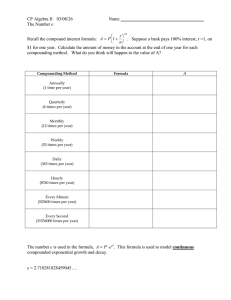

TERM PAPER Question # 1 (i): What functions finance manager performs to maximize the wealth of shareholders? Answer: Introduction: A finance manager is one of the most important persons in an organization. He looks after all the financing activities of an organization with a clear goal in his mind. His main aim is to maximize the wealth of the shareholders. Functions of a Financial Manager: There are various functions of a financial manager. Some of these functions are as following: Procurement of Funds: The first and foremost responsibility of a finance manager is to procure funds for business activities. He might have to negotiate with some creditors or financial institutions for this purpose. Acquisition of Assets: Another important responsibility of the finance manager is to acquire assets which would be used in the business. He has to make the decisions whether the asset should be bought or leased keeping in mind the left side of the balance sheet. Asset Management: The job of a finance manager doesn’t simply end after acquiring the asset. He has to maintain that asset efficiently and get the maximum output from it. Allocation of Funds: The finance manager has to make decisions regarding funds allocation. He decides whether dividend should be given or not. If yes, how much dividend should be given and how much funds should be kept in the retained earnings. Maximizing Earning per Share: The goal of a finance manager should be maximizing the earning per share of the shareholders. He must consider all other options before issuing more shares. Risk Consideration: Before undertaking any task or project, a finance manager must consider the amount of risk in it. All his moves should be calculated. (ii) In general, what are the principles on which the Modified Accelerated Cost Recovery System (MACRS) is based? Answer: MACRS: The Modified Accelerated Cost Recover System or MACRS is an accelerated depreciation method which is used for the tax purposes. The Tax Reform Act, 1986 allows companies to use this method. It has eight property classes under which a prescribed life or cost recovery period is determined. General Principles: The general principles on which MACRS is based upon are as following: The double declining or 200% declining balance method is used for the 3-, 5-, 7- and 10years property class. For the remaining undepreciated book value in the first year, this method then switches to straight line depreciation method if it yields an equivalent or more prominent deduction than the double declining balance method. The 150% declining balance method is used for the assets in the 15- and 20- year classes. At optimal time, it again switches to the straight-line method. Question # 2: Define Time Value of Money. Explain the concepts of compounding and discounting of different streams of cash flows with hypothetical data. (Explanations must include time line, formula and solution of formula with annual compounding as well as compounding more than once in a year) Answer: Time Value of Money: Time Value of Money is one of the core concepts of Financial Management. It tells us about the value of a certain amount at a certain point of time. This concept includes the interest that we earn along the way. The value of an amount changes as time passes and interest is added to it. For example, the value of $100 was different 10 years ago from the value of $100 today. The interest can be either simple or compound. Simple interest is paid on the original amount whereas Compound interest is paid on the principle amount as well as the any interest earned before. Hence, we can say that the concept of Time Value of Money is that the money which we have now will have a different worth at another time. Compounding: As explained in TVM, the money which is now in our possession will have a different worth in future. Finding the future value of money which has changed due to interest on original amount as well as accumulated interest is called Compounding. Following is the procedure to carry out compounding in different streams: Discounting: Discounting is opposite to Compounding. In compounding, we determine the future value of an amount whereas in Discounting, we work out the present value of a future amount. The concept of discounting tells us what will be the present value of a sum we have to receive in the future. It helps us to place all cash flows on currenting footings to help us make comparison. Different streams of cash flow: There is a total of 3 streams of cash flows which are: Single Stream Annuities Mixed Flow Single Stream: Cash inflow or outflow that only takes place one time in a single stream. Compounding of single stream: Compounding in a single stream tells us what will be the value of a certain amount in future which we are depositing now. Formula: FVn = P0 (FVIFi, n) where, FVIFi, n = (1 + i) n Example: Mr. X wishes to know what will be the value of his deposit of $15000 at a compound annual interest rate of 9% after 4 years. Solution and Timeline: 0 1 2 3 4 9% $15000 FV4 Po = $15000 i = 9% n = 4 years FVn = Po (FVIFi, n) FVIFi, n = (1 + i) n FVIFi, n = (1 + 0.09)4 FVIFi, n = (1.09)4 FVIFi, n = 1.4116 FVn = 15000(1.4116) FVn = 21173.72 The value of Mr. X’s deposit after 4 years would be $21173.72. Discounting of single stream: Discounting in a single stream tells us the amount which we should deposit in order to get a certain some after some time. Formula: PV0 = FVn (PVIFi, n) where PVIFi, n = 1 / (1 + i) n Example: A wants to know how much of a deposit to make so that the money will grow to $11,000 at a discount rate of 10% in 3 years. Solution and Timeline: 0 1 2 3 10% $11000 PV0 FVn = $11000 i = 10% n = 3 years PV0 = FVn (PVIFi, n) PVIFi, n = 1 / (1 + i) n PVIFi, n = 1 / (1 + 0.10)3 PVIFi, n = 1 / 1.331 PVIFi, n = 0.7513 PV0 = 11000 (0.7513) PV0 = 8264.46 A should deposit $8264.46 for the money to grow to $11000 after 3 years. Annuities: Series of payments that takes place after a regular interval and the amount of cash is also equal is called Annuity. There are two types of annuities: Ordinary Annuity: An ordinary annuity is a type of annuity in which the payments take place at the end of the period. Compounding of Ordinary Annuity: By compounding an ordinary annuity, we work out the amount we will receive at the end of the periods. Formula: FVAn = R(1+i) n-1 + R(1+i) n-2 +... + R(1+i)1 + R(1+i)0 Another formula through which we can find out Ordinary Annuity is: FVAn = R (FVIFAi, n) where FVIFAi, n = [(1 + i) n – 1]/i Example: Suppose a person deposits $2000 in a savings account for 4 years at an annual interest rate of 11%. What amount will he have at the end of the year? Solution and Timeline: 0 1 2 3 $2000 $2000 $2000 4 11% $2000 $2220 $2464.2 $2735.262 $9419.462 FVA4 = R(1+i) n-1 + R(1+i) n-2 + R(1+i)n-3 + R(1+i)n-4 FVA4 = $2000 (1 + 0.11)4-1 + $2000 (1 + 0.11)4-2 + $2000 (1 + 0.11)4-3 + $2000 (1 + 0.11)4-4 FVA4 = $2000 (1.11)3 + 2000(1.11)2 + 2000(1.11)1 + 2000(1.11)0 FVA4 = $2000 (1.367631) + $2000 (1.2321) + $2000 (1.11) + 2000 FVA4 = $2735.262 + $2464.2 + $2220 + $2000 FVA4 = $9419.462 Similarly, using other formula: R = $2000 i = 11% n = 4 years FVAn = R (FVIFAi, n) FVIFA11%, 4 = [(1 + i) n – 1]/i FVIFA11%, 4 = [(1 + 0.11)4 – 1]/0.11 FVIFA11%, 4 = [(1.11)4 – 1]/0.11 FVIFA11%, 4 = (1.5181 – 1)/0.11 FVIFA11%, 4 = 0.5181/0.11 FVIFA11%, 4 = 4.7097 FVA4 = R (4.7097) FVA4 = $2000 (4.7097) FVA4 = $9419.462 Discounting of Ordinary Annuity: Discounting of an Ordinary Annuity tells us the amount which we should deposit now in order to withdraw certain equal amounts after equal intervals until a specific period. Formula: PVAn = R/(1+i)1 + R/(1+i)2 + ... + R/(1+i) n Another formula through which we can use is: PVAn = R (PVIFAi, n) where PVIFAi, n = [1 – 1/(1 + i)n /i] Example: Suppose a person wants to withdraw $1500 for 3 years at an annual interest rate of 7%. What amount should he deposit at present in order to make the above transactions? Solution and Timeline: 0 1 2 $1500 $1500 3 7% $1500 $1401.87 $1310.16 $1224.45 $3936.48 PVA3 = R/(1+i)1 + R/(1+i)2 + R/(1+i)3 PVA3 = $1500/(1 + 0.07)1 + $1500/(1 + 0.07)2 + $1500/(1 + 0.07)3 PVA3 = $1500/(1.07)1 + $1500/(1.07)2 + $1500/(1.07)3 PVA3 = 1401.87 + 1310.16 + 1224.45 PVA3 = $3936.48 Similarly, using other formula: R = $1500 i = 7% n = 3 years PVAn = R (PVIFAi, n) PVIFAi, n = [1 – 1/(1 + i)n /i] PVIFA7%, 3 = [1 – 1/(1 + 0.07)3 /0.07] PVIFA7%, 3 = [1 – 1/(1.07)3 /0.07] PVIFA7%, 3 = [1 – 1/1.225043 /0.07] PVIFA7%, 3 = [1 – 0.8163 /0.07] PVIFA7%, 3 = [0.1837 /0.07] PVIFA7%, 3 = 2.6243 PVA3 = $1500 (2.6243) PVA3 = 3936.45 Annuity Due: An annuity due is the second type of annuity in which the payments take place at the beginning of the period. Compounding of Annuity Due: The future value of an annuity due is simply equal to the future value of a comparable ordinary annuity compounded for one more period. FVADn = FVAn (1+i) Formula: FVADn = R(1+i)n + R(1+i)n-1 + ... + R(1+i)2 + R(1+i)1 Another formula to find Annuity Due is: FVADn = R (FVIFADi, n) where FVIFADi, n = [(1 + i)n – 1/i] x (1 + i) Example: Find the compounded value of annuity due for a period of 4 years where R = $2500 and i = 8%. Solution and Timeline: 0 1 2 3 4 $2500 $2500 $2500 $2700 8% $2500 $2916 $3149.28 $3401.22 $12166.5 FVAD4 = R(1+i)4 + R(1+i)4-1 + R(1+i)4-2 + R(1+i)4-3 FVAD4 = 2500 (1+0.08)4 + 2500 (1+0.08)4-1 + 2500 (1+0.08)4-2 + 2500 (1+0.08)4-3 FVAD4 = 2500 (1.08)4 + 2500 (1.08)3 + 2500 (1.08)2 + 2500 (1.08)1 FVAD4 = 3401.22 + 3149.28 + 2916 + 2700 FVAD4 = 12166.5 Similarly, using other formula: R = 2500 i = 8% n = 4 years FVADn = R (FVIFADi, n) FVIFADi, n = [(1 + i)n – 1/i] x (1 + i) FVIFAD8%, 4 = [(1 + 0.08)4 – 1/0.08] x (1 + 0.08) FVIFAD8%, 4 = (0.3605/0.08) x (1.08) FVIFAD8%, 4 = 4.8667 FVAD4 = 2500 (4.8667) FVAD4 = 12166.5 Discounting of Annuity Due: Discounting of an annuity due is the reverse process of compounding of an annuity due. We can think of the present value of annuity due as the present value of ordinary annuity that had been brough back one period too far. PVADn = PVAn (1+i) Formula: PVADn = R/(1+i)0 + R/(1+i)1 + ... + R/(1+i)n-1 Another formula to work out the value of annuity due is: PVADn = R (PVIFADi, n) where PVIFADi, n = [1 – 1/(1 + i)n /i] x (1 + i) Example: Calculate the present value of annuity due for a period of 5 years with an annual interest rate 6% and receipt of $1000. Solution and Timeline: 0 1 2 3 4 $1000 $1000 $1000 $1000 5 6% $1000 $943.40 $890 $839.62 $792.09 $4465.1 PVAD5 = R/(1+i)0 + R/(1+i)1 + R/(1+i)2 + R/(1+i)3 + R/(1+i)4 PVAD5 = 1000/(1+0.06)0 + 1000/(1+0.06)1 + 1000/(1+0.06)2 + 1000/(1+0.06)3 + 1000/(1+0.06)4 PVAD5 = 1000/(1.06)0 + 1000/(1.06)1 + 1000/(1.06)2 + 1000/(1.06)3 + 1000/(1.06)4 PVAD5 = 1000 + 943.40 + 890 + 839.62 + 792.09 PVAD5 = 4465.1 Similarly, using other formula: R = 1000 i = 6% n = 5 years PVADn = R (PVIFADi, n) PVIFADi, n = [1 – 1/(1 + i)n /i] x (1 + i) PVIFAD6%, 5 = [1 – 1/(1 + 0.06)5 /0.06] x (1 + 0.06) PVIFAD6%, 5 = [1 – 1/(1.06)5 /0.06] x (1.06) PVIFAD6%, 5 = [0.252741827/0.06) x (1.06) PVIFAD6%, 5 = 4.4651 PVAD5 = 1000 (4.4651) PVAD5 = 4465.1 Perpetuity: If the payments or receipts for an ordinary annuity continue forever, it is known as perpetuity. Formula: PVA∞ = R/I Example: Suppose you receive $1200 every year for an annual interest rate of 10%. Find perpetuity. Solution: R = $1200 I = 10% PVA∞ = R/I PVA∞ = 1200/0.10 PVA∞ = $12000 Mixed Flows: Mixed flow consists of uneven cash flows. It means that there is neither a single flow nor a single annuity but multiple of them. There are two ways to solve a mixed cash flow: Piece-at-a-time Group-at-a-time Example: Find the present value of $3000 to be received annually at the end first two years, followed by $4000 annually at the year 3rd and 4th year and concluding $1500 at the end of 5th, all discounted at 7%. Solution and Timeline: 0 1 2 3 4 5 $3000 $4000 $4000 $1500 7% $3000 $2803.8 $2620.2 $3265.2 $3051.6 $1069.5 $12810.3 Solving piece-at-a-time: PV0 = FV0 (PVIFi, n) PVIFi, n = 1 / (1 + i) n PV0 = FV1 (PVIF7%, 1) PV0 = FV2 (PVIF7%, 2) PV0 = FV3 (PVIF7%, 3) PV0 = FV4 (PVIF7%, 4) PV0 = FV5 (PVIF7%, 5) PV0 = $3000(0.9346) = $2803.8 PV0 = $3000(0.8734) = $2620.2 PV0 = $4000(0.8163) = $3265.2 PV0 = $4000(0.7629) = $3051.6 PV0 = $1500(0.7130) = $1069.5 PV0 of Mixed Cash Flows = $12810.3 Solving group-at-a-time: The pattern of the flows in the above timeline is equal to: $4000 $4000 $4000 $4000 minus $1000 $1000 plus $1500 PV0 = FV4 (PVIFA7%, 4) PV0 = 4000 (3.387255429) PV0 = $13549.02 minus PV0 = FV2 (PVIFA7%, 2) PV0 = 1000 (1.808018171) PV0 = $1808.01 plus PV0 = FV5 (PVIF7%, 5) PV0 = 1500 (0.712986179) PV0 = $1069.48 PV0 of Mixed Cash Flows = $12810.4 Compounding More Than Once a Year: Compounding can be carried out more than once a year. Interest can be paid on a deposit more than one time. The general formula of compounding is: FVn = PV0(1 + [i/m])mn where, n = Number of years m = Compounding periods per year i = Annual interest rate FVn,m = FV at the end of year n PV0 = PV of the Cash flow today Compounding more than once a year can be of many times. Some are: Semiannual Compounding: Compounding which takes place twice every year is called Semiannual compounding. Example: Mr. Z has deposited $10000 at an annual interest rate of 7%. Find the future value after one year using Semiannual compounding. Solution: PV0 = $10000 FV1 = $10000[1+ (.07/2)](2)(1) FV1 = $10000 x (1.035)2 = $10712.25 Quarterly Compounding: Compounding which take place four times every year is called quarterly compounding. Example: A person deposited $1000 at an annual interest rate of 5%. Assume quarterly compounding and find FV after one year. Solution: PV0 = $1000 FV1 = $1000(1+ [.05/4])(4)(1) FV1 = $1000(1.0509) = $1050.95 Monthly Compounding: Compounding which takes place every month of the year is called monthly compounding. Example: A deposits $2500 in his savings at an annual interest rate of 9%. Find future value using monthly compounding after one year. Solution: PV0 = $2500 FV1 = $2500(1+ [.09/12])(12)(1) FV1 = $2500(1.0938) = $2734.52 Daily Compounding: Compounding which is done for every day of the year is called daily compounding. Example: Find out the future value for a deposit of $5000 at an annual interest rate of 11% for one year using daily compounding. Solution: PV0 = $5000 FV1 = $5000(1+[.11/365])(365)(1) FV1 = $5000(1.0003) = $5001.51 Question # 3 Explain valuation of different types of Bonds considering their maturities and interest rates. (e.g., perpetual Bond, Coupon and Zero Coupon Bond with annual and semi-annual coupon rate) Answer: Introduction: A bond is a long-term debt instrument. It is issued by a government or an organization. This instrument represents the bond issuer’s obligation to pay to the person who holds the bond. A bond has a face value which the issuer is liable to pay to the holder at the maturity of the bond. This time at which the issuer will have to pay the holder of the bond is called maturity. The terms of the bond decide whether the issuer will pay coupon to its holder period after period or not. Usually in the United States of America, most bonds have a face value of $1000. Valuation of Bonds: This procedure is carried out to determine a fair price of a specific bond. There are some values which come in to play to valuate a given bond. These are: Maturity Value: It is the face price of the bond which the issuer must pay to the holder at the maturity of the bond. Coupon Rate: It is the interest rate which will be paid by the issuer to the holder. Capitalization Rate: This rate depends on the risk structure of the bond. It is also known as discount rate. Techniques for valuation of bonds: Bonds are further divided into different categories depending upon various factors. These types are: Perpetual Bonds: A perpetual bond is a type of infinite bond. This type of bond never matures. The holder keeps getting paid the decided coupon period after period. It is also called a consol. Formula: V = I/(1 + kd)1 + I/(1 + kd)2 + … + I/(1 + kd)∞ V = ∑ I/ (1 + kd)t V = I (PVIFAkd, ∞) In simple form, V = I / kd Example: A bond has a maturity value of $5000 and provides its holder $250 forever. The rate of return is 11%. Find its value. Solution: I = $250 Kd = 11% V = I / kd V = 250 / 0.11 V = 2272.73 Zero-Coupon Bond: A Zero-coupon bond is a type of finite bond which sells at a deep discount from its maturity value. This kind of bond pays no interest to its holder. Formula: V = MV / (1 + kd)n V = MV (PVIFkd, n) Example: Bond X has a $1500 maturity value and a 7 years life. The discount rate is 10%. What is the value of the zero-coupon bond? Solution: MV = $1500 n = 7 years kd = 10% PVIFkd, n = 1 / (1 + kd)n PVIF10%, 7 = 1 / (1 + 0.10)7 PVIF10%, 7 = 1 / 1.9487171 PVIF10%, 7 = 0.5132 V = MV (PVIF10%, 7) V = 1500 (0.5132) V = 769.8 Nonzero Coupon Bond: It is a kind of finite bond in which coupon is paid to the bondholder by the issuer. Formula: V = I / (1 + kd)1 + I / (1 + kd)2 + … + I + MV / (1 + kd)n V = ∑ I / (1 + kd)t + MV / (1 + kd)n V = I (PVIFA kd, n) + MV (PVIF kd, n) Example: Find the value of a coupon bond if the Bond has a face value of $2500 and gives an annual coupon 9% for 6 years. Kd is 12%. Solution: MV = $2500 Kd = 12% n = 6 years V = I (PVIFA kd, n) + MV (PVIF kd, n) PVIFAkd, n = [1 – 1/ (1 + kd)n / kd] PVIFA12%, 6 = [1 – 1/ (1 + 0.12)6 / 0.12] PVIFA12%, 6 = [1 – 1/ (1.12)6 / 0.12) PVIFA12%, 6 = 4.11 PVIFkd, n = 1 / (1 + kd)n PVIF12%, 6 = 1 / (1.12)6 PVIF12%, 6 = 0.5066 V = I (PVIFA kd, n) + MV (PVIF kd, n) V = 225 (4.11) + 2500 (0.5066) V = 924.75 + 1266.5 V = 2191.25 Semiannual Coupon Rate: Interest is paid twice a year on most bonds. Slight adjustments are needed in compounding of these bonds. The adjustments required are: o Multiply n by 2 o Divide Kd by 2 o Divide I by 2 Formula for Compounding of Nonzero Coupon Bond: V = I/2 (PVIFAkd /2 ,2n) + MV (PVIFkd /2 ,2n) Example: A bond with a maturity value of $1000 gives a 12% annual coupon for 10 years with semiannual compounding. The annual discount rate is 8%. Find its value. Solution: MV = $1000 Kd = 8% n = 10 years V = I/2 (PVIFA8%/2 ,2*10) + MV (PVIF8%/2 ,2*10) V = I/2 (PVIFA4%,20) + MV (PVIF4% ,20) PVIFAkd, n = [1 – 1/ (1 + kd)n / kd] PVIFA4%, 20 = [1 – 1/ (1 + 0.04)20 / 0.04] PVIFA4%, 20 = [1 – 1/ (1.04)20 / 0.04] PVIFA4%, 20 = (1 - 0.456386 / 0.04) PVIFA4%, 20 = 13.5903 PVIFkd, n = 1 / (1 + kd)n PVIF4%, 20 = 1 / (1 + 0.04)20 PVIFkd, n = 1 / 2.191123143 PVIFkd, n = 0.456386 V = 120 (13.5903) + 1000 (0.456386) V = 1630.836 + 456.386 V = 2087.22 Question # 4: Explain valuation of Common Stock considering different dividend policies (e.g., zero growth, constant growth and growth phases) Answer: Common Stock: Common stocks are securities that show a proprietorship in an organization. They entitle their holders to get dividends. The amount of the dividend may fluctuate depending upon the fortunes of the company. The holders of the common stock can claim a share in the company’s profit. They have the authority to select the Board of Directors and can also take part in the elections. The holders are also responsible for devising the strategies of the company. Common stocks usually yield higher rate of returns as compared to bonds or preferred stocks. Valuation of Common Stock: Valuation of Common Stock is not much different than the valuation of other securites. It is a procedure through which we can determine the theoretical value of a stock. The value of a share of common stock can be regarded as the discounted value of all the expected cash dividends which will be paid by the firm until period is over. It can be represented as: V = D1 / (1 + ke)1 + D2 / (1 + ke)2 + … + D∞ / (1 + ke)∞ V = ∑ Dt / (1 + ke)t The process for the valuation of common stock is briefly explained as following: Dividend Discount Model (DDM): The Dividend Discount Model or DDM is a quantitative technique which is designed in order to compute the intrinsic value of a share of a common stock. This model is based on specific assumptions such as the anticipated growth pattern of the future dividends and the discount rate. It is based on the hypothesis that its current day value is the same as the value of all of its future dividends discounted back to its present value. There are a total of three such models which are: Constant Growth Model: In constant growth model, we suppose that the dividends will grow every year at a constant rate g. Formula: V = D0 (1 + g) / (1 + ke)1 + D0 (1 + g)2 / (1 + ke)2 + … + D0 (1 + g)∞ / (1 + ke)∞ In reduced form, V = D1 / (ke – g) Example: Find the value of ABC Company’s Common Stock if it has an expected dividend growth rate of 8%. Dividend per share is expected to $5 i.e. D1. The appropriate discount rate is 10%. Solution: D1 = $5 ke = 10% = 0.10 g = 8% = 0.08 V = D1 / (ke – g) V = 5 / (0.10 – 0.08) V = 5 / (0.02 V = $250 No Growth: In the No growth model, we assume that the value of g for dividends will forever be equal to zero. Formula: VZG = D1 / (1 + ke)1 + D2 / (1 + ke)2 + … + D∞ / (1 + ke)∞ In reduced form, VZG = D1 / ke Example: A stock has an expected growth rate of 0%. Each share of stock received an annual $3 dividend per share whereas ke is equal to 11%. Calculate the value of the common stock? Solution: D1 = $3 ke = 11% VZG = D1 / ke VZG = 3 / 0.11 VZG = $27.272 Growth Phases: Our assumption in the growth phases model is that dividends will grow at two or more different rates for each share. Formula: V = ∑ D0 (1 + g1)t / (1 + ke)t + ∑ Dn(1+g2)t / (1 + ke)t For the second phase of this model, the dividends will grow at a constant rate g2. For this, the formula can be rewritten as: V = ∑ D0 (1 + g1)t / (1 + ke)t + [1 / (1 + ke)n] [Dn+1 / ke – g2] Example: Stock XYZ has an expected growth rate of 7% for the first 3 years and 4% thereafter. Each share of stock just received an annual $3 dividend per share. The discount rate is 10%. Find the value of common stock in this case. Solution: Year Dividend PVIF10%,t 1 3(1.07)1 3.21 0.9091 PV of Dividend 2.92 2 3(1.07)2 3.4347 0.8264 2.84 3 3(1.07)3 3.6751 0.7513 2.76 8.52 4 3.6751 3.9324 D4 = 3.9324 V at the end of year 3 = 3.9324/(.10 - .04) V at the end of year 3 = $65.54 PV of $65.54 at end of year 3 = $65.54 x (PVIF10%, 3) PV of $65.54 at end of year 3 = $65.54 x 0.7513 PV of $65.54 at end of year 3 = $49.24 Now, putting in formula, V = ∑ D0 (1 + g1)t / (1 + ke)t + [1 / (1 + ke)n] [Dn+1 / ke – g2] V = ∑ D0 (1 + 0.07)t / (1 + 0.10)t + [1 / (1 + 0.10)n] [Dn+1 / 0.10 – 0.04] V = $8.52 + $49.24 V = $57.76 Question # 5: Measure Risk and Return using probability distribution of an individual security and portfolio of two security. (use hypothetical data for measurement) Answer: Risk: Risk can be defined as a probability that an outcome or return might be different from what is expected. Return: Any gain which a person receives from any investment can be called as return. That return can be availed from two sources: o Income o Price Appreciation One period return for common stock can be defined as: R = Dt + (Pt-Pt-1) / Pt-1 Measuring Risk of a Single Security through Probability Distribution: Probability distribution can be defined as a set of possible values that an arbitrary variable can assume and their related probabilities of occurrence. The risk can be calculated using two values of the probability distribution. These values are: Expected Return: Expected return can defined as the yield which a security holder expects to earn from a funding having known rates of return. Formula: R̅ = ∑ (Ri) (Pi) where, R = Expected return for the asset Ri = Return for the ith possibility Pi = Probability of that return occurring n = Total number of possibilities Standard Deviation: A quantitative measure of the variability of a group around its middle value. It is also the square root of Variance. Formula: σ = √ ∑ (Ri - R)2(Pi) Calculation of Expected Return and Standard Deviation: Possible Return Probability of Expected (Ri) Occurrence (Pi) Return(R) (Ri)(Pi) Variance (σ2) (Ri – R)2(Pi) 0.10 0.04 0.004 0.000369 0.15 0.06 0.009 0.001193 0.20 0.08 0.016 0.002708 0.25 0.10 0.025 0.005063 ∑ = 0.054 ∑ = 0.00933 = σ2 σ = 0.0966 For the above table, the expected return is equal to 5 percent whereas its standard deviation is 9.66 percent. Co-efficient of Variation: Standard deviation can sometimes be misguiding for the comparison if certain alternatives are different in size. Due to this, Coefficient of Variation is sometimes used. Consider two investments X and Y: Investment A Investment A Expected Return 0.05 0.45 Standard 0.03 0.15 Deviation Co-efficient of 0.6 0.33 Variation Portfolio Analysis: A portfolio is a mix of two or more securities or assets. The anticipated return of a portfolio is solely a weighted average of the expected returns of the securities which make up the portfolio. Portfolio Expected Return: The general formula for the expected return of a portfolio is: Rp = ∑ WjRj Here, RP = Expected return for the portfolio Wj = Weight for the jth asset in the portfolio Rj = Expected return of the jth asset Portfolio Standard Deviation: The general formula for the standard deviation of a portfolio is: σp = √ ∑ ∑Wj Wk σ jk In this formula, Wj = Weight for the jth asset in the portfolio, Wk = Weight for the kth asset in the portfolio, σsk = Covariance between returns for the jth and kth assets in the portfolio Calculation of Expected Return and Standard Deviation by Portfolio Analysis: Suppose there are two stocks, Stock X and Stock Y. Identical amounts are invested in both stocks. The expected returns of Stock X and Stock Y are 12% and 20% respectively. Their standard deviations are 11% and 13% respectively. The correlation coefficient between them is 0.30. We have to work out expected return and standard deviation. W1 = 0.25 W2 = 0.25 RP = (W1) (R1) + (W2) (R2) RP = (0.25) (12%) + (0.25) (20%) RP = (3%) + (5%) Expected Return = RP = 8% Row 1 Row 2 Column 1 W1W1 r σ 1, 1 W2W1 r σ 2, 1 Column 2 W1W2 r σ1, 2 W2W2 r σ 2, 2 This shows the variance-covariance matrix for the two-asset portfolio. Row 1 Row 2 Row 1 Row 2 Column 1 (0.25)(0.25)(1)(0.11)(0.11) (0.25)(0.25)(0.30)(0.13)(0.11) Column 1 0.00076 0.00027 Column 2 (0.25)(0.25)(0.30)(0.11)(0.13) (0.25)(0.25)(1)(0.13)(0.13) Column 2 0.00027 0.00106 σp = √ ∑ ∑Wj Wk σ jk σp = √ 0.00076 + 0.00027 + 0.0027 + 0.0106 σp = √ 0.0119 σp = 0.1091 σp = 10.91% Summary of Portfolio Analysis: Return S.D C.V Stock 1 Stock 2 Portfolio 12% 10% 8% 11% 13% 10.91% 0.92 1.3 1.3638 Using all these various techniques, the risk and return can be calculated in order to make the best decision regarding where to invest.