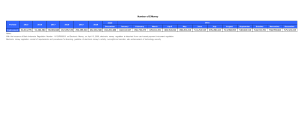

Topic - The impact of Covid- 19 pandemic on stock market volatility. A case study of the ZSE listed Companies 1.1 Background of the study The COVID-19 pandemic is an extreme event that has brought uncertainty to the financial markets, led to a sudden fall in stock prices, and has given rise to financial volatility (Cobert, 2021). The novel coronavirus disease (COVID-19) is an infectious disease that spreads rapidly to almost all countries worldwide and caused a global pandemic. The total cases and mortalities due to COVID19 pandemic have increased sharply between 2020 and in 2021 (Ganesh, 2021). This rapid spread of cases and deaths due to the COVID-19 pandemic had a significant negative impact on the global economy and on the financial markets (Baker, 2020). In this research, the researcher shall empirically investigate the impact of the COVID-19 pandemic on stock market volatility during and after its initial outbreak mainly focusing on Zimbabwe Stock Exchange (ZSE) listed companies covering the period from July to October, 2020 and 2021, respectively. The first half of the year 2020 saw one of the most dramatic stock market crashes in history. The crash was caused by the virus that originated in Wuhan, China. The first case of COVID-19 was reported in December 2019 in Wuhan city. Initially, it was not believed that this virus could be deadly and could spread to every part of the world. The rapid spread of the virus across the globe and the subsequent fear it created finally led to the halt of various economic activities. Many countries imposed strict lockdowns including Zimbabwe to contain the further spread of the virus and halted all major economic operations, which ultimately were received negatively by stock market exchanges, hence the inevitable stock market crash in March 2020. The Zimbabwean stock exchange crashed immediately by 5% at that time (Mahata, 2021). According to Dima (2021), the Government of Zimbabwe gazetted the Public Health (Covid-19 Containment and Treatment) National Lockdown) Order, 2020 through Statutory Instrument 83 of 2020. Section 4 (1) of SI 83 of 2020 Orders a Lockdown for a period of 21 days with effect from 30 March 2020 to 19 April 2020. Before the gazetting of the lockdown Order, Issuers were struggling to finalize their half-year and full-year financial statements because of the unsettling effects of Covid-19. The ZSE then issued a blanket dispensation to all issuers whose half-year and full-year financial statements were due for publication by 31 March 2020 to be published on or before 30 April 2020. Following the issuance of the lockdown Order some listed entities scaled 1|Page down and some completely halted their operations and the future remains uncertain. In the unfortunate event that the lockdown was extended, it put operational and financial pressure on many listed companies. Thampanya (2020) added that, the Zimbabwe Stock Exchange Limited (‘ZSE’) is a licensed securities exchange in terms of the Securities and Exchange Act (24:25) with a core mandate of facilitating long term capital raising through listing of securities as well as offering secondary market securities trading and issuer regulation services. The ZSE currently provides a listing and trading platform for Equity, Debt, Depository Receipts, Unit Trusts, Exchange Traded Funds and Real Estate Investment Trusts (Dima, 2021). The impact of Covid-19 was felt across the globe and the ZSE implemented measures in line with most industries and this included remotely working from home for most of its employees. Trading hours were reduced to comply with government health regulations to contain the Covid-19 impact. The ZSE’s resilience was on the back of increased infrastructure investment on the IT systems and upgrade of skills in the team. The Zimbabwe Stock Exchange’s (ZSE) main All Share Index (ALSI) was down by 38.5% during the second quarter of the year 2021 whilst the Top 10 index firmed 53.98%, driven by gains in Cassava, Simbisa and Econet. The mining index registered a notably lower return than the All Share index during the quarter. Prices for mining stocks were relatively sticky. Fama (2021) postulated thatIt should be noted however that foreign investors were net sellers of ZW$0.7b worth of equities on the ZSE and accounted for 6.84% of the value traded in Q3 2021 compared to 38.72% traded in Q3 2020 (Zimbabwe Stock Exchange Annual Report, 2021). Trading in the quarter was marked by a significant decline in the value of foreign investor activity in blue chip companies (Figure 1.1). Activity in other blue chip companies was limited and largely on the sell side due to Covid-19 (ZSE Annual Report, 2020). Figure 1.1 Value of shares traded from 1 Jan – 31 Dec 2020 2|Page [Source: Zimbabwe Stock Exchange Annual Report 2020] ZSE recorded a net foreign seller’s position of $9.73 billion in the year 2021 compared to a net sell position of $5.42 billion in 2020. Foreign investor participation declined to 11.74% in 2021 compared to 22.81% in 2020 because of Covid-19. According to ZSE Annual Report (2020), Active users on ZSE Direct grew fivefold to 5,000 in 2021 from 1,000 in 2020. The value of trades also increased to $248.5 million in 2021 from $14.4 million in 2020. A mobile application version of ZSE Direct was also introduced for both ios and android users in 2021. Mining activities were largely depressed, during the last quarter of 2020, compared to the same period in 2019, largely on account of the Covid-19 induced lockdowns, both domestically and globally. The underperformance of coal, gold, chrome and platinum largely weighed down mining. In addition, Total gold output stood at 4 794 kg in the fourth quarter of 2020, down by 36% from 7 458kg produced in the comparable period in 2019. This was largely on due to Covid 19. Global economic activity slowed down in 2020 as most economies imposed stringent lockdown measures in the first half of 2020 in response to the wave of Covid-19 infections. In its January 2021 update of the World Economic Forum report, the IMF estimated the global growth contraction for 2020 at -3.5%. The downturn was, however, less severe than what was projected on the onset of the Covid-19 outbreak. Growing concerns about the magnitude of the spread of COVID-19 and its economic impact triggered a global sell-off in financial markets in February and March 2020, which was associated with surging levels of volatility and trading volumes, as 3|Page well as liquidity contractions. A summary of the initial impact of these events on markets and securities processing follows. According to IMF (2020). Volatility quickly spread across the globe in the wake of the COVID19 outbreak as the S&P 500 index fell by 20% in just over three weeks (the shortest time ever for a bear market to materialize) and continued its decline by 30% in a record 30 days. The Euro STOXX 50 index recorded the quickest fall in its history. From February 20 to March 9, the 10year U.S. Treasury note yield dropped from 1.52% to 0.54%. By March 23, major Asian equity markets had recorded an aggregate YTD loss of 28.2%, while risk premium in Asian bond markets had tripled. On March 16, the CBOE Volatility Index, or VIX, closed at an all-time high of 82.69, breaking the previous record close that was set on November 20, 2008. In Europe, the VSTOXX, which measures implied volatility of EURO STOXX 50 Index options, reached an intraday high of 90% on March 18, up from levels of around 15-20% during the first half of February. In addition, trading volumes surged across several asset classes during the same period. On the last day of February, 19.3 billion U.S. shares were traded, more than twice the average daily volume of 7.0 billion shares over 2019. The 10 highest volume days for U.S. shares by notional volume or trade count of all time occurred in 2020. The European Securities and Markets Authority (ESMA) reported that transaction volumes on European trading venues had reached all-time highs in 1Q 2020. Equity trade volumes in the Asia-Pacific region increased significantly as well. Also, the average number of daily municipal bond transactions reached 75,000 on March 23, more than twice the volume recorded in mid-February. At the same time, significant volumes of equity trading moved from venues where prices are not shown pre-trade (dark pools and over-the-counter markets) to transparent exchange trading, as investors sought certainty of execution during periods of liquidity stress. This article aims to analyze the impact of COVID-19 on stock market volatility. 1.2 Statement of the problem The Stock market financial system plays an important role in the global economy as it acts an intermediary between lenders and borrowers (Maiti, 2021). The COVID-19 outbreak has disturbed the victims’ economic conditions and posed a significant threat to economies worldwide and their respective financial markets. The majority of the world stock markets have suffered losses in the trillions of dollars, and international financial institutions were forced to reduce their forecasted growth for 2020 and the years to come (Baker, 2020). The price index on ZSE remained pretty 4|Page steady in the early weeks of the crisis but saw a sharp decline in the weeks following the announcement of a lockdown in Zimbabwean stock market and fell to its lowest point in the week following the announcement of social distancing in the country. The industries that have been hardest hit include tourism and leisure (which includes air travel), fossil fuels production and distribution, insurance, retailers (excluding food and drug retailers) and some large manufacturing industries (ZSE Annual Report, 2020). This research deals with the impact of the COVID-19 pandemic on the Zimbabwean Stock Exchange. Objectives of the study The main objective is to investigate the impact of Covid- 19 pandemic on stock market volatility. Primary objectives of the study are as follows: 1. To determine the influence of Covid-19 daily infections on the stock market returns across industrial indices on the Zimbabwe Stock Exchange 2. To determine the effect of daily infections on the stock market price 3. To explore the impact of Covid-19 lockdowns on the trading volumes across asset classes taking place on the ZSE 1.3 Research Questions The main research question is: Investigate the impact of Covid- 19 pandemic on stock market volatility. The primary research questions of the study are as follows: 1. How do the Covid-19 daily infections influence the stock market returns across industrial indices on the Zimbabwe Stock Exchange? 2. What is the effect of daily infections on the stock market price? 3. What is the effect of Covid-19 lockdowns on the trading volumes across asset classes taking place on the ZSE? 1.4 Research Hypothesis H0: Stock market returns on the ZSE are positively correlated to Covid-19 pandemic H1: The Covid-19 pandemic and stock market returns on the ZSE are negatively correlated 5|Page 1.5 Scope of the Study The main focus of this research was on the impact of Covid-19 on the stock market volatility. The Zimbabwe Stock Exchange (ZSE) was the center of a detailed case study. The influence on stock market prices and the trading volumes attempts to broaden the financial market experiences during Covid-19 were the subject of the case study. However, because the Zimbabwe Stock Exchange (ZSE) is Zimbabwe's largest stock market and has the country's top performing companies, all companies cannot be studied at the same time. As a result, the study was limited to a few of the top 10 performing companies on the ZSE index. Old Mutual Zimbabwe and Seedco were among the finalists. Investors, company shareholders were among the study's chosen respondents. The study will cover period from March 2020 to August 2022. 1.6 Significance of the study The research study is importance to a number of stakeholders of the community including the following: Shareholders/Investors Stock exchanges form a critical component of the global financial market ecosystem, serving as gatekeepers linking companies to investors and as a platform for trading the securities of listed companies. Investors, as providers of capital, are customers of stock exchanges, and constitute a key stakeholder base. In many areas, investors and stock exchanges are aligned in their views about promoting the health of financial markets, the protection of investors and the corporate governance of listed companies. Brokers Brokers are major stakeholders in the capital market. They are professionals who facilitate the trading of stocks for their clients. Most brokers are capable of dealing in all types of securities in the market. They help clients to buy or sell shares in the market and take a percentage of the trade value as commission. Listed companies 6|Page Last but not the least, the companies that list their stocks on the exchange too are one of the stakeholders. After all, it is their stocks that are being traded. They, thus, are very much concerned about the activities of the stock market. Government Stock markets provide a trading platform for governments too. Sometimes a local, state or national government may need more money to develop a community housing estate, build a water treatment plant or initiate any other public projects. Instead of increasing taxes to raise the required revenue, it can issue bonds through the stock market. When investors buy these bonds, the government is able to raise the money it needs to launch various projects that can ease the cost of living or even create jobs for locals. In the long run, this improves the economy. 1.7 Assumptions of the Study The researcher anticipated that company shareholders and directors collaborated and shared important data. Key subscribers offered non-biased and factual information about the Zimbabwe Stock Exchange (ZSE). Respondents from the entire population sample were included. 1.8 Literature review As the COVID-19 pandemic emerged, many studies have covered several aspects of the crisis, including its economic developments. As new information arrives in the stock markets markets, it generates skepticism over market efficiency and the interrogation on investors over or under reaction to the news. Although the existent literature examines a wide variety of theories on the equity market over COVID-19, this review centers on the stock market responses to lockdowns, number of cases and media news. In addition, this section also reveals existing literature on the effect of natural disasters and terrorism, as well as the causes of previous financial recessions. Yilmazkuday (2020) examines the impact of COVID-19 daily cases on global economic activities based on commodities’ daily shipping (transportation). He finds that daily cases adversely affect the global economic activity and argues that COVID-19 has brought significant disruptions on 7|Page global economic activity through disrupted transportations among the supply chains. Yilmazkuday (2020) finds that COVID-19 has also increased the U.S.’s unemployment rate, especially in March 2020. Furthermore, He later finds that a one percent increase in the cumulative daily COVID-19 cases in the U.S. resulted in 0.01 percent negative daily return in the S&P 500 index. Onali (2020) finds that COVID-19 significantly affects the U.S. equity market toward the end of February 2020. Using daily data from China, India, Japan and Korea, Garg (2020) examine the relationship between oil price returns and stock returns and find that falling oil prices brings a negative signal to the stock markets. Recent studies have also examined the impact of COVID-19 on the equity markets’ volatility and trading volume. Baek (2020) find a significant increase in absolute risk for the US equity market due to the COVID-19 deaths. Salisu and Akanni (2020) construct a global fear index (GFI) based on the cases and deaths from the COVID-19. They find that GFI is a good predictor of stock returns in the OECD and the BRICS countries during the pandemic. Zhang, Hu, and Ji (2020) examine the impact of COVID-19 on stock market volatility across 11 developed countries and China and find that the volatility has increased substantially from February to March 2020. COVID-19 studies have also examined the impact on the commodity markets, specifically crude oil (energy) markets. Narayan (2020) examines the effect of the threshold of the COVID-19 case on oil prices and finds that news on oil prices has a limited effect on price when conditioned on COVID-19 cases. Under the oil price volatility threshold, both COVID-19 cases and negative news on the oil process significantly affect oil prices. Using hourly data, Devpura (2020) show that COVID-19 cases and deaths led to a significantly greater daily volatility in the oil process. Salisu and Adediran (2020) find that the equity market volatility tracker of COVID-19 (Baker, Bloom, Davis, Terry et al., 2020) is a good predictor for energy market volatility. Qin, Zhang, and Su (2020) find that the COVID-19 pandemic index negatively affects the oil prices due to lower demand during the infection period of 2019 and early 2020. Albulescu (2020) examines the impact of COVID-19 on the stock market volatility in the US and finds that the global new cases and fatality ratio increase the volatility. Arias (2020) find evidence that COVID-19 has increased herding behavior in returns, volatility, and trading volumes among five major European equity markets. Chiah and Zhong (2020) examine the impact of COVID-19 on the trading volumes across 37 international equity 8|Page markets and find a massive increase in trading volume attributable to the national culture and institutional environment in each country. Although a number of studies have investigated the impact of different diseases on stock market performance, emerging literature presents new evidence on the impact of the COVID-19 pandemic and the reaction of financial markets to its spread worldwide. For example, Liu et al. (2020) demonstrated in an event study that the COVID 19 outbreak had a negative impact on stock markets and weakened their performance in many countries, including Korea, Japan, the USA, Germany, the UK, etc. Ashraf (2020) found that confirmed COVID-19 cases had a quick and negative impact on stock markets. This study showed that responses from the stock markets varied over time depending on the stage of outbreak. For example, a negative market reaction was strong during the early days of confirmed cases. Al-Awadhi et al. (2020) showed in an experimental study on COVID-19 that the daily growth in total number of confirmed cases and total number of deaths had a significant negative impact on stock returns of all companies in the Chinese stock market. Albulescu (2020) highlighted that confirmed cases and deaths due to COVID-19 positively influenced the market volatility index within and outside China. Baker et al. (2020) demonstrated that voluntary social distancing and government restrictions on commercial activity were the main reasons the US stock market reacted more heavily to the COVID-19 than to previous pandemics. Khan et al. (2020) investigated the stock markets of sixteen countries and came to the conclusion that once the WHO confirmed the human-to human transmissibility of COVID-19, all stock markets reacted negatively. While the aforementioned studies demonstrate the negative impact of the COVID-19 pandemic on stock markets in different countries, Singh et al. (2020) found that after some time (app. 1.5 months) stock markets recovered from the negative impact of COVID19 in G-20 countries. Loh (2006) investigated to what extent the airline companies traded in the financial markets of Taylan, China, Canada, Hong Kong, and Singapore are affected by SARS. For this purpose, Ftest, Siegel Tukey, Bartlett, Levene, and Brown tests were performed by using the data obtained from December 1, 2002 to July 5, 2003. As a result of the analysis, it is indicated that the epidemic harmed airline companies. Giudice and Paltrinieri (2017) examined monthly flows and performances of 78 equity mutual funds in African countries for the period of 2006-2015. As a result of the analyzes and examinations, it is concluded that two significant events, which are Ebola 9|Page and the Arab Spring, have significantly affected the funds flows, fund performance, expenses, and market returns. Laing (2020) examined the effect of coronavirus on certain precious metals. In order to measure the price changes, he compared the prices of aluminum, copper, gold, lead, nickel, and zinc for the period between March 4, 2020 and April 2, 2020. As a result of this comparison, it is found that the price of aluminum, copper, gold, lead, nickel, and zinc decreased by 15%, 14%, 2%, 10%, 11%, and 6% respectively in the period given. Al-Awadhi et al. (2020) have investigated the effect of the coronavirus outbreak on financial markets. They included 82 companies operating in The Hang Seng Index and Shanghai Stock Exchange Composite Index and divided them into ten sectors according to their fields of activity. Then, they collected daily data of validated cases, deaths, and stock market values of companies from January 10, 2020 to March 16, 2020. By using panel data analysis, they concluded that the number of daily confirmed cases and daily death cases had significant negative effects on the financial markets of the countries included in the study. 1.8.1 Theoretical Framework Efficient Market Hypothesis theory The Efficient Market Hypothesis (EMH) is one of the main discussed theories in finance literature, which defends the impossibility of outperforming the market consistently on a risk adjusted basis. Introduced by Fama (1970), this theory defines an efficient market as a market in which asset prices reflect all past and present information. Only new information moves security prices, and as new information is unknown and occurs at random, upward or downward price movements are unknown and therefore move randomly. An important point in market efficiency is that prices should only react to information that is not expected by investors, otherwise the piece of information should already be considered at the security price. The main conclusion behind the EMH is that securities always trade at their fair market value, meaning that it is virtually impossible to sell overvalued stocks at a premium or to buy undervalued ones at a discount. In a highly effective market, investors prefer passive investment strategy to an active investment strategy due to lower costs, such as transaction or information-seeking costs. In his study, Fama (1970) suggested three types of efficiency: a weak form, a semi strong form and a strong form. The author defined each form according to the availability of information that 10 | P a g e is reflected in prices. Weak form: security prices fully reflect all past market dates. If markets are weak-form, past trading is already reflected in security prices and investors cannot forecast future price changes. As a result, it assumes that technical analysis does not offer any consistent excess return over the market. Under Semi strong form security prices fully reflect all publicly available information, including financial statement data and market data. Therefore, it improves the weak form by assuming that neither technical nor fundamental analysis provides an advantage over the market. Under Strong form security prices fully reflect public and private information. Thus, no investor can achieve higher returns than others because of inside information. However, this is an unlikely scenario because of the strict prohibitions against insider trading. Based on the literature, there are two opposing schools of thought regarding market efficiency. The first school of thought claims that markets are efficient and that investors cannot forecast returns. On the other hand, the second school of thought provides empirical evidence that challenges the theory of efficient markets. Behavioural finance appeared for the first time in Bondt & Thaler (1985) attempting to explain that emotions and human behaviour play a significant role in investor decisions. The theory does not assume that investors consider all available information and act rationally when deciding. The main assumption behind behavioural finance is that investors are humans and, therefore, not perfect. A key point for explaining this theory are the behavioural biases of individuals, which explain market inefficiencies. Market Anomalies Although there is significant evidence showing that markets are efficient, researchers have identified several apparent market inefficiencies, called anomalies (Jensen, 1978). If a change in the price of an asset cannot be attributed to the release of new information, it surges an anomaly over market efficiency. Based on the analysis method that identified the anomaly, there are two types of categories: timeseries anomalies, which use time series of data; and cross-sectional anomalies, which use a sample of companies. Time-series anomalies can be sub-categorized in calendar anomalies, which are situations linked to a particular point in time; and momentum and overreaction anomalies, which relate to short-term price patterns. Calendar anomalies include the January effect the weekend effect or the turn of-the-month effect (Ariel, 1987). Momentum and overreaction anomalies were introduced in by affirming that most people tend to overreact to unexpected and dramatic event 11 | P a g e news. In addition, Folkinshteyn et al. (2015) document a recurring trend of investor overreacting through five of the most important stock market crashes of the last three decades. As for crosssectional anomalies, two of the most researched situations are the size effect and the value effect. The size effect, first observed by (Banz, 1981), results from the observation that small-cap companies stock tends to outperform large-cap companies’ stock. The value effect results from the observation that value stocks have consistently outperformed growth stocks through long periods of time (Basu, 1977). 1.9.2 Conceptual framework Figure 1.2: Conceptual Framework • Covid-19 pandemic Independent variable Dependent variable • Stock market volatility [Source: Arash (2021) Covid 19 and Stock market performance] The objective of this study is to examine the impact of the global Covid-19 pandemic in the Zimbabwean stock market. Hence, Covid 19 is the independent variable as it is independent of the stock market. Stock market volatility is depending or react based on the confirmed cases or daily infections of Covid-19, hence it is the dependent variable. 1.9 Research Methodology 12 | P a g e Research design The research strategy serves as a guide for achieving goals and finding answers. It emphasizes the significance of a time- and activity-based approach in study design. It creates a framework for describing the connection between the research variables. Two of the most well-known personalities in the world are Cooper and Schindler (Saunders, 2015). The investigation was carried out using a descriptive research methodology. The method was chosen because it would make it easier to spot trends in attitudes and behavior and enable generalization of the study's findings. The reason descriptive research was chosen was so that a more accurate profile of a circumstance, person, or event could be created. Robson (Robson, 2016). This research approach was chosen because it saves time, money, and allows for the legitimate collection of quality data while minimizing interviewer bias because participants complete selfreport questionnaires with similar wording (Faberge, 2015). Due to time constraints, a crosssectional approach was not used in this work. To examine a specific event at a specific time, researchers can employ cross-sectional research. The survey tactic is typically used in this research methodology (Robson, 2016). Sampling method The method of judgmental sampling was used. It permits researchers to use their judgment in selecting the sample that will allow them to answer the research questions and meet the study objectives. It is also known as intentional sampling (Saunders et al, 2007). The researcher attempts to draw a representative sample using their own judgment. Wegner (2013) cautions that if this method is used, the researcher must ensure that the sample chosen is representative of the entire community. This sort of sampling is commonly employed when working with small samples, such as in case study research, or when the researcher wants to select cases that are particularly instructive. When a large number of groups have to be chosen, the advantage is that group size balance is ensured. The Shareholders or investors, brokerage firms and company executives who took part in the study were chosen by a judgmental sampling procedure. Sample size 13 | P a g e According to Bougie and Sekaran (2016), for most scientific empirical social science research, a sample size of larger than 30 and equivalent to 500 is appropriate since it achieves the statistical power required in social science research. To lower standard error, a large sample size is required. Saunders et al. (1996) added to this by adding that the larger the sample size, the less likely it is to generalize incorrectly to the population, and the margin of error should be within acceptable limits. The study's sample size was thirty (30), with 22 shareholders and 8 executives chosen at random. The sample size was substantial and representative enough for the researcher to draw reasonable findings. Choosing exceptionally large samples, according to Saunders et al. (1996), does not pay off. Data collection techniques In this study, a semi-structured electronic questionnaire based on the interview guide was utilized to collect data, and it was sent via email and on the ZSE official website. The opinions of the students were then obtained by introducing the questionnaire link. Top 10 performing industries on the ZSE around the country provided a total of 30 open-ended questionnaires. Shareholders were requested to provide their ZSE IDs so that the survey could be managed to ensure that only those listed on ZSE completed it. Within a month, all of the data had been collected. The participants were not asked for any personally identifiable information. The instruments utilized in this investigation were questionnaires. The items were created by the researcher because no appropriate item could be identified in the present literature. The questionnaires were created with the study's goal in mind. Closed-ended Likert scale statements were used on the questionnaire forms (quantitative data). The questionnaire was graded on a fivepoint Likert scale (Strongly Agree= 1 Agree= 2, Not sure/Neutral= 3, Disagree= 4, and Strongly Disagree= 5). The demographic data of respondents was collected using a nominal scale as shown in Table 3.1 Below: Strongly Agree Agree Uncertain Disagree Strongly Disagree 1 2 3 4 5 14 | P a g e Table 1.1: Likert scale The entire questionnaire was split into two groups: A and B. The respondents' backgrounds are explored in Section A, which includes their age, gender, education, and length of time they have been learning at the universities. Section B discusses the main study objectives. Data Analysis and Presentation A quantitative technique will be used to analyze the data. Microsoft Office Excel will be used in the banking industry to examine the relationship between Covid-19 and Stock market volatility. SPSS and Excel will be the primary analytical tools for analyzing the study's findings. The raw data would be summarized and presented in the form of tables and percentages. Based on the study's findings and conclusions, appropriate recommendations for strengthening the online learning experience of students will be made. In addition, Statistical Package for the Social Sciences (SPSS) Statistics version 20.0 was used to analyze the questionnaires. Hence, Descriptive statistics (discreet variables and respondents' demographics were analyzed using frequencies and charts) Regression/Correlation analyses were calculated using (IBM SPSS 20). Reliability, Validity and Ethical Considerations Research involves not just talent and diligence, but it also necessitates honesty and integrity. This is done to preserve the rights of the study participants. This research was carried out in such a way that the participants felt safe and their privacy and confidentiality were protected. The rights of self-determination, anonymity, secrecy, and informed consent were observed to make the study ethical, as argued by Burn and Groves (1993). To begin, the researcher obtained permission from universities to conduct the study. The respondents' agreement was sought prior to completing the questionnaires. Burns and Grove (1993) define informed consent as a prospective respondent's voluntary assent to participate in a study after being informed about the study's purpose. The participants were advised of their rights to freely consent, decline to participate, or withdraw their participation at any time with a penalty. The participants were told about the study's goals, what it hoped to accomplish, how the data would be collected, and how the data would be used. 15 | P a g e The researcher maintained anonymity and secrecy during the investigation. Burns and Grove (1993) define anonymity as the inability to link the specific opinions of responders. The respondents' privacy was preserved in this study by the researcher not revealing their identity on the questionnaires or research reports. While reporting on the findings, the researcher preserved confidentiality for the purposes of this study by not releasing the gathered data or the identity of the respondents. Finally, the researcher's contact information was provided in case there were any questions. 1.10 Definition of key terms Stock market – Is a market which consists of exchanges in which stock shares and other financial securities of publicly held companies are bought and sold Covid-19 - The novel coronavirus disease (COVID-19) is an infectious disease that spreads rapidly to almost all countries worldwide and caused a global pandemic. The total cases and mortalities due to COVID-19 pandemic have increased sharply in the last months of 2020 and in 2021. This rapid spread of cases and deaths due to the COVID-19 pandemic had a significant negative impact on the global economy and on the financial markets. Stock volatility – It is the standard deviation of a stock’s annualized returns over a given period and shows the range in which its price may increase or decrease. If the price of a stock fluctuates rapidly in short period, hitting new highs and lows, it is said to have high volatility Lockdown – It is a restriction policy for people or community to stay where they are, usually due to specific risks to themselves or to others if they can move and interact freely. Market Index – Is a hypothetical portfolio of investment holdings that represent a segment of the financial market. 1.11 Work Plan Table 1.2 Proposed Dissertation Working Schedule Milestone First submission date To be done by Chapter 1 Literature review 16 | P a g e Methodology and Research Instruments Data collection Corrected Methodology Chapter 4 Chapter 5 Final draft 17 | P a g e References Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A. and Alhammadi, S. (2020). Death and Contagious Infectious Diseases: Impact of the COVID-19 Virus on Stock Market Returns. Journal of Behavioral and Experimental Finance, 27, pp.1-5. Ayittey, F. K., Ayittey, M. K., Chiwero, N. B., Kamasah, J. S. & Dzuvor, C. (2020). Economic impacts of Wuhan 2019‐nCoV on China and the World. Journal of Medical Wirology, 10.1002/jmv.25706, pp. 1-3. Becker, R., Enders W. and Lee, J. (2006). A Stationarity Test in the Presence of an Unknown Number of Smooth Breaks. Journal of Time Series Analysis, 27(3), pp. 381–409. Bloom, D. E., Cadarette, D. and Sevilla, J. (2018). New and Resurgent Infectious Diseases Can Have Far-Reaching Economic Repercussions. Finance and Development, 55(2), pp. 46-49. Brounen, D. and Derwall, J. (2010). The Impact of Terrorist Attacks on International Stock Markets. European Financial Management, 16(4), pp. 585-598. Cepoi, C.O. (2020). Asymmetric Dependence Between Stock Market Returns and News During COVID-19 Financial Turmoil, Finance Research Letters, 36, 101658. Chen, M.-P., Lee, C.-C., Lin, Y.-H. and Chen, W.-Y. (2018). Did the SARS Epidemic Weaken the Integration of Asian Stock Markets? Evidence from Smooth Time Varying Cointegration Analyisis. Economic Research, 31, pp. 908-926. Enders, W. and Jones, P. (2015). Grain Prices, Oil Prices, and Multiple Smooth Breaks in a VAR. Studies in Nonlinear Dynamics & Econometrics, 20(4), pp. 399-419. 18 | P a g e Engle R. F. and Granger C.W.J. (1987). Cointegration and Error Correction: Representation, Estimation, and Testing. Econometrica, 55(2), pp. 251–276. Estrada, M.A., Park, D., Koutronas, E., Khan, A. and Tahir, M. (2020a). The Economic Impact of Massive Infectious and Congagious Diseases: The Case of Wuhan Coronavirus. Available at SSRN: https://ssrn.com/abstract=3533771 or http://dx.doi.org/10.2139/ssrn.3527330 Estrada, M.A., Koutronas, E., and Lee, M. (2020b). Stagpression: The economic and financial impact of Covid-19 Pandemic, SSRN Electronic Journal, January 2020. Fan, V. Y., Dean, T. J. and Summers, L. H. (2018). Pandemic Risk: How Large are the Expected Losses? Bulletin of The World Health Organization, 96(2), pp. 129-134. Giudice, A. D. and Paltrinieri, A. (2017). The Impact of the Arab Spring and the Ebola Outbreak on African Equity Mutual Fund Investor Decisions. Research in International Business and Finance, 41, pp. 600-612. Goodell, J. W. (2020). COVID-19 and Finance: Agendas for Future Research. Finance Research Letters, 35, pp.101512. Gregory A.W. and Hansen B.E. (1996). Residual-based Tests for Cointegration in Models with Regime Shifts. Journal of Econometrics, 70, pp. 99-126 19 | P a g e 20 | P a g e