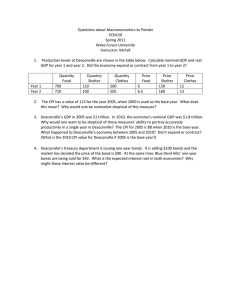

Ch. 24 Measuring the Cost of Living 9/26/2022 The Consumer Price Index • How do economists measure overall cost of living? • Consumer price index (CPI) – Measure of the overall level of prices • inversely related to the value of money – Measure of the overall cost of goods and services – Bought by a typical consumer – Bureau of Labor Statistics • 통계청 in Korea 2 Calculating CPI • How the CPI is calculated: 1. Fix the basket – – Find the basket of goods/services bought by the typical consumer Important goods have larger weights in the basket 2. Find the prices – – At each point in time Monthly 3. Compute the basket’s cost – – Same basket of goods (same weights) The effects of price changes are isolated 3 Calculating CPI 4. Choose a base year and compute the CPI – Base year = benchmark year (e.g. 2015) – Compute CPI • Price of the basket in current year (e.g. 2021) • Divided by price of basket in base year • Times 100 5. Compute the inflation rate CPI in year 2 - CPI in year 1 Inflation rate in year 2 100 CPI in year 1 4 Calculating the Consumer Price Index and the Inflation Rate: An Example This table shows how to calculate the consumer price index and the inflation rate for a hypothetical economy in which consumers buy only hot dogs and hamburgers. 5 Calculating the Consumer Price Index and the Inflation Rate: An Example This table shows how to calculate the consumer price index and the inflation rate for a hypothetical economy in which consumers buy only hot dogs and hamburgers. 6 The Consumer Price Index • Inflation rate – Percentage change in the price index • From the preceding period • Other price indices – Core CPI • Measure of the overall cost of consumer goods and services excluding food and energy • Less volatile price index – Producer price index, PPI • Measure of the cost of a basket of goods and services bought by firms • Changes in PPI are often thought to be useful in predicting changes in CPI – Why? 7 The Typical Basket of Goods and Services (US CPI) This figure shows how the typical consumer divides spending among various categories of goods and services. The Bureau of Labor Statistics calls each percentage the “relative importance” of the category. 8 The Typical Basket of Goods and Services (Korean CPI) 2017 basket 의류 및 신발; 6,11 기타상품 및 서비스; 5,69 식료품 · 비주류음료; 13,76 음식 및 숙박; 13,18 주택·수도·전기 및 연료; 16,59 교육; 8,96 오락 및 문화; 6,12 통신; 5,35 주류 및 담배; 1,58 교통; 11,26 9 보건; 6,98 가정용품 및 가사서비스; 4,42 The Consumer Price Index • Problems in measuring the cost of living – Substitution bias • Prices do not change proportionately – Prices of some goods in the basket can increase less than other goods • Then, consumers tend to substitute toward goods that have become relatively less expensive • CPI uses fixed basket therefore does not account for the substitution effects • CPI can overstate the increase in the cost of living – An increase in CPI may not be felt as severely to consumers because they can shift to less expensive goods – e.g. When CPI increases by 10%, living costs may increase by less than 10% because of the substitution effects. » 10% ↑ CPI will overstate the increase in the cost of living. 10 The Consumer Price Index • Problems in measuring the cost of living – Introduction of new goods • More variety makes one dollar worth more than before • It means actual cost of living falls as new goods are introduced • This effect is not captured in CPI – overstate? understate? – Unmeasured quality change • Quality of goods change over time • If price does not change but quality improves, one dollar would be worth more than before. • How would it affect cost of living? 11 GDP deflator versus CPI • Two measures of overall level of prices: – GDP deflator and CPI • Definitions: – GDP deflator • Ratio of nominal GDP to real GDP • What is real GDP? – Prices of goods in base year are fixed. The fixed prices are used to calculate the value of domestically produced final goods over time. – CPI • Value of the basket consumed by the typical consumer • The basket is fixed 12 GDP deflator versus CPI • First difference: – GDP deflator • Reflects prices of all goods & services produced domestically – CPI • Reflects prices of goods & services bought by a typical consumer – The goods in the CPI basket doesn’t have to be produced domestically • Prices of oil 13 GDP deflator versus CPI • Second difference: – GDP deflator • Compares the price of currently produced goods and services – To the base year price of the same goods and services – CPI • Compares price of a fixed basket of goods and services – To the price of the basket in the base year – The weight of the prices in GDP deflator changes, but they do not change in CPI 14 Two Measures of Inflation This figure shows the inflation rate—the percentage change in the level of prices— as measured by the GDP deflator and the consumer price index using annual data since 1965. Notice that the two measures of inflation generally move together. 15 Correcting for Inflation • Correcting economic variables for the effects of inflation – Knowing how the price levels have changed, we can compare dollar figures from different times – As price levels change, we can accordingly adjust other important economic variables 16 Correcting for Inflation • Dollar figures from different times – How much is $1 in 2008 worth in 2018? Price level today Amount in today′s dollar𝑠 = Amount in year T dollars × Price level in year T – How would you estimate salary in 1931 in 2012 dollars? Salary in 1931 in 2012 dollars = Salary in 1931 dollars × 17 Price level in 2012 Price level in 1931 Correcting for Inflation • Indexation – Automatic correction by law or contract of a dollar amount for the effects of inflation – COLA: Cost of living allowance • indexation of the wage to the CPI – Brackets of the federal income tax are also indexed for inflation • How about income tax brackets for Korea? 18 Correcting for Inflation • Real and Nominal Interest Rates • Nominal interest rate – Interest rate as usually reported – Without a correction for the effects of inflation • Should you be happy with 100% yearly interest rate? • It depends … • Real interest rate – equals “Nominal interest rate – Inflation rate” – Interest rate corrected for the effects of inflation 19 Interest rates in the U.S. Economy • Nominal interest rate – Almost always exceeds the real interest rate – U.S. economy has experienced rising consumer prices in every year • Inflation varies – Real and nominal interest rates do not always move together • Periods of deflation – Real interest rate exceeds the nominal interest rate 20 Real and Nominal Interest Rates This figure shows nominal and real interest rates using annual data since 1965. The nominal interest rate is the rate on a 3-month Treasury bill. The real interest rate is the nominal interest rate minus the inflation rate as measured by the consumer price index. Notice that nominal and real interest rates often do not move together. 21 Review questions • Which of the problems in the construction of the CPI might be illustrated by each of the following situations? – the invention of the cell phone – greater use of fuel-efficient cars after gasoline prices increase – more scoops of raisins in each package of raisin • Suppose that a borrower and a lender agree on the nominal interest rate to be paid on a loan. Then inflation turns out to be higher than they both expected. – Is the real interest rate on this loan higher or lower than expected? – Does the lender gain or lose from this unexpectedly high inflation? Does the borrower gain or lose? • If the price of imported French wine rises, is the CPI or GDP deflator affected more? why? 22