Accounting 12A Course Outline: Partnership & Corporation Accounting

advertisement

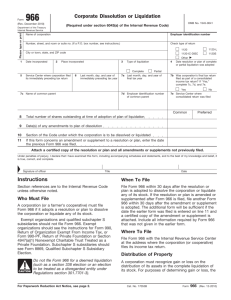

PILGRIM CHRISTIAN COLLEGE United Church of Christ in the Philippines Capistrano – Akut Sts., Cagayan de Oro City COURSE OUTLINE Course Title/ Number Course Description Week 1-2 2 Acctg. 12 A ( ESSENTIALS OF ACCOUNTING 2) - 2nd Sem 2022 - 2023 This is a continuation of the first course in accounting. It deals with transactions, financial statements, and problems peculiar to the operations of partnership and corporations as distinguished from sole proprietorships. Topics include: partnership formation and operations including accounting for the admission of partners, changes in capital, and profit-and loss sharing ratios, the conversion of an unincorporated enterprise into a corporation; accounting for incorporated enterprises, including the preparation of financial statements for internal and external purposes; and sample financial statements of companies in the service, manufacturing and trading industries. Course Rationale: To contribute to the full appreciation of the course, a student should be exposed to the formation, operations, dissolution, and liquidation of partnerships, basic considerations in forming a corporation and stock transactions. Topic PCC Vision, Mission and Goals, Vision, Mission and Objectives of the School of Business and Accountancy Nature and Scope of the Course and Course Requirements Grading System, Class Policies and Other Guidelines Partnership (Definition, Nature and Formation Definition of Terms Partnership Contract and Characteristics of Partnership Classification of Partners Feb. 1 2 Assignment/ Quiz Partnership Operations Division of Profits and Losses Use of Worksheet for a Partnership operations Adjusting Entry for income tax expenses Closing Entries Statement of Changes in Partner’s Equity Pre – Lim Exams (Feb. 8 – 11) 3rd week of Feb. Changes in Partnership Ownership Changes in Partnership Ownership Admission of a New Partner Purchase of Interest Investment of assets into the Partnership Retirement or Death of a Partner 4th week Partnership Liquidation Dissolution vs. liquidation Steps in partnership liquidation Liquidation Process Illustrative problems on different cases of liquidation Journal entries for liquidation Statement of liquidation Quiz 2 Partnership Liquidation by Installment Nature of installment Liquidation Procedure for Installment liquidation Schedule of Safe payments Cash priority program Journal Entries for installment liquidation Mid Term Exam (Mar. 9 -11) March 2nd wk Corporation: Formation and Share Capital Transactions Nature of a Corporation Similarities and distinctions between a corporation and a partnership Advantages and disadvantages of a corporation Classes of a corporation One person corporation Components of a corporation Articles of Incorporation By-Laws of a Corporation Corporate Capital Structure Accounting for Share Capital transactions Delinquent Subscription Incorporation of a sole proprietorship or a partnership Semi-Final Exam (April 15 - 18) Corporation: Transactions after Formation Accounting Cycle of a Corporation Components of shareholders’ equity Dividends – Cash dividends, Property dividends, Share dividends or Bonus issue, Scrip dividends Allocation of Cash dividends between preference share and ordinary share Appropriation of retained earnings Treasury Shares Retirement of Share Capital Book Value per share Final Exam (May 16 -20) III. Methods of Instruction/ Assessment: A. Lectures B. Problem Solving C. Answer Chapter exercises E. Graded recitation F. Online Learning B. Quizzes C. Examinations D. Assignment D. Class discussion and participation V. Recommended Textbook: Fundamentals of Accounting, Vol. 2, Partnership and Corporation by Patricia Empleo, et al. Grading System Midterm Grade Enabling Outcome Activities (quizzes/assignments, oral recitations and other student engagements)-----------30% Prelim and Midterm Exams ----------30% Culminating Outcome (Partial) ------- 40% Partial Final Grade Enabling Outcome Activities (quizzes/assignments, oral recitations and other student engagements)----30% Pre final and Final Exams -----------30% Culminating Outcome (Final)---------- 40% Total 100% Total 100% A. Get 30% B. Get 70% Final Grade: 100% Passing Grade: 75% with Equivalent Grade of 3.0 Prepared by: OLIVIA C. FLORES, CPA, MM