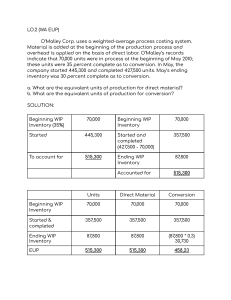

Solution A

Step 1

For this problem, we will be applying costs under the assumption that the FIFO method is used for process costing.

Step 2

## Requirement 1 In the first requirement, we are asked to determine the **equivalent units of production**. The first thing we are going to determine is the **units started and

completed**. Under the FIFO method, the equivalent units of production account for the percentage of completion. That said, the units started and completed during the period

are the units that will be fully accounted for in the equivalent units of production. These units may be determined using the total started units and the ending units in the work

in process (WIP). Therefore, the following details will be used:

|**Given**|| |:--|--:| |Started units|510,000| |Ending WIP|70,000|

Step 3

The difference between the started units and the ending inventory are the units started and completed. Therefore, the **units started and completed** are determined as

follows:

Units started and completed = Started units − Ending WIP

= 510,000 − 70,000

= 440, 000

The total units started and completed during the month are **440,000 units**. The ending units were deducted as these are units started but not yet completed during the

period.

Step 4

Therefore, these are the components of the equivalent units of production:

|**Particulars**|**Units**| |:--|--:| |Beginning WIP|60,000| |Started and completed|440,000| |Ending WIP|70,000|

Step 5

In computing the equivalent units of production for materials, we will be using the following percentages of completion:

|**Particulars**|**Percentage completed**| |:--|--:| |Beginning WIP|60%| |Ending WIP|80%|

Step 6

Therefore, the **equivalent units of production per materials** are determined as follows:

Particulars

EUP

Beginning WIP

60, 000 × (1 − .60)

Started and completed

Ending WIP

70, 000 × .80

Equivalent units of production

24,000

440,000

56, 000

520, 000

The equivalent units of production for materials are **520,000 units**. Notice that the percentage of completion multiplied by the beginning units in work in process is the

residual completion percentage since those were the materials used during the month. In other words, the percentage of completion given indicates the materials used during

the previous month.

Step 7

As for the computation of the equivalent units of production per conversion, we will be using the following percentages of completion:

|**Particulars**|**Percentage completed**| |:--|--:| |Beginning WIP|30%| |Ending WIP|40%|

Step 8

Therefore, the **equivalent units of production per conversion** are determined as follows:

Particulars

EUP

Beginning WIP

60, 000 × (1 − .30)

Started and completed

Ending WIP

70, 000 × .40

Equivalent units of production

42,000

440,000

28, 000

510, 000

The equivalent units of production per conversion are **510,000 units**.

Step 9

## Requirement 2 For the second requirement, we will be computing the **cost per equivalent unit** for the month of July. Under the FIFO method, the cost per equivalent unit

is determined by dividing the **cost added during the month** over the equivalent units of production (EUP). Therefore, to provide the requirements, we will be using the

following given:

|**Given**|| |:--|--:| |EUP of materials|520,000| |EUP of conversion|510,000| |Cost added to materials|$$468,000| |Cost added to conversion|357,000|

Step 10

Starting with the materials, the **cost per equivalent unit for materials** is determined as follows: $$\begin{aligned} \text{Cost per equivalent unit}&=\dfrac{\text{Cost added to

materials}}{\text{EUP of materials}}\\[15pt] &=\dfrac{\text{\$$468,000}}{\text{520,000}}\\[15pt] &=\boxed{\text{\$$0.90}} \end{aligned}$$ The cost per equivalent per unit for

materials is **$$0.90.**

Step 11

Meanwhile, the **cost per equivalent unit for conversion** is determined as follows: $$\begin{aligned} \text{Cost per equivalent unit}&=\dfrac{\text{Cost added to conversion}}

{\text{EUP of conversion}}\\[15pt] &=\dfrac{\text{\$$357,000}}{\text{510,000}}\\[15pt] &=\boxed{\text{\$$0.70}} \end{aligned}$$ The cost per equivalent per unit for labor is

**$$0.70**.

Step 12

## Requirement 3 For the fourth requirement, we are going to compute the costs of ending inventory and units transferred out. Starting with the **costs of ending work in

process (WIP) inventory**, we will multiply the cost per equivalent unit by the respective equivalent units of production. Therefore, the following details will be used with

reference to the prior requirements:

|**Particulars**|| |:--|--:| |EUP of materials, ending WIP|56,000| |EUP of conversion, ending WIP|28,000| |Cost per equivalent unit, materials|$$0.90| |Cost per equivalent unit,

conversion|0.70| The equivalent units of production (EUP) were previously computed for the second requirement.

Step 13

The **total cost of ending inventory** is determined as follows: $$\begin{array}{l r r r r} \text{Cost of ending WIP inventory}&{}&{\hspace{5pt}}\\ \text{\hspace{5pt}Materials}&{}&

{\hspace{5pt}}\\ \text{\hspace{15pt}EUP of materials, ending}&{}&{{56,000}}\\ \text{\hspace{15pt}Multiply: Cost per equivalent unit, materials}&

{}&\$$\hspace{5pt}\underline{\hspace{15pt}{0.90}}&\$$\hspace{5pt}{\hspace{0pt}50,400}\\ \text{\hspace{5pt}Conversion}&{}&{\hspace{5pt}}\\ \text{\hspace{15pt}EUP of

conversion, ending}&{}&{{28,000}}\\ \text{\hspace{15pt}Multiply: Cost per equivalent unit, conversion}&{}&\$$\hspace{5pt}\underline{\hspace{15pt}

{0.70}}&\hspace{5pt}\underline{\hspace{0pt}19,600}\\ \textbf{Total cost of ending WIP inventory}&{}&{}&{\$$\hspace{5pt}\underline{\underline{70,000}}}\\ \end{array}$$ The

total cost ending inventory is **$$70,000**.

Step 14

Now, let us compute the **cost of units transferred to the next department** consist of those (1) costs of the units in the beginning work in process inventory, (2) costs to

complete the work in process inventory, (3) and the units started and completed during the period. The first component refers to the completed portion of the units of the

beginning work in process inventory during the previous period, whereas the second component refers to those portions that were completed during the current period.

Step 15

Let us first compute the **total costs of the beginning work in process inventory (WIP)** which is composed of the first two costs mentioned earlier. The costs given related to

the beginning work in process inventory refer to the costs associated with the completed portion during the previous period. Therefore, in our solution, we will be using the

following given:

|**Particulars**|| |:--|--:| |EUP of materials, beginning WIP|24,000| |EUP of conversion, beginning WIP|42,000| |Cost of beginning WIP **materials**, previous period|$$27,000|

|Cost of beginning WIP **conversion**, previous period|13,000| |Cost per equivalent unit, materials|0.90| |Cost per equivalent unit, conversion|0.70|

Step 16

The **total cost of the beginning inventory** is determined as follows: $$\begin{array}{l r r r r} \textbf{Cost to complete beginning inventory}&{}&{\hspace{5pt}}\\

\text{\hspace{5pt}Materials}&{}&{\hspace{5pt}}\\ \text{\hspace{15pt}EUP of materials, beginning}&{}&{{24,000}}\\ \text{\hspace{15pt}Multiply: Cost per equivalent unit,

materials}&{}&\$$\hspace{5pt}\underline{\hspace{15pt}{0.90}}&\$$\hspace{5pt}{\hspace{0pt}21,600}\\ \text{\hspace{5pt}Conversion}&{}&{\hspace{5pt}}\\

\text{\hspace{15pt}EUP of conversion, beginning}&{}&{{42,000}}\\ \text{\hspace{15pt}Multiply: Cost per equivalent unit, conversion}&

{}&\$$\hspace{5pt}\underline{\hspace{15pt}{0.70}}&\hspace{5pt}\underline{\hspace{0pt}29,400}\\ \text{}&{}&{}&{\$$\hspace{5pt}51,000}\\ \text{Add: Costs of beginning WIP

inventory}&{}&{{}}\\ \text{\hspace{15pt}Materials}&{}&{\$$\hspace{7pt}27,000}\\ \text{\hspace{15pt}Conversion}&

{}&\underline{\hspace{0pt}13,000}&\$$\hspace{5pt}\underline{\hspace{0pt}40,000}\\ \textbf{Total cost of beginning WIP}&{}&{}&

{\$$\hspace{5pt}\underline{\underline{91,000}}}\\ \end{array}$$ The total cost of beginning inventory is **$$91,000**.

Step 17

Now, to compute for the **total cost of the units transferred out**, the total cost of beginning work in process inventory is added to the cost of the units started and completed.

To follow: $$\begin{array}{l r r r r} \text{Cost of units started and completed}&{}&{\hspace{5pt}}\\ \text{\hspace{5pt}Materials}&{}&{\hspace{5pt}}\\ \text{\hspace{15pt}Units

started and completed}&{}&{{440,000}}\\ \text{\hspace{15pt}Multiply: Cost per equivalent unit, materials}&{}&\$$\hspace{5pt}\underline{\hspace{15pt}{0.90}}&\$$\hspace{5pt}

{396,000}\\ \text{\hspace{5pt}Conversion}&{}&{\hspace{5pt}}\\ \text{\hspace{15pt}Units started and completed}&{}&{{440,000}}\\ \text{\hspace{15pt}Multiply: Cost per

equivalent unit, conversion}&{}&\$$\hspace{5pt}\underline{\hspace{15pt}{0.70}}&\hspace{5pt}\underline{\hspace{0pt}308,000}\\ \text{}&{}&{}&{\$$\hspace{5pt}704,000}\\

\text{Total cost of beginning WIP inventory}&{}&{\hspace{10pt}}&\hspace{5pt}\hspace{5pt}\underline{\hspace{5pt}91,000}\\ \textbf{Total cost of units transferred out}&{}&{}&

{\$$\hspace{5pt}\underline{\underline{795,000}}}\\ \end{array}$$ The total cost of the units transferred out is **$$795,000**.

Step 18

## Requirement 4 For the last requirement, we are going to prepare a cost reconciliation report. A **cost reconciliation report** presents the costs to be accounted for and the

costs accounted for, which should be equal. The costs to be accounted for consist of those costs associated with the completed beginning work in process inventory

completed in the previous month and costs added during the month. As for the costs accounted for, these are costs associated with the ending work in process inventory and

units transferred out.

Step 19

The following details, with reference to previous solutions, are included in the presentation of the cost reconciliation report:

|**Given**|| |:--|--:| |Cost of beginning WIP, materials|$$27,000| |Cost of beginning WIP, conversion|13,000| |Cost added to production, materials|468,000| |Cost added to

production, conversion|357,000| |Cost of ending WIP|70,000| |Cost of units transferred out|795,000|

Step 20

Therefore, the **cost reconciliation report** for Etching Department for the month of August is as follows:

Etching Department

Cost Reconciliation

$$\begin {array}{l r r r} \text{Costs to be accounted for:}&{}&{}&{\hspace{14pt}}\\ \text{\hspace{15pt}Cost of beginning WIP inventory}&{}&{}&{}\\ \text{\hspace{25pt}Materials}&

{}&{\$$\hspace{10pt}27,000}&{}\\ \text{\hspace{25pt}Conversion}&{}&\underline{\hspace{5pt}13,000}&\$$\hspace{5pt{\underline{\hspace{5pt}40,000}}}\\

\text{\hspace{15pt}Cost added during the month}&{}&{}&\underline{}\\ \text{\hspace{25pt}Materials}&{}&{\hspace{5pt}468,000}&{}\\ \text{\hspace{25pt}Conversion}&

{}&\underline{\hspace{0pt}357,000}&\underline{\hspace{0pt}825,000}\\ \text{\hspace{20pt}Total cost to be accounted for}&{}&\underline{\underline{}}&{\$$\hspace{5pt}

{\underline{\underline{865,000}}}}\\ &\\ \text{Costs accounted for:}&{}&{}&{\hspace{14pt}}\\ \text{\hspace{15pt}Cost of ending WIP inventory}&{}&{}&{\$$\hspace{10pt}70,000}\\

\text{\hspace{15pt}Cost of units transferred out}&{}&{}&\underline{\hspace{0pt}795,000}\\ \text{\hspace{20pt}Total cost accounted for}&{}&\underline{\underline{}}&

{\$$\hspace{5pt}{\underline{\underline{865,000}}}}\\ \end{array}$$

![Math 333: Homework 5: Due: Tuesday, Dec. 1, 2015 in... 1. [5pt] A basis for V = IR is S =](http://s2.studylib.net/store/data/011404034_1-53d463947a3637f67e02016907a9eca7-300x300.png)