1999 JFE Opler et al The determinants and implications of corporate cash holdings

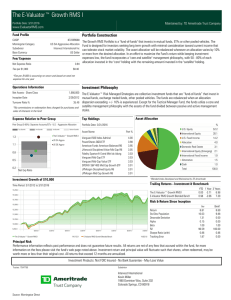

advertisement