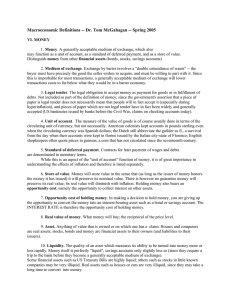

Required reading: Ch 13,14 Lecture 17: Money and Banking Econ 201, Autumn 2022 1 11/22/22 Money and Banking } } } } Monetary policy is shifting AD around by manipulating the money supply We need to understand the role money plays in aggregate demand and aggregate expenditure Need to understand the role banks play Need to understand the Federal Reserve The Meaning of Money } Money is any asset that can easily be used to purchase goods and services } By definition, it is the most liquid asset } } } Liquidity is how easily as asset can be turned into cash without loss of value. Checking account: very liquid. A home: not very liquid The Meaning of Money } Currency in circulation is cash held by the public. } Currency sitting in bank vaults don’t count! } Checkable bank deposits are bank accounts on which people can write checks. } The money supply is the total value of financial assets in the economy that are considered money – that is, that can easily be used to purchase goods and services. The Meaning of Money } What is money for? } We’ve talked about ‘sales’ when defining GDP Money was needed to make all those sales } } } } A bunch of things. Every dollar of goods was purchased with money We somehow need 4 trillion dollars of money to buy all our GDP A medium of exchange is an asset that individuals acquire for the purpose of trading rather than for their own consumption. Roles of Money } People often hold cash as a way to save or insure themselves against risk. } A store of value is a means of holding purchasing power over time. } People compare prices using money } A unit of account is a measure used to set prices and make economic calculations. The Role of Money } Anything that is all three things } } } Medium of Exchange Store of Value Unit of Account } is money } Lots of things have been money! } } } Cigarettes in POW camps Gold coinage Little pieces of paper The Role of Banks } } } } } Banks transform liquid assets into illiquid assets Take in cash, send out loans Provide a place to store your cash, and provide funds to finance investment for firms. Banks profit by charge an interest rate on loans they make that is larger than the interest rate they pay out to people who deposited cash with them. Perform an information-processing role; instead of lending out your money yourself, they find firms and do it for you. The Monetary Role of Banks } A bank is a financial intermediary that uses liquid assets in the form of bank deposits to finance the illiquid investments of borrowers. } Now we’re learning how the market for loanable funds actually works } A T-account is a tool for analyzing a business’s financial position by showing, in a single table, the business’s assets (on the left) and liabilities (on the right). } Bank reserves are the currency banks hold in their vaults plus their deposits at the Federal Reserve. } The reserve ratio is the fraction of bank deposits that a bank holds as reserves. Assets and Liabilities of First Street Bank A T-account summarizes a bank’s financial position. The bank’s assets, $900,000 in outstanding loans to borrowers and reserves of $100,000, are entered on the left side. Its liabilities, $1,000,000 in bank deposits held for depositors, are entered on the right side. Banks and the Money Supply } } Some checking accounts come from depositing cash in a bank. But others are created out of thin air by the banks when they make a loan } When bank makes a loan, it creates a checkable deposit for the firm receiving it } Now there is new money in the system that didn’t exist before! Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Initial effect before bank makes new loans: Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:900 1,000 Reserves:100 Reserves: 900 Deposits: 900 Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:900 1,000 Reserves:100 Loans: 810 Reserves:90 Deposits: 900 Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:900 1,000 Reserves:100 Loans: 810 900 Reserves:90 Reserves:810 Deposits: 810 Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:900 1,000 Reserves:100 Loans: 810 900 Reserves:90 Loans:729 Reserves: 81 Deposits: 810 Reserves, Bank Deposits, and the Money Multiplier } Excess reserves are bank reserves over and above the bank’s required reserves. } The bank wants to lend these out. Lending out excess reserves is how the bank makes money. Increase in bank deposits from $1,000 in excess reserves = $1,000 + ($1,000 × (1 − rr)) + ($1,000 × (1 − rr)2) + ($1,000 × (1 − rr)3) + . . . This can be simplified to: Increase in bank deposits from $1,000 in excess reserves = $1,000/rr } A Multiplier effect! } } } Firm gets a loan, spends money That money goes into someone else’s bank account Some of money gets lent out } } } } } The reserve ratio fraction gets kept Firms gets a loan, spends money … So 1 dollar in new excess reserves means (1/rr) dollars in new money That original dollar in cash means many dollars in new money The Money supply grows! Cash In Circulation Demand Deposits 100 0 0 100 0 100 100 100 I made a Deposit 90 100 10 190 0 190 100 190 Bank loaned out 90 The person who got the loan deposited it 81 190 19 271 The bank mad a loan Reserves Money Supply Action Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:800 1,000 Reserves:200 Reserves: 800 Deposits: 800 Determining the Money Supply Effect on the money supply of a deposit at First Street Bank Effect after bank makes new loans: Assets Liabilities Loans:800 1,000 Reserves:200 Loans: 640 Reserves:160 Deposits: 800 The Money Multiplier in Reality § The monetary base is the sum of currency in circulation and bank reserves. § The money multiplier is the ratio of the money supply to the monetary base. The Federal Reserve System § A central bank is an institution that oversees and regulates the banking system and controls the monetary base. § The Federal Reserve is a central bank—an institution that oversees and regulates the banking system, and controls the monetary base. § The Federal Reserve system consists of the Board of Governors in Washington, D.C., plus 12 regional Federal Reserve Banks. The Federal Reserve System } In charge of oversight and regulation of Banks Control the Monetary Base } Semi-autonomous } } } Local districts are confederations of private banks, elect local Fed Presidents Board of Governors in Washington } } Members of the Board of Governors serve a 14 year term Chairman of the Board of Governors serves a 4 year term The Federal Reserve System } The Fed makes policy decisions in the Federal Open Market Committee } } The Board of Governors + five of the Regional Presidents } } } FOMC The 5 Rotate Always includes New York President Current Chair: Jerome Powell The Federal Reserve System } Current Board of Governors } Jerome Powell, Chairman. Chair term ends 2026, membership ends 2028 } Lael Brainard, Vice Chair, term ends 2026 } Michael BArr, Vice Chair for supervision term ends 2032 } } } } } Lisa Cook Term ends 2024 Miki Bowman: Term ends 2034 Philip Jefferson, Term ends 2036 Chris Waller, Term Ends2030 Current Bank Presidents John C. Williams, Pres NY Susan Collins, Boston Loretta Mester, Cleveland Helen Mucciolo, 1st Pres NY James Bullard, St. Louis Charles Evans, Chicago Mary Daly, San Francisco Neel Kashkari, Minneapolis Raphael Bostic, Atlanta Lorie Logan, Dallas Esther George, Kansas City Thomas Barkin, Richmond Patrick Harker, Philadelphia The Federal Reserve System } } Created 1913 in response to a financial panic in 1907 No central bank at the time } } } No “Lender of Last Resort” JP Morgan took on that role during the crisis. Need for a permanent public institution to do it. The Fed has three major policy tools } } } The Reserve Requirement The Discount Rate Open Market Operations The Federal Reserve System } } } The FOMC meets every 5-8 weeks Decides the course of Monetary Policy, which open market operations to carry out The New York Fed executes the actual trades on the New York Markets } } } } That’s why they are always on the FOMC Banks used to be paired Now the rest are in groups of 3, besides Chicago and Cleveland, which are still paired. This might be changed, soon! Reserve Requirements and the Discount Rate § The federal funds market allows banks that fall short of the reserve requirement to borrow funds from banks with excess reserves. § Allows them to meet their overnight reserve requirements § The federal funds rate is the interest rate determined in the federal funds market. § Not under direct Fed Control, but § The discount rate is the rate of interest the Fed charges on loans to banks. § The Fed funds rate tracks this closely. Reserve Requirements and the Discount Rate } The discount rate is for borrowing directly from Fed } Historically, a bad sign for a bank to need the Fed’s money. } Historically, set to FFR + .01 } Set to FFR + .0025 curing crisis } } “Opening the Discount Window” Lower FFR and Discount Rate can encourage more lending by banks Open Market Operations by the Fed } Open Market Operations are simply the Fed buying and selling assets in the open market, like any other trader. } Typical Trade: Fed buys US treasury Bills, pays with cash Open Market Operations by the Fed } Why is it different when the Fed buys an asset, instead of a regular trader? } You buy, the person you buy from gets new cash in their account } } But your account has less money } } } Money Multiplier effect Money Multiplier effect in opposite direction They Cancel But when the Fed buys, they pay with brand new money that didn’t exist before! } Electronic Money, not cash, but is the same thing. Open-Market Operations Open-market operations by the Fed are the principal tool of monetary policy: the Fed can increase or reduce the monetary base by buying government debt from banks or selling government debt to banks. The Federal Reserve’s Assets and Liabilities: Open-Market Operations by the Federal Reserve An Open-Market Purchase of $100 Million Open-Market Operations by the Federal Reserve An Open-Market Sale of $100 Million Money Creation in Detail Action My Account 100 I Buy a 0 bond My Bank’s Reserves Trader’s Trader’s Account Banks Reserves Fed’s Assets Fed’s Liabilities 10 0 0 10 10 +100 =+10 + 90 10 10 10-100=-90 +100 Now, my bank must borrow to meet it’s reserve requirements, and the trader’s bank has 90 in excess reserves it can lend out. These cancel. Money Creation in Detail Action Fed Buys Bond My Account My Bank’s Reserves Trader’s Trader’s Account Banks Reserves Fed’s Assets Fed’s Liabilities 100 10 0 0 10 10 100 10 100 100 110 110 Now, my bank doesn’t have to do anything. The trader’s bank has 90 in excess reserves to lend out. The Money supply increased. Open-Market Operations by the Federal Reserve } When the Fed buys assets, it increases the money supply } } Pays with new money à new loans, increases M1 When the fed sells assets, it decreases the money supply } Takes in money, reducing lending, makes no new loans à decreases M1 Open Market Operations } What assets does the Fed Have? } } } Lots! Fed is largest holder of US Government Debt First built up assets during WWII } } Realized it was creating money almost accidentally Fed earns a lot of interest! } } Only profitable branch of government Returns extra income to Congress } } After it spends as much as it wants Another reason it is autonomous The Fed Balance Sheet 21-Jul-2015 21-Jul-2012 21-Jul-2009 21-Jul-2006 21-Jul-2003 21-Jul-2000 21-Jul-1997 21-Jul-1994 21-Jul-1991 21-Jul-1988 21-Jul-1985 21-Jul-1982 21-Jul-1979 21-Jul-1976 21-Jul-1973 21-Jul-1970 21-Jul-1967 21-Jul-1964 21-Jul-1961 21-Jul-1958 21-Jul-1955 21-Jul-1952 21-Jul-1949 21-Jul-1946 21-Jul-1943 21-Jul-1940 21-Jul-1937 21-Jul-1934 21-Jul-1931 21-Jul-1928 21-Jul-1925 21-Jul-1922 21-Jul-1919 21-Jul-1916 Fed Balance Sheet since 1916 as a share of GDP\GNP 0.3 0.25 0.2 0.15 0.1 0.05 0 Next Class: Money and the Federal Reserve 47 9/6/2011