p

MULTIPLE CHOICE

Principles

1. An excise tax on transfers inter-vivas

a. Donor's tax

c. Income .tax

b. Estate tax

d. VAT

2. An ex(;ise on ·transfers morfis causa

a. VAT

b. Estate tax

c. Income tax

d. Donor's tax

3. Which among the following statements is not correct? .

· I.

Estate taxation is governed by the statute in force at the time

of death of the decedent.

II.

Estate tax accrues as of the death of the decedent.

111.

Succession takes place and the right .of the State to tax the

privilege to transmit. the estate vests ·instantly upon death ..

a. I only

c. Ill only

b. 11 only

d. None of the above

4. Estate tax is a tax on the righ.t of the deceased person to transmit his

estate to his lawful heirs and beneficiaries. Hence, it is

I.

A tax on property.

II.

An excise tax

c. Both I and II

a. I only

d. Neither I nor II

b. II only

5. Estate tax is imposed upon the:

a. Decedent

b. Property or rights transferred

c. Right to transfer property upon death

d. Privilege to receive inheritance .

6. When

a.

b.

c.

d.

will the. transfer through succession be effective?

Upon the signing of a written will.

Upon payment of estate tax.

Upon death of the testator

Upon registration in th~ register of deeds.

71

I

cljt« £erciies .

• not

following 15

E&tce ~

a characteristic of donation rnortis

. ' ocable while donor is alive ·

7. Which of the

·s ,rrev

causa?

fer to the donee I f rtle or ownership to the don~

a. The tra_ns

nveyance o I

b There rs no co

h donor

·

. before the death of_t ethe fuli or naked ownership and COntroi

c The transferor ret~ms live

.

.

.

· of the property ~hrle a ~oid if the donor should survive the

d. The transfer should be ..

donee.

.1

c.

lnvestmer

business

alien.

d. Shares c

establish1

12. The rule of recip1

Non

to old age, death may b~ imminent.

8. Mr. Wais thought th~t edu; estate tax is high, he disposed his

Knowing that t~e ~au I h ·rs prior to his death (transfer in

properties . to hrs ngh~tfu To ~~event undue avoidance of tax, inter-

a.

b.

C.

d.

f

i~~~~~:~~i0~1ii~~~t~mplation of death is ~ub~~~1 ~x

a Donor's tax

Estate tax

c. nc .

d. ~xc1se tax

b:

1 3_ Intangible Pers,

Situs in the Phil

I.

The dee

a foreig '

an esta1

propert~

foreign

ti.

The lav

residen

exem·p1

intangil

Philippi

a. I only

b. II only

Classification of Taxpayers

9. The gross estate of a_decedent shall b~ compris_ed of the :ollow!ng

properties and interest therein at the time of his death, including

re·vocable transfers and transfers for insufficient consideration, etc.:

I.

Residents and citizens: All properties,· real or personal or

intangible, wherever situated.

II.

1.

Nonresident aliens: Only properties situated in the Philippines,

!hat, with respect to ·intangible personal property, its inclusion

m the gross estate is not subject to the rule of reciprocity

a. I only

c. Both I and 11

b. II only _

d. Neither I nor II

10. The personal property of a n

•d

would not be included. th on_-res1 ent, not citizen .of the Philippines,

.

rn e gross estate if;

~: i~! ;~:~~:~:: ~~~;naf i~'fPerty is i~ th_e Philippines.

·

clause of the estate t : 1 n th e _Phrlrpprnes anc;j the reciprocity

c. The t

'bl

aw applies.

.angi e property is in the Ph

d. Th~ personal propert is

'ippines.

corporation 90% of wh Y b sh_ares of stocks qf a domestic

ose us1ness . . th

11 Wh· h

· IS in e Philippines.

.

ic of the following is sub·e t .

r ·

·

~- (ar in the Philippine~ ocw~:~he rule o~ reciprocity?

st

· r~~~ men~ in stock in a

, ent ahen decedent.

72

u:Y

Ca non-resident alien decedent.

orporation owned . by a non-

·~

14. One of the foll

the Philippine~

t.

Share:

socied

in acc1

11.

Share

where

Ill.

Share

such i

the Pl·

IV.

Share

establ

a. I only

b. II only

c£jter q;trcuu -

E&de

~

In 1estment in bond in a U.S.-Corporatian that h0 acq ·reo

business situs in the PhrHppjnes, and is a11naJ 1rY/ a resv.16

c,

alien.

Shares owned by a non-resident

established in the Philippines,

d.

12. The rule of reciproci y applies to:

Non•resident alien

decedent

a.

b,

Yes

No

Yes

,No

C.

d.

ar6n

in a

partne< · P

Intangible personal properft£.

in the Philippines

Yes

0

0

Yes

13. rntangible Personal Property of , on-Hes· ent Af -n Decedent ·1 •

Situs in the Philippines shall be Exempt from Taxation if:

L

The decedent, at the time of his death nas a resident citizen of

a foreign country v1hich at the time of his death did not i pose

an estate tax of any character in respect of intangibte personal

property of citizens of the PhiHppines not residing in that

foreign country,

IL

The laws of the foreign country of /nich the decedent ,as a

resident citizen at the time of his death all u a si Har

exemption from estate taxes of every character, in respect o~

intangible personal property ow ed by citize iS of

e

Philippines not residing in that foreign countr1.

a. I only

c. Either I or II

b. 11 only

d. leither I nor II

14. O

€

of the fof11.J wing is n o1 an intangible personal property srtuated in

e P lilippines:

L

Snares, o · afions or bonds issued by any corpora · n or

·ooad a onirna organized and constituted in the Philippines

i acco~ ance 1ith rts la111s.

IL

s! ?.res, bligati s or bo ds issued by any fore' gn corporation

// ere ge::o/£ fits si ess is located in the Philippines.

a .e s, . Hga ,

r :,on s issued by a fore➔gn corpora ·on rf

IIL

s

i atio s or ' · s ha ,e acqu·red business in

ths

I,

z. I

• II

·a

i a !f part ership, busi ess or 1ndustry

tside the Philippines.

. 111 1y

. I ✓ ly

c~- q«cisM

'f·1

'

I

E.rblte. ~ ;

. ,, f- property of a decedent

Situs of Estate

wing rules on "situs 0

.

15. Which of the. follo

•tus of rea 1. property 1s the place or

correct?

eneral rule, the s1 .

.

t.

As a 9

it is situated.

'ble personal property 1s the

country whe~ le the situs of_tang; ally located at the time OI

II.

As a genera ru ' here such is ac u .

I ce or country w

.

Pa d cedent's death.

.

'ble personal property 1s the

~; ~le that situs of mtang~ner does not apply when the

Ill.

e

domicile

or re s'1dence of the o

roperty has a situs elsewherr non-resident alien decedent is

~he test of situs of property O 81 the transmissions of property

IV.

t II because on Y

· ·t

not important a ~- . . are subject to estate ax.

.

.

located in the Philippines

I II and 111 only

·

C. I

a. I only

d I 11 111 and IV

b. I and II only

. ' ' '

16. Which is no~ a test of shituds?bt in case of accounts receivable.

a Residence oft e e or . .

f t ks

b. Place of storage in case of certificates o s oc . .

c.· Location of depository bank in ca~e of bank deposit

d. Place of exercise in·case of _copyright.

17. One of the following is not an intangible personal property situated in

the Philippines:

_

.

a. Shares, obligations or bonds issued by any corpor~~10~ or

sociedad anonima organized or constituted in the Ph1llppmes

in accordance with its law;

.

b. Shares, obligations or bonds issued by any foreign corporation

85% of the business of which is located in the Philippines;

c. . Shares, obligaUons or bonds issueo by any·foreign corporation

if such shares, obligations or bonds have acquired business

situs in the Philippines;

·

,

d. corporation.

Shares, _obligations or bonds issued IJy a non-resident foreign

18. Which of the folloWing statements is correct? _

.

a. The estate tax accrues

f h

·

d

the accrual of the ta . · a~

t e dea,th of the decedent an .

same. ·

x is diSbnct from the obligation to pay th e

b. Estate taxation is governed b

,

. e

th

the return is filed .

· Y e statute in force at the tirn

c. Both "a" and "b"

d. Neither "a" nor "b''

?

7,1

19_ Which of

Philippinei:

a. Franct

Philip~

b. Share

whose

c. Bond 1

reside

d. Forei~

20. Pedro die

common

the PhilipI

Common

in the stc

share.

·P referred

stock exc

par value

Car (cm

P400,00C

Real pro1

The gros

a. P-817

b. P81E

Use the folio

21 . Followin!

values:

House ;

Bank d

bank

Bank d◄

Shares

(ce1

Franc~i

Receive

19. Which of the following item is considered situated outside the

Philippines?

a. Franchise in the name of the decedent which is exercised in the

Philippines

b. Share of stock holdings. of decedent in a foreign corporation

whose business fs 90% done in the Philippines

c. Bond certificate issued by a domestic corporation owned by ? nonresident decedent

·

d. Foreign currency deposited in bank outside the Philippines

20. Pedro died on April 13, 2021, leaving the following properties:

Common stocks of Sunchamp Corporation (2,000 shares) - listed in

the Philippine Stock Exchange (highest - P40; lowest- P39).

Common stocks of AgriNurture Corporation (1,500 shares) - not listed

in the stock exchange. Cost - PS0 per share; book value - P45 per

share.

·

·

· ·

Preferred stocks of Greenergy .Inc. (3,000 shares) - not listed in the

stock exchange. Cost - P70 per share; book value - P60 per share;

par value - _P50 per share

Car (cost - P600,000; book value - P350,000; market value

P400,000)

.

.

Real properties (zonal value - P120,000; assessed value - P72,000)

The gross estate of Pedro is a. P-817,500

C. P-824,QQQ

b. P-816,500

· d. P-846,500

Use the following data for the next two (2) questions

21. Following are properties in the gross estate with their fair market

values:

·

· 1,500,000

House and lot, family home in Quezon City

500,000

Bank deposit in the foreign branch of a domestic

bank

Bank deposit in Makati branch of a foreign bank

300,000

Shares of stock issued by a domestic corporation - 1,000,000

(certificate kept in Canada)

800,000

Franchise exercised in Manila

200,000

Receivable, debtor from Mindanao

75

.

l::- rcrc,:us Cllf/LV

. .

.1

.

1

.

E...,-fidt• ~

'

fl~

.

d there is rec1proc1ty, propert

non.resident a/Jen an

Y

If the decedefnt wag~oss estate Is valued a~2 300,000

.

excluded rom

c.

'

000

a. P2,800,000

d. P2,000,

b P2,600,000

.

.

.

·

.

.

.

and

there

1s

no

rec1proc1ty,

the

-resident a1,en

22 If the decedent V'as non

.

· gross estate is valued at.

c. P3,500,000

.

a. P4,300,000

d p3 200,000

.b. P3,800,000

. . '

.

in Hawaii during his lifetime, left

23. A Filipino decedent residing

following properties:

P10,000,000

House and lot, USA

50,000,000

Mansion, Philippines

2,000,000

cars, Philippines ·

5,000,000

Shares of stock, Singapore

.

·3,000,000

Accounts receivable, USA

The gross estate of the deceden.t is

· . a. P?0,000,000

.

b. P67,000,000

-

I

the

c. P65,000,000

d. P62,000,000

Use the following data for the next two (2) questions

The gross estate of a decedent included the following:

·

Cost

Land and building, Philippin~s

P1,600,'000

House ·and lot, UK

1,800,000

Personal prop.erties, UK

1,000,000

House and lot, Philippines

.4,000,000

Shares of stocks, UK corp.

Shares of stocks, domestic corp.

(certificate kept in UK)

Shares . of stocks, domestic corp.

(certificate kept in Phils.)

Franchise exercised in the Phils.'

Franchise exercised in UK .

Receivables, debtor is from UK

Receivables, debtor is from Phils.

Fair value

P2,000,000

1,500,000

600,000

3,500,000

200,000

250,000

76

b. F

Valuation of E!

26. When the p

the tax shal

a. Fair

b. Fair

the

c. Fair

d. Cm

27. As a rule, t

fair market

case of do1

the fair maI

a. ThE

ass

b. Nel

c. Ac<

d.

Issi

28. Which of U

a. Fai

b. Fai

c. Zo1

rec

d. Bo

· ex,

100,000

200',000

150,000

50 ,000

50,000

24. If_!h~ decedent was a nonresid

·.

.

.

F1l1p1no . citizen from estate tax e~t ahen and his colJntry exempts a

subject to reciprocity?

' ow much of .his assets would be

a. P1 ,000,000

c. P6oo,ooo

b. Paoo,ooo

,

d. P3SO,ooo

25. If the decec

reciprocity, t

a. F

29. The follow

a deceden

1.

Va

lhE

leg

11.

Re

pril

a. I or

b. II 0 1

25. If the decedent was a nonresident alien and assuming there is no

reciprocity, how much is the gross estate?

· .

·

a. P10,700,000

c. P6,100,000

b. P6,600,000

d. PS,850,000

Valuation of Estate

26. When the property is donated in contemplation of death, the basis of

the tax shall be

·

a. Fair market value at the time of donation

b. Fair market value in the hands of the .donor before the time of

the donation.

c. Fair market value at the time of death of-the donor

d. Cost when the property was acquired

27. As a rule, the basis of valuation of property in the gross estate is the

fair market :,.,alue prevailing at the time of decedent's death. In the

case of domestic shares of stock not traded thru the stock exchange, · ·

the fair market value is

.

a. The value appearing in the schedule of fixed values from the

assessor's office

b. Net realizable value

c. Acquisition cost

d. Issuer's book value.

28. Which

a.

b.

c.

of the following value is not used when valuing gross estate?

Fair market value at the ~ime of death~ 1

Fair market v~lue at the time the estate return is filed;

Zonal value when higher ·than the assessed value in case of

real property;

·

d. Book value in case of shares not traded in the stock

· exchange.

29. The following statements pertain to rules on valu\ng the estate left by

a decedent. Select the incorrect statement.

I.

Values in the gross estate are based ·on values at the time of

the decedent's death because it is at this time that the heir

legally succeeds to the inheritance.

II.

Receivable are appraised on the . basis of the amount of. the

principal and interests due and unpaid at the time. of death:

a. I only

c. Both I and II .

b. ti only

d. Neither I nor II

77

\.

I

I

c~ cerd,e.5 -

~---~

Es&ue, ~ -

land. The following data were available i

, A decedent left a piece of

n

30 connection with the properfY(1.) onth before death

P2,500,0oo

Assessed valued, one

m

2,000 ooo

zonal value, time affil~eath tate tax return

3,000:000

1

FMV at the time of ,ng es

What would be the value of the piece of land in the gross estate?

P3 ooo ooo

c. p2,ooo,ooo

.

~: P : ;

d. cannot be determined

2 500 000

Use the following data for the next four (4) questions:

·

A decedent left 1,000 XYZ Corporation com~on shares. The shares were

not traded in the stock exchange. The followrng data were made available·

Capital stock, XYZ Corporation

P10,000,000

·

Retained earnings

2,000,000

Outstanding shares

100,000

31. What was the value included the decedent's gross estate?

a. P100,000

c. P150,000

b. P120,000

d. PO

32. Assume that the shares were 1 •ri d

was the value included the dece~asf' ,e as preference shares, what

a. P100 ooo

en s. gross estate?

b. P120,000

c. P150,000

'

d. PO

?? As

""· sume that the shares were traded .

.

.

~~rther ~at the average value ·at th in te stock exchange. Assume

a:. P1hoaotowas the value included t~e dime of death was P100 per

•

, 00

ecedent's g

t ?

b. P110,000

c. P120,000

ross esta e.

->

d. P150,000

34. Assume that the sh

.

.

the quoted price ar~s were traded in the

.

Nonetheless, the hi\ .the time of deathstock exchange. However,

market were P140 a~/st and lowest quot ·. was not determinable.

the decedent's gross es~~O, respectively w~1ons of the shares in the

~- P100,ooo

a e?

'

at Was the value included

. P110,ooo

c. P120,ooo

d. P1so,ooo

.,,..

35. Oeceden1

owned b)

his death

after 2 y

market v

estate in

thereon

What we

a. F

b. F

INCLUSION

Decedent's

36. Decede

I.

11.

a.

b.

37. Which

citizen

a.

b.

C.

d.

Transfer i

38. Transf

I.

11.

ciy-ter Eercise.,

~

Es&d& 'l~

35, Decedent died in 2020 leaving a will which directed all real estate

owned by him not to be disposed or sold for a period of 2 years after

his death, and ordered that the property be given to Juan Dela Cru~

after 2 years. In 2020, the estate left by the decedent had a fair

market value of P500,000. In 2022, the fair market value o_

f the said

estate increased by P4,500,000 and the BIR Commissioner assessed

thereon estate tax based on assessed value of P4,000,000 in 2020.

What would be the correct amount of the gross estate?

a. P5,0Q0,000

c. P4,500,000

b. P4,000,000

d. P500,000

re

e:

INCLUSIONS IN THE GROSS ESTATE

Decedent's Interest

36. Decedent's Interest

I.

Refers to the extent of equity or ownership participation of the

decedent ·on any property physically existing and present in

the gross estate, whether in his possession, control or

dominion.

II.

Refers to the value of any interest, having value or capable of

being valued or transferred, in property owned or possessed

by the decedent at the time of his death.

a. I only

c. Both I and II

b. II only

d. Neither I nor II

r

37. Which of the following is not to be included in the gross estate of

citizen decedent?

a. Dividend income declared, but not yet actually received at

date of death

b. Share in partnership's profit earned immediately after date of

death

·

·

c. Rent income accrued before death but collected after ·death

d. None of the abo~e

Transfer in Contemplation of Death

38. Transfer in contemplation of de~th

I.

Contemplates a situation where the transferor during his

lifetime, transfers property in contemplation of or intended to

take effect in possession or enjoyment at or after his death.

II.

Includes situations where the transferor retains. for life the

possession or enjoyment, or the right to the income from 'the

property, or the right to designate the person who shall

possess or enjoy the property or the income therefrom. .

79

\

cfter E{oz·/a"'

f-.,/,1/,

I,~•

d ath the deced ,nt n J ~

fme

of the ·decedenth'spr~perty form part of hi..,, gr~

1

.

111 _ At the

.

arty

I

but sue

owned the prop

' poses.

tate tor estate tax pur

All of the above

a. ~~nly

~: None of the ab V..,

b. I and II only

, 11 ·ng is correct?

.

f 1h j

39. Which among the ,o ow1

'es which at the time o ~ e c ecea ,n t

1.

There may be. propert, tate because they were tran fermo by

death are not ,n the es

him during his lifetime. ur oses of the estate tax, may t,X ,G<;

The gross esta te, for

P . ts at the time of his death a ·t

,

the actual value of his asse

.

b h' d ,

includes the value of transfers of property Y 1

U~~9 hi~

lifetime that partake of the nature of testamentary d1 po.;:i1tioni.

I only

c, Both I and II

· ~: 11 only

d. Neither I nor 11

11.

P

m,

40. Which of the following shall be included in the gros e. tat<; of a

decedent?

I.

Transfer of property in favor of another p.e rson, but th e tran fer

was intended to take effect only upon the transferor' death,

II.

Transfer by gift intended to take effect at death, or after death,

or ~nder which the donor reserved the income or the right to

designate the persons who should enjoy the income.

Ill.

Transfer with retention or reservation of certa in righ ts. The

de~dent had. transferred his property during hi lifetime, but

r~tained for. h1~self beneficial enjoyment of the thing or the

right to receive income from the same

a. I and II only

c. All of th. b

b. II and Ill only

d. None ott~e :~eove

,

44, All IJf th8· t

,

b,

d,

41. The following are deemed transfer .

.

a. While still alive, the deC:dn contemplation of death , except

donation will take effect at th e7_t donat~d property where the

b. The decedent transte ed e ime of his death.

the business ope,auot a property in the regular cour e of

C. The deced

.

. ent donated

·

~~/she will enjoy the fruits ~,Property with the condition that

d. de etiecedent transferred a such While still alive

a

· Property to take effect after his/hef'

4 ,'ft1 r ,A -~- ~~

marke ah e

eath nr;re F

the 1al e of ·

a. P1 ,

b, P25

I

80

tr

.

ofter ier@e,

42. Transfers in contemplation of death:

Consideration

received

· Land

P1,500,000

Shares· of stock

100,000

Vint~ge car

50,000

Painting

250,000

FMV upon

fMV upon

death

transfer

P2,000,000

P1,500,000

150,000

50,000

100,000

80,000

500,000

400,000 ·

The correct gross estate should be

a. P120,000

c. P350,000

b. P300,000

d. P400,000

Transfer with r~servation of rights and revocable Transfers

43. An agreement created by· will or an agreement under which title to

property is passed to· another for conservation or investment with the

income therefrom and ultimately . the corpus to be distributed in•

accordance with the directives of the creator as expresseq in the

governing instrument

a .. Estate

c. Fiduciary

b.- Trust

d. Beneficiary

44. All of the following statements are true, except

a. In a revpcable transfer, the decedent during his lifetime may

revoke, alter, amend, ·or terminate the terms of enjoyment or

ownership of the property.

b. A revocable transfer is always includible in the gross estate of

the decedent-transferor. .

c. The power of the decedent-transferor to revoke terms may be

exercised just once.

d. A revocable transfer shall be included in the gross estate of

the decedent-transferor even though the power to revoke was

not exercised.

45. A revocable transfer was made for a consideration of P100,000. Fair

· market values of the·property at the time of tran~fers and at the time of

death were P250,000 and P300,000, respectively._In the gross estate,

the value of the property was

a. P100,000 ·

c. P200,000

b. P250,000

. d. Exempt

81

cfw· qercise.<

Estate, 4(1'

.

.

. r of appointment

nder general powe

.

Transfer u

t regarding transfer under general

46 Which of the following state~e~r!nsfer under special power of

. power of appointment an

.

appointment is correct?

· sons involved under this rule; the

I.

There are .three per f ee and the second transferee. The

transferor, the first trans er 't

.

i

is the deceden .

.

•

first tran~ e~ee

d b tt-le transferor to the first transferee to

11.

If auth~nty is grante ~ho upon the latter's death, would next

determine th e p~rsont,he p'roperty transferred, his. authority

possess or enJoy

· t

t

emanates from a general power of appo1n men.

. Ill.

If the transferor himself had determined beforehand who upon

th d ath of the first transferee, would next possess or enjoy

th! ;roperty, then the authority o~ the first transferee

emanated from a special power of appointment.

a. I and II only

c. All of the above

b. II and Ill only

d. None of the above

47. Which is wrong?

a. A power of appo'intment is the right to designate the person or

persons who shall succeed to the property of a prior .decedent.

b. A special power of appointment authorized the donor of the

power to appoint only from among a designated class or group

of persons including himself.

c. The done-decedent of a special power of appointment only

holds the property in trust,. hence, the property shall not form

part of the done-decedent's gross estate.

d. None of the above

49. The power of i

through .the foll

I.

By will

II.

By dee

his dea

Ill.

By dee

not as1

period

a. I only

b. II only

Transfer for lnsu1

50. Which

a.

b.

c.

of the fc

Transf1

Transf1

Transf1

money

d. Transf1

51. In determining

· by a decedent

yourself, wast

I.

II.

48. Which of the following statements is not true?

If yes, the,

the consid1

If no, ther

..

et'ermmin•

a. I only

b. II only

1d

a. A general power of appointment authorizes the donee of the

Proceeds of life i1

0

b. ~ ;:~!~a~P~~:!:: perso~ to possess or enjoy the property.

power the owner of theapf0 1;tmen_t makes the donee of the

c. A power of appo· t

~ p rty.

.

d. The appointed ~~om:nt ,s not ?lways general.

appointment is not i~c~d·bfs~ing under a general power of

1 e in the gross estate of the donee·

decedent.

°

82

I

.52. Proceeds of lif1

a. lnsurar

b. Amoun

admini:

by the i

c. Amoun

insuran

d. Procee

employ

o'J,"'· Et_e,-we,s -

£<W--e, T'k':

49 , The power of appointment may be exercised by the donor-decedent

through the following modes

I.

By will

II.

By deed to take effect in possession or enjoyment at or after

his death.

Ill.

By deed under which he has retained for his life or any ·period

not ascertainable without reference to his death or for ~ny

period which does not in fact end before his death.

a. I only

c. I and II only

b. II only

d. I, II and Ill

Transfer for Insufficient Consideration

50. Which

a.

b.

c.

of the following transfer is not included in the gross estate?

Transfer with reservation of certain rights

Transfer for insufficient consideration

Transfer for an adeql:late full consideration in money or

money's worth

·

d. Transfer ·in contemplation of death

51. In determining whether the value of a property transferred onerously

by a decedent during his lifetime should be included 1n his estate, ask

yourself, was the considera.tion insufficient?

·

·

I.

II.

If yes, then add the excess of the FMV at the time of death_over

the consideration received.

1It 110, then it was a bona fide sale.

Exclude the property in

determining the decedent's gross estate.

a. I only

, c. Both I and II

b. 11 only

d. Neither I nor II

Proceeds of life insurance

.52. Proceeds of life insurance includible in the taxable gross estate

a. Insurance.proceeds from SSS or GSIS

b. Amount receivable OY any beneficiary other than the estate

administrator or executor, irrevocably designated in the policy

by the insured

,

,

c. Amount receivaQle by any beneficiary designated in the

insurance policy

d. Proceeds of group insurance taken out by a ·company for its

employees.

83

-

~

/"'{,;t{'I· l Lz ·c✓ -l·,:,,: \·

(j /l}

.

16rtc:

?:, ·

It

t te of the deceased , his executor

53. Amounts receivable ~y t : n : :nder policy taken by the

administrator as _an msu

decE:de:

upon his own life ,s:

ross estate.

.

.

a. Excl~ded from th e 9 t

hether the beneficiary 1s revocable

. b. Part of the gross esta e w

Or

57. Ms. Balo, Sp(

Transport), n

P9

irrevocable.

t ·t the beneficiary is revocable.

c. Part of the gross esttaat: the beneficiary is irrevocable.

d. Part·of the gross es

:f

.

P1

I

.

)

.

.

ot included in the gross estate?

here the consideration is not sufficient

a. Revocable trans fer wwhere the power of revocation was not

b. Revocable trans er

P4

exercised

fi ·

d ·

Proceeds of life insurance ~he~e _the bene ic1ary es1gnated is

c. the estate and the designation 1s irrevocable .

.

d. Proceeds of life insurance wher~ ~he benebfi1c1ary designated is

1

the mother and the designation 1s 1rrevoca e.

The

54. Which of the following isf n

'J

)

a. P90

55. Proceeds of life insurance where the beneficiary of the decedent is not

his estate, executor or administrator is

a. Part of gross income if the beneficiary is revocable

b. P~rt of gross income regardless of whether the beneficiary is

revocable or irrevocable

c. Not part of gross estate if the beneficiary is irrevocable

d. Part of gross estate regardless of whether the beneficiary is

revocable or irrevocable

56. Proceeds of life insurance to the extent of the amount receivable by

I

·

the estate of the deceased, his executor or administrator

policies taken out by .the decedent upon his own life shall be

under

b. P1,:

Claims against

58 . Which of th,

persons?

a. The

. liabi

b. The

esta

c. The

accc

d.

Clai

who

I.

11.

111.

·IV.

Part ~f the gross estate irrespective of whether the insured

retained the power of revocation

Not part of the gr~ss estate if the beneficiary is irrevocable.

Part of the gross income if the designation of the beneficiary is

revocable

~ot part 0 ~ th e gross income irrespe.ctive of whether

insured retained the power of revocation

a. I and II

b. I and 111

C.

I and IV

d. only I

84

11,e

59. Which i co

I.

In

d b

11.

It cc

t

m

I on

b. II r

1 ,d11 /,,

57. Ms. Balo, s

Transport), r

f ti

P

P

P1 . 00,000

P400,000

dt: nt wh di . d In b

00 br k n d wn · f<

Frorn H 1b

1n

Ir

A II Ins

t

n

rt 191, tin

I

r

fl

,I

t ((.

I'

Id nt (Hon trot

:

·

I

omp1: r Y·

J

· nt

ry.

f! rom W I ng H inrmun n uro In ur 1nc

d

dont

mp ny t :1 k n

ut by th

Irr

vo

ablo

d ign ting

hi .

wlf

A

b n -flcl ry.

Fr m H rur t Tr n port omp ny (own · r (

cld nt) whor

th

bus Inv lved In th

s ttl ment w

m d - out Id • court

proce ding .

The gross estate of the deced nt h II Include

a. P900,000

c. P2, 100,000

b. P1 ,200,000

d. P2,500 ,000

Claims against insolvent persons

58. Which of the following is not true regarding a cl aim against insolvent

persons?

a. The decedent's claim is deductible in full because the debtor's

· liabilities exceed his remaining assets.

b. The decedent's claim must be included in full in the gross

estate.

,

c. The decedent's claim which cannot be collected is deductible

according to the ratio of the debtor's assets to his liabilities.

d. Claim against insolvent person is a claim against person

whose assets are not sufficient to pay his liabilities.

59 . Which is correct?

I.

11.

In a claim against insolvent person, the insolvency of the

debtor must be proven and not merely alleged.

It could be that the amount to be included as part of the gross

estate in a claim against insolvent person is less than the full

amount owed .

c. Both I Ind II

d. Neithe I nor 11

a. I only

b. II only

85

_/' {l'/• l. ~ {'(:/'l •/ ,f(' ,,\

{J/t/1)

· ·

.,

.

• I

he income of th e

·s included In l

i/11 I('

0

,..I._, .

f(C' .

!' lb 1,

60. Which of the follqwlng ,

e of a decea ed person durln

decedent? ·

lved by the estat ttlement of the e tale.

g

a. lncom~ ~~~ administration orhse pprai sed value placed upon

. L

. .'

'

f

/

b r:c~:;1oof selling pr!~ee ~~e~e~t~,awhere the pro perty wa so1u

. the property at the t1 h state.

tter the settlement oft e 0f operty passed to the executor or

a

. . · the value o pr

·

c. Apprec1at1on in on death of decedent.

.

administrator up

. kind to legatee or dev1see.

d. Dei'ivery of property ,n

.

.

I

et

t t of a decedent 1s a claim against

aP~OO 000. The insolvent debtor can

an insolvent person amo~ntmg o

'

,

still pay P100,000 out of the P500,000.

.

61 . One of the items in the gro~s

..

.

d d . nd deducted from the gross estate?

How much will be ,nclu e in a

Deduction

Gross estate

p 100 000

C.

P100,000

P500,000

P500,000

'

P100,000

P400,000

d.

None

None

a.

2)

b.

•

•

ft~

alien d ~ c

a. W'r

del

b. Pa

re"

de

c,

Pr

de

th,

d. PE

de

m

65. Which of

a. M

di

SC

b. tv'

is

c. 8

d.

EXCLUSIONS FROM THE GROSS ESTATE

·1or1

64 , n

~

I

'

62. The following are transactions exempt from transfer tax except:

a. Transmission from the first heir or donee in favor of another

· beneficiary in accordance with the des_ire of the predecessor

b. transmission or delivery of the inheritance or legacy by the

· fiduciary heir or legatee to the fideicommissary.

c. The merger of usufruct in the owner of the naked title.

d. All bequest, devices, legacies, or transfers to social welfare,

cultural and charitable ,institutions

·

66 . Which

c

?!PPOintrr

k

E

ii

(

11.

r

'63. Wfhhich of th e f~llowing exempt transmissions will still require inclusion

0

I

t e property in the gross estate?

111.

a. Merger of the usufruct in the owner the naked t ·t·1 .

b Legacy to a h ·t bl

.

I e,

. expen

d'd c an a e institutioris whose ., administrative

T

ses. I not exceed 30% of the legacy·

c.

ransfer from a first heir t

'

decedent;

·

, 0 a second heir C:lesignated by the

d. Death benefits under the GSIS and

· 86

GS.IS.

a. I

b. I

(·

.

G1

f ,y-

E ,·er.-i,c·

Es6th 7,L,

64. One of the following is included in the gross estate of a nonresident

alien decedent:

a. Wholly un~llectible claims against a debtor who absconded ,

debt_or resides outside the Philippines.

b. Partially collectible claims against an insolvent person who

resides in Manila the country of the nonresident alien

decedent does not impose transfer taxes of any kind.

c. Proceeds of life insurance of the decedent where the

decedent's estate was designated as irrevocable beneficiary,

the policy was procured in Manila.

d. Pe·rsonal property .situated in the Philippines donated by ·the

decedent before he died to a son on account of the son's

marriage.

65. Which of the following is a transfer in contemplation of death?

a. Mhalapit Nha has been fighting for his life since he · was

diagnosed to have a terminal illness. Accepting his fate , he

sought the assistance of Atty. Lho Yer, and made his will.

b. Mr.· Matibay celebrated his 101 st birthday. Feeling that death

is not far, he transferred all his properties to Pedro and Juan.

c. Both "a" and "b"

d. Neither "a" nor "b"

66 . Which of the following is a transfer under special power of

?IPPOintment?

k

II.

Ill.

Earl transfers his property in trust for his son, Gabry and then

in -trust for anybody whom Gabry may, by will, appoint or

designate.

Mr. Byahero frequently travels due to the nature of his

profession. He thinks that he is not spared from meeting

accidents considering the rampant occurrence of accidents

these days. He decided to execute his last will and testament

appointing his properties to his children.

Georgia designated his special friend , E. Garcia as beneficiary

of an insurance which he took upon his own life.

c. All of th~ above

d. None of the above

a. 1·only

b. II only

87

~

· · ns

Administrative Prov1s10

·

.

•tuations an estate tax return is requ·

67. Under which of the follo~1~gL:~?

.

Ir~

to be filed under the !RA ·subject to estate tax.

a. Transfers which _a;e of registered or registra_

b le properties for

b. The estate consis ~ m the BIR is required as a ·condition

which a clearance ro

h' .

precedent for the transfer of owners ip.

.

c. · Both "a" and "b"

d. Neither "a" nor "b"

68. Who shall file the estate tax return?

.

a. Executor, or administrator, or any of the legal heirs

b., Creditors of the decedent

c. Personal secretary of the decedent

d. Debtors of the decedent

69. Statement 1: The estate· tax imposed under the Tax ·Code shall be

paid by the executor or administrator before . the delivery of the

distributive share in the inheritance to any heir'or beneficiary.

Statement 2: The executor or administrator of an .estate has the

prim~ry obl!ga~i?n to pay_the estate tax but the heir or beneficiary has

s~bs!d,~ry l!ab11lty for paying that portion of the estate corresponding to

. hrs d1strrbut1ve share in the value of the total net estate.

·

a. Statements 1 and 2 are false ·

··

·b. Statement 1 is true but statement 2 is false

c. Statement 1 is false but statement 2 is true

d. Statements 1 and 2 are true

70. Statement 1: The Commis· .

.

authorized by him pursuant t~ioner or any of the Reve~ue Officer

th e tax code shall have the authority to

grant, in meritorious case

thirty (30) days for filing the s;et:r~~asonable ext~nsion not exceeding

Statement 2: The application for

.

tax retu:n must be filed with-the Rth e extens,0n of time to file the estate

secure its TIN and file tax r t

DO where the estate is required to

a. Statements 1 and ; urn of the estate.

b. Statement 1 i t

are false·

s rue but stat

Sta

c.

tement 1 is false b

ernent 2 is false

d. Statements 1 and 2 ut staterner:it 2 is true

.

are true

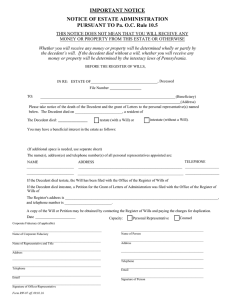

Deduction~

To compute

that can be ded

Code . .RR 12-2

Code, as .amenI

estate to arrive

determining the

Deductions ·

1. Ordina11

2. Special

3. Share o·

Beginning Ja1

allowable deduc1

TABLE 3~1. SUM

OED

A. Ordinary Deduc

1. LIT e (Los:

Taxes, etc

2. Vanishing

3.

Transfer f(

8. Special Deduct

1. Standard I

2. Family Ho

3. RA491 7

C. Share of the Su

For married de1

*** Total LITe x

88

(GJ