Business Combinations: PFRS Accounting Principles & Measurement

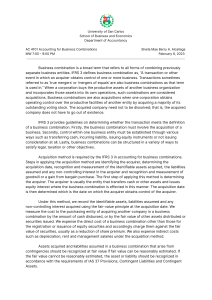

advertisement

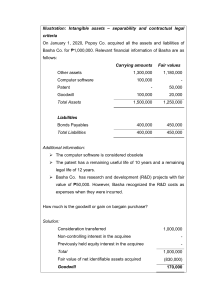

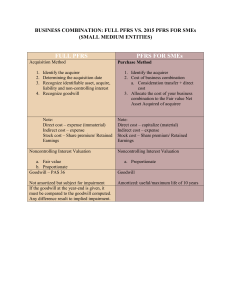

1. Introduction/Overview This module aims to provide students a comprehensive understanding and application of the proper accounting principles for the recognition and measurement relating to a business combination. It also provides the students with the comparison between the full Philippine Financial Reporting Standard (PFRS) and the Philippine Financial Reporting Standard for Small and Medium-sized Entities (PFRS for SMEs). 2. Learning Outcomes 1. 2. 3. 4. 5. 6. Define a business combination. Identify a business combination transaction. Explain briefly the accounting requirements for a business combination. Apply the proper accounting principle for business combination transaction. Compute for goodwill. Compare the difference between the full PFRS and PFRS for SMEs. 3. Business Combination (Recognition & Measurement) A business combination occurs when one company acquires another or when two or more companies merge into one. After the combination, one company gains control over the other. The company that obtains control over the other is referred to as the parent or acquirer. The other company that is controlled is the subsidiary or acquiree. PFRS 3 Business Combinations is the standard to be applied for business combination transactions to improve the relevance, reliability, and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects. 3.1. PFRS 3 defines the following: A. Business combination • the transaction or other events in which an acquirer obtains control of one or more businesses B. Business • An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities C. Acquisition Date • • The date on which the acquirer obtains control of the acquire D. Acquirer • The entity that obtains control of the acquiree E. Acquiree • The business or businesses that the acquirer obtains control of in a business combination 3.2. Business Combination is carried out either through: A. Asset acquisition o o 1. Merger ▪ ▪ 2. Acquirer purchases assets and assumes liabilities in exchange for cash or non-cash consideration Under the Revised Corporation Code of the Philippines, a business combination effected through asset acquisition may be either: Occurs when two or more companies merge into a single entity which shall be one of the combining companies. A Co. + B Co. = A Co. or B Co. Consolidation occurs when two or more companies consolidate into a single entity which shall be the consolidated company ▪ A Co. + B Co. = C Co. ▪ B. Stock acquisition o o o o Acquirer obtains control over the acquire by acquiring a majority ownership interest in the voting rights of the acquire (generally more than 50%). Acquirer is known as the parent while the acquiree is known as the subsidiary. After the business combination, both companies retain their separate legal existence and continue to maintain their own separate accounting books. For financial reporting purposes, both the parent and subsidiary are viewed as a single reporting entity. C. A business combination may also be described as: 1. Horizontal combination ▪ ▪ A business combination of two or more entities with similar businesses (e.g., a bank acquires another bank). 2. Vertical combination ▪ 3. A business combination of two or more entities operating at a different level in a marketing chain (e.g., a manufacturer acquires its supplier of raw materials) Conglomerate ▪ A business combination of two or more entities with dissimilar businesses (e.g., a real estate developer acquires a bank) 3.3. Advantages and Disadvantages of a Business Combination Advantages of a business combination A. Competition is eliminated or lessened o A competition between the combining constituents with similar business is eliminated while the threat of competition from other market participants is lessened B. Synergy o C. Synergy occurs when the collaboration of two or more entities results in greater productivity than the sum of the productivity of each constituent working independently. It can be simplified by the expression 1 + 1 = 3 Increased business opportunities and earnings potential o Business opportunity and earnings potential may be increased through: 1. An increased variety of products or services available and a decreased dependency on a limited number of products and services; 2. Widened dispersion of products or devices and better access to new markets; 3. Access to either of the acquirer’s or acquiree’s technological know-how, research and development, secret processes, and other information. 4. Increased investment opportunities due to increased capital; or 5. Appreciation in worth due to an established trade name by either one of the combining constituents D. Reduction of operating costs o Operating costs of the combined entity may be reduced. 1. Under a horizontal combination, operating costs may be reduced by the elimination of unnecessary duplication of costs 2. Under a vertical combination, operating costs may be reduced by the elimination of costs of negotiation and coordination between the companies and mark-ups on purchases. E. Combinations utilize economies of scale o o Economies of scale refer to the increase in productive efficiency resulting from the increase in the scale of production. An entity that achieves economies of scale decreases its average cost per unit as production is increased because fixed costs are allocated over an increased number of units produced. F. Cost savings on business expansion o The cost of business expansion may be lessened when a company acquires another company instead of putting up a branch. G. Favorable tax implications o o Deferred tax assets may be transferred in a business combination. Business combinations effected without transfers of considerations may not be subjected to taxation. Disadvantages of a business combination 1. The business combination brings a monopoly in the market which may have a negative impact on society. This could result in an impediment to healthy competition between market participants. 2. The identity of one or both of the combining constituents may cease, leading to loss of sense of identity for existing employees and loss of goodwill. 3. Management of the combined entity may become difficult due to incompatible internal cultures, systems, and policies. 4. The business combination may result in over-capitalization which may result in diffusion in market price per share and attractiveness of the combined entity’s equity instruments to potential investors. 5. The combined entity maybe subjected to stricter regulation and scrutiny by the government, most especially if the business combination poses threat to consumers’ interests. 3.4. PFRS 3 Business Combinations PFRS 3 outlines the accounting when an acquirer obtains control of a business (e.g. an acquisition or merger). Such business combinations are accounted for using the ‘acquisition method’, which generally requires assets acquired and liabilities assumed to be measured at their fair values at the acquisition date. As defined in PFRS 3, the business combination is a transaction or other event in which the acquirer obtains control of one or more businesses. Essential Elements in the definition of Business Combination: A. Control o o o As provided in PFRS 10, “an investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee.” Control is normally presumed to exist when the acquirer holds more than 50% interest in the acquiree’s voting interest. Control can also be obtained when: 1. The acquirer has the power to appoint or remove the majority of the board of directors of the acquiree; or 2. The acquirer has the power to cast the majority of votes at board meetings or equivalent bodies within the acquiree; or 3. The acquirer has power over more than half of the voting rights of the acquiree because of an agreement with other investors; or 4. The acquirer controls the acquiree’s operating and financial policies because of a law or an agreement. o An acquirer may obtain control of an acquiree in a variety of ways, for example: 1. By transferring cash or other assets; 2. By incurring liabilities; 3. By issuing equity interests; 4. By providing more than one type of consideration; or 5. Without transferring consideration, including by contract alone. B. Business o o As defined by PFRS 3, business is an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members, or participants. A business has the following three elements: 1. 2. 3. Input ▪ any economic resource that results to an output when one or more processes are applied to it ▪ any system, standard, protocol, convention or rule that when applied to an input, creates an output ▪ the result of input and process that provides investment returns to the stakeholders of the business Process Output 3.5. Determining whether a transaction is a business combination (Is it a business combination or not?) Any investor who acquires some investment needs to determine whether this transaction or event is a business combination or not. PFRS 3 requires that assets and liabilities acquired need to constitute a business, otherwise it’s not a business combination and an investor needs to account for the transaction as a regular asset acquisition in line with other PFRS. The three elements of a business should be considered to determine if the transaction is a business combination. 4. Accounting for Business Combination Business combinations are accounted for using the acquisition method. PFRS 3 provides that, applying this method requires the following steps: 1. Identifying the acquirer; 2. Determining the acquisition date; 3. Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree; and 4. Recognizing and measuring goodwill or a gain from a bargain purchase. 4.1. Step 1: Identifying the acquirer • • The acquirer is the entity that obtains control of the acquiree. PFRS 3 provides the following guidance in identifying the acquirer: 1. In a business combination effected primarily by transferring cash or other assets or by incurring liabilities ▪ 2. the acquirer usually the entity that transfers the cash or other assets or incurs liabilities. In a business combination effected primarily by exchanging equity interests ▪ ▪ ▪ the acquirer is usually the entity that issues its equity interests. if it is a reverse acquisition, the issuing the entity is the acquiree. Other pertinent facts and circumstances shall also be considered in identifying the acquirer in a business combination effected by exchanging equity interests including the following: a. Whose owner, as a group, have the largest portion of the voting rights of the combined entity. b. Whose a single owner or organized group of owners holds the largest minority voting interest in the combined entity. c. Whose owners have the ability to appoint or remove a majority of the members of the governing body of the combined entity d. Whose (former) management dominates the management of the combined entity e. That pays a premium over the pre-combination fair value of the equity interests of the other combining entity or entities. 3. As to size ▪ The acquirer is usually the combining entity whose relative size is significantly greater than that of the other combining entity or entities 4. In a business combination involving more than two entities ▪ 5. The acquirer is usually the one who initiated the combination. In a business combination wherein a new entity is formed ▪ The acquirer is identified as follows: a. If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination shall be identified as the acquirer by applying the guidance provided above. b. In contrast, a new entity that transfers cash or other assets or incurs liabilities as consideration may be the acquirer 4.2. Step 2: Determining the Acquisition Date • • • The acquirer shall identify the acquisition date, which is the date on which it obtains control of the acquiree. The date on which the acquirer obtains control of the acquiree is generally the date on which the acquirer legally transfers the consideration, acquires the assets and assumes the liabilities of the acquiree—the closing date. However, the acquirer might obtain control on a date that is either earlier or later than the closing date. For example, the acquisition date precedes the closing date if a written agreement provides that the acquirer obtains control of the acquiree on a date before the closing date. An acquirer shall consider all pertinent facts and circumstances in identifying the acquisition date. 4.3. Step 3: Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree A. Acquired assets and liabilities Recognition Principle ▪ On acquisition date, the acquirer recognizes, separately from goodwill the identifiable assets acquired, the liabilities assumed and any non-controlling interest (NCI) in the acquiree. Recognition Conditions a. Identifiable assets acquired and liabilities assumed must meet the definitions of assets and liabilities provided under the Conceptual Framework at the acquisition date. b. It must be part of what the acquirer and acquiree exchanged in the business combination transaction rather than the result of separate transactions. c. Applying the recognition principle may result to the acquirer recognizing assets and liabilities that the acquiree had not previously recognized in its financial statements Classifying identifiable assets acquired and liabilities assumed ▪ Identifiable assets acquired and liabilities assumed are classified at the acquisition date in accordance with other PFRSs that are to be applied subsequently Measurement Principle The acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition-date fair values. ▪ Separate valuation allowances are not recognized at the acquisition date because the effects of uncertainty about future cash flows are included in the fair value measurement. ▪ All acquired assets are recognized regardless of whether the acquirer intends to use them. ▪ B. Non-controlling Interest o o o 1. As provided in PFRS 3, non-controlling interest (NCI) or “minority interest” is the equity in a subsidiary not attributable, directly or indirectly, to a parent. For example, there is no NCI when an investor acquires 100% share in a company because the investor owns the subsidiary’s equity in full. But, when an investor acquires 75% (less than 100%), then 25% is NCI. For each business combination, the acquirer measures any non-controlling interest in the acquiree either at: Fair value; or 2. The NCI’s proportionate share of the acquiree’s identifiable net assets. 4.4. Step 4: Recognizing and measuring the goodwill • • • • Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that is not individually identified and separately recognized. On acquisition date, the acquirer computes and recognizes goodwill or gain on a bargain purchase using the following formula: A negative amount resulting from the formula is called “gain on a bargain purchase” (also referred to as “negative goodwill”) On the acquisition date, the acquirer recognizes a resulting: a. Goodwill as an asset b. Gain on bargain purchase as gain in profit or loss ▪ Before recognizing, the acquirer shall reassess to ensure that the measurements appropriately reflect consideration of all available information as of the acquisition date. (Application of the concept of conservatism) ▪ If the gain on a bargain purchase remains after reassessment, the acquirer shall recognize the resulting gain in profit or loss on the acquisition date. The gain shall be attributed to the acquirer. A. Consideration Transferred o The consideration transferred is measured at fair value, which is the sum of the acquisition-date fair values of the assets transferred by the acquirer, the liabilities incurred by the acquirer to former owners of the acquiree and the equity interests issued by the acquirer. Examples of potential forms of consideration include: 1. 2. 3. 4. 5. 6. Cash other assets a business or a subsidiary of the acquirer contingent consideration ordinary or preference equity instruments, options, warrants member interests of mutual entities. Additional concepts on consideration transferred ▪ ▪ ▪ The consideration transferred in a business combination includes only those that are transferred to the former owners of the acquiree. It excludes those that remain within the combined entity. Assets and liabilities transferred to the former owners of the acquiree are remeasured to acquisition-date fair values. Any remeasurement gain or loss is recognized in profit or loss. Assets and liabilities remain within the combined entity are not remeasured but rather ignored when applying the acquisition method. B. Acquisition-related costs o These are costs the acquirer incurs to effect a business combination. Examples: 1. Finder’s fees 2. Professional fees, such as advisory, legal, accounting, valuation and consulting fees 3. General administrative costs, including the costs of maintaining an internal acquisitions department 4. Costs of registering and issuing debt and equity securities o Acquisition-related costs are expenses when they are incurred, except the cost to issue debts or equity securities which shall be recognized in accordance with PAS 32 and PFRS 9: 1. Costs to issue debt securities measured at amortized costs are included in the initial measurement of the resulting financial liability. 2. Costs to issue equity securities are deducted from share premium. If the share premium is insufficient, the issue costs are deducted from retained earnings. C. Previously held equity interest in the acquiree o This pertains to any interest held by the acquirer before the business combination. This affects the computation of goodwill only in a business combination achieved in stages (discussed in the next module) 4.5. Illustration 4.5. Illustrations Illustration 1: Asset Acquisition On January 1, 2020, Popoy Co. acquired all assets and assumed all liabilities of the Basha Co. Due to the business combination Popoy Co. incurred transaction costs for accounting and legal fees amounting to ₱100,000. The carrying amounts and fair values of the assets and liabilities of Basha acquired by Popoy are shown below: As of January 1, 2020 Assets Carrying amounts Cash in bank Fair values 20,000 20,000 Receivables 220,000 150,000 Allowance for doubtful accounts (50,000) - 510,000 430,000 1,500,000 100,000 1,200,000 50,000 Inventory Building – net Goodwill Total Assets Liabilities 2,300,000 1,850,000 500,000 300,000 500,000 300,000 Accounts Payable Total Liabilities Assumption #1: Popoy Co. paid ₱2,000,000 cash as consideration for acquiring the net assets of Basha, how much is the goodwill (gain on bargain purchase) on the business combination? Solution: Consideration transferred 2,000,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired Goodwill 2,000,000 (1,500,000) 500,000 The fair value of the net identifiable assets of the acquiree is computed as follows: Fair value of identifiable assets acquired excluding goodwill 1,800,000 Fair value of liabilities assumed (300,000) Fair value of net identifiable assets acquired 1,500,000 The goodwill recorded by the acquiree is unidentifiable, thus, it should be excluded from the identifiable assets acquired. Only identifiable assets are recognized. Entries in the books of the Popoy (acquirer): Jan. 1, Cash in bank 2020 20,000 Receivables 150,000 Inventory 430,000 Building 1,200,000 500,000 Goodwill 300,000 2,000,000 Accounts Payable Cash in bank To record the assets acquired and liabilities assumed on a business combination Jan. 1, 2020 Professional fees expense 100,000 Cash in bank 100,000 To record the acquisition related costs Basha Co. should account the business combination as a liquidation of a business. Such that, all the assets, liabilities, and equity are derecognized and the difference between the carrying amount of the items derecognized and the proceeds of the disposal is treated as a gain or loss on disposal of business. The entries in Basha’s books are as follows: Jan. 1, Cash on hand 2020 2,000,000 Allowance for doubtful account 50,000 Accounts payable 500,000 20,000 Cash in bank 220,000 Receivables 510,000 Inventory 1,500,000 Building 100,000 200,000 Goodwill Gain on disposal of business To record the liquidation of the business Jan. 1, Share capital (& other accounts in equity) 2020 Gain on disposal of business 1,800,000 200,000 2,000,000 Cash on hand To record the settlement of owner’s equity Assumption #2: If Popoy Co. paid ₱1,300,000 cash as consideration for the net assets of Basha Co., how much is the goodwill (gain on bargain purchase) on the business combination? Solution: Consideration transferred 1,300,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired Gain on a bargain purchase 1,300,000 (1,500,000) (200,000) Entries in the books of the Popoy (acquirer): Jan. 1, Cash in bank 20,000 2020 Receivables 150,000 Inventory 430,000 Building 1,200,000 Accounts Payable 300,000 1,300,000 200,000 Cash in bank Gain on bargain purchase To record the assets acquired and liabilities assumed on a business combination Jan. 1, 2020 Professional fees expense 100,000 Cash in bank To acquisition-related costs 100,000 record the Illustration 2: Stock acquisition with NCI Popoy Co. acquired 75% of the voting shares of Basha Co. on January 1, 2020. On this date, Basha’s identifiable assets and liabilities have fair values of ₱1,400,000 and ₱400,000, respectively. Assumption #1: Popoy Co. paid ₱1,300,000 for the 75% interest in Basha Co. and elects the option to measure non-controlling interest at fair value. The independent consultant engaged by Popoy Co. determined that the fair value of the 25% non-controlling interest in Basha Co. is ₱200,000. How much is the goodwill or gain in bargain purchase on the business combination? Solution: Consideration transferred 1,300,000 Non-controlling interest in the acquiree 200,000 Previously held equity interest in the acquiree - Total 1,500,000 Fair value of net identifiable assets acquired (1,000,000) Goodwill 500,000 Entries are as follows: To record the acquisition in Popoy’s separate books of accounts: Jan. 1, Investment in subsidiary 1,300,000 2020 Cash 1,300,000 To include Basha in Popoy’s consolidated financial statements: Jan. 1, Identifiable assets acquired 20x1 Goodwill Liabilities assumed Investment in subsidiary Non-controlling interest Basha Co. 1,400,000 500,000 400,000 1,300,000 200,000 Note: The non-controlling interest is presented in the consolidated statement of financial position within equity but separately from the equity of the owners of Popoy Co. (parent). Assumption #2: Popoy Co. paid ₱1,300,000 for the 75% interest in Basha Co. and elects the option to measure non-controlling interest at the non-controlling interest’s proportionate share of Basha’s net identifiable assets. How much is the goodwill or gain on bargain purchase on the business combination? Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 1,300,000 250,000 1,550,000 (1,000,000) 550,000 The NCI’s proportionate share of Basha’s identifiable assets is computed as follows: Fair value of net identifiable assets acquired Multiply by: Non-controlling interest NCI’s proportionate share in net identifiable assets 1,000,000 25% 250,000 Illustration 3: Transaction costs On January 1, 2020, Popoy Co. acquired all the identifiable assets and assumed all the liabilities of Basha Co. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱1,600,000 and ₱600,000, respectively. Popoy incurred the following acquisition-related costs: legal fees ₱20,000, due diligence costs ₱100,000, and general administrative costs of maintaining an internal acquisition department ₱30,000. Assumption #1 As consideration for the business combination, Popoy transferred 10,000 of its own equity instruments with par value per share of ₱100 and fair value per share of ₱120 to Basha’s former owners. Costs of registering the shares amounted to ₱50,000. How much is the goodwill or gain on bargain purchase on the business combination? Solution: Consideration transferred (10,000 sh. X 120) 1,200,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total 1,200,000 Fair value of net identifiable assets acquired (1,000,000) Goodwill 200,000 Entries in the books of the acquirer: Jan. 1, Identifiable assets acquired 2020 Goodwill 1,600,000 200,000 Liabilities assumed 600,000 1,000,000 200,000 Share capital Share Premium To record the issuance of shares as consideration for the business combination Jan. 1, 2020 Share Premium 50,000 50,000 Cash in bank To record the costs of equity transaction Jan. 1, Professional fees expense 2020 General and administrative costs Cash in bank 120,000 30,000 150,000 To record the acquisition related costs Note: The acquisition-related costs are expensed, except for the costs to issue equity securities which are deducted from share premium. Assumption #2 As consideration for the business combination, Popoy Co. issued bonds with face amount and fair value of ₱1,200,000. Transaction costs incurred in issuing the bonds amounted to ₱50,000. How much is the goodwill or gain on bargain purchase on the business combination? Solution: Consideration transferred 1,000,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total 1,200,000 Fair value of net identifiable assets acquired (1,000,000) Goodwill 200,000 Entries in the books of the acquirer: Jan. 1, Identifiable assets acquired 2020 Goodwill 1,600,000 200,000 Liabilities assumed 600,000 1,200,000 Bonds payable To record the issuance of bonds as consideration for the business combination Jan. 1, 2020 Bond issue costs 50,000 50,000 Cash To record the bond issue costs Jan. 1, Professional fees expense 2020 General and administrative costs Cash in bank To record the acquisition related costs 120,000 30,000 150,000 Notes: The bond issue costs are deducted when determining the carrying amount of the bonds. The carrying amount of the bonds payable is P1,150,000. For goodwill computation: a. the consideration transferred is measured at the fair value of the debt securities issued without deduction for the transaction costs. b. the acquisition-related costs, including costs of issuing debt and equity securities, do not affect the computation of goodwill. Illustration 4: Consideration transferred On January 1, 2020, Popoy acquired all the identifiable assets and assumed all the liabilities of Basha Co.. The assets and liabilities have fair values of ₱1,500,000 and ₱600,000, respectively. As consideration: Popoy agrees to pay ₱1,000,000 cash, of which half is payable on January 1, 2020 and the other half on December 1, 2024. The prevailing market rate as of January 1, 2020 is 10%. In additions, Popoy agrees to transfer a building with a carrying amount of ₱500,000 and fair value of ₱400,000 shall be transferred to the former owners of Basha. After the combination, Popoy will continue the activities of Basha. Popoy agrees to provide a patented technology with a carrying amount of ₱60,000 in the books of Popoy and a fair value of ₱80,000 for use in Basha’s activities. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,210,461 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total 1,210,461 Fair value of net identifiable assets acquired (900,000) Goodwill 310,461 The fair value of the consideration transferred is determined as follows: Cash payment 500,000 Present value of future cash payment 310,461 (1M x 50% X PV of ₱1 @ 10%, n=5) Land transferred to former owners of XYZ (at fair value) Fair value of consideration transferred 400,000 1,210,461 Notes: The building is remeasured to acquisition date fair-value before it is transferred. The ₱100,000 adjustment is recognized as impairment loss. The patented technology is not included in the consideration transferred because it remains within the combined entity. The patented technology continues to be measured at carrying amount. Illustration 2: Consideration transferred – Dividends on On January 1, 2020, Popoy Co. acquired all the assets and assumes all the liabilities of Basha Co. for ₱1,500,000. The assets and liabilities have fair values of ₱1,500,000 and ₱600,000, respectively. Basha’s liabilities include ₱100,000 cash dividends declared on December 28, 2019, to shareholders of record on January 15, 2020, and payable on January 31, 2020. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,400,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total 1,400,000 Fair value of net identifiable assets acquired (900,000) Goodwill 500,000 For purposes of computing the goodwill, the ₱100,000 payment is excluded from the consideration transferred because this is not a payment for the business combination, but rather for the purchased dividends. Journal entries: Jan. 1, Identifiable assets acquired 2020 1,500,000 500,000 Goodwill Liabilities assumed 600,000 (including 1,400,000 dividends) Cash Jan. 1, Dividends payable 2020 Cash 100,000 100,000 5. Restructuring provisions • PAS 37 provides that restructuring is a program that is planned and controlled by management and materially changes either: 1. The scope of a business undertaken by an entity; or 2. The manner in which that business is conducted Restructuring provisions may include the costs of an entity’s plan 1. To exit the activity of the acquiree. 2. To involuntarily terminate employees of the acquiree, or 3. To relocate non-continuing employees of the acquiree. The costs above are sometimes referred to as “liquidation costs”. However, a restructuring provision does not include such costs as: 1. Retraining or relocating continuing staff, 2. Marketing, or 3. Investment in new systems and distribution networks. • Restructuring provisions are generally not recognized as part of business combination unless the acquiree has at the acquisition date an existing liability for restructuring that has been recognized in accordance with PAS 37 Provisions, Contingent Liabilities and Contingent Assets. A restructuring provision will be recognized as: 1. Liability if it meets the definition of liability as to the acquisition date: ▪ Acquirer incurs a present obligation to settle the restructuring costs assumed, such as when the acquiree developed a detailed formal plan for the restructuring and raised a valid expectation in those affected that the restructuring will be carried out by publicly announcing the details of the plan or has begun implementing the plan on or before the acquisition date. 2. Post-combination expenses of the combined entity when incurred: Acquiree’s restructuring plan is conditional on it being acquired (not the present obligation nor contingent liability) ▪ Restructuring provisions that do not meet the definition of a liability at the acquisition date ▪ 6. Specific Recognition Principles PFRS 3 provides the following specific recognition principles: I. Operating Leases A. Acquiree is the lessee General rule: The acquirer shall not recognize any assets or liabilities related to an operating lease in which the acquiree is the lessee. Exception: The acquirer shall determine whether the terms of each operating lease in which the acquiree is the lessee are favorable or unfavorable. If the terms of an operating lease relative to market terms is: 1. Favorable – the acquirer shall recognize an intangible asset 2. Unfavorable – the acquirer shall recognize a liability B. Acquiree is the lessor If the acquiree is the lessor, the acquirer shall not recognize any separate intangible asset or liability regardless of whether the terms of the operating lease are favorable or unfavorable when compared with market terms. llustration: Specific recognition principles – Operating leases On January 1, 2020, Popoy Co. acquired all the identifiable assets and assumed all the liabilities of Basha Co. for ₱1,500,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱1,600,000 and ₱600,000, respectively. Assumption #1: Popoy is renting out a building to Basha under an operating lease. The terms of the lease compared with market terms are favorable. The fair value of the differential is estimated at ₱50,000. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,500,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired 1,500,000 (1,050,000) Goodwill 450,000 The fair value of the net identifiable assets acquired is computed as follows: FV of identifiable assets acquired, including intangible asset on the operating lease with favorable terms 1,650,000 FV of liabilities assumed Fair value of net identifiable assets acquired (600,000) 1,050,000 Assumption #2: Popoy is renting out a patent to Basha under operating lease. The terms of the lease compared with market terms are unfavorable. The fair value of the differential is estimated at ₱50,000. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,500,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired Goodwill 1,500,000 (950,000) 550,000 The fair value of net identifiable assets acquired is computed as follows: FV of identifiable assets acquired 1,600,000 FV of liabilities assumed, including liability on the operating lease with favorable terms Fair value of net identifiable assets acquired (650,000) 950,000 Assumption #3: Popoy is renting a building from Basha under operating leases. The terms of the operating lease compared with market terms are favorable. The fair value of the differential is estimated at ₱50,000. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,500,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired Goodwill 1,500,000 (1,000,000) 500,000 No intangible asset or liability is recognized, regardless of the terms, because the acquiree is the lessor. II. INTANGIBLE ASSETS The acquirer recognizes, separately from goodwill, the identifiable intangible assets acquired in a business combination. An intangible asset is identifiable if it is either (a) separable or (b) arises from contractual or other legal rights A. Separability criterion An intangible asset is separable if it is capable of being separated from the acquiree and sold, transferred, licensed, rented or exchanged, either individually or together with a related contract, identifiable asset or liability. The separability criterion is met even if: 1. The exchange transactions are infrequent and regardless of whether the acquirer is involved in them, as long as there is evidence of exchange transaction for that type of asset or similar type; or 2. The acquirer does not intend to sell, license or otherwise exchange the identifiable intangible asset B. Contractual-legal criterion An intangible asset that is not separable is nonetheless identifiable if it arises from contractual or other legal rights Example: Entity A acquires Entity B, an owner of a nuclear power plant. Entity A obtains Entity B’s license to operate the nuclear power plant. However, the terms of the license prohibit Entity A from selling or transferring the license to another party. Analysis: The license is an identifiable intangible asset because, although it is not separable, it meets the contractual-legal criterion. llustration: Intangible assets – separability and contractual legal criteria On January 1, 2020, Popoy Co. acquired all the assets and liabilities of Basha Co. for ₱1,000,000. Relevant financial information of Basha are as follows: Carrying amounts Other assets 1,300,000 1,180,000 100,000 - - 50,000 100,000 20,000 1,500,000 1,250,000 400,000 450,000 400,000 450,000 Computer software Patent Goodwill Total Assets Fair values Liabilities Bonds Payables Total Liabilities Additional information: The computer software is considered obsolete The patent has a remaining useful life of 10 years and a remaining legal life of 12 years. Basha Co. has research and development (R&D) projects with fair value of ₱50,000. However, Basha recognized the R&D costs as expenses when they were incurred. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,000,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired Goodwill 1,000,000 (830,000) 170,000 The fair value of net identifiable assets acquired is computed as follows: Fair value of identifiable assets acquired, excluding computer software and recorded goodwill but including patent and R&D 1,280,000 Fair value of liabilities assumed (450,000) Fair value of net identifiable assets acquired 830,000 An acquirer recognizes an acquiree’s R&D as intangible asset even if the acquiree has already expensed the related costs. Illustration 2: Intangible assets On January 1, 2020, Popoy Co. acquired all the assets and liabilities of XYZ, Inc. for ₱1,500,000. XYZ’s assets and liabilities have fair values of ₱1,600,000 and ₱600,000, respectively. Not included in the fair of assets are the following unrecorded intangible assets: Type of intangible asset Fair value Customer list Customer contract #1 50,000 20,000 Customer contract #2 10,000 Order (production) backlog 20,000 Internet domain name 25,000 Trademark 35,000 Trade secret processes 25,000 Mask words 15,000 Total 200,000 Additional information: Customer contract #1 refers to an agreement between Basha and a customer, wherein Basha is to supply goods to customer for a period of 5 years. The remaining period of the contract is 3 years. The agreement is expected to be renewed at the contract-end but is not separable. Customer contract #2 refers to Basha’s insurance segment’s portfolio of oneyear motor insurance contracts that are cancellable by policy holders. Basha transacts with its customers solely through purchase and sales orders. As of acquisition date, has a backlog of customer purchase orders from 60% of its customers, all of whom are recurring customers. The other 40% are also recurring customers but Basha has no open purchase orders or other contracts with those customers. The internet domain name is registered. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,500,000 Non-controlling interest in the acquiree - Previously held equity interest in the acquiree - Total Fair value of net identifiable assets acquired 1,500,000 (1,200,000) Goodwill 300,000 7. Exceptions to the recognition or measurement principles PFRS 3 provides limited exceptions to its recognition and measurement principles. Exception to the recognition principle – Contingent liabilities • • The requirements of PAS 37 do not apply when accounting for contingent liabilities related to the business combination as of the acquisition date. Under PFRS 3, a contingent liability assumed in a business combination is recognized if: a. It is a present obligation that arises from past events and b. Its fair value can be measured reliably. • Therefore, contrary to PAS 37, the acquirer recognizes a contingent liability assumed in business combination at the acquisition date even if it is NOT probable that an outflow of resources embodying economic benefits will be required to settle the obligation. As long as both the conditions above are satisfied, a contingent liability will be recognized. Illustration: Contingent liabilities On January 1, 2020, Popoy Co. acquires 90% interest in Basha Co. for ₱1,000,000. Basha’s recognized assets and liabilities have fair values of ₱1,600,000 and ₱600,000, respectively. ABC opts to measure the non-controlling interest at fair value. The NCI’s fair value is ₱100,000. Basha has a pending litigation, for which no provision was recognized because Basha strongly believes that it will win the case. The fair value of settling the litigation is ₱50,000. How much is the goodwill or gain on bargain purchase? Solution: Consideration transferred 1,000,000 Non-controlling interest in the acquiree 100,000 Previously held equity interest in the acquiree - Total 1,100,000 Fair value of net identifiable assets acquired (950,000) Goodwill 150,000 The adjusted fair value of net identifiable assets acquired is computed as follows: Fair value of identifiable assets acquired 1,600,000 Total fair value of liabilities assumed: Fair value of liabilities assumed Contingent liability (pending litigation) Fair value of net identifiable assets acquired 600,000 50,000 (650,000) 950,000 The contingent liability is recognized even if it is NOT probable because it (a) represents a present obligation and (b) has fair value. Exceptions to both the recognition and measurement principles The following items shall be recognized and measured as at acquisition date under other applicable standards: 1. Income taxes • • are accounted for using PAS 12 Income Taxes. For example, deferred taxes are measured based on temporary differences arising from the measurement of identifiable assets and liabilities assumed by the acquirer at the acquisition date. Deferred taxes affect the amount of goodwill or gain on bargain purchase recognized at the acquisition date. However, PAS 12 prohibits the recognition of deferred tax liabilities arising from the initial recognition of goodwill. 2. Employee benefits • 3. are accounted for using PAS 19 Employee benefits. For example, defined benefit obligations are measured through actuarial valuations. Indemnification assets • • • arises when the former owners of the acquiree agree to reimburse the acquirer for any payments the acquirer eventually makes upon settlement of liability. The acquirer shall recognize an indemnification asset at the same time and on the same basis as the indemnified item. Accordingly, if the indemnified item is measured at fair value, the indemnification asset is also measured at fair value. If the indemnified item is measured at other than fair value, the indemnification asset is measured using assumptions consistent with those used to measure the indemnified item. Example: Entity A acquires Entity B. At the acquisition date, the taxing authority is disputing Entity B’s tax returns in prior years. The former owners of Entity B agree to reimburse Entity A in case Entity A will be held liable to pay Entity B’s tax deficiencies in the prior years. At the acquisition date, Entity A recognizes a tax liability to the taxing authority and an indemnification asset for the reimbursement due from the former owners of Entity B Exceptions to the measurement principle A. Reacquired rights Reacquired rights are measured based on the remaining term of the related contract. (Discussed in the next chapter) B. Share-based payment transactions Liabilities and equity instruments related to the acquiree’s share-based payment transactions are accounted for using the PFRS 2 Share-based payment. C. Assets held for sale A non-current asset (or disposal group) that is classified as held for sale at the acquisition date at fair value less costs to sell in accordance with PFRS 5 Non-current Assets Held for sale and Discontinued Operations, rather than at fair value under PFRS 3. 8. Differences between the provisions of the full PFRS and the PFRS for SMEs IFRS for SMEs - Section 19