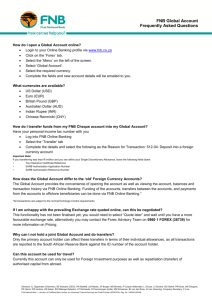

When my family’s financial goals changed, I got help with the right solutions and advice from FNB. Helping you and your family reach your financial goals with SA’s Best Value and leading financial rewards* FNB Premier Annual Pricing Guide 1 July 2022 - 30 June 2023 See more *FNB Fusion Premier was named SA’s best value account in the 2022 Solidarity Bank Charges Report Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card Choose FNB Fusion Premier for only R230 and enjoy SA’s best value for you and your family, with the help of credit at a single monthly account fee with the FNB Fusion account. The FNB Fusion account gives you simplified everyday banking with a linked credit facility to help you manage unexpected expenses. PLUS 50% discount on your spouse’s/partner’s monthly account fee and ZERO monthly account fees for your children under 25. FNB Global Account Bank charges Home Finance Invest With SA’s best financial rewards, you get up to R8 back per litre at Engen, 8 SLOW Lounge visits, earn and spend eBucks at iStore, Checkers and Clicks, 40% back in eBucks life insurance, 40% on Spotify and Netflix subscriptions for family. Access more value with Important information Udemy course for only R50 activation fee per course, Contact us GuardMe powered by Aura, weekly coffee rewards from Starbucks and eBucks games. You also get FNB Connect Data, Voice Minutes and SMSs every month on your FNB Connect SIM Card. Enjoy personalised interest rates on credit solutions, including car and home. Terms, conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value Get the best value for you and your family We are continuously looking to find valuable solutions for you and your family and therefore have included even more value to the FNB Premier banking offering. You will have access to the following benefits included in your monthly account fee. eBucks Product overview Do more and get more Fees Family • FNB Fusion Premier Account has the lowest monthly fee for a transactional account with a linked credit facility that offers up to 30 days interest-free on card purchases • 50% discount on your spouse’s or partner’s monthly account fee (R115 per month for FNB Fusion Premier or R120 for FNB Premier Current Account) • No increase in the monthly account fee on your FNB Premier Credit Card with a credit facility that offers up to 55 days interest free on credit card purchases • No monthly account fee for FNB Youth Accounts for children under the age of 25 • Get up to 40%** off selected flights for you and your family with eBucks Travel • Access to SLOW Domestic Lounge** with up to 8 complimentary entries per annum • Unlock up to 12 bonus SLOW Lounge visits per annum* when you book a flight with eBucks Travel • Up to 40% back in eBucks on your video streaming (Netflix) and music streaming (Spotify®) subscriptions when your family banks with FNB Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us • Get an FNB Premier credit card included on the bundle pricing option, with a budget facility of between 6 and 60 months, interest rate of prime or prime +2%* on emergency medical transactions and from partners such as iStore, The Pro Shop, Cycle Lab and KOODOO.co.za Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. *Discount excludes taxes **Only applies if you and your spouse/partner are verified as a family and you both have an FNB Fusion Premier Account or FNB Premier Current Account AND your spouse/partner are on the Spousal pricing option OR you have an active FNB Account linked to your profile (only applicable to children under 18 years of age Visit www.ebucks.com or click on the eBucks link on the FNB App to read about the rewards criteria. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Get the best value for you and your family (continued) Introduction Get the best value eBucks • A linked savings account that earns you a competitive interest rate • No charge on eBucks membership to earn rewards that never expire • Save while you spend with FNB Bank Your Change®. We round up your card purchase value and transfer the difference from the purchase amount to your savings account • Pay no monthly fees on your taxfree cash deposit or tax-free shares account and pay no admin fees on your tax-free unit trust account • • Two FNB Send Money transactions per billing cycle via the App at no charge Save towards your retirement and pay no monthly (platform) fees on your retirement annuity • Protect your retirement funds and pay no monthly (platform) fees on your preservation fund • Financial advice session (telephonic) at no extra charge • Invest for the long term and pay no monthly (platform) fees on your FNB Personal Share Portfolio • Will drafting at no extra charge Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Help Added value • Get rewarded up to 1GB data, 30 voice minutes and 30 SMSs every month1 on your FNB Connect SIM when you qualify for eBucks Rewards. Plus get rewarded with up to 1GB extra data every month when you spend* R100 or more on your FNB Connect SIM card and qualify for eBucks Rewards at the time that you spend • Access a team of Premier Advisors and get integrated financial advice to support you on your financial journey powered by innovative platforms and rewards to help you reach your financial goals by understanding your needs • A team of bankers available 24/7 via Secure Chat® on the FNB App to help you manage your money, and give you guidance on making the most out of being with FNB Premier - applying for a home loan or vehicle and asset finance through WesBank and more *Spend is defined as all purchases and/or fees charged to the customers FNB Connect SIM card account, namely, SIM card subscription fees, recharge fees and purchases, SIM and Connection fees, Call Line Identify (CLI) fees and itemised billing fees. All Prepaid, Top Up and Post-Paid Plans (including To Up Go) that are in use and that were sold with smartphone devices, there device bundle subscription is included in the spend calculation. All device purchases and/or fees charged to the customers that relate to a device only are excluded and all penalty fees are excluded from this spend calculation. Please be advised that extra data rewards are subject to successful debit orders checks and there may be an allocation delay based on debit order processing. 1 Please visit fnb.co.za/fnb-connect for more information. Simply order your SIM card on the FNB App today! Or visit your nearest branch. New customers need to ensure they have a network active FNB Connect SIM card, FNB Transactional Accounts in good standing and FNB Connect Accounts in good standing each month, for 2 months, there after they need to ensure they qualify for eBucks. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us eBucks rewards eBucks rewards is about helping you stretch your spend every month. By offering real value and benefits, you’re able to use eBucks to buy fuel, groceries, clothes, holidays and so much more. FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards Introduction As an FNB Premier Account holder, you could also be rewarded with these exciting benefits. Get the best value eBucks Product overview Do more and get more Even more ways to earn New reward partners • Earn up to R900 back in eBucks every month when you spend at Checkers/ Shoprite, Clicks and Engen • • Plus earn up to R600 back in eBucks with smart spend when you use your FNB Premier card for all your monthly spend Udemy: Enroll for up to 2 Udemy courses per month and a total of 6 courses per year. For only R50 activation fee per course • eBucks Games: Enjoy uninterrupted play with ad-free mobile gaming and no subscription fees • Earn additional eBucks with smart spend when you use your FNB Fusion Premier Card, FNB Premier Credit Card, FNB Premier Debit card or FNB Pay for your monthly spend • GuardMe: Get the first 3 months at no cost. Protect your family from R19.90 per month, thereafter get up to 100% of your subscription fees back in eBucks monthly • Starbucks: Use your FNB Virtual Card, FNB pay or partner wallet for any purchase, 5 times a week and get a complimentary tall cappuccino every week • eBucks Travel: Explore the world with up to 40% off flights and great benefits including complimentary SLOW Lounge visits Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards (continued) Introduction Get the best value eBucks Product overview Connect Bonus SLOW Lounge Visits • Get rewarded with up to 1GB data, 30 voice minutes and 30 SMSs every month on your FNB Connect SIM when you qualify for eBucks Rewards • • Plus get up to 1GB extra data when you spend* R100 or more on your FNB Connect SIM each month and qualify for eBucks at the time you meet your spend minimum • Plus Seniors 60 years of age and above will receive 1GB of extra data every month on your FNB Connect SIM Card when you meet the minimum spend* of R100 and qualify for eBucks at the time you meet the spend* minimum • Plus Customers that do not qualify for eBucks will get 200MB of extra data each month on their FNB Connect SIM Card when they meet the minimum spend* of R100 (max 3 allocations) Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Enjoy up to 12 bonus complimentary Domestic and International SLOW Lounge visits per year, when you book your flight through eBucks Travel Important information Contact us Track your eBucks earn, spend and benefits conveniently on the FNB App under the eBucks tab. View ‘Earn more eBucks’ and ‘Track my rewards’ to learn how you can maximise your rewards. *Spend is defined as all purchases and/or fees charged to the customers FNB Connect SIM card account, namely, SIM card subscription fees, recharge fees and purchases, SIM and Connection fees, Call Line Identify (CLI) fees and itemised billing fees. All Prepaid, Top Up and Post-Paid Plans (including To Up Go) that are in use and that were sold with smartphone devices, there device bundle subscription is included in the spend calculation. All device purchases and/or fees charged to the customers that relate to a device only are excluded and all penalty fees are excluded from this spend calculation. Please be advised that extra data rewards are subject to successful debit orders checks and there may be an allocation delay based on debit order processing. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks rewards (continued) Earn up to 100% of your monthly FNB Fusion Premier Account or FNB Premier Current Account fee back in eBucks when you invest with FNB eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Maintain investment balances Invest in qualifying accounts Maintain an overall minimum saving and investment account balance of R500 000. Of this, a minimum of R50 000 must be invested in qualifying FNB Wealth and Investments solutions (stipulated accounts and funds). The remaining funds must be invested in qualifying cash investment solutions (stipulated accounts). If you have a qualifying FNB Islamic Premier Current Account, you need to have a minimum of R500 000 invested in an FNB Savings and Investment Account(s). FNB Cash investments • FNB Cash Investments • Any cash investment solution • FNB Channel Islands Open any 12, 18, 24 or 36 month fixed deposit account in GBP, USD or EURs Wealth and Investments Home Finance • Living annuity Invest • Pension and provident preservation funds • Segregated portfolios: Fully managed and tailored to client need: • FNB Retirement Annuity Endowment • FNB Tax-free Unit Trust • FNB Investment Account • FNB Tax-free Shares Important information Contact us Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards (continued) Introduction Get the best value eBucks Product overview Invest in qualifying funds and solutions Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Funds wealth and investments FNB Local segregated portfolios FNB Horizon unit trust FNB Global segregated portfolio FNB Wealth segregated portfolio Equity portfolio Income fund Global Leaders Portfolio (USD) Wealth stable ETF Balanced portfolio Stable fund Global Equity Income Portfolio (USD) Wealth moderate ETF Dividend income portfolio Moderate fund Global Equity Growth Portfolio (USD) Wealth growth ETF Islamic portfolio Growth fund FNB ETF Cautious Portfolio (USD) Wealth stable portfolio Growth plus fund (closed to new business) FNB ETF Balanced Portfolio (USD) Wealth stable portfolio FNB Islamic Balanced fund FNB ETF Growth Portfolio (USD) Wealth growth portfolio Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards (continued) Introduction Get the best value Maintain eBucks reward level points eBucks Your monthly transactional account fee refund will be based on your eBucks rewards level. Product overview Do more and get more Credit card FNB Global Account Reward level Refund 0% 10% 25% 50% 75% 100% Level 0 Level 1 Level 2 Level 3 Level 4 Level 5 Bank charges Home Finance Invest Important information Contact us Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). For example: if you are an FNB Premier client (who is on reward level 5) and have an FNB Money Maximiser Account with R450 000 invested and an FNB Retirement Annuity with R50 000 invested (total investment is R500 000), you will get 100% of your monthly transactional account fee back in eBucks. FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards (continued) Introduction Get the best value eBucks Product overview Do more and get more Credit card Get rewarded up to 1GB data, 30 voice minutes and 30 SMSs every month on your FNB Connect SIM when you qualify for eBucks Rewards. Plus get rewarded with up to 1GB extra data every month when you spend* R100 or more on your FNB Connect SIM card and qualify for eBucks Rewards at the time that you spend. To qualify for monthly rewards you must: To qualify for extra data: • • • Have an active FNB Connect SIM Card Qualify for eBucks Rewards • FNB Global Account • Bank charges Home Finance Invest Important information Contact us Spend* R100 or more on your FNB Connect SIM each month and qualify for eBucks at the time you meet your spend minimum Seniors 60 years of age and above will receive 1GB Extra every month on your FNB Connect SIM Card when you meet the minimum spend* of R100 and qualify for eBucks at the time you meet the spend* minimum Customers that do not qualify for eBucks will get 200MB of extra data each month on their FNB Connect SIM Card when they meet the minimum spend of R100 (max 3 allocations) If you join FNB on or after 1 July 2022: To welcome you to FNB Connect, you will receive a once-off 1GB data, 30 voice minutes and 30 SMSs within 5 business days of activating your FNB Connect SIM card. As long as you: • • • Have an active FNB Connect SIM Card. All FirstRand Bank accounts are active and in good standing Plus you will qualify for 1GB data, 30 voice minutes and 30 SMS’s for the first two months by meeting the following criteria ie Have an active FNB Connect SIM Card and ensure all FirstRand Bank accounts are active and in good standing. Thereafter, you will need to have a network active FNB Connect SIM Card and qualify for eBucks in order to get your FNB Connect reward every month *Spend is defined as all purchases and/or fees charged to the customers FNB Connect SIM card account, namely, SIM card subscription fees, recharge fees and purchases, SIM and Connection fees, Call Line Identify (CLI) fees and itemised billing fees. All Prepaid, Top Up and Post-Paid Plans (including To Up Go) that are in use and that were sold with smartphone devices, there device bundle subscription is included in the spend calculation. All device purchases and/or fees charged to the customers that relate to a device only are excluded and all penalty fees are excluded from this spend calculation. Please be advised that extra data rewards are subject to successful debit orders checks and there may be an allocation delay based on debit order processing. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 eBucks rewards (continued) Introduction Get the best value Get rewarded up to 2GB data, 30 voice minutes and 30 SMSs every month on your FNB Connect SIM. eBucks Have an active FNB Connect SIM Card Qualify for eBucks Rewards Product overview Do more and get more Credit card FNB Global Account Bank charges Reward Level Monthly Voice Reward (min) Monthly Data Reward Monthly SMS Reward Plus an Extra data Reward when you spend* R100 1 30 200MB 30 200MB 2 30 400MB 30 400MB 3 30 600MB 30 600MB 4 30 800MB 30 800MB 5 30 1GB 30 1GB Home Finance Invest Activation Reward New FNB Customer Monthly Reward (qualified for eBucks) Extra Data Reward Seniors (customers Extra Data Reward Free voice (min) 30 30 30 N/A N/A N/A Free data (MB) 1 000 1 000 Based on eB Reward level Based on eB Reward level 1 000 200 Free SMSs 30 30 30 N/A N/A N/A Important information Contact us whom join after 01 July 2022 (max 2 allocations) 60 years of age and above) (did not qualify for eBucks - max 3 allocations) *Spend is defined as all purchases and/or fees charged to the customers FNB Connect SIM card account, namely, SIM card subscription fees, recharge fees and purchases, SIM and Connection fees, Call Line Identify (CLI) fees and itemised billing fees. All Prepaid, Top Up and Post-Paid Plans (including To Up Go) that are in use and that were sold with smartphone devices, there device bundle subscription is included in the spend calculation. All device purchases and/or fees charged to the customers that relate to a device only are excluded and all penalty fees are excluded from this spend calculation. Please be advised that extra data rewards are subject to successful debit orders checks and there may be an allocation delay based on debit order processing. This is not meant to be a comprehensive guide to the eBucks Rewards Programme earn rules. Please visit eBucks.com for the complete earn rules. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Whatever your needs, we have the solution for you Annual Pricing Guide 2022-2023 A fully functional transactional account with a linked credit card that allows you to: Introduction Access a team of Premier Advisors and get integrated financial advice to support you on your financial journey. With a team of bankers available 24/7 to help you manage your money plus innovative digital banking solutions with our award winning app. Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account R230p.m. FNB Fusion Premier Account R240p.m. FNB Premier Current Account R115/120p.m. FNB Fusion Premier/Current Account Bank charges Home Finance Invest Important information Contact us • Your spouse/partner gets 50% off their monthly account fee to have the same account as you - regardless of their income. Plus, your kids get FNBy and FNBy Next Accounts at no extra cost • Switch your credit to us and save on your home, car or personal loan repayments • Up to 30 days interest free on FNB Fusion card purchases • Start investing with FNB Money Maximiser*, FNB Share Zero and FNB Global Account - included in your Premier package at no extra costs • Guard Me, Udemy, Starbucks and eBucks games • Earn up to R8 per litre back in eBucks per quarter at Engen when your vehicle is financed through WesBank • Your spouse/partner gets 50% off their monthly account fee to have the same account as you - regardless of their income. Plus, your kids get FNBy and FNBy Next Accounts at no extra cost • Switch your credit to us and save on your home, car or personal loan repayments • Start investing with FNB Money Maximiser, FNB Share Zero and FNB Global Account - included in your Premier package at no extra costs • Guard Me, Udemy, Starbucks and eBucks games up to R8 back in eBucks on fuel from participating Engens • The FNB Premier Current and FNB Fusion Premier Accounts for your spouse or partner, offers your spouse or partner a discounted monthly account fee and a complete day-to- day banking product suite, as well as additional transactions. We are also proud to offer you an FNB Islamic Premier Account, with similar value-adds, reward benefits and pricing as an FNB Premier Account. With Islamic Banking, you earn a competitive monthly profit share on your linked Islamic Savings Account. For more information, contact the Islamic Banking Suite on 087 578 6786. Please note: We have replaced the fee waiver you previously received for meeting certain investment criteria with a monthly eBucks Reward. Visit www.ebucks.com or click on the eBucks link on the FNB App to read about the rewards criteria. With Islamic Banking, you earn a competitive monthly profit share on your linked Islamic Savings Account. For more information, contact the Islamic Banking Suite on 087 578 6786. Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Product comparison with an FNB Premier Account Introduction Get the best value eBucks Product overview Monthly account fee Do more and get more Bank charges Home Finance Invest Important information Contact us FNB Premier Current Account Premier Current Account for your spouse or partner Premier PAYU9 R230 R240 R115/R1204 R55 FNB Fusion Premier Account/Current Account Premier credit card account Credit card FNB Global Account FNB Fusion Premier Account Credit card facility service fee 1 additional credit card (linked to your FNB Premier Credit Card) Products included in your discounted monthly fee Access to unlimited FNB Virtual Cards at no extra cost – ideal for online shopping with added safety because its dynamic 3-digit CVV changes hourly Savings account with FNB Bank Your Change® FNB Global Account5 2 send money transactions per billing cycle via the FNB App8 FNB Connect added value: up to 2GB data, 30 voice minutes and 30 SMSs on your FNB Connect SIM card every month.7 No fee charge on withdrawals up to R4000 per billing cycle. This includes withdrawals made using Cash@Till®, cardless cash withdrawals and at FNB ATMs8 No fee charge on FNB ATM deposits up to R4000 per billing cycle8 All international transactions displayed in this pricing guide will incur a 2% currency conversion. Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. 4 Available on both the FNB Fusion Premier Account and the FNB Premier Current Account 5 Fees are applicable to Foreign Exchange transactions. You may also be charged an annual card fee 7 Please visit fnb.co.za/fnb-connect for more information. Simply collect a Connect SIM card from your nearest branch. Account must be in good standing. Good standing means it’s not overdrawn, in arrears or in default, and you are not undergoing sequestration or any legal process. 8 Per account billing cycle. 9 Not available to new sales A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Do more and get more FNB Premier Annual Pricing Guide 2022-2023 Do more and get more with an FNB Premier Account Introduction Get the best value eBucks Product overview Digital Banking • • Withdraw cash at Shoprite and Checkers, Pick n Pay, Boxer Superstores and selected Spar and Usave tills • Additional protection from unauthorised online transactions with online secure, giving you a One Time PIN (OTP) to protect your card’s exclusivity • The ability to make convenient and secure payments with your contactless card and FNB Pay • The opportunity to purchase FNB’s Lifestyle Protection, providing lifestyle cover for your loved ones in the event of your death • Cancel and replace your card via the FNB App • No charge on card swipes when you use your FNB Fusion Premier, Debit or credit card to pay • No charge on subscription to inContact. This means we’ll notify you every time more than R100 goes out of – or into – your account • No charge on third party payment notifications • No charge on subscription to the FNB App and online banking. Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us A team of premier bankers to help you manage your money 24/7 plus innovative digital banking solutions with our award-winning app Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). • No charge on balance enquiries using the FNB App or online banking. • No charge on monthly electronic statements accessed via FNB Online Banking or FNB App • No charge on lost card protection and PIN replacement • No charge on auto payment, offering you the convenience of having your accounts paid on time each month • Automatic debt protection to settle your outstanding credit card debt in the event of death or permanent disability at no extra charge. Sign up for FNB’s Top-up Debt Protection Plan, for which there is a charge FNB Premier Annual Pricing Guide 2022-2023 Do more and get more with an FNB Premier Account (continued) Introduction Get the best value Borrow eBucks FNB Fusion Premier Account credit facility Overdraft • Full day-to-day banking capability, allowing for salary deposits, point-of-sale purchases, ATM withdrawals, EFTs, debit orders, etc • • Personalised interest rates As a FNB Premier Current Account holder, you have access to credit in the form of an overdraft facility without having to pay initiation fees • No initiation fee • You only pay for your facility when you use it Credit card • Only pay for the facility when you use it • FNB Global Account • Up to 30 days interest free on FNB Fusion Card purchases • A single credit limit to maintain Your overdraft facility is a convenient credit facility that helps you prepare for monthly cash flow shortages with a personalised interest rate based on your individual credit profile. You also have the option of taking up debt protection • The ability to earn maximum rewards by only using one card Home Finance • One card, one delivery, one account to manage all your banking needs Invest • FNB Global Travel Insurance when you purchase your local or international return travel ticket(s) • Unlock a bonus SLOW Lounge visit when you book a flight with eBucks Travel Product overview Do more and get more Bank charges Important information Contact us Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. FNB Fusion Accounts are only available to customers under the age of 70. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Do more and get more with an FNB Premier Account (continued) Introduction Get the best value Borrow eBucks FNB Revolving Facility FNB Credit Card • • Earn eBucks on your credit card purchases from in-store and online eBucks partners • Manage your money easily with up to 55 days’ interest-free card purchases made on your straight facility Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Our revolving facility offers you a credit facility that helps you pay for unbudgeted expenses over time and is linked to your FNB Premier Current Account which gives you access to funding 24/7. You can choose between variable and fixed repayment options and you can opt in to our new shortfall protection option which means no more bounced debit orders or declined POS transactions. Optional debt protection is available too - a facility that helps you prepare for monthly cash flow shortages with a personalised interest rate based on your individual credit profile • Personalised and competitive interest rates based on your personal profile • Access to a budget facility with repayment periods from 6-60 months for purchases over R200 • Embedded debt protection of up to R12 000 of outstanding balance in the event of death and permanent disability, with option to top-up • Access to unlimited virtual cards at no extra cost It’s simple, safe and smart enough to change its 3-digit CVV hourly • Purchase Protect cover up to R10 000 on items such as furniture, clothing, cellphones and laptops purchased using your FNB Virtual Credit Card Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. For more on eBucks Rewards, go to the eBucks website. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). • Global Travel Insurance cover for the first 90 days of your journey when you use your qualifying FNB Credit Card to purchase your international return travel ticket(s) • Auto payment solution – enjoy the convenience of having your credit card account paid on time, every time • Access to SLOW Domestic Lounge with up to 8 complimentary entries per annum • Unlock up to 12 additional SLOW Lounge visits - Domestic or International - for you and your family when you book flights through eBucks Travel • The option for FNB to move your unexpected medical transactions to budget at an interest rate of prime or prime +2% • Access to exclusive FNB offers from retailers, such as iStore, The Pro Shop, Cycle Lab and KOODOO.co.za at an interest rate of prime or prime +2% FNB Premier Annual Pricing Guide 2022-2023 Do more and get more with an FNB Premier Account (continued) Introduction Get the best value Borrow eBucks FNB Temporary Loan You can benefit from: • • A personalised interest rate from as low as 12.75%* per annum • A payment break every January** • A fixed and flexible monthly repayment making it easy for budgeting, with no penalties for settling your loan early. Your repayment remains the same each month and you can choose your own repayment term between 1 and 60 months • Top up your existing loan and pay no initiation fee Product overview Do more and get more • Credit card FNB Global Account Bank charges Important information Contact us This loan is offered in line with the way you’ve managed your credit profile. Once you’ve accepted the offer, funds are immediately available in your account FNB Personal Loan • Home Finance Invest Temporary loans are quick and easy. There are no forms to fill in and you can easily accept your loan via the FNB App and online banking We can help you get a personal loan of up to R300,000. Whether you have planned or unplanned expenses like renovating your home, a personal loan can help you achieve your goals. Using the right credit for the right reason can change your life FNB Student Loan • Whatever the aspiration, a student loan can help you to cover your tuition fees but also the cost of textbooks, study materials, devices, equipment and accommodation. You can access funds from R4 000 to R80 000 per year Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. Credit is subject to qualifying criteria. *Interest rate is based on your risk profile. **On loan terms of over 6 months and where the account is not in arrears. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). Credit switch • Consolidate your qualifying credit from various credit providers into one convenient personal loan and you could save every month with one set of fees, one reduced monthly repayment and one personalised interest rate FNB Premier Annual Pricing Guide 2022-2023 Do more and get more with an FNB Premier Account (continued) Introduction Get the best value eBucks Product overview Save Live • A linked savings account that earns you a competitive interest rate • Get access to smartphones, tablets or laptops at discounted prices over a 24-month period • Save while you spend with FNB Bank Your Change®. We round up your card purchase value and transfer the difference from the purchase amount to your savings account. • Get FNB Global Travel Insurance for no fee, keeping you covered for international travel when you buy your return travel ticket(s) using your FNB Fusion Premier Card, Premier Debit, Credit Card or eBucks11 • Monthly coupons on your FNB App, offering discounts on a range of products from retailers Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. 11 Valid for customers under the age of 70 only. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us FNB Premier Credit Card FNB Premier Annual Pricing Guide 2022-2023 Introduction FNB Premier Credit Card An FNB Premier Credit Card is more than just plastic in your wallet. It’s the key to your lifestyle, unlocking new worlds and opening up an array of exclusive benefits, rewards, and features to help you along the way. Get the best value eBucks Product overview Credit facility fees Do more and get more Credit facility service fee R1712 Credit card Initiation fee (once-off) Up to a maximum of R175 FNB Global Account Credit card account fees Bank charges FNB Premier Credit Card monthly account fee R7513 Home Finance Additional card fees No charge on additional card, thereafter R18.50 per card linked to account Invest Credit card budget purchases No charge Important information Linked Petrol Card (per card linked to account) R29.50 R92p.m. FNB Premier Credit Card Account Contact us For all other fees, refer to “Bank Charges”. Bank Charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. 12 Credit Facility service fee is charged monthly for the routine administration of maintaining your Credit Facility. This fee is included in the FNB Fusion Premier and Current Account monthly fee. 13 Credit Card monthly account fee is charged monthly for the administration and maintenance of your Credit Card account. This fee is included in the FNB Fusion Premier and Current Account monthly fee. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us FNB Global Account Be a Global Citizen and save and transact globally FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value FNB Global Account FNB Premier offers you an FNB Global Account to save and transact in foreign currency; whether you are saving for offshore travel, require quick access to manage currency risk or are receiving and making international payments occasionally the FNB Global Account is the ideal choice. eBucks Product overview Do more and get more Other fees GBP USD EUR Annual card fee £20 $25 €23 Card swipes and international online card payments No charge International ATM withdrawal14 £3 $5 €4 Home Finance Card replacement (lost, stolen or damaged) £7 $10 €8 Invest Balance enquiry £0.35 $0.50 €0.40 Important information Insufficient funds fee (ATM and Point-of-Sale transactions) £0.50 $0.80 €0.60 Credit card FNB Global Account Bank charges Contact us Currency conversion (when a specific currency card is used in a different currency zone) For all other fees, refer to “Bank Charges”. Bank Charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. 14 Some ATMs overseas might also charge you a withdrawal fee over and above our fee. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). Same Currency - No Charge | Cross Currency 1% FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Bank charges Bank charges FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Bank charges The following pages contain our standard fees for transactions that are not included in your monthly account fee or that you will be charged if you go over the limits outlined above. These fees are applicable to: The FNB Fusion Premier Account, Current Account and Credit Card. Product overview Do more and get more No charge transaction (applicable to Fusion and Current) Credit card Card purchases FNB Global Account Bank charges Prepaid airtime purchases using FNB App and online channels Electronic payments Home Finance Electronic transfers Invest Internal debit orders Important information External debit orders Contact us Subscription to inContact, online banking, cellphone banking, telephone banking and the FNB App Subscription to eBucks rewards Savings account Bank charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). No charge FNB Premier Annual Pricing Guide 2022-2023 Bank charges Introduction Please note that any transactions not included or in excess of the limits above will be charged as per the tables below. (continued) Get the best value eBucks Fees applicable on other products Monthly FNB Fusion credit facility fee Product overview (applies to NCA clients with credit agreements concluded between 1 June 2007 and 6 May 2016) Monthly FNB Fusion credit facility fee Do more and get more Credit card FNB Global Account Bank charges (applies to NCA clients with credit agreements concluded since 6 May 2016) Monthly overdraft service fee (applies to NCA clients with credit agreements concluded between 1 June 2007 and 6 May 2016) Monthly overdraft service fee (applies to NCA clients with credit agreements concluded since 6 May 2016) Monthly rebate on FNB Fusion credit facility fee for facilities of R1 000 only (applies to NCA clients with credit agreements concluded between 1 June 2007 and 6 May 2016) Monthly rebate on FNB Fusion credit facility fee for facilities of R1 000 only (applies to NCA clients with credit agreements concluded since 6 May 2016) Home Finance Monthly revolving facility service fee** (applies to NCA clients with credit agreements concluded between 1 June 2007 and 6 May 2016) Invest Monthly revolving facility service fee** (applies to NCA clients with credit agreements concluded since 6 May 2016) Important information Once-off revolving facility initiation fee** Contact us Home finance – application for new home loan monthly service fee (applies to NCA clients with credit agreements concluded since 6 May 2016) These fees are in accordance with the National Credit Act 34 of 2005 as applicable to your home loan agreement. The fees quoted are VAT inclusive. Home finance – application for new home loan once-off initiation fee Bank charges R57.50 R69 R57.50 R69 R27.50* R39* R57.50 R69 R155 R69 These fees are in accordance with the National Credit Act 34 of 2005 as applicable to your home loan agreement. The fees quoted are VAT inclusive. *Existing customers that enter into a new agreement will be charged a monthly service fee of R69 once approved. R6 037.50 Personal loan monthly service fee R69 Personal loan once-off initiation fee (no initiation fee when you top up your existing personal loan) Up to R1 207.50 Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. * Accounts must be in good standing ** Monthly revolving facility service fee and revolving facility initiation fee applicable to clients with revolving loans. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Payments Cellphone banking, the FNB App, telephone banking - IVR, FNB ATM and online banking R8.50 Telephone banking (consultant assisted) R80 FNB Branch R80 Do more and get more Internal debit orders No Charge Credit card External debit orders R19 International card purchase fee 2% of transaction value (max R100) eBucks Product overview FNB Global Account Bank charges Linked Account Transfers Cellphone banking, the FNB App, telephone banking - IVR, FNB ATM and online banking No Charge Home Finance Telephone banking - (Consultant assisted) R80 Invest FNB Branch R80 Important information Contact us Bank charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Cash withdrawals FNB ATM R2.30 per R100 Cash@Till® No Charge Cardless cash withdrawals R1.15 per R100 Credit card cash on budget R80 + R2.85 per R100 Other banks’ ATMs R12 + R2.30 per R100* FNB Branch R80 + R2.85 per R100 Bank charges International branch R80 + R2.85 per R100** Home Finance International ATM R80 + R2.85 per R100** eBucks Product overview Do more and get more Credit card FNB Global Account Invest Important information Contact us Bank charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. *If you withdraw cash at another banks’ ATM on the 1st, 3rd, 25th or 31st of the month, the R12 portion of the fee will be rebated. **Additional 2% commission and conversion fee apply. Some ATMs overseas might charge a withdrawal fee. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Debit order management eBucks Stop payment – digital channels No charge Product overview Stop payment – telephone banking (consultant assisted) R40 Do more and get more Stop payment – branch R80 Debit order dispute – telephone banking (consultant assisted) R45 Debit order dispute – branch (consultant assisted) R45 Debit order dispute - online and App (digital) R5 Credit card FNB Global Account Bank charges Home Finance Invest Deposits Cash Deposits at FNB ATM R1.30 per R100 Cash deposit at FNB Branch R80 + R2.85 per R100 Deposit@Till Pricing is determined by the merchant and is subject to change* Important information Contact us Bank charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. *Available at selected merchants. Checkers ,Shoprite, Usave, PnP Stores and Boxer Stores A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Prepaid purchases eBucks FNB Connect prepaid airtime purchase using Cellphone Banking, FNB ATMs, Online Banking and the FNB App No charge Product overview Prepaid airtime purchase using other banks’ ATMs R15 Do more and get more Prepaid airtime transaction fee (Cellphone banking) (spend<=R10) R0.50 Prepaid airtime transaction fee (Cellphone banking)) (R10 <spend<=R25) R1 Prepaid airtime transaction fee (Cellphone banking)) (spend>R25) R2 Other prepaid airtime using App and online banking No charge Entertainment, gaming, music and transport vouchers R2.70 LottoTM/Powerball, prepaid electricity, traffic fines* R2.70 Invest Daily Lotto R1 Important information Balance enquiries Credit card FNB Global Account Bank charges Home Finance Contact us Using FNB Cellphone Banking, FNB ATMs, online banking and the FNB App No Point-of-sale R1.75 Other banks’ ATMs, international point-of-sale, branch or telephone banking (consultant assisted) R7.30 Bank charges Terms, Conditions and Earn Rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Statements eBucks Cellphone banking mini statement No charge Product overview FNB ATM transaction list R3.75 (per statement) Do more and get more Statements – online banking and FNB App (download/view/email) No charge Emailing/printing of statements – branch and telephone banking R50 (per statement) Printed statements (Smart kiosk) R3.75 per page Interim statements R25 per page max (R50) Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Bank charges Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Additional statements (fee per month) eBucks Product overview Online Do more and get more Credit card FNB Global Account Paper Daily R65 Weekly R30 Twice-monthly R17 Daily R135 Weekly R57 Twice-monthly R29 Bank charges Unsuccessful transactions (insufficient funds) Home Finance Invest Important information FNB ATM No charge Point-of-sale, scheduled payment and other banks’ ATMs R8.50 Insufficient funds fee (returned item debit order) Thereafter R105 (per unpaid item 9 or more)21 Contact us Bank charges Terms, Rules and conditions apply. 21 Applicable over a rolling 12 month period. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value eBucks Product overview Copies of vouchers (deposit slips) Online banking No charge Branch and telephone banking (consultant assisted) R80 Do more and get more Credit card FNB Global Account SLOW Lounge fees25 Bank charges Domestic lounges R250 Home Finance International lounge R400 Invest Important information Contact us Bank charges Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. 25 SLOW Lounge fees are applicable for every additional entry over and above complimentary entries, as well as for every entry where the cardholder does not qualify for complimentary entries due to the cardholder’s eBucks rewards level. For more information on SLOW Lounge visit fnb.co.za/slow-lounge. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Card delivery fees eBucks Standard delivery No charge Product overview Urgent delivery R260 Do more and get more Scheduled delivery R150 International delivery R730 FNB Branch delivery No charge Credit card FNB Global Account Bank charges Home Finance Invest Important information Card replacement fees Current Account Card/Fusion Card/Credit Card R125 Temporary card R110 Branch replacement No charge FNB Petrol Card R125 Contact us Bank charges Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Convenience and value-added services Buy LOTTO™/Powerball/ R2.7026 Daily Lotto R1 DStv payments R7 Pay and clear now R45 FNB Instant Payment* R7 FNB Global Account Payshap** R7 Bank charges Cash swop fee No charge Home Finance Payment honouring fee27 Invest Common Monetary Area (CMA) cross-border receipt R100 plus applicable cash deposit fee Important information Account confirmation letter / visa letter (online banking / FNB APP) No Charge Contact us Account confirmation letter / visa letter (branch) R30 Online banking account verification R3.54 eBucks Product overview Do more and get more Credit card Honoured Value <R45: Charged at Honoured Value*** Honoured Value >=R45: Charged at R45 per R100 (Max. R200)*** Electronic subscriptions services (fee per month) Bank charges My limit alert R3.30 Scheduled payment alert R3.30 Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. 26 LOTTO™ purchases are excluded from the Islamic Premier Current Account. 27 A service fee is charged for each payment honoured where there is not enough money in your transactional account. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). * ** *** Only available from 1 October 2022. Only available from 13 March 2023. Customer transaction honoured for a value of R10. Fee charged R10. Customer transaction honoured for a value of R50. Fee charged R45. FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value eBucks Product overview Balance alert (fee per month) Monthly R1.20 Weekly R3.30 Daily R16 Do more and get more Credit card FNB Global Account Payment notifications Email No charge SMS No charge Bank charges Other fees Home Finance Invest Important information Contact us Bank charges Online banking password reset telephone banking (consultant assisted) R80 Online banking payment history (older than 3 months) R7 Online banking account verification fee (FNB and other banks’ accounts) R3.54 Monthly petrol card fee25 R24 Petrol card fuel purchases R6.25 Monthly device payment fee Device dependant Additional credit card purchase fees Fuel transaction fee (Petrol cards only) Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. 25 FNB Fusion Premier Account and Premier Current Account A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). R6.25 FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Credit card deposit fees eBucks FNB ATM with Automated Deposit Terminal (ADT) R1.30 per R100 Product overview FNB Branch and FNB ATM with envelope deposit facilities R80 + R2.85 per R100 Do more and get more Deposit at till Pricing determined by merchant and is subject to change* Credit card Credit card linked account transfers and account payments FNB Global Account IVR Smart Transfer to FNB No charge Bank charges Third party payments R8.50 Home Finance Telephone banking (consultant assisted) R80 Transfers and payments at branch R80 International card purchase fee 2% of transaction value (max R100) Invest Important information Contact us Bank charges Voucher retrieval requests Local R105 International R295 Other credit card fees Declined transaction fee R8.50 Card replacement fee R125 per card Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value Credit card convenience fees eBucks Pay2Cell R8.50 Product overview Prepaid airtime transaction fee (APP and online) No charge Do more and get more Prepaid airtime transaction fee (Cellphone banking) – Transactions between R0.01 – R10 R0.50 Prepaid airtime transaction fee (Cellphone banking) – Transactions between R10.01 – R25 R1 Prepaid airtime transaction fee (Cellphone banking) – Transactions between R25.01 – R40 R1.50 Prepaid airtime transaction fee (Cellphone banking) – Transactions >R40 R2 LottoTM/Powerball, prepaid electricity, traffic fines* R2.70 Home Finance Daily Lotto R1 Invest Uncapped ADSL fee R2.50 Credit card FNB Global Account Bank charges Important information Contact us Bank charges Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. *Payment fee which is dependent on account pricing option (Bundled vs PAYU). A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value eWallet eBucks Fees for sender Product overview Send money from FNB Account to eWallet R2 + R2.30 per R100 Do more and get more Reversal of incorrect ‘Send Money to eWallet’ transaction – telephone/branch R65 Reversal of incorrect ‘Send Money to eWallet’ transaction – cellphone banking R16.50 Credit card FNB Global Account Fees for recipient Monthly account fee No charge Withdraw cash from an FNB ATM, FNB Mini ATM or participating retailers No charge Purchases at participating retailers No charge Invest Prepaid airtime transaction fee (Cellphone banking) (spend<=R10) R0.50 Important information Prepaid airtime transaction fee (Cellphone banking) (R10 <spend<=R25) R1 Contact us Prepaid airtime transaction fee (Cellphone banking) (spend>R25) R2 Prepaid electricity R2.70 Bank charges Home Finance Bank charges Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank charges (continued) Introduction Get the best value eWallet eBucks Fees for recipient Product overview Inactivity fee per month (after 6 months of inactivity) R4.95 Do more and get more Transfer from your eWallet to your FNB Account No charge eWallet balance enquiry No charge eWallet mini-statement No charge Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Bank charges Terms, conditions and earn rules apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Bank Charges Introduction Get the best value MoneyGram30 eBucks Send amount (USD) Send fee (USD) Send amount (USD) Send fee (USD) Product overview $0.01 - $50 $7 $500.01 - $600 $29 Do more and get more $50.01 - $100 $10 $600.01 - $700 $34 $100.01 - $150 $11 $700.01 - $800 $39 $150.01 - $200 $13 $800.01 - $900 $44 $200.01 - $250 $15 $900.01 - $1 000 $49 $250.01 - $300 $17 $1 000.01 - $1 200 $55 $300.01 - $400 $19 $1 200.01 - $1 500 $63 $400.01 - $500 $24 $1 500.01 - $1 800 $70 Credit card FNB Global Account Bank charges Home Finance Invest MoneyGram30 Important information Contact us Bank charges Terms, Rules and conditions apply. 30 MoneyGram fees exclude VAT. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us FNB Home Finance The right solutions for the right home. We offer finance solutions and tools to guide you through the entire home loan process - from start to finish. FNB Premier Annual Pricing Guide 2022-2023 Home Finance Introduction Get the best value FNB Collective Buying FNB makes it easier for you to buy a home with up to 12 family members or friends with collective buying. eBucks Product overview Do more and get more Credit card Cost effective lending • Discounted attorney bond registration costs (only when applying via nav»Home) • Preferential interest rates on your home loan • No early termination fee charged • Get rewarded with up to R6 100 back in eBucks (when applying via any of the FNB internal channels).** FNB Global Account Bank charges Monthly service fee Home Finance New customers R69 Invest Existing customers No change in fee* Important information Once-off Initiation fee R6 037.50 Contact us These fees are in accordance with the National Credit Act 34 of 2005 as applicable to your Home Loan agreement. The fees quoted are VAT inclusive. Please note: The monthly service fee applicable to your home loan will be charged irrespective of the balance outstanding and will only cease when the bond is cancelled at the deeds office. For more information, please refer to the FNB Home Finance pricing guide on the FNB website. * Existing customers that enter into a new agreement will be charged a monthly service fee of R69 once approved. **The eBucks benefit is calculated at 50% of your first home loan repayment and is capped at eB61000. Terms , Conditions and Rules apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Invest Save and Invest Save and Invest to improve your financial future. FNB Premier Annual Pricing Guide 2022-2023 Savings and Cash Investments Introduction Savings account Get the best value A no fee FNB Savings account linked to your Current account. No transactional fees apply to your savings account. eBucks Product overview Do more and get more Credit card + FNB Money Maximiser FNB Global Account Earn a money market fund related rate, plus your capital and quoted returns are fully guaranteed. Accounts opened on the FNB App or in the Premier bundles will not be charged a monthly fee. With your Premier bundle you can start investing with FNB Money Maximiser, Share Zero, Tax free Shares, Tax Free Unit Trust, Retirement Annuity, Preservers and Personal Share Portfolios. Bank charges Home Finance Invest Important information Contact us Invest Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Invest Wealth and Investment FNB Premier Annual Pricing Guide 2022-2023 Introduction FNB Wealth Get the best value and Investments Tax-Free Shares With your Tax-free shares account you are invested in the Ashburton Top 40 ETF and Ashburton Midcap ETF. This gives you access to the top 100 companies on the JSE, offering you an instantly diversified portfolio. Enjoy all the benefits of investing while paying no tax on capital gains, dividends and interest earned. eBucks Annual Pricing Guide 2022-2023 Product overview Share Investing Do more and get more Stockbroking and Portfolio management Credit card General fees Monthly account fee No fee Investor Platform FNB Global Account Wills, Estate administration, Trusts and Estate Planning Bank charges Trade option First trading day of month / Delayed trades (Today at 15:00) Brokerage fees Important information Home Finance First trading day 0.12% excl VAT Delayed trades (Today at 15:00) 0.60% (min of R50) excl VAT Contact us Invest Important information Contact us Invest Investing Share Please note: For the purpose of calculating fees all “sell” instructions will be considered a delayed trade – even if placed on the first trading day of the month. FNB a division of FirstRandBank Ltd Authorised Financial Services Provider. Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Additional services Introduction FNB Wealth Get the best value and Investments eBucks Annual Pricing Guide 2022-2023 Product overview Share Investing Do more and get more Stockbroking and Portfolio management Credit card Investor Platform FNB Global Account Wills, Estate administration, Trusts and Estate Planning Bank charges Important information Home Finance Contact us Invest Share transfer (per counter) incl VAT Account transfer in No fee Account transfer out R135 Internal transfer No fee Portfolio move in No fee Portfolio move out R100 Transaction fees Transaction fees Electronic Telephone Branch Transfers Free R80 R80 Payments R8.50 R80 R80 Important information Contact us Share removal (per instruction) R1 – R50 000 R990 R50 000 – R2 000 000 R2 000 000+ Normal R1 550 R1 650 Fast Track R2 650 Invest Investing Share FNB a division of FirstRandBank Ltd Authorised Financial Services Provider. Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). R2 750 R4 800 FNB Premier Annual Pricing Guide 2022-2023 Fee schedule Introduction FNB Wealth Get the best value and Investments eBucks Annual Pricing Guide 2022-2023 Product overview Share Investing Do more and get more Stockbroking and Portfolio management Credit card Annual administration fee for living annuities and endowment products (incl VAT) Aggregated assets on the platform All funds* FNB Horizon Series Funds1 Ashburton Stable Income Fund2 Ashburton SA Income Fund3 Ashburton Money Market Fund4 First R1 000 000 0.46% 0.29% 0.12% 0.17% 0.17% Next R2 000 000 0.35% 0.29% 0.12% 0.17% 0.17% Above R3 000 000 0.23% 0.29% 0.12% 0.17% 0.17% Investor Platform FNB Global Account Wills, Estate administration, Trusts and Estate Planning Bank charges Annual administration fee for all other products** (excl VAT) Important information Home Finance First R1 000 000 0.40% 0.25% 0.10% 0.15% 0.15% Contact us Invest Next R2 000 000 0.30% 0.25% 0.10% 0.15% 0.15% Above R3 000 000 0.25% 0.25% 0.10% 0.15% 0.15% Important information Contact us Invest *Excluding 1, 2, 3 & 4 **Not applicable to the Tax-Free Unit Trust product when invested in FNB Funds FNB CIS Manco (RF) (Pty) Ltd is an approved manager of Collective Investment Schemes in terms of Collective Investments Scheme Control Act, 45 of 2002 by the Financial Sector Conduct Authority and is also a full member of the Association for Savings and Investment SA (ASISA). Ashburton Fund Managers (Proprietary) Limited is a licensed Financial Services Provider (“FSP”) in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002, FSP number 40169. FNB Investor Services Proprietary Limited (Reg number 2011/139123/07) is an authorised administrative financial services provider (FSP number 44341) (“FNB”). Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Fee schedule (continued) Introduction FNB Wealth Get the best value and Investments eBucks Annual Pricing Guide 2022-2023 Product overview Share Investing Do more and get more Stockbroking and Portfolio management Credit card Investor Platform FNB Global Account Wills, Estate administration, Trusts and Estate Planning Bank charges Personal share portfolio annual administration fee for all other products (excl VAT) First R7 500 000 0.25% Next R7 500 000 0.15% Next R10 000 000 0.10% Above R25 000 000 0.05% Personal share portfolio annual administration fee for living annuity (incl VAT) Important information Home Finance First R7 500 000 0.29% Contact us Invest Next R7 500 000 0.17% Next R10 000 000 0.12% Above R25 000 000 0.06% Important information Contact us For the full Wealth and Investments pricing guide please visit FNB Online Banking > Rates + Pricing > Overview > Invest Invest For more information on the fee structure of the Horizon Series funds, please refer to the latest fund fact sheets available at www. fnb. co.za> Invest> For yourself> I know what I want> Unit Trusts FNB CIS Manco (RF) (Pty) Ltd is an approved manager of Collective Investment Schemes in terms of Collective Investments Scheme Control Act, 45 of 2002 by the Financial Sector Conduct Authority and is also a full member of the Association for Savings and Investment SA (ASISA). Ashburton Fund Managers (Proprietary) Limited is a licensed Financial Services Provider (“FSP”) in terms of the Financial Advisory and Intermediary Services Act, 37 of 2002, FSP number 40169. FNB Investor Services Proprietary Limited (Reg number 2011/139123/07) is an authorised administrative financial services provider (FSP number 44341) (“FNB”). Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Retirement solution Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance FNB understands that life changes as you move through different life stages and therefore has retirement solutions for clients who are 60 years and above, especially designed to helping you make the transition into this exciting new life stage. Retired individuals can now share in the benefits of a solution designed specifically to cater for your unique needs, post retirement. Get more with our retirement solution • Enjoy all the value that being a Premier client brings together with additional benefits that retirement brings. As an FNB Premier client, if you invest R200,000 you will get 50% off your monthly transactional account fee or invest R500,000 and get 100% off More Value - Less Fees Invest Get more More rewards More help Earn preferential rates on your fixed deposits Double* investment eBucks points Your team of bankers will still be available to help you manage your money Important information Contact us Protect your money with FNB Lliving Annuity or Preservation Discounted estate administration fee Invest Invest your money with FNB Tax-Free Shares, FNB Tax-Free Unit Trust, FNB Investment Account or FNB Stockbroking and FNB Portfolio Management Segregated Portfolios: Fully managed and tailored to client need Terms, Rules and conditions apply. Certain benefits are dependent on your account and eBucks rewards level. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). Advice session to ensure you are on track FNB Premier Annual Pricing Guide 2022-2023 Gear up your finances to unlock cashflow Introduction Set and manage your financial goals on the FNB App to get the best benefit from your account Get the best value eBucks Product overview Do more and get more Credit card nav» Money 1 4 Credit status Track to spend Understand your money in and money out. And view your auto-categorised spend View your free credit status, personalised tips and offers FNB Global Account Bank charges 2 Home Finance Smart budget Invest Set budget alerts and get notified along the way 5 Savings goal Set, track and pause savings goals Important information Contact us 3 6 Money coach Available funds Understand how much you will have left before the end of your month Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). Get money smart with podcasts, tips and quizzes FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Important information The small print Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Standard terminology FNB Premier Annual Pricing Guide 2022-2023 Important Information Introduction • These prices include VAT • Interest rates are personalised to you and appear on the FNB Fusion Premier Account, FNB Premier Current Account and credit card statements • Visit FNB’s website for a copy of the terms, conditions and rules that govern our agreements Do more and get more • If your credit facility goes into arrears, you will be liable for collection fees and loans in accordance with the National Credit Act Credit card • Should you require further information on any Credit Card products or services, please contact credit card customer enquiries on 087 575 11 11 (standard rates apply) Bank charges • Credit facility service fee is charged monthly for the routine administration of maintaining your credit facility Home Finance • Credit card monthly account fee is charged monthly for the administration and maintenance of your credit card account Get the best value eBucks Product overview FNB Global Account Invest Important information Contact us Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 The small print Introduction Get the best value eBucks Product overview Our small print is straightforward. Information on our products and prices • Do more and get more Credit card • FNB Global Account Bank charges Home Finance Invest Important information • • • • FNB, a division of FirstRand Bank Ltd. reserves the right to change fees or introduce new fees from time to time. If we do this, though, we’ll give you at least 20 business days’ notice of these changes. You’ll find these changes on FNB’s website • We strive to keep the information provided in the pricing guide as accurate as possible, and we will not be held responsible if an error or omission is found • You must apply for each facility or product individually • The granting of any facility or product is subject to you meeting the qualifying criteria of that product or facility Each facility or product has a set of terms and conditions for that specific facility or product. We agree on these terms and conditions with the applicant • If there is disagreement between the product or facility specific terms and conditions and what’s outlined in this pricing guide, we’ll follow the product or facility-specific terms and conditions that apply to such a facility or product FNB reserves the right to change the features of any product or facility at any time Fees quoted as “per R100” include parts thereof Where cellphone banking is referred to, standard network rates apply All fees quoted are VAT inclusive and are effective from 1 July 2022 - 30 June 2023 Contact us Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Standard terminology Introduction Get the best value eBucks Product overview If you want to compare FNB’s fees with those of other banks, we have, as far as possible, used standard terminology throughout this pricing guide. This is in line with Section 13 of the Code of Banking Practice (COBP). In the case where we’ve used FNB-specific terminology, we’ve added this here showing the wording that other banks may use. Do more and get more Credit card FNB Global Account Bank charges Glossary of terms FNB term (As Used In Guide) Standard terminology Card purchase Card transaction Payment Third party payment/stop order Slimline devices Mini ATMs eChannels Online banking, telephone banking, Interactive Voice Response (IVR) and FNB ATMs Mobile channels Cellphone banking and the FNB App Home Finance Invest Important information Contact us Terms, Rules and conditions apply. A division of FirstRand Bank Limited. An authorised Financial Services and Credit Provider (NCRCP20). FNB Premier Annual Pricing Guide 2022-2023 Introduction Get the best value eBucks Product overview Do more and get more Credit card FNB Global Account Bank charges Home Finance Invest Important information Contact us Contact us For more information on how we can help you grow and manage your money contact your Premier Bankers 24/7 via SecureChat on the FNB App 087 577 7000