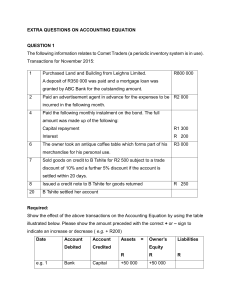

Review questions 26.5 Give the journal entries needed to record the corrections of the following. Narratives are not required. a) b) c) d) e) Extra capital of £12,000 paid into the bank had been credited to Sales account. Goods taken for own use £140 had been debited to Sundry Expenses. Private rent £740 had been debited to the Rent account. A purchase of goods from F. Smith £530 had been entered in the books as £350. Cash banked £620 had been credited to the bank column and debited to the cash column in the cash book. f) Cash drawings of £270 had been credited to the bank column of the cash book. g) Returns inwards £205 from N. Sturgeon had been entered in error in G. Milne’s account. h) A sale of an old printer for £70 had been credited to Office Expenses. 26.2 Show the journal entries necessary to correct the following errors: a) A sale of goods for £630 to J. Trees had been entered in J. Tees’s account. b) The purchase of a printer on credit from D. Hogg for £846 had been completely omitted from our books. c) The purchase of a laptop for £389 had been entered in error in the Office Expenses account. d) A sale of £260 to G. Lee had been entered in the books, both debit and credit, as £206. e) Commission received £340 had been entered in error in the Sales account. f) A receipt of cash from A. Salmond £130 had been entered on the credit side of the cash book and the debit side of A. Salmond’s account. g) A purchase of goods for £410 had been entered in error on the debit side of the Drawings account. h) Discounts Allowed £46 had been entered in error on the debit side of the Discounts Received account. Question 3 An examination of the accounts of Xavier Co. for the month of December 2021 revealed the following errors after the transactions were journalized and posted. a. While recording depreciation expense, accumulated depreciation expense was debited by $2,150 and cash account was credit by $2,150. b. While recording purchase of machinery for $10,800, the book keeper debited purchases account and credited bank account. c. While recording the receipt of commission on sales in cash $400, book keeper debited cash account and credited sales account. d. Owner withdrew $3,590 from bank account for personal use. The bookkeeper debited sundry expenses by $590 and credited bank $590. e. A receipt of payment from accounts receivable for $740 was debited to cash and credited to accounts payables. f. When accruing interest on investment, the book keeper debited interest receivable by $290 and credited interest payable for $290.