The Calculus of Finance

For our entire range of books please use search strings "Orient

BlackSwan", "Universities Press India" and "Permanent Black" in

store.

The

Calculus

of

Finance

Amber Habib

Mathematical Sciences Foundation

New Delhi

THE CALCULUS OF FINANCE

Universities Press (India) Private Limited

Registered Office

3-6-747/1/A & 3-6-754/1, Himayatnagar, Hyderabad 500 029

(Telangana), INDIA

e-mail: info@universitiespress.com

Distributed by

Orient Blackswan Private Limited

Registered Office

3-6-752 Himayatnagar, Hyderabad 500 029 (Telangana), INDIA

e-mail: info@orientblackswan.com

Other Offices

Bengaluru, Bhopal, Chennai, Guwahati, Hyderabad, Jaipur, Kolkata,

Lucknow, Mumbai, New Delhi, Noida, Patna, Visakhapatnam

© Universities Press (India) Private Limited 2011

First Published in 2011

Reprinted 2018

eISBN 9789389211023

e-edition:First Published 2019

ePUB Conversion: TEXTSOFT Solutions Pvt. Ltd.

All rights reserved. No part of this publication may be reproduced,

distributed, or transmitted in any form or by any means, including

photocopying, recording, or other electronic or mechanical methods,

without the prior written permission of the publisher, except in the

case of brief quotations embodied in critical reviews and certain

other noncommercial uses permitted by copyright law. For

permission requests write to the publisher.

To my brother Faiz,

for lighting my way

Contents

Preface

List of Notation

1 Basic Concepts

1.1 Arbitrage

1.2 Return and Interest

1.3 The Time Value of Money

1.4 Bonds, Shares and Indices

1.5 Models and Assumptions

2 Deterministic Cash Flows

2.1 Net Present Value

2.2 Internal Rate of Return

2.3 A Comparison of IRR and NPV

2.4 Bonds: Price and Yield

2.5 Clean and Dirty Price

2.6 Price –Yield Curves

2.7 Duration

2.8 Term Structure of Interest Rates

2.9 Immunisation

2.10 Convexity

2.11 Callable Bonds

3 Random Cash Flows

3.1 Random Returns

3.2 Portfolio Diagrams and Efficiency

3.3 Feasible Set

3.4 Markowitz Model

3.5 Capital Asset Pricing Model

3.6 Diversification

3.7 CAPM as a Pricing Formula

3.8 Numerical Techniques

4 Forwards and Futures

4.1 Forwards and Futures

4.2 Forward and Futures Price

4.3 Value of a Futures Contract

4.4 Method of Replicating Portfolios

4.5 Hedging with Futures

4.6 Currency Futures

4.7 Stock Index Futures

5 Stock Price Models

5.1 Lognormal Model

5.2 Geometric Brownian Motion

5.3 Suitability of GBM for Stock Prices

5.4 Binomial Tree Model

6 Options

6.1 Call Options

6.2 Put Options

6.3 Put–Call Parity

6.4 Binomial Options Pricing Model

6.5 Pricing American Options

6.6 Factors Influencing Option Premiums

6.7 Options on Assets with Dividends

6.8 Dynamic Hedging

6.9 Risk-Neutral Valuation

7 The Black–Scholes Model

7.1 Risk-Neutral Valuation

7.2 The Black–Scholes Formula

7.3 Options on Futures

7.4 Options on Assets with Dividends

7.5 Black–Scholes and BOPM

7.6 Implied Volatility

7.7 Dynamic Hedging

7.8 The Greeks

7.9 The Black–Scholes PDE

7.10 Speculating with Options

8 Value at Risk

8.1 Definition of VaR

8.2 Linear Model

8.3 Quadratic Model

8.4 Monte Carlo Simulation

8.5 The Martingale

Appendix A: Calculus

A.1 One Variable Calculus

A.2 Partial Derivatives

A.3 Lagrange Multipliers Method

A.4 Differentiating under the Integral Sign

A.5 Double Integrals

Appendix B: Probability and Statistics

B.1 Basic Probability

B.2 Random Variables

B.3 Cumulative Distribution Function

B.4 Binomial Random Variable

B.5 Normal Random Variable

B.6 Expectation and Variance

B.7 Lognormal Random Variable

B.8 Cauchy Random Variable

B.9 Bivariate Distributions

B.10 Conditional Probability

B.11 Independence

B.12 Multivariate Distributions

B.13 Covariance Matrix

B.14 Linear Regression and Least Squares

B.15 Random Sampling

B.16 Sample Mean, Variance and Covariance

B.17 Central Limit Theorem

B.18 Stable Distributions

B.19 Data Fitting

B.20 Monte Carlo Simulation

Appendix C: Solutions to Selected Exercises

Bibliography

Preface

Mathematics has always enjoyed a close relationship with financial

matters. Early developments in arithmetic owed much to the needs

of accounting, and even geometry was influenced by the need of the

State to measure area to fix taxes. While economics deals with the

general issues regarding money and its place in society, finance has

a narrower aim: how should we invest our money to make it grow the

most? This sharper focusmakes itmore tractable to mathematical

treatment. It is exciting that relatively elementary mathematics can

lead to quite deep results in finance, including work that haswon

theNobel Prize. At the same time, the problems of finance have

helped motivate new mathematics of the highest order. Mathematical

finance offers a new solution to the perennial problem

mathematicians face—convincing people that our work has some

significance for society.

This book will introduce you to the basic concepts and products of

modern finance. The emphasis is not somuch on the details of the

financialworld as the basic principles by which we seek to

understand it. Thus the aim of the book is to teach you how to think

about finance. This seems particularly pertinent in the context of

market upheavals that appear to be caused, to a fair extent, by the

careless application of mathematical tools to the creation and pricing

of complicated contracts. The carelessness stems from a lack of

intuition or regard for the importance of the assumptions underlying

the models, leading to incorrect evaluation of risk. As this book will

show you, the understanding and quantification of risk is the central

problem of finance.

The book is based on material developed for the courses in

mathematical finance of the Mathematical Sciences Foundation,

Delhi. (MSF’s website is www.mathscifound.org) These courses are

mainly aimed at undergraduates, but also attract students of

professional courses as well as those in employment. They are

taught portfolio analysis and financial derivatives, with the highlights

being the Markowitz Model, the Capital Asset Pricing Model and the

Black– Scholes approach to options pricing. The students come from

a wide variety of backgrounds and so the required mathematics is

also taught in parallel to the material on finance. We emphasise

hands-on work, with extensive lab as well as student projects where

theory is applied to (and tested by) real-life data.

I have tried to retain the flavour of theMSF programs in that the

book should be accessible to undergraduates and others of varying

backgrounds. (Exposure to basic calculus and probability is all that is

required. No prior knowledge of economics or finance is needed.)

For those who have not taken any probability or calculus after high

school, the required mathematics is described in fair detail in the

Appendix. The book is peppered with examples that use real-life

data to ground the theory. Exercises are also scattered through the

text—their purpose varies fromsimple practice in applying formulas

to extending the ideas in the text to new situations.

The numbering of the exercises and examples needs some

explanation. Exercise 1.4.2 will be found in Chapter 1, Section 4.

Examples share the same numbering scheme with Exercises, so

that Example 1.4.3 is found in Chapter 1, Section 4, just after

Exercise 1.4.2.

As you read the book, you will notice that not many references

have been provided to the original sources. One reason is that it is

not always clear who first had a certain idea, or how much credit

should be given to the person who put it in its final or most popular

form. For instance, a technique may be used, perhaps implicitly, by

traders and investors long before it gets academic treatment and

acquires a provenance. A large and contentious book could be

written on the many claims to originality (one already has been:

Rubinstein [42]). The best thing would be for you to followup this

bookwith one ormore of the detailed texts on finance, for example,

Bodie, Kane and Marcus [7], Brealey andMyers [8], Cuthbertson and

Nitzsche [16], Hull [26], Luenberger [28], and Sharpe, Alexander and

Bailey [45]. Formore onMathematical Finance, the following books

are at about the same level as this one, but with varying choices of

coverage: Capinski and Zastawniak [9], Ross [40], and Stampfli and

Goodman [48]. To read more advanced texts, you would need to

become proficient in stochastic calculus. A gentle start in this

direction is provided by Mikosch [33], while the two volumes of

Shreve [46, 47] are more advanced and comprehensive.

I am grateful to my colleagues at MSF for support and inspiration

in countless ways. Perhaps the most striking is their commitment to

creating innovative teaching and research programs centered

around the interaction of mathematics with all aspects of the world

we live in. I particularly thank Professor Dinesh Singh, Director, MSF,

for inviting me to take part in MSF activities and for sharing his vision

of mathematics. Professor Sanjeev Agrawal has been a constant

source of ideas, advice, and energy. Other colleagues who have

helped me refine my thoughts on finance are Charu Sharma, Divya

Beri, Jatin Anand, Niteesh Sahni and Ziaur Rehman.

At Universities Press, I must thank its Director, Madhu Reddy, and

editors Shubashree Desikan and Sreelatha Menon for

encouragement, advice, and gentle prodding. Thanks are due to the

referee for pointing out various ways of improving the text.

Two old friends have played a special role in this story. Surajit

Basu added to the long list of kindnesses he has done me by

commenting on an early draft. Adnan Aziz rode in like the proverbial

white knight just before publication and saved me from an army of

ambiguities and omissions. I appeal to the reader to help root out

those that remain by writing to me at amber@mathscifound.org.

And, finally, my most heartfelt thanks to my wife Abha and son

Zafar for continually showing me new ways of looking at life.

Amber Habib

Mathematical Sciences

Foundation New Delhi

List of Notation

β, 82

, 217

B(n,p), 217

Cov[X,Y ], 229

δC , 166

DFW, 47

DM, 39

e, 10

, 214

≐, 197

E[X], 221

fS,T, 43

FX , 214

fX , 212, 213

fX,Y , 227

γC , 168

μ, 120

∇f, 203

N(μ,σ), 219

Ω, 210

Φ, 157

ℙ, 210

p* , 139, 141, 148

R, 247

R2 , 91

r, 59

reff, 13

ρ, 230

ρC , 171

S, 209

σ, 59, 120

σX , 222

σI , 165

σX 2, 222

σXY , 229

S2 , 244

sT , 42

SXY , 246

ΘC , 170

Var[X], 222

V C , 170

X, 243

x+ , 157

xq , 216

1 Basic Concepts

T

he aim of finance is to explore how money should be invested.

Imagine that you have inherited a large sum of money from a

rich uncle. The sum is so large that even when you have

satisfied your immediate needs, you still have a considerable amount

left over. What can you do with it? Some typical responses are:

1. Put it in a savings account.

2. Put it in a fixed deposit.

3. Buy bonds.

4. Buy shares.

5. Invest in a mutual fund.

6. Buy gold.

7. Buy real estate.

Of course, there are many other possibilities, but let us start with just

these. The question which arises is––in which of these should we put

our money? This naturally depends on how the nature of these

investments matches with our requirements.

For example, the advantage of a fixed deposit as opposed to a

savings account is that the former pays a higher rate of interest. The

savings account, on the other hand, allows you constant access to

your money, while a fixed deposit requires the money to be with the

bank for a set time such as three months or a year.

A bond provides regular payments over a set time period in return

for an initial payment and is thus rather like a fixed deposit. Many

bonds can be traded during their lifetime, and this provides additional

flexibility to the investor. Bonds are also issued by companies, not

only banks, and typically offer higher gains than fixed deposits. But

there is a downside––if the company hits sufficiently bad times it may

not be able to meet its obligations and the investor may not receive

the promised payments or even get the initial payment back. In other

words, the investor faces default risk, though only in exceptional

circumstances. Risk also enters the picture if the investor wishes to

sell the bond before its expiry, since the price would be affected by

prevailing market conditions and the perceived financial stability of the

issuer.

Risk comes into even more prominence when we consider the

remaining possibilities for investing. Share prices, for instance, vary

greatly from day to day. Even if we invest in a company with an

excellent record, there is no guarantee that we will gain by owning its

shares over the next few months. On the other hand, if we hold on to

the shares for many years we have a good chance of making a

handsome profit. It used to be thought that bonds provide the optimal

way to do well in the long run––say over 20 or 30 years. The current

opinion, however, is in the favour of shares, provided one invests in a

diverse collection of companies and thus reduces the possible loss

due to one or more of them doing badly. Mutual funds, which

distribute the investor’s money over such a collection, cater to the

investor who wants steady long-term growth. The investor who

wishes to make money quickly would invest in just a few shares that

he believes are going to do exceptionally well in the immediate future.

Such an investor would naturally be exposed to high levels of risk.

RISK AND PROFIT

Our discussion has brought forth some aspects of risk and profit.

In this book we shall investigate these in greater detail. The main task

is to quantify the relationship between risk and profit, so we can make

well-informed and precise decisions.

The initial problem is to figure out the ‘correct’ price for a product,

by which we mean a price that satisfies both buyer and seller. We will

refer to it as the value of the product. The products, by the way, could

be anything from commodities like cars or wheat, to bonds and

shares, or even contracts about future transactions. We will use the

generic term asset for the products being traded. A collection of

assets will be called a portfolio.

Beyond pricing, the main decision is what assets to invest in.

Naturally, we would like to invest in ones whose value seems likely to

increase at a faster rate. It is almost a law of Nature, however, that

bigger promises are also less reliable. In fact, less reliable promises

must be bigger if they are to have any takers. Thus, there is a tradeoff between expected profit and risk: to aim for higher profit, the

investor must undertake greater risk.

The fundamental problem in finance is to understand the

relationship between risk and profit.

The word risk is used in finance in a special way. It refers to

uncertainty and does not necessarily have a purely negative

connotation. Thus, consider the choice between putting money in a

bank account or using it to buy shares in a company. The second

investment is riskier because it has more uncertainty, but it is not

obvious how its worth compares with that of the the first one. Lotteries

provide an extreme instance of high-risk investments which are

nevertheless popular.

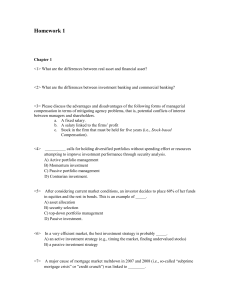

Figure 1.1: Long term behaviour of the return from some asset classes in the

US over the years 1926–1999. (Data from Stocks, Bonds, Bills and Inflation

2002 Yearbook, Ibbotson Associates. Used with permission from Morningstar,

Inc.) Note how the classes with greater mean return are also the ones with

greater fluctuation. Treasury bills, which are considered essentially risk free,

barely outperform inflation!

PROBABILITY

This discussion leads us to the role of probability in finance. The

relative worth of an investment depends on the probabilities of the

possible pay-offs. If higher pay-offs are perceived as more likely, its

value should increase. For example, if we can model the fluctuations

in prices of a stock, we can assign probabilities to the possible payoffs from buying that stock, and thus estimate its value to the

investor.1 Specifically, we treat the future profit as a random variable.

Its expectation then represents the expected profit, while its

standard deviation represents fluctuations and hence risk. (See

Figures 1.1 and 1.2.) 2

Figure 1.2: This diagram considers the 65 stocks making up the Dow Jones

Composite Index and their weekly profits over the one year period ending

November 6, 2006. The mean profit (per dollar invested) is plotted on the

vertical axis, and the standard deviation of the profits (representing risks) is

plotted on the horizontal axis. The curve has been drawn to emphasise the

absence of stocks with high mean profit but low risk – this indicates that higher

mean profit requires greater risk.

RISK-FREE ASSETS

Some assets can be viewed as free of risk. For instance, deposits in

banks and bonds bought from governments are typically treated as

risk-free. Of course, both banks and governments can collapse, but

such instances are rare. We shall soon see that there is good reason

to expect that all risk-free assets will gain in value at the same rate,

and we may therefore talk of the risk-free rate of growth. This rate is

not universally fixed, but varies with market and time.

PORTFOLIOS

So far, we have considered individual assets. To design a portfolio,

we need to consider not only the individual characteristics (regarding

profit and risk) of the assets, but also their relationships with each

other. Two assets could be linked together in certain ways––for

instance, they may show a tendency to rise or fall in value together.

Alternately, one may tend to move in the opposite direction to the

other. In the latter case, a rise in one would be offset by a fall in the

other, and a portfolio consisting of both these assets would be less

risky than a portfolio consisting of only one of them! By combining

assets in various ways, we can tailor a portfolio to satisfy the risk

preferences of any investor.

HEDGING

The process of reducing risk by combining assets appropriately is

called hedging. By hedging we reduce risk and therefore, also lower

our expected profit. One of the goals we will pursue in this text is to

see how to hedge against specific risks to which a portfolio is

exposed, for instance fluctuations in the prices of stocks or in interest

rates. If the hedging is complete, no risk will remain, and the portfolio

will grow slowly at the risk-free rate. Therefore, we will also consider

how to hedge to the right extent, so that the remaining risk just falls

within acceptable levels and the portfolio is able to grow at a faster

rate.

In the latter part of this book we will consider the financial

instruments known as derivatives. Derivatives are contracts that fix

the terms for future trades. A simple example is a contract that binds

two parties to a sale of crude oil, six months from now, at a price of

$50 per barrel.3 A prime use of derivatives is to reduce uncertainty

about future expenses (or profits), and they have become a very

popular means of hedging. The creation and pricing of suitable

derivatives is a major focus of modern finance.

1.1 ARBITRAGE

Arbitrage is the making of profit without undertaking risk. It can be

earned, for instance, when a product is being sold at different prices

in different markets. Then risk-free profit can be made by selling it

where it is costlier and buying it where it is cheaper. A variation is

when the different prices are at different times, so that it is possible to

buy today at a low price and sell some days later at a higher price.

For this profit to qualify as arbitrage, however, it must be absolutely

certain beforehand that the price will go up.

Exercise 1.1.1 Consider the following situations. Is it possible to

exploit them so that profit is certain?

1. A kind relative offers to sell you a share whose value has gone

up by at least 15% every year for 50 years.

2. A valid lottery ticket is lying on the road.

3. Horses A and B race against each other. If you bet a rupee on

horse A and it wins, you get back Rs 2. If you bet a rupee on

horse B and it wins, you get back Rs 4. If you bet on a horse that

loses, you lose your money.

Here is an early use of the term arbitrage in our sense, occurring in a

description of stock and derivative trading in eighteenth-century

Holland:

‘There are other arbitrages and other profitable combinations

independent of gambles or events, which are executed by combining

2 or 3 simultaneous transactions.’ Traite de la Circulation et du Credit

by Isaac de Pinto, 1771. (Quoted in Poitras [36])

Deciding whether a profit has been made can be tricky. If you

invest Rs 10 and after a while it becomes Rs 20, you may feel you

have made a profit of Rs 10. Suppose however, that you are based in

another country and count your gains in dollars. In the given time

period, if the value of the rupee in terms of dollars falls sufficiently far

you will perceive a loss rather than a gain. Yet again, suppose that in

the same period a rupee put in a savings account would have more

than doubled. Then it would be difficult to see the first investment as

truly representing a profit.

A simple way to resolve these ambiguities is to demand that

arbitrage must be carried out without investing your own money

(essentially, this means you start by borrowing some money and then

pay off the loan by the end). If you start with zero and end up with

something, you have definitely made a profit.

A basic principle is that arbitrage opportunities are short-lived:

Prices evolve in such a way as to eliminate them. For, as soon as it is

realised that a product is under-valued and is creating an arbitrage

opportunity, investors will rush to buy it. This will drive up its price,

reducing and ultimately eliminating the arbitrage opportunity. Similarly,

if the opportunity arises from an over-priced product, there will be a

rush to sell it and this will drive its price down.

Reflecting on this process, we are led to the formal definition of

arbitrage. We start by noting that the amount of profit does not have

to be known beforehand: it is enough to know that it cannot be

negative and has a chance of being positive. This will suffice to attract

investors and initiate the stabilisation process described above.

Definition 1.1.2 An investment strategy is said to lead to arbitrage if:

1. It does not involve an initial investment of the investor’s own

money.

2. It is known that at some future time the investment will have a

value which is definitely non-negative and additionally has a nonzero probability of being strictly positive.

Exercise 1.1.3 Which of the following situations provides an

arbitrage opportunity?

1. A guarantee that in return for Rs 10 paid now, Rs 20 will be

returned after ten years.

2. A guarantee that in return for Rs 10 paid now, Rs 20 will be

returned tomorrow.

3. A lottery ticket.

4. A free lottery ticket.

5. Bank A loans money at an annual interest rate of 10%, while

bank B pays 15% interest annually on deposits.

6. Bank A loans money at an annual interest rate of 15%, while

bank B pays 10% interest annually on deposits.

How long an arbitrage opportunity lasts depends on the

communication within the market. The better it is, the faster investors

will react to the situation and eliminate the opportunity. Thus, in the

idealised situation of an efficient market, in which communication is

instantaneous and complete, arbitrage opportunities will die

immediately. This is our main assumption and is used throughout

our text. Its brief statement is:

No Arbitrage Principle: In an efficient market, there are no arbitrage

possibilities.

The No Arbitrage Principle is a surprisingly powerful tool for

establishing the ‘correct’ price of a product and underlies every

important result in this book. It seems to have been first noticed by

Louis Bachelier in his doctoral thesis in 1900 when he described

‘transactions in which one of the parties makes a profit at all prices’

and also noted that ‘these are never found in practice.’4 Its systematic

use in modern finance, however, was initiated by Franco Modigliani

and Merton Miller in the 1950s. Both received the Nobel Prize in

economics––Modigliani in 1985 and Miller in 1990.

1.2 RETURN AND INTEREST

Consider an asset whose value evolves from V0 at an initial time t = 0

to VT at a later time t = T. Then the return from this asset over the

time interval [0, T] is defined to be

Return = VT – V0.

The rate of return is defined by

Rate of return =

.

Commonly, one also writes ‘return’ for ‘rate of return’. Confusion is

avoided by noting that return has a currency as unit, while the rate of

return is unit-free. We will further express rate of return in

percentages. Thus the phrase ‘The return was Rs 10’ refers to the

first definition, while ‘The return was 10%’ refers to the second and

conveys that the rate of return was 0.1.

INTEREST

We will call the income from an investment interest if it is earned

regularly and in a predetermined manner, without risk. (This is a

rather narrow use of the word and we employ it for clarity at this initial

stage.)

Interest can be calculated according to different conventions.

Consider a starting amount P (called the principal) on which interest

is earned over a time period T. The amount of interest earned is given

by the rate of interest, denoted r, in accordance with the adopted

convention. The rate r is given relative to some time interval, called its

period. The most commonly used period is one year, in which case

the rate is called annual.

Rates are commonly given as percentages, which have to be

converted to fractions for calculations.

SIMPLE INTEREST

In simple interest, the interest earned over one period is not added to

the principal (e.g., it may be returned to the investor), and further

interest is again earned on the principal alone. Thus, if P is invested

at a rate of interest r, the amount after one period is

A = P + Pr = P(1 + r).

During the second period, interest is again earned on P alone, so

that the amount after two periods is

A = P(1 + r) + Pr = P(1 + 2r).

This calculation easily extends to the general case:

Theorem 1.2.1 Suppose simple interest is earned on an investment

P at a rate r over n periods. Then the final amount A is

A = P(1 + nr).

□

Example 1.2.2 A common example of simple interest is the provision

of certain types of fixed deposits by banks. The interest earned on the

money in such a fixed deposit account is returned to the investor so

that future interest is earned on the original principal alone.

□

DISCRETE COMPOUND INTEREST

In compound interest, interest earned over one period is added to the

principal and earns interest in subsequent periods. If an amount P is

invested at a rate r, then the amount after one period is

A = P(1 + r),

just as for simple interest. However, in the second period P(1 + r)

serves as the principal, so that the amount after two periods is

A = P(1 + r)(1 + r) = P(1 + r)2.

The general case is again easy to obtain:

Theorem 1.2.3 Suppose compound interest is earned on an

investment P at a rate r over n periods. Then the final amount A is

A = P(1 + r)n.

□

Sometimes the period for which the rate is quoted is not the same as

the interval at which interest is compounded. For instance, the rate

may be given as an annual one, while the interest is calculated every

6 months. In this situation, the rate is adjusted linearly, as in the

following example.

Example 1.2.4 Suppose you invest Rs 10,000 for one and a half

years at an annual rate of 10% with semiannual compounding (that is,

the compounding is every six months). Then interest is calculated for

each six-month period at half the annual rate, i.e., at 5%.

Therefore, over one-and-a-half years, the invested amount

becomes

A = 10,000 × 1.053 = 11,576.25.

□

If interest is compounded m times during the period of the rate, then

the rate per compounding period is set to r/m and so we have the

following result.

Theorem 1.2.5 Suppose compound interest is calculated with a rate

r and is compounded m times per period. Then, over n periods an

investment P grows into an amount A given by:

A=P

n.

□

Example 1.2.6 Savings accounts in banks provide an example of

compound interest since the interest earned on the amount in the

account is fed back into the account.

□

Exercise 1.2.7 Suppose you take a loan of Rs 1000, and have to pay

it back in two equal and equally spaced installments over a year. The

annual rate of interest applied to this loan is 15% and the interest is

compounded semi-annually.

a. What will be the size of each installment?

b. How much of each installment will go toward the principal and

how much toward the interest? (Assume that each payment has

to pay off the outstanding interest at the time.)

CONTINUOUS COMPOUND INTEREST

Consider a bank offering interest compounded annually at a rate r.

Suppose it allows an investor who withdraws his money at a time t

before one year to earn interest at a linearly adjusted rate of rt. For

example, an investor can withdraw his investment of P after 6

months, together with the interest earned. It would total P(1 + r/2). He

can then immediately reinvest it for another 6 months. This strategy

nets him a final amount of

A = P(1 + r/2)(1 + r/2) = P(1 + r + r2⁄4),

which is slightly better than the P(1 + r) he would have had if he had

just let the money sit in the bank for the whole year. An investor who

can create this strategy will certainly think of pushing it further by

using smaller and smaller investment periods. In general, if he

withdraws and reinvests m times, he will end up with

m.

A=P

For example, if P = 100 and r = 10%, we have

m=2

⟹

A = 110.250

m=4

⟹

A = 110.381

m = 12

⟹

A = 110.471

m = 52

⟹

A = 110.506

m = 365

⟹

A = 110.516

The larger the value of m, the greater is his profit. This naturally leads

to considering the limit case m →∞. To evaluate this limit, we need to

recall the number e, which is called Euler’s number and is defined by

Euler’s number is approximately 2.71828. Now we can calculate:

This suggests creating a new kind of interest calculated by A = Per for

a single period.

Interest calculated according to this formula is said to have been

continuously compounded, and r is called the continuously

compounded rate of interest.

Theorem 1.2.8

Suppose continuously compounded interest is

calculated with a rate r per period. Then, over n periods an

investment P grows into an amount A given by

A = Penr.

□

Again, if we take P = 100 and r = 10%, then the continuously

compounded amount after a year is

A = 100 e0.1 = 110.517,

while daily compounding over a year gave 110.516. Thus daily

compounding is barely differentiable from continuous compounding!

INTEREST AT ARBITRARY TIMES

We have been considering the interest earned when money is

invested for a full time period, or for n full time periods. Now we look

at what happens when an investor withdraws her money at some

intermediate time. In particular, let the investor withdraw her money

after a time T which consists of n full time periods and a final fraction t

of a time period (so 0 ≤ t < 1).

The convention we will adopt is that during the fractional period

the rate of interest is adjusted linearly to rt. (Note that this is

consistent with the convention used when the period for the quoted

rate differs from the compounding period.) Then, over the time T, the

invested amount becomes

Simple interest: A = P(1 + nr) + Prt = P(1 + rT)

Discretely compounded interest: A = P(1 + r)n(1 + rt)

Continuously compounded interest: A = Penrert = PerT

The formulas for simple and continuously compounded interest are

mathematically simple, while that for discrete compounding is slightly

more complicated. If we plot A versus T, then for simple interest we

get a straight line, for discretely compounded interest a sequence of

straight line segments with increasing slope, and for continuously

compounded interest a smooth exponential curve (Figure 1.3).

Figure 1.3: This diagram shows the growth of Rs 100 according to the

different interest rates, each with r = 10%, over a period of 10 years.

Exercise 1.2.9 Consider a bank that offers to double your investment

in 10 years. What is the corresponding annual rate of interest if we

assume the interest is:

a. simple

b. compounded annually

c. compounded continuously.

Continuous compounding is mathematically pleasant in another way.

Withdrawing and reinvesting becomes just the same as making a

single long investment since

erT1erT2 = er(T1+T2).

Moreover, if continuous compounding is used, the same r can be

used for borrowing and lending without creating arbitrage

opportunities. This is not the case with discrete compounding.

Exercise 1.2.10 Suppose a bank has fixed an annual 5% discretely

compounded interest rate for both deposits and loans. Show that this

creates an arbitrage opportunity.

Exercise 1.2.11 Given that continuous compounding has nicer

behaviour than discrete compounding, can you explain why financial

institutions use the latter?

Let us now consider the possibility of different interest rates being

available in the market. The differences could be of various types:

1. Use of different types of interest (simple or compound with

different periods).

2. Different rates offered by different financial institutions.

3. Different rates for deposits and loans.

4. Different rates for investments of different time durations.

Typically, institutions use discretely compounded interest. The

difference would be in the frequency of compounding. The same

value of r but with more frequent compounding leads to more interest

being earned. Thus institutions doing more frequent compounding

would also use slightly lower values of r. Continuous compounding is

used more in mathematical modelling, and these models would use a

value of r that is essentially equivalent to that being used for discrete

compounding in the real world.

EFFECTIVE RATE OF INTEREST

One way to reduce the confusion from different kinds of interest is to

calculate for each the amount of interest it earns over one year. In

other words, we calculate the annually compounded interest rate that

would generate the same amount of interest.

Thus, suppose that a principal P has grown to an amount A by

earning interest over a year. Then the interest earned is A–P. The

corresponding effective rate of interest is defined to be the interest

earned in one year per unit invested:

reff =

.

We can expect that the effective rates of various available interestearning schemes would be the same.

The quoted rate of interest is called the nominal rate, to

distinguish it from the corresponding effective rate.

Example 1.2.12 Consider a nominal rate r of 10% annually. If this is

used with annual compounding, then the corresponding effective rate

is again 10%. If the compounding is semi-annual (every 6 months),

the effective rate becomes (1 + 0.1⁄2)2 – 1 = 0.1025, i.e. 10.25%.

Finally, if continuous compounding is used, the effective rate is e0.1 –

1 = 0.1052 or 10.52%.

□

Exercise 1.2.13 A credit card offers a cash withdrawal facility at a

“low” monthly rate of 2%. What is the corresponding effective annual

rate?

Exercise 1.2.14 Consider two investments A and B of the same

amount, and at the same effective annual interest rate. Suppose A

earns semi-annually compounded interest and B earns continuously

compounded interest.

a. Which one earns more interest if the period of the investment is:

6 months, 9 months, 1 year?

b. Suppose the invested amount is Rs 1000, and the common

effective rate is 10%. What is the maximum difference in the

interests earned by A and B at any point during the first 6

months? (The answer is quite small, so use a good number of

decimal places in your calculations.)

Let us now look at the other kinds of variations in interest rates listed

on page 12. The second kind of variation can be expected to be small

due to competition. A bank offering lower interest on deposits than its

competitors would soon start losing customers and would have to

raise its rates.5

The third kind certainly exists. Thus, a bank will offer lower interest

on deposits than it will exact on loans. However, it should be noted

that only the first rate can be reasonably seen as risk-free. The

second rate involves a risk taken by the bank, which explains why it is

higher.

Exercise 1.3.15 Show that the No Arbitrage Principle rules out a

bank offering higher interest on deposits as compared to loans.

The fourth kind of difference is quite important and we will consider it

in detail later (§2.8). As a general (but not universal) rule, investments

for longer time durations are granted higher interest rates. The idea is

that such an investment is exposed to more risk over its life and, to

compensate, it must promise a higher profit.

Example 1.2.16 In April 2005, 6-month investments in Reserve Bank

of India bonds were earning 5.4% interest, while 12-month

investments were earning 5.6%.

□

We can, therefore, expect the same effective interest rates for

investments of the same duration. Thus, we may (and do) talk of a

common risk-free rate that applies to all risk-free investments over

the same time period.

1.3 THE TIME VALUE OF MONEY

Consider two offers: the first promises you one rupee right away and

the other, after a month. Assuming both the offers are from

trustworthy sources, do you have any reason to prefer one to the

other? The simple answer is that it is better to get the money early, as

it can be put in a bank to start earning interest. This example

illustrates the important idea that the value of a transaction involves

not only an amount of money but also the time at which it is

undertaken.

PRESENT AND FUTURE VALUE

We have observed that holding a rupee now is not the same as

holding it a year from now. Well then, what is the precise difference

between the two? It depends on how much the rupee could have

earned in a year by means of interest.

Example 1.3.1 Suppose a rupee can be invested at a simple annual

rate of 5%. Then, after a year, it becomes 1.05 rupees. In this

situation, earning a rupee now is equivalent to earning 1.05 rupees

after a year.

□

In the above example, Rs 1.05 is the future value of Rs 1.

Conversely, Rs 1 is the present value of Rs 1.05.

In general, consider two amounts P and F that exist at times t1

and t2 respectively, with t1 < t2. Let the risk-free rate of return over the

interval [t1,t2] be r. Then we call P the present value of F (at t1) if

P=

.

Conversely, F is the future value of P (at t2). The factor C = 1/(1 + r) is

called the discount factor for this period.

If the risk-free rate is given in terms of interest, then the

corresponding discount factor can be calculated as follows:

1. Suppose the annual interest rate is r, with compounding being m

times a year (after equal periods of time). Then the discount

factor over n periods is

C=

.

2. If the interest is compounded continuously, then the discount

factor over T years is

C = e−rT.

The following cannot be over-emphasised:

Amounts of money existing at different times must not be compared

or combined without taking into account the relevant discount

factors.

INFLATION

Another way that the value of money changes through time is with

respect to its purchasing power. Typically, the same amount of money

can buy less and less as time progresses––this phenomenon is

known as inflation. Inflation shows up as a general increase in

prices. Occasionally, prices may fall, and then we have a deflation

situation. But inflation is the general trend.

By averaging the rise in prices over various commodities, one can

arrive at a single number––the rate of inflation f––which represents

the annual decrease in purchasing power of a unit of currency.

Purchasing power after 1 year =

.

If an amount A is invested at the risk-free rate r for a year, then the

effective amount one has after a year is

A,

and so, we may talk of the real risk-free rate r′ defined by

1 + r′ =

, or r′ =

.

Exercise 1.3.2 If continuous rates are used for inflation as well as

risk-free growth, show that the real risk-free rate is given by r′ = r − f.

Example 1.3.3 The Reserve Bank of India calculates inflation rates

from the Wholesale Price Index (WPI) which tracks the price of a

certain varied mix (or ‘basket’) of commodities. The RBI also

maintains subindices for food articles, manufactured articles, and so

on. The table below shows the WPI during 1993−99:

For example, the inflation rate over 1994-95 would be calculated as

follows. Since the price of the basket rose from 100 to 112.6, we

could say that the purchasing power of the rupee changed by a factor

of 100/112.6 = 0.888. The rate of inflation can now be obtained:

=

= 0.888

f = 0.126 or 12.6%.

We can repeat these calculations to obtain the inflation rate for

each period:

Exercise 1.3.4: If an investment (in rupees) earned an annually □

compounded 8% interest throughout the period 1993–99, what

would be the return from it in real terms (i.e., in terms of purchasing

power)?

In this book, we will not worry about inflation. The above

discussion shows that, if necessary, inflation can be taken into

account by a suitable modification of the risk-free rate.

Indeed, the fact that inflation applies to all amounts of money

makes it less relevant to financial choices than we may expect. For

example, consider a choice between the following offers:

1. Rs 100 now

2. Rs 110 a year from now

Suppose the available interest rate is 8%. Then the first amount

grows to Rs 108 over a year – and this is a bit less than Rs 110. Most

people, however, still prefer the first choice. They argue that the Rs

110 will also be subject to inflation and so they would prefer to have

the Rs 100 now.

Yet the point to remember is that present value is not just a

theoretical notion––it has practical implications. If we are sure of

receiving Rs 110 in a year, we can borrow its present value against it

today. In this case that amounts to Rs 101.85. In other words, the

second offer is equivalent to an offer of Rs 101.85 today, and so it

wins no matter what the rate of inflation is.

1.4 BONDS, SHARES AND INDICES

Bonds and shares are the principal means by which institutions raise

money for their operations, and hence they provide the chief avenues

for investment.

A bond is a contract written by a company or government (called

its issuer). The purchaser of the bond makes an immediate payment

to the issuer and, in return, is entitled to a predetermined number of

regular payments in the future. Thus, a bond is essentially a loan.

Institutions use bonds to raise money when the amount needed is too

large to be obtained from a single source. Investors use bonds as

relatively safe investments providing a higher rate of return than a

simple deposit in a bank. Judiciously used, they can provide

insulation from interest rate changes as well. (We will take up this

application in §2.9.)

A share represents a part of the capital of a company. Its owner is

thus a part-owner of the company and takes part in its fortunes. The

share may offer him certain voting rights in the affairs of the company.

Many companies also release regular payments, called dividends, to

their shareholders out of their profits. The term stock is also used for

a share. Another usage of the word stock is the total capital

represented by the shares, or the total market capitalisation (TMC)

of the company.

A stock index is a hypothetical portfolio used for keeping track of

the general trends in the market.

Here are some examples of stock indices from India6:

1. BSE Sensex is based on 30 stocks forming a sample of large,

liquid and representative companies listed on the Bombay Stock

Exchange (BSE).

2. S&P CNX Nifty consists of the 50 stocks with highest TMC on the

National Stock Exchange of India (NSE). It represents about 60%

of the TMC on the NSE.

3. S&P CNX 500 consists of 500 stocks and covers 91% of the total

turnover on NSE and 92% of the market capitalisation.

4. CNX Realty Index represents 85% of market capitalisation and

88% of turnover in the real estate sector.

Here are some international examples:

1. Standard and Poor’s 500 Index (S&P 500), is based on 500 US

stocks. S&P 500 covers about 70% of the total TMC and 78% of

the total traded value.

2. Dow Jones Industrial Average (DJIA) consists of 30 of the largest

public companies in the US. It was created in 1896, when it

consisted of 12 companies (See Figure 1.4).

Figure 1.4: The Dow Jones Industrial Average Index (DJIA) between

1928 and 2008

3. NASDAQ 100 consists of 100 of the largest companies (including

non-US ones) listed on the NASDAQ exchange. It is relatively

heavy in IT companies. Infosys is one of the current components

of this index.

4. NASDAQ Composite (or just ‘the NASDAQ’) includes every

company listed on the NASDAQ exchange––currently more than

3000.

5. NYSE Composite includes each of the over 2000 stocks listed on

the New York Stock Exchange.

6. FTSE 100 consists of the top 100 companies in terms of TMC on

the London Stock Exchange. It represents about 80% of the TMC

on the London Stock Exchange.

7. Nikkei 225 is based on the Tokyo Stock Exchange.

8. Hang Seng Index consists of 39 companies listed on the Hong

Kong Stock Exchange and comprising 65% of its TMC.

Figure 1.5: In this diagram we plot the logarithms of the DJIA values and see

that they have a strong linear trend. They also enable a clearer look at the

relative size of fluctuations over a long term.

Of these various stock indices, the smaller ones (with 30–50

constituents) give a summary of some particular aspect of the

economy––perhaps of its largest companies, or of those belonging to

a particular sector. Larger ones attempt to portray the national

economy as a whole. Recently, stock indices have been created that

track entire continents or the whole world.

In this book we will consider two important uses of stock indices.

One is as a benchmark against which other portfolios are measured.

This aspect will be prominent in the applications of the Capital Asset

Pricing Model. Another, which we take up during our study of financial

derivatives, is as a tool to hedge against the general movements of

the economy.

1.5 MODELS AND ASSUMPTIONS

Any mathematical treatment of ‘real life’ must start by simplifying and

thereby distorting it. A good choice of simplification is one that distorts

less and yet leads to more insight. We may even accept a choice that

we know is an over-simplification if it brings clarity to some essentials.

Thus, the nature of mathematical modelling is quite different from

what we generally expect of mathematics. We are less concerned

with the validity of our deductions than with the value of the final

result.

In this text, the main mathematical assumption is the No Arbitrage

Principle, sitting atop the assumption of an efficient market. In the real

world, arbitrage opportunities do exist and, in fact, some financial

institutions invest considerable effort in quickly detecting and

exploiting them. The assumption, however, is almost indispensable

because of the tremendous direction it gives to our work. It is further

justified by the observation that arbitrage opportunities, when they

exist, do not exist for long.

We have also ignored many other aspects of real markets.

Foremost among these are the various costs associated with

transactions––fees charged by exchanges and brokers as well as

taxes to governments. These are collectively known as friction in the

financial world since they slow down its machine by lowering profits.

Friction also has the effect of obliterating small arbitrage

opportunities. The result is that the No Arbitrage Principle does not

yield a finely balanced single ‘correct’ price but a range of valid prices.

Yet another issue is the linearity of prices. This is, after all, true

only for small trades. Further, high volume trades affect prices. If you

attempt to offload a large amount of a particular stock at today’s price,

your act will lower its price, and you will likely end up with less than

you had hoped for. We have not taken up such complications in our

book.

The material in this book, therefore, constitutes only the first few

steps on the path to acquiring a detailed understanding of finance. Yet

these few steps are the most crucial and bring to you tools of great

power and reach.

1 We shall look at specific stock price models in Chapter 5 of this book.

2 You can ignore this discussion for now if you are unfamiliar with the terms

random variable, expectation, and standard deviation. However, you should

start your study of the basics of probability (Appendix B) and familiarise yourself

with these concepts as they will soon become essential.

3 A barrel of oil equals 159 litres. Between January and December 2008, the

price of a barrel of crude oil rose from $85 to $122 (in June) and then fell all the

way to $33!

4 The English translation is by Davis and Etheridge on page 24 of [17]. The

seminal contributions of Bachelier are described in more detail in the

introductory remarks of our fifth chapter.

5 The rates would have to be compared after taking into account any fees

charged by the banks. A bank offering better service might also get away with a

lower rate. Thus, in the real world, we only expect the differences to be small –

not absent.

6 For more information, consult the websites of the National Stock Exchange of

India

(www.nse-india.com)

(www.bseindia.com).

and

the

Bombay

Stock

Exchange

2 Deterministic Cash Flows

A

cash flow is a sequence x0,x1,…,xn of cash transactions

occurring at corresponding times t0, t1, …, tn (We will always

take t0 = 0, the present time). Earnings are represented by

positive signs, and expenditures by negative signs. For example, if a

cash flow has annual transactions –1000, 400, and 700, then the first

entry is an expenditure while the next two are earnings.

A cash flow may, for example, represent the earnings and

expenses associated with a particular investment, or a portfolio of

investments, or the entire cash transactions of a company. It may also

represent a single transaction.

An investor or a manager needs to know how to choose between

competing investments or projects. To do this, she has to be able to

summarise the corresponding cash flows by one or two numbers that

characterise the profits associated to them. The final decision will be

made on the basis of these numbers. We will see that there isn’t any

one number that works universally. Instead, there are different

methods of comparison catering to the different requirements that she

may have.

In general, a cash flow is random in that the entries are not known

ahead of their time. We will start, however, by imagining that the

entries are known in advance, i.e., the cash flow is deterministic.

This is justified on the grounds that there are important cash flows

which are indeed deterministic (for example, income from government

bonds, which we shall study later on in this chapter). Furthermore,

when choosing between two projects, we calculate their projected

earnings and expenses and, for the purpose of comparison, act as if

these cash flows will indeed happen.

It is often convenient to depict a cash flow by a diagram like the

one given in Figure 2.1. In this diagram, the times when the

transactions occur are marked along the horizontal axis. The

transactions are represented by vertical arrows—these point up for

earnings and down for payments, while their lengths represent the

amounts of cash involved.

Figure 2.1

2.1 NET PRESENT VALUE

Consider a cash flow x0, x1, …, xn occurring at times t0 = 0, t1, …, tn.

Let Ci be the discount factor for the time interval [t0, ti]. Recall that the

discount factor gives the present value of an investment. Thus the

present value of xi is Ci xi .

The net present value or NPV of the cash flow is just the sum of

the present values of all the entries:

NPV = ∑ i=0nC ixi.

Owning this cash flow is equivalent to an immediate earning equal to

its NPV. To see this, we split the NPV into its constituent parts, C0x0 =

x0, C1x1, …, Cnxn. We invest each part Cixi in a risk-free asset for the

corresponding time ti. Then, over this time it grows into the amount xi.

Thus, the NPV is the exact amount needed now to generate the given

cash flow.

Hence one way to compare different cash flows is to compare

their NPVs.

Example 2.1.1 Consider two projects with projected annual earnings

as given below:

0

1

2

A

–500

–100

700

B

–500

700

–100

Let the discount factors for the first and second years be 0.9 and 0.8

respectively. Then the net present values of A and B are given by

NPV(A)

=

–500 – 0.9 × 100 + 0.8 × 700

=

–30

NPV(B)

– 500

–500 + 0.9 × 700 – 0.8 × 100 = 50.

=

50

Thus, on the basis of NPV, project B is better than project A. If the

time value of money had not been taken into account, the projects

would have appeared identical, each showing a total expenditure of

600 and an earning of 700.

□

An important special case is when the cash flow occurs at regular

intervals (e.g., it may consist of annual payments), and the same riskfree rate can be applied to all its entries. Thus, suppose the risk-free

rate is r over each interval and we use discrete compounding. Then

the discount factors are

and so,

where x0 is earned at time zero, x1 after the first interval, and so on.

Example 2.1.2 An annuity consists of annual payments of the same

amount A. An annuity lasting for n years would be represented by

Figure 2.2.

Figure 2.2

The NPV of an n-year annuity, with the first payment after 1 year, can

be calculated as follows (assuming a constant risk-free rate r):

Here we have a geometric sum of the form

Fortunately, there is a formula for such a sum:

, with x = 1⁄(1 + r).

We substitute this formula in the previous equation and obtain

If the annuity is from a source that can be considered risk-free, then

this NPV is the fair price at which the annuity should be traded at time

0.

□

Example 2.1.3 A perpetuity is an annuity that extends forever. Its

NPV can be obtained by letting n →∞ in the previous calculation:

NPV =

.

The formula is more easily understood by treating the NPV as the

amount which can generate annual payments of A when the rate of

interest is r. This immediately gives

NPV × r = A.

□

Until the First World War, perpetuities were a popular way for

European governments to raise money, particularly for war.

Speculation centered around trade in these perpetuities was a major

financial activity. In 1900, the center for such trade was the Paris

Stock Exchange, and the total capital loaned through perpetuities was

70 billion gold francs (by the governments of France, Germany,

Russia, etc.). In comparison, the annual budget of France was 4

billion francs! (Source: Taqqu [49])

Net present value is an easy-to-calculate technique for choosing

between projects. Another nice property of NPV is additivity: the NPV

of two cash flows taken together is the sum of their NPVs. In symbols,

NPV(A + B) = NPV(A) + NPV(B).

Thus one can build up a view of a project by separately evaluating its

parts.

Example 2.1.4

Figure 2.3(a).

Consider two cash flows, A and B, as shown in

Figure 2.3(a)

The cash flow A+B collects these transactions into a single cash flow

shown in Figure 2.3(b).

Figure 2.3(b)

□

It is important to keep in mind that net present value does not use

only the intrinsic properties of the cash flows but is closely tied to

market conditions in the form of interest rates. Since interest rates

fluctuate with time, a project that starts off with higher NPV may not

stay that way. For instance, in Example 2.1.1, if the sequence of

discount factors is changed to 0.8, 0.9, then project A becomes better

than project B.

In the next section we will study a measure which uses only the

intrinsic properties of a cash flow to evaluate it.

2.2 INTERNAL RATE OF RETURN

Once again, consider a deterministic cash flow sold at time t = 0 for a

price P. Its internal rate of return or IRR is that rate of interest r

which would allow the flow to be generated from its price. Another

way of putting this is to say that IRR is the rate of interest which would

make the cash flow’s NPV equal to P.

Let us look at some simple examples.

Example 2.2.1 Consider a cash flow of 2,4 occurring after 1 and 2

years respectively. Suppose it is sold at a price P = 5 at time t = 0. For

a (discretely compounded) interest rate r, the NPV of this flow is

+

.

Therefore the IRR is obtained by solving the following equation for r:

5=

+

.

This can be rearranged into a quadratic equation

5(1 + r)2 – 2(1 + r) – 4 = 0,

leading to the two values

r = 0.12, – 1.72.

Now, since the price paid is less than the total earned, it is clear that r

should be positive. So we reject the value –1.72 and obtain 0.12 as

the IRR.

□

IRR need not always be positive. For example, suppose the cash flow

in the last example was bought at a price P = 7. Then the two

solutions for r are

r = – 0.09, – 1.63.

Both solutions are negative, which was to be expected since the

amount paid is more than that received. Can we still reject one? Since

some of the amount paid does come back, it is clear that the loss

does not reach 100%. Hence we should have r > –1. This leads us to

reject the value –1.63 and take the IRR to be –0.09.

Figure 2.4: Internal rate of return for the cash flow in Example 2.2.1

In Figure 2.4 we plot the NPV of the last example as a function of

r:

f(r) =

+

.

The intersection of the graph with the horizontal line at height P gives

the possible values of IRR if this cash flow is sold for P at time 0.

Figure 2.4 shows that we always obtain one value below –1 and one

value above –1. Due to the reasons given above, the value which is

above –1 is taken to be the IRR.

Consider a regular cash flow of amounts x1, …, xn, occurring at

times 1, …, n and sold at time t = 0 for a price P. Its IRR is then a

solution of the equation

(2.1)

If we include P as part of the cash flow, we obtain the cash flow x0 = –

P,x1,…,xn, occurring at times 0,1,…,n. In this notation the IRR

equation is

(2.2)

The internal rate of return has the virtue of using only knowledge of

the cash flow, without any reference to external and transient factors

like interest rates. The characterisation of a cash flow by a rate of

growth is also intuitively appealing, and so, the most popular

technique for attracting investors is to promise a high IRR.

The IRR is a solution of a polynomial equation since equation (2.2)

can be rearranged into

Unfortunately, a polynomial equation may have no solution, and in

that case IRR will not be defined.

One of the earliest non-trivial cubics to be solved was

+

+ 15x = 50

by Dardi of Pisa, circa 1350 AD. The equation arose out of a

calculation of monthly interest on a loan (Source: Hughes[25]).

Exercise 2.2.2 Consider the cash flow x0 = –1,x1 = 0,x2 = –1. Show

its IRR is not defined.

Exercise 2.2.3 Consider a cash flow in which x0 < 0 and the net

inflow is greater than the net outflow. Show its IRR equation has a

solution.

A more significant source of trouble is that a polynomial equation may

have many solutions, and then we may not be able to say which is the

‘right’ IRR.

Exercise 2.2.4 Consider the cash flow – 1, 8, – 17, – 2, 24 at times

0,1,2,3,4. Its IRR equation is

– (1 + r)4 + 8(1 + r)3 – 17(1 + r)2 – 2(1 + r) + 24 = 0.

You can verify by substitution that the solutions are r = – 2,1,2,3.

□

There is one situation in which the IRR is defined without ambiguity.

Consider a cash flow occurring at times 0, 1, …, n such that there is

exactly one sign change in the transactions. Such a flow has the form

– x0,– x1,…,– xk,xk+1,…,xn,

or

x0,x1,…,xk,– xk+1,…,– xn,

with each xi ≥ 0. In both cases the IRR equation is

– x0 –

–

–

+

+

= 0.

We multiply each term by (1 + r)k and rearrange:

x0(1 + r)k + x 1(1 + r)k–1 +

+ xk =

+

+

.

Figure 2.5

Consider the left side of this equation as a function of r. As r varies

over (–1,∞), the values of this function increase from xk to ∞. On the

other hand, the right-hand side decreases from ∞ to 0. Therefore the

two sides meet at exactly one point, as depicted in Figure 2.5.

Hence, in this situation, there is a unique value of r which satisfies

the IRR equation as well as r > –1.

TECHNIQUES FOR CALCULATING IRR

In the situations when the internal rate of return is defined, we still

have to solve equation (2.1) to find it. Usually, it is not possible to

solve it exactly, but there are techniques for finding approximate

solutions. The simplest one is the following.

BISECTION METHOD

Consider the function

Calculate values of f(r) for different values of r until you find values r1

and r2 such that f(r1) > P > f(r2). Then the IRR is between r1 and r2.

Let r3 be the midpoint of r1 and r2. If f(r3) > P, the IRR is between r3

and r2; otherwise it is between r3 and r2. Take the appropriate

midpoint and continue the process. The midpoints give a sequence of

gradually improving approximations to the IRR.

Example 2.2.5 Consider a cash flow of 1,2,2,4 at years 1,2,3,4.

Suppose it was sold for a price of P = 5 at time 0. Let

f(r) =

+

+

+

.

We calculate f(0.1) = 6.8 and f(0.5) = 2.9; hence the IRR is between

0.1 and 0.5. Their midpoint is 0.3 and f(0.3) = 4.3, so the IRR is

between 0.1 and 0.3. The next midpoint is 0.2, with f(0.2) = 5.3.

Proceeding in this way, we create the following sequence of

approximations to IRR:

0.3, ,0.2, 0.25, 0.225, 0.2375, 0.23125, 0.228125, …

In fact, f(0.228) = 4.979, so 0.228 is a reasonable approximation to

the IRR.

□

We now present a more sophisticated technique for solving f(r) = P.

NEWTON–RAPHSON METHOD

We first calculate the derivative of f(r):

We then define

The method starts with any choice of a value r1 of r. We then define r2

= g(r1), r3 = g(r2), and so on. If this sequence converges to some

value s, then by taking limits on both sides of the definition of g, we

see that

s=s–

, and hence f(s) = P,

which means that s is the IRR.

Example 2.2.6 Let us apply the Newton–Raphson method to the

situation of Example 2.2.5. If we start with r1 = 0.5, the rule rk+1 = g(rk)

creates the following sequence:

0.5, 0.08, 0.19, 0.224, 0.22618, …

We find that f(0.22618) = 5.00007, so this method has given a much

better approximation than the bisection method, and in fewer steps! □

These methods are built into spreadsheet programs such as Microsoft

Excel and OpenOffice Calc. Both of these have a tool called Goal Seek

in which we can set up the values and solve the IRR equation.

IRR AND PROJECT CHOICE

IRR attempts to capture the rate of growth of an investment. Hence,

we would usually prefer a cash flow with a higher IRR.

Example 2.2.7 Consider the two projects of Example 2.1.1.

The IRR of A is 8.7%. The IRR equation for B has two solutions:

23.8% and –83.9%. Since the investment in B is less than the gain,

we reject the negative value and take 23.8% as the IRR. So, on the

basis of IRR, we would choose B.

□

The next example illustrates that some caution is needed while

applying this principle.

Example 2.2.8 Consider the following cash flows.

t=0

t=1

A

100

–150

B

–100

150

Cash flow A represents borrowing while cash flow B represents

lending; both have an IRR of 50%. While this high IRR is good for the

lender, it is bad for the borrower!

NPV, unlike IRR, would have distinguished between the situations

of borrowing and lending. For instance, with the risk free rate set at

5%, NPV(A) = –42.86, and NPV(B) = 42.86.

□

In a cash flow with a single sign change, we can say which side of the

deal we are on whether we are giving or taking the loan. If the cash

flow has initial positive signs we are taking the loan and if the initial

signs are negative we are giving it. In more complicated flows we

cannot say, and then a high IRR is just as likely to be bad as good!

2.3 A COMPARISON OF IRR AND NPV

We have encountered two ways of evaluating projects, with rather

different characteristics. They may make opposing recommendations,

so it is important to have some understanding of their relative

strengths and weaknesses. The main features of NPV are:

1. It is always well defined, and easy to calculate once the interest

rates are known.

2. It is linear: the NPV of the whole is the sum of the NPVs of the

parts.

3. It gives a sense of the total profit over the life of the project.

4. It does not give a sense of the rate of growth of the project—

either in the sense of profit per unit investment or in the sense of

growth per unit time.

Let us emphasise the last point with a couple of examples.

1. Is an NPV of a million really desirable? What if it is earned from a

project with a total investment of a billion?

2. Again, is an NPV of a million from a project that lasts 20 years

obviously better than an NPV of 500,000 from a project that lasts

5 years?

The first of these difficulties can be handled as follows. Given a cash

flow, we let

I = magnitude of the NPV of the negative entries,

N = NPV of the full cash flow.

Then the present value ratio (N⁄I) gives the value per unit invested.7

With IRR, the situation is just the reverse.

1. It is only well defined for very simple cash flows, and even then it

is not easy to calculate. On the other hand, it requires no extra

information (like interest rates).

2. The IRR of the whole cannot be obtained from the IRRs of the

parts.

3. It does not give a sense of the total profit over the life of the

project.

4. It gives a sense of the rate of growth of the project—both in the

sense of profit per unit investment and in the sense of growth per

unit time.

5. Finally, let us recall from the last session that it may not be clear

whether a high IRR indicates a high rate of profit or a high rate of

loss!

Here, we would be troubled by questions such as:

1. Is a small project with an IRR of 30% to be preferred to a large

project with an IRR of 20%?

2. Is a project with an IRR of 30% over 10 years to be preferred to a

project with an IRR of 20% over 20 years?

NPV and IRR are indicators of the virtues or faults of a project.

Neither should be taken as giving the final word. The information they

convey must be supplemented by a careful analysis of the investor’s

needs and plans. For example, if a project is a stand-alone

opportunity with a clear-cut life, then NPV is better. An example of this

is the construction and sale of an office building. Starting and running

a car factory is a project of a very different kind. Here one would be

interested in the annual growth of profit rather than the total gain over

the life of the factory—here IRR is the natural fit.

MODIFIED IRR

In recent years, another measure of the rate of growth has gained

popularity. It is called the modified internal rate of return or

modified IRR or MIRR. It is a sort of hybrid of NPV and IRR. In

MIRR, we evaluate a project’s cash flow within the context of the firm

undertaking it. All negative entries (outflows) are assumed to be

generated by investing at a certain rate called the finance rate. All

positive entries (inflows) are assumed to be reinvested at another rate

called the reinvestment rate. Typically, the finance rate is taken to be

the market risk-free rate. The reinvestment rate is usually the firm’s

cost of capital—the rate at which its overall growth is taking place.

We estimate the total investment by taking the NPV of all the

negative entries using the finance rate. Let us denote the magnitude

of this NPV by P. The gains are estimated by taking the net future

value of all the positive entries using the reinvestment rate at the

conclusion of the cash flow. Let us denote this net future value by A.

The MIRR μ is then defined to be the interest rate under which P

would grow into A over the life of the cash flow. If the life is n time

periods, then the MIRR per period is defined by

P(1 + μ)n = A.

Example 2.3.1 Consider the cash flow with annual payments of –

1000, 2000, –1000, 2000. Suppose the relevant annually

compounded rates are:

Finance rate

=

10%

Reinvestment rate

=

20%.

Then,

P = 1000 +

= 1961.17,

A = 2000 × 1.202 + 2000 = 4880.

Therefore, the MIRR μ is defined by

1961.17(1 + μ)3 = 4880,

and this gives MIRR= 0.36 or 36%. On the other hand, the IRR of this

flow is 100%!

□

2.4 BONDS: PRICE AND YIELD

A fixed income security is a tradeable contract detailing a

deterministic cash flow. The buyer of the security receives

predetermined amounts of money at predetermined times over the life

of the contract. The basic problem is of pricing: how much should the

buyer pay for this security? This can be tackled through NPV and

IRR. Such securities can be seen as risk-free, except for the

possibility of default, where the writer of the contract is unable to

make the promised payments. However, there is an additional

element of risk: the value of a cash flow depends on the interest rates

in effect and will fluctuate with changes in these rates. Therefore, we

need a measure not only of the price but of the sensitivity of the price

to market conditions. These, and related matters, will be taken up in

the rest of this chapter.

The most common form of a fixed income security is a bond.

While bonds come in various flavours, the simplest one consists of n

equal payments (called coupon payments or coupons) of an

amount C paid at regular intervals, together with an additional

payment F (called the face value) made with the last coupon

payment. This is represented in Figure 2.6.

Figure 2.6

The face value is also called the maturity value or par value. The

date on which it is paid is called the maturity date. Bonds with this

simple structure are called straight or plain vanilla bonds. More

complicated bonds may offer one party the right to terminate the

contract early or allow for some fluctuation in the coupon payments.

Suppose the cash flow offered by a bond is purchased for some

price P. This price depends not only on the structure of the bond itself

but also on certain external factors. Two important factors are:

1. The current interest rates: Higher interest rates reduce the

present value of the future payments and hence the value P of

the bond.

2. The risk of default by the writer of the bond: If the perceived risk

is higher, the bond has to offer greater return to compensate.

This is achieved by a decrease of P.

In this book we shall ignore the second factor and treat bonds as if

they are risk-free. We only note that the investor can use credit

ratings from various agencies to gauge the risk of default. In the US,

the popular rating agencies are Moody’s, Standard and Poor’s (S&P)

and Fitch IBCA. In India we have CRISIL (Credit Rating Information

Services of India, Ltd) and CARE (Credit Analysis and Research,

Ltd). The compensation or premium for the default risk is calculated

via a statistical study of the historical loss from default at each of the

rating levels.

The following terminology is used to give a quick idea of the current

status of a bond:

At par: The bond is selling at a price equal to its face value.