxpayer (beginning with the month in which the taxpayer first realizes benefits from such expenditures). An amount set aside for a specific project which comes within one or more purposes of the accredited nongovernment organization may be treated as a utilization, but only if at the time such amount is set aside, the accredited nongovernment organization has established to the satisfaction of the Commissioner that the amount will be paid for the specific project within a period to be prescribed in rules and regulations to be promulgated by the Secretary of Finance, upon recommendation of the Commissioner, but not to exceed five (5) years, and the project is one which can be better accomplished by setting aside such amount than by immediate payment of funds. The election provided by paragraph (2) hereof may be made for any taxable year beginning after the effectivity of this Code, but only if made not later than the time prescribed by law for filing the return for such taxable year. The method so elected, and the period selected by the taxpayer, shall be adhered to in computing taxable income for the taxable year for which the election is made and for all subsequent taxable years unless with the approval of the Commissioner, a change to a different method is authorized with respect to a part or all of such expenditures. The election shall not apply to any expenditure paid or (3) V a lu a t ion . - The amount of any charitable contribution of property other than money shall be based on the acquisition cost of said property or the book value or carrying value if the property is depreciable property. 63 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 incurred during any taxable year for which the taxpayer makes the election. ( 4 0 % ) of its gross income as defined in Section 32 of this Code. Unless the taxpayer signifies in his/its return his/its intention to elect the optional standard deduction, he/its shall be considered as having availed himself/itself of the deductions allowed in the preceding Subsections. Such election when made in the return shall be irrevocable for the taxable year for which the return is made: Provided, That an individual or corporation who is entitled to and claimed for the optional standard shall not be required to submit with his/its tax return such financial statements otherwise required under this Code: Prov ided, furt her, That except when the Commissioner otherwise permits, the said individual shall keep such records pertaining to his gross sales or gross receipts, or the said corporation shall keep such records pertaining to his its gross income as defined in Section 32 of this Code during the taxable year, as may be required by the rules and regulations promulgated by the Secretary of Finance, upon recommendation of the Commissioner. Ex a m ple : (3) Lim it at ions on deduct ion. - This Subsection shall not apply to: (a) Any expenditure for the acquisition or improvement of land, or for the improvement of property to be used in connection with research and development of a character which is subject to depreciation and depletion; and (b) Any expenditure paid or incurred for the purpose of ascertaining the existence, location, extent, or quality of any deposit of ore or other mineral, including oil or gas. (J) [BAR!] Pe n sion Tr ust s (Pension Fund or Employees’ Pension Fund). - An employer establishing or maintaining a pension trust to provide for the payment of reasonable pensions to his employees shall be allowed as a deduction (in addition to the contributions to such trust during the taxable year to cover the pension liability accruing during the year, allowed as a deduction under Subsection (A) (1) of this Section ) a reasonable amount transferred or paid into such trust during the taxable year in excess of such contributions, but only if such amount: (1) has not theretofore (previously) been allowed as a deduction, and (2) is apportioned in equal parts over a period of ten (10) consecutive years beginning with the year in which the transfer or payment is made. 1. Are all domestic and resident foreign corporations allowed to avail of the 40% OSD? ANS: NO, proprietary educational institutions, non-profit hospitals, GOCCs, International Carriers, OBUs and Regional Operating Headquarters of Multinational companies are not allowed to avail of the OSD. 2. Ex a m ple : The following is a partial income statement of a taxpayer for 2013: Gross Sales LESS: sales discounts, returns & allowances NET sales LESS: Cost of Sales Gross Profit or Gross Income On January 2, 2014, Corp. A established a pension trust and deposited with a trustee Php 20M as initial pension fund. The pension plan requires the corporation to deposit Php 1M per annum beginning January 2, 2011. The annual contribution of Php 1M is an allowable deduction as ordinary and necessary expense, while the amount of annual amortization of (Php 20M ÷ 10 years) Php 2M, is an allowable deduction as pension trust under this subsection from 2011 to 2020. a. Compute the income tax if the taxpayer is a DC Gross Sales LESS: OSD (Php 3M x 40%) (K) Addit ional Requirem ent s for Deduct ibilit y of Cert ain Pay m ent s. - Any amount paid or payable which is otherwise deductible from, or taken into account in computing gross income or for which depreciation or amortization may be allowed under this Section, shall be allowed as a deduction only if it is shown that the tax required to be deducted and withheld therefrom has been paid to the Bureau of Internal Revenue in accordance with this Section 58 and 81 of this Code. Income Tax b. 64 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) Php 3,000,000.00 1,200,000.00 Php 1,800,000.00 30% Php 540,000.00 Compute the income tax if the taxpayer is an RC, married and with 4 qualified dependent children Gross Sales LESS: OSD (Php 10,150,000.00 x 40%) Net Income LESS: Personal and additional expenses Taxable Income First Php 500,000.00 Excess (Php 5,440,000.00 x 32%) Income Tax (L) Opt ional St andard Deduct ion. - In lieu of the deductions allowed under the preceding Subsections (A to J), an individual subject to tax under Section 24 (RC, NRC and RA), other than a nonresident alien, may elect a standard deduction in an amount not exceeding forty percent ( 4 0 % ) of his gross sales or gross receipts, as the case may be. In the case of a corporation subject to tax under Se ct ion s 2 7 ( A) (DC) and 2 8 ( A) ( 1 ) (RFC), it may elect a standard deduction in an amount not exceeding forty percent Php 10,150,000.00 150,000.00 Php 10,000,000.00 7,000,000.00 Php 3,000,000.00 Php 10,150,000.00 4,060,000.00 Php 6,090,000.00 150,000.00 Php 5,940,000.00 125,000.00 1,740,800.00 Php 1,865,800.00 lOMoARcPSD|12553117 (M) Pr e m iu m Pa ym e n t s on Healt h and/ or Hospit alizat ion I nsurance of an I ndividual Tax pay er. - The amount of premiums not to exceed Two thousand four hundred pesos ( P2 ,4 0 0 ) per family or Two hundred pesos (P200) a month paid during the taxable year for health and/or hospitalization insurance taken by the taxpayer for himself, including his family, shall be allowed as a deduction from his gross income: Pr ovide d, That said family has a gross income of not more than Two hundred fifty thousand pesos ( P2 5 0 ,0 0 0 ) for the taxable year: Pr ovide d, fin a lly, That in the case of married taxpayers, only the spouse claiming the additional exemption for dependents shall be entitled to this deduction. • Only business-connected expenses are deductible from income derived from trade or business or the practice of s profession or simply, business income. The only exceptions are charitable and other contributions (GPP, Estate, Trust, NRA not engaged and NRFC are not allowed to deduct charitable and other contributions) which are allowed to be deducted by corporations and business partnerships and by individuals and premium payments for health and/or hospitalization insurance by an individual although such contributions or payments are nonbusiness in nature. o Section 34 covers all deductions in arriving at taxable business income of corporations, partnerships and individuals. There is no more distinction Exceptions: 1. Premium Payments and/or Hospitalization Insurance – allowed only to individual tax payers Deductions from income tax purposes partake in the nature of tax exemptions; hence, if tax exemptions are strictly construed, then deductions must also be strictly construed. It is not incumbent upon the taxing authority to prove that the amount of items being claimed is unreasonable. The burden of proof to establish the validity of claimed deductions is on the taxpayer. They cannot be extended by mere implication or inference. o Tax Credit – refers to an amount that is subtracted directly from one’s total tax liability, an allowance against the tax itself, or a deduction from what is owed; It reduces the tax due. Tax Deduction – reduces the income that is subject to tax to arrive at taxable income GENERAL As a rule, if a taxpayer does not, within any year, deduct all his authorized allowable deductions, he cannot deduct them from the income of the next succeeding year. 3. o A tax deduction may also refer to the subtraction from gross income the amount so allowed by law. o Charitable & Other Contributions: Individual – 10%; Corporation – 5% between corporations and individuals with respect to deductions from gross income from business. Gross compensation income of an individual is taxable without deductions e xce pt premium payments and personal and additional exemptions. Notwithstanding the provision of the preceding Subsections, The Secretary of Finance, upon recommendation of the Commissioner, after a public hearing shall have been held for this purpose, may prescribe by rules and regulations, limitations or ceilings for any of the itemized deductions under Subsections (A) to (J) of this Section: Provided, That for purposes of determining such ceilings or limitations, the Secretary of Finance shall consider the following factors: (1) adequacy of the prescribed limits on the actual expenditure requirements of each particular industry; and (2)effects of inflation on expenditure levels: Prov ided, furt her, That no ceilings shall further be imposed on items of expense already subject to ceilings under present law. o 2. • OSD: Individual – 40% of Gross Sales or Receipts Corporation – 40% of Gross Income Deductions from business income o The itemized deductions enumerated in the Tax Code may be claimed by individuals (engaged in business or practice of profession) and corporate taxpayers ex ce pt that only premium payments and personal and additional exemptions may be claimed by individuals taxpayers whose income is derived solely from compensation o In lieu of the deductions allowed under Subsections A to J, an individual taxpayer, other than a non-resident alien (whether engaged in business or not) may elect an optional standard deduction (OSD) in an amount not exceeding 40% of gross sales or gross receipts. In addition to the OSD, he is also allowed to deduct premium payments on health and/or hospitalization insurance subject to certain conditions, under Subsection (M) and personal and additional exemptions D e du ct ions fr om com pe nsa t ion incom e – the deductions of items specified in Section 34 are not allowed with respect to compensation income arising from personal services rendered under an employeeemployer relationship. o Only premium payments and personal and additional exemptions are deductible from compensation income 65 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o • Individual taxpayers engaged in business or practice of profession may also avail of OSD and still claim deduction for premium payments INTEREST • The partner’s distributive share of the net income of a GPP is subject to tax determined in accordance with the schedule prescribed in Section 24(A). He shall report such distributive share, actually or constructively received, as gross income in his income tax return. Re qu isit e s of Deductibility of Interest: 1. Taxpayer must have an indebtedness 2. Interest must have been paid or incurred during the taxable year in connection with the trade, business or exercise of profession 3. Interest must have been stipulated in writing 4. Interest must be legally due indebtedness has not yet prescribed EXPENSES • • [Impt!] Re qu isit es of Deductibility of Business Expense: 1. Ordinary and necessary expenses 2. Paid or incurred during the taxable year in carrying on or directly attributable to operation and/or conduct of the trade, business or exercise of a profession 3. Reasonable in amount 4. Supported by adequate proof 5. Not against law, morals, public policy, or public order • Ta x e s means taxes proper (or basic) and, therefore, no deductions are allowed for amounts representing: 1. Interest (not deductible as tax but is deductible as interest in Subsection B) by reason of late payment of tax 2. Surcharge 3. Penalties (such as compromise penalty) or fines incident to delinquency • [Impt!] Business taxes such as VAT, other percentage taxes, excise taxes, documentary stamp taxes, customs duties, e tc. (such as local taxes, real property taxes and community taxes), are deductible. The electric energy consumption tax is now allowed as a deduction • Ta x Cr e dit – it refers to the taxpayer’s right to deduct from the income tax due in the Philippines the amount of tax the taxpayer has paid to a foreign country, subject to limitations. Not deductible at all “ Or dina r y” an d “ne ce ssar y” – it has been said that to be deductible, expenses “must be incurred by a taxpayer in doing the ordinary and necessary things his business requires to be done to make it function as such” and must be necessary in the ordinary course of its conduct. o o • TAXES Ca pit a l ex pen dit u re s (such as extraordinary repairs of building, machinery and equipment which are added to the cost of such building, machinery and equipment to be depreciated using the remaining life of said assets) are not “ordinary and necessary” expenses Bon u s given to corporate officers as their share of the profit realized from the sale of corporate property could not be considered as a selling expense nor be deemed reasonable and necessary business expense as to make it deductible for tax purposes even if the sale could be considered as a transaction for carrying on the trade or business of the corporation, there being no evidence of any service actually rendered by the corporate officers which could be the basis of grant to them of a bonus. W h e n ex pen se or din a r y – it has the connotation of normal, usual or customary • W h e n ex pen se n e ce ssa r y – “necessary” means “appropriate” and “helpful” in the development of the taxpayer’s business • Representation expenses fall under the category of business expenses which are allowable deductions from gross income, if they meet the conditions prescribed by law Because • they are taxable on income from w/in and w/o the Phils Because they are • taxable on income only from w/in the Phils. • Th ose en t it le d t o t a x cr e dit 1. Resident citizens 2. Domestic corporations 3. Members (resident citizens) of professional partnerships 4. Beneficiaries of estates and trusts (decedent was or trustor is a resident citizen) Th ose n ot en t it le d 1. Non-resident citizens 2. Resident and non-resident aliens 3. Resident and non-resident foreign corporations LOSSES Re qu isit e s of Deductibility of Losses: 1. Be that of a taxpayer 2. Actually sustained and charged off within the taxable year 3. Been incurred in trade, business, or profession 4. [BAR!] [VIP!] Evidenced (such as final decision of the court denying the claim of the insured/taxpayer from the insurer in case of loss of property insured caused by natural disaster such as fine) by a closed and completed transaction 5. Not have been compensated for by insurance or other forms of indemnity 66 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 3. • • • • Ca su alt y losse s – any loss arising from fires, storms or other casualty, and from robbery, theft or embezzlement, is generally allowable as deduction under Subsection (D) for the taxable year in which the loss is sustained 4. 5. The tax code limits the time for the taxpayer to declare casualty losses. The taxpayer is required to file declaration of loss within 9 0 da ys after the date of the discovery (no longer occurrence) of casualty or robbery, theft, or embezzlement containing the required information and prove the elements of the loss claimed Ba d de bt is a debt due to a taxpayer arising from a loan of money or sale of goods or rendition of service proved by the taxpayer to be worthless or uncollectible Bad debts sustained in a transaction entered into between related taxpayers mentioned in Section 36(B) are not deductible. The bad debts must be written off in full or not at all. A partial charging-off is not allowed. Neither can there be a partial writing off of a loss or bad debt. For such losses or bad debts must be ascertained to be so and written off during the taxable year; therefore, losses or bad debts are deductible in full or not at all, in the absence of any express provision in the Tax Code authorizing partial deductions • N e t ope r a t in g loss ca r r y- ove r – exists when the allowable deductions exceed the gross income of the business in a taxable year It is now allowed to be carried over and deducted from gross income for the next 3 consecutive taxable years (if the loss was totally deducted during the next taxable year nothing can be deducted during the 2 following years of successive years) immediately following the year of such loss Se cu r itie s becom in g w or t h less (the issuing corporation became insolvent or bankrupt) – the loss sustained by the holder of the securities, which are capital assets to h im (he is not a dealer in securities), is to be treated as a capital loss as if incurred from a sale or exchange transaction. The mere strinkage (or decline) in value of securities is not deductible o • • When securities become worthless, there is strictly no sale or exchange but the law deems the loss anyway to be “a loss from sale or exchange of capital assets” • Capital losses are allowed to be deducted only to the extent of capital gains, i.e., gains derived from the sale or exchange of capital assets, and not from any other income of the taxpayer. • W a ge r in g losses (deductible only from wagering gains) should be deemed to apply only to individuals unless it can be said that corporations can legally gamble Ta x be ne fit ru le or doct r ine – the recovery of bad debts previously allowed as deduction in the preceding year or years shall be included as part of the taxpayer’s gross income in the year of such recovery to the extent of the income tax benefit of said deduction. o Re ce ipt of re a lize d ta x a ble in com e – if, in the year the taxpayer claimed deduction of bad debts written-off, he realized a reduction of the income tax due from him on account of the said deduction, his subsequent recovery thereof from his debtor shall be treated as a receipt of realized taxable income o M e r e r ecove r y or r e t u rn of ca pit a l – conversely, if the said taxpayer did not benefit from the deduction of the said bad debt written-off because it did not result to any reduction of his income tax in the year of such deduction (i.e., where the result of his business operation was a net loss even without deduction of the bad debts written-off), then his subsequent recovery thereof shall be treated as a mere recovery or a return of capital; hence, not treated as receipt of realized taxable income DEPRECIATION • D e pr e cia t ion is the reduction in the service value of property used in profession, business, or trade resulting from exhaustion, wear and tear and obsolescence. The term is also applies to amortizations of the value of intangible assets the use of which in the trade or business is definitely limited in duration • Re qu isit e s of Deductibility of Depreciation 1. Reasonable 2. For the exhaustion, wear and tear of property used in the trade or business 3. Charged off during the taxable year • St r a igh t line or fix e d pe rcen t a ge m e th od – the total depreciable value or cost-scrap value is spread in equal annual amounts over the useful life of the asset, i.e., the basis (such as cost) of the property less the scrap or salvage value is divided by its estimated useful life BAD DEBTS • Must be actually charged off from the books of accounts of the taxpayer as of the end of the taxable year Must have arisen in connection with the trade, business or profession of the taxpayer Must not be sustained in a transaction entered into between related parties (such as members of family) enumerated under Section 36(B) Re qu isit e s of Deductibility of Bad Debts: 1. Must be an existing indebtedness due to the taxpayer which must be valid and legally demandable (has not yet prescribed) 2. Must be actually ascertained to be worthless or uncollectible as of the end of the taxable year 67 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 DEPLETION • OPTIONAL STANDARD DEDUCTION D e ple t ion is the exhaustion of natural resources like mines and oil and gas wells as a result of production or severance (or extraction) from such mines or wells • CHARITABLE AND OTHER CONTRIBUTIONS • • Re qu isit e s of Deductibility of Charitable and Other Contributions 1. Actually paid or made to any of those specified in the Tax Code 2. Made within the taxable year 3. Not more than 10% of the individual taxpayer’s and 5% of the corporate taxpayer’s taxable income to be computed without including the contribution 4. Supported by adequate proof CORPORATIONS 1. Domestic corporation 2. Resident foreign corporation The amount of any charitable contribution of property other than money shall be based on the a cqu isit ion cost (or carrying value or book value) of the property, not its current market value NOT ALLOWABLE DEDUCTION; ADDITIONAL REQUIREMENT • RESEARCH AND DEVELOPMENT • A taxpayer may treat research and development expenditures as ordinary and necessary expenses deductible from gross income during the taxable year under Subsection (A). At the election of the taxpayer, the expenditures may be treated as deferred expenses which shall be allowed as a deduction as research and development ratably (or equally) distributed in computing taxable income. The expenses may be deferred over a period of not less 60 months or 5 years beginning with the month in which the taxpayer first realizes benefit from such expenditures • • Payments to employees’ pension trusts which are deductible are: 1. Allowable deduction as Ordinary & Necessary Expense – amounts contributed by the employer during the taxable year to cover the pension liability accruing during the year 2. W it h h oldin g of cr e dit a ble in com e t ax e s – Section 57(B) authorizes the Secretary of Finance to require withholding of creditable income taxes from certain income payments. Subsection (K) requires proof of such withholding and payment to the BIR as an additional condition for deductibility of such income payments (income on the part of the recipient but expense on the part of the taxpayer) from gross income of the payor The purpose is to insure the collection of the income tax on these payments which constitute income to the recipients thereof and, therefore, includible in their gross income. Thus, when one engaged in trade or business makes payments that are deductible from his gross income for tax purposes, it is not enough that he proves that such payments have been made. He must also show proof that he withheld the tax and remitted it to the BIR before he can deduct the same as business expense PENSION TRUSTS • The following may be allowed to claim OSD in lieu of the itemized deductions INDIVIDUALS 1. Resident citizens 2. Non-resident citizens 3. Resident alien 4. Taxable estate and trust Allowable deduction as Pension Trust – 1/10 of the reasonable amount paid by the employer to cover pension liability applicable to the year prior to the taxable year, or so paid to place the trust in a sound financial basis Pr e m iu m pa ym en t s 1. For health and/or hospitalization 2. Premium does not exceed Php 2,400.00 per family or Php 200.00 a month during the taxable year 3. Insurance taken by the taxpayer for himself including his family 4. Family has a gross income of not more than Php 250,000.00 If all the requisites are present, only the spouse claiming the additional exemption for dependents is entitled to this deduction Re qu isit e s of Deductibility of Pension Trusts: 1. Employer must have established a pension or retirement plan 2. Pension plan must be reasonable and actuarially sound 3. Must be funded by the employer 4. Amount contributed must no longer be subject to his control or disposition 5. Amount has not been allowed before as a deduction 6. Amount if apportioned in equal parts over a period of 10 consecutive years beginning with the year in which the transfer or payment is made SEC. 3 5 . Allow ance of Personal Ex em pt ion for I ndiv idual Tax pay er. – (A) In General. - For purposes of determining the tax provided in Se ct ion 2 4 ( A) (RC, NRC & RA) of this Title, there shall be allowed a basic personal exemption amounting to Fifty thousand pesos ( P5 0 ,0 0 0 ) for each individual taxpayer: In the case of married individuals where only one of the spouses is deriving gross income, only such spouse shall be allowed the pe r son a l e xe m pt ion . 68 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 exemptions as if the spouse or any of the dependents died, or as if such dependents married, became twenty-one (21) years old or became gainfully employed at the close of such year. (B) Additional Exemption for Dependents. - There shall be allowed an a ddit ion a l e xe m pt ion of Twenty-Five thousand pesos ( P2 5 ,0 0 0 ) for each dependent not exceeding four (4). [Death of a qualified dependent child is deemed to have taken place at the beginning of the year] The additional exemption for dependent shall be claimed by only one of the spouses in the case of married individuals. Ex a m ple : The taxpayer is married and has 4 qualified dependent children. On March 31, 2014 the taxpayer died. The taxpayer or his estate will file 2 income tax returns the first will cover the period from Jan. 1 to March 31, 2014 and he is entitled to personal exemption of Php 50,000.00 and additional exemption of Php 100,000.00. The 2nd return will cover the period from April 1 – Dec. 31, 2014, if his estate consists of income producing properties, and his estate shall be entitled to personal exemption of Php 20,000.00 (Section 62). In the case of le ga lly se par a t e d spouse s (if they are separated in fact apply the immediately preceding paragraph), additional exemptions may be claimed only by the spouse who has custody of the child or children: Pr ovide d, That the total amount of additional exemptions that may be claimed by both shall not exceed the maximum additional exemptions herein allowed. For purposes of this Subsection, a 'de pen den t ' means a legitimate, illegitimate or legally adopted child 1chiefly dependent upon and living with the taxpayer if such dependent is 2not more than twenty-one (21) years of age, 3unmarried and 4not gainfully employed or if such dependent, regardless of age, is incapable of self-support because of mental or physical defect. (D) Personal Exemption Allowable to Nonresident Alien Individual. - A n on r e siden t a lien in dividu a l en ga ge d in trade, business or in the exercise of a profession in the Philippines shall be entitled to a personal exemption in the amount equal to the exemptions allowed in the income tax law in the country of which he is a subject - or citizen, to citizens of the Philippines not residing in such country, not to exceed the amount fixed in this Section as exemption for citizens or resident of the Philippines: Provided, That said nonresident alien should file a true and accurate return of the total income received by him from all sources in the Philippines, as required by this Title. [Under the NIRC, only married individuals with qualified dependent child or children and legally separated spouses with custody of their qualified dependent child or children are entitled to additional exemption. Hence, single individuals, widow and widower with qualified dependent child or children are not entitled to additional exemption. Single individual, widow or widower may be entitled to additional exemption under Special Laws such as Single Parent Law] [The personal exemption of NRA engaged is Php 50,000.00 or the amount of exemption granted to non-resident Filipinos engaged in business in that country whichever is lower] (C) Change of Status. - If the taxpayer marries or should have additional dependent(s) as defined above during the taxable year, the taxpayer may claim the corresponding additional exemption, as the case may be, in fu ll (exemption may be availed of in full or not at all because partial exemption is not allowed) for such year. Death of the taxpayer or of his dependent child or the latter’s disqualification is deemed to have taken place at the end of the year, hence, the taxpayer is still entitled to full exemption • Ex a m ple : In 2013, A married, had 2 qualified dependent children. On Dec. 31, 2014, the wife of A gave birth to twin babies. In 2014 A shall be entitled to additional exemption for qualified dependent children of Php 100,000.00 because under the law if the taxpayer should have additional dependents during the taxable year he may claim the additional exemption in full for such year. Hence, having additional dependent child or children is deemed to have taken place at the beginning of the year. Pe r son s e n t it le d t o pe rson a l and additional exe m pt ion s 1. Resident citizens 2. Non-resident citizens 3. Resident aliens [Suppose the country of the resident alien does not grant exemptions to resident Filipinos therein, is the former entitled to exemptions in the Phils.? AN S: YES, there is no reciprocity provision in the NIRC regarding resident aliens] 4. If the taxpayer dies during the taxable year, his estate may still claim the personal and additional exemptions for himself and his dependent(s) as if he died at the close of such year. If the spouse or any of the dependents dies or if any of such dependents marries, becomes twenty-one (21) years old or becomes gainfully employed during the taxable year, the taxpayer may still claim the same Non-resident aliens engaged in trade or business in the Philippines (only personal exemption) [Suppose the country of the NRA engaged grants both personal and additional exemptions to non-resident Filipinos engaged in business in that country, will the NRA engaged be also entitled to both personal and additional exemptions in the Phils.? AN S: NO, the NRA engaged is entitled only to personal exemption because there is no reciprocity provision regarding additional exemption] 69 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Under Subsection (D), the amount of (basic) personal exemption allowable to non-resident alien individuals is that allowed by the income tax law of his country or Php 50,000.00, whichever is lower • [These expenses are not connected with trade, business or profession] (2) Any amount paid out for new buildings (private educational institutions are allowed) or for permanent improvements, or betterments made to increase the value of any property or estate; [Capital Expenditures – charged to assets, not to expenses] H u sba n d a n d w ife – they are treated as separate taxable persons o o Where both spouses derive taxable income, each is allowed to claim the Php 50,000.00 personal exemption for married individuals This Subsection shall not apply to intangible drilling and development costs incurred in petroleum operations which are deductible under Subsection (G) (1) of Section 34 of this Code. The additional exemption for dependents shall be claimed by only one of the spouses in the case of married individuals. Since the law makes no qualification as to gender, i.e., whether the husband or the wife, then it is up to the spouses to decide who between them should avail of the additional exemptions, e x ce pt as provided below when both are employer and receive compensation income o When a husband and wife each are recipients of wages, the additional exemptions for qualified independent children shall be claimed by the husband who is deemed the head of the family u n le ss he explicitly waives his right in favour of his wife in the withholding exemption certificate o In case of legally separated spouses, the additional exemptions may be claimed only by the spouse who has custody of the child or children • Ch ie f su ppor t means principal or main support. It is more than ½ of the support required by the dependent • Status of a taxpayer o [VIP!] In case of change of status (by birth of additional dependents) during the taxable year, the taxpayer may claim the corresponding additional exemptions in full of such year o If the effect of such change of status (by reason of death, marriage, or attainment of the age of majority, or gainful employment by any dependent) is to reduce the amount of such exemptions, the taxpayer (or his estate) may still claim the same exemptions for such year (3) Any amount expended (extraordinary repairs which are also considered capital expenditures) in restoring property or in making good the exhaustion thereof for which an allowance is or has been made; or (4) [BAR!] Premiums (if the officer or employee dies the taxpayer or employer receives the proceeds of the policy which are exempt from income tax) paid on any life insurance policy covering the life of any officer or employee, or of any person financially interested in any trade or business carried on by the taxpayer, individual or corporate, when the taxpayer (employer) is directly or indirectly a beneficiary (if the beneficiary is the estate or the family of the officer or employee, the premiums are allowable deduction on the part of the taxpayer/employer as ordinary and necessary expense) under such policy. (B) [BAR!] [VIP!] Losses from Sales or Exchanges of Propert y . - In computing net income, no deductions shall in any case be allowed in respect of losse s (but gains are taxable) from sales or exchanges of property (does not apply to real property located in the Phils. classified as Capital Asset because the sale thereof will never result to a loss because such sale is always subject to 6% CGT based on GSP or FMV or FMV whichever is highest) directly or indirectly – (1) Between members of a family. For purposes of this paragraph, the family of an individual shall include only his brothers and sisters (whether by the whole or half-blood), spouse, ancestors, and lineal descendants; or (2) Ex ce pt in th e case of dist r ibu t ion s in liquidat ion , between an individual and corporation more than fifty percent (50%) in value of the outstanding stock of which is owned, directly or indirectly, by or for such individual; or Apportionment of personal and additional exemptions is not allowed SEC. 3 6 . I t e m s n ot D e du ct ible .- Ex a m ple : On Jan. 2, 2005 X bought 60% of the Capital Stock of Corp. A for Php 50M. On Jan. 2, 2014 Corp. A was dissolved and X received properties from the former worth Php 40M by way of liquidation. (A) General Rule. - In computing net income, no deduction shall in any case be allowed in respect to – (1) Personal, living or family expenses; 70 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 1. 2. If X is a dealer in securities, the loss of Php 10M is an allowable deduction under Sec. (34)(D)(1)(a) If X is not a dealer in securities, the capital loss of Php 10M is deductible from his capital gains, if any. (B) Mut ual I nsurance Com panies. - In the case of mutual fire and mutual employers' liability and mutual workmen's compensation and mutual casualty insurance companies requiring their members to make premium deposits to provide for losses and expenses, said companies shall not return as income any portion of the premium deposits returned to their policyholders, but shall return as taxable income all income received by them from all other sources plus such portion of the premium deposits as are retained by the companies for purposes other than the payment of losses and expenses and reinsurance reserves. (3) Except in the case of distributions in liquidation, between two corporations more than fifty percent (50%) in value of the outstanding stock of which is owned, directly or indirectly, by or for the same individual if either one of such corporations, with respect to the taxable year of the corporation preceding the date of the sale of exchange was under the law applicable to such taxable year, a personal holding company or a foreign personal holding company; (C) Mut ual Marine I nsurance Com panies. - Mutual marine insurance companies shall include in their return of gross income, gross premiums collected and received by them less amounts paid to policyholders on account of premiums previously paid by them and interest paid upon those amounts between the ascertainment and payment thereof. (4) Between the grantor (or trustor) and a fiduciary (or trustee)of any trust; or (5) Between the fiduciary of and the fiduciary of a trust and the fiduciary of another trust if the same person is a grantor with respect to each trust; or (D) Assessm ent I nsurance Com panies. - Assessment insurance companies, whether domestic or foreign, may deduct from their gross income the actual deposit of sums with the officers of the Government of the Philippines pursuant to law, as additions to guarantee or reserve funds. (6) Between a fiduciary of a trust and beneficiary of such trust. SEC. 3 8 . Losse s fr om W a sh Sa le s of St ock or Securit ies. – • Ca pit a l Ex pen ditu r e s – expenditures that result in obtaining benefits of a permanents nature such as lands, buildings and machineries • Life in su r an ce pr e m iu m s – where a corporation takes out insurance on the life of a key officer, designating as beneficiary thereby the family of the insured, the premiums paid can be claimed by the corporation as a deductible business expense from its gross income as long as the members of the key officer’s family are not so situated or so related with the corporation as would make it an indirect beneficiary of the proceeds of the insurance • The purpose behind Subsection (B,1) is the prevention of simulated or “sham” sales or exchanges by persons who are members of a family to avoid payment of income tax. It is immaterial whether the transactions are bona fide or not. the losses therefrom are not deductible but the gains realized are taxable (A) In the case of any loss claimed to have been sustained from any sale or other disposition of shares of stock or other securities where it appears that within a period beginning thirty (30) days before the date of such sale or disposition and ending thirty (30) days after such date, the taxpayer has acquired (by purchase or by exchange upon which the entire amount of gain or loss was recognized by law), or has entered into a contact or option so to acquire, substantially identical stock or other securities, then no deduction for the loss shall be allowed under Section 34 u nle ss the claim is made by a dealer in stock or securities and with respect to a transaction made in the ordinary course of the business of such dealer. (B) If the amount of stock or securities acquired (or covered by the contract or option to acquire) is less than the amount of stock or securities sold or otherwise disposed of, then the particular shares of stock or securities, the loss form the sale or other disposition of which is not deductible, shall be determined under rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. SEC. 3 7 . Special Pr ovisions Regarding I ncom e and Deduct ions of I nsurance Com panies, Whet her Dom est ic or Foreign. – (C) If the amount of stock or securities acquired (or covered by the contract or option to acquire which) resulted in the non-deductibility of the loss, shall be determined under rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. (A) Spe cia l D e du ct ion Allow e d t o I n su r an ce Com pa n ies. - In the case of insurance companies, whether domestic or for e ign (resident) doing business in the Philippines, the net additions, if any, required by law to be made within the year to reserve funds and the su m s (face amounts of policies paid by the insurance company to policy holders in case of death of the person insured or destruction of property insured) other than dividends paid within the year on policy and annuity contracts may be deducted from their gross income: Pr ovide d, h ow e ve r , That the released reserve be treated as income for in the year of release. • [Mem!] W a sh Sa les is a sale or other disposition of shares of stock or other securities where substantially identical securities are purchased (if within a period of 61 days there are 2 or more sales there is no wash sale even is 1 or some or all of them resulted in losses) within a 61-day period, beginning 30 days before the sale and ending 30 days after the sale which 71 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 resulted in a loss. If the sale resulted in a gain the transaction is plain and simple sale not a wash sale • (2) N e t Ca pit al Ga in . - The term 'net capital gain' means the excess of the gains from sales or exchanges of capital assets over the losses from such sales or exchanges. Gains from sales are taxable but losses therefrom are non-deductible subject to the exception provided in Subsection (A) in the case of dealer in stock or securities o (3) N e t Ca pit a l Loss. - The term 'net capital loss' means the excess of the losses from sales or exchanges of capital assets over the gains from such sales or exchanges. 8/10/2011 – purchase of 100 shares for Php 2,000.00; 8/25/2011 – purchase of 50 shares for Php 1,500.00; and 9/22/2011 – sale of 100 shares purchased on 8/10/2011 for Php 1,800.00, the nondeductible loss is Php 200.00 (B) Percent age Taken int o Account . [This is known as the “Holding Period Rule” which does not apply if the Capital Asset is share of stock in a domestic corporation or real property located in the Philippines] – In the case of a taxpayer (individual or estate or trust), ot h e r t ha n a cor por a t ion , only the following percentages of the gain or loss recognized upon the sale or exchange of a capital asset shall be taken into account in computing net capital gain, net capital loss, and net income: [It is not necessary in wash sale that the stock sold must have at least 30 days before. What is important is that there is a purchase or acquisition of stock at least 30 days before or at least 30 days after the sale] o • (1) One hundred percent ( 1 0 0 % ) if the capital asset has been held for not more than twelve (12) months; and 8/15/2011 – purchase of 100 shares for Php 2,000.00; 9/20/2011 – sale of the 100 shares for Php 1,500.00; and 9/22/2011 – sale of 100 shares for Php 1,900.00, the non-deductible loss is Php 500.00 (2) Fifty percent ( 5 0 % ) if the capital asset has been held for more than twelve (12) months; Su bst a n t ially ide n tical means that the stock or other securities are the same or are similar on their important features (e.g., bonds which differ only as to interest rates). Common stock and preferred stock, voting stock and non-voting stock, etc. are not substantially identical (C) Lim it at ion on Capit al Losses. - Losses (this means that the net capital loss cannot be deducted from the taxable income from trade, business or profession of the taxpayer but net capital gain is added thereto) from sales or exchanges of capital assets shall be allowed only to the extent of the gains from such sales or exchanges. If a bank or trust company incorporated under the laws of the Philippines, a substantial part of whose business is the receipt of deposits, sells any bond, debenture, note, or certificate or other evidence of indebtedness issued by any corporation (including one issued by a government or political subdivision thereof), with interest coupons or in registered form, any loss resulting from such sale shall not be subject to the foregoing limitation (because a bank or trust company is considered by law as dealer in securities, hence, the net capital loss is deductible from income from trade or business of such bank or trust company) and shall not be included in determining the applicability of such limitation to other losses. [BAR!] SEC. 3 9 . Capit al Gains and Losses. – (A) Definit ions. - As used in this Title – (1) Ca pit a l Asse t s. - the term 'capital assets' means property held by the taxpayer (whether or not connected with his trade or business [examples of Capital Assets: (1) connected with trade/business receivables and investments (2) not connected with trade/business – residential house and lot, home appliances, pieces of jewelry and cars used for personal purposes]), bu t doe s n ot inclu de 1stock in trade (such as merchandise of trading business and finished goods of manufacturing business) of the taxpayer or other property (such as raw materials, work in process and factory supplies of a manufacturing business) of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year, or 2property (such as subdivision lots of real estate dealer and securities of a dealer in securities) held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business, or 3property (such as building, machineries, equipment, furniture and fixtures, patent, franchise and copyright) used in the trade or business, of a character which is subject to the allowance for depreciation provided in Subsection (F) of Section 34; or 4real property (such as land and wasting assets of a mining company) used in trade or business of the taxpayer. [Nos. 1-4 are ordinary assets] (D) N e t Ca pit a l Loss Ca r r y- ove r . - If any taxpayer, ot he r t ha n a cor por a t ion , sustains in any taxable year a net capital loss, such loss (in an amount not in excess of the net income for such year) shall be treated in the succeeding taxable year as a loss from the sale or exchange of a capital asset held (100%) for not more than twelve (12) months. (E) Re t ir e m e n t of Bon ds, Et c. - For purposes of this Title, amounts received by the holder upon the retirement of bonds, debentures, notes or certificates or other evidences of indebtedness issued by any corporation (including those issued by a government or political subdivision thereof) with interest coupons or in registered form, shall be considered as amounts received in exchange therefor (retirement of bonds is considered by law as sale or exchange of said bonds although actually there is no sale or exchange). 72 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 2014. B accepted the offer of A and agreed to buy 1,000 shares at Php 1,000.00 per share and today B paid A Php 1M. On Dec. 11, 2014 the expectation of A materialized and on that date the market or quoted price of the shares of stock was Php 900.00 per share and A purchased 1,000 shares from the stock market at Php 900,000.00. And he delivered the certificate of stock to B on said day. Ex a m ple : A. A, a resident citizen, purchased a Php 5M face value bond in Corp. A on Jan. 2, 2004 with maturity of 10 years. On Jan. 2, 2009, A sold the said bond to B at Php 4.8M. On Jan. 2, 2014, B surrendered he said bond to Corp. A for Retirement and the latter paid B the face value of Php 5M. This retirement is considered by law as sale or exchange of the bond. Is the Capital Gain of Php 200,000.00 realized by B upon redemption taxable? The above transaction resulted to an ordinary gain on the part of A in the amount of Php 100,000.00. AN S: NO, if the maturity period of the bond is more than 5 years, the gain realized on retirement is excluded from Gross Income under Section 32(B,7,g) B. Ex a m ple : A. X, a resident citizen who operates a grocery business, had the following Capital Assets transactions in 2013: The same facts in A except that A sold the bond to B on Jan. 2, 2009 at a price of Php 5.2M, is the loss sustained by B on Jan. 2, 2014 upon retirement of the bond a deductible loss? AN S: YES, said loss is deductible from Capital Gains, if any, of B in 2014. 1. Investment in bonds with maturity period of 5 years acquired in 2011 at a cost of Php 500,000.00 was sold at Php 460,000.00 2. Jewelry acquired on March 1, 2013 at a cost of Php 750,000.00 was sold at Php 800,000.00 on Dec. 25, 2013 3. Car used by his family acquired on July 1, 2013 at a cost of Php 560,000.00 was sold at Php 450,000.00 on Dec. 31, 2013 4. Shares of stock in a resident foreign corporation acquired in 2011 at a cost of Php 1M were sold at Php 1.2M (F) Gains or losses from Sh or t Sa le s, Et c. - For purposes of this Title – (1) Gains or losses from short sales of property shall be considered as gains or losses from sales or exchanges of capital assets (if the seller is NOT a dealer in securities) ; and Ex a m ple : A offered to sell his piece of land to B at a price of Php 5M but on that date, B has no money to buy the said land. A and B agreed that the latter is given a period of 60 days within which to produce the Php 5M and in the event that B can produce said amount the deed of sale shall be executed. By reason of the Option Period of 60 days granted by A to B the latter paid the former Php 100,000.00 as Option Money. Compute the Net Capital Gain or Net Capital Loss Solu t ion : Sale of investment in bonds (P460k-P500k x 50%) (Php 20,000.00) Sale of Jewellery (P800k-750k x 100%) 50,000.00 Sale of car (P450k-P560k x 100%) (110,000.00) Sale of shares of stock (P1.2M-P1M x 50%) 100,000.00 NET CAPITAL GAIN Php 20,000.00 B paid to produce the Php 5M, hence, to him by A in which case he lost the Php 100,000.00 The Php 20,000.00 net Capital Gain is to be added to the taxable income from business of X in 2013. In this case A realized a Capital Gain of Php 100,000.00 while B sustained a Capital Loss of Php 100,000.00 B. (2) Gains or losses attributable to the failure to exercise privileges or options to buy or sell property shall be considered as capital gains or losses. The same facts in (A) except that the Car was sold at Php 350,000.00 instead of Php 450,000.00 and that the taxable income of X from his business in 2013 was Php 50,000.00. Compute the Net Capital Gain or Net Capital Loss Ex a m ple : A, a dealer in securities, is expecting that 60 days from now, the market price of the shares of stock of Corp. X will decline at 10%, more or less. The current market price or quoted price of said shares is Php 1,000.00 per share and he offered to sell 1,000 shares to his client B at a price of Php 1,000.00 per share on condition that A will deliver the shares of stock to B on Dec. 11, Solu t ion : Sale of investment in bonds (P460k-P500k x 50%) (Php 20,000.00) Sale of Jewellery (P800k-750k x 100%) 50,000.00 Sale of car (P350k-P560k x 100%) (210,000.00) Sale of shares of stock (P1.2M-P1M x 50%) 100,000.00 NET CAPITAL LOSS (Php 80,000.00) 73 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 The net capital loss of Php 80,000.00 is not deductible from the taxable income of X in 2013 but may be carried over in 2014 as a short-term capital loss (100%) deductible from Capital Gains in 2014 if any. The amount which can be carried over as short-term capital loss in 2014 is the Net Capital Loss in 2013 or the taxable income in 2013 whichever is lower, hence, the net capital loss carried over is Php 50,000.00 their loans with the bank should be treated as “ordinary assets” (these fall under Section 39 (A,1) “other property of a kind which would properly be included in the inventory of the taxpayer”) of the bank and, therefore, the sale thereof will not be subject to CGT imposed under Section 27 (D,5) N OTE: If X’s capital asset transactions in 2013 include Sale of Shares of Stock in a domestic corporation not traded in Stock Exchange and Sale of Real Property located in the Philippines classified as Capital Asset they are not included in the computation of Net Capital Gain or Net Capital Loss because they are subject to final tax. In other words sale of shares of stock in a domestic corporation not traded in stock exchange and sale of real property located in the Philippines classified as Capital Assets are not covered by Section 39. • If the taxpayer sells or exchanges any of the properties enumerated, any gain or loss relative thereto is an ordinary gain or loss; the gain or loss from the sale or exchange of all other properties of the taxpayer is a capital gain or a capital loss Subdivision lots are considered ordinary assets since they are properties held primarily for sale to customers in the ordinary course of trade or business, under Subsection (A) Properties which have remained vacant and idle since acquisition for the past 3 years and have been recorded in the books of the corporation as an investments on real estate, do not fall under any of the assets enumerated under Subsection (A)(1) and are properly classified as capital assets; hence, their sale is subject to the 6% CGT. Property not actually used in trade or business of the taxpayer, or is not held for lease or sale to customers is a capital asset o Sh or t - t e r m ca pit a l a sse t s (100%) are those which have been held by the taxpayer for 12 months or less o Lon g- t e r m ca pit a l a sse t s (50%) are those which have been held by the taxpayer for more than 12 months • An e qu it y in vest m e n t (investment in the form of shares of stock) is a capital, not ordinary, asset of the investor the sale or exchange of which results in either a capital gain or a capital loss. Thus, shares of stock, like other securities defined in the Tax Code would be an ordinary asset only to a dealer in securities or a person engaged in the purchase and sale of, or an active trader in securities. • In order that capital gain or loss may be recognized, the requisites are: o Transaction must involve property classified as capital asset o Transaction must be a sale or exchange or one considered as equivalent to a sale or exchange • In the case of individual taxpayers, the following are the rules on the recognition of capital gains or losses from the disposition of personal property classified as capital asset: o Percentages (100% (short-term, 12 months or less) or 50%(longterm, more than 12 months)) of gain or loss to be taken into account o Capital losses shall be deducted only to the extent of the capital gains o Ordinary losses are deductible from ordinary gains but net capital loss cannot be deducted from ordinary gain or income o “Net capital loss carry-over” is allowed during the subsequent year only [Mem!] Ca pit al Asse t s include all property held by the taxpayer whether or not connected with trade or business but not including those enumerated in Subsection (A,1) as ordinary asset s. The law defines the term by exclusion or exceptions. In other words, if an asset does not fall into one of these exceptions, then it is a capital asset o The expropriation of property classified as a capital asset is subject to CGT except Expropriation under the CARL and DST based on the amount of just compensation pursuant to Rev. Memo. Cir. No. 41-91 and Section 196, respectively [VIP!] NOTE: Capital gains derived by individuals from the sale or other disposition of real property located in the Philippines and classified as Capital Asset is subject to the final tax on capital gains (6% of gross selling price or fair market value under Section 24D (the holding period rule does not apply)) Real and other properties owned or acquired by a bank usually through foreclosures, other than those used for banking purposes held in the investment portfolio, acquired in settlement of loans and/or for other reasons, most of which were acquired through foreclosure of collaterals of client borrowers who were unable to pay • In the case of corporate taxpayers, the “net capital loss carry-over” is not applicable. There is no holding period. Capital gains and losses are recognized to the extent of 100% regardless of the holding period 74 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • • account as a principal and holding himself out as lessor of real properties being rented out or offered for rent The following are considered as sales or exchanges of capital assets: o Retirement of bonds o Short sales of property o Failure to exercise privilege or option to buy or sell o Securities becoming worthless o Distribution in liquidation of corporations All real properties of the real estate lessor, whether land and/or improvements, which are for lease/rent or being offered for lease/rent, or otherwise for use or being used in the trade or business shall likewise be considered as ordinary assets A sh or t sa le is a transaction in which the seller sells securities which he does not currently own and, therefore, cannot himself supply the securities for delivery, in expectation of the decline in their price o o The seller in this case is a mere speculator. To complete the transaction, the seller must borrow the property (this is true ONLY if the buyer does not agree that the delivery will be in the future). For tax purposes, a short sale does not give rise to profit or loss until the delivery to the lender of the securities acquired by the taxpayer to cover the sale. In other words, the determination of the gain or loss to be recognized would not be made until the borrowed property is repaid. Should the price of the securities go up, he incurs a loss; otherwise, he makes a gain. Gain or loss on short sales is always a short-term capital gain or loss. • An opt ion is property which is in the hands of a taxpayer who does not deal in options may be considered a capital asset. Thus, where a corporation leased from another certain properties with option to buy them, which option was later assigned to a third corporation, the gain derived from the sale or assignment of the option by the first corporation is a capital gain. • [BAR!] [VVIP!] Guidelines in determining whether a particular real property is a capital asset or ordinary asset 1. A property purchased for future use in the business, even though his purpose is later thwarted by circumstances beyond the taxpayer’s control, does not lose its character as an ordinary asset. Nor does a mere discontinuance of the active use of the property change its character previously established as a business property or ordinary asset 2. Ta x pa ye r n ot en ga ge d in t he r e al e st a te bu sin ess – In case of a taxpayer not engaged in the real estate business but is engaged in other business, real properties whether land, building, or other improvements, which are used or being used or have been previously used in the trade or business of the taxpayer shall be considered as ordinary assets. These include buildings and/or improvements subject to depreciation and lands used in the trade or business of the taxpayer 3. In the case of a taxpayer who changed its real estate business to a non-real estate business, or who amended its Articles of Incorporation from a real estate business to a non-real estate business, such as a holding company, manufacturing company, trading company, etc., the change of business or amendment of the primary purpose of the business shall not result in the re-classification of real property held by it from ordinary asset to capital asset 4. In the case of subsequent non-operation by taxpayers originally registered to be engaged in the real estate business, all real properties originally acquired by it shall continue to be treated as ordinary assets 5. Real properties formerly forming part of the stock in trade of a taxpayer engaged in the real estate business, or formerly being used in the trade or business of a taxpayer engaged or not engaged in the real estate business, which were later on abandoned and became idle, shall continue to be treated as ordinary assets. 6. Real properties classified as capital or ordinary asset in the hands of the seller/transferor may change their character in the hands of the buyer/transferee. Classification of such property in the hands of the buyer/transferee shall be determined in accordance with the following rules: Ta x pa ye r s en ga ge d in t he re a l e st a t e busine ss a. Re a l e st a t e de a le r – it shall refer to any person engaged in the business of buying and selling or exchanging real properties on his own account as a principal and holding himself out as a full or part-time dealer in real estate. All real properties acquired by the real estate dealer shall be considered as ordinary assets b. c. Re a l e st a te de velope r – it shall refer to any person engaged in the business of developing real properties into subdivisions, or building houses on subdivided lots, or constructing residential or commercial units, townhouses and other similar units for his own account and offering them for sale or lease a. Re a l est a t e le ssor – it shall refer to any person engaged in the business of leasing or renting real properties on his own 75 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) Real property transferred through succession or donation to the heir or done who is not engaged in the real estate business with respect to the real property inherited or donated, and who does not subsequently use such property in lOMoARcPSD|12553117 trade or business, shall be considered as a capital asset in the hands of their heir or done b. 7. • classified as ordinary asset, regardless of the classification thereof, all of which are located in the Philippines, shall be subject to ordinary income tax (30%) under Section 27(A) of the Tax Code Real property received as dividend by the stockholders who are not engaged in the real estate business and who do not subsequently use such real property in trade or business shall be treated as capital assets in the hands of the recipients even if the corporation which declared the real property dividend is engaged in real estate business c. In the case of involuntary transfers of real properties, including expropriation or foreclosure sale, the involuntariness of such sale shall have no effect on the classification of such real property in the hands of the involuntary seller, either as capital asset or ordinary asset, as the case may be [VVIP!] 1. In the case of individual citizens (including estates and trusts), resident aliens, and non-resident aliens engaged in trade or business in the Philippines a. Capital gains presumed to have been realized from the sale, exchange of real property located in the Philippines, classified as capital assets, shall be subject to the 6% CGT based on the gross selling price or fair market value as determined in accordance with Section 6(E), whichever is higher b. 2. 3. The sale of real property located in the Philippines, classified as ordinary assets, shall be subject to ordinary income tax imposed under Section 24(A)(1)(c) (seller is RC, NRC or RA) or 25(A)(1) (seller is non-resident alien engaged), as the case may be, based on net taxable income (GSP or FMV or FMV, whichever is highest MINUS cost or other basis) In the case of non-resident aliens not engaged in trade or business in the Philippines – Capital gains presumed to have been realized by nonresident aliens not engaged in trade or business in the Philippines on the sale of real property located in the Philippines classified as Capital Asset shall be subject to 6% CGT imposed under Section 25(B), in relation to Section 24(D)(1), based on the GSP or FMV as determined in accordance with Section 6(E), whichever is higher b. Capital gains presumed to have been realized from the sale of lands and/or buildings located in the Philippines, which are classified as capital assets, shall be subject to a CGT of 6% based on the GSP or FMV as determined in accordance with Section 6(E), whichever is higher, of such land and/or building The sale of land/or building classified as ordinary asset and other real property such as machinery and equipment also 4. I n ca se of re side n t for eign cor por a t ion s – real property located in the Philippines, regardless of classification, sold by a resident foreign corporation shall be subject to the ordinary income tax (30%) under Section 28(A)(1) 5. I n t he case of n on - r e side n t fore ign cor por a t ion – the gain fro the sale or real property located in the Philippines regardless of classification by a non-resident foreign corporation shall be subject to final tax at the rate of 30% 6. [VIP!] Gain realized from the sale or real property not located in the Philippines, regardless of classification, by resident citizens, or domestic corporations shall be subject to the ordinary income tax imposed on Section 24(A)(1) (seller is Resident Citizen), or Section 27(A) (seller is Domestic Corporation) or (E), as the case may be. Such income/gain shall be exempt (because these tax payers are taxable only on income from sources within the Philippines) in the case of non-resident citizens, alien individuals whether Resident or Nonresident and foreign corporations whether Resident or Non-resident • In the case of foreclosed real property, the tax is due if it is not redeemed within the redemption of 1 year period. No CGT is due in case of redemption because there is no sale or conveyance of property. • The conversion of common shares of a corporation to redeemable preferred shares will not be subject to CGT, since the holders merely change the form of their shareholdings, and they do not realize any gain or economic benefit therefrom • Real property acquired through dacion en pago in payment of a debtor’s loan obligation does not result in the acquisition of an ordinary asset; hence, the sale thereof is subject to the 6% CGT • Land which has remained vacant, idle, unproductive and unimproved since its acquisition is a capital asset even in the hands of a real estate company. As such, the sale thereof is subject to the 6% final CGT and DST. • Real property, which had been previously leased but has become and been abandoned and idle for 4 years now, can be considered a capital asset, the sale of which will be subject to 6% CGT • Real properties transferred by a taxpayer engaged in real estate business to a taxpayer who is not engaged in real estate business and who will not In the case of domestic corporations a. Sale of real property, other than land and building, classified as Capital Asset shall be included in determining Net Capital Gain or Net Capital Loss 76 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 use said properties in the ordinary course of its trade or business are considered capital assets in the hands of the transferee • donation) or the last preceding owner (there are at least 2 donations) by whom it was not acquired by gift, ex ce pt that if such basis is greater than the fair market value of the property at the time of the gift then, for the purpose of determining loss, the basis shall be such fair market value; or Real properties classified as ordinary assets for being used in business by a taxpayer who is not engaged in real estate business are automatically converted into capital assets, upon showing proof that the same have not been used in business for more than 2 years prior to the consummation of the transaction involving said properties. As such, the sale thereof is subject to CGT but not to the 12% VAT • Sale of factory, building, machinery, and equipment originally intended for use in business but not used because of the taxpayer’s failure to commence business operations is subject to the CGT because the properties are considered capital asset • [Impt!] The sale of real property located in the Phils. classified as CA by a company through auction sale/public bidding is subject to CGT based on the highest or winning bid price even if the zonal valuation of the real property is higher than the winning bid price. Such sale is among the exceptions to the use of the zonal valuation as the tax base in computing the CGT [For the purpose of determining the gain, the basis shall be the same as if it would be in the hands of the donor who did not acquire it by gift] Ex a m ple : A. In 2003, A purchased a Rolex Watch at a cost of Php 500,000.00. In 2011, when the FMV of the watch was Php 700,000.00, A donated the watch to B. In 2013, B sold the watch to C for Php 800,000.00. How much is the Capital Gain or Capital Loss? Solu t ion : Selling Price LESS: Basis Capital Gain B. SEC. 4 0 . Det erm inat ion of Am ount and Recognit ion of Gain or Loss. – (A) Com put at ion of Gain or Loss. - The gain from the sale or other disposition of property shall be the excess of the amount realized therefrom (selling price) over the basis (such as cost) or adjusted basis (such as cost increased by capital expenditures and decreased by depreciation) for determining gain, and the loss shall be the excess of the basis or adjusted basis for determining loss over the amount realized. The amount realized from the sale or other disposition of property shall be the sum of money received plus (if payment is partly in money and partly in kind) the fair market value of the property (other than money) received; In 1997, A purchased from Corporation X, a domestic corporation, shares of stock not traded in stock exchange at a cost of Php 1M. In 2002, A donated said shares of stock to B when their FMV as Php 2M. In 2010, B donated said shares of stock to C when their FMV was Php 3.5M. In 2013, C sold said shares to D for Php 4,000,000.00. How much is the Capital Gain or Capital Loss? Solu t ion : Selling Price LESS: Basis Capital Gain C. [Not applicable to capital gain on sale of real property located in the Philippines classified as capital asset because what is taxable is the GSP or FMV or FMV, whichever is highest, therefore cost and other basis is irrelevant, except if the taxpayer opted to treat the sale under Section 24A] D. (1) The cost thereof in the case of property acquired on or after March 1, 1913, if such property was acquired by purchase; or (2) The fa ir m a r k e t pr ice or value as of the date (of death of the predecessor) of acquisition, if the same was acquired by inheritance; or Php 250,000.00 350,000.00 Php 100,000.00 In 2009, A purchased from Corp. X, a domestic corporation, shares of stock not traded in stock exchange at a cost of Php 2M. In 2020, A donated said shares of stock to B when their FMV was Php 1.8M. In 2013, B sold said shares of stock to C for Php 2.2M. How much is the Capital Gain or Capital Loss? Solu t ion : Selling Price LESS: Basis Capital Gain (3) If the property was acquired by gift (or donation), the basis shall be the same as if it would be in the hands of the donor (only one Php 4,000,000.00 1,000,000.00 Php 3,000,000.00 In 2009, A purchased a car at a cost of Php 500,000.00. In 2010, when the FMV of said car was Php 350,000.00, A donated it to B. In 2013, B sold the car to C for Php 250,000.00. How much is the Capital Gain or Capital Loss? Solu t ion : Selling Price LESS: Basis Capital Loss (B) Basis for Det erm ining Gain or Loss fr om Sale or Disposit ion of Propert y . The basis of property shall be – Php 800,000.00 500,000.00 Php 300,000.00 77 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) Php 2,200,000.00 2,000,000.00 Php 200,000.00 lOMoARcPSD|12553117 (3) Ex change Not Solely in Kind. – (4) If the property was acquired for less than an adequate consideration in money or money's worth, the basis of such property is the amount paid by the t r a n sfe re e (who is now the seller) for the property; or Ex a m ple : A piece of land owned and used 2M was sold by A to his son B likewise used in his business. 3 Php 3M which is the same as its of B? Solu t ion : Selling Price LESS: Basis Ordinary Gain (a) If, in connection with an exchange described in the above exceptions, an individual, a shareholder, a security holder or a corporation receives not only stock or securities permitted to be received without the recognition of gain or loss, but also money and/or property, the gain, if any, but not the loss, shall be recognized but in an amount not in excess of the sum of the money and fair market value of such other property received: Provided, That as to the shareholder, if the money and/or other property received has the effect of a distribution of a taxable dividend, there shall be taxed as dividend to the shareholder an amount of the gain recognized not in excess of his proportionate share of the undistributed earnings and profits of the corporation; the remainder, if any, of the gain recognized shall be treated as a capital gain. by A in his business with FMV of Php for Php 500,000.00 which the latter years later, B sold said land to C for FMVs. How much is the ordinary gain Php 3,000,000.00 500,000.00 Php 2,500,000.00 (b) If, in connection with the exchange described in the above exceptions, the transferor corporation receives not only stock permitted to be received without the recognition of gain or loss but also money and/or other property, then (i) if the corporation receiving such money and/or other property distributes it in pursuance of the plan of merger or consolidation, no gain to the corporation shall be recognized from the exchange, but (ii) if the corporation receiving such other property and/or money does not distribute it in pursuance of the plan of merger or consolidation, the gain, if any, but not the loss to the corporation shall be recognized but in an amount not in excess of the sum of such money and the fair market value of such other property so received, which is not distributed. (5) The basis as defined in paragraph (C)(5) of this Section, if the property was acquired in a transaction where gain or loss is not recognized under paragraph (C)(2) of this Section. (C) Ex ch an ge of Pr ope r t y. – (1) General Rule. - Except as herein provided, upon the sale or exchange of property, the entire amount of the gain or loss, as the case may be, shall be recognized. (2) Ex ce pt ion . - No gain or loss shall be recognized if in pursuance of a plan of merger or consolidation – (a) A corporation, which is a party to a merger or consolidation, exchanges property solely for stock in a corporation, which is a party to the merger or consolidation; or (4) Assum pt ion of Liabilit y . – (a) If the taxpayer, in connection with the exchanges described in the foregoing exceptions, receives stock or securities which would be permitted to be received without the recognition of the gain if it were the sole consideration, and as part of the consideration, another party to the exchange assumes a liability of the taxpayer, or acquires from the taxpayer property, subject to a liability, then such assumption or acquisition shall not be treated as money and/or other property, and shall not prevent the exchange from being within the exceptions. (b) A shareholder exchanges stock in a corporation, which is a party to the merger or consolidation, solely for the stock of another corporation also a party to the merger or consolidation; or (c) A se cu rit y h olde r (such as bond holder) of a corporation, which is a party to the merger or consolidation, exchanges his securities in such corporation, solely for stock or securities in such corporation, a party to the merger or consolidation. [BAR!] No gain or loss shall also be recognized if property is transferred to a corporation by a person in exchange for stock or unit of participation in such a corporation of which as a result of such exchange said person, alone or together with others, not exceeding four (4) persons, gains control of said corporation: Provided, That stocks issued for services shall not be considered as issued in return for property. (b) If the amount of the liabilities assumed plus the amount of the liabilities to which the property is subject exceed the total of the adjusted basis of the property transferred pursuant to such exchange, then such excess shall be considered as a gain from the sale or exchange of a capital asset or of property which is not a capital asset, as the case may be. (5) Basis – 78 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (d) The Secretary of Finance, upon recommendation of the Commissioner, is hereby authorized to issue rules and regulations for the purpose 'substantially all' and for the proper implementation of this Section. (a) The basis of the stock or securities received by the transferor upon the exchange specified in the above exception shall be the same as the basis of the property, stock or securities exchanged, decreased by (1) the money received, and (2) the fair market value of the other property received, and increased by (a) the amount treated as dividend of the shareholder and (b) the amount of any gain that was recognized on the exchange: Provided, That the property received as 'boot' shall have as basis its fair market value: Provided, further, That if as part of the consideration to the transferor, the transferee of property assumes a liability of the transferor or acquires form the latter property subject to a liability, such assumption or acquisition (in the amount of the liability) shall, for purposes of this paragraph, be treated as money received by the transferor on the exchange: Provided, finally, That if the transferor receives several kinds of stock or securities, the Commissioner is hereby authorized to allocate the basis among the several classes of stocks or securities. • The gain or loss may be computed with the use of the following formula: Selling price of the property LESS: Basis_____________ Gain (or loss) from sale The “adjusted basis” of the property disposed of is its original cost adjusted to the date of its disposition the adjustment may consist of adding capital expenditures (e.g. improvements) made to the property and deducting capital recoveries (e.g. depreciation) • (b) The basis of the property transferred in the hands of the transferee shall be the same as it would be in the hands of the transferor increased by the amount of the gain recognized to the transferor on the transfer. [VIP!] Ba sis of t h e pr ope r t y – it depends primarily on the manner in which the taxpayer acquired the property 1. Pr ope r t y a cqu ire d by pu r ch ase – its cost, the purchase price plus expense of acquisition (such as transportation, insurance and handling cost) 2. Pr ope r t y a cqu ire d by in he r it an ce – its fair market price or value as of the date of acquisition (date of death of the previous owner) of the same 3. Pr ope r t y a cqu ire d by gift or don a t ion – the basis to the transferee (who is not the transferor) shall be the same as if it would be in the hands of the donor or last preceding owner who acquired it not by gift, but if such basis is greater than the FMV of the property at the same time of donation, then for the purpose of determining loss, the basis shall be such value 4. Pr ope r t y a cqu ire d for le ss t ha n a n a de qua t e con side r a t ion – the basis is the amount paid by the transferee (who is not the transferor) for the property (6) Definit ions. – (a) The term 'securities' means bonds and debentures but not 'notes" of whatever class or duration. (b) The term 'merger' or 'consolidation', when used in this Section, shall be understood to mean: (i) the ordinary merger or consolidation, or (ii) the acquisition by one corporation of all or substantially all the properties of another corporation solely for stock: Provided, That for a transaction to be regarded as a merger or consolidation within the purview of this Section, it must be undertaken for a bona fide business purpose and not solely for the purpose of escaping the burden of taxation: Provided, further, That in determining whether a bona fide business purpose exists, each and every step of the transaction shall be considered and the whole transaction or series of transaction shall be treated as a single unit: Provided, finally , That in determining whether the property transferred constitutes a substantial portion of the property of the transferor, the term 'property' shall be taken to include the cash assets of the transferor. • The gain or loss in an exchange of property is measured by the difference between the fair market value of the property received and the cost or basis of the property given in exchange • Illustration for Subsection (C, 2, a and b) X Corporation transfers all its assets and liabilities to Y Corporation in exchange for the latter’s shares of stock; Y shares are issued to X stockholders solely in exchange for their stock-holdings in X. As a result, Y becomes the surviving corporation and X ceases to exist or is dissolved (c) The term 'control', when used in this Section, shall mean ownership of stocks in a corporation possessing at least fiftyone percent (51%) of the total voting power of all classes of stocks entitled to vote. This reorganization is a merger within the contemplation of Subsection (C,2). Accordingly, the transfer by X of all its assets and liabilities to Y solely in exchange for the latter’s shares shall not give rise to the 79 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • recognition of gain or loss. No gain or loss shall be recognized by X upon the distribution of Y shares to X stockholders in complete liquidation of their stock, and by X stockholders upon the exchange of their stocks solely for Y stocks • The present law and the implementing regulations permit a taxpayer to use any method of inventory valuation, provided it conforms as nearly as possible to the best accounting practice in the trade or business and it must clearly reflect income. It is recognized that inventory rules can not be uniform but must give effect to trade customs which come within the scope of the best accounting practice in the particular trade or business Illustration for second paragraph in Subsection (C, 2, c) A and B assigned or conveyed to X Corporation real properties in payment for the stocks of X; after the exchange, and as a result of such exchange, A and B gained control (or further control) of X. Accordingly, no gain or loss shall be recognized by both transferors (A and B) and the transferee (X) Ex a m ple : A, who is engaged in merchandising business, has 1,000 units of merchandise at a cost of Php 1,000.00 per unit as of Jan. 1, 2013. During the year 2013 A purchased 12,000 units at Php 1,050.00 per unit. During 2013 A was able to sell 12,000 units, hence, his inventory as of Dec. 31, 2013 is 1,000 units. How much is the inventory as of Dec. 31, 2013? SEC. 4 1 . I nvent ories. - Whenever in the judgment of the Commissioner, the use of inventories is necessary in order to determine clearly the income of any t a x pa yer (engaged in merchandising business or manufacturing or sale of real properties such as real estate developer), inventories shall be taken by such taxpayer upon such basis as the Secretary of Finance, upon recommendation of the Commissioner, may, by rules and regulations, prescribe as conforming as nearly as may be to the best accounting practice in the trade or business and as most clearly reflecting the income. If a taxpayer, after having complied with the terms and conditions prescribed by the Commissioner, uses a particular method of valuing its inventory for any taxable year, then such method shall be used in all subsequent taxable years (Principle of Consistency) u nle ss: (i.) with the approval of the Commissioner, a change to a different method is authorized; or (ii.) the Commissioner finds that the nature of the stock on hand (e.g., its scarcity, liquidity, marketability and price movements) is such that inventory gains should be considered realized for tax purposes and, therefore, it is necessary to modify the valuation method for purposes of ascertaining the income, profits, or loss in a move realistic manner: Provided, how ever, That the Commissioner shall not exercise his authority to require a change in inventory method more often than once every three (3 years: Provided, furt her, That any change in an inventory valuation method must be subject to approval by the Secretary of Finance. • [Mem!] I n ven t or y is an itemized list of goods or merchandise on hand (not yet sold) at the end of the tax period or accounting period in a business containing a designation or description of each specific article with its valuation • Re qu ire m e n t s which each inventory must meet The bases of valuation which are commonly used in business concerns and are acceptable for purposes of the income tax law are: 1. Cost price 2. Cost or market price, whichever is lower a. If A is using the cost method of valuing his inventory the amount of his inventory as of Dec. 31, 2013 is (1,000 x Php1,050.00) Php 1,050,000.00 b. If A is using cost or market whichever is lower and the current market price of the merchandise as of Dec. 31, 2013 is Php1,030.00 per unit his inventory as of Dec. 31, 2013 is (1,000 x Php1,030.00) Php 1,030,000.00. Under the cost or market whichever is lower method the value of the inventory is the cost or current market price, whichever is lower. SEC. 4 2 . I ncom e fr om Sources Wit hin t he Philippines.- [Sometimes called Situs of Taxation] (A) Gr oss I n com e From Sources Wit hin t he Philippines. - The following items of gross income shall be treated as gross income from sources within the Philippines: (1) I n t e r est s. - Interests derived from sources within (such as interest income from bank deposits in the Philippines) the Philippines, and interests on bonds, notes or other interest-bearing obligation of residents (if the person paying the interest is a resident of the Philippines the interest income of the recipient is from sources within the Philippines regardless of place where the instrument is located, place where the transaction took place or place where the payment is made), corporate or otherwise; (2) D ivide n ds. - The amount received as dividends: 1. It must conform as nearly as possible to the best accounting practice in the trade or business; a n d (a) From a domestic corporation; and 2. It must clearly reflect the income (b) From a foreign corporation (resident), u nle ss less than fifty percent (50%) of the gross income of such foreign corporation 80 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 for the three-year period ending with the close of its taxable year preceding the declaration of such dividends (or for such part of such period as the corporation has been in existence) was derived from sources within the Philippines as determined under the provisions of this Section; but only in an amount which bears the same ratio to such dividends as the gross income of the corporation for such period derived from sources within the Philippines bears to its gross income from all sources. (3) Se r vice. - Compensation for labor or personal services performed in the Philippines; [If the services are performed partly within and partly outside the Philippines and there is no accurate allocation, the allocation of the compensation income shall be on the basis of number of days] (4) Re n t a ls a n d Roya lt ie s. (The source of rent income is from within the Philippines if the property rented is located in the Philippines. The source of royalty income is from within the Philippines if the right or privilege is exercised in the Philippines such as in case of royalty on patented invention the manufacturing or production activity is done in the Philippines) - Rentals and royalties (the right or privilege is exercised in the Philippines) from property located in the Philippines or from any interest in such property, including rentals or royalties for – Ex a m ple : 1. Corp. X, a resident foreign corporation, declared cash dividend on Jan. 30, 2013 out of its earnings in 2010. A, one of the stockholders of Corp. X who is a resident alien, received from said corporation cash dividend of Php 500,000.00. For the years 2010, 2011 and 2012 the gross income of said corporation follows: Philippines Other Countries WORLD GROSS INCOME (a) The use of or the right or privilege to use in the Philippines any copyright, patent, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; Php 6,000,000,000.00 4,000,000,000.00 Php 10,000,000,000.00 If the gross income of the RFC in the Philippines is 50% or more of the WGI, the entire dividend received by a stockholder is from within the Philippines, hence, there is no apportionment. Therefore, the entire Php 500,000.00 cash dividend received by A is from sources within the Philippines and is taxable under Section 24(A) and not FT of 10% under Section 24(B,2). Because the final tax of 10% on dividends is applicable only to dividends from a DC. 2. (b) The use of, or the right to use in the Philippines any industrial, commercial or scientific equipment; (c) The supply of scientific, technical, industrial or commercial knowledge or information; (d) The supply of any assistance that is ancillary and subsidiary to, and is furnished as a means of enabling the application or enjoyment of, any such property or right as is mentioned in paragraph (a), any such equipment as is mentioned in paragraph (b) or any such knowledge or information as is mentioned in paragraph (c); The same facts in #1 except that the gross income in the Philippines is Php 4B while the gross income in other countries is Php 6B. If the gross income of the RFC in the Philippines is less than 50% of the WGI, the dividend received by a stockholder shall be apportioned partly within and partly without the Philippines in proportion to the gross income of the RFC from within and from without the Philippines. Therefore, out of the Php 500,000.00 cash dividend received by A only (Php 4B ÷ Php 10B) 40% or Php 200,000.00 is from sources within the Philippines and is taxable under Section 24(A) not final tax of 10%. 60% of the Php 500,000.00 or Php 300,000.00 is from sources without the Philippines and is not taxable in the Philippines because a resident alien is taxable only on income from sources within the Philippines. (e) The supply of services by a nonresident person or his employee in connection with the use of property or rights belonging to, or the installation or operation of any brand, machinery or other apparatus purchased from such nonresident person; (f) Technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme; and (g) The use of or the right to use: (h) Motion picture films; 3. The same facts in #2 except that A is an RC, apportionment is not necessary because A is taxable on his income from all sources, hence, the Php 500,000.00 is taxable under Section 24(A) and not final tax of 10%. (i) Films or video tapes for use in connection with television; and (ii) Tapes for use in connection with radio broadcasting. 81 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (4) Re n t a ls or royalties from property located without the Philippines or from any interest in such property including rentals or r oya lt ie s for the use of or for the privilege of using without the Philippines, patents, copyrights, secret processes and formulas, goodwill, trademarks, trade brands, franchises and other like properties; and (5) Sa le of Re a l Pr ope r t y. - gains, profits and income from the sale of real property located in the Philippines; and (6) Sa le of Pe r son a l Pr ope r t y. - gains; profits and income from the sale of personal property, as determined in Subsection (E) of this Section. (5) Gains, profits and income from the sale of real property located without the Philippines. (B) [Read!] Ta x a ble I n com e From Sources Wit hin t he Philippines. – (D) Tax able I ncom e From Sources Wit hout t he Philippines. - From the items of gross income specified in Subsection (C) of this Section there shall be deducted the expenses, losses, and other deductions properly apportioned or allocated thereto and a ratable part of any expense, loss or other deduction which cannot definitely be allocated to some items or classes of gross income. The remainder, if any, shall be treated in full as taxable income from sources without the Philippines. (1) General Rule. - From the items of gross income specified in Subsection (A) of this Section, there shall be deducted the expenses, losses and other deductions properly allocated thereto and a ratable part of expenses, interests, losses and other deductions effectively connected with the business or trade conducted exclusively within the Philippines which cannot definitely be allocated to some items or class of gross income: Provided, That such items of deductions shall be allowed only if fully substantiated by all the information necessary for its calculation. The remainder, if any, shall be treated in full as taxable income from sources within the Philippines. (E) I n com e Fr om Sou r ce s Pa r t ly W it h in and Pa r t ly W it h ou t t h e Ph ilippine s.- Items of gross income, expenses, losses and deductions, other than those specified in Subsections (A) and (C) of this Section, shall be allocated or apportioned to sources within or without the Philippines, under the rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. Where items of gross income are separately allocated to sources within the Philippines, there shall be deducted (for the purpose of computing the taxable income therefrom) the expenses, losses and other deductions properly apportioned or allocated thereto and a ratable part of other expenses, losses or other deductions which cannot definitely be allocated to some items or classes of gross income. The remainder, if any, shall be included in full as taxable income from sources within the Philippines. In the case of gross income derived from sources partly within and partly without the Philippines, the taxable income may first be computed by deducting the expenses, losses or other deductions apportioned or allocated thereto and a ratable part of any expense, loss or other deduction which cannot definitely be allocated to some items or classes of gross income; and the portion of such taxable income attributable to sources within the Philippines may be determined by processes or formulas of general apportionment prescribed by the Secretary of Finance. Ga in s, pr ofit s an d incom e from the sale of personal property produced (or manufactured) (in whole or in part) by the taxpayer within the Philippines and sold without the Philippines, or produced (or manufactured) (in whole or in part) by the taxpayer without the Philippines and sold within the Philippines, shall be treated as derived partly from sources within and partly from sources without the Philippines. (2) Except ion. - No deductions for interest paid or incurred abroad shall be allowed from the item of gross income specified in subsection (A) unless indebtedness was actually incurred to provide funds for use in connection with the conduct or operation of trade or business in the Philippines. (C) [Impt!] Gr oss I n com e From Sources Wit hout t he Philippines. - The following items of gross income shall be treated as income from sources without the Philippines: (1) I n t e r est s (if the person paying the interest is a non-resident, the interest income of the recipient is from sources outside the Philippines regardless of place where the instrument is located, place where the transaction took place or place where the payment is made) other than those derived from sources within the Philippines as provided in paragraph (1) of Subsection (A) of this Section; (2) D ivide n ds (if the gross income of the RFC in the Philippines is less than 50% of the WGI portion of the dividend received by a stockholder is from sources without or outside the Philippines. If the dividend received by a stockholder is from a non-resident foreign corporation the entire dividend is from sources outside the Philippines) other than those derived from sources within the Philippines as provided in paragraph (2) of Subsection (A) of this Section; (3) Com pe n sa t ion for la bor without the Philippines; or pe r son al se rvices [50% of the gain or profit or income is from within and 50% thereof is from without] Ga in s, pr ofit s an d in com e derived from the purchase of personal property within the Philippines and its sale without the Philippines, or from the purchase of personal property without the Philippines and its sale within the Philippines shall be treated as derived entirely from sources within the country in which sold: Pr ovide d, h ow e ve r , That gain from the sale of shares of stock in a domestic corporation shall be treated as derived performed 82 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 entirely form sources within the Philippines regardless of where the said shares are sold. The transfer by a nonresident alien or a foreign corporation to anyone of any share of stock issued by a domestic corporation shall not be effected or made in its book unless: (1) the transferor has filed with the Commissioner a bond conditioned upon the future payment by him of any income tax that may be due on the gains derived from such transfer, or (2) the Commissioner has certified that the taxes, if any, imposed in this Title and due on the gain realized from such sale or transfer have been paid. It shall be the duty of the transferor and the corporation the shares of which are sold or transferred, to advise the transferee of this requirement. • The determination of the source of income is important in view of the following: 1. Resident citizens, domestic corporations and estate or trust where the decedent was or the trustor is a resident citizen are taxable upon income derived from all sources 2. Non-resident citizens are taxed only on their income from sources within the Philippines 3. Aliens and foreign corporations, whether resident and non-resident, are liable to pay income tax only on their income from sources within the Philippines (F) Definit ions. - As used in this Section the words 'sale' or 'sold' include 'exchange' or 'exchanged'; and the word 'produced' includes 'created', 'fabricated,' 'manufactured', 'extracted,' 'processed', 'cured' or 'aged.' • Formulas • a. ���������� ����� ������ Cla ssifica t ion of incom e a s t o sou r ce – as to source, income under the Tax Code is classified into income which is derived: 1. 2. 3. b. In full from sources within the Philippines In full from sources outside the Philippines Partly from sources within and partly from outside the Philippines a. b. c. Dividend received from RFC if the GI in the Philippines of the said RFC is less than 50% of its WGI Compensation for labor or personal services performed partly within and partly without the Philippines Gain from sale of personal property produced or manufactured by the taxpayer within the Philippines and sold without the Philippines OR produced or manufactured by the taxpayer without the Philippines and sold within the Philippines • Te st of t h e t a x a bilit y of a n in com e – the test is the “source” or situs or place of the activities or property which produce the income and in the case of an income derived from labor (services) the factor which determines the sources of the income is not the residence of the payor or payer, or the place where the contract for the services is entered into, or the palce of payment but the place where the labor or service is actually rendered or performed. o Gains or profit derived from the sale of shares of stock of a domestic corporation, even if consummated abroad, should be deemed as income from Philippine sources. • [Impt!] The residence of the obligor (or debtor or payor) who pays the interest rather than the physical location of the securities, bonds or notes or the place of payment is the determining factor of the source of interest income. Accordingly, if the obligor is a resident of the Philippines, the interest payment paid by him can have no other source than within the Philippines Re siden t For e ign Cor por a t ion c. ����� ����� ������ × 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑖𝑛𝑐𝑜𝑚𝑒 = 𝐼𝑛𝑐𝑜𝑚𝑒 𝑤𝑖𝑡ℎ𝑖𝑛 𝑃ℎ𝑖𝑙𝑖𝑝𝑝𝑖𝑛𝑒 𝑠𝑜𝑢𝑟𝑐𝑒𝑠 Pe r son a l se r vice or la bor ��.�� ���� ����� ��� ��������� �� ��� ����� ����� ��.�� ���� ����� ��� ��������� × 𝑇𝑜𝑡𝑎𝑙 𝑐𝑜𝑚𝑝𝑒𝑛𝑠𝑎𝑡𝑖𝑜𝑛 𝑟𝑒𝑐𝑒𝑖𝑣𝑒𝑑 = 𝐼𝑛𝑐𝑜𝑚𝑒 𝑤𝑖𝑡ℎ𝑖𝑛 𝑃ℎ𝑖𝑙𝑖𝑝𝑝𝑖𝑛𝑒 𝑠𝑜𝑢𝑟𝑐𝑒𝑠 I n com e t a x for m u la for divide n ds fr om ou t side t he Ph ilippin es ������� ����� ������ ����� ����� ������ × 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑖𝑛𝑐𝑜𝑚𝑒 = Dividend income from source outside the Philippines Chapter 8 – Accounting Periods and Methods of Accounting SEC. 4 3 . General Rule. - The taxable income shall be computed upon the basis of the taxpayer's annual accounting period (fiscal ye a r or ca le n da r ye a r, as the case may be) in accordance with the method of accounting (such as Accrual Method, Cash Method, Hybrid Method, Percentage of Completion Method, Installment Method, etc.) regularly employed in keeping the books of such taxpayer, but if no such method of accounting has been so employed, or if the method employed does not clearly reflect the income, the computation shall be made in accordance with such method as in the opinion of the Commissioner clearly reflects the income. If the taxpayer's annual accounting period is other than a fiscal year, as defined in Section 22(Q), or if the taxpayer has no annual accounting period, or does not keep books, or if the taxpayer is an individual, estate or trust or GPP the taxable income shall be computed on the basis of the calendar year. [Only corporations and business or taxable or ordinary partnerships are allowed to adopt fiscal year accounting period] • There is no uniform method of accounting prescribed for all taxpayers. The law contemplates that each taxpayer shall adopt such forms and systems of accounting as are in his judgment best suited to his purpose 83 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • [Impt!] In general, any method of accounting may be employed, provided that it correctly reflects the income of the taxpayer for each taxable year • Pr in cipa l a ccou n t in g m e th ods 1. Ex a m ple : A is a stockholder in Corp. X and on April 2, 2014, the latter declared cash dividend payable on July 1, 2014. The cash dividend allotted to A is Php 1M. This Php 1M is taxable to A even if he did not withdraw cash dividend from Corp. X on July 1, 2014. In fact, the cash dividend is subject to final tax of 10% to be deducted from the Php 1M by the Corp. to be remitted to the BIR. Ca sh r ece ipt s an d disbur se m en t s m e t h od or ca sh ba sis – income earned by the taxpayer is not included in gross income until cash is received and expenses are not deducted until paid within the taxable year SEC. 4 4 . Period in w hich I t em s of Gross I ncom e I ncluded. - The amount of all items of gross income shall be included in the gross income for the taxable year in which received by the taxpayer, unless, under methods of accounting permitted under Section 43, any such amounts are to be properly accounted for as of a different period. In the case of the death of a taxpayer, there shall be included in computing taxable income for the taxable period in which falls the date of his death, amounts accrued up to the date of his death if not otherwise properly includible in respect of such period or a prior period. This method of accounting is generally used by taxpayers who do not keep regular books of accounts. Under this method, income is realized upon receipt of cash • • 2. Accr ua l ba sis – income is included in gross income when earned, whether cash is received or not, and expenses are allowed as deductions when incurred although not yet paid 3. H ybr id m e t h od – the taxpayer reports his income and expenses by employing the combination of cash and accrual methods SEC. 4 5 . Period for w hich Deduct ions and Credit s Taken. - The deductions provided for in this Title shall be taken for the taxable year in which 'paid or accrued' or 'paid or incurred', dependent upon the method of accounting the basis of which the net income is computed, unless in order to clearly reflect the income, the deductions should be taken as of a different period. In the case of the death of a taxpayer, there shall be allowed as deductions for the taxable period in which falls the date of his death, amounts accrued up to the date of his death if not otherwise properly allowable in respect of such period or a prior period. Spe cia l accoun t in g m e t h ods 1. Cr op ye a r basis which is applicable only to farmers engaged in the production of crops which takes more than a year from the time of planting to the process of gathering and disposal 2. Pe r cen t a ge of com ple t ion ba sis – in the case of long-term contract ([VIP!] NOTE: Contractors are no longer allowed to adopt the completion of contract basis) 3. Income over the term of the lease basis and income in the year of completion basis in the case of leasehold improvements 4. Deferred payment basis and instalments basis in the case of deferred payments sales • [VIP!] Re t u r n s t o be file d in ca se of dea t h of a n in dividu a l – in case an individual dies, the following tax returns shall be filed: 1. An income tax return covering the income and deductions of the decedent from January 1 to the date of his death shall be filed. Although the period covered by the return consists of less than 12 months, such period shall be considered as a “taxable year” pursuant to Section 22 (P) 2. If the settlement of the estate of the decedent is the object of judicial testimony or intestate proceedings I n com e con st ru ct ive ly r e ce ive d – income which is credited to the account of or set apart for a taxpayer and which may be drawn upon him at any time without any substantial limitation or condition upon which payment is to be made is subject to tax for the year during the income was credited or set apart, although not yet received or reduced to actual possession o D oct r in e of con st ru ct ive r e ce ipt of incom e is designed to prevent the exclusion from taxable income of items, the actual receipt of which could, at the option of a taxpayer on the cash basis, be deferred or indefinitely postponed (Purpose of the Doctrine) 3. An income tax return for the est a t e as a taxable person shall be filed by the fiduciary (such as executor or administrator) administrator. The estate’s income tax return (the taxpayer is the estate and is entitled to an exemption of Php 20,000.00 [Section 62]) shall cover the income and deductions of the estate for the period from the date immediately following the death of the decedent to the end of the taxable year. Thereafter, annually a return for the estate shall be filed until the estate is terminated (or partitioned among the heirs) In the case of an estate of the decedent, the settlement of which is the object of judicial testamentary or intestate proceedings, income of the properties left by the decedent is taxable directly to heirs or beneficiaries. Each heir or beneficiary must include in 84 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) not the the his lOMoARcPSD|12553117 • income tax return, his distributive share of the taxable income of the estate or co-ownership The personal and additional exemptions prescribed in Section 35 shall be allowed in full for the decedent and for the heirs/beneficiaries. The estate is likewise entitled to the exemption prescribed in Section 62. The taxpayer here is the deceased individual, hence, he is entitled to personal exemption of Php 50,000.00 and additional exemption of Php 25,000.00 per QDc, not exceeding 4, and this is true even if the taxpayer died, for example, on Jan. 31, Feb. 28, March 31, etc., because death of a taxpayer is deemed to occur at the end of the year (Sec. 35, C). Exemption may be availed of in full or not at all, because there is no partial exemption. SEC. 4 6 . Change of Account ing Period. If a t a x pa ye r (corporation), other than an individual, estate, trust and GPP, changes his its accounting period from fiscal year to calendar year, from calendar year to fiscal year, or from one fiscal year to another, the net income shall, with the approval of the Commissioner, be computed on the basis of such new accounting period, subject to the provisions of Section 47. • [Impt!] An individual, estate, trust and GPP cannot change his accounting period from the calendar year to the fiscal year. He or it is only allowed to use the calendar year. A corporation and a partnership (ordinary or business or taxable) have the option to choose between the calendar year and the fiscal year Kin ds of a ccou n t in g pe r iod – the accounting period may be either: 1. Ca len da r ye a r – 12-month period, beginning January 1 and ending December 31 of every year 2. Fiscal ye a r – any 12-month period, ending on the last day of any month other than December • The following returns may be filed for a period of less than 12 months: 1. Final return of a decedent from Jan. 1 to the date of death 2. The return of a decedent’s estate in the year of death beginning 1 day after death to Dec. 31 3. Returns for short periods in case of change of accounting period 4. Return of a taxpayer whose taxable period is terminated such as when the taxpayer cases to engage in business 5. Return of a corporation contemplating dissolution or retirement 6. Return of a newly organized corporation • [VIP!] The calendar year shall be the basis of computing the net income when the taxpayer does not keep books of accounts or has no annual accounting period. By provision of law, individuals and estates and trusts and GPPs must be on a calendar year basis The “taxpayer” mentioned in Section 46 and 47 refers to a corporation since only corporations are permitted to choose the fiscal year or calendar year as basis of computing income. The term “corporation” includes partnerships (ordinary or business or taxable) e xce pt general professional partnerships. Section 43, however, does not prohibit professional partnerships from adopting a fiscal year basis of accounting [Read!] SEC. 4 7 . Final or Adj ust m ent Ret urns for a Period of Less t han Tw elve ( 12) Mont hs. [THIS IS WRONG! Because GPP cannot use or adopt Fiscal Year because the individual partners are required to report in their respective ITRs their distributive share in the net income of the GPP. Since individuals composing the GPP are required to adopt Calendar Year necessarily GPP must also adopt Calendar Year] (A) Ret urns for Short Period Result ing fr om Change of Account ing Period. - If a taxpayer, other than an individual, with the approval of the Commissioner, changes the basis of computing net income from fiscal year to calendar year, a separate final or adjustment return shall be made for the period between the close of the last fiscal year for which return was made and the following December 31. If the change is from calendar year to fiscal year, a separate final or adjustment return shall be made for the period between the close of the last calendar year for which return was made and the date designated as the close of the fiscal year. If the change is from one fiscal year to another fiscal year, a separate final or adjustment return shall be made for the period between the close of the former fiscal year and the date designated as the close of the new fiscal year. [VIP!] SEC. 4 8 . Account ing for Lon g- t e r m Con t r a ct s. - Income from long-term contracts sh all be reported for tax purposes in the manner as provided in this Section. As used herein, the term “ lon g- t erm con t r a ct s” means building, installation or construction contracts covering a period in excess of one (1) year. Persons whose gross income is derived in whole or in part from such contracts sha ll report such income upon the basis of percentage of completion (Completed Contract Method or basis is no longer allowed beginning January 1, 1998). The return should be accompanied by a return certificate of architects or engineers showing the percentage of completion during the taxable year of the entire work performed under contract. There should be deducted from such gross income all expenditures made during the taxable year on account of the contract, account being taken of the material and supplies on hand at the beginning and end of the taxable period for use in connection with the work under the contract but not yet so applied. If upon completion of a contract, it is found that the taxable net income arising thereunder has not been clearly reflected for any year or years, the Commissioner may permit or require an amended return. (B) I ncom e Com put ed on Basis of Short Period. - Where a separate final or adjustment return is made under Subsection (A) on account of a change in the accounting period, and in all other cases where a separate final or adjustment return is required or permitted by rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner, to be made for a fractional part of a year, then the income shall be computed on the basis of the period for which separate final or adjustment return is made. 85 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Be for e (January 1, 1998), the taxpayer was given the option to choose between the percentage of completion and the completed-contract method • Beginning January 1, 1998, income from long-term contracts is required to be reported using this method (Percentage of Completion Method) only (RA 9224) pesos (P1,000), or (2) of a sale or other disposition of real property (Ordinary Asset), if in either case the initial payments do not exceed twenty-five percent (25%) (if initial payments exceed 25% of selling price, the gross income must be reported on accrual basis or in the year of sale) of the selling price, the income may, under the rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner, be returned or reported on the basis and in the manner above prescribed in this Section. As used in this Section, the term “in it ia l pa ym e n t s” means the payments received in cash or property other than evidences of indebtedness of the purchaser during the taxable period in which the sale or other disposition is made. Ex a m ple : A entered into a construction contract with B whereby A will construct the commercial building of B at a contract price of Php 20M. The estimated cost to construct this building is Php 14M, hence, the estimated gross income of A from this contract is Php 6M. the construction began in 2011 and was completed in 2013 with the following cost incurred: 2011 2012 2013 - (C) Sales of Real Property Considered as Capit al Asset by I ndividuals. - An individual who sells or disposes of real property located in the Philippines, considered as capital asset, and is otherwise qualified to report the gain therefrom under Subsection (B) may pay the capital gains tax (but the entire presumed capital gain (GSP or FMV or FMV, whichever is highest) must be reported in the year of sale; 6%) in installments under rules and regulations to be promulgated by the Secretary of Finance, upon recommendation of the Commissioner. Php 7,000,000.00 Php 4,200,000.00 Php 2,800,000.00 Php 14,000,000.00 The formula to compute the gross income is 𝑒𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑔𝑟𝑜𝑠𝑠 𝑖𝑛𝑐𝑜𝑚𝑒 × ��������� ���� Therefore, the gross income in 2011 is (Php 6M × gross income in 2012 is [(Php 6M × gross income in 2013 is [(Php 6M × (D) Change from Accrual t o I nst allm ent Basis. - If a taxpayer entitled to the benefits of Subsection (A) elects for any taxable year to report his taxable income on the installment basis, then in computing his income for the year of change or any subsequent year, amounts actually received during any such year on account of sales or other dispositions of property made in any prior year shall not be excluded. ������ ���� �������� ��� ��.�� ��� ��� ��� ��� ��� �� ) Php 3M. The ��� ��� ) – Php 3M] Php 1.5M. The ) – Php 4.8M] Php 1.2M. ��� ��� Ex a m ple : A is engaged in car dealership and he sold a car to B at an installment price of Php 1M and its cost is Php 700,000.00, hence, the estimated gross income is Php 300,000.00. The car was sold on January 2, 2011 with a downpayment of Php 280,000.00 and the balance of Php 720,000.00 is payable on installment at Php 20,000.00 per month for 3 years. The first installment is due on Jan. 31, 2011 and the other monthly installments are due at the end of each succeeding months. The gross profit rate is gross profit income ÷ gross selling price (Php 300,000.00 ÷ Php 1M) or 30%. The gross income to be realized annually is equal to the total amounts collected × gross profit rate. Therefore, the gross income in 2011 is (Php 20,000.00 × 12 + Php 280,000.00 × 30%) Php 156,000.00. The gross income in 2012 is (Php 20,000.00 × 12 × 30%) Php 72,000.00. The gross income in 2013 is (Php 20,000.00 × 12 × 30%) Php 72,000.00. N OTE: Under the completed contract method, which is no longer allowed by law, A will not report any income in 2011 and 2012 and the entire gross income of Php 6M will be reported in the year of completion or in 2013. SEC. 4 9 . I n st a llm e n t Ba sis. – (A) Sales of Dealers in Personal Propert y. - Under rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner, a person who regularly sells (the sale is in the ordinary course of his business) or otherwise disposes of personal property on the installment plan m a y (the taxpayer may at his option report his gross income on accrual basis (in the year of sale) or on installment basis) return or report as income therefrom in any taxable year that proportion of the installment payments actually received in that year, which the gross profit realized or to be realized when payment is completed, bears to the total contract price. N OTE: Under the accrual basis the gross income of Php 300,000.00 shall be reported by A in the year of sale or in 2011. • (B) Sales of Realt y and Casual Sales of Personalit y. - In the case (1) of a casual sale (not in the ordinary course of business) or other casual disposition of personal property (capital asset) (other than property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year), for a price exceeding One thousand I n it ial pa ym e n ts – it covers any downpayment made, and includes all payments actually or constructively received during the year of sale. The aggregate of all such payments determines whether or not the limit which the law has set (25% of selling price) has been exceeded 86 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Assume that on October 15, 2011, an individual sold for P100,000 a real property with an adjusted basis of P60,000 under the following terms: P10,000 upon execution of sale; the balance of P90,000 in 18 equal monthly installments of P5,000 each beginning November 15, 2011 alien individual engaged in business or practice of profession within the Philippine shall file an income tax return, regardless of the amount of gross income (even if the same is less than the total exemptions); The taxpayer qualifies to pay the capital gains tax on installment because the initial payment consisting of the amount of P10,000 he received upon the sale and the amount he expects or is scheduled to receive – P5,000 on November 15, 2011 and P5,000 on December 15, 2011, or a total of P20,000 during the year of sale do not exceed 25% of the selling price (b) An individual with respect to pure compensation income, as defined in Section 32 (A)(1), derived from sources within the Philippines, the income tax on which has been correctly withheld under the provisions of Section 79 of this Code: Pr ovide d, That an individual deriving compensation concurrently from two or more employers at any time during the taxable year shall file an income tax return even if the income taxes have been correctly withheld. SEC. 5 0 . Allocat ion of I ncom e and Deduct ions. - In the case of two or more organizations, trades or businesses (whether or not incorporated and whether or not organized in the Philippines) owned or controlled directly or indirectly by the same interests, the Commissioner is authorized to distribute, apportion or allocate gross income or deductions between or among such organization, trade or business, if he determined that such distribution, apportionment or allocation is necessary in order to prevent evasion of taxes or clearly to reflect the income of any such organization, trade or business. (c) An in dividu a l (such as NRA not engaged) whose sole in com e (passive) has been subjected to final withholding tax pursuant to Section 57(A) of this Code; and (d) A minimum wage earner as defined in Section 22(HH) of this Code or an individual who is exempt from income tax pursuant to the provisions of this Code and other laws (such as Senior Citizen’s Law), general or special. Chapter 9 – Returns and Payment of Tax (3) The foregoing notwithstanding, any individual not required to file an income tax return may nevertheless be required to file an in for m a t ion r e t u rn pursuant to rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. [VIP!] SEC. 5 1 . I n dividua l Re tu r n. – (A) Requirem ent s. – (1) Except as provided in paragraph (2) of this Subsection, the following individuals are required to file an income tax return: (4) The income tax return shall be filed in duplicate by the following persons: (a) Every Filipino citizen residing in the Philippines on his income from sources within and without the Philippines; (a) A resident citizen - on his income from all sources; (b) Every Filipino citizen residing outside the Philippines, on his income from sources within the Philippines; (b) A nonresident citizen - on his income derived from sources within the Philippines; (c) Every alien residing in the Philippines, on income derived from sources within the Philippines; and (c) A resident alien - on his income derived from sources within the Philippines; and (d) Every nonresident alien engaged in trade or business or in the exercise of profession in the Philippines on his income from sources within. (d) A nonresident alien engaged in trade or business in the Philippines - on his income derived from sources within the Philippines. [NRA not engaged is NOT required to file ITR because his income in the Philippines is subject to final tax] (B) Where t o File. - Except in cases where the Commissioner otherwise permits, the return shall be filed with an authorized agent bank, Revenue District Officer, Collection Agent or duly authorized Treasurer of the city or municipality in which such person has his legal residence or principal place of business in the Philippines, or if there be no legal residence or place of business in the Philippines, with the Office of the Commissioner. (2) The following individuals sh a ll n ot be required to file an income tax return; (a) An individual whose gross income does not exceed his total personal and additional exemptions for dependents under Section 35: Pr ovide d, That a citizen of the Philippines and any (C) When t o File. – 87 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (1) The return of any individual specified above shall be filed on or before the fifteenth (15th) day of April of each year covering income for the preceding t a x a ble ye a r (Calendar year). taxpayer discloses the nature and extent of his tax liability by formally making a report of his income and allowable deductions for the taxable year in the prescribed income tax form (2) Individuals subject to tax on capital gains; (a) From the sale or exchange of shares of stock in a domestic corporation not traded thru a local stock exchange as prescribed under Section 24(c) shall file a return within thirty ( 3 0 ) da ys after each transaction and a final consolidated return on or before April 15 of each year covering all stock transactions of the preceding taxable year; and (b) From the sale or disposition of r e a l pr ope r t y (located in the Philippines classified as Capital Asset) under Section 24(D) shall file a return within thirty ( 3 0 ) da ys following each sale or other disposition. [Consolidated return is NOT required] In substituted filing of income tax return of employees receiving compensation income from only 1 employer, the e m ploye r ’s a n nu a l in for m a t ion re t u rn (or Alpha List) filed will be considered as the “substituted” ITR of the employee inasmuch as the information he provided the BIR in his own ITR would exactly be the same information contained in the employer’s annual information return • I n dividu als ea r n in g com pen sa t ion incom e – individuals earning pure compensation income derived from sources within the Philippines, the income tax on which has already been correctly withheld pursuant to Section 79 are no longer required to file the annual income tax return The following individuals, h ow e ver , are still required to file income tax return: (D) Husband and Wife. - Married individuals, whether citizens, resident or nonresident aliens, who do not derive income pu r e ly (or solely) from compensation (if both of them derive income purely or solely from compensation they are NOT required to file an ITR), shall file a return for the taxable year to include the income of both spouses, but where it is impracticable for the spouses to file one return, each spouse may file a separate return of income but the returns so filed shall be consolidated by the Bureau for purposes of verification for the taxable year. (E) Ret urn of Parent t o I nclude I ncom e of Children. - The income of unmarried minors derived from property received from a living parent (How about if the income of the minor is derived from exercise of his profession or trade or business, will his income be included in the ITR of his parent? AN S: NO, this will require a separate a separate ITR under subsection F) shall be included in the return of the parent, e x ce pt (this will require a separate ITR under subsection F) (1) when the donor's tax has been paid (if the donor’s tax has not yet been paid the income of the minor shall be included in the ITR of the parent) on such property, or (2) when the transfer of such property is exempt from donor's tax (the value of the property donated is Php 100,000.00 or less). o Those deriving compensation concurrently from 2 or more employers at any time during the taxable year o Those, whether citizens, residents, or non-resident aliens, who did not derive income purely from compensation o Those on whose pure compensation the income tax has not been withheld or has been incorrectly withheld The tax exemption granted under RA No. 7432 to senior citizens with income below P60,000 per annum, applies only to income derived from compensation. Hence, interest income from bank deposit does not fall under such exemption SEC. 5 2 . Corporat ion Ret urns. – (A) Requirem ent s. - Eve r y cor por a t ion (1. Domestic Corporation; 2) Ordinary or Business or Taxable Partnership; 3) Resident Foreign Corporation) subject to the tax herein imposed, e xce pt (NRFC is subject to Final Tax, hence, it is not required to file ITR) foreign corporations not engaged in trade or business in the Philippines, shall render, in duplicate, a true and accurate quarterly income tax return (3 ITRs) a n d final or adjustment return in accordance with the provisions of Chapter XII of this Title. The return shall be filed by the president, vice-president or other principal officer, a n d shall be sworn to by such officer and by the treasurer or assistant treasurer. (F) Pe r son s Un de r D isa bilit y (such as minor). - If the taxpayer is unable to make his own return, the return may be made by his duly authorized agent or representative or by the guardian or other person charged with the care of his person or property, the principal and his representative or guardian assuming the responsibility of making the return and incurring penalties provided for erroneous, false or fraudulent returns. (G) Signat ure Presum ed Correct . - The fact that an individual's name is signed to a filed return shall be prima facie evidence for all purposes that the return was actually signed by him. • • (B) Taxable Year of Corporat ion. - A cor por a t ion (including ordinary, business or taxable partnership but excluding GPP) may employ either calendar year or fiscal year as a basis for filing its annual income tax return: Pr ovide d, That the corporation shall not change the accounting period employed I n com e t a x r e tu r n is a sworn statement or declaration, including attachments thereto, designed to be part of said return, in which the 88 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 without prior approval from the Commissioner in accordance with the provisions of Section 47 of this Code. r e t u r n (information return) of its income, except income exempt under Section 3 2 ( B) (exclusions from gross income) of this Title, setting forth the items of gross income and of deductions allowed by this Title, and the names, Taxpayer Identification Numbers (TIN), addresses and shares of each of the partners. (C) [Read!] Ret urn of Corporat ion Cont em plat ing Dissolut ion or Reorganizat ion. - Every corporation shall, within thirty (30) days after the adoption by the corporation of a resolution or plan for its dissolution, or for the liquidation of the whole or any part of its capital stock, including a corporation which has been notified of possible involuntary dissolution by the Securities and Exchange Commission, or for its reorganization, render a correct return to the Commissioner, verified under oath, setting forth the terms of such resolution or plan and such other information as the Secretary of Finance, upon recommendation of the commissioner, shall, by rules and regulations, prescribe. The dissolving or reorganizing corporation shall, prior to the issuance by the Securities and Exchange Commission of the Certificate of Dissolution or Reorganization, as may be defined by rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner, secure a certificate of tax clearance from the Bureau of Internal Revenue which certificate shall be submitted to the Securities and Exchange Commission. (D) [VIP!] Ret urn on Capit al Gains Realized from Sale of Shares of St ock not Traded in t he Local St ock Ex change. - Every corporation deriving capital gains from the sale or exchange of shares of stock in a domestic corporation not traded thru a local stock exchange as prescribed under Sections 24 (c), 25 (A)(3), 27 (E)(2), 28(A)(8)(c) and 28 (B)(5)(c), shall file a return within thirty (30) days after each transaction and a final consolidated return of all transactions during the taxable year on or before the fifteenth (15th) day of the fourth (4th) month following the close of the taxable year. [In the case of Capital Gain from sale of land and/or building shall file a return within 30 days following its sale but consolidated return is NOT a required period [Section 51,C,2,b, by analogy]) [Read!] SEC. 5 3 . Ex t ension of Tim e t o File Ret urns. - The Commissioner may, in meritorious cases, grant a reasonable extension of time for filing returns of income (or final and adjustment returns in case of corporations), subject to the provisions of Section 56 of this Code. [Read!] SEC. 5 4 . Ret urns of Receivers, Trust ees in Bankrupt cy or Assignees. - In cases wherein receivers, trustees in bankruptcy or assignees are operating the property or business of a corporation, subject to the tax imposed by this Title, such receivers, trustees or assignees shall make returns of net income as and for such corporation, in the same manner and form as such organization is hereinbefore required to make returns, and any tax due on the income as returned by receivers, trustees or assignees shall be assessed and collected in the same manner as if assessed directly against the organizations of whose businesses or properties they have custody or control. • Corporations subject to income tax are required to file quarterly income tax returns and a final or adjustment return • Ba n k w it h a for e ign cu r r en cy de posit un it ( FCD U) – it must file 2 income tax returns for the same taxable year covering the 2 different types of income, namely the FCDU income and the regular banking unit (RBU) income • Ele ct r on ic Filin g a n d Pa ym en t Syst e m ( EFPS) is an alternative mode of filing returns and payment of taxes which deviates from the conventional manual process of encoding paper bound tax returns filed which is highly susceptible to human errors and intervention. The system allows the taxpayers to directly encode, submit their tax returns and pay their taxes due online over the internet through the BIR website, thereby reducing the government’s administrative and operational costs in interacting with taxpayers and collecting taxes • There is no statute or regulation that prohibits the use of foreign currency in financial statements of Philippine taxpayers. The prohibition against the use of foreign currency has been lifted with the repeal of RA No. 529 or the “Uniform Currency Act” • Fu n ction a l cu r re ncy is a currency of the primary economic environment in which the reporting entity operates, that is, the currency of the environment in which an entity primarily generates and expends cash • For e ign cu r re ncy is a currency which is other than the functional currency of the qualified entity • Pr e scr iptive pe riod for cla im in g a r e fu n d – it is the Final Adjustment Return, in which amounts of the gross receipts and deductions have been audited and adjusted, which is reflective of the results of the operations of a business enterprise (domestic corporation and resident foreign corporation). It is only when the return, covering the whole year, is filed that the taxpayer will be able to ascertain whether a tax is still due or a refund can be claimed based on the adjusted and audited figures. Hence, at the earliest, the 2-year prescriptive period for claiming a refund commences to run on the date of filing of the adjusted final tax return • Ge n e r al pr ofe ssion a l pa r t ne r sh ips – as such, they are not subject to income tax. It is the partners who are liable for income tax in their separate and individual capacities. The partner shall report as gross income his distributive (or computed) share, actually and constructively received in the net income of the partnership SEC. 5 5 . Ret urns of General Pr ofessional Part ner ships. - Every general professional partnership shall file on or before April 15 of the following year, in duplicate, a 89 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 authorizing registration) that such transfer has been reported, and the tax herein imposed, if any, has been paid. SEC. 5 6 . Paym ent and Assessm ent of I ncom e Tax for I ndividuals and Corporat ion. (A) Paym ent of Tax . – (B) Assessment and Payment of Deficiency Tax. - After the return is filed, the Commissioner shall examine it and assess the correct amount of the tax. The tax or deficiency income tax so discovered shall be paid upon n ot ice (formal or final or official assessment notice) and demand from the Commissioner. (1) I n General. - The total amount of tax imposed by this Title shall be paid by the person subject thereto at the time the return is filed (pay as you file basis or pay as you file system). In the case of tramp vessels, the shipping agents and/or the husbanding agents, and in their absence, the captains thereof are required to file the return herein provided and pay the tax due thereon before their departure. Upon failure of the said agents or captains to file the return and pay the tax, the Bureau of Customs is hereby authorized to hold the vessel and prevent its departure until proof of payment of the tax is presented or a sufficient bond is filed to answer for the tax due. As used in this Chapter, in respect of a tax imposed by this Title, the term 'deficiency' means: (1) The amount by which the tax imposed by this Title exceeds the amount shown as the tax by the taxpayer upon his return; but the amount so shown on the return shall be increased by the amounts previously assessed (or collected without assessment) as a deficiency, and decreased by the amount previously abated, credited, returned or otherwise repaid in respect of such tax; or (2) I nst allm ent of Paym ent . - When the tax due is in excess of Two thousand pesos ( P2 ,0 0 0 ) , the t a x pa yer (individual or estate or trust) other than a corporation may elect to pay the tax in two (2) equal installments in which case, the first installment shall be paid at the time the return is filed and the second installment, on or before July 15 following the close of the calendar year. If any installment is not paid on or before the date fixed for its payment, the whole amount of the tax unpaid becomes due and payable, together with the delinquency penalties. (2) If no amount is shown as the tax by the taxpayer upon this return, or if no return is made by the taxpayer, then the amount by which the tax exceeds the amounts previously assessed (or collected without assessment) as a deficiency; but such amounts previously assessed or collected without assessment shall first be decreased by the amounts previously abated, credited returned or otherwise repaid in respect of such tax. (3) [Read!] Pay m ent of Capit al Gains Tax. - The total amount of tax imposed and prescribed under Section 24 (c), 24(D), 27(E)(2), 28(A)(8)(c) and 28(B)(5)(c) shall be paid on the date the return prescribed therefor is filed by the person liable thereto: Provided, That if the seller submits proof of his intention to avail himself of the benefit of exemption of capital gains under existing special laws, no such payments shall be required : Provided, further, That in case of failure to qualify for exemption under such special laws and implementing rules and regulations, the tax due on the gains realized from the original transaction shall immediately become due and payable, subject to the penalties prescribed under applicable provisions of this Code: Provided, finally, That if the seller, having paid the tax, submits such proof of intent within six (6) months from the registration of the document transferring the real property, he shall be entitled to a refund of such tax upon verification of his compliance with the requirements for such exemption. • Pa y a s you file syst e m – the total amount of income tax due shall be paid at the time the return is filed. The “date prescribed for the payment of the tax” is the date prescribed for the filing of the return • [VIP!] Time and place of payment of tax from sales, exchanges, or transfers of real property o Ca pit a l ga in s t a x (6%) – within 30 days following each sale of lands and/or buildings which are classified as capital assets located in the Philippines, the CGT Return shall be filed by the seller or the buyer with, and payment of taxes mode to, an Authorized Agent Bank (AAB) located within the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located [VIP!] SEC. 5 7 . Wit hholding of Tax at Source. – In case the taxpayer elects and is qualified to report the gain by installments under Section 49 of this Code, the tax due from each installment payment shall be paid within (30) days from the receipt of such payments. [Items of Passive Income subject to final tax are no longer included in the ITR of the recipient of income] [Impt!] No registration of any document transferring real property shall be effected by the Register of Deeds un less the Commissioner or his duly authorized representative has ce r t ifie d (the BIR issues certificate (A) W it h h oldin g of Fin al Ta x on Ce r t a in Passive I n com e s. - Subject to rules and regulations the Secretary of Finance may promulgate, upon the recommendation of the Commissioner, requiring the filing of income tax return by certain income payees, the tax imposed or prescribed by Sections 2 4 ( B) ( 1 ) (interests, royalties, prizes and other winnings of RC, 90 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • NRC and RA), 2 4 ( B) ( 2 ) (dividends from DC), 2 4 ( C) (CGT on Sale of Shares of Stock in a DC not traded in stock exchange), 2 4 ( D ) ( 1 ) (CGT on Sale of Real Property classified as CA and located in the Philippines); 25(A)(2), 25(A)(3), 25(B), 25(C), 25(D), 25(E), 27(D)(1), 27(D)(2), 27(D)(3), 27(D)(5), 28 (A)(4), 28(A)(5), 28(A)(7)(a), 28(A)(7)(b), 28(A)(7)(c), 28(B)(1), 28(B)(2), 28(B)(3), 28(B)(4), 28(B)(5)(a), 28(B)(5)(b), 28(B)(5)(c); 33; and 282 of this Code on specified items of income shall be withheld by payor-corporation and/or person individual and paid in the same manner (EXCEPT Capital Gains Tax on sale of shares of stock in a DC not traded in stock exchange and CGT on sale of Real Property classified as CA and located in the Philippines where the return is filed and the tax paid or remitted within 30 days from sale or transaction and not quarterly) and subject to the same conditions as provided in Section 58 (quarterly) of this Code. This results in administrative savings, prompt and efficient collection of taxes, prevention of delinquencies and reduction of governmental effort to collect taxes through more complicated means and remedies. (B) W it h h oldin g of Cr e dit a ble Ta x a t Sou r ce . - The Secretary of Finance may, upon the recommendation of the Commissioner, require the withholding of a tax on the items of income (such as salaries, rents, contract prices, etc.) payable to natural or juridical persons, residing in the Philippines, by payor-corporation/persons individuals as provided for by law, at the rate of not less than one percent (1%) but not more than thirty-two percent (32%) thereof, which shall be credited against the income tax liability (or income tax) of the taxpayer for the taxable year. [The recipient of income will include in his ITR the income received and after computing the tax due he will deduct the tax withheld by the payer as tax credit] (C) Tax- free Covenant Bonds. - In any case where bonds, mortgages, deeds of trust or other similar obligations of domestic or resident foreign corporations, contain a contract or provisions by which the obligor agrees to pay any portion of the tax imposed in this Title upon the obligee or to reimburse the obligee for any portion of the tax or to pay the interest without deduction for any tax which the obligor may be required or permitted to pay thereon or to retain therefrom under any law of the Philippines, or any state or country, the obligor shall deduct bonds, mortgages, deeds of trust or other obligations, whether the interest or other payments are payable annually or at shorter or longer periods, and whether the bonds, securities or obligations had been or will be issued or marketed, and the interest or other payment thereon paid, within or without the Philippines, if the interest or other payment is payable to a nonresident alien or to a citizen or resident of the Philippines. • Withholding tax on income obviously and necessarily implies that the amount of the tax withheld comes from the income earned by the taxpayer • A withholding tax on income is not a new kind of tax but simply a manner or system by which income taxes may be collected when the income is paid or received. It is in the nature of advance tax payment by a taxpayer on the annual tax which may be accrue at the end of the taxable year The system was devised for t h re e prim a r y re a son s; first, to provide the taxpayer a convenient manner to meet his probable income tax liability; second, to ensure the collection of income tax which can otherwise be lost or substantially reduced through failure to file the corresponding returns; and third, to improve the government’s cash flow • [BAR!] “All events test” – Under the accrual basis or method of accounting, income is reportable when all the events have occurred that fix the taxpayer’s right to receive the income, and the amount can be determined with reasonable accuracy. Thus, it is right to receive income, and not the actual receipt of cash, that determines when to include the amount in gross income. The following are the requisites of this method (accrual) : 1. Right to receive the amount must be valid, unconditional and enforceable, i.e., not contingent upon future time 2. Amount must be reasonably susceptible of accurate estimate 3. There must be a reasonable expectation that the amount will be paid in due course • [Impt!] The tax withheld at source may be either a final or creditable tax 1. Fin a l w it h h oldin g t a x – under the final withholding tax (FWT) system, the amount of income tax withheld by the withholding agent (Payer-corporation or Payer-individual) is constituted as a full and final payment of the income tax due from the payee on the said income (recipient of income such as bank depositor in the case of interest income, stockholder in the case of dividend and patentee in the case of royalty). The liability for payment of the tax rests primarily on the payor as a withholding agent. Thus, in case of his failure to withhold the tax or in case of under withholding, the deficiency tax shall be collected from the payor/withholding agent. The payee is not required to file an income tax return for the particular income [If the withholding agent does not withhold or fails to withhold, he is directly and personally liable to the BIR not only of the tax supposed to be withheld but including the penalties such as surcharge and interests] 2. Cr e dit a ble w ith h oldin g t a x – Under the creditable withholding tax (CWT) system, taxes (such as income tax of contractors, lessors of property, consultants, employees, etc.) withheld on certain income payments are intended to equal or at least approximate the tax due from the payee on said income. The income recipient is still required to file an income tax return, as prescribed in Sections 51 and 52, to report the income and/or pay the difference between the tax withheld and the tax due on the income. Taxes withheld on income payments covered by the expanded withholding tax and compensation income are creditable in nature 91 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • • Cla im for t a x cr e dit or r e fu nd – the person entitled to claim a tax refund is the taxpayer but in case the taxpayer does not file a claim for refund (the withholding agent is the proper party in interest to file a written claim for refund with the CIR [Proctor & Gamble Phils, Inc and Wander Phils, Inc. Case]), the withholding agent may file the claim The taxes deducted and withheld by the withholding agent shall be held as a special fund in trust for the government until pa id (or remitted) to the collecting officers. The return for fin al (on passive income) withholding tax shall be filed and the payment made within twenty-five ( 2 5 ) da ys from the close of each calendar quarter, while the return for cr e dit a ble withholding taxes (such as tax withheld on compensation income, rent income, contractor’s income, etc.) shall be filed and the payment made not later than the last day of the month following the close of the quarter during which withholding was made: Pr ovide d, That the Commissioner may, with the approval of the Secretary of Finance, may require these withholding agents to pa y (or remit) or deposit the taxes deducted or withheld at more frequent intervals when necessary to protect the interest of the government. Comparison FWT The amount of income tax withheld by the withholding agent is constituted as a full and final payment of the income tax due from the payee on the said income The liability for payment of the tax rests primarily on the payor as a withholding agent The payee is not required to file an income tax return for the particular income CWT Taxes withheld on certain income payments are intended to equal or at least approximate the tax due of the payee on said income Payee of income is required to report the income and/or pay the difference between the tax withheld and the tax due on the income. The payee also has the right to ask for a refund if the tax withheld is more than the tax due The income recipient is still required to file an income tax return, as prescribed in Sections 51 and 52 • [VIP!] The withholding agent is directly and independently liable for the correct amount of the tax that should be withheld from the dividend remittance. He is subject to and liable for deficiency assessments, surcharges and penalties should the amount of the tax withheld be finally found to be less than the amount that should have been withheld under the law • W it h h oldin g in ca se of dou bt – in case of doubt, a withholding agent may always protect himself by withholding the tax due, and promptly causing a query to be addressed to the CIR for the determination whether or not the income paid to an individual is not subject to withholding. In case the CIR decides that the income paid to an individual is not subject to withholding, the withholding agent may thereupon r e m it (should be refund) the amount of tax withheld. (B) St at em ent of I ncom e Pay m ent s Made and Tax es Wit hheld. - Every withholding agent required to deduct and withhold taxes under Section 57 shall furnish each recipient, in respect to his or its receipts during the calendar quarter or year, a written statement showing the income or other payments made by the withholding agent during such quarter or year, and the amount of the tax deducted and withheld therefrom, simultaneously upon payment at the request of the payee, but not late than the twentieth (20th) day following the close of the quarter in the case of corporate payee, or not later than March 1 of the following year in the case of individual payee for creditable withholding taxes. For final withholding taxes, the statement should be given to the payee on or before January 31 of the succeeding year. (C) An n ua l I n for m a t ion Re t ur n . - Every withholding agent required to deduct and withhold taxes under Section 57 shall submit to the Commissioner an annual information return containing the list (Alpha List) of payees and income payments, amount of taxes withheld from each payee and such other pertinent information as may be required by the Commissioner. In the case of final withholding taxes (such as final tax on passive income), the return shall be filed on or before January 31 of the succeeding year, and for creditable withholding taxes, not later than March 1 of the year following the year for which the annual report is being submitted. This return, if made and filed in accordance with the rules and regulations approved by the Secretary of Finance, upon recommendation of the Commissioner, shall be sufficient compliance with the requirements of Section 68 of this Title in respect to the income payments. The Commissioner may, by rules and regulations, grant to any withholding agent a reasonable extension of time to furnish and submit the return required in this Subsection. SEC. 5 8 . Ret urns and Paym ent of Taxes Wit hheld at Source. – (A) Qu a r t e rly Re t u r ns and Paym ent s of Tax es Withheld. - Taxes deducted and withheld under Section 57 by withholding agents shall be covered by a return and pa id (or remitted) to, except in cases where the Commissioner otherwise permits, an authorized Treasurer of the city or municipality where the withholding agent has his legal residence or principal place of business, or where the withholding agent is a corporation, where the principal office is located. (D) I ncom e of Recipient. - Income upon which any creditable tax is required to be withheld at source under Section 57 shall be included in the return of its recipient but the excess of the amount of tax so withheld over the tax due on his return shall be refunded to him subject to the provisions of Section 204; if the income tax collected at source is less than the tax due on his 92 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 return, the difference shall be paid in accordance with the provisions of Section 56. SEC. 5 9 . Tax on Profit s Collect ible from Ow ner or Ot her Persons. - The tax imposed under this Title upon gains, profits, and income not falling under the foregoing and not returned and paid by virtue of the foregoing or as otherwise provided by law shall be assessed by personal return under rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner. The intent and purpose of the Title is that all gains, profits and income of a taxable class, as defined in this Title, shall be charged and assessed with the corresponding tax prescribed by this Title, and said tax shall be paid by the owners of such gains, profits and income, or the proper person having the receipt, custody, control or disposal of the same. For purposes of this Title, ownership of such gains, profits and income or liability to pay the tax shall be determined as of the year for which a return is required to be rendered. All taxes withheld pursuant to the provisions of this Code and its implementing rules and regulations are hereby considered trust funds and shall be maintained in a separate account and not commingled with any other funds of the withholding agent. (E) [Impt!] Regist rat ion w it h Regist er of Deeds. - No registration of any document (such as deed of sale) transferring real property shall be effected by the Register of Deeds u n le ss the Commissioner or his duly authorized representative has certified (the BIR has issued a certificate authorizing registration) that such transfer has been reported, and the capital gains or creditable withholding tax, if any, has been paid: Prov ided, how ev er, That the information as may be required by rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, shall be annotated by the Register of Deeds in the Transfer Certificate of Title or Condominium Certificate of Title: Prov ided, furt her, That in cases of transfer of property to a corporation, pursuant to a merger, consolidation or reorganization, and where the law allows deferred recognition of income in accordance with Section 40, the information as may be required by rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, shall be annotated by the Register of Deeds at the back of the Transfer Certificate of Title or Condominium Certificate of Title of the real property involved: Prov ided, finally, That any violation of this provision by the Register of Deeds shall be subject to the penalties imposed under Section 269 of this Code. Decision rendered by 2 different divisions of the Supreme Court • Chapter 10 – Estates and Trusts [For income tax purposes, estates and trusts are considered taxpayers separate from the beneficiaries thereof] SEC. 6 0 . I m posit ion of Tax . (A) Applicat ion of Tax . - The t a x (income tax) imposed by this Title upon individuals shall apply to the income of estates or of any kind of property held in trust, in clu din g: [VIP!] Pa r t y e n t it le d t o r e fu n d in case of ove r pa ym e n t – The withholding agent cannot claim for refund of the overpaid taxes; the claimant should be the taxpayer, being the real party in interest. Here, the withholding agent is a wholly-owned (DC) subsidiary of the non-resident foreign corporation (mother corporation which is Proctor & Gamble USA). In another case rendered on the same date, the SC ruled that the withholding agent, a DC which is also a wholly-owned subsidiary of the non-resident foreign corporation, is the proper entity which should claim for refund or credit of overpaid withholding tax on dividends paid or remitted to the mother corporation for the reason that “it became a withholding agent of the government not by choice but by compulsion” and it “may be assessed for deficiency withholding tax plus penalties consisting of surcharge and interest.” Taxable to the estate or trust (1) Income accumulated in trust for the benefit of unborn or unascertained person or persons with contingent interests, a n d income accumulated or held for future distribution under the terms of the will or trust; Taxable to the beneficiary (2) Income which is to be distributed currently by the fiduciary (trustee) to the beneficiaries, a n d income collected by a guardian of an infant which is to be held or distributed as the court may direct; Taxable partly to the estate or trust and partly to the beneficiary (3) Income received by estates of deceased persons during the period of administration or settlement of the estate; and (4) Income which, in the discretion of the fiduciary, may be either distributed to the beneficiaries or accumulated. (B) [Mem!] [BAR!] Except ion. - The tax imposed by this Title shall not apply (the income of Ees’ trust fund or pension fund or pension trust is exempt from income tax) to employee's trust which forms part of a pension, stock bonus or profit-sharing plan of an employer for the benefit of some or all of his employees (1) if contributions are made to the trust by such employer, or employees, or both for the purpose of distributing to such employees the earnings (such as interest and dividend) and principal (or contributions or corpus or capital) of the fund accumulated by the trust in accordance with such plan, a n d (2) if under the trust instrument it is impossible, at any time prior to the satisfaction of all liabilities with respect to employees under the trust, for any part of the corpus (or principal or capital or contributions) or income to be (or earnings) (within the taxable year or In Comm. vs Proctor and Game Phil. Mfg. Corp (204 SCRA 377, Dec. 2, 1991) (appealed decision), the SC ruled that the private respondent, a wholly-owned subsidiary of a non-resident foreign corporation, was a “taxpayer” within the meaning of Section 204 (see Section 22[N]), and was impliedly authorized to file the claim for refund and the suit to recover such claim. If the withholding agent is the agent both of the government and of the taxpayer, his authority may reasonably include the authority to file a claim for refund 93 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 Such as when the employee resigns before retirement age but not when he retires because in the latter case, such receipt will constitute retirement benefit which is exempt from income tax under Section 32(B,6,a) thereafter) used for, or diverted to, purposes other than for the exclusive benefit of his employees the pension fund and the income thereof are within the absolute control of the trustee and the employer cannot under any circumstances use said fund other than for the exclusive benefit of his employees: Pr ovide d, That any amount actually distributed to any employee or distributee shall be taxable to him in the year in which so distributed to the extent that it exceeds the amount contributed by such employee or distributee. (A) There shall be allowed as a deduction in addition to the allowable deductions under Section 34 in computing the taxable income of the estate or trust the amount of the income of the estate or trust for the taxable year which is to be distributed currently by the fiduciary to the beneficiaries, an d the amount of the income collected by a guardian of an infant which is to be held or distributed as the court may direct, but the amount so allowed as a deduction shall be included in computing the taxable income of the beneficiaries, whether distributed to them or not. Any amount allowed as a deduction under this Subsection shall not be allowed as a deduction under Subsection (B) of this Section in the same or any succeeding taxable year. Ex a m ple : X was an employee of Corporation A and after 20 years with the corporation, X resigned. His total contributions to the pension fund is Php 240,000.00 while Corporation A’s counterpart is also Php 240,000.00. The accumulated earnings in the form of interest and dividend of the Php 480,000.00 amount to Php 220,000.00. Upon resignation, X received Php 700,000.00 from the trustee. (B) In the case of income received by estates of deceased persons during the period of administration or settlement of the estate, and in the case of income which, in the discretion of the fiduciary, may be either distributed to the beneficiary or accumulated, there shall be allowed as an additional deduction in computing the taxable income of the estate or trust the amount of the income of the estate or trust for its taxable year, which is properly paid or credited during such year to any legatee, heir or beneficiary bu t the amount so allowed as a deduction shall be included in computing the taxable income of the legatee, heir or beneficiary. How much, if any, is the taxable income of X? AN S: The taxable income of X is the amount received in excess of his contribution to the fund or (Php 700,000.00 – Php 240,000.00) Php 460,000.00. The Php 240,000.00 representing his contribution to the fund is NOT taxable because it is mere return of capital) (C) In the case of a trust administered in a foreign country, the deductions mentioned in Subsections (A) and (B) of this Section shall not be allowed: Provided, That the amount of any income included in the return of said trust shall not be included in computing the income of the beneficiaries. (C) Com put at ion and Paym ent . – Ex a m ple : A conveyed his commercial properties to B under a trust agreement for a period of 10 years from January 1, 2013 to December 31, 2022. The trust instrument or deed of trust provides, among others, that out of the net income after tax of the trust B shall deliver to C, the beneficiary, Php 1M per annum. The gross income of the trust in 2013 is Php 5M while the allowable deductions amount to Php 2M. (1) I n General. - The tax shall be computed upon the taxable income (gross income LESS allowable deductions under Section 34 and exemption of Php 20,000.00) of the estate or t r u st (other than employees’ trust) and shall be paid by the fiduciary (or executor or administrator in the case of estate or trustee in the case of trust), e x ce pt (income of such trust is taxable to the grantor or trustor) as provided in Section 63 (relating to revocable trusts) and Section 64 (relating to income for the benefit of the grantor). Compute the taxable income of the trust. (2) Consolidat ion of I ncom e of Tw o or More Trust s. - Where, in the case of 1two or more trusts, the cr e a t or (or grantor or trustor) of the trust in each instance is the same person, a n d (2 trusts of the same creator or grantor or trustor BUT with different beneficiaries – individual ITRs not consolidated ITR) 2the beneficiary in each instance is the same, the taxable income of all the trusts shall be consolidated and the tax provided in this Section computed on such consolidated income, and such proportion of said tax shall be assessed and collected from each trustee which the taxable income of the trust administered by him bears to the consolidated income of the several trusts. AN S: Gross Income LESS: allowable deductions amount distributed to C NET INCOME LESS: exemption TAXABLE INCOME Php 5,000,000.00 Php 2M 1M 3,000,000.00 2,000,000.00 20,000.00 Php 1,980,000.00 Php N OTE: The Php 1M given to C by the trustee is included in computing his (C) taxable income in 2013. [VVIP!] SEC. 6 1 . Ta x a ble I n com e . - The taxable income of the estate or trust shall be computed in the same manner and on the same basis as in the case of an individual, e x ce pt that: SEC. 6 2 . Ex e m pt ion Allow ed t o Est at es and Tr ust s. - For the purpose of the tax provided for in this Title, there shall be allowed an exemption of Twenty thousand pesos ( P2 0 ,0 0 0 ) from the income of the estate or trust. 94 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • SEC. 6 3 . Revocable t rust s. - Where at any time the power to revest (power to get back the principal or capital or corpus) in the grantor title to any part of the corpus of the trust is vested (1) in the grantor either alone or in conjunction with any person not having a substantial adverse interest in the disposition of such part of the corpus or the income therefrom, or (2) in any person not having a substantial adverse interest in the disposition of such part of the corpus or the income therefrom, the income of such pa r t (that will revert to the grantor) of the trust shall be included in computing the taxable income of the grantor. Definition of terms o Est a t e refers to all property, rights and obligations of a person which are not extinguished by his death and also those which have accrued thereto since the opening of succession o Tr u st is an arrangement created by will or by an agreement under which title to property is passed to another for conversation or investment with the income therefrom and ultimately the corpus (principal) to be distributed in accordance with the directions of the creator (or grantor or trustor) as expressed in the governing instrument o Fidu cia r y means a guardian, trustee, executor, administrator, receiver, conservator, or any person acting in any fiduciary capacity for any person o Em ploye e ’s t r u st is a trust maintained by an employer to provide retirement, pension, or other benefits to its employees. It is a separate entity established for the exclusive benefit of the employees SEC. 6 4 . I ncom e for Benefit of Grant or.(A) Where any part of the income of a trust (1) is, or in the discretion of the grantor or of any person not having a substantial adverse interest in the disposition of such part of the income may be held or accumulated for future distribution to the grantor, or (2) may, or in the discretion of the grantor or of any person not having a substantial adverse interest in the disposition of such part of the income, be distributed to the grantor, or (3) is, or in the discretion of the grantor or of any person not having a substantial adverse interest in the disposition of such part of the income may be applied to the payment of premiums upon policies of insurance on the life of the grantor, such part of the income of the trust shall be included in computing the taxable income of the grantor. (B) As used in this Section, the term 'in the discretion of the grantor' means in the discretion of the grantor, either alone or in conjunction with any person not having a substantial adverse interest in the disposition of the part of the income in question. SEC. 6 5 . Fidu ciar y Re t u r n s. - Guardians, trustees, executors, administrators, receivers, conservators and all persons individuals or corporations, acting in any fiduciary capacity, shall render, in duplicate, a return of the income of the person, trust or estate for whom or which they act, and be subject to all the provisions of this Title, which apply to individuals in case such person, estate or trust has a gross income of Twenty thousand pesos ( P2 0 ,0 0 0 ) or over during the taxable year. Such fiduciary or person filing the return for him or it, shall take oath that he has sufficient knowledge of the affairs of such person, trust or estate to enable him to make such return and that the same is, to the best of his knowledge and belief, true and correct, and be subject to all the provisions of this Title which apply to individuals: Provided, That a return made by or for one or two or more joint fiduciaries filed in the province where such fiduciaries reside; under such rules and regulations as the Secretary of Finance, upon recommendation of the Commissioner, shall prescribe, shall be a sufficient compliance with the requirements of this Section. SEC. 6 6 . Fiduciaries I ndem nified Against Claim s for Tax es Paid. - Trustees, executors, administrators and other fiduciaries are indemnified against the claims or demands of every beneficiary for all payments of taxes which they shall be required to make under the provisions of this Title, and they shall have credit for the amount of such payments against the beneficiary or principal in any accounting which they make as such trustees or other fiduciaries. • [Impt!] The items of gross income of estates and trusts are the same items of gross income of individuals as provided in Section 32(A) of the Tax Code and shall include the income enumerated in Section 60(A,1-4). In other words, estates and trusts (except employees’ trust) are considered as individuals taxable as a separate taxpayer e x ce pt revocable trusts (Section 63) the income of which shall be included in computing the taxable income of the grantor • [Impt!] I n com e of a n e st a te or t r ust m a y be ta x a ble 1. To the estate or trust 2. To the beneficiary 3. Partly to the estate or trust and partly to the beneficiary, depending upon the disposition of the income under the will or deed of trust 4. To the fiduciary or beneficiary, depending upon the amounts which are properly paid or credited to the beneficiary 5. To the grantor • [VVIP!] I n com e t a x ex e m pt ion of e m ploye e s’ t r u st s – the exemption of employees’ trust which forms part of a pension, etc. was conceived in order to encourage the formation of pension trust systems for the benefit of labourers and employees outside the Social Security Act o The tax exemption privilege of employees’ trusts, as distinguished from any other kind of property held in trust, springs from Section 60(B). Employees’ trusts or benefit plans normally provide economic assistance to employees upon the occurrence of certain contingencies, particularly, old age, retirement, death, sickness, or disability. It provides security against certain hazards to which members of the Plan may be exposed. It is an independent and 95 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o additional source of protection for the working group established for their exclusive benefit and for no other purpose matter of business or for profit or otherwise the collection of foreign payments of such interests or dividends by means of coupons or bills of exchange. It is evident that tax-exemption is likewise to be enjoyed by the income of the pension trust (usually from interests on bank deposits and dividends from corporations); otherwise, taxation of those earnings would result in a diminution of accumulated income and reduce whatever the trust beneficiaries would receive out of the trust fund. Accordingly, interest income derived by a private benefit plan from its investments in money market placements, bank deposits, deposit substitutes, trust funds, purchase of treasury bills and other similar investments is exempt from income tax and consequently, from the 20% withholding tax SEC. 6 9 . Ret urn of I nform at ion of Brokers. - Every person, corporation or duly registered general co-partnership (compania colectiva), doing business as a broker in any exchange or board or other similar place of business, shall, when required by the Commissioner, render a correct return duly verified under oath under such rules and regulations as the Secretary of Finance, upon recommendation of the Commissioner, may prescribe, showing the names of customers for whom such person, corporation or duly registered general co-partnership (compania colectiva) has transacted any business, with such details as to the profits, losses or other information which the Commissioner, may require as to each of such customers as will enable the Commissioner to determine whether all income tax due on profits or gains of such customers has been paid. [Mem!] The interest income derived by the retirement plan from its depository bank under the expanded foreign currency deposit system is exempt from the 7.5% final tax imposed under Section 24(B)(1) SEC. 7 0 . Ret urns of Foreign Corporat ions. – (A) Requirem ent s. - Under rules and regulations prescribed by the Secretary of finance, upon the recommendation of the Commissioner, any attorney, accountant, fiduciary, bank, trust company, financial institution or other person, who aids, assists, counsels or advises in, o with respect to; the formation, organization or reorganization of any foreign corporation, shall, within thirty (30) days thereafter, file with the Commissioner a return. Chapter 11 – Other Income Tax Requirements SEC. 6 7 . Collect ion of Foreign Pay m ent s. - All persons, corporations, duly registered general co-partnerships (companias colectivas) undertaking for profit or otherwise the collection of foreign payments of interests or dividends by means of coupons, checks or bills of exchange shall obtain a license from the Commissioner, and shall be subject to such rules and regulations enabling the government to obtain the information required under this Title, as the Secretary of Finance, upon recommendation of the Commissioner, shall prescribe. (B) Form and Cont ent s of Ret urn. - Such return shall be in such form and shall set forth; under oath, in respect of each such corporation, to the full extent of the information within the possession or knowledge or under the control of the person required to file the return, such information as the Secretary of Finance, upon recommendation of the Commissioner, shall prescribe by rules and regulations as necessary for carrying out the provisions of this Title. Nothing in this Section shall be construed to require the divulging of privileged communications between attorney and client. SEC. 6 8 . I nform at ion at Source as t o I ncom e Pay m ent s. - all persons, corporations or duly registered co- partnerships (companias colectivas), in whatever capacity acting, including lessees or mortgagors of real or personal property, trustees, acting in any trust capacity, executors, administrators, receivers, conservators and employees making payment to another person, corporation or duly registered general co-partnership (compania colectiva), of interests, rents, salaries, wages, premiums, annuities, compensations, remunerations, emoluments or other fixed or determinable gains, profits and income, other than payment described in Section 69, in any taxable year, or in the case of such payments made by the Government of the Philippines, the officers or employees of the Government having information as to such payments and required to make returns in regard thereto, are authorized and required to render a true and accurate return to the Commissioner, under such rules and regulations, and in such form and manner as may be prescribed by the Secretary of Finance, upon recommendation of the Commissioner, setting forth the amount of such gains, profits and income and the name and address of the recipient of such payments: Provided, That such returns shall be required, in the case of payments of interest upon bonds and mortgages or deeds of trust or other similar obligations of corporations, and in the case of collections of items, not payable in the Philippines, of interest upon the bonds of foreign countries and interest from the bonds and dividends from the stock of foreign corporations by persons, corporations or duly registered general co-partnerships (companias colectivas), undertaking as a SEC. 7 1 . Disposit ion of I ncom e Tax Ret urns, Publicat ion of List s of Tax pay ers and Filers. - After the assessment shall have been made, as provided in this Title, the returns, together with any corrections thereof which may have been made by the Commissioner, shall be filed in the Office of the Commissioner and shall constitute public records and be open to inspection as such upon the order of the President of the Philippines, under rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner. The Commissioner may, in each year, cause to be prepared and published in any newspaper the lists containing the names and addresses of persons who have filed income tax returns. SEC. 7 2 . Suit t o Recov er Tax Based on False or Fraudulent Ret urns. - When an assessment is made in case of any list, statement or return, which in the opinion of the Commissioner was false or fraudulent or contained any understatement or undervaluation, no tax collected under such assessment shall be recovered by any suit, unless it is proved that the said list, statement or return was not false nor fraudulent and did not contain any understatement or undervaluation; but this provision shall not apply to statements or returns made or to be made in good faith regarding annual depreciation of oil or gas wells and mines. 96 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 be taxed (as dividend) to them in their individual capacity, whether actually distributed or not. [Impt!] SEC. 7 3 . Dist ribut ion of div idends or Asset s by Corporat ions. (A) Definit ion of Div idends. - The term 'divide n ds' (cash or property dividend; taxable as dividend either 10% or 20% or 25% or 15%) when used in this Title means any distribution made by a corporation to its shareholders out of its e a rn in gs (Unrestricted Retained Earnings – this term means the accumulated net income after the tax of the corporation which is in the custody or is retained by the corporation and not set aside or restricted for any particular purpose) or profits and payable to its shareholders, whether in money or in other property. • Where a corporation distributes a ll of it s a sse t s (or liquidating dividend) in complete liquidation or dissolution, the gain realized or loss sustained by the stockholder, whether individual or corporate, is a taxable income (the liquidation dividend is taxable not as dividend but as capital gain) or a deductible loss, as the case may be. (B) St ock D ivide n d. - A stock dividend representing the transfer of su r plu s (Unrestricted Retained Earnings – this term means the accumulated net income after the tax of the corporation which is in the custody or is retained by the corporation and not set aside or restricted for any particular purpose) to capital account shall not be subject to tax. However, if a corporation cancels or redeems stock issued as a dividend at such time and in such manner as to make the distribution and cancellation or redemption, in whole or in part, essentially equivalent to the distribution of a taxable dividend, the amount so distributed in redemption or cancellation of the stock shall be considered as taxable income to the extent that it represents a distribution of earnings or profits. [Impt!] The basic principle for the taxation of distributions in liquidation is that they are treated as a sale or exchange rather than as ordinary dividends (cash or property) even thought the liquidating distributions include earnings and profits. The stocks owned by the stockholders are the property disposed of and the liquidating distributions whether out of earnings or profits or other source are regarded as the proceeds of the sale o The difference between the amount received (liqu ida t in g dividen d) from the corporation in complete liquidation of dissolution and the cost of the shares (investment cost) surrendered is taxable income (as capital gain) or deductible loss, as the case may be o In case the liquidating dividends consist of real property, its current FMV has to be determined. The gain, if any, derived by the stockholders consisting of the difference between the FMV of the liquidating dividends and the adjusted cost to the stockholders of their respective shareholdings in the corporation shall be subject to ordinary income tax (Section 24A) at the rates prescribed for individuals and corporations o A corporation in complete liquidation transfers its remaining assets Ex a m ple : X is one of the stockholders in Corporation A. 20 years ago, X purchased shares of stock from said corporation at a cost of Php 10M. Today, Corporation A was dissolved and liquidated and after having paid all the corporate creditors, the corporation distributed all its remaining assets to the stockholders and X received a property with FMV of Php 12M. X realized a gain of Php 2M which is taxable as capital gain under Section 24A and not as dividend under Section 24 (B,2). (C) Dividends Dist ribut ed are Deem ed Made from Most Recent ly Accum ulat ed Profit s. - Any distribution made to the shareholders or members of a corporation shall be deemed to have been made form the most recently accumulated profits or surplus, and shall constitute a part of the annual income of the distributee for the year in which received. (D) [Mem!] Net I ncom e of a Pa r t n e rship (ordinary or business or taxable) Deem ed Const ruct ively Received by Part ners. - The taxable income declared (in its ITR) by a partnership for a taxable year which is subject to tax under Section 27 (A) (30%) of this Code, after deducting the corporate income tax imposed therein, shall be deemed to have been actually or constructively received by the partners in the same taxable year and shall The transfer is not considered a sale of these assets. The corporation in liquidation does not realize any gain or loss in a partial or complete liquidation. Since the conveyance is without any valuable consideration, the liquidating corporation is not subject to corporate income tax, CGT not to VAT, or DST under Section 189. It is not subject to VAT since it is not made in the course of trade or business The receipt, however, of the liquidating dividends by the stockholder, is a taxable gain or deductible loss, if it results in a gain or loss, respectively. The liquidating gain or loss is the difference between the FMV of the properties received and the stockholder’s cost basis of the shares. The amounts distributed in the liquidation of a corporation are treated as payments for the shares held by the stockholder. The liquidating gain is treated as a gain from the sale or exchange of shares subject to the ordinary income tax rate(s) imposed on individuals or corporations, and not to the 5%/10% CGT rate Ex a m ple : X is a stockholder in Corp. A and when the latter was liquidated, X received from the corporation liquidating dividend in the form of a piece 97 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 of land with FMV of Php 14M. The shares of stock of X which he purchased from Corp. A 10 years ago costs Php 10M. 2. How much is the capital gain of X? AN S: The capital gain realized by X is the difference between the FMV of the land and the cost of his shares of stock or (Php 14M – Php 10M x 50%) Php 2M. The difference between the FMV of the land and the Cost of the shares of stock is multiplied by 50% because the holding period of the Capital Asset is more than 1 year. The Php 2M is taxable under Section 24A if X is either RC, or NRC or RA. A and B received 20,000 shares as stock dividend, hence, their equity in the corporation has increased from 20% to (120,000 ÷ 540,000) 22.22% • Section 73(B) lays down the general rule known as the “ pr opor t ion a t e t e st ” . The general rule states that: “A stock dividend representing the transfer surplus to the capital account shall not be subject to tax.” Strictly speaking, stock dividends represent capital and do not constitute income to its recipient. So that the mere issuance thereof is not yet subject to income tax as they are nothing but an “enrichment through increase in value of capital investment.” • [VIP!] Intercorporate dividends or dividends received by a domestic corporation or by a resident foreign corporation from a domestic corporation shall not be subject to income tax; but if the recipient is a nonresident foreign corporation, a final withholding tax at the rate of 1 5 % (tax sparing scheme) is imposed subject the condition that the country in which the corporation is domiciled allows a tax credit against the taxes deemed to have been in the Philippines • [VIP!] Pr ope r t y divide n ds – dividends in the form of real property are exempt from the 6% CGT on the part of the corporation which declared and distributed the property dividend but it is taxable on the part of the stockholder/recipient at 10% or 20% or 25% final tax to be withheld by the corporation by requiring the stockholder/recipient to pay in cash the dividend tax beore the deed of conveyance is executed by the corporation. However, a certificate authorizing transfer of real property without payment of the capital gains tax of 6% shall be secured from the RDO of the Revenue District where the property is located before said property is transferred in the name of the stockholder but the RDO will require proof of payment of dividend tax • [Impt!] Sa le of pr ope r t y or sha r es r eceive d a s dividen ds If X subsequently sells the land he received from Corp. A as liquidating dividend, the sale shall be subject to 6% CGT if X is not a real estate dealer or broker, because if he is, the sale is subejct to VAT of 12% • [VIP!] Ta x t r e a t m e n t of st ock divide n d – A stock dividend is: 1. N ot t a x a ble, if the new shares confer no different rights or interest than did the old – the new certificated plus the old, representing the same proportionate interest in the net assets of the corporation as did the old 2. Ta x a ble, if it gives the shareholder a greater proportional interest in the corporation after its distribution. Thus, if the 50% stock dividend is payable in stock or cash, the stock dividend received by stockholders who chose to be paid in stock instead of cash would be taxable and the other stockholders opted to be paid in cash. If all the stockholders opted to be paid in stock, the stock dividend is not taxable Ex a m ple s: 1. The authorized capital stock of Corp. A is 1,000,000 shares at Php 100.00 par value per share. During the first 5 years of Corp. A’s operations it has issued 500,000 shares to its 5 stockholders as follows: A B C D E - 100,000 100,000 100,000 100,000 100,000 500,000 The same facts in #1 except that only A and B opted to receive stock dividend while C, D and E opted to receive cash dividend. The stock dividend received by A and B is taxable and the cash dividend received by C, D and E is likewise taxable. shares shares shares shares shares shares At the beginning of its 6th year when its unrestricted retained earnings has a balance of Php 20M it declared 100,000 shares as stock dividend and distributed them to each stockholder at 20,000 shares. The equity of each stockholder before the issuance of stock dividend is (100,000 ÷ 500,000) 20% and the equity of each stockholder after the issuance of stock dividend is (120,000 ÷ 600,000) 20% 1. Sale of real property received as dividends is taxed at 6 % (if the stockholder/recipient/seller is NOT a real estate dealer because if he is, the sale is subject to 12% VAT and ordinary income tax under Section 24A) based on the GSP or the current FMV, as determined in accordance with Section 6(E), whichever is higher 2. Sale of shares of stock received as property or stock dividend is subject to percentage tax at ½ of 1% based on the GSP or gross value in money if the shares are listed and traded through a local stock exchange; ot h e r w ise, the net capital gain which is not over Php 100,000.00 is subject to income tax of 5% and any amount in excess of Php 100,000.00, at 10% 98 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • Sh a r e s of pa r t ne r s in ne t in com e of pa r t n er sh ip (ordinary or business or taxable) – the taxable income declared by a partnership after deducting the 30% corporate income tax is deemed to have been actually or constructively received by the partners in the same year although not actually distributed to them summary declaration of its gross income and deductions on a cumulative basis for the preceding quarter or quarters upon which the income tax, as provided in Title II of this Code, shall be levied, collected and paid. The tax so computed shall be decreased by the amount of tax previously paid or assessed during the preceding quarters and shall be paid not later than sixty (60) days from the close of each of the first three (3) quarters of the taxable year, whether calendar or fiscal year. Chapter 12 – Quarterly Corporate Income Tax SEC. 7 6 . Final Adj ust m ent Ret urn. - Every cor por a t ion ([1] Domestic; [2] Ordinary or Business or Taxable Partnership; [3] Resident Foreign Corporation) liable to tax under Section 27 shall file a final adjustment (the 4th ITR) return covering the total taxable income for the preceding calendar or fiscal year. If the sum of the quarterly tax payments (3 quarters) made during the said taxable year is not equal to the total tax due on the entire taxable income of that year, the corporation shall either: Annual Declaration and Quarterly Payments of Income Taxes SEC. 7 4 . Declarat ion of I ncom e Tax for I ndividuals. (A) I n General. - Except as otherwise provided in this Section, every individual subject to income tax under Sections 24 and 25(A) of this Title, who is receiving self-employment income, whether it constitutes the sole source of his income or in combination with salaries, wages and other fixed or determinable income, shall make and file a declaration of his estimated income for the current taxable year on or before April 15 of the same taxable year. In general, self-employment income consists of the earnings derived by the individual from the practice of profession or conduct of trade or business carried on by him as a sole proprietor or by a partnership of which he is a member. Nonresident Filipino citizens, with respect to income from without the Philippines, and nonresident aliens not engaged in trade or business in the Philippines, are not required to render a declaration of estimated income tax. The declaration shall contain such pertinent information as the Secretary of Finance, upon recommendation of the Commissioner, may, by rules and regulations prescribe. An individual may make amendments of a declaration filed during the taxable year under the rules and regulations prescribed by the Secretary of Finance, upon recommendation of the Commissioner. (A) Pay the balance of tax still due; or (B) Carry-over the excess (of payments for the 3 quarters over the tax due for the whole year and this will happen only if the corporation sustained or suffered a loss during the last quarter) as tax credit; or (C) Be credited or refunded with the excess amount paid (the corporation must file a written claim for tax credit or tax refund with the CIR within 2 years from the filing of the final adjustment return), as the case may be. In case the corporation is entitled to a t ax cr e dit or r e fun d of the excess estimated quarterly income taxes paid, the excess amount shown on its final adjustment return may be carried over and credited against the estimated quarterly income tax liabilities for the taxable quarters of the succeeding taxable years. Once the option to carry-over and apply the excess quarterly income tax against income tax due for the taxable quarters of the succeeding taxable years has been made, such option shall be considered irrevocable for that taxable period and no application for cash refund or issuance of a tax credit certificate shall be allowed therefor. (B) Ret urn and Paym ent of Est im at ed I ncom e Tax by I ndividuals. - The amount of estimated income as defined in Subsection (C) with respect to which a declaration is required under Subsection (A) shall be paid in four (4) installments. The first installment shall be paid at the time of the declaration and the second and third shall be paid on August 15 and November 15 of the current year, respectively. The fourth installment shall be paid on or before April 15 of the following calendar year when the final adjusted income tax return is due to be filed. SEC. 7 7 . Place and Tim e of Filing and Pay m ent of Quart erly Corporat e I ncom e Tax. (A) Place of Filing. -Except as the Commissioner other wise permits, the quarterly income tax declaration required in Section 75 and the final adjustment return required I Section 76 shall be filed with the authorized agent banks or Revenue District Officer or Collection Agent or duly authorized Treasurer of the city or municipality having jurisdiction over the location of the principal office of the corporation filing the return or place where its main books of accounts and other data from which the return is prepared are kept. (C) Definit ion of Est im at ed Tax. - In the case of an individual, the term 'estimated tax' means the amount which the individual declared as income tax in his final adjusted and annual income tax return for the preceding taxable year minus the sum of the credits allowed under this Title against the said tax. If, during the current taxable year, the taxpayer reasonable expects to pay a bigger income tax, he shall file an amended declaration during any interval of installment payment dates. (B) Tim e of Filing t he I ncom e Tax Ret urn. - The corporate quarterly declaration shall be filed within sixty (60) days following the close of each of the first three (3) quarters of the taxable year. The final adjustment return shall be filed on or before the fifteenth (15th) day of April of the following year if on a Calendar year basis, or on or before the fifteenth (15th) day of the fourth (4th) month following the close of the fiscal year if on a fiscal year basis example: if the fiscal year of the corporation starts April 1 it will end on [Impt!] SEC. 7 5 . Declarat ion of Quart erly Corporat e I ncom e Tax. - Every cor por a t ion ([1] Domestic; [2] Ordinary or Business or Taxable Partnership; [3] Resident Foreign Corporation) shall file in duplicate a quarterly (3 quarters) 99 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 March 31 of the following year and the final adjustment return shall be filed on or before July 15, as the case may be. (B) [Read!] Payroll Period. - The term 'payroll period' means a period for which payment of wages is ordinarily made to the employee by his employer, and the term 'miscellaneous payroll period' means a payroll period other than, a daily, weekly, biweekly, semi-monthly, monthly, quarterly, semi-annual, or annual period. (C) Tim e of Pay m ent of t he I ncom e Tax. - The income tax due on the corporate quarterly returns and the final adjustment income tax returns computed in accordance with Sections 75 and 76 shall be paid at the time the declaration or return is filed in a manner prescribed by the Commissioner. • • (C) Em ploy ee. - The term 'e m ploye e ' refers to any individual who is the recipient of wages and includes an officer, employee or elected official of the Government of the Philippines or any political subdivision, agency or instrumentality thereof. The term 'employee' also includes an officer of a corporation. Under Section 76, the corporation, in case of excess tax payments, has the option to file claims for refund or tax credit. The amendment by RA No. 8424 gives the taxpayer also the option to carry-over and apply the excess quarterly income tax against the income tax due for the taxable quarters of the succeeding taxable years. Such option when exercised shall be considered irrevocable for the whole amount of the excess income tax for that taxable period and no cash refund or tax credit may be availed of (D) Em ploy er. - The term 'e m ploye r' means the person for whom an individual performs or performed any service, of whatever nature, as the employee of such person, except that: (1) If the person for whom the individual performs or performed any service does not have control of the payment of the wages for such services, the term 'employer' (except for the purpose of Subsection(A) means the person having control of the payment of such wages; and The 2 year prescriptive period (to claim tax refund or tax credit) provided in Section 229 should be counted from the filing of the Adjustment Return or Annual Income Tax Return and final payment of income tax, if any Chapter 13 – Withholding on Wages (2) In the case of a person paying wages on behalf of a nonresident alien individual, foreign partnership or foreign corporation not engaged in trade or business within the Philippines, the term 'employer' (except for the purpose of Subsection(A) means such person. SEC. 7 8 . Definit ions. - As used in this Chapter: (A) Wages. - The term 'w a ge s' means all remuneration (other than fees paid to a public official) for services performed by an employee for his employer, including the cash value of all remuneration paid in any medium other than cash, e x ce pt that such term shall not include remuneration paid: Withholding is not required but the recipient of the wage or salary may or may not be subject to income tax SEC. 7 9 . I ncom e Tax Collect ed at Source.(A) Requirem ent of Wit hholding. – Except in the case of a minimum wage earner (exempt from income tax) as defined in Section 22(HH) of this Code, every employer making payment of wages shall deduct and withhold upon such wages a tax determined in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner. (1) For agricultural labor paid entirely in products of the farm where the labor is performed, or (2) For domestic service in a private home, or (B) Ta x Pa id by Recipie n t . - If the employer, in violation of the provisions of this Chapter, fails to deduct and withhold the tax as required under this Chapter, and thereafter the tax against which such tax may be credited is paid by the employee, the tax so required to be deducted and withheld shall not be collected from the employer; bu t this Subsection shall in no case relieve the employer from liability for any penalty or addition to the tax otherwise applicable in respect of such failure to deduct and withhold. (3) For casual labor not in the course of the employer's trade or business, or (4) For services by a citizen or resident of the Philippines for a foreign government or an international organization. [Read!] If the remuneration paid by an employer to an employee for services performed during one-half (1/2) or more of any payroll period of not more than thirty-one (31) consecutive days constitutes wages, all the remuneration paid by such employer to such employee for such period shall be deemed to be wages; but if the remuneration paid by an employer to an employee for services performed during more than one -half (1/2) of any such payroll period does not constitute wages, then none of the remuneration paid by such employer to such employee for such period shall be deemed to be wages. (C) Refunds or Credit s. – (1) Em ploye r . - When there has been an overpayment of tax under this Section, refund or credit shall be made to the employer only to the extent that the amount of such overpayment was not deducted and withheld hereunder by the employer (this means that the Er assumed the income tax of the employee). 100 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (2) Em ployees. -The amount deducted and withheld under this Chapter during any calendar year shall be allowed as a credit to the recipient of such income against the tax imposed under Section 24(A) of this Title. Refunds and credits in cases of excessive withholding shall be granted under rules and regulations promulgated by the Secretary of Finance, upon recommendation of the Commissioner. exemption certificate, the employer shall withhold the taxes prescribed under the schedule for z e r o e x e m ption (for QDC [qualified dependent children]) of the withholding tax table determined pursuant to Subsection (A) hereof. (E) Wit hholding on Basis of Av erage Wages. - The Commissioner may, under rules and regulations promulgated by the Secretary of Finance, authorize employers to: Any excess of the taxes withheld over the tax due from the taxpayer shall be r e t ur ne d (or refunded) or credited within three (3) months from the fifteenth (15th) day of April. Refunds or credits made after such time shall earn interest at the rate of six percent (6%) per annum, starting after the lapse of the three-month period to the date the refund of credit is made. (1) estimate the wages which will be paid to an employee in any quarter of the calendar year; (2) determine the amount to be deducted and withheld upon each payment of wages to such employee during such quarter as if the appropriate average of the wages so estimated constituted the actual wages paid; and Refunds shall be made upon w a r r a n t s (treasury warrants or government checks) drawn by the Commissioner or by his duly authorized representative without the necessity of counter-signature by the Chairman, Commission on Audit or the latter's duly authorized representative as an exception to the requirement prescribed by Section 49, Chapter 8, Subtitle B, Title 1 of Book V of Executive Order No. 292, otherwise known as the Administrative Code of 1987. (3) deduct and withhold upon any payment of wages to such employee during ;such quarter such amount as may be required to be deducted and withheld during such quarter without regard to this Subsection. (D) Personal Exem pt ions. – (F) [Impt!] Husband and Wife. - When a husband and wife each are recipients of wages, whether from the same or from different employers, taxes to be withheld shall be determined on the following bases: (1) I n General. - Unless otherwise provided by this Chapter, the personal and additional exemptions applicable under this Chapter shall be determined in accordance with the main provisions of this Title. (1) The husband shall be deemed the head of the family and proper claimant of the additional exemption in respect to any dependent children, un le ss he explicitly waives his right in favor of his wife in the withholding exemption certificate. (2) Ex e m pt ion Ce r t ifica te . – (a) When t o File. - On or before the date of commencement of employment with an employer, the employee shall furnish the employer with a signed withholding exemption certificate relating to the personal and additional exemptions to which he is entitled. (2) Taxes shall be withheld from the wages of the wife in accordance with the schedule for zero exemption of the withholding tax table prescribed in Subsection (D)(2)(d) hereof. (G) Nonresident Aliens. - Wages paid to nonresident alien individuals engaged in trade or business in the Philippines shall be subject to the provisions of this Chapter. (b) Change of St at us. - In case of change of status of an employee as a result of which he would be entitled to a le sser (one of the qualified dependent children becomes disqualified such as by marriage or reaching the age of 21 or becoming gainfully employed, but the lesser exemption will not be in the year of disqualification but in the succeeding year because disqualification of a dependent child is deemed to occur at the end of the year) or gr e a t e r (birth of a child during the year) amount of exemption, the employee shall, within ten (10) days from such change, file with the employer a new withholding exemption certificate reflecting the change. (H) Year- end Adj ust m ent . - On or before the end of the calendar year but prior to the payment of the compensation for the last payroll period (Dec. 16 to Dec. 31), the employer shall determine the tax due from each employee on taxable compensation income for the entire taxable year in accordance with Section 24(A). The difference between the tax due from the employee for the entire year and the sum of taxes withheld from January to November or Dec. 15 shall either be withheld from his salary in December of the current calendar year or refunded (by the Er to the employee, this is the reason why the BIR does not refund to the Ee) to the employee not later than January 25 of the succeeding year. (c) Use of Cert ificat es. - The certificates filed hereunder shall be used by the employer in the determination of the amount of taxes to be withheld. • (d) Failure t o Furnish Cert ificat e. - Where an employee, in violation of this Chapter, either fails or refuses to file a withholding The withholding tax on wages is not applicable and effective abroad and does not apply to foreign-sourced income or wages of non-resident citizen contract workers because the provisions of the NIRC do not apply to 101 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 foreign employers or the Philippines has no jurisdiction over foreign employers. It applies only to wages or income derived from sources within the Philippines • Re qu isit e s of withholding tax on wages 1. Employer-employee relationship 2. Payment (actual or constructive) of wages for services rendered 3. Payroll Period • Ca su al la bor includes labor which is occasional, incidental or irregular • The emergency allowance received by an employee forms part of his gross compensation income and, hence, subject to income tax. Accordingly, it is subject to withholding tax • Loya lt y Ca sh Aw a r d Since loyalty cash award is similar to a bonus, which means a sum of money over and above the usual current or stipulated wages/salaries of officials and employees, it is considered as remuneration for services performed by the officials/employees for the employer; hence, taxable income subject to withholding tax • SEC. 8 1 . Filing of Ret urn and Pay m ent of Tax es Wit hheld. - [Read!] Except as the Commissioner otherwise permits, taxes deducted and withheld by the employer on wages of employees shall be covered by a return and paid to an authorized agent bank; Collection Agent, or the duly authorized Treasurer of the city or municipality where the employer has his legal residence or principal place of business, or in case the employer is a corporation, where the principal office is located. The r e t ur n (withholding tax return [filed by Er]) shall be filed and the payment made within twenty-five (25) days from the close of each calendar quarter: Pr ovide d, h ow e ve r , That the Commissioner may, with the approval of the Secretary of Finance, require the employers to pay or deposit the taxes deducted and withheld at more frequent intervals (under the present rules and regulations Ers are required to withhold tax on wages monthly and the return must be filed and the tax must be paid within 10 days after the end of each month except December where the return must be filed and the tax must be paid on or before January 25), in cases where such requirement is deemed necessary to protect the interest of the Government. The taxes deducted and withheld by employers shall be held in a special fund in trust for the Government until the same are paid to the said collecting officers. SEC. 8 2 . Ret urn and Pay m ent in Case of Governm ent Em ploy ees. - If the employer is the Government of the Philippines or any political subdivision, agency or instrumentality thereof, the return of the amount deducted and withheld upon any wage shall be made by the officer or employee (such as the treasurer) having control of the payment of such wage, or by any officer or employee duly designated for the purpose (such as accountant). [VIP!] Te r m in a l Le a ve Pa y (it is in the nature of retirement benefit) – such pay received by a government official or employee is not subject to income tax [VIP!] SEC. 8 0 . Liabilit y for Tax . – SEC. 8 3 . St at em ent s and Ret urns. - (A) Em ployer. - The employer shall be lia ble (or responsible) for the withholding and remittance of the correct amount of tax required to be deducted and withheld under this Chapter. If the employer fails to withhold and remit the correct amount of tax as required to be withheld under the provision of this Chapter, such tax shall be collected from the employer together with the penalties or additions to the tax otherwise applicable in respect to such failure to withhold and remit. (A) [Read!] Requirem ent s. - Every employer required to deduct and withhold a tax shall furnish to each such employee in respect of his employment during the calendar year, on or before January thirty-first (31st) of the succeeding year, or if his employment is terminated before the close of such calendar year, on the same day of which the last payment of wages is made, a written statement confirming the wages paid by the employer to such employee during the calendar year, and the amount of tax deducted and withheld under this Chapter in respect of such wages. The statement required to be furnished by this Section in respect of any wage shall contain such other information, and shall be furnished at such other time and in such form as the Secretary of Finance, upon the recommendation of the Commissioner, may, by rules and regulation, prescribe. (B) Em ployee. - Where an employee 1fails or refuses to file the withholding exemption certificate or 2willfully supplies false or inaccurate information thereunder, the tax otherwise required to be withheld (this is applicable only to #2 such as when the employee states that he has 4 QDC when in truth he only has 2 because in #1 it will result to excess taxes withheld since the employee will fall under 0-exemption for QDC) by the employer shall be collected from h im (employee) including penalties or additions to the tax from the due date of remittance until the date of payment. On the other hand, excess taxes withheld made by the employer due to: (B) [Impt!] An n u a l I n for m a t ion Re t u rn s. - Every employer required to deduct and withhold the taxes in respect of the wages of his employees shall, on or before January thirty-first (31st) of the succeeding year, submit to the Commissioner an annual information return (Alpha List) containing a list of employees, the total amount of compensation income of each employee, the total amount of taxes withheld therefrom during the year, accompanied by copies of the statement referred to in the preceding paragraph, and such other information as may be deemed necessary. This return, if made and filed in accordance with rules and regulations (1) failure or refusal to file the withholding exemption certificate; or (2) false and inaccurate information shall not be refunded (such as when the employee declared that he has 2 QDC instead of 4) to the employee but shall be forfeited in favor of the Government. 102 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 promulgated by the Secretary of Finance, upon recommendation of the Commissioner, shall be sufficient compliance with the requirements of Section 68 of this Title in respect of such wages. (C) Ext ension of t im e. - The Commissioner, under such rules and regulations as may be promulgated by the Secretary of Finance, may grant to any employer a reasonable extension of time to furnish and submit the statements and returns required under this Section. • Taxes deducted and withheld on compensation income shall be remitted within 10 days after the end of each calendar month with the filing of the appropriate return. However, taxes withheld from the last compensation payment for the calendar year (December) shall be remitted on or before the 25th of January of the succeeding year • RATA is not taxable • Like RATA, personnel economic relief assistance (PERA) is not taxable; hence, not subject to withholding tax • The cash equivalent of vacation leave credits and accumulated leave credits given to company’s employees by reason of compulsory retirement or termination of employment for cause beyond the control of the said employees are not subject to income tax and, consequently, to withholding tax [Happens if there is a CBA in private companies] 103 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 [BAR!] • TITLE 3 ESTATE AND DONOR’S TAXES Chapter 1 – Estate Tax SEC. 8 5 . Gross Est at e. - The value of the gross estate of the decedent shall be determined by including the value (Fair Market Value) a t t h e t im e of h is de a t h (even if the property is received or is to accrue after the death of the decedent such as proceeds of life insurance and death benefits, said property is included in the gross estate) of all property, real or personal, tangible or intangible, wherever situated: Pr ovide d, h ow e ve r , that in the case of a nonresident alien decedent who at the time of his death was not a citizen of the Philippines, only that part of the entire gross estate which is situated in the Philippines shall be included in his taxable estate. wherever situated: Classification of decedents – Location of property to be included in gross estate 1. Resident Citizen - wherever situated 2. Non-resident Citizen - wherever situated 3. Resident Alien - wherever situated 4. Non-resident Citizen - only property located in the Philippines SEC. 8 4 . Rat es of Est at e Tax. There shall be levied, assessed, collected and paid upon the transfer of the net estate as determined in accordance with Sections 85 and 86 of every dece de n t (Filipino citizen or alien), whether resident or nonresident of the Philippines, a tax based on the va lu e (FMV at the time of death) of such net estate, as computed in accordance with the following schedule: If the net estate is: Bu t Ove r Ove r N ot Th e Ta x sh all be Plu s Of t h e Exce ss Ove r P 200,000 Exempt P 200,000 550,000 0 5% P 200,000 500,000 2,000,000 P 15,000 8% 500,000 2,000,000 5,000,000 135,000 11% 2,000,000 5,000,000 10,000,000 465,000 15% 5,000,000 10,000,000 And Over 1,215,000 20% 10,000,000 (A) D e ce de n t 's I n te r est (Equity or claim). - To the extent of the interest therein of the decedent at the time of his death; [VIP!] [Section 85A refers to properties absolutely and exclusively owned by the decedent at the time of his death] [Impt!] [Section 85A refers to properties absolutely and exclusively owned by the decedent at the time of his death including equities or claims or interests in properties such as share in a partnership where he is a coowner, naked ownership in a property the usufruct of which belongs to another, usufruct in property the naked ownership belongs to another person, and absolute community properties or conjugal properties of the decedent and his surviving spouse] Ex a m ple : If the net estate is Php 8M the estate tax is: First Php 5M EXCESS (Php 8M – Php 5M x 15%) ESTATE TAX Php 465,000.00 450,000.00 Php 915,000.00 • [Impt!] Taxes upon the gratuitous disposition of property are known as transfer taxes. Under the Tax Code, they are the e st a t e t a x , don or ’s t a x . They are e xcise (or privilege) taxes • [Mem!] Est a t e t a x is the tax on the right to transmit property at death and on certain transfers by the decedent during his lifetime which are made by the law the equivalent of testamentary dispositions • Php 200,000.00 (deduction after the net estate of decedent) should not be included in computing the estate tax because the amounts under the column “the tax shall be” in Section 84 were arrived at after deducting the Php 200,000.00 exemption In the schedule, the Php 200,000.00 exemption is already deducted where the value of the (taxable) net estate is more than Php 200,000.00 but not more than Php 500,000.00. Hence, it should not be deducted anymore. (B) Tr a n sfer in Con t e m pla t ion of D e a th . - To the extent of any interest therein of which the decedent has at any time (during his lifetime) made a transfer, by trust or ot h e r w ise (by donation), in contemplation of or intended to take effect in possession or enjoyment at or after death, or of which he has at any time made a transfer, by trust or otherwise, under which he has retained for his life or for any period which does not in fact end before his death (1) the possession or enjoyment of, or the right to the income from the property, or (2) the right, either alone or in conjunction with any person, to designate the person who shall possess or enjoy the property or the income therefrom; except in case of a bonafide sale for an adequate and full consideration in money or money's worth. Ex a m ple : A consulted his doctor on Jan. 2, 2013 and the findings revealed that A’s life will probably last for not more than 6 months immediately thereafter, A donated his farmland to B because of fear of his 104 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 impending death but he retained for himself the possession and enjoyment of the said farmland until his death. and his surviving spouse, but ultimately, the net share of the surviving spouse is deducted from the gross estate] On Jan. 28, 2014, A died. (D) Pr ope r t y Pa ssin g Un de r Gen e r al Pow e r of Appoin t m e n t . - To the extent of any property passing under a general power of appointment exercised by the decedent: (1) by will, or (2) by deed executed in contemplation of, or intended to take effect in possession or enjoyment at, or after his death, or (3) by deed under which he has retained for his life or any period not ascertainable without reference to his death or for any period which does not in fact end before his death (a) the possession or enjoyment of, or the right to the income from, the property, or (b) the right, either alone or in conjunction with any person, to designate the persons who shall possess or enjoy the property or the income therefrom; e x ce pt in case of a bona fide sale for an adequate and full consideration in money or money's worth. The farmland is part of the gross estate of A which is called transfer in contemplation of death (C) Re voca ble Tr a nsfe r. – (1) To the extent of any interest therein, of which the decedent has at any time made a transfer (ex ce pt in case of a bona fide sale for an adequate and full consideration in money or money's worth) by trust or otherwise, where the enjoyment thereof was subject at the date of his death to any change through the exercise of a power (in whatever capacity exerciseable) by the decedent alone or by the decedent in conjunction with any other person (without regard to when or from what source the decedent acquired such power), to alter, amend, revoke, or terminate, or where any such power is relinquished in contemplation of the decedent's death. Ex a m ple : (There must be 2 decedents) Jan. 2, 2010 (2) For the purpose of this Subsection, the power to alter, amend or revoke shall be considered to exist on the date of the decedent's death even though the exercise of the power is subject to a precedent giving of notice or even though the alteration, amendment or revocation takes effect only on the expiration of a stated period after the exercise of the power, whether or not on or before the date of the decedent's death notice has been given or the power has been exercised. In such cases, proper adjustment shall be made representing the interests which would have been excluded from the power if the decedent had lived, and for such purpose if the notice has not been given or the power has not been exercised on or before the date of his death, such notice shall be considered to have been given, or the power exercised, on the date of his death. To B: I am donating to you my commercial lot and building and you are hereby authorized to designate any person of your choice to be the ultimate donee/beneficiary of said property. In the meantime, you may enjoy the ownership of said property. Sgd A On Jan. 2, 2014, A died. The commercial lot and building are NOT part of the gross estate of A because the transfer made to B is neither a transfer in contemplation of death nor a revocable transfer Jan. 12, 2014 Ex a m ple : Dec. 24, 2010 To C: I hereby deisgnate you as the ultimate donee/beneficiary of the commercial lot and building which were previously donated to me by A and you may take possession and enjoyment of said property after my death. Sgd B To A: I hereby donate to you my apartment lot and building and you may take possession and administer the same as well as to receive the rentals therefrom. However, should you prove unfit or unworthy as beneficiary/donee, I shall revoke this donation. Sgd B On Nov. 30, 2014, B died. On Jan. 28, 2014, B died. The commercial lot and building are part of the gross estate of B The apartment lot and building are part of the gross estate of B, which is called revocable transfer (E) [BAR!] Pr oce e ds of Life I n su r an ce . - To the extent of the amount receivable by the estate of the deceased, his executor, or administrator, as insurance under policies taken out by the decedent upon his own life, irrespective of whether or not the insured retained the power of revocation, or to the extent of the amount receivable by any beneficiary designated in [The gross estate of the decedent consist of his exclusive properties and the absolute community properties or conjugal properties of the decedent 105 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 the policy of insurance, e x ce pt when it is expressly stipulated that the designation of the beneficiary is irrevocable. (H) Capit al of t he Surv iv ing Spouse. - The capital exclusive property (share of the surviving spouse in the community properties or conjugal properties is included in the gross estate of the decedent/spouse but the net share in the community properties or conjugal properties is deducted) of the surviving spouse of a decedent shall not, for the purpose of this Chapter, be deemed a part of his or her gross estate. Ex a m ple : When is the proceeds of the life insurance part of the GE of the decedent? AN S: 1. Beneficiary designated is the estate, executor or adminitrator, whether the designation is revocable or irrevocable 2. • Beneficiary designated is other than the estate, executor or administrator, such as spouse and/or children of the decedent, if the designation is revocable When is the proceeds of life insurance NOT part of the GE of the decedent? [Impt!] Tr a n sfe r I n t e r Vivos – the gross estate of a decedent for purposes of the estate tax may exceed the actual value of his assets at the time of his death as it includes the value of transfers of property or interest in property made by him during his lifetime which partake of the nature of testamentary dispositions. These transfers inter vivos may be grouped as follows: 1. 2. 3. 4. 5. Section 85(A) AN S: If the beneficiary designated is other than the estate or administrator or executor, such as spouse and/or children of the decedent and the designation is irrevocable Transfers in contemplation of death Transfers with retention or reservation of certain rights Revocable transfers Transfers of property arising under a general power of appointment Transfers for insufficient consideration The purpose of the law is to reach such transfers and thus prevent the avoidance of the estate tax (F) Prior I nt erest s. - Except as otherwise specifically provided therein, Subsections (B), (C) and (E) of this Section shall apply to the transfers, trusts, estates, interests, rights, powers and relinquishment of powers, as severally enumerated and described therein, whether made, created, arising, existing, exercised or relinquished before or after the effectivity of this Code. (G) Tr a n sfer s of I n su fficien t Con side r a t ion. - If any one of the transfers, trusts, interests, rights or powers enumerated and described in Subsections (B), (C) and (D) of this Section is made, created, exercised or relinquished for a consideration in money or money's worth, but is not a bona fide sale for an adequate and full consideration in money or money's worth, there shall be included in the gross estate only the excess of the fair market value, at the time of death, of the property otherwise to be included on account of such transaction, over the value of the consideration received therefor by the decedent. • [Impt!] Tr a n sfe r s in con t e m pla t ion of de a t h – the words mean that it is the thought of death, as a controlling motive, which induces the disposition of the property for the purpose of avoiding the tax (estate) • Cir cu m st an ce s t a ke n in t o a ccou n t – the following are examples of circumstances which may be taken into consideration (by the BIR) in determining whether the transfer was made in contemplation of death: Ex a m ple : In 2009, when the FMV of the land of A was Php 4M, he sold it to B for Php 2M. When A died in 2014, its FMV was Php 5M. How much will be included in the gross estate of A? • AN S: To be included in the gross estate of A is the FMV of the land at the time of his death which is Php 5M MINUS the consideration received which is Php 2M or Php 3M. 1. Age and state of health of the decedent at the time of the gift (or transfer), especially where he was aware of a serious illness 2. Length of time between the gift and the date of death. A short interval suggests the conclusion that the thought of death was in the decedent’s mind, and a long interval suggests the opposite 3. Concurrent making of a will or making a will within a short time after the transfer Pow e r of a ppoin t m e n t – it refers to a right to designate the person or persons who shall enjoy or possess certain property (the ultimate or second donee/s) from the estate of a prior decedent 1. Section 85 B, C, D and G refer to properties already transferred by the decedent to other persons during his lifetime and therefore, no longer his at the time of his death, but are considered by law as part of and should be included in his gross estate. It is general when it authorizes the donee (first donee) (decedent [present or second donee]) to appoint any person he pleases, including himself (the first donee may execute an affidavit of selfadjudication), thus having as full dominion over the property as though he owned it 106 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 2. It is special when he can appoint only among a restricted or designated class or persons other than himself 2. If it is general, a power makes the appointed property for most purposes a part of the donee’s (first donee) property. Property which passes under a special power of appointment is not includible in the gross estate of the first donee/second decedent • AN S: The actual funeral expenses amount to Php 500,000.00, 5% of the gross estate is (Php 3M x 5%0 Php 150,000.00 while the maximum amount if Php 200,000.00. Therefore, the allowable deduction is Php 150,000.00 which is the lowest among the 3 amounts. [BAR!] Life in su r a nce pr oce e ds – the designation of a beneficiary in a life insurance policy is presumed to be revocable; hence, the insurance proceeds are includible in the gross estate of the insured upon his death, even if he failed to exercise his right to revoke the designation. Said proceeds are, therefore, subject to estate tax whoever is beneficiary whether the estate, executor or administrator of the decedent or the beneficiary is other than the estate, executor or administrator of the decedent, such as spouse or children (c) For claims (or payables or liabilities of the decedent) against the estate: Pr ovide d, That at the time the indebtedness was incurred the debt instrument (such as promissory note) was duly notarized an d, if the loan was contracted within three (3) years before the death of the decedent, the administrator or executor shall submit a statement showing the disposition of the proceeds of the loan; They are not considered as part of the decedent’s estate, and therefore, not subject to estate tax only when it is expressly stipulated in the policy that such designation is irrevocable and the beneficiary is other than the estate, his executor or administrators [The purpose of the law is to prevent claims against the estate which are fictitious] (d) For claims of the deceased against insolvent persons (or receivables which are uncollectible or simple bad debts) where the value of decedent's interest therein is included in the value of the gross estate; and SEC. 8 6 . Com put at ion of Net Est at e. - For the purpose of the tax imposed in this Chapter, the value of the net estate shall be determined: (A) D e du ct ions Allow e d t o t he Est at e of Cit izen or a Resident . - In the case of a citizen (resident or non-resident) or resident (alien) of the Philippines, by deducting from the value of the gross estate - [In order that bad debts may be deducted the receivables must be included in the gross estate] (e) For unpaid mortgages upon, or any indebtedness in respect to, property (such as unpaid balance of property purchased by the decedent) where the value of decedent's interest therein, undiminished by such mortgage or indebtedness, is included in the value of the gross estate, bu t n ot in clu din g any 1income tax upon income received after the death of the decedent, or 2 property taxes not accrued before his death, or any 3estate tax. The deduction herein allowed in the case of claims against the estate, unpaid mortgages or any indebtedness shall, when founded upon a promise or agreement, be limited to the extent that they were contracted bona fide and for an adequate and full consideration in money or money's worth. 4There shall also be deducted losses incurred during the settlement (the property which was damaged or lost was still existing at the time of death, hence, included in the gross estate) of the estate arising from fires, storms, shipwreck, or other casualties, or from robbery, theft or embezzlement, when 1 such losses are not compensated for by insurance or otherwise, and if 2at the time of the filing of the re t u r n (estate tax return) such losses have not been claimed as a deduction for the income tax purposes in an income tax return, and provided that 3such losses were incurred not later than the last day for the payment of the estate tax (6 months from (1) Ex pe n se s, Losse s, I n de bt e dn ess, a n d t a xe s. - Such amounts – The cash or amounts disbursed must be included in the gross estate; hence, if these expenses are paid by a relative the same are not deductible (a) For actual funeral expenses or in an amount equal to five percent ( 5 % ) of the gross estate, whichever is lower, but in no case to exceed Two hundred thousand pesos ( P2 0 0 ,0 0 0 ) ; [Actual funeral expenses or 5% of gross estate or Php 200,000.00, whichever is lowest] (b) For judicial expenses proceedings; of the testamentary or The actual funeral expenses amount to Php 500,000.00 while the gross estate is Php 3M. How much is the allowable deduction as funeral expenses? intestate Ex a m ple s: 1. The actual funeral expenses amount to Php 1M while the gross estate is Php 10M. How much is the allowable deduction as funeral expenses? AN S: The actual funeral expenses amount to Php 1M, 5% of the gross estate is (Php 10M x 5%) Php 500,000.00 while the maximum is Php 200,000.00, therefore, the allowable deduction is Php 200,000.00 which is the lowest among the 3 amounts 107 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 decedent’s death as a rule) as prescribed in Subsection (A) of Section 91. of Dec. 10, 2014. The expenses, losses, indebtedness and taxes pertaining to A’s estate amount to Php 7M and the will of A provides that a parcel of land with FMV of Php 3M be devised to the government of Naga City exclusively for public purposes. [Income tax that accrued before death and real property taxes that accrued before death of the decedent are allowable deductions but estate tax is always NOT deducible] Compute the vanishing deduction from the gross estate of A (2) [BAR!] [VVIP!] Pr ope r t y Pr e viou sly Ta xe d (or Vanishing Deduction). - An amount equal to the value specified below of 1any property forming a part of the gross estate 2situated in the Philippines of any pe r son w h o die d (previous or prior decedent) 3within five (5) years prior to the death of the decedent (present), or transferred to the decedent by gift within five (5) years prior to his (decedent) death, 4where such property can be identified as having been received by the decedent from the donor by gift, or from such prior decedent by gift, bequest, devise or inheritance (or legitime), or which can be identified as having been acquired in exchange for property so received: One hundred percent ( 1 0 0 % ) of the value, if the prior decedent died within one (1) year prior to the death of the present decedent, or if the property was transferred to him (present decedent) by gift within the same period prior to his (present decedent) death; Eighty percent ( 8 0 % ) of the value, if the prior decedent died more than one (1) year but not more than two (2) years prior to the death of the present decedent, or if the property was transferred to him by gift within the same period prior to his death; Sixty percent ( 6 0 % ) of the value, if the prior decedent died more than two (2) years but not more than three (3) years prior to the death of the present decedent, or if the property was transferred to him by gift within the same period prior to his death; Forty percent ( 4 0 % ) of the value, if the prior decedent died more than three (3) years but not more than four (4) years prior to the death of the present decedent, or if the property was transferred to him by gift within the same period prior to his death; SOLU TI ON : Value of PPT Php LESS: Mortgage indebtedness paid by A Initial basis Php LESS: Second deduction (Php 6M ÷ Php 50M × Php 10M) Final Basis Php Rate of Deduction Vanishing Deduction or PPT Php Whichever is lower To be included in the gross estate of the present decedent is the FMV of the property at the time of his death. For purposes of computing the vanishing deduction the amount to be shown as PPT is the FMV at the time of the death of the prior decedent or the FMV at the time of the death of the present decedent, whichever is lower Twenty percent ( 2 0 % ) of the value, if the prior decedent died more than four (4) years but not more than five (5) years prior to the death of the present decedent, or if the property was transferred to him by gift within the same period prior to his death; 8M 2M 6M 1.2 M 4.8 M 60% 2,880,000.00 These This deductions shall be allowed only where a 5donor's tax or estate tax imposed under this Title was finally determined and paid by or on behalf of such donor, or the estate of such prior decedent, as the case may be, and 6only in the amount finally determined as the value of such property in determining the value of the gift, or the gross estate of such prior decedent, an d only to the extent that the value of such property is included in the present decedent's gross estate, and 7only if in determining the value of the estate of the prior decedent, no deduction was allowable under paragraph (2) in respect of the property or properties given in exchange therefor. Where a deduction was allowed of any mortgage or other lien in determining the donor's tax, or the estate tax of the prior decedent, which was paid in whole or in part prior to the decedent's death, then the deduction allowable under said Subsection shall be reduced by the amount so paid. Such deduction allowable shall be reduced by an amount which bears the same ratio to the amounts allowed as deductions under paragraphs (1) and (3) of this Subsection as the amount otherwise deductible under said paragraph (2) bears to the value of the decedent's estate. Where the property referred to consists of two or more items, the aggregate value of such items shall be used for the purpose of computing the deduction. [Vanishing deduction can only be availed of once] Ex a m ple : A died in 2008 and he left a parcel of land to his son B. B died in 2011 and the estate of B claimed vanishing deduction with respect to the property inherited by B from A. In 2014 C, who inherited from his father B the property which B inherited from A, died. The estate of C can no longer claim Vanishing deduction with respect to the property he inherited from B who in turn inherited the property from A Ex a m ple : On June 1, 2012 the father of A died and the latter received as inheritance a parcel of land with FMV of Php 8M. On said date the land was mortgaged with a bank and A paid the mortgage indebtedness together with the interest thereon on March 31, 2013 in the amount of Php 2M. The estate tax on the properties left by A’s father was paid by his executor on Dec. 18, 2012 the gross estate of A at the time of his death on Dec. 10, 2014 is Php 50M which includes the said parcel of land with FMV of Php 9M as (3) Tr a n sfer s for Pu blic Use . - The amount of all the bequests, legacies, devises or transfers to or for the use of the Government of 108 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 the Republic of the Philippines, or any political subdivision thereof, for exclusively public purposes. properties or net conjugal properties DIVIDE by 2 = net share of the surviving spouse) [The property given by the decedent to the gov’t must be included in his gross estate] (B) D e du ct ions Allow e d t o N on r e side n t Estates Alie n De ce den t s. - In the case of a nonresident (not deductible are: (1) family home, (2) standard deduction, (3) medical expenses, (4) death benefits) not a citizen of the Philippines, by deducting from the value of that part of his gross estate which at the time of his death is situated in the Philippines: [The transfer made by the decedent to the gov’t must either be in his will or a separate document or instrument but in the latter’s case the document or instrument must conform to the formalities of a will] (1) Ex pe n se s, Losse s, I n de bt e dn ess a n d Tax e s. - That proportion of the deductions specified in paragraph (1) of Subsection (A) of this Section which the value of such pa r t (the gross estate situated in the Philippines) bears to the value of his entire gross estate wherever situated; (4) Th e Fa m ily H om e . - An amount equivalent to the current fair market value of the decedent's family home: Pr ovide d, h ow e ve r, That if the said current fair market value exceeds One million pesos (P1,000,000), the excess shall be subject to estate tax. As a sine qua non condition for the exemption or deduction, said family home must have been the decedent's family home as certified by the barangay captain of the locality. [If the gross estate located in the Phils. of the non-resident alien decedent is Php 10M while his entire or world gross estate is Php 50M and the total expenses, losses, indebtedness and taxes is Php 8M the allowable deduction is (Php 10M ÷ Php 50M x Php 8M) Php 1.6M] Ex a m ple s: 1. If the current FMV of the family home is Php 2M, the amount to be shown as part of the gross estate is Php 2M and as part of the allowable deductions Php 1M. (2) Pr ope r t y Pr e viou sly Ta xe d (or Vanishing Deduction). - An amount equal to the value specified below of any property forming part of the gross estate situated in the Philippines of any person who died within five (5) years prior to the death of the decedent, or transferred to the decedent by gift within five (5) years prior to his death, where such property can be identified as having been received by the decedent from the donor by gift, or from such prior decedent by gift, bequest, devise or inheritance, or which can be identified as having been acquired in exchange for property so received: 2. If the current FMV of the family home is Php 800,000.00, the amount to be shown as part of the gross estate is Php 800,000.00 and as part of allowable deductions Php 800,000.00. (5) St a n da r d D e duct ion (in addition to not in lieu of the itemized deductions). - An amount equivalent to One million pesos (P1,000,000). One hundred percent (100%) of the value if the prior decedent died within one (1) year prior to the death of the decedent, or if the property was transferred to him by gift, within the same period prior to his death; (6) M e dica l Ex pe nse s. - Medical Expenses incur r e d (suppose the medical expenses had already been paid at the time of the decedent’s death and therefore the amount could have no longer be included in his gross estate, is the amount deductible? ANS: It is believed that the answer is YES) by the decedent within one (1) year prior to his death which shall be duly substantiated with receipts: Pr ovide d, That in no case shall the deductible medical expenses exceed Five Hundred Thousand Pesos (P500,000). Actual medical expenses or Php 500,000.00, whichever is lower Eighty percent (80%) of the value, if the prior decedent died more than one (1) year but not more than two (2) years prior to the death of the decedent, or if the property was transferred to him by gift within the same period prior to his death; Sixty percent (60%) of the value, if the prior decedent died more than two (2) years but not more than three (3) years prior to the death of the decedent, or if the property was transferred to him by gift within the same period prior to his death; (7) Am ou n t Re ce ive d by H eir s Under Republic Act No. 4917. - Any amount received by the heirs from the decedent - employee as a consequence of the death of the decedent-employee in accordance with Republic Act No. 4917: Pr ovide d, That such amount is included in the gross estate of the decedent. Forty percent (40%) of the value, if the prior decedent died more than three (3) years but not more than four (4) years prior to the death of the decedent, or if the property was transferred to him by gift within the same period prior to his death; and (8) N e t sh ar e of t he su rvivin g spou se in t he Com m u n it y Pr ope r t ies or Con j u ga l Pr ope r t ie s ( Se ct ion 8 6 C) . (Community properties or conjugal properties MINUS allowable deductions chargeable to the community properties or conjugal properties = net community Twenty percent (20%) of the value, if the prior decedent died more than four (4) years but not more than five (5) years prior to the 109 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 death of the decedent, or if the property was transferred to him by gift within the same period prior to his death. (2) Lim it at ions on Credit . - The amount of the credit taken under this Section shall be subject to each of the following limitations: These deductions shall be allowed only where a donor's tax, or estate tax imposed under this Title is finally determined and paid by or on behalf of such donor, or the estate of such prior decedent, as the case may be, and only in the amount finally determined as the value of such property in determining the value of the gift, or the gross estate of such prior decedent, and only to the extent that the value of such property is included in that part of the decedent's gross estate which at the time of his death is situated in the Philippines; and only if, in determining the value of the net estate of the prior decedent, no deduction is allowable under paragraph (2) of Subsection (B) of this Section, in respect of the property or properties given in exchange therefore. Where a deduction was allowed of any mortgage or other lien in determining the donor's tax, or the estate tax of the prior decedent, which was paid in whole or in part prior to the decedent's death, then the deduction allowable under said paragraph shall be reduced by the amount so paid. Such deduction allowable shall be reduced by an amount which bears the same ratio to the amounts allowed as deductions under paragraphs (1) and (3) of this Subsection as the amount otherwise deductible under paragraph (2) bears to the value of that part of the decedent's gross estate which at the time of his death is situated in the Philippines. Where the property referred to consists of two (2) or more items, the aggregate value of such items shall be used for the purpose of computing the deduction. (a) The amount of the credit in respect to the tax paid to any country shall not exceed the same proportion of the tax against which such credit is taken, which the decedent's net estate situated within such country taxable under this Title bears to his entire net estate; and (b) The total amount of the credit shall not exceed the same proportion of the tax against which such credit is taken, which the decedent's net estate situated outside the Philippines taxable under this Title bears to his entire net estate. (3) Tr a n sfer s for Pu blic Use . - The amount of all bequests, legacies, devises or transfers to or for the use of the Government of the Republic of the Philippines or any political subdivision thereof, for exclusively public purposes. (C) Share in t he Absolut e Com m unit y Propert y or Conj ugal Propert y . - the net share of the surviving spouse in the absolute community property or conjugal partnership property as diminished by the obligations properly chargeable to such property shall, for the purpose of this Section, be deducted from the net gross estate of the decedent. • Section 86 gives the items that are deductible from the gross estate. The or din a r y de du ct ions are those mentioned in Subsection (A,1), and the spe cia l de duct ion s, those enumerated in Subsection (A, 2-8) • [Impt!] Expenses incurred after the interment, such as for prayers, masses, entertainment, or the like are not deductible. Any portion of the funeral and burial expenses borne or defrayed by relatives and friends of the deceased are not deductible • Actual funeral expenses shall mean those which are actually incurred in connection with the interment or burial of the deceased. The expenses must be duly supported by receipts or invoices or other evidence to show that they were actually incurred. • Ju dicia l e x pe n se s – deduction for judicial expenses is allowed only if the settlement of the estate of the decedent has been the object of testamentary or intestate proceedings. In case the estate is settled extrajudicially, a reasonable amount for legal fees and accounting expenses may be allowed. o (D) Miscellaneous Prov isions. - No deduction shall be allowed in the case of a nonresident not a citizen of the Philippines, unless the executor, administrator, or anyone of the heirs, as the case may be, includes in the return required to be filed under Section 90 the value at the time of his death of that part of the gross estate of the nonresident not situated in the Philippines. Ju dicia l ex pe nse s – all expenses “essential to the collection of the assets, payment of debts or the distribution of the property to the persons entitled to it In other words, the expenses must be essential to the proper settlement of the estate. Expenditures incurred for the individual benefit of the heirs, devisees or legatees are not deductible o (E) Ta x Cr e dit for Est a t e Tax e s pa id t o a For e ign Cou n t r y. – [Not deductible from the estate tax of a non-resident alien decedent] (1) I n General. - The tax imposed by this Title shall be credited with the amounts of any estate tax imposed by the authority of a foreign country. In short, the deductible items are expenses incurred during the settlement of the estate but not beyond the last day prescribed by law, or the extension thereof, for the filing of the estate tax return. Judicial expenses may exclude: Fees of executor or administrator Attorney’s fees Court fees Accountant’s fees Appraiser’s fees 110 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 • • Clerk hire Costs of preserving and distributing the estate Costs of storing or maintaining property of the estate and Brokerage fees for selling property of the estate In order that they may be allowed as deduction, the following requisites must be present: [Impt!] Cla im s a ga in st t h e dece de n t ’s e st a te – the word “claims” is generally construed to mean debts or demands of a pecuniary nature which could have been enforced against the deceased in his lifetime and could have been reduced to simply money judgments. 1. Ca su alt y Losse s – include all losses incurred during the settlement of the estate arising from fires, storms, shipwreck or other casualties, or from robbery, theft or embezzlement. 1. 2. 3. 4. In order that such claims may be deducted, the following requisites must concur: (Requisites) 5. a. b. c. d. e. 2. • • • The debt or claim instrument was duly notarized Indebtedness was contracted by the decedent in good faith and for an adequate and full consideration in money or money’s worth Existing at the time of the death of the decedent and reasonably certain in amount Valid and legally enforceable obligation of the decedent Must not have been condoned by the creditor and the action to enforce its collection has not prescribed • Loss arising from any of the causes given above Loss is not compensated for by insurance or otherwise Loss has not been claimed as a deduction for income tax purposes Loss was incurred after death but not later than the last day for the payment of the estate tax Value of the property lost must have been included in the gross estate [Mem!] V an ish in g D e du ct ion – it operates (the reason why it is an allowable deduction) to ease the harshness of successive taxation of the same property within a relative short period of time (up to 5 years) occasioned by the untimely death of the transferee after the receipt of the property from the prior decedent or donor. [or Property Previously Taxes refers to the property acquired by the decedent within 5 years prior to his death either by succession or donation from a prior decedent or from a donor] In case the loan was contracted within 3 years before the death of the decedent, the administrator or executor is required to submit a statement showing the disposition of the proceeds of the loan [Mem!] The following condit ion s (or requisites) must be present so that the claim for vanishing deduction may be allowed: Cla im s (or Bad Debts) of t he de ce de n t a ga in st in solve n t pe r son s – To avail of this deduction, it is essential that: 1. Amount thereof has been initially included as part of his gross estate 2. Incapacity of the debtors to pay their obligations is proven Un pa id m or t ga ge in de bte dne ss of a dece de n t – in order that they may be deducted, the following requisties must be present: 1. Fair market value (at the time of death of the decedent) of the mortgaged property without deducting the mortgage indebtedness has been initially included as part of the gross estate 2. The mortgage indebtedness was contracted in good faith and for an adequate and full consideration [VIP!] Un pa id t a x e s – taxes owed by the decedent and unpaid, being obligations in favour of the gov’t, are also deductible as a claim against the estate but income taxes upon income received after the death of the decedent, or property taxes not accrued before his death, or any estate tax are not because they are chargeable to (or deductible from) the income of the estate except Estate Tax (Section 34C, #1C) 1. Prior decedent must have died or the donation must have been made within 5 years before the present decedent’s death 2. Property subject to the vanishing deduction must be the same property inherited or donated from the prior decedent or donor 3. Vanishing deduction is based on the value of the property at the time of the donation or death of the prior decedent or at the time of the death of the present decedent, whichever is lower 4. Donor’s tax or estate tax due on the donation or estate of the prior decedent must have been paid 5. Can be availed of only once The value of PPT is in the amount as finally determined for the purpose of the prior estate tax or the value of such property in present decedent’s gross estate, whichever is lower. If there is no mortgage debt paid, the value of PPT would be the initial basis. If the PPT was received as gift and not as inheritance, the date of the gift determines the applicable rate or percentage of deduction [Impt!] [Unpaid income tax on income earned before the death and unpaid real property tax that accrued before the death are deductible as claims against the estate. Estate tax on the property left by the decedent is always not deductible] • Tr a n sfer s for pu blic use (the property transferred must be included in the gross estate of the decedent) – the Tax Code allows the deduction from the gross estate, the amount of all devises, legacies, or transfers, to or for the use of the government or any political subdivision thereof for 111 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 ����.����� ������ exclusively public purposes. The transfer must be testamentary in character (because devises and legacies are effective only if the decedent left a valid and probated will, there can be no devises and legacies if the decedent died intestate) or by way of donation mortis causa (this is also testamentary in character because the “donation” must conform with the formalities of a will) executed by the decedent before his death • • Fa m ily H om e – from the value of the gross estate shall also be deducted the current FMV of the decedent’s family home. The limit is Php 1M. Any amount in excess thereof is subject to estate tax. To avail of the deduction, the said family home must have been the decedent’s family home as certified by the barangay captain to the locality Con dit ion s (or requisites) for the allowance of family home as a deduction from gross estate are the following: • 1. Family home must be the actual residential home of the decedent and his family home at the time of his death, as certified by the barangay captain of the locality where the family home is situated 2. Total value (FMV at the time of death of the decedent) of the family home must be included as part of the gross estate of a person who died o o × Deductions claimed = Allowable deduction [VIP!] Sh a r e in th e con j u ga l ( or com m u nit y) Subsection (C), where the decedent was married pr ope r t y – under 1. Community or Conjugal property shall first be determined 2. All obligations properly chargeable to it shall be deducted therefrom 3. From the balance (net community properties or not conjugal estate), the net share (1/2 thereof) of the surviving spouse shall be deducted from the net estate of the decedent for purposes of imposing the estate tax The special deductions are not taken into account in determining the net community properties or net conjugal estate. The ordinary deductions properly chargeable to the community or conjugal estate are not to be deducted from the separate property of the deceased spouse SEC. 8 7 . Ex em pt ion of Cert ain Acquisit ions and Transm issions. - Th e follow in g sh a ll n ot be t a xe d (or not included in the gross estate of the decedent): St a n da r d D e du ct ion , m e dical e x pen ses an d de a t h be ne fit s o ������ �� ����� ����� ������ (A) The merger of usufruct in the owner of the naked title; Standard deduction of Php 1M may be availed of in addition to itemized deductions, including deduction for family home with an FMV not exceeding Php 1M (B) The transmission or delivery of the inheritance or legacy or devise by the fiduciary heir or legatee or devise to the fideicommissary; Medical expenses (e.g. hospital bills, costs of medicine, doctor’s fees, etc.) must be (a) incurred whether paid or unpaid, by the decedent within 1 year prior to his death and (b) duly substantiated by receipts and such other documents in support thereof. The amount deductible is limited to the actual amount incurred but not exceeding Php 500,000.00 (C) The transmission from the first heir, legatee or devise or donee in favor of another beneficiary, in accordance with the desire of the predecessor; and (D) All bequests, devises, legacies or transfers to social welfare, cultural and charitable institutions, no part of the net income of which insures to the benefit of any individual: Pr ovide d, h ow e ve r , That not more than thirty percent (30%) of the said bequests, devises, legacies or transfers shall be used by such institutions for administration purposes. Re t ir e m e n t ben e fit s received by employees of private firms in accordance with a reasonable benefit plan maintained by the employer are exempt from all taxes, provided that the retiring employee has been in the service of the same employer for at least 10 years and is not less than 50 years of age at the time of his retirement. The amount must have been received by the heirs of the decedent-employee as a consequence of the latter’s death and included in the gross estate of the decedent [The decedent must have made a will giving a real property or personal property to a social welfare or cultural or charitable institution, this property is not included in the gross estate of the decedent] • N e t sha r e of sur vivin g spouse (1/2 of the absolute community properties or conjugal properties, as the case may be, after deducting the allowable deductions chargeable against them) If the devise or legacy is given in favour of educational or religious institution the property is subject to estate tax which means that the devise or legacy shall be included in the gross estate of the decedent and is not an allowable deduction unlike a legacy or devise in favour of the government for exclusive public purposes • The deduction allowed to non-resident estates (non-resident decedents) may be expressed in the following formula: In order that the devise or legacy will not be subject to estate tax the property should rather be donated by the decedent prior to his death to the alien 112 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 educational or religious institutions because donation to said institutions is exempt from donor’s tax under Section 101 (1) The fair market value as determined by the Commissioner, or (2) The fair market value as shown in the schedule of values fixed by the Provincial and or City Assessors. Ex a m ple s: A. In 2010, A donated the usufruct of his farmland in favour of B while the naked ownership thereof was donated by A to C. In 2013 B died and as a consequence thereof the usufruct was merged with the naked title to C. Ex a m ple : A donated the usufruct of his property in favour of B for a period of 20 years and that should B die before the expiration of 20 years the usufruct shall be enjoyed by the heirs of B until the expiration of 20 years. The net income derived by B from the property is Php 2M per annum. At the end of 15 years B died. When B died the usufruct was not extinguished conformably with the provision in the deed of usufruct The usufruct is NOT subject to estate tax and therefore excluded from the gross estate of B. B. The gross estate of B shall include the usufruct valued at (Php 2M x 5) Php 10M In his will A gave to C a devise in the form of a farmland. Considering that C was still a minor at that time the devise was given to B, the father of C, as trustee or fiduciary. When C, the fideicommissary, attained the age of majority B died. • The devise is excluded from the gross estate of B because it is a transmission or delivery of a devise by a fiduciary heir (B) to a fideicommissary (C) C. A donated her diamond ring to her daughter B on the condition that B cannot dispose of it except to give it to C, daughter of B and granddaughter of A, by way of a legacy. 2 years later B died. V a lu a t ion est a t e – the properties comprising the gross estate shall be valued based on their market value as of the time of death. Accordingly, any income from, or increase in the value of the properties left by the decedent after his death, will not form part of his gross estate, but should be attributed to the undistributed shares (estate as an income taxpayer) among the heirs o In the case of shares of stocks, the FMV shall depend on whether the shares are listed or unlisted in the stock exchanges: The diamond ring is excluded from the gross estate of B because it is a transmission from a donee (B) in favour of another beneficiary (C) in accordance with the desire of the predecessor (A) • • The above specific exemptions are not taken into account (the properties are not included in the gross estate of the decedent) in the computation of the gross estate The exemption in (A) to (C) is premised on the fact that in all the transfers mentioned, there is really 1 transmission of property, i.e., from the previous testator or donor - to the owner of the naked title, or to the fideicommissary, or to the second beneficiary, as the case may be. Hence, the exemption from the tax because the property was previously subject thereto SEC. 8 8 . Det erm inat ion of t he V a lu e of t he Est at e . (A) Usu fr u ct . - To determine the value of the right of usufruct, use or habitation, as well as that of annuity, there shall be taken into account the probable life of the beneficiary in accordance with the latest Basic Standard Mortality Table, to be approved by the Secretary of Finance, upon recommendation of the Insurance Commissioner. o (B) Pr ope r t ie s other than usufruct. - The estate shall be appraised at its fair market value as of the time of death. However, the appraised value of real property as of the time of death shall be, whichever is higher of – Unlisted common shares are valued based on their book value while unlisted preferred shares are valued at par value. In determining the book value of common shares, appraisal surplus shall not be considered as well as the value assigned to preferred shares, if there are any For shares which are listed in the stock exchanges, the FMV shall be the arithmetic mean between the highest and lowest quotation at a date nearest the date of death, if none is available on the date of death itself If there have been previous bona fide sales/exchanges of such shares, the price at which such shares exchanged hands should be taken or considered as their FMV The shares of stock of a corporation which had been found insolvent and presently under liquidation may be given a zero valuation for estate tax purposes. In other words, should the said shares later on appreciate in value and are subsequently sold or disposed of, for tax purposes, their cost basis shall be zero If there was no zonal valuation of real property at the time of the decedent’s death, the value of the property for estate tax purposes shall be based on it assessed value or market value as indicated in the tax declaration, whichever is higher 113 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 SEC. 8 9 . Not ice of Deat h t o be Filed. - In all cases of transfers (properties of the decedent transferred to his heirs upon his death) subject to tax imposed herein, or where, though exempt from tax, the gross value of the estate exceeds Twenty thousand pesos ( P2 0 ,0 0 0 ) , the executor, administrator or any of the legal heirs, as the case may be, within two (2) months after the decedent's death, or within a like period after qualifying as such executor or administrator, shall give a written notice thereof to the Commissioner. A certified copy of the schedule of partition and the order of the court approving the same shall be furnished the Commissioner within thirty (30) after the promulgation of such order. (C) Ex t ension of Tim e. - The Commissioner shall have authority to grant, in meritorious cases, a reasonable extension not exceeding thirty (30) days for filing the return. SEC. 9 0 . Est at e Tax Ret urns. - (D) Pla ce of Filin g. - Except in cases where the Commissioner otherwise permits, the return required under Subsection (A) shall be filed with an authorized agent bank, or Revenue District Officer, Collection Officer, or duly authorized Treasurer of the city or municipality in which the decedent was domiciled at the time of his death or if there be no legal residence in the Philippines, with the Office of the Commissioner. (A) Requirem ent s. - In all cases of transfers subject to the tax imposed herein, or where, though exempt from tax, the gross value of the estate exceeds Two hundred thousand pesos (P2 0 0 ,0 0 0 ), or regardless of the gross value of the estate, where the said estate consists of registered or registrable property such as real property, motor vehicle, shares of stock or other similar property for which a clearance from the Bureau of Internal Revenue is required as a condition precedent for the transfer of ownership thereof in the name of the transferee, the executor, or the administrator, or any of the legal heirs, as the case may be, shall file a return (estate tax return) under oath in duplicate, setting forth: • The BIR agent may grant the request for an extension of 3 0 da ys (from the expiration of 6 months from decedent’s death) within which to file the estate tax return, but the estate shall be liable to the corresponding interest (20% per annum; no surcharge provided the estate tax is paid during the extended period) that have accrued thereon up to the time of the filing of the return and the payment of the estate tax (1) The value of the gross estate of the decedent at the time of his death, or in case of a nonresident, not a citizen of the Philippines, of that part of his gross estate situated in the Philippines; • The application for the extension of time to file the estate tax return must be filed with the RDO where the estate is required to secure its TIN and file the tax returns of the estate (2) The deductions allowed from gross estate in determining the estate as defined in Section 86; and • [Impt!] Place of filing the return and payment of the tax (3) Such part of such information as may at the time be ascertainable and such supplemental data as may be necessary to establish the correct taxes. o In case of a resident decedent, the administrator or executor shall register the estate of the decedent and secure a new TIN therefor from the RDO where the decedent was domiciled at the time of his death and shall file the estate tax return and pay the corresponding estate tax with the Accredited Agent Bank (AAB), RDO, Collection Officer or duly authorized Treasurer of the city or municipality where the decedent was domiciled at the time of his death o In case of non-resident decedent, whether non-resident citizen or non-resident alien, with executor or administrator in the Philippines, the estate tax return shall be filed with and the TIN for the estate shall be secured from the RDO where such executor or administrator is registered: Pr ovide d, h ow e ve r , That estate tax returns showing a gross value exceeding Two million pesos ( P2 ,0 0 0 ,0 0 0 ) shall be supported with a statement duly certified to by a Certified Public Accountant containing the following: (a) Itemized assets of the decedent with their corresponding gross value at the time of his death, or in the case of a nonresident, not a citizen of the Philippines, of that part of his gross estate situated in the Philippines; (b) Itemized deductions from gross estate allowed in Section 86; and In case the executor or administrator is not registered, the estate tax return shall be filed with and the TIN of the estate shall be secured from the RDO having jurisdiction over the executor or administrator’s legal residence Nonetheless, in case the non-resident decedent does have an executor or administrator in the Philippines, estate tax return shall be filed with and the TIN for estate shall be secured from the Office of Commissioner (c) The amount of tax due whether paid or still due and outstanding. (B) Tim e for filing. - For the purpose of determining the estate tax provided for in Section 84 of this Code, the estate tax return required under the preceding Subsection (A) shall be filed within six (6) months from the decedent's death. 114 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) not the the the lOMoARcPSD|12553117 SEC. 9 1 . Paym ent of Tax. - AN S: 1. Interest for 30 days on extension for filing the ETR is (Php 3M x 20% ÷ 12) Php 50,000.00 (A) Tim e of Paym ent . - The estate tax imposed by Section 84 shall be paid at the time the return is filed (within 6 months from decedent’s death OR within 30 days from the extenstion granted by the commissioner) by the executor, administrator or the heirs. 2. (B) Ext ension of Tim e. - When the Commissioner or his duly authorized representative finds that the payment on the due date of the estate tax or of any part thereof would impose undue hardship upon the estate or any of the heirs, h e (commissioner) may extend the time for payment of such tax or any part thereof not to exceed five (5) years, in case the estate is settled through the courts, or two (2) years in case the estate is settled extrajudicially. In such case, the amount in respect of which the extension is granted shall be paid on or before the date of the expiration of the period of the extension, and the running of the Statute of Limitations (prescriptive period to assess) for assessment as provided in Section 203 (3 years from filing of the ETR) of this Code shall be suspended for the period of any such extension. Interest on 2 years extension of the time for payment (Php 3M x 20% x 2) Php 1.2M Therefore, the total interest is Php 1,250,000.00 • Where the taxes are assessed by reason of negligence, intentional disregard of rules and regulations, or fraud on the part of the taxpayer, no extension will be granted by the Commissioner. The grant of extension to pay the estate tax rests on the discretion of the Commissioner. The estate shall be liable to the corresponding in t e re st (20% per annum) that have accrued up to the time of filing the return and payment of the estate tax due but not to surcharge o The application for extension of time to file the return and to pay the estate tax shall be filed with the RDO where the estate is required to secure its TIN and file the estate tax return. This application shall be approved by the Commissioner or his duly authorized representative o An heir’s request for a 2-year extension (reckoned from the expiration of the normal 6-month period from the decedent’s death) within which to file the estate tax return (should not exceed 30 days) cannot be granted, but a 2-year extension within which to pay the estate tax can be granted if the request is based on justifiable reasons. No surcharge and penalties will be imposed on the estate tax. However, the estate shall be liable for the corresponding interest that has accrued thereon from the expiration of the 6-month period from decedent’s death up to the time of actual payment of the estate tax If an extension for payment is granted, the Commissioner may require the executor, or administrator, or beneficiary, as the case may be, to furnish a bond in such amount, not exceeding double the amount of the tax and with such sureties as the Commissioner deems necessary, conditioned upon the payment of the said tax in accordance with the terms of the extension. (C) Liabilit y for Pay m ent - The estate tax imposed by Section 84 shall be paid by the executor or administrator before delivery to any beneficiary (or heir) of his distributive share of the estate. Such beneficiary shall to the extent of his distributive share of the estate, be subsidiarily liable for the payment of such portion of the estate tax as his distributive share bears to the value of the total net estate. • Section 203 limits the period of assessment of a tax within 3 years from the filing of a return, and prohibits, where there is no assessment, the commencement of a judicial action to collect tax after the expiration of the 3-year period • An estate tax can be collected from the heirs even after the distribution of the properties of the decedent. An heir is liable for the assessment as an heir and as a holder-transferee of property belonging to the estate/taxpayer For the purpose of this Chapter, the term 'executor' or 'administrator' means the executor or administrator of the decedent, or if there is no executor or administrator appointed, qualified, and acting within the Philippines, then any person in actual or constructive possession of any property of the decedent. Ex a m ple : The estate tax due is Php 3M. The ETR should have been filed on Jan. 2, 2015 but a request for extension of time to file the return was granted by the Commissioner for 30 days. The ETR was filed on Feb. 1, 2015 but a request for extension of time for payment was granted by the Commissioner for 2 years. The estates tax was paid on Jan. 31, 2017. How much is the interest? • o As an heir, he is individually answerable for the part of the tax proportionate to the share he received from the inheritance. His liability, however, cannot exceed the amount of his share o As a holder of property belonging to the estate, he is liable for the tax up to the amount of the property in his possession [Impt!] The executor or administrator of an estate has the primary obligation to pay the estate tax but the heir or beneficiary has subsidiary liability for the payment of that portion of the estate which his distributive share bears to the value of the total net estate. The extent of his liability, however, shall in no case exceed the value of his share in the inheritance 115 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 of the deceased pay his debts to the heirs, legatee, executor or administrator of his creditor, unless the certification of the Commissioner that the tax fixed in this Chapter had been paid is shown; but he may pay the executor or judicial administrator without said certification if the credit is included in the inventory of the estate of the deceased. [Read!] SEC. 9 2 . Discharge of Ex ecut or or Adm inist rat or from Personal Liabilit y . - If the executor or administrator makes a written application to the Commissioner for determination of the amount of the estate tax and discharge from personal liability therefore, the Commissioner (as soon as possible, and in any event within one (1) year after the making of such application, or if the application is made before the return is filed, then within one (1) year after the return is filed, but not after the expiration of the period prescribed for the assessment of the tax in Section 203 shall not notify the executor or administrator of the amount of the tax. The executor or administrator, upon payment of the amount of which he is notified, shall be discharged from personal liability for any deficiency in the tax thereafter found to be due and shall be entitled to a receipt or writing showing such discharge. SEC. 9 6 . Rest it ut ion of Tax Upon Sat isfact ion of Out st anding Obligat ions. - If after the payment of the estate tax, new obligations of the decedent shall appear, and the persons (executor or administrator or heir) interested shall have satisfied them by order of the court, they shall have a right to the restitution of the proportional part of the tax paid. SEC. 9 7 . Pay m ent of Tax Ant ecedent t o t he Transfer of Shares, Bonds or Right s. There shall not be transferred to any new owner i on the books of any corporation, sociedad anonima, partnership, business, or industry organized or established in the Philippines any share, obligation, bond or right by way of gift inter vivos or mortis causa, legacy or inheritance, u nle ss a certification from the Commissioner that the taxes fixed in this Title and due thereon have been paid is shown. [Read!] SEC. 9 3 . Definit ion of Deficiency. - As used in this Chapter, the term 'deficiency' means: a) b) The amount by which the tax imposed by this Chapter exceeds the amount shown as the tax by the executor, administrator or any of the heirs upon his return; but the amounts so shown on the return shall first be increased by the amounts previously assessed (or collected without assessment) as a deficiency and decreased by the amount previously abated, refunded or otherwise repaid in respect of such tax; or If a bank has knowledge of the death of a person, who maintained a bank deposit account alone, or jointly with another, it shall not allow any withdrawal from the said deposit account, un le ss the Commissioner has certified that the taxes imposed thereon by this Title have been paid: Pr ovide d, h ow e ve r , That the administrator of the estate or any one (1) of the heirs of the decedent may, upon authorization by the Commissioner, withdraw an amount not exceeding Twenty thousand pesos ( P2 0 ,0 0 0 ) without the said certification. For this purpose, all withdrawal slips shall contain a statement to the effect that all of the joint depositors are still living at the time of withdrawal by any one of the joint depositors and such statement shall be under oath by the said depositors. If no amount is shown as the tax by the executor, administrator or any of the heirs upon his return, or if no return is made by the executor, administrator, or any heir, then the amount by which the tax exceeds the amounts previously assessed (or collected without assessment) as a deficiency; but such amounts previously assessed or collected without assessment shall first be decreased by the amounts previously abated, refunded or otherwise repaid in respect of such tax. [Impt!] SEC. 9 4 . Paym ent before Delivery by Execut or or Adm inist rat or. - No judge shall authorize the executor or judicial administrator to deliver a distributive share to any party interested in the estate u nle ss a certification (Tax Clearance Certificate or Certificate Authorizing Registration) from the Commissioner that the estate tax has been paid is shown. SEC. 9 5 . Dut ies of Cert ain Officers and Debt ors. - Registers of Deeds shall not register in the Registry of Property any document transferring real property or real rights therein or any chattel mortgage, by way of gifts inter vivos (donation) or mortis causa (or devise), legacy or inheritance, u nle ss a certification (Tax Clearance Certificate or Certificate Authorizing Registration) from the Commissioner that the tax fixed in this Title and actually due thereon had been paid is show, and they shall immediately notify the Commissioner, Regional Director, Revenue District Officer, or Revenue Collection Officer or Treasurer of the city or municipality where their offices are located, of the non payment of the tax discovered by them. Any lawyer, notary public, or any government officer who, by reason of his official duties, intervenes in the preparation or acknowledgment of documents regarding partition or disposal of donation intervivos or mortis causa, legacy or inheritance, shall have the duty of furnishing the Commissioner, Regional Director, Revenue District Officer or Revenue Collection Officer of the place where he may have his principal office, with copies of such documents and any information whatsoever which may facilitate the collection of the aforementioned tax. Neither shall a debtor • Under Section 94, m e r e official r ece ipt (what is required by law is tax clearance certificate) of payment is not sufficient to authorize the delivery of the distributive share to any party interested in the estate • In order that a taxpayer may claim the benefits of Section 96, it is necessary for him to show the following: • o Obligations of the deceased not known at or before the time of the payment of the tax o Obligations have been judicially recognized as proper claims against the estate of the deceased o Court ordered them paid o Have been actually paid o A written claim for a fund must be filed with the CIR within 2 years from payment Claim for taxes by the BIR, whether assessed before or after the death of the deceased, can be collected from the heirs even after the distribution of 116 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 the properties of the decedent. The heirs shall be liable therefor in proportion to their share in the inheritance (B) The tax shall apply whether the transfer is in trust or otherwise, whether the gift is direct or indirect, and whether the property is real or personal, tangible or intangible. [The liability of the heirs is NOT principal but only subsidiary and such liability is not solidary but merely joint] • Ta x Clea r an ce Registration) o o o Ce r t ifica t e (before it is Certificate Authorizing Upon the filing of the estate tax return and full payment of the estate tax due on the transmission of the estate of a decedent, the RDO of the revenue district where the decedent was previously registered shall issue the tax clearance certificate (formerly certificate authorizing registration) identifying the specific properties it covers. The certificate shall be issued by the RDO of the revenue district where the decedent was domiciled or registered at the time of his death regardless of the location of his properties • [Mem!] Gift or don a t ion is a voluntary transfer of property from one person to another without any consideration or compensation therefor • Donor’s tax is imposed on donations inter vivos or those made between living persons to take effect during the lifetime of the donor. D on a t ion s m or t is ca u sa (in reality these are devises and legacies) or those which are to take effect upon the death of the donor and, therefore, partake of the nature of testamentary dispositions, are subject to estate tax • [Mem!] Re qu isit es of a donation – for purposes of the donor’s tax 1. 2. 3. If the estate of the decedent is not registered, the executor/administrator or any of the heirs shall register the estate of the decedent with the RDO in the place of residence of the decedent at the time of his death, and the Tax Clearance Certificate shall be issued by the Revenue District Officer of said district office 4. • In case the decedent is a non-resident citizen or non-resident alien at the time of his death, the resident executor/administrator or heir shall register the estate with the RDO where said executor/administrator or heir is registered, in which case, upon filing the estate tax return and payment of the estate tax due, the Tax Clearance Certificate shall be issued by the RDO of the said district office Capacity of the donor Donative Intent (or pure liberality) Delivery, whether actual or constructive [It does not make a contract of donation a real contract because donation is either consensual or formal or solemn contract] [Impt!] Acceptance of the gift by the donee Com ple t e d gift – the donor’s tax shall not apply unless there is a completed gift o Transfer of property by gift is perfected from the moment the donor knows of the acceptance by the donee. It is completed by the delivery, either actually or constructively, of the donated property to the donee. Thus, the law in force at the time of the completion of the donation shall govern the imposition of the donor’s tax o A gift that is incomplete because of reserved powers, becomes complete when either: (a) donor renounces the power; or (b) his right to exercise the reserved power ceases because of the happening of some event or contingency or the fulfilment of some condition Chapter 2 – Donor’s Tax Classification of Donor 1. Resident Citizen 2. Non-resident Citizen 3. Resident Alien 4. Non-resident Alien 5. Domestic Corporation 6. Foreign Corporation - location of property donated wherever situated wherever situated wherever situated only property situated in the Philippines wherever situated only property situated in the Philippines • [VIP!] Re n u ncia t ion by an h e ir o Renunciation by the surviving spouse of his/her share in the conjugal partnership or absolute community after the dissolution of the marriage in favour of the heirs of the deceased spouse or any other person/s is subject to donor’s tax o Ge n e r al r en un cia t ion (without specifying to whom the share of the renouncing heir will go or be given) by an heir, including the surviving spouse, of his/her share in the hereditary estate left by the decedent is not subject to donor’s tax, u nle ss (subject to donor’s tax) specifically and categorically done in favour of identified heir/s to the exclusion or disadvantage of the other coheirs in the hereditary estate SEC. 9 8 . I m posit ion of Tax. (A) There shall be levied, assessed, collected and paid upon the transfer by a n y pe r son (natural or juridical), resident or nonresident, of the property by gift, a tax, computed as provided in Section 99. 117 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 o o • o o • • Polit ica l con t r ibu t ions – for internal revenue purposes, political contributions in the Philippines are considered taxable gift rather than taxable income SEC. 9 9 . Ra t e s of Ta x Pa ya ble by D on or . (A) I n General. - The tax for each calendar year shall be computed on the basis of the total net gifts (on accumulated basis) made during the calendar year in accordance with the following schedule: As a rule, when a person renounces/repudiates his/her part of the inheritance, the right of accretion takes place (without earmarking) and the same is added or incorporated to the share of the co-heirs, co-devisees, or co-legatees. The share of the heir making renunciation/waiver shall accrue to his/her co-heirs in the same proportion they inherit pursuant to Articles 1018 and 1019 of the Civil Code. There is no donation of property which had never become the renouncer’s If the net total gifts is: Plu s Of the Ex ce ss Ove r 0 2% P100,000 500,000 2,000 4% 200,000 500,000 1,000,000 14,000 6% 500,000 1,000,000 3,000,000 44,000 8% 1,000,000 3,000,000 5,000,000 204,000 10% 3,000,000 5,000,000 10,000,000 404,000 12% 5,000,000 1,004,000 15% 10,000,000 Bu t N ot Ove r Th e Ta x sh a ll be P 100,000 Exempt P 100,000 200,000 200,000 Ove r For give n ess of in de bt e dn e ss – the cancellation and forgiveness of indebtedness may amount to a receipt of income, to a gift, or to a capital transaction, depending upon the circumstances o • • In general renunciation, there is no donation since the renouncer has never become the owner of the property/share renounced. If the renunciation by an heir or heirs is made in favour of one or more heirs but not all the other heirs, the act of renunciation (subject to donor’s tax) is, in effect, an act of disposition inasmuch as the benefits thereof are not enjoyed by everybody but only by one or more heirs If, an individual performs services for a creditor, who, in consideration thereof cancels the debt, income to that amount is realized by the debtor as compensation for his services (*subject to income tax) If, however, a creditor merely desires to benefit a debtor and without any consideration therefor cancels the debt, the amount of the debt is a gift from the creditor to the debtor and need not be included in the latter’s gross income (*subject to donor’s tax) 10,000,000 If a corporation to which a stockholder is indebted forgives the debt, the transaction has the effect of the payment of dividend (*subject to dividend tax) (B) Ta x Pa ya ble by D on or if D on ee is a St r a n ge r . - When the donee or beneficiary is stranger, the tax payable by the donor shall be thirty percent ( 3 0 % ) of the net gifts. For the purpose of this tax, a 'st r a n ge r ,' is a person who is not a: Con t r ibu t ion t o a e m ploye e s’ r e t ire m e n t plan – No donor’s tax can be imposed even if the transfer is without consideration because the contribution of the company to the fund is in compliance with its legal obligation to contribute therein. Since there is no act of liberality, there is no donation to speak of and hence, no donor’s tax can be imposed (1) Brother, sister (whether by whole or half-blood), spouse, ancestor and lineal descendant; or (2) Relative by consanguinity in the collateral line within the fourth degree (up to first cousin) of relationship. Pa ym e n t by su r e t y of pr incipa l obliga t ion – the payment by the surety of the principal obligation shall not be considered transfer of property by gift because the surety has the right to be indemnified by the borrower or principal debtor (C) Any contribution in cash or in kind to any candidate, political party or coalition of parties for campaign purposes shall be governed by the Election Code, as amended. D on a t ion be t w e en spou ses du r in g m a r r ia ge – Under Article 87 of the Family Code, every donation (not subject to donor’s tax) between the spouses during the marriage is void except m oder a t e gift s (if the value is Php 100,000.00 or less, the moderate gift is exempted from Donor’s Tax. If the moderate gift is in excess of Php 100,000.00 the excess is subject to Donor’s Tax) which the spouses may give each other on the occasion of any family rejoicing • There are NO allowable deductions in donor’s tax and the exemption of Php 100,000.00 is already deducted in arriving “the tax shall be” in Section 99 • In the schedule, the Php 100,000.00 exemption is already deducted where the value of the gift is Php 200,000.00 or above. Thus, if the net gift is Php 118 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 120,000.00, the donor’s tax due is Php 400.00; if Php 220,000.00, the donor’s tax due is Php 2,800.00 • • Com pu t a t ion of don or ’s t a x on a cu m ula t ive ba sis – the donor’s tax shall be computed on the basis of the total gifts made during the calendar year o o Subsection (B) does not exclude the application of the Php 100,000.00 exemption in case of donation to a stranger. The exemption is granted to the donor, and, therefore, if he is entitled to it, it should make no difference whether or not the donation is to a stranger o The only transfers excluded from Donor’s Tax are those made bona fide in the ordinary course of business, at arm’s length, and free from any donative intent, even if the consideration is inadequate on account, for example, of bad bargain Ex a m ple : A is engaged in Real Estate Business and he sold a subdivision lot with an FMV of Php 3M to his friend B for Php 1M. The difference between the FMV of Php 3M over the selling price of Php 1M or Php 2M is a gift and is subject to donor’s tax of 30% Under Subsection (B), an “in-law,” whether father, mother, brother, sister, son or daughter is treated as a stranger for he/she cannot qualify under either No. (1) or (2) • W h e r e t h er e is n e ith e r a sa le , e xch an ge or don a t ion o The transfer of stocks in a corporation organized as a mutual benefit association, to its members, which transfer is merely a conversion of the owner-member contributions to shares of stock is not subject to CGT or Donor’s Tax because it is neither a sale, exchange nor donation o The transfer of community or conjugal properties in favour of the children pursuant to a court order arising from the declaration of nullity of marriage of the parents is not subject to donor’s tax since there is no donative intent on the part of the spouses, because the transfer is only in compliance with the court order. Neither is the transfer subject to CGT and DST as the transfer is considered a delivery of presumptive legitime (this is NOT subject to estate tax because the parents are still alive) under Article 50 of the Family Code A le gally a dopt e d ch ild (lineal descendant) shall not be considered a stranger. Donations made between business organizations and those made between a business organization and an individual shall be considered as a donation made to a stranger Donation of community or conjugal property – husband and wife are considered as separate and distinct taxpayers for purposes of the donor’s tax. However, if what was donated is a conjugal or community property and only the husband signed the deed of donation, there is only one donor for donor’s tax purposes, without prejudice to the right of the wife to question the validity of the donation without her consent pursuant to the pertinent provisions of the Civil Code and the Family Code [VIP!] SEC. 1 0 0 . Transfer for Less Than Adequat e and full Considerat ion. - Where property, ot h e r t ha n real property referred to in Section 24(D) (if the property is real property located in the Philippines and is classified as Capital Asset the sale is subject to CGT of 6% or FMVs whichever is higher and the difference between such FMV and selling price is not subject to Donor’s Tax), is transferred for less than an adequate and full consideration in money or money's worth, then the amount by which the fair market value of the property exceeded the value of the consideration shall, for the purpose of the tax imposed by this Chapter, be deemed a gift, and shall be included in computing the amount of gifts made during the calendar year. [Mem!] SEC. 1 0 1 . Exem pt ion of Cert ain Gift s. - The following gifts or donations shall be exempt from the tax provided for in this Chapter: (A) I n t he Case of Gift s Made by a Re siden t ([1] RC; [2] RA; [3] NRC; [4] DC; [5] RFC; Nos. 4 and 5 do not apply to A1). – (1) Dowries or gifts made on account of marriage and before its celebration or within one year thereafter by parents to each of their legitimate, recognized natural illegitimate, or adopted children to the extent of the first Ten thousand pesos ( P1 0 ,0 0 0 ) : Ex a m ple : A is the owner of a residential lot with FMV as determined by the Commissioner of Php 2M and FMV appearing in the schedule of values in the Assessor’s Office of Php 1.8M. A sold said lot to his brother B at a price of Php 500,000.00. The sale is subject to CGT of 6% of Php 2M or Php 120,000.00. The difference between the higher FMV of Php 2M and the selling price of Php 500,000.00 or Php 1.5M is not subject to donor’s tax • Where the consideration is fictitious, the entire value of the property transferred shall be subject to donor’s tax. Consideration may be monetary or non-monetary (e.g. services) or may include both Donation to strangers o • o [Wedding gift made by parents to a legitimate child in the form of cash amounting to Php 110,000.00 is exempt from donor’s tax [Sections 99A and 101,A,1] (2) Gifts made to or for the use of the National Government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government; and Tr a n sfer of pr ope r t y for le ss th a n it s value – the transfer constitutes a gift and is subject to donor’s tax, although there is no donative intent 119 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 (3) Gifts in favor of an e duca t ion al and/or ch ar it a ble, re ligiou s, cu ltu r a l or social w elfa re corporation, institution, accredited nongovernment organization, trust or philanthrophic organization or research institution or organization: Pr ovide d, h ow e ve r , That not more than thirty percent (30%) of said gifts shall be used by such donee for administration purposes. For the purpose of the exemption, a 'non-profit educational and/or charitable corporation, institution, accredited nongovernment organization, trust or philanthrophic organization and/or research institution or organization' is a school, college or university and/or charitable corporation, accredited nongovernment organization, trust or philanthrophic organization and/or research institution or organization, incorporated as a nonstock entity, paying no dividends, governed by trustees who receive no compensation, and devoting all its income, whether students' fees or gifts, donation, subsidies or other forms of philanthrophy, to the accomplishment and promotion of the purposes enumerated in its Articles of Incorporation. (b) The total amount of the credit shall not exceed the same proportion of the tax against which such credit is taken, which the donor's net gifts situated outside the Philippines taxable under this title bears to his entire net gifts. Same as in A Nos. 2 and 3 (B) I n t he Case of Gift s Made by a N on r e sident n ot a Cit iz e n of t he Philippines. • D on a t ion of ope n spa ce by su bdivision de ve lope r – Donation of open space reserved for parks and playgrounds by subdivision developer/owner to homeowners’ association is subject to donor’s tax because it is not covered by the exemption privileges provided under Section 101(A)(2) • D on a t ion t o t r u st e e for be n e fit of be n e ficia ry – where a gift is made to a trustee for the benefit of one or more beneficiaries, the beneficiaries and not the trustee, are the donees of the gifts • D on a t ion s t o disa ble per son s – RA No. 7277, is special law which grants tax incentives to foreign donor/s on donation, bequest, subsidy or financial aid made to government agencies engaged in the rehabilitation of disable persons and organizations of disable persons • Gifts/donations extended to a non-stock, non-profit organization duly registered with the SEC and the DOST as an accredited science foundation are exempt from the payment of donor’s tax pursuant to Section 101(A,3). However, if the donated equipment would come from abroad, the importation thereof shall be subject to 10% (now 12%) VAT based on the total value used by the Bureau of Customs in determining tariff and customs duties, excise taxes, etc., pursuant to Section 87 (1) [NRA] Gifts made to or for the use of the National Government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government. (2) [NRFC] Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation, institution, foundation, trust or philanthrophic organization or research institution or organization: Provided, however, That not more than thirty percent (30% of said gifts shall be used by such donee for administration purposes. [Impt!] SEC. 1 0 2 . V a lu a t ion of Gift s M a de in Pr ope r t y. - If the gift is made in property other than cash, the fair market value thereof at the time of the gift shall be considered the amount of the gift. In case of real property, the provisions of Section 88(B) shall apply to the valuation thereof. (C) Ta x Cr e dit for D on or 's Ta x es Pa id t o a For e ign Cou n t r y. – (1) I n General. - The tax imposed by this Title upon a donor who was is a cit izen (Resident or Non-resident) or a r e siden t (Resident Alien and Domestic Corporation) at the time of donation shall be credited with the amount of any donor's tax of any character and description imposed by the authority of a foreign country. [The tax credit does not apply to Non-resident Alien and Foreign Corporations, whether resident or non-resident, because their donations of property located outside the Philippines are NOT subject to donor’s tax in the Philippines] • In gift taxation, the properties are valued at the time the gift is made. If the gift is in money, then the amount thereof is the valuation • The FMV of the real property as determined by the CIR or the FMV as shown in the schedule of values fixed by the Provincial or City Assessor, whichever is higher, at the time of the gift, shall be considered as the amount of the gift SEC. 1 0 3 . Filing of Ret urn and Pay m ent of Tax. (A) Requirem ent s. - any individual person or donor who makes any transfer by gift (except those which, under Section 101, are exempt from the tax provided for in this Chapter) shall, for the purpose of the said tax, make a return under oath in duplicate. The re t u rn (donor’s tax return) shall set forth: (2) Lim it at ions on Credit . - The amount of the credit taken under this Section shall be subject to each of the following limitations: (a) The amount of the credit in respect to the tax paid to any country shall not exceed the same proportion of the tax against which such credit is taken, which the net gifts situated within such country taxable under this Title bears to his entire net gifts; and (1) Each gift made during the calendar year which is to be included in computing net total gifts; (2) The de du ct ions (there are NO deductions in donor’s tax) claimed and allowable; 120 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com) lOMoARcPSD|12553117 exceeds the amounts previously assessed, (or collected without assessment) as a deficiency, but such amounts previously assessed, or collected without assessment, shall first be decreased by the amount previously abated, refunded or otherwise repaid in respect of such tax. (3) Any previous net gifts (already included in No. 1) made during the same calendar year; (4) [2] The name of the donee; and (5) [3] Such further information as may be required by rules and regulations made pursuant to law. (B) Tim e a n d Pla ce of Filin g a n d Pa ym en t . - The return of the donor required in this Section shall be filed within thirty (30) days after the date the gift is made and the tax due thereon shall be paid at the time of filing. Except in cases where the Commissioner otherwise permits, the return shall be filed and the tax paid to an authorized agent bank, the Revenue District Officer, Revenue Collection Officer or duly authorized Treasurer of the city or municipality where the donor was domiciled at the time of the transfer, or if there be no legal residence in the Philippines, with the Office of the Commissioner. In the case of gifts made by a nonresident, the return may be filed with the Philippine Embassy or Consulate in the country where he is domiciled at the time of the transfer, or directly with the Office of the Commissioner. SEC. 1 0 4 . Definit ions. - For purposes of this Title, the terms 'gr oss e st a t e ' and 'gift s' include real and personal property, whether tangible or intangible, or mixed, wherever situated: Pr ovide d, h ow e ve r , That where the decedent or donor was or is a nonresident alien at the time of his death or donation, as the case may be, his real and personal property so transferred but which are situated outside the Philippines shall not be included as part of his 'gross estate' or 'gross gift s': Provided, further, That franchise which must be exercised in the Philippines; shares, obligations or bonds issued by any corporation or sociedad anonima organized or constituted in the Philippines in accordance with its laws; shares, obligations or bonds by any foreign corporation eighty-five percent (85%) of the business of which is located in the Philippines; shares, obligations or bonds issued by any foreign corporation if such shares, obligations or bonds have acquired a business situs in the Philippines; shares or rights in any partnership, business or industry established in the Philippines, shall be considered as situated in the Philippines: Provided, still further, that no tax shall be collected under this Title in respect of intangible personal property: (a) if the decedent at the time of his death or the donor at the time of the donation was a citizen and resident of a foreign country which at the time of his death or donation did not impose a transfer tax of any character, in respect of intangible personal property of citizens of the Philippines not residing in that foreign country, or (b) if the laws of the foreign country of which the decedent or donor was a citizen and resident at the time of his death or donation allows a similar exemption from transfer or death taxes of every character or description in respect of intangible personal property owned by citizens of the Philippines not residing in that foreign country. The term 'deficiency' means: (a) the amount by which tax imposed by this Chapter exceeds the amount shown as the tax by the donor upon his return; but the amount so shown on the return shall first be increased by the amount previously assessed (or Collected without assessment) as a deficiency, and decreased by the amounts previously abated, refunded or otherwise repaid in respect of such tax, or (b) if no amount is shown as the tax by the donor, then the amount by which the tax 121 Downloaded by Rowell Ian Gana-an (rganaan@yahoo.com)