Statement of Financial Position: Accounting Basics

advertisement

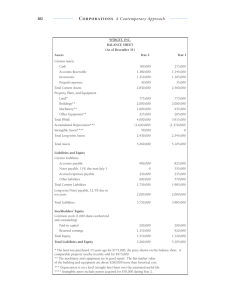

Chapter 1: Statement of Financial Position STATEMENT OF FINANCIAL POSITION ELEMENTS OF THE ACCOUNTING EQUATION ASSETS= LIABILITIES+ CAPITAL The elements of balance sheets ASSETS Current Assets Cash and cash equivalents Receivable Merchandise inventory Prepaid expenses Non-current Assets Long term investments Land Building Equipment Furniture and fixtures Goodwill, patent, copyright, trademarks LIABILITIES Current liabilities Accounts payable Unearned income Output vat payable SSS payable Pag-IBIG payable Philhealt Payables Salaries and Wages Payable Taxes Payable Accrued Expense Payable Non-current liabilities Notes payable Loans payable OWNER’S CAPITAL OR EQUITY Current and Non-current (Assets and Liabilities) Current Assets – Assets that can be realized (collected, sold, used up) one year after year-end date. Examples include Cash, Accounts Receivable, Merchandise Inventory, Prepaid Expense, etc. Current Liabilities – Liabilities that fall due (paid, recognized as revenue) within one year after yearenddate.ExamplesincludeNotesPayable,AccountsPayable,AccruedExpenses(example:Utilities Payable), Unearned Income,etc. CurrentAssetsarearrangedbasedonwhichassetcanberealizedfirst(liquidity).Currentassets liabilities are also called short term assets and shot termliabilities. and current Noncurrent Assets – Assets that cannot be realized (collected, sold, used up) one year after yearend date. Examples include Property, Plant and Equipment (equipment, furniture, building, land), Long Term investments, Intangible Assets etc. Noncurrent Liabilities – Liabilities that do not fall due (paid, recognized as revenue) within one year after year-end date. Examples include Loans Payable, Mortgage Payable, etc. Noncurrent assets and noncurrent liabilities are also called long term assets and long term liabilities. Statement of Financial Position – Also known as the balance sheet. This statement includes the amounts of the company’s total assets, liabilities, and owner’s equity which in totality provides the condition of the company on a specific date. (Haddock, Price, & Farina, 2012) Permanent Accounts – As the name suggests, these accounts are permanent in a sense that their balances remain intact from one accounting period to another. (Haddock, Price, & Farina, 2012)ExamplesofpermanentaccountincludeCash,AccountsReceivable,AccountsPayable,Loans Payable and Capital among others. Basically, assets, liabilities and equity accounts are permanent accounts. They are called permanent accounts because the accounts are retained permanently in the SFP until their balances become zero. This is in contrast with temporary accounts which are found in the Statement of Comprehensive Income (SCI). Temporary accounts unlike permanent accounts will have zero balances at the end of the accounting period. Contra Assets – Contra assets are those accounts that are presented under the assets portion of the SFP but are reductions to the company’s assets. These include Allowance for Doubtful Accounts and Accumulated Depreciation. Allowance for Doubtful Accounts is a contra asset to Accounts Receivable. This represents the estimated amount that the company may not be able to collect from delinquent customers. Accumulated Depreciation is a contra asset to the company’s Property, Plant and Equipment. This account represents the total amount of depreciation booked against the fixed assets of the company. Differences between Report Form and Account Form: Report Form – A form of the SFP that shows asset accounts first and then liabilities and owner’s equity accounts after. (Haddock, Price, & Farina, 2012)The balance sheet shown earlier is in report form. Account Form – A form of the SFP that shows assets on the left side and liabilities and owner’s equity on the right side just like the debit and credit balances of an account. (Haddock, Price, & Farina, 2012) Difference of the Statement of Financial Position of a Service Company and of a MerchandisingCompany The main difference of the Statements of the two types of business lies on the inventory account. A service company has supplies inventory classified under the current assets of the company. While a merchandising company also has supplies inventory classified under the current assets of the company, the business has another inventory account under its current assets which is the Merchandise Inventory, Ending. Parts of the Statement of FinancialPosition EXAMPLE 1: 1. MR. CRUZ INVESTED CASH TO THE BUSINESS FOR P75 000 2. THE OWNER PURCHASED SUPPLIES IN CASH P3000 3. THE OWNER PURCHASED ADDITION SUPPLIES ON CREDIT FOR P5 000 EFFECTS OF THE ABOVE EXAMPLE TRANSACTION No. 1 2 3 A Assets 75 000 3000 (3000) 5 000 COLUMN TOTAL EQUATION TOTAL 80 000 80 000 = B Liabilities + 5000 5000 75000 80 000 TO THE BALANCE SHEET ABC Company Balance Sheet As of December 31, 2017 Cash Supplies ASSETS 72, 000 8,000 LIABILITIES & CAPITAL Accounts Payable 5, 000 Mr.Cruz Capital Total assets 80, 000 C Capital 75 000 75, 000 Total liabilities&capital 80, 0000 Example 2 The trial balance of San Diego Enterprise was prepared for the period covering January 1 to June 30, 2021. As an accountant you are required to prepare Statement of Financial Position as of June 30, 2021 in an ACCOUNT FORMAT SAN DIEGO ENTERPRISES Trial Balance June 30, 2021 Cash Accounts Receivable Supplies Prepaid Rent Delivery Vehicle Office equipment Furniture Accumulated depreciation Accounts payable VAT payable Notes payable San Diego Capital San Diego Drawing Net Income TOTAL Ca Ca Ca Ca nca nca nca cl cl ncl oe oe Debit Credit 150 000.00 25 000.00 10 000.00 60 000.00 75 000.00 15 000.00 10 500.00 15 000.00 15 500.00 5 000.00 45 000.00 250 000.00 20 000.00 365 500.00 35 000.00 365 500.00 SOLUTION TO EXAMPLE 2 ACCOUNT FORM SAN DIEGO ENTERPRISES Statement of Financial Position As of June 30, 2021 ASSETS Current Assets: Cash Account receivable Supplies Prepaid rent Total Current Assets: 150 000 25 000 10 000 60 000 245 000 Non-current Assets Delivery vehicle 75 000 Office equipment 15 000 Furniture 10 500 Total non-current Assets: 100 500 Less: Accumulated 15 000 depreciation Net Book Value 85 500 Total Assets : 330 500 LIABILITIES Current Liabilities Accounts payable 15 500 VAT payable 5000 Total Current liabilities 20 500 Non-current liabilities Notes payable 45 000 Total Liabilities 65 500 San Diego Capital CAPITAL 265 000 Total Liabilitie& Capital 330 500 REPORT FORM ASSETS Current Assets: Cash Account receivable Supplies Prepaid rent Total Current Assets: 150 000 25 000 10 000 60 000 245 000 Non-current Assets Delivery vehicle 75 000 Office equipment 15 000 Furniture 10 500 Total non-current Assets: 100 500 Less: Accumulated 15 000 depreciation Net Book Value 85 500 Total Assets : 330 500 LIABILITIES Current Liabilities Accounts payable 15 500 VAT payable 5000 Total Current liabilities 20 500 Non-current liabilities Notes payable 45 000 Total Liabilities 65 500 San Diego Capital CAPITAL 265 000 Chapter test 1-1 Choose the letter of the correct answer 1. The other name for the Statement of Financial Position is: a. working balance sheet b. financial position sheet c. balance sheet d. none of the above 2. The statement of Financial Position period in its heading is expressed as: a. for the period covered and followed by a date b. as of and followed by a date c. a date only d. all of the above 3. Which of the following is not an element of the balance sheet? a. assets b. liabilities c. capital d. owner's drawings 4. Which of the following is an asset account? a. unearned revenues b .prepaid expenses c. drawings d. none of the above 5. Which of the following is a contra account? a. accumulated depreciation b. accounts payable c. uncollectible accounts expenses d. accrued expenses 6. All of the following are components of a capital except for: a. additional investment of the owner b. owner's drawing c. net income or loss d. gain on sale of assets 7. One of this is a form of a balance sheet a. vertical form b. report form c. horizontal form d. none of the above 8. Example of non-current liabilities is: a. notes payable b. loans payable c. mortgage payable d .all of the above 9. Which of the following names is NOT associated with the statement of comprehensive income? a. foreign currency translation adjustments b. actuarial gains and losses arising on defined benefit pension plan c. revaluations of property, plant and equipment d. none of the above 10. This represent things of value with no physical form: a. Tangible asset b. un-seen asset c. intangible asset d. none of the above Chapter Test 1-2 Write TRUE of the statement is correct or FALSE if otherwise 1. The statement of Financial Position is like a frozen pictures taken at certain periods of time 2. One of the three elements of balance sheet is drawing account 3. Current assets are tangible or intangible assets that have a life span of more than one year 4. Tangible assets are things that represent things of value with no physical form 5. A net profit results when expenses exceed over the income 6. The owners drawing is an addition to the capital account 7. Capital or equity are contributions of the owner to the business which be in form of cash only 8. Assets can be used to settle obligations 9. Noncurrent Liabilities are liabilities that do not fall due (paid, recognized as revenue) within one year after year-end date. 10. Current Liabilities are liabilities that fall due (paid, recognized as revenue) within one year after yearend date. Chapter Test 1-3 Instruction: indicate if the following are : Current assets ( CA), non-current assets (NCA), current liabilities ( CL) , non-current liabilitie ( NCL) 1. Cash 2. Accounts payable 3. Notes payable 4. Prepaid expenses 5. Accrued expenses 6. Accounts receivable 7. Land 8. Furniture and fixtures 9. Supplies inventories 10. Wages payable Chapter Test 1-4 ( Performance Task 1) The following is the trial balance of Gregorio Enterprise as of June 30, 2022 GREGORIO ENTERPRISE Trial Balance June 30, 2022 Cash Accounts Receivable Supplies Prepaid Rent Delivery Vehicle Office Equipment Furniture Accumulated Depreciation Accounts Payable Vat Payable Notes Payable Gregorio Capital Prepare Balance Sheet in Account Form 120 000 50 000 12 000 35 500 165 000 23 200 11 450 30 000 26 550 4 500 75 000 281 100 Chapter Test 1-5 ( Performance Task 2) Using the following info, prepare a properly classified Statement of Financial Position for Graduation Company as at December 31, 20xx a) Account Form b) Report Form Accruals and other current liabilities 125,890 Bonds payable 5,000,000 Cash and cash equivalents 2,500,000 Current income tax payable 589,660 Intangible assets, net 2,654,700 Investment in associate 1,890,600 Investment in equity securities 3,650,400 Investment property 1,968,740 Long-term notes payable 2,000,000 Merchandise inventory 2,789,000 Office and store supplies 400,000 Other noncurrent assets 600,000 Other noncurrent liabilities 750,000 Owner's Equity 18,211,250 Prepayments and other current assets 385,000 Property, plant, and equipment, net 9,856,250 Short-term notes payable 320,000 Trade and other payables 1,562,890 Trade and other receivables 1,865,000