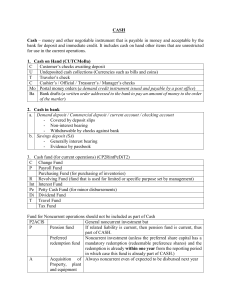

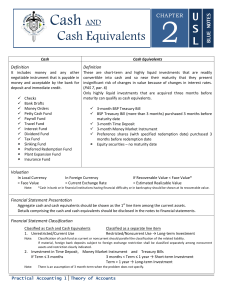

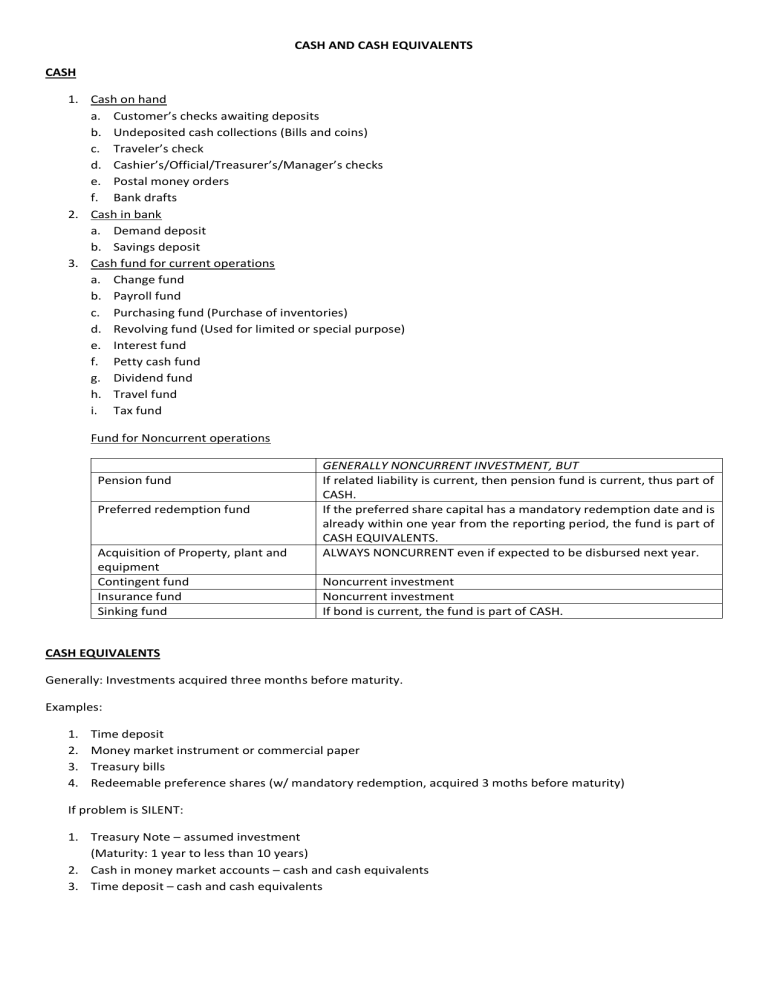

CASH AND CASH EQUIVALENTS CASH 1. Cash on hand a. Customer’s checks awaiting deposits b. Undeposited cash collections (Bills and coins) c. Traveler’s check d. Cashier’s/Official/Treasurer’s/Manager’s checks e. Postal money orders f. Bank drafts 2. Cash in bank a. Demand deposit b. Savings deposit 3. Cash fund for current operations a. Change fund b. Payroll fund c. Purchasing fund (Purchase of inventories) d. Revolving fund (Used for limited or special purpose) e. Interest fund f. Petty cash fund g. Dividend fund h. Travel fund i. Tax fund Fund for Noncurrent operations Pension fund Preferred redemption fund Acquisition of Property, plant and equipment Contingent fund Insurance fund Sinking fund GENERALLY NONCURRENT INVESTMENT, BUT If related liability is current, then pension fund is current, thus part of CASH. If the preferred share capital has a mandatory redemption date and is already within one year from the reporting period, the fund is part of CASH EQUIVALENTS. ALWAYS NONCURRENT even if expected to be disbursed next year. Noncurrent investment Noncurrent investment If bond is current, the fund is part of CASH. CASH EQUIVALENTS Generally: Investments acquired three months before maturity. Examples: 1. 2. 3. 4. Time deposit Money market instrument or commercial paper Treasury bills Redeemable preference shares (w/ mandatory redemption, acquired 3 moths before maturity) If problem is SILENT: 1. Treasury Note – assumed investment (Maturity: 1 year to less than 10 years) 2. Cash in money market accounts – cash and cash equivalents 3. Time deposit – cash and cash equivalents Note: If an item cannot be included as cash equivalent because of time cut-off (i.e., three months), it will always be classified as investments (short-term or long term) even if it matures within three months from the end of the reporting period. ITEMS THAT COULD AFFECT CASH AND CASH EQUIVALENTS Items Remarks Cash Cash in foreign currency Measured at face value Translate to Philippine Peso using the closing rate or spot rate at the reporting date. Deposit in foreign bank a. Unrestricted – cash b. Restricted – noncurrent asset Cash in closed bank or banks in Noncurrent asset bankruptcy Bank overdraft If the entity is maintaining two or more accounts in: -Different banks – current liabilities or may be offset if immaterial -Same bank – maybe offset against the account with positive amount but cannot be offset against restricted account. Compensating balance a. Not legally restricted – cash b. Legally restricted: Not cash Loan is short term – current asset Loan is long term – noncurrent asset Undelivered/unreleased check Revert back to cash Stale check Revert back to cash Postdated check a. Entity is issuer – revert back to cash b. Customer’s check – not part of cash IOUs Receivables Equity securities (Ordinary shares, No maturity date, therefore, not classified as cash equivalents. etc.) Except: Redeemable preference share Redeemable preference shares Preferred shares with specified redemption date and acquired three months before redemption date are classified as cash equivalents. Callable preference shares Part of shareholder’s equity NSF/DAIF/DAUD checks Receivables Expense advances Receivables or prepaid expenses Unused credit line This is the difference between the amount of line of credit applied for and approved by a bank and the amount actually borrowed. Treasury warrants Disclose only in the notes. A warrant for the payment of money into or from public treasury. Escrow deposit Certificate of deposit Postage stamps on hand Include as part of cash. Excluded from cash. Use three-month rule. Supplies or prepaid expenses.