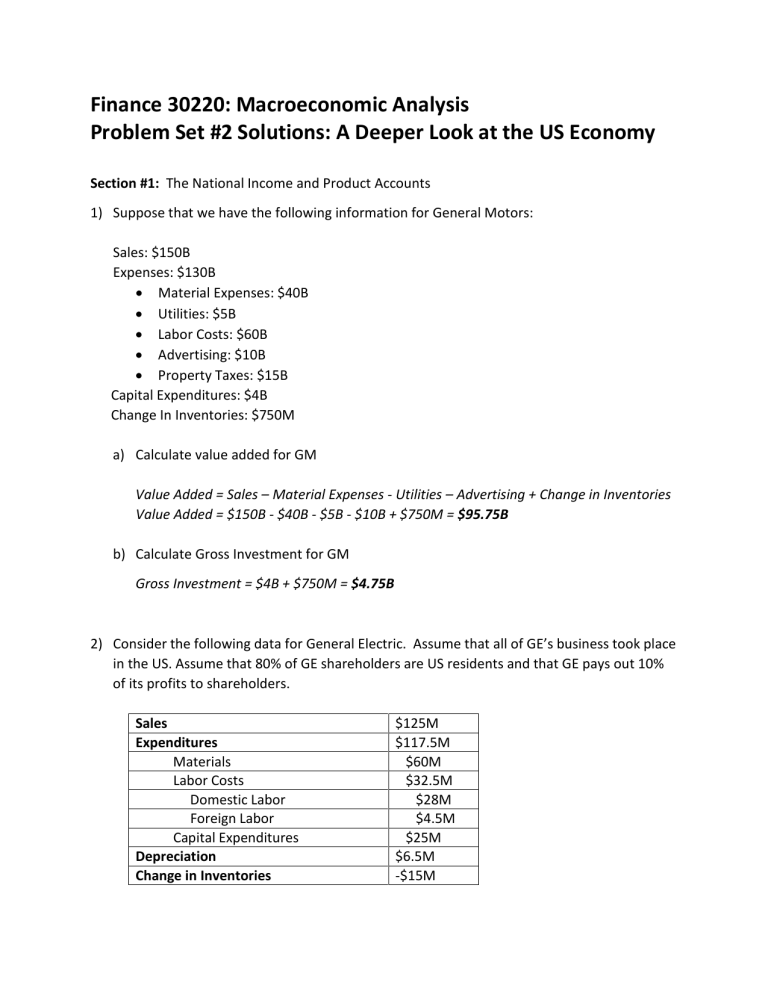

Finance 30220: Macroeconomic Analysis Problem Set #2 Solutions: A Deeper Look at the US Economy Section #1: The National Income and Product Accounts 1) Suppose that we have the following information for General Motors: Sales: $150B Expenses: $130B • Material Expenses: $40B • Utilities: $5B • Labor Costs: $60B • Advertising: $10B • Property Taxes: $15B Capital Expenditures: $4B Change In Inventories: $750M a) Calculate value added for GM Value Added = Sales – Material Expenses - Utilities – Advertising + Change in Inventories Value Added = $150B - $40B - $5B - $10B + $750M = $95.75B b) Calculate Gross Investment for GM Gross Investment = $4B + $750M = $4.75B 2) Consider the following data for General Electric. Assume that all of GE’s business took place in the US. Assume that 80% of GE shareholders are US residents and that GE pays out 10% of its profits to shareholders. Sales Expenditures Materials Labor Costs Domestic Labor Foreign Labor Capital Expenditures Depreciation Change in Inventories $125M $117.5M $60M $32.5M $28M $4.5M $25M $6.5M -$15M Calculate the contribution of GE to GDP, GNP, National Income, and Personal Income. GDP is just GM’s value added: GDP = Value Added = $125M - $60 + (-$15M) = $50M = Labor Income + Corporate Profits (EBITDA) Change in Revenues Materials Expense Inventories GDP = $50M = $32.5M + $17.5M Total Wages Profits (EBITDA) GNP (Represents Income Earned by Americans) = GDP + Net Primary Income • GM pays out 10% of its profits ($17.5M) to shareholders, 20% of which are foreign. ($17.5M)(.10)(.20) = $.35M Paid to foreign shareholders • GM pays out $4.5M to foreign labor GNP = $50 - $0.35 - $4.5 = $45.15 Income Payments to ROW National Income = GNP – Depreciation = $45.15M - $6.5M = $38.65M National Income = $38.65M = $28M + $10.65M American Wages American Profits (EBIT) Personal Income represents only income received by households. • GE pays out 10% of its profits ($17.5M) to shareholders, 80% of which are American. ($17.5M)(.10)(.80) = $1.4M Paid to American shareholders • GE pays out $28M to American labor Personal Income = $38.65M - $10.65M + $1.4M = $29.4M = $28M + $1.4M National Income American Profits (EBIT) Income from Assets American Wages Dividends received 3) Consider the following data for expenditures in the US economy. Category Consumption Gross Investment Government Net Exports Exports Imports GDP (Billions of Dollars) $13,233.2 $3,337.9 $3,360.0 -$571.9 $2,316.3 $2,888.2 $19,359.2 Annualized Growth 2.9% 5.7% 0.0% --3.6% 2.5% ??? Calculate annualized real growth in Gross Domestic Product GDP growth is the weighted average of each sector’s growth where the weights are that sector’s share of GDP. GDP = Consumption + Gross Investment + Government + Exports - Imports 13,233.2 3,337.9 3,360.0 2,316.3 2,888.2 Growth = (2.9% ) + (5.7% ) + (0% ) + (3.6% ) − (2.5% ) = 3% 19,359.2 19,359.2 19,359.2 19,359.2 19,359.2 Don’t forget the minus sign!!! 4) Suppose that we have the following data: Variable Retail Sales GDP 2019Q4 $4,558.5B $21,729.1B Suppose that retail sales for the month of January grew at 0.25% (for the month). Assuming that every other expenditure category grows at the prior quarter’s rate of GDP growth (2% per year), calculate an estimate for annualized growth in GDP for the first quarter of 2020. First, calculate retail sales as a percentage of GDP: 4,558.5 = 21% 21,729.1 Now, calculate annualized retail sales growth: . (10025 )12 = 10304 . → 3% Now, calculate growth in GDP as a weighted average of retail sales growth and everything else Growth =.21(3)+.79(2) = 2.21% 5) Suppose that you have the following information on an economy: • • • • • • • • Gross Domestic Product: $5,000 Government Consumption: $1,500 Government Investment = $500 Tax Revenues: $500 Net Exports: -$1,000 Net Primary Income: $200 Depreciation: $400 Consumption Expenditures: $3,000 Find (a) Gross National Product (b) National Income, the (c) Current Account, (d) Personal Savings (Assume that national income and personal income are equal), (e) Gross Savings, (f) Gross Private Savings, and Gross Public Savings. First, we can convert GNP = GDP + NPI: a) GNP = $5,000 + $200 = $5,200 Now, to get National Income, we subtract depreciation b) National Income = $5,200 - $400 = $4,800 The current account is given by net exports plus net primary income: c) Current Account = -$1,000 + $200 = -$800. Gross savings is GNP – Consumption – Government Cons. d) Gross Savings = $5,200 - $3,000 - $1,500 = $700 Gross Public Savings is taxes minus government consumption e) Gross Public Savings = $500 - $1,500 = -$1,000 Gross Savings is Gross Private Savings (Personal Savings plus business savings) plus Gross Public Savings (Taxes minus government consumption), so Gross Private savings is Gross Savings minus Gross Public Savings f) Gross Private Savings = $700 – (-$1,000) = $1,700 6) Consider the following numbers for WWII: Variable Government Consumption (% of GDP) Government Investment (% of GDP) Government Deficit (% of GDP) Gross Savings (% of GDP) Gross Private Investment (% of GDP) 1943 30% 18% 29% 23% 5% Trade in 1943 was balanced (NX = CA =0). Assuming personal income equals GDP, no undistributed profits, and that there are no transfer payments, calculate the private savings rate in (GDP – Taxes – Consumption) 1943 (as a % of GDP). So, we have Now, GC G G + GI − T T = 19% = 29% , so = 30% , I = 18% and C GDP GDP GDP GDP G SG C C = 23% = 1 − − C , so = 47% GDP GDP GDP GDP Finally, PS T C = 1− − = 34% GDP GDP GDP Alternately, we could use taxes and government consumption to get government savings (as a percentage of GDP) G T − C = 19 − 30 = −11% GDP GDP PS SG GS = − = 23 − ( −11) = 34% (Private savings = gross savings minus GDP GDP GDP government savings) 7) Consider the following information from the international transaction accounts (ITA): Current Account Exports Goods Services Income Receipts Imports Goods Services 2018 $400,000 $250,000 $30,000 $640,000 $180,000 Income Payments $10,000 Also, the US acquired $175,000 of foreign assets (Foreign Direct Investment, Portfolio Assets, deposits, etc.) a) Calculate the US Trade Deficit (Net Exports) Net Exports = ($400,000 + $250,000) – ($640,000 + $180,000) = -$170,000 Exports of goods and services Imports of goods and services b) Calculate the US Current Account Current Account = -$170,000 + ($30,000 - $10,000) = -$150,000 Net Exports Net Primary Income c) Is the US a borrower or lender? Explain. The US is a net borrower. Start with Output equals expenditures: GDP = C + I G + G + NX + NPI + NPI (Add net primary income to both sides) G GNP = C + I + G + CA Solve for the current account: CA = GNP − (C + I G + G ) Our Income Our Spending So, a current account that in negative means we spend more than we earn. To do this, we must either sell assets or incur liabilities. (In this case, $170,000 worth of lost assets or increased liabilities) d) Calculate the increase/decrease in US incurrence of liabilities. In addition to our current account deficit, we acquired $175,000 in foreign assets, so our total increase in liabilities is $150,000 + $175,000 = $325,000 Section #2: Price Indices and Inflation 8) In 1965, the base price for a Chevrolet Corvette was $4,100. Today, the base price of a Chevrolet Corvette is $55,900. We have the following information for the consumer price index: Year 1965 2000 2019 CPI (1983 = 100) 31.5 172.7 255.5 a) Calculate the inflation adjusted price of a 1965 Corvette in year 2019 $s . 2555 P2019 = $4,100 = $33,255 315 . b) Calculate the inflation adjusted price of both the 2019 and 1965 Corvette in year 2000 $s. 2019 Corvette 172.7 P2000 = $55,900 = $37,784 2555 . 1965 Corvette 172.7 P2000 = $4,100 = $22,478 315 . 9) Suppose that you are tasked with reporting the price for “rent of primary residence”. In past years, you have reported the rent of a 1,000 square foot apartment without an attached garage (the norm for the past several years) at $1,250 per month. Now, you find that the new norm is a 1,300 square foot apartment with an attached garage. You run the following regression to gauge the impact of square footage and the garage on price: ln(rent ) = 6.38+.70( sqft )+.10( garage) Where RENT is the monthly rent, SQFT is the square footage of the apartment in thousands and GARAGE is a dummy variable equal to 1 if the apartment has a garage and 0 If it doesn’t. You find that the monthly rent for a 1,300 square foot apartment with a garage is $1,600. a) Calculate the inflation rate for the rent. So, here we just calculate the percentage change the rental price: 1,600 − 1,250 INF = = 28% 1,250 b) Calculate the hedonically adjusted inflation rate for the rent. To do this, we need to hedonically adjust to correct for the increase in size and the addition of the garage. We know from the regression that each 1,000 square feet in size adds 70% to the price and the garage adds another 10%, so: rent = $1,250(170 . ) (110 . ) = $1,612 .3 Now, the inflation rate is 1,600 − 1,612 INF = = −0.74% 1,612 Note: an approximation would be to say that if 1,000 square feet adds 70%, then 300 square feet adds 70%/3.3 = 21% rent = $1,250(121 . )(110 . ) = $1,663 1,600 − 1,663 . INF = = −38% 1,663 Note: You could also just plug in the variables into the regression equation: ln(rent ) = 6.38+.70(13 . )+.10(1) = 7.39 e 7.39 = $1,619 1,600 − 1,619 . INF = = −12% 1,619 10) Suppose that you have the following price data: Year 2010 2011 2012 2013 Apples ($/lb.) $2.00 $2.50 $2.75 $3.10 Oranges ($/lb.) $3.50 $3.60 $3.90 $4.25 Bananas ($/lb.) $1.75 $1.95 $2.25 $2.40 a) Using 2011 as your base year, calculate a consumer price index (CPI) assuming that the average household spent 30% of their income on apples, 50% on oranges, and 20% on bananas in the base year. The CPI is a weighted average of each goods relative price (current year price divided by base year price) where the weights are each good’s expenditure share. 2010 . . 2.00 350 175 CPI =.30 +.50 +.20 =.91 2.50 3.60 195 . 2011 . 2.50 3.60 195 CPI =.30 . +.50 +.20 = 100 2.50 3.60 195 . 2012 2.75 3.90 2.25 CPI =.30 . +.50 +.20 = 110 2.50 3.60 195 . 2013 . 310 4.25 2.40 . CPI =.30 +.50 +.20 = 121 2.50 3.60 195 . b) Calculate the annual inflation rate using your constructed CPI. 2010 – 2011 1−.91 Inflation = = 9.9% .91 2011 – 2012 . − 1 11 Inflation = = 10% 1 2012 – 2013 . − 110 . 121 Inflation = = 10% 110 . 11) Suppose that we have the following information: Year GDP 1950 2000 $280.8 $10,248 Real GDP (2012 $s) $2,185 $12,924 Calculate the average annual inflation rate for the GDP deflator. The GDP Deflator is defined as the ratio of GDP (current price) and GDP (Base Year Price) 1950 Def 1950 = 2000 Def 2000 = 280.8 =.13 2,185 10,248 =.79 12,924 1 50 . 79 Inflation = − 1 = 3.6% .13 12) Suppose that we have an economy that produces manufactured goods and services. Further, assume that the average consumer spends 65% of their income on services and 35% on manufactured goods. We have the following information for production and prices in this economy. January 1983 January 2018 January 2019 Manufacturing Price Quantity $55 250 $115 450 $125 495 Price $25 $30 $38 Services Quantity 550 800 750 a) Using 1983 as the base year, calculate the inflation rate for the CPI from 2018 to 2019. 2018 115 30 CPI =.35 . +.65 = 151 55 25 2019 38 125 . CPI =.35 +.65 = 178 25 55 . − 151 . 178 Inflation = = 17.9% 151 . b) Using 2018 as the base year, calculate the inflation rate for the GDP deflator from 2018 to 2019. 2018 GDP(2018$) = $115(450) + $30(800) = $75,750 GDP( BY$) = $115(450) + $30(800) = $75,750 $75,750 Def 2018 = =1 $75,750 2019 GDP(2019$) = $125(495) + $38(750) = $90,375 GDP( BY$) = $115(495) + $30(750) = $79,425 $90,375 . = 114 Def 2018 = $79,425 . − 1 114 Inflation = = 14% 1