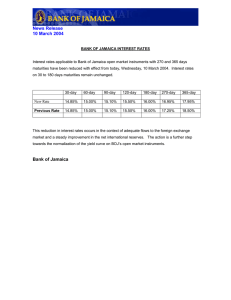

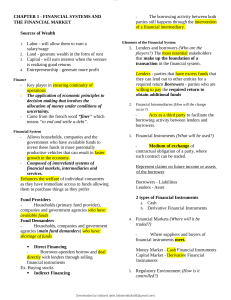

TENECIO, JULIANNE NICOLE M. 1. FIN 3153 (2-032) Why do we study Financial Markets and Institutions? Financial markets play a critical role in the accumulation of capital and the production of goods and services in our society. With proper capital allocation, it will lead to the growth in societal wealth, income, and economic opportunity. In studying financial markets and institutions, we will be able to understand more about these and how they can help the economy. We can understand how money flows where it is needed the most. In their desire to earn greater returns, financial institutions help to funnel money to the most successful businesses, which allows them to grow faster and supply even more of the desirable goods and services. This is how financial institutions greatly contribute to the efficient allocation of economic resources. 2. What is the difference between primary and secondary markets; money markets and capital markets? Primary markets are markets in which users of funds raise funds by issuing new financial instruments. An example for this is when corporations raise funds by issuing stocks and bonds. On the other hand, secondary markets are markets where existing financial instruments are traded among investors. An example is when stocks are exchanged or traded. Money markets are markets that trade debt securities with maturities of one year or less. It has little or no risk of capital loss, but it has low return. Capital markets are markets that trade debt and equity instruments with maturities of more than one year. It has substantial risk of capital loss, but it has higher promised return. 3. What are the risks faced by financial institutions? It is often said that profit is a reward for risk bearing. Nowhere is this truer than in the case of banking industry. Banks are literally exposed to many different types of risks. A successful banker is one that can mitigate these risks and create significant returns for the shareholders on a consistent basis. Mitigation of risks begins by first correctly identifying the risks, why they arise and what damage can they cause. The risks faced by financial institutions are credit risks, foreign exchange, country, interest rate risks, market risks, liquidity, off-balance-sheet, liquidity, technology, operational risks, and insolvency risks. 4. Why is Financial institutions need to be regulated? Financial institutions need to be regulated in order to put rules in place to stop things from going wrong, and to safeguard the wider financial system and protect consumers if they do go wrong. They are heavily regulated to protect society at large from market failures. Regulators also attempt to maximize social welfare while minimizing the burden imposed by regulation.