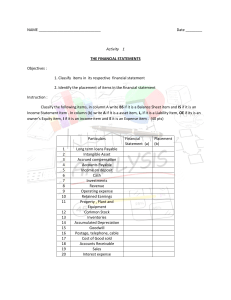

Chapter 5 Adjustments • Understand what adjusting journal entries are and why they are important to process • Process closing transfers at the end of the financial period • Prepare financial statements after adjustments/closing entries have been taken into account • Understand the implications of the accrual basis. Recording and Reporting Recording Reporting • Bookkeeper • Accountant • Records • Prepares financial transactions statements • Processes journal (reports) entries • Information • Posts to the ledger prepared/presented • Extracts trial according to balance IFRS/GAAP 3 Recording process Transactions: source document Prepare journal entry Post to the general ledger Extract a trial balance Occurs daily during the financial year Occurs daily/monthly during the financial year Monthly during the financial year Adjusting entries • On every reporting date, the accountant ensures that the general ledger is correct according to IFRS – Do assets and liabilities in the ledger still meet the asset/liability definition and recognition criteria in the framework? – Is the ledger complete i.e. are all the assets and/or liabilities that should be recognised, listed in the ledger? – Are items in the ledger measured at correct amount? • If the answer to any of these questions is “NO”, the accountant must ADJUST the general ledger by preparing adjusting/correcting journal entries. Adjusting entries Ensures that the information used to prepare financial statements accurately reflects the assets, liabilities, equity, income and expenses of the business at that point in time Recording process Pre-adjustment trial balance Prepare adjusting journal entries Post to the general ledger Accounting Equation A+E+D=C+I+L a/c type Debit Credit Asset + - Expenses + Drawings + a/c type Debit Credit Capital - + - Income - + - Liabilities - + Pre-adjustment trial balance EXTRACT Pre-adjustment trial balance Capital 8 000 Drawings 720 Stationery on hand 200 Prepaid talk-time 440 Sales 6 711 Cost of sales 2 940 1. Pre-adjustment trial balance shows what HAS been recorded in the books of the business 2. There is no stationery or talk-time on hand at year end Adjusting journal entry DR Stationery expense CR 200 Stationery on hand 200 Stationery used recognised as an EXPENSE Dr 31/1 Dr 31/1 + Stationery on hand Balance 200 31/1 Stationery Asset - Cr Stationery Expense Stationery (Expense) 200 + Cr 200 Stationery derecognised (credited) – no longer an asset. Assets decrease, no change in liabilities Decrease in NAV not due to transaction with owner Stationery expense recognised (debited) Adjusting journal entry DR Talk-time expense CR 440 Prepaid talk-time 440 Talk-time used recognised as an EXPENSE Dr 31/1 Dr 31/1 + Prepaid talk-time Balance Prepaid talktime 440 31/1 - Cr Talk-time Expense Talk-time (Expense) 440 + Cr 440 Prepaid talk-time derecognised (credited) – no longer an asset. Assets decrease, no change in liabilities Decrease in NAV not due to transaction with owner Talk-time expense recognised (debited) Post-adjustment Trial Balance EXTRACT Pre-adjustment trial balance Account Debit Credit Capital 8 000 Drawings 720 Stationery on 200 hand Prepaid talk 440 time Sales 6 711 Cost of sales 2 940 EXTRACT POST-adjustment trial balance Account Debit Credit Capital 8 000 Drawings 720 Stationery 200 expense Talk time 440 expense Sales 6 711 Cost of sales 2 940 Recording/reporting process Post-adjustment trial balance Prepare closing entries Post to the general ledger Post-closing trial balance Prepare Financial Statements Closing entries SEE PG 87 At the end of the financial year, the business needs to calculate the profit or loss. Once all adjusting journal entries are processed, the income and expenses need to be closed of to zero Profit or Loss= Income - Expenses What are closing entries? Closing entries are transactions that allow all income/expense, losses/gains to be closed off to a zero balance to the profit and loss account – and transferred to an equity account. Closing entries SEE PG 87 When do we process closing entries? Annual accounts - Income and expense, gains and losses are closed off to relevant EQUITY accounts i.e. Retained Earnings during the year-end process. Close off income and expenses DR Sales income (P/L) CR 6 711 Profit or Loss (E) 6 711 Close off sales income to Profit/Loss account DR Profit or Loss (E) CR 2 940 Cost of sales expense (P/L) 2 940 Close off cost of sales expense to Profit/Loss account Dr 31/1 Cost of sales Dr 31/1 2 940 31/1 Sales Sales income (Equity) Profit/Loss account Dr 31/1 Profit/Loss account (Equity) Balance 6 711 31/1 Balance Cost of sales expense (Equity) 2 940 31/1 Profit/Loss account Cr + 6 711 Cr + 6 711 Cr + 2 940 16 Close off income and expenses DR Profit/Loss (E) CR 200 Stationery expense (P/L) 200 Close off stationery expense to profit and loss account DR Profit/Loss (E) CR 440 Talk-time expense (P/L) 440 Close off talk-time expense to profit and loss account Dr - Profit/loss (Equity) Cost of Sales Sales Cr + 6 711 Dr - Stationery expense Balance 2 940 Stationery expense 200 Talk-time expense 440 200 Profit/ loss Dr – Talk time expense Balance 440 Profit/ loss Cr + 200 Cr + 440 Close off Profit/Loss DR Retained earnings (E) CR 720 Drawings (E) 720 Close off drawings to retained earnings account DR Profit/loss (E) CR 3 131 Retained earnings (E) 3 131 Close off profit to retained earnings account Dr - Profit/loss (Equity) Cost of Sales Stationery expense Sales Cr + 6 711 Dr – Retained earnings Cr + Drawings 2 940 720 Profit/ loss Dr - Drawings 3 131 Cr + 200 Balance Talk-time expense 440 Retained earnings 3 131 720 Retained earnings 720 Post-closing Trial Balance Extract from POST-adjustment trial balance Account Debit Credit Capital 8 000 Drawings 720 Stationery 200 expense Talk time 440 expense Sales 6 711 Cost of sales 2 940 Extract from post-CLOSING trial balance Account Debit Credit Capital 8 000 Retained Profit 2 411 [3 131 – 720] Points to note • Adjusting entries processed to get correct balances to prepare the financial statements. • Closing entries processed after adjusting entries • Closing entries processed to net income and expense account balances off to zero. • Asset and liability accounts not affected by closing entries Recording Business purchases R3 000 stationery Bookkeeper Dr Stationery exp Cr Bank/TP OR Dr Stationery Asset Cr Bank/TP Which is correct? Recording Either !!!! – when information is recorded initially When is it important that A, E and L are accurate? When the Financial statements are prepared Financial statements are generally prepared at the end of the financial period! Reporting Regardless of how the transaction was initially recorded, the following must be disclosed: Financial statements Stationery used Expense SOCI Stationery on hand Asset SOFP Reporting The financial statements need to be prepared at 31 December: • Assume stationery of R1 000 is on hand • How should the records be adjusted so that the reports are accurate? Adjusting journal entries If the bookkeeper initially recorded: If the bookkeeper initially recorded: Dr Stationery EXPENSE R3 000 Cr Bank/TP R3 000 Dr Stationery ASSET Cr Bank/TP Then the adjusting entry is: Dr Stationery asset R1 000 Cr Stationery expense R1 000 Then the adjusting entry is: Dr Stationery expense R2 000 Cr Stationery asset R2 000 We need to show that some of the stationery originally purchased and treated as an expense is still ON HAND and is an ASSET We need to show that some of the stationery originally purchased and treated as an asset has been USED and is an EXPENSE R3 000 R3 000 So, what sort of Adjusting journal entries need to be made? Adjustments….. Accrued Expense: The benefit has been used but not paid for therefore a liability recognised; Prepaid expense: The expense has been paid for in advance and the expense has not yet been recognised; Income Accrued: The income has been earned but not received; Income received in advance: Income received but the service has not been provided for An example Extract of AA Stores Pre-Adjustment trial balance as at 31 August x9 Debit Credit Plant and equipment 410 000 Trade receivables 55 000 Sales income 1 000 000 Rent income 16 500 Cost of sales expense 425 000 Rent expense 56 000 Water & electricity 8700 expense An example • AA Stores estimates it used water and electricity worth R9 000 during the year. The bookkeeper records all payments of electricity as an expense. Accrued expense Benefit used but not paid W&E expense in TB @ 31/8/x9 = R8 700 1/9/x8 What was paid: R8 700 What was used: R9 000 The business paid R300 TOO LITTLE Expenses Liability We owe for a service we have USED – recognise a liability Adjusting journal entry DR Water and electricity exp CR 300 Accrued expenses 300 Unpaid W&E recognised as a LIABILITY Dr - Accrued expenses (L) + Cr 31/8/9 Water and electricity exp Dr 31/8/9 + Water and electricity exp Balance Accrued expenses 8 700 300 300 - Cr An example • AA Stores rents a property and is charged R4 000 rental per month. The bookkeeper records all cash payments for rent as expenses. Prepaid expense Paid but benefit not used Rent expense in TB @ 31/8/x9 = R56 000 1/9/x8 What was paid: R56 000 What was used: R48 000 [R4 000 x 12] The business paid R8 000 TOO MUCH Expenses Asset They owe us a service – recognise an asset Adjusting journal entry DR Prepaid rent (A) CR 8 000 Rent expense 8 000 Unused rent recognised as an ASSET Dr - 31/8/9 Balance Dr 31/8/9 + Rent expense Rent expense + Cr 56 000 31/8/9 Prepaid rent Prepaid rent (A) 8 000 8 000 - Cr An example • AA Stores owns a building in Parow industrial. The rent income is R1 500/month. The tenant has occupied the building for the full financial year. Accrued income Earned but not received Rent income in TB @ 31/8/x9 = R16 500 1/9/x8 What was received: R16 500 What was earned: R18 000 [R1 500 x 12] The business received R1 500 TOO LITTLE Income Asset They owe us for a service – recognise an asset Adjusting journal entry DR Accrued income (A) CR 1 500 Rent income 1 500 Income not yet received (but earned) recognised as an ASSET Dr Dr 31/8/9 - + Rent income Rent income Cr 31/8/9 Balance 16 500 Accrued income 1 500 Accrued income (A) 1 500 + - Cr An example • On 1 August X9, a customer ordered and paid for running shoes amounting to R3 500. The shoes will only be delivered during September. The bookkeeper included this amount in sales income. Income received in advance Received but not earned 1/9/x8 Sales in TB @ 31/8/x9 = = R1 000 000 What was received: R1 000 000 What was earned: R996 500 [R1 000 000 – R3 500] The business received R3 500 TOO MUCH Income Liability We still owe goods – recognise a liability Adjusting journal entry DR Sales CR 3 500 Income received in advance 3 500 Unearned income recognised as a LIABILITY Dr - Income received in advance (L) + 31/8/9 Sales Dr 31/8/9 Income received in advance Sales 3 500 3 500 + Balance Cr Cr 1 000 000 Post adjustment Trial balance Extract of AA Stores Pre-Adjustment trial balance Extract of AA Stores POST-Adjustment trial balance Sales income 1 000 000 Sales income 996 500 Rent income 16 500 Rent income 18 000 Rent expense Water & electricity exp 56 000 Rent expense 48 000 8 700 Water & electricity exp 9 000 Inc received in advance 3 500 Accrued inc 1 500 Prepaid exp 8 000 Accrued exp 300 Cash and accrual: expenses Effect on profit calculation Cash paid this Recognise year, benefit from expense this year expense used this profit decreases year Cash paid this No effect on this year, benefit from years profit expense used calculation next year Benefit from Recognise expense used this expense this year year, cash paid profit decreases next year Effect on statement of financial position No new asset or liability recognised Recognise a prepaid expense (asset) Recognise an accrued expense (liability) Cash and accrual: Income Effect on profit calculation Effect on the statement of financial position Cash received this Recognise income No new asset or year, service this year - profit liability recognised provided this year increases Cash received this No effect on this Recognise income year, service year’s profit received in provided next calculation advance (liability) year Service provided Recognise income Recognise an this year, cash this year - profit accrued income received next year increases (asset) In preparing the financial statements, the business will question whether the amounts in the pre-adjustment trial balance for Property, Plant and Equipment (PPE), Trade receivables and Inventory are the amounts that should be shown on the Statement of financial position. Let’s look at PPE • Why would a business purchase PPE? To generate benefit for the business by using the asset e.g Machinery; Vehicles • Does the business expect PPE to be used forever? No, the asset is expected to be used for a specified time or units after which it is disposed of • The TIME used OR amount of UNITS it can produce (i.e. Km driven by a vehicle) referred to as the estimated useful life Depreciation As the business is using the asset, how must it recognise the cost of using up the asset? ‘Depreciation is a systematic allocation of the depreciable amount of an asset over its estimated useful life’ • Residual value - estimated amount (less disposal costs) at which asset sold for at end of its estimated useful life. • It is only used to calculate depreciation Depreciable amount – amount of the cost of the asset allocated as an expense over the life of the asset. Cost – Residual value = Depreciable amount Depreciation • How do we calculate depreciation? • For each asset we need the following information: ‘Period’ of 1. 2. 3. 4. benefits • Time • Number of actions Cost Residual value Estimated useful life • Time – Method of SLM/DB depreciation • Number of actions Depreciation • Cost: R410 000 • Residual Value: R 50 000 • Estimated useful life: 3 years (R410 Straight line method 000 – R50 000) 3 = R120 000 Straight-line assumes that the benefits are used evenly Adjusting journal entry DR Depreciation expense CR 120 000 Accumulated depreciation: vehicle 120 000 Allocate one year’s depreciation Dr - Accumulated depreciation: vehicle Yrend Dr + Yr-end Depreciation expense Depreciation expense Accumulated depreciation: vehicle 120 000 + Cr 120 000 - Cr Accumulated depreciation • Do NOT credit asset account • Credit an account called accumulated depreciation • WHY - IAS 16: keep record of asset’s original cost or revalued amount in general ledger. • Purpose of accumulated depreciation account - reduce the carrying value of the asset i.e. vehicle, when reported on the statement on financial position. Depreciation R410 000 – R50 000/3 = R120 000 annual depreciation Dr - Accumulated depreciation: vehicle Yr-end 1 Yr-end 2 CA = 410 - 120 290 000 Purchased Yr-end 1 + Cr Depreciation expense Depreciation expense 120 000 Yr-end Depreciation 3 expense 120 000 CA = 410 - 240 170 000 Yr-end 2 120 000 CA = 410 - 360 50 000 Yr-end 3 Carrying amount (CA) = Cost – Accumulated depreciation Let’s look at Trade receivable • Businesses sell goods on credit • They expect to receive payment in the future, however, sometimes they do not receive part or all of the amount owed to them... Bad debts • Carrying value of trade receivables reported on the statement of financial position cannot be greater than the expected future economic benefits (i.e. the payments expected to be received from debtors). • On every reporting date, the trade receivables asset should be impaired by the amount the business expects will not be paid by the debtors in the future Bad debts • A debtor had gone insolvent. He owed R700 • The business is aware of the specific debtor who is unable to pay – The trade receivables account is decreased (i.e. credited). – The business recognizes an expense – bad debts Adjusting journal entry DR Bad debts expense CR 700 Trade Receivables 700 Write off the debt of a specific debtor Dr + Trade Receivables Cr Yrend Dr Yr-end Bad debts expense Bad debts expense Cr Trade Receivables 700 700 + Allowance for doubtful debts Debtors purchase goods on credit Year 1 Unlikely that ALL of these debtors will pay Year in which they pay (or are meant to pay) Year 2 Experience shows that it is more likely than not that a certain percentage of trade receivables owing at year-end will not be collected. The inflow of FEBs are not probable - This amount is recognised as an expense Allowance for doubtful debts • Based on past experience accountant reliably estimated business will NOT collect 2% of outstanding debtors at year end. Trade receivable balance = R15 000 The inflow of these FEB’s is not probable 2% of R15 000 = R300 Allowance for doubtful debts • Recognise the R300 as an expense • Which account will we CR??? • The business does not know which debtors will not pay – so we cannot CR trade receivables • CR Allowance for doubtful debts (-A) Adjusting journal entry DR Bad debts expense CR 300 Allowance for doubtful debts 300 Create an allowance for the 2% reliably estimated not to pay Dr - Allowance for doubtful debts Yrend Dr + Yr-end Bad debts expense Allowance for doubtful debts 300 + Bad debts expense Cr 300 - Cr Statement of financial position At what amount will Trade receivables appear on the SOFP??? Current Assets Trade Receivable R14 700 R15 000– R300 OR R15 000 x 98% the probable FEB’s Allowance for doubtful debts • The Trade receivable account is credited when the specific customer is known • The Allowance for doubtful debts account is credited when it is expected that some customers will not pay, but the specific customers have not been identified. Year 2 Year 1 Year 2 2% of trade receivable balance irrecoverable. Trade receivable R15 000 R15 000 x 2% = R300 Allowance for doubtful debts 2% of trade receivable balance irrecoverable. Trade receivable R18 000 R18 000 x 2% = R360 Already a balance of R300 Allowance for doubtful debts Balance Bad debts 300 300 Bad debts 60 Bad debts All for DD 300 P/L Bad debts 300 All for DD 60 P/L 60 Financial statements Year 1 SOFP Current assets Trade receivable SPLOCI Bad debts expense Year 2 14 700 300 R15 000 – 300 OR R15 000 x 98% - the probable FEB’s SOFP Current assets Trade receivable 17 640 SPLOCI Bad debts expense 60 R18 000 – 360 OR R18 000 x 98% - the probable FEB’s Reversing adjusting entries • When and how does an adjusting entry processed in one financial period affect the following financial period • When new asset/liability accounts created i.e. prepaid expense • The benefit inherent in this account is used up in the following period • The obligation inherent in the new liabilities i.e. accrued expense is settled in the following period Reversals of adjustments • When we made adjustments relating to incomes and expenses (prepaid expenses, accrued expenses, income received in advance and accrued income), we created new asset and liability accounts • These accounts can be reversed at the start of the next financial period Reversals: Prepaid expense Year 1 Process adjustments New Asset and Liability accounts created Close off income and expense accounts Year 2 This asset account is still in the books at the start of year 2. By the end of the year the benefit will be consumed i.e. expensed Prepaid electricity (A) Prepaid electricity (A) 31/12 Electricity expense 200 31/12 Electricity 1/1 Electricity expense 200 expense 200 Electricity expense 1/1 Prepaid electricity 200 Reversal entry Reversals: Accrued expense Year 1 Used R500 Electricity expense – still not paid for Year 2 When R500 paid in year 2 DR electricity account. This is cancelled by the CR (reversal) Accrued electricity (L) 31/12 Electricity expense 500 Accrued electricity (L) 1/1 Electricity expense 500 31/12 Electricity expense 500 Electricity expense Reversal entry 1/1 Accrued electricity 500 Reversals: Accrued income Year 1 Earned R25 for interest –not yet received Accrued interest income (A) 31/12 Interest income 25 Year 2 When R25 received in year 2 CR interest income. This is cancelled by the DR (reversal) Accrued interest income (A) 31/12 Interest income 25 1/1 Interest income 25 Interest income 1/1 Accrued interest income 25 Reversal entry Reversals: Income received in advance Year 2 Year 1 Received R120 – not yet earned The business will earn R120 by supplying the goods – no further cash will be received Income received in advance (L) 31/12 Sales 120 Income received in advance (L) 1/1 Sales 120 31/12 Sales 120 Sales Reversal entry 1/1 Inc Rec in advance 120