The E-Valuator™ Growth RMS I - E-Valuator Risk Managed Strategies

advertisement

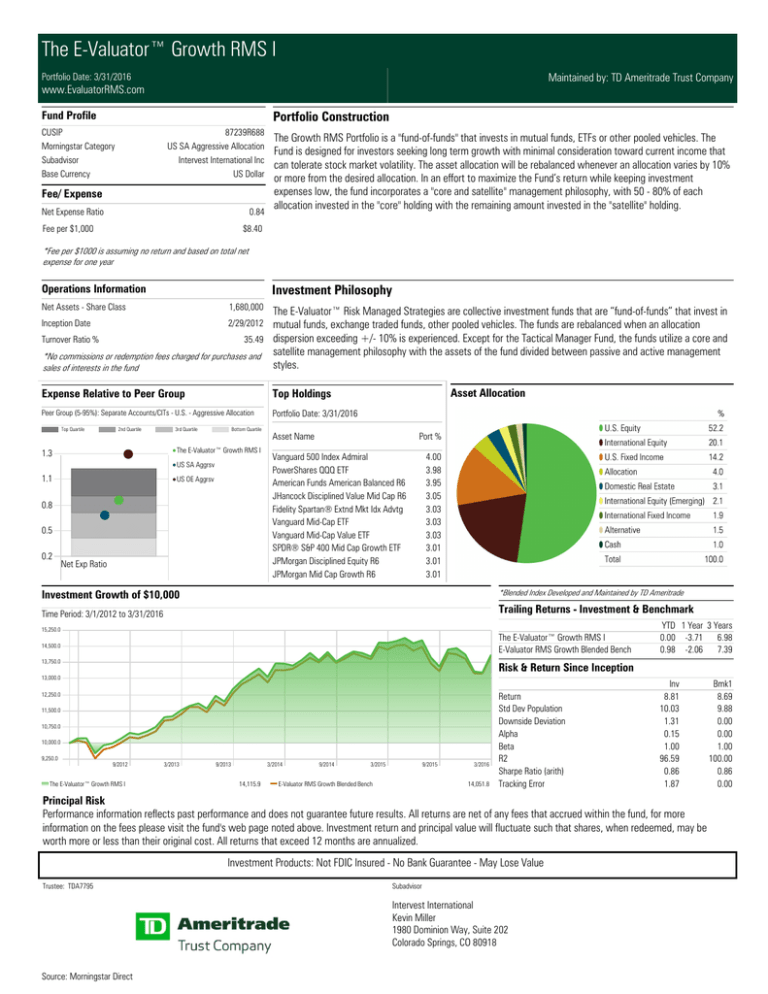

The E-Valuator™ Growth RMS I Portfolio Date: 3/31/2016 Maintained by: TD Ameritrade Trust Company www.EvaluatorRMS.com Portfolio Construction Fund Profile CUSIP Morningstar Category Subadvisor Base Currency 87239R688 US SA Aggressive Allocation Intervest International Inc US Dollar Fee/ Expense Net Expense Ratio 0.84 Fee per $1,000 The Growth RMS Portfolio is a "fund-of-funds" that invests in mutual funds, ETFs or other pooled vehicles. The Fund is designed for investors seeking long term growth with minimal consideration toward current income that can tolerate stock market volatility. The asset allocation will be rebalanced whenever an allocation varies by 10% or more from the desired allocation. In an effort to maximize the Fund’s return while keeping investment expenses low, the fund incorporates a "core and satellite" management philosophy, with 50 - 80% of each allocation invested in the "core" holding with the remaining amount invested in the "satellite" holding. $8.40 *Fee per $1000 is assuming no return and based on total net expense for one year Investment Philosophy Operations Information Net Assets - Share Class 1,680,000 Inception Date 2/29/2012 The E-Valuator™ Risk Managed Strategies are collective investment funds that are “fund-of-funds” that invest in mutual funds, exchange traded funds, other pooled vehicles. The funds are rebalanced when an allocation Turnover Ratio % 35.49 dispersion exceeding +/- 10% is experienced. Except for the Tactical Manager Fund, the funds utilize a core and *No commissions or redemption fees charged for purchases and satellite management philosophy with the assets of the fund divided between passive and active management styles. sales of interests in the fund Expense Relative to Peer Group Top Quartile 2nd Quartile 3rd Quartile Bottom Quartile The E-Valuator™ Growth RMS I 1.3 US SA Aggrsv 1.1 US OE Aggrsv 0.8 0.5 0.2 Asset Allocation Top Holdings Peer Group (5-95%): Separate Accounts/CITs - U.S. - Aggressive Allocation Net Exp Ratio Portfolio Date: 3/31/2016 Asset Name Port % Vanguard 500 Index Admiral PowerShares QQQ ETF American Funds American Balanced R6 JHancock Disciplined Value Mid Cap R6 Fidelity Spartan® Extnd Mkt Idx Advtg Vanguard Mid-Cap ETF Vanguard Mid-Cap Value ETF SPDR® S&P 400 Mid Cap Growth ETF JPMorgan Disciplined Equity R6 JPMorgan Mid Cap Growth R6 4.00 3.98 3.95 3.05 3.03 3.03 3.03 3.01 3.01 3.01 Investment Growth of $10,000 *Blended Index Developed and Maintained by TD Ameritrade Time Period: 3/1/2012 to 3/31/2016 Trailing Returns - Investment & Benchmark 15,250.0 The E-Valuator™ Growth RMS I E-Valuator RMS Growth Blended Bench 14,500.0 13,750.0 Risk & Return Since Inception 13,000.0 12,250.0 11,500.0 10,750.0 10,000.0 9,250.0 YTD 1 Year 3 Years 0.00 -3.71 6.98 0.98 -2.06 7.39 9/2012 The E-Valuator™ Growth RMS I 3/2013 9/2013 3/2014 14,115.9 9/2014 3/2015 9/2015 E-Valuator RMS Growth Blended Bench 3/2016 14,051.8 Return Std Dev Population Downside Deviation Alpha Beta R2 Sharpe Ratio (arith) Tracking Error Inv 8.81 10.03 1.31 0.15 1.00 96.59 0.86 1.87 Principal Risk Performance information reflects past performance and does not guarantee future results. All returns are net of any fees that accrued within the fund, for more information on the fees please visit the fund's web page noted above. Investment return and principal value will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. All returns that exceed 12 months are annualized. Investment Products: Not FDIC Insured - No Bank Guarantee - May Lose Value Trustee: TDA7795 Subadvisor Intervest International Kevin Miller 1980 Dominion Way, Suite 202 Colorado Springs, CO 80918 Source: Morningstar Direct Bmk1 8.69 9.88 0.00 0.00 1.00 100.00 0.86 0.00