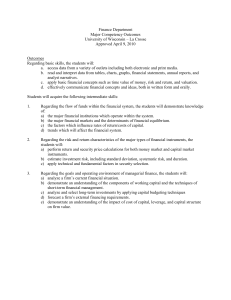

Example Finance Questions with outlined answers on money markets and companies

advertisement

Finance Critical questions: 2.6 How do large companies adjust their liquidity in the money markets? Liquidity is defined as the ability to convert assets into cash quickly without loss of value. This characteristic serves an important element in the ability of large companies to raise cash and invest cash surpluses. Large companies adjust their liquidity because their cash inflows and outflows are rarely synchronised. Therefore, two scenarios may occur, either cash expenditures exceed cash receipts or cash receipts exceed cash expenditures. In the first scenario, if the company holds a portfolio of money market instruments, it can sell some of these securities for cash or borrow short term in the money markets to increase their inflow of cash. On the other hand, where receipts exceed expenditures, companies can temporarily invest their funds in short-term money market instruments to prevent surplus money from being idle. Large companies are willing to invest large amounts of idle cash into money market instruments because of their high liquidity and low default risk. - Large companies take advantage of money markets to adjust for their liquidity By selling or buying short-term financial instruments e.g. commercial paper, CDs or Treasury notes Companies with cash surplus can invest in short-term securities Companies with cash shortfall can sell securities or borrow funds on short-term basis Money market instruments matured between one day and one year Are very liquid and less risky than long-term debt 2.9 Describe the informational differences that separate the three forms of market efficiency. There are three forms of market efficiencies. These consist of the strong form of market efficiency, semi-strong efficiency, and the weak-form efficiency. Strong form of market efficiency states that all information about a security is reflected in its price. This means that no private information that is not available to investor would not alter or affect the price of the security if released to the public, because the information would not exist. All available information would already be reflected in security prices. The semi-strong efficiency is a weaker form of efficient market hypothesis holds that only public information available to investors is reflected in the security’s price. Therefore, investors who have private information could potentially profit by trading on this information before it becomes public. The third and weakest form of efficient market hypothesis is known as the weak from which holds that there is both public and private information that is not reflected in the security’s price. This means that having access to the information would lead to abnormal profits. 2.1 Financial system: What is the role of the financial system, and what are the two major components of the financial system? Two major components of the financial system consist of financial markets and financial institutions. Financial markets consist of various markets, such as the money market and capital market to permit the creation and exchange of financial assets. Examples of financial assets are of loans, bonds and shares. Financial institutions, on the other hand, consist of companies such as commercial banks, credit unions and superannuation funds that provide financial services to the economy. In essence the role of a well-developed financial system through the existence of financial markets and institutions is to gather money from people and business in the economy with surplus funds and channel (lender-savers) and channel the money to businesses and consumers who need to borrow money (borrower-spenders). 2.5 Financial markets: Suppose you own a security that you know can be easily sold in the secondary market, but the security will sell at a lower price than you paid for it. What would this mean for the security’s marketability and liquidity? The secondary market is any market where owners of securities can sell their securities to other investors. Two important characteristics of a security to investors is its marketability and liquidity. Marketability is the ease with which a security can be sold and converted into cash. The extent to which a security’s marketability is affected is dependent on whether buyers for the security are readily available, and on the costs of trading and searching for information. Alternatively, liquidity is the ability to convert an asset into cash with ease without loss of its value. Supposing a security can be sold easily in the secondary market at a lower price than previously paid, its marketability will increase because new investors will purchase the security at a lower cost than what was previously purchased by the owner. On the other hand, in-relation to the definition of liquidity, liquidity of the security will decrease because the security will be sold to a new investor at a lower price than what was paid. This therefore means that the value of the security has decreased. 2.18 Money markets: What is the primary role of money markets? How do money markets work? The primary role of money markets is to provide large corporations or companies with an option to adjust their liquidity positions. The option to adjust liquidity is beneficial to companies because cash receipts and cash expenditures are rarely synchronised. Due to this factor, money markets allow companies to temporarily invest their idle cash into either Treasury bills or bank certificates of deposit. If a company’s outflow of cash exceeds their inflow, companies can borrow money from the money market by selling commercial paper at a lower interest rate than commercial banks. 2.19 Capital markets: How do capital market instruments differ from money market instruments? The significant difference between capital market instruments and money market instruments is that the money market focuses on short-term debt instruments that have a maturity of less than 1 year before they are sold, and the capital market focuses on the trading of long-term and intermediate-term debts and corporate shares. Each market, however, have significant differences in their instruments. Money market instruments carry lower risk than other securities because of their high liquidity and low default risk. In-contrast, capital market financial instruments carry more default risk and have longer maturities. Examples of capital market instruments consist of treasury bonds, corporate bonds, and Eurobonds, residential mortgage securities. On the other hand, money market instruments consist of treasury notes, bank bills and commercial paper.