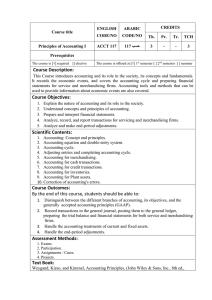

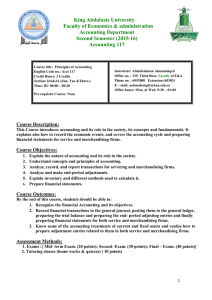

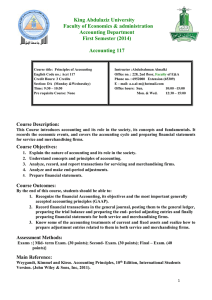

BACC 201 – Principles of Accounting I Basic Information Course Title: Code: Hours: Prerequisite: Academic Year/Level: Principles of Accounting I. BACC 201 Lecture: 3 Credit: 3 None. Year: 1 Term: 1 1-Course Description and Overall Objectives: This course introduces accounting in general, then covers the basics of financial accounting through the accounting cycle for service and merchandising business. The main objective of this course is to introduce the theoretical foundation of financial accounting (concepts, assumptions, and principles) and the financial statements of a profit seeking enterprise. The course prepares the student to be capable of performing the different steps of the accounting cycle for service and merchandising businesses. Course Objectives: Upon completion of this course, students should be able to: A. Introduce accounting in general. B. Identify the basics of financial accounting through the accounting cycle for service and merchandise business. C. Apply the theoretical foundation of financial accounting (concepts, assumptions, and principles) and the financial statements of a profit seeking enterprise. D. Perform the different steps of the accounting cycle for service and merchandising businesses. 2-Intended Learning Outcomes of the Course (ILOs): (A) Through knowledge and understanding, students will be able to: (K1) Identify the basis of measurement, presentation, and disclosure issues related to items presented in income statements and balance sheets (K2) Define journal and ledger. (K3) Specify the significance of alternative accounting procedures. (K4) List the appropriate theories, principles, and concepts relevant to financial accounting. (B) Through intellectual skills, students will be able to: (I1) Apply an appropriate judgment in selecting and presenting information using various methods relevant to financial accounting. (I2) Discuss a reasoned argument to the solution of familiar and unfamiliar problems relevant to financial accounting. (C) Through professional and practical skills, students will be able to: (P1) Develop practical activities using techniques and procedures appropriate to financial accounting. (P2) Display how to change within the external and internal accounting environment. (D) Through general and transferable skills, students will be able to: (G1) Articulate appropriate effective written and oral communication skills relevant to accounting. (G2) Demonstrate the ability to work effectively as part of a group, Involving leadership, group dynamics and interpersonal skills relevant to financial accounting. (G3) Show how to solve problems relevant to financial accounting using ideas and techniques some of which are at the forefront of the discipline. 3-Course Outline: Week Number 1: Accounting is the Language of Business Week Number 2: Who uses Accounting Data Week Number 3: The Recording Process Using Accounting Equation Week Number 4: The Recording Process Using the double entry system Week Number 5: The Financial Statements Week Number 6: The Income statement and the Balance sheet Week Number 7: First Assessment (Lecture will continue after the assessment) Week Number 8: Adjusting The Accounts Week Number 9: Completing the Accounting Cycle Week Number 10: The closing entries and Post-Closing Trial Balance Week Number 11: Summary of the Accounting Cycle Week Number 12: Second Assessment (Lecture will continue after the assessment) Week Number 13: Recording purchases & sales periodic /perpetual Systems Week Number 14: Accounting for merchandising operations Week Number 15: Purchase and sales returns, discount, and allowance Week Number 16: Final Examination 4-Teaching and Learning Methods: The course comprises a combination of lectures, and case discussions. Required facilities: Data Show. 5-Student Assessment Methods, Schedule and Grading: Assessment No. 1 2 3 Type First Assessment Second Assessment Final Examination Total Start Week No. Submit Week No. 1 8 7 12 16 Weight % 30 30 40 100 25% 6-List of References: (a) Course Notes: Weygandt, J., Kieso, D., and Kimmel, P., Accounting Principles, Wiley & Sons, Inc., 7th Edition, 2004. (b) Essential Books (Text Books): Needles, B., Powers, M., and Crosson, S., Financial and Managerial Accounting, Cengage Learning, 8th Edition, 2008. (c) Recommended Books: Wild, J., Larson, K., and Chiappetta, B., Fundamental Accounting Principles, McGraw-Hill Companies, Inc., 18th Edition, 2007. (d) General References: Emerald Database through iConnect.bau.edu.lb