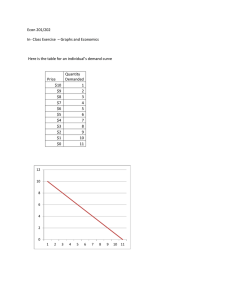

Microeconomics: Demand, Supply, Market Equilibrium Market: An arrangement where buyers and sellers of goods, services and resources are linked together to carry out exchanges Competition: Occurs when there are many buyers and sellers acting independently so that no one has the ability to influence the price at which the product is sold in the market. Competitive Markets: A market composed of many buyers and sellers acting independently, none of whom has any ability to influence the price of the product. Demand: The quantity of a good or service that a consumer is willing and able to buy at different possible prices in a given period of time ceteris paribus. Demand Curve: A curve showing the relationship between the price of a good and the quantity of the good demanded Law of Demand: There is a negative relationship between the price of a good and its quantity demanded over a particular period of time: as the price of a good increases, the quantity demanded falls Market Demand: The sum of all individual demands for a good. Non-price determinants of Demand: The variables other than price that can influence demand. Normal Goods: Demand for the good increases in response to an increase in consumer income Inferior Goods: Demand for the good falls as consumer income increases Substitutes: Goods that satisfy a similar need so that one good can be used in place of another. Increase in price of one leads to increase in demand for the other. Complements: Two goods that tend to be used together Assumptions Underlying the Law of Demand: Law of Diminishing Marginal Utility: As consumption of a good increases, marginal utility decreases with each additional unit consumed (underlies the law of demand as shows a consumer will be willing to buy additional unit only if price falls) ● Maximum total utility is when marginal utility =0 The Substitution Effect: Inverse relationship between price and quantity demanded exists because as price falls, consumers substitute (buy more of) the now less expensive good for other products. The Income Effect: As price falls, real income increases (purchasing power increases) causing the consumer to buy more of the good Supply: The quantities of a good or service that suppliers are willing and able to produce and sell at different possible prices in a given period of time. Supply Curve: A curve showing the relationship between the price of a good and the quantity of the good supplied Law of Supply: Positive relationship between the quantity of a good supplied over time and its price; as the price of a good increases, the quantity supplied increases too. Market Supply: The sum of all individual firms’ supplies for a good. Non-Price Determinants of Supply: The variables (other than price) that can influence supply and that determine the position of a supply curve; change in determinant causes a shift of supply. Competitive Supply: Case of two goods, refers to production of one or the other by a firm. Two goods compete with each other for the same resources (corn and wheat). Joint Supply: Refers to production of two or more goods derived from a single product so that it is not possible to produce more of one without producing more of the other (butter and skimmed milk) Subsidy: An amount of money paid by the government to firms for a variety of reasons (to prevent an industry failing, support producer income/ form of protection against imports). Short run: A time period during which at least one input is fixed and cannot be changed by the firm. Long run: Time period when all inputs are variable/ can be changed. Total Product: The total quantity of output produced by the firm Marginal Product: The additional output produced by one additional unit of variable input Total Cost: Total cost of production incurred by firm Assumptions Underlying Law of Supply: Law of diminishing marginal returns: As more units of variable input are added to fixed input, the marginal product of the variable input increases initially before decreasing. Assumes that the fixed input remains fixed. Marginal Cost: The additional cost of producing one more unit of output (part of supply curve is shown by marginal cost curve, as output increases, firms accept higher prices to cover their increasing costs). Excess Supply / Surplus: Occurs when quantity demanded exceeds quantity supplied Excess Demand/ Shortage: Quantity demanded is smaller than quantity supplied Equilibrium: A state of balance such that there is no tendency to change. Market Equilibrium: Where the quantity demanded equals the quantity supplied Equilibrium Price: the quantity consumers are willing and able to buy is exactly equal to quantity firms are willing and able to sell at. Competitive Market Equilibrium: Quantity demanded equals quantity supplied, and there is no tendency for the price to change. Price Mechanism: System where prices are determined by demand and supply in competitive markets resulting from the free interaction of buyers and sellers. Signalling Function: Function of price mechanism that communicates information to decision-makers Incentive Function: Prices motivate decision-makers to respond Marginal Benefit: The extra benefit from each additional unit bought Consumer Surplus: The highest price consumers are willing to pay for a good – price actually paid ● Area under demand curve until price paid Producer Surplus: The price received by firms for selling their good – lowest price that they are willing to accept to produce the good. ● Area above supply, below price received, until quantity produced Social/ Community Surplus: Sum of producer and consumer surplus (maximum at competitive market equilibrium) Welfare: Refers to amount of consumer and producer surplus Welfare/ Deadweight Loss: Loss of portion of social surplus that arises when marginal social benefits are not equal to marginal social cost.