Uploaded by

Fluffy

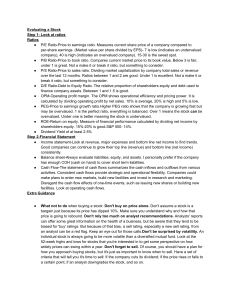

Finance Theory Exam Questions: Valuation Methods

Question 7.1 Under finance theory, the value of a financial claim is: A. B. C. D. The present value of the cash payoffs that claimholders receive. The future value of the cash payoffs that claimholders receive. A function of current and past dividends. A function of the expected value of future dividends. Question 7.2 An analyst produces the following series of annual dividend forecasts: Year t+1 t+2 t+3 Expected dividend $10 $20 $10 The analyst believes that dividends will be zero after year t+3. The company’s cost of equity is 10 per cent. Under these assumptions, what will be equity value at the end of year t? A. B. C. D. $31.16 $33.13 $36.36 $40 Question 7.3 An analyst predicts that a company’s dividend at the end of year t+1 will be $10. The analyst further expects that after year t+1 the company’s dividends will grow indefinitely at a rate of 2 per cent. The cost of equity is 7 per cent. Under these assumptions, what will be equity value at the end of year t? A. B. C. D. $209.35 $111.11 $142.86 $200 Question 7.4 Analysts produce forecasts for a near-term period. This is commonly referred to as: A. B. C. D. The finite horizon. Present value. Expected value. The forecast horizon. Question 7.5 Why might the dividend discount model not be used in practice? A. B. C. D. Because there are also debt holders who have a claim on the firm. Because equity value is created through operating activities. Because dividend payouts are uncertain. None of these choices. Question 7.6 Abnormal earnings are calculated as: A. B. C. D. Net income adjusted for the ending book value of equity. Gross income adjusted for a capital charge. Net income adjusted for a capital charge. Gross income adjusted for the ending value of book equity. Question 7.7 Under the discounted abnormal earnings valuation method the deviation of a firm’s market value from its book value depends on its ability to: A. B. C. D. Manipulate the ending book value of equity. Generate abnormal earnings. Eliminate abnormal earnings. None of these choices. Question 7.8 An analyst at time t is calculating the present value of abnormal earnings. She has the following information: • • • Beginning book value of equity = $50 000 Net income = $10 000 Cost of equity = 12 per cent What would be the present value of abnormal earnings at t+1? A. B. C. D. $3 189 $3 571 $8 929 $7 972 Question 7.9 Why would estimated values based on discounted abnormal earnings not be affected by the choice of accounting methods and accrual estimates? A. Because all distortions of accounting will ultimately reverse in the future. B. Because the nature of double-entry bookkeeping is not self-correcting. C. Because cash flows can be a good proxy for abnormal earnings in the presence of distortion. D. All of these choices. Question 7.10 Abnormal earnings-based valuations are unaffected by variation in accounting decisions on the condition the analyst is aware of biases arising from: A. B. C. D. E. Aggressive accounting choices. Conservative accounting choices. Both aggressive and conservative accounting choices. Both aggressive accounting choices and sustainable competitive strategy. Sustainable competitive strategy. Question 7.11 Which of the following would be important to consider when conducting an abnormal earnings valuation? A. B. C. D. All of these choices. Analysing the beginning book value of equity. The strategy analysis. The accounting analysis. Question 7.12 Consider the following information on a firm: • • • • Beginning book value = $100 000 Ending book value = $200 000 Total abnormal earnings = $100 000 Cumulative present value of abnormal earnings = $80 000 Based on this information, what would be the equity value of this firm? A. B. C. D. $280 000 $180 000 $200 000 $100 000 Question 7.13 Which of the following methods of valuation would not require multipleyear forecasts about parameters such as the cost of capital? A. B. C. D. Both discounted dividends and multiple-based valuations. Discounted abnormal earnings. Discounted dividends. Multiple-based valuations. Question 7.14 Under the multiple-valuation approach an analyst relies on: A. Multiple-year forecasts about a variety of parameters. B. The market to consider the implications of growth and profitability prospects and the implications for the values of comparable firms. C. Discounted dividends. D. All of these choices. Question 7.15 Consider the following information: Peer 1 Peer 2 ROE Price-to-book ratio 10% 20% 1 1 Price-earnings ratio 10 5 Which of the following statements about these industry peers is correct? A. Investors expect that the ROE of the currently best-performing peer will decrease in the future. B. Investors expect that the ROE of the currently worst-performing peer will decrease in the future. C. Investors expect that the ROE of the currently best-performing peer will increase in the future. D. None of these choices. Question 7.16 A firm’s equity-to-book ratio is a function of: A. Future abnormal ROE, beginning book value of equity, and cost of equity capital. B. Future abnormal ROE, growth in book value of equity, and cost of equity capital. C. Future normal ROE, growth in book value of equity, and cost of equity capital. D. Future normal ROE, beginning book value of equity, and cost of equity capital. Question 7.17 The random walk model for abnormal earnings implies that a good indicator of future expected abnormal earnings is: A. B. C. D. Current abnormal earnings. Current normal earnings. Current normal earnings adjusted for the cost of equity. Future abnormal earnings adjusted for the cost of equity. Question 7.18 A company’s current ROE is 12 per cent. An analyst assumes the company ROE will grow indefinitely at a rate of 2 per cent. The cost of equity is 10 per cent. Under these assumptions, what is the estimated equity value-to-book multiple of this company? A. B. C. D. 1.00 1.10 1.12 1.25 Question 7.19 Consider the following information: • • • • Net income = $100 000 Gross income = $300 000 Change in book value of assets = ($50 000) Cost of equity = 12 per cent Using the discounted cash flow model, what would be the present value of free cash flows at t+1? A. B. C. D. $312 500 $133 929 $44 643 $178 571 Question 7.20 Consider the following information: • • • • Net income = $100 000 Gross income = $300 000 Change in book value of assets = ($50 000) Cost of equity = 12 per cent Assume this information remains unchanged over two years. Using the discounted cash flow model, what would be the value of equity at the end of year 2? A. B. C. D. $625 000 $267 858 $253 508 None of these choices. Question 7.21 Which of the following would not be undertaken when using the discounted cash flow model? A. B. C. D. Determining the present value of free cash flows. Forecasting free cash flow available to debt holders. Forecasting free cash flow available to equity holders. Deducting the beginning book value of assets from the ending book value of assets. Question 7.22 As long as the analyst makes the same assumptions about company fundamentals, the value estimates under any valuation derived from the dividend discount model will: A. Be different. B. Identical for abnormal earnings and discounted cash flow, but different for discounted dividends. C. Identical for discounted dividen ds and discounted cash flow, but different for abnormal earnings. D. Be identical. Question 7.23 Which of the following would not be a difference between valuation models – all derived from the dividend discount model? A. B. C. D. All of these choices. They have the same implications for estimating terminal values. They have the same level of structure for valuation analysis. They require a focus on the same issues. Question 7.24 Consider the following valuation approaches: • • • • Discounted abnormal earnings. Discounted abnormal ROE. Free cash flow. Discounted dividends. Which of these will require the least structure? A. B. C. D. E. Discounted dividends. Discounted abnormal earnings. Discounted abnormal ROE. Free cash flow. They all require the same level of structure. Question 7.25 Analysts often consider a parameter (beta) when forecasting abnormal earnings. What is the purpose of this parameter, and what values can it take? ANSWER: Two components to the question, therefore answers should clearly identify: • The parameter represents the speed at which abnormal earnings decay over time. • It can take on a value between 0 and 1. Students may interpret 0 as complete decay and 1 as no decay. Question 7.26 Consider the following information Year Profit 1 2 3 $100 $120 $60 Ending book value Ending book value of assets of debt $1 030 $720 $1 060 $740 $1 000 $800 At the end of year t, the company’s book value of assets and debt are $1 000 and $700, respectively. The analyst expects that after year t+3 profit will be $0 and the book values of assets and debts will not change from the prior year. The cost of equity (WACC) is 10 per cent. Calculate the present value of free cash flows for the end of each year. ANSWER: Year Profit 1 2 3 $100 $120 $60 Change in BV assets $30 $30 $-60 Change in Free BV debt flow $20 $50 $20 $70 $60 $180 cash PV of free cash flow $45.45 $57.85 $135.24 Question 7.27 List three reasons why, despite producing the same value estimates (pending assumptions), models derived from the dividend discount model differ. ANSWER: The three answers will be: • • • Each model focuses the analyst’s task on different issues. Each model requires different levels of structure for valuation analysis. Each model has different implications for estimating terminal values.