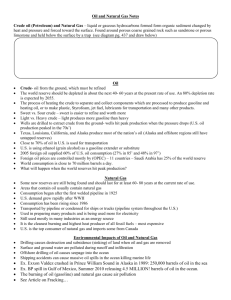

The Persian Gulf nation has an estimated 100 million barrels of crude and condensate in storage that can be released onto the market almost immediately. PHOTO: BLOOMBERG The return of Iranian crude remains uncertain, but if a deal is reached to restore the 2015 nuclear accord, the Persian Gulf nation's production could rise quickly and exports will surge even sooner. Lengthy negotiations over the restoration of the Joint Comprehensive Plan of Action (or JCPOA, as the deal between Iran, the five permanent members of the United Nations Security Council, Germany and the European Union is known) seem to be approaching their end. The US is examining the Iranian response to a 'final' accord tabled by the EU. The reply from Tehran has been described as constructive. But nothing is agreed until everything is agreed, and there are as many reasons to be pessimistic as there are for optimism. Goldman Sachs Group Inc, for one, sees a stalemate as 'mutually beneficial.' For oil buyers, though, the return of Iranian crude to a market that is about to face a big loss of Russian barrels cannot come soon enough. EU nations are still importing about 1.2 million barrels a day of Russian crude by sea, two-thirds of the amount they were taking before Moscow's troops invaded Ukraine. But sanctions due to come into effect in December will curb that flow. Shipments from Iran could help fill the gap. When sanctions were eased in 2016, after the JCPOA was adopted, Iran's crude production was restored more quickly and more completely than analysts had predicted. With no evidence of damage to oil fields or facilities, that feat can be repeated. At the start of 2016, analysts surveyed by Bloomberg expected the Persian Gulf nation to raise production by 400,000 barrels a day in six months and 675,000 barrels a day after a year. In fact, it exceeded the 12-month forecast in half that time and boosted output by almost 1 million barrels a day, to 3.8 million barrels a day, within a year of restrictions being eased. The ramp-up in exports was even quicker, with huge volumes of crude stored in onshore tanks and ships around Iran's coast ready to be moved as soon as buyers returned. The nation is in a similar position today, with an estimated 100 million barrels of crude and condensate in storage that can be released onto the market almost immediately. The International Energy Agency cautioned, back in March, that "it would likely take many months to fully off-load the oil" because Iranian tankers would "need to be re-certified and insured." I am not sure they are right. China has been willing to accept Iranian tankers at its ports throughout the most recent period of sanctions, whether certified or not. That is not likely to change. India, another big buyer of Iranian oil in the past, has shown itself willing to facilitate its new imports of Russian crude by quickly certifying Russian tankers shunned elsewhere. If Iran is willing to compete with Russia for the Indian market, I have no doubt that the government in New Delhi will do what is necessary to make the shipments happen. Even if Iranian crude is not going to flow to the US anytime soon, that still leaves Asian buyers such as South Korea and Japan and those in Europe who might require Iran's ageing tankers to be recertified. Looking back to the period when the JCPOA was in operation, between 2016 and 2018, almost none of the deliveries of Iranian crude to Europe or Japan was made on an Iranian tanker. So it seems likely that, just as in 2016, Iran's crude will return to the market more quickly than most analysts expect. If it does, it will provide welcome relief for refiners in the Mediterranean, who took around 600,000 barrels a day of Iranian crude last time around. They risk losing a similar volume of Russian barrels when EU sanctions come into force and, while they are not an exact match for each other, most Iranian crude would be a reasonable substitute for Urals export grade. A quick return of stored barrels, followed by a rapid ramp-up in production from shuttered wells, could see Iranian crude filling a Russia-shaped hole in Mediterranean crude balances. Now all we need is to get the deal done. Julian Lee. Illustration: TBS Julian Lee is an oil strategist for Bloomberg First Word. Previously he worked as a senior analyst at the Centre for Global Energy Studies.