6 Taxable Income from Business Operations Chapter

advertisement

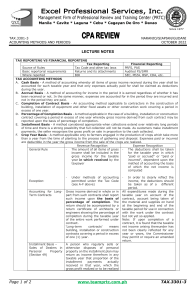

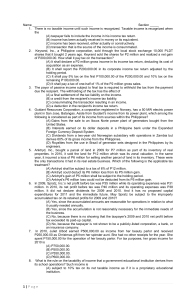

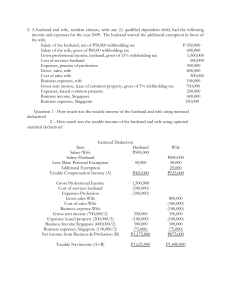

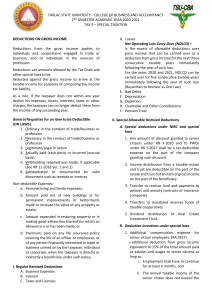

Chapter 6 Taxable Income from Business Operations Taxable Income Taxable income = gross income less allowable deductions Gross income: Sale of tangible goods → gross profit (sales – cost of goods sold) Sale of services → all charges, fees, commissions, bonuses, etc. Compensation for allowing use of property → gross rents, royalties, etc. Other sources of income → increases in net worth arising from trade or business activities are recognized as income: Receipt of property other than cash in satisfaction of obligation for services or goods sold or exchanged Generally, income recognized is equal to value of property received Forgiveness of indebtedness is recognized as income to extent it increases borrower’s net worth (i.e., to extent such forgiveness increases solvency) Many forms of “disguised” exchanges generate income as well—e.g.: Discounted purchases, below-market interest rate loans, etc. Gross Income vs. Net Income “Gross” income is distinguished from “net” income in that the latter is what is left after deduction of expenses Deductions are allowed for all “ordinary and necessary expenses … in carrying on any trade or business.” Ordinary expense → “normal, usual or customary” “May be infrequent to an individual taxpayer, but not in the life of the group, the community, of which he is a part” For example, payment in settlement of defamation charges filed against a newspaper Necessary → “appropriate and helpful for the development of the [taxpayer's] business” Generally speaking, illegal payments will not be considered ordinary, and therefore will not be deductible Expenses are also denied if they are against public policy (e.g., fines & penalties)