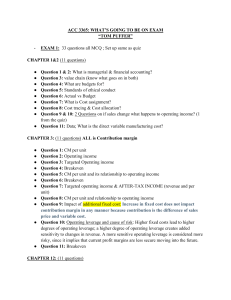

N UMERICAL P ROBLEMS | 4.1| EBIT, Operating BEP The following relationship exists for National Soap Company, a manufacture of superior quality soaps. Each unit of output is sold for Rs.45 the fixed costs are Rs.175,000; and variable costs are Rs.20 per unit. a. What is the firms gain or loss at sales of 5,000 units? b. What is the break-even point? | 4.2| Operating BEP A company estimates that its fixed operating costs are Rs. 500,000, and its variable costs are Rs 3.00 per unit sold. Each unit produced sells for Rs. 4.00. What is the company's breakeven point? In other words, how many units must it sell before its operating income becomes positive? | 4.3| Operating BEP Aquarium suppliers, Inc., produces 10-gallon aquariums. The firm's variable costs equal 40 percent of rupee sales, while fixed costs total Rs. 150,000. The firm plans sell the aquarium for Rs. 10 each. a. What is Aquarium suppliers' breakeven quantity of sales? b. What is Aquarium suppliers' breakeven sales volume? c. What price must Aquarium Suppliers charge to breakeven at sales of 40,000 units? | 4.4| Operating BEP, EBIT The Himalayan Company manufactures a line of ladies watches hat is sold through discount house. Each watch is sold for Rs. 25; the fixed costs are Rs.140,000 for 30,000 watches or less; variable costs are Rs.15 per watch. a. What is the firm's gain or loss at sale of 8,000 watches? Of 18,000 watches? b. What is the operating breakeven point? Illustrate by mean of a chart. c. What is Weaver's degree of operating leverage at sales of 8,000 units? Of 18,000 units? d.. What happens to the operating breakeven point if the selling price rises to Rs.31? What is the significance of the change to the financial manager? e. What happens to the operating breakeven point if the selling price rises to Rs.31 but variable costs rise to Rs. 23 a unit. | 4.5| Operating BEP, EBIT The following relationship exist for Balaju Industries a manufacturer of electronic components. Each unit of output is sold for Rs.45; the fixed costs are Rs.175,000, of which Rs.110,000 are annual deprecation charges; variable costs are Rs.20 per unit. a. What is the firm's gain or loss at sales of 5,000 units? Of 12,000 units? b. What is the operating income breakeven point? c. What is the cash breakeven point? d. Assume Balaju is operating at a level of 4,000 units. Are creditors likely to seek the liquidation of the company if it is slow in paying its bills? | 4.6| Operating BEP Bob's Bikes Inc. (BBI) manufactures biotech sunglasses. The variable material cost is Rs-0.74 per unit and the variable labor cost is Rs.2.61 per unit. a. What is the variable cost per unit? b. Suppose BBI incurs fixed costs of Rs. 610,000 during a year in which total production is 300,000 units. What are the total costs for the year? c. If the selling price is Rs.7.00 per unit, does BBI break even on a cash basis? If depreciation is Rs.150,000 per year, what is the accounting break-even point? | 4.7| Operating BEP, Cash BEP The following price and cost data are given for firms M, N, and O: M Rs. 25 Rs. 10 Rs. 30,000 Selling price per unit Variable cost per unit Fixed operating costs N Rs. 12 Rs. 6 Rs. 24,000 O Rs.15 Rs.5 Rs. 100,000 Calculate (a) the break-even point for each firm, and (b) the cash break-even point for each firm, assuming Rs. 5,000 of each firm's fixed costs are depreciation, (c) Rank these firms in terms of their risk. | 4.8| Operating BEP, Desired profit, Cash BEP Ayam Books is planning to market a book entitled 'Financial Management’ in Nepal. The marketing in charge has suggested that it can be sold at Rs. 65 per piece. It is estimated that the annual fixed operating costs, including Rs 70,000 depreciation, will be Rs. 200,000 and the variable cost per book will be Rs 57 a. What minimum number of books should the company sell to attain operating breakeven? b. What minimum number of books should the company sell to attain cash break even? c What should be the sales volume (in units and rupees) to achieve after tax profit of Rs. 100,000? d. What should be the sales volume (in units and rupees) to achieve after tax profit of Rs. 200,000? Assume 25 percent corporate tax rate. | 4.9| EBIT, BEP, DOL The Laxmi Corporation produces teakettle, which it sells for Rs.15 each. Fixed costs are Rs.700,000 for up to 400,000 units of output. Variable costs are Rs.10 per kettle. a. What is the firm's gain or loss at sales of 125,000 units? Of 175,000 units? b. What is the breakeven point? Illustrate by means of a chart. c. What is Laxmi degree of operating leverage at sales of 125,000 units? Of 50,000 units? Of 175,000 units? | 4.10| Operating BEP, DOL, EBIT The following information provided for Firm A and B. Firm Selling price per unit Variable cost per unit Fixed operating costs a. b. c. | 4.11| A Rs.8 Rs. 4.8 Rs. 80,000 B Rs.8 Rs.4 Rs. 120,000 Determine the break-even point for each firm. Which firm has the higher operating leverage at any given level of sales. Explain. At what level of sales in units, do both firms earn the same operating profit? DOL, DFL, DCL, Operating BEP, Cash BEP, Financial BEP You are supplied with the following analytical income statement for your firm. It reflects last year's operations. Particulars Sales (100,000 units) Variable cost Revenue before fixed cost Fixed cost (including Rs 500,000 annual depreciation) EBIT Interest expenses EBT Taxes Amount (Rs) Rs 18,000,000 7,000,000 11,000,000 6,000,000 5,000,000 1,750,000 Rs 3,250,000 1,250,000 Net income a. b. c. d. e. f. g. | 4.12| Rs 2,000,000 At this level of output, what is the degree of operating leverage? What is the degree of financial leverage? What is the degree of combined leverage? If sales should increase by 15 percent, by what percent would earnings before taxes (and net income) increase? What is the firm's break-even point in units and sales rupees? What is the firm's cash break-even point in units and sales rupees? What is the financial break-even point for the firm? DOL, DFL, DCL, Operating BEP You have developed the following analytical income statement represents the most recent year's operations, which ended yesterday. Particulars Sales Variable cost Revenue before fixed cost Fixed cost EBIT Interest expenses EBT Taxes (50%) Net income for your corporation. It Amount (Rs) Rs 20,000,000 12,000,000 8,000,000 5,000,000 3,000,000 1,000,000 Rs 2,000,000 1,000,000 Rs 1,000,000 Your supervisor in the controller's office has just handed you a memorandum that asking for written responses to the following questions: a. At this level of output, what is the degree of operating leverage? b. What is the degree of financial leverage? c. What is the degree of combined leverage? d. What is the firm's break-even point in sales rupees? e. If sales should increase by 20 percent, by what percent would earnings before taxes (and net income) increase? | 4.13| DOL, DFL, DCL Everest Company 2014 income statement is shown below. Income Statement of Everest Company for December 31, 2014 (Thousand of rupees) Particulars Sales Cost of goods sold Gross profit Fixed opening costs Earnings before interest and taxes Interest Earning before taxed Taxes (40%) Net income Dividends (50%) a. b. Amount (Rs) Rs.36,000 (25,200) Rs.10,800 (6,480) Rs.4,320 (2,880) Rs.1440 (576) Rs.864 Rs.432 Compute the degree of operating leverage (DLO), degree of financial leverage (DFL), and degree of total leverage (DTI for Everest company. Interpret the meaning of each of the numerical values you computed in part a. c. | 4.14| Briefly discuss some ways Everest can reduce its degree of total leverage. DFL, Financial BEP Bardiya Timber Corporation has the following partial income statement for 2014. Particulars Earning before interest and taxes Interest 1Earning before taxes Taxes (40%) Not Income Number of common shares a. b. c. 4.15| If Bardiya's has no preferred stock, what is its financial breakeven point? Show the amount you come up with actually is the financial breakeven by recreating the portion of the income statement shown above for that amount. What is the degree of financial leverage for Bardia's at EBIT equal to Rs.4,500? What does this value mean? If Bardia's actually has preferred stock that requires payment of dividends equal to Rs.600, what would be the financial break-even point? Show the amount you compute is the financial breakeven by recreating the portion of the income statement shown above for that amount. EBIT, Operating BEP, Financial BEP, DOL, DFL, DCL Jumla apple Company manufactures golf balls. The following income statement information is relevant for Jumla apple in 2014. Particulars Selling price per sleeve of balls (P) Variable cost of goods sold (% of price, P) Fixed operating costs Interest expense Preferred dividends Marginal tax rate Number of common shares a. b. c d. | 4.16| Amount (Rs) Rs.4,500 (2,000) Rs.2,500 (1.000) Rs.1.500 1,000 Amount (Rs) Rs. 5.00 75% Rs. 50,000 Rs. 10,000 Rs. 0.00 40% 20,000 What level of sales dose Jumla apple need to achieve in 2014 to breakeven with respect to operating income? At its operating break-even, what will be the EPS for Straight Arrow? How many sleeves of golf balls (units) does Straight Arrow need to sell in 1996 to attain the financial breakeven points? If Jumla apple expects its sales to be Rs.300,000 in 1996, what is its degree of operating leverage, its degree of financial leverage and its degree of total (combine) leverage? Based on the degree of total leverage, compute the earnings per share you would expect in 2014 if sales actually turn out to be Rs.270.000. DOL, DFL, DCL You are given the following information about the Sanima Company, which manufactures small ball pens: Price = Rs.35; Variable costs = Rs.19 per unit; Fixed costs = Rs.200,000; Debt (B) = Rs.300,000; Interest rate = 12%; Tax rate = 40% In 2009, Sanima's net income was Rs.600,000. a. How many ball pens were sold in 2009? b. Calculate the degrees of operating, financial, and combined leverage for Sanima. c. Suppose that Sanima restructures its balance sheet, increasing debt to Rs.l million. Prepare a pro forma income statement and calculate the degree of the combined leverage assuming the same level of sales calculated in Part a. | 4.17| Operating BEP, Desired Profit Annapurna Publishing Company expects to earn Rs. 210,000 next year after taxes. Sales be Rs. 4 million. Selling price per unit is Rs. 200 and a variable cost per unit of Rs. 150 per unit. The tax rate is 30 percent. a. What are the firm's fixed costs expected to be next year? b. Calculate the firm's break-even point in both units and rupees. c. If the firm require an after tax profit of Rs 250,000, what is the target unit and rupees of sales required?