CapitalStructureDeterminantsofAutomotiveFirmsEvidencefromFourASEANCountries (1)

advertisement

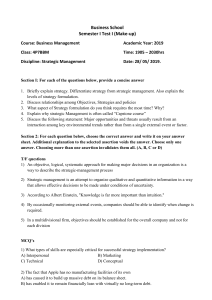

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/344862586 Capital Structure Determinants of Automotive Firms: Evidence from Four ASEAN Countries Research · October 2018 DOI: 10.13140/RG.2.2.19831.44961 CITATIONS READS 0 920 1 author: Raymond Chia Tsun Siung University of Malaya 2 PUBLICATIONS 0 CITATIONS SEE PROFILE All content following this page was uploaded by Raymond Chia Tsun Siung on 24 October 2020. The user has requested enhancement of the downloaded file. Capital Structure Determinants of Automotive Firms: Evidence from Four ASEAN Countries Raymond Chia Tsun Siung1* 1 Postgraduate candidate of Faculty of Business and Accountancy, University of Malaya, 50603 Kuala Lumpur, Malaysia. Email: rtschia@gmail.com Abstract This paper aims to investigate the relationship between a firm’s financial performance and its choice of capital structure on the basis of automotive firms listed on the KLSE, SGX, SET, and IDX over the period 2001–2016. Unbalanced panel data from the quarterly data of 66 listed automotive firms across the four countries, in order to answer the following two questions: Are capital structures of automotive firms in the four countries driven by firm-specific determinants similar to capital structures previously described in the literature? Do country-specific determinants play a role in the automotive firm’s choice of financing? We employed two different proxies for firm financial performance (return on asset and return on equity). We include the firm-specific variables size, tangibility, liquidity, revenue growth, and country-specific variables—these last refer to fluctuation of the national currency against the greenback, GDP growth, inflation, and country financial depth. Our study suggests that the ROA significantly influences the total debt ratio across the automotive firms in the four ASEAN countries, although this is not the case with ROE, and the sign of correlation of the other firm variables are mixed, indicating equivocal evidence supporting both trade-off theory and pecking order theory. Keywords: Capital Structure, ASEAN, Automotive Industry JEL Classification Code: D01, D22, G32 1. Introduction The automotive industry, dubbed the industry of industries, is one of the most globalized business at present (Wad, 2009). One reason for its nickname is possibly the role it has played in guiding individual countries’ economic development and industrialization (Tai, 2016), which can be observed even today in developing countries, where robust development of the infrastructure landscape, such as the construction of more highways, is made possible, leading to feasible logistic and economic activities. However, concern over the impact of the fourth industrial revolution, as described by Wad (2009), and the increasing needs of robotic automation, observed by the International Labour Organization (2016), are just some of the factors calling for extensive capital expenditures. All things being equal, which source of funding should be utilized? 1 This paper aims to investigate the capital structure determinants of listed automotive firms in four ASEAN countries—namely Indonesia, Malaysia, Singapore, and Thailand. The term capital structure refers to the mix of debt and equity (Brealey et al., 2014) of a firm, and the studies that have been conducted in this field have attempted to explain the financing decisions of firms for their real investment (Myers, 2001). In this paper, we focus on investigating the capital structure determinants of the automotive industry in this region, whether the commonly used determinants are applicable to this industry, and how some of the macroeconomic key indicators of each countries affect this decision. Firms must to be efficient if they are to stay relevant in the competitive business world. One of the details that we had to take into the account was the choice of the mix of capital structure, which does influence the value of a firm (Modigliani & Miller 1963, Kraus & Litzenberger 1973). We look into the capital structure determinants of the automotive industry by making a comparison between four countries in the ASEAN region. In terms of the automotive industry, the ASEAN region tends to be considered as a single country. Our comparison also allowed us to see whether automotive firms in this region behave similarly when making the debt or equity decision. In 2015, ASEAN was the seventh largest vehicle producer globally (International Labour Organization, 2016), and it is likely to climb past Japan and Russia to the fifth place by year 2020 (Frost & Sullivan, 2014). The sales and production of both commercial and private motor vehicles in Indonesia, Malaysia, and Thailand has been consistently above the regional average, with the exception of Singapore, which is the only ASEAN country considered a developed nation. Numbers obtained from the ASEAN Automotive Federation show that, in 2016, the cars produced in Thailand, Malaysia, and Indonesia represented more than 90% of the total cars produced in ASEAN, and that over 75% of the cars sold in the ASEAN market are sold in Thailand, Malaysia, and Indonesia. In spite a slowdown in sales and production during 2014 and 2015, both sales and production in the four selected countries showed resilient growth at respectively 3.1% and 3.2% in 2016, compared to 2015, and the five-year compound annual growth rate of sales and production since 2011 were respectively 4.1% and 6.1%. The four selected ASEAN countries are Common Law countries (Alves & Ferreira, 2011), so we assumed the political and legal effects to be a constant captured in the intercept. 2. Literature Review The basic source of income for any firm is the stream of cash flows produced by its various assets, be they tangible or intangible. If the firm is financed entirely by equity, then all these generated cash flows belong to the stockholders, while if the firm is financed partially by both debt and equity, then these cash flows would be split accordingly between the bondholders and the stockholders. Research on firm capital structure originated with the seminal paper of Modigliani & Miller (1958), who put forward the controversial proposition that the mix of capital structure is irrelevant to the firm’s value. Their thirty-seven-page paper suggested a total of three propositions, often known now as the capital structure irrelevance theory, based the assumptions that the financial market is perfect; that there is no cost to bankruptcy, no financial friction, and no taxation; that the management of the firm is always acting in the best interest of the shareholders, and that individual investor and firm could borrow at the same interest rate. These assumptions are important, because they are fundamental to the rise of many subsequent capital structure theories, as one by one each of 2 these assumptions was relaxed, thus forming the building blocks of our understanding of how firms finance their assets. One well-known capital structure theory, trade-off theory, was created when Modigliani & Miller (1963) lifted their assumption of no taxation, which was subsequently furthered by Kraus & Litzenberger (1973) with the lifting of the assumption that there is no bankruptcy cost. The ideas of trade-off theory revolve around the trade-off between the benefit and cost of issuing additional debt, which are respectively the tax shield and financial distress. This classical idea has since been extended with the dynamic assumption of market imperfection, where the capital structure is adjusted in order to obtain optimum firm value. The adoption of transaction costs, for example, produces three strongly debated research questions (Getzmann et al., 2014) concerning the speed of adjustment, the magnitude of the transaction cost, and the firm’s behavior in response to the capital structure shock. By lifting the assumptions that managers always act in the best interest of the principal and that investors and the firm can borrow at the same rate, the agency cost of debt theory was introduced by Jensen & Meckling (1976); this later developed into the free cash flow theory of Jensen (1986), which suggested the role of debt in mitigating the agency cost. The fundamental idea of signaling theory (Ross, 1977) was extended to pecking order theory (Majluf & Myers, 1984) and market timing theory (Wurgler & Baker, 2002), all of which are based on the idea of asymmetrical information raising the problem of adverse selection and moral hazard. Extensive empirical investigations aimed at verifying the claims of each of these capital structure theories have been carried over the last few decades (Kumar et al., 2017). In earliest empirical investigations, which used company data from the G7 countries (Rajan & Zingales, 1995) and from ten developing countries (Booth et al. 2001), four firm-specific determinants—namely, firm size, tangibility, market-to-book ratio, and profitability—were found to have an unequivocally significant effect on the debt ratio. The debt ratio has been used as a proxy for the firm’s choice of capital structure. In a direct comparison between developed and developing countries, Demirgüç-Kunt & Maksimovic (1999) confirmed similar findings. A subsequent survey by Bancel & Mittoo (2002) however, found no evidence for any of the capital structure theories being practiced in reality. According to Bancel & Mittoo (2002), firms in reality seek accessibility of financing facilities, regardless of the economic outlook and of the effect of acquiring more equity or debt on the financial statement ratios. We have found that recent papers on capital structure have mostly focused on the effects of country-level determinants on the variation in capital structure decision (such as Cheng, 2014; Fan et al., 2012; Gungoraydinoglu & Oztekin, 2011; Alvesa & Ferreira, 2011; De Jong et al., 2008; Deesomsak et al., 2004). In the econometric method, the most commonly used static models are pooled, fixed effect, and random effect models, while the most commonly used dynamic models are the two-stage least square model and the generalized method of moments (Arvanitis et al., 2012). Regression models are used here to test whether firms in their respective country aggregates can be explained by either trade-off theory or pecking order theory. The basic difference between these competing theories is that trade-off theory suggests the use of debt to gain as much extra benefit from the tax shield as possible, maximizing the firm’s value while staying at a tolerable level of distress (Ahmad & Abdullah, 2013; Abdeljawad & Mat Nor, 2017; Kraus & Litzenberger, 1973); pecking order theory, on the other hand, suggests the use of debt only when the firm’s internal funds are exhausted, in order to avoid adverse 3 selection problems due to asymmetrical information that could cause the firm to bear an extra unnecessary cost of finance (Miglo, 2017; Gao & Zhu, 2015; Majluf & Myers, 1984). We posit that there may be commonly used firm-specific determinants based on borrowing constraints, such as collateral and enforcement of covenants as required by funders. Because of this, we find that past capital structure studies conducted on the example of automotive firms have been performed rather similarly to studies of the capital structure of other industries. Rafique (2011), for example, uses the panel data of eleven automotive firms listed on the Karachi Stock Exchange in Pakistan from 2005 to 2009 but found no significant effect of profitability or degree of financial leverage on the debt ratio—possibly because the high industry growth in the study period impeded firm dependency on debt. Masnoon & Saeed (2014) used pooled data of ten automotive firms listed on the Karachi Stock Exchange from 2008 to 2012, and found that the profitability and liquidity had a significant negative effect on the debt-to-equity ratio, although tangibility, firm size, and earnings growth were found to not significantly affect the debt ratio. The significant negative relationship of firm profitability and liquidity to the firm debt ratio shown by Masnoon & Saeed (2014) exhibits certain criteria of pecking order theory. This may due to the environment in the country possessing a certain degree of information asymmetry, causing firms to behave in such a way as to avoid adverse selection problems. Automotive firms in developed countries, however, can exhibit a somewhat different financing behavior. Pinkova (2014) uses panel data from 2006 to 2010 on the Czech automotive industry, finding that the profitability and tangibility have significant positive effects on the total debt ratio, while firm size and liquidity have significant negative effects. We posit that this result arises because, in developed countries, the asymmetrical information problem is minuscule as a result of the well-developed financial intermediation, effective information flow, legal structure, and enforcement. We should thus be able to explain why firms in such environments will tend to be exhibit the behavior suggested by trade-off theory, where profitable firms and firms with high collateral value, as measured by tangibility, would borrow more due to lower financial distress and the benefit of the extra tax shield. However, this may not be entirely true because Pinkova (2014), in the same paper, also found that automotive firms with lower liquidity exhibit higher debt ratios. This is not a criterion of trade-off theory, but rather of pecking order theory. The automotive industry is a capital-intensive industry (Wad, 2009), meaning that automotive firms with low liquidity may not be able to meet their current liabilities. This is why Pinkova (2014) found that lower liquidity automotive firms tend to issue additional debt to avoid the higher adverse selection problem associated with issuing additional equity. While the use of firm size as a proxy for the probability of default was discarded by Rajan & Zingales (1995), it remains one of the more commonly used determinants showing significant effect on the debt ratio over the decades. Pinkova (2014), like Rajan & Zingales (1995), has shown that large firms tend to rely on equity, while small firms rely more on debt for external financing, which explains why significant negative effects were found among European automotive firms. We posit that asymmetrical information is low in the case of large firms due to higher exposure to media attention. As pointed out by Rajan & Zingales (1995) and in the literature review of Harris & Raviv (1991), the consensus on leverage determinants is that leverage increases with fixed assets, nondebt tax shield, investment opportunities and firm size, while it decreases with volatility, advertising expenditure, bankruptcy, profitability, and uniqueness of product. Since 4 then, we have seen repeated use of these variables in studies of capital structure. This paper thus narrows down the use of these variables to the automotive industry in four ASEAN countries to better understanding the determinants of firm choice in the mix of their capital structure in this region. 3. Methodology We use unbalanced panel data from the quarterly financial statements of the listed firms that are categorized by Thompson Reuters Eikon as belonging to the automotive industry in the four selected ASEAN countries. The three largest automobile markets in ASEAN (International Trade Administration 2010)—Thailand, Malaysia and Indonesia, with the addition of Singapore—are taken in this paper to represent the automotive industry of the region. There are a total of twenty-five automotive firms (of which twenty-four were selected for study) listed on the Kuala Lumpur Stock Exchange, KLSE Malaysia; there are twentythree (all selected) listed on the Stock Exchange of Thailand, SET; fourteen (thirteen selected) on the Indonesia Stock Exchange, IDX; and eight (six selected) on the Singapore Exchange, SGX. The firm’s quarterly financial data from 2001 to 2016 was obtained from Thompson Reuters Eikon. Country quarterly macroeconomic and financial data over the same period was obtained from the International Monetary Fund (IMF). The number of available firms and the number of firms selected for this study do not tally due to data constraints. 3.1 Variable definitions The dependent variable is the capital structure. Various measures of capital structure have employed in past studies, including debt-to-equity ratio (Jani & Bhatt, 2015; Masnoon & Saeed, 2014; Rafique 2011), total debt ratio, long-term debt ratio, short-term debt ratio (Abdeljawad & Mat Nor, 2017; Mirza et al., 2017; Chaklader & Chawla, 2016; Mohsin, 2016; Adhari & Viverita, 2015; Pinkova, 2012), and quasimarket value leverage (Alves & Ferreira, 2011; Deesomsak et al. 2004; Booth et al. 1999; Rajan & Zingales, 1995). In order to capture the effect of both long-term debt and short-term debt in the mix of the debt–equity decision, we here employ the total debt ratio, calculated as the ratio of total debt to total assets (TDA)—both as book values, because of the limited availability of their market valuations—as a proxy of the capital structure. Firm performance is seen as being the same as firm efficiency (see Margaritis & Psillaki, 2010), and is also equated to firm value (see Dawar, 2014; Sheikh & Wang, 2013), depending on which of the capital structure theories is employed. We use the last of these definitions. Authors have mostly used accounting-based ratios (Alves & Ferreira, 2011; Jong et al., 2008), such as return on assets, return on capital, or ratio of net operating cash flow to total asset, which are derived using information from financial statements. Some notable measures of firm performance include Tobin’s Q ratio (Hong, 2017; Zeitun & Saleh, 2015; Lin & Chang, 2009), which combines market and book values. Two different measures, return on asset (ROA) and return on equity (ROE), both in book-value form, are used in this paper to proxy firm performance so as to capture the efficiency of the firm in making use of its resources (assets and equity) to generate financial return. The return is obtained from the income statement, which shows earnings before interest and tax, in order to allow comparison across countries. Interest and taxation are also external factors. 5 Tangibility is also known as asset structure. We select the ratio of the total property, plant, and equipment to the total book value of assets reported in the firm’s balance sheet as one of the four firm-specific control variables in line with past reports in the literature (Abdeljawad & Nor, 2017; Mirza et al., 2017; Adhari & Viverita, 2015; Haron, 2014; Dawar, 2014; Kodongo 2014; Sheikh & Wang, 2013; Fan et al., 2012; Arvanitis et al., 2012, Gungoraydinoglu & Oztekin, 2011; Margaritis & Psillaki, 2010; Pandey, 2001). Tangibility can be seen as the ability to serve as collateral when the firm is applying for debt (Pandey, 2001). A high tangibility could indicate lower financial risk for the lender and a control in the case of bankruptcy (Gungoraydinoglu & Oztekin 2011). Making use of this, a firm could borrow at higher debt ratio at lower cost. In brief, past findings have exhibited mixed results—for example, Sheikh & Wang (2013) and Kodongo et al. (2014) have shown a negative correlation in Pakistan and Kenya, respectively; while Arvanitis et al. (2012) and Pandey (2001) have shown there to be a positive correlation between the tangibility and debt ratio of European and Malaysian firms, respectively. The firm size used in this study is the natural logarithm of the firm’s total assets. Past reports have suggested that larger firms are usually more diversified and have an established and stable cash flow; for this reason, larger firms can easily exhibit a higher debt ratio than smaller firms. We posit that this is due to the fact that the funds supplier—be it a bank or the capital market—would tend to be relatively at ease and impose lower financial friction when lending to such larger firms. In spite of this, literature reports evidently show mixed evidence that this is indeed the case. For example, positive correlation between firm size and leverage was found by Abdeljawad & Nor (2017) in Malaysia, Chancharat (2015) in Thailand, Kodongo (2015) in Kenya, Yazdanfar & Ohman (2015) in Swedish SMEs, Zeitun & Saleh (2015) in the GCC countries, and Sheikh & Wang (2011) in Pakistan; on the other hand, Hong (2017) found a negative correlation between firm size and leverage in South Korea. Mirza et al. (2017) found mixed evidence using a different definition of capital structure for firms in China. Liquidity plays an important role in the automotive industry, as in all manufacturing firms. A manufacturing firm without liquidity might opt to cease operation, whether temporarily or permanently. The use of liquidity in this paper is measured using the ratio of operating cash flow to the total current liabilities. We posit that the use of operating cash flow is better than the conventional use of current asset to measure liquidity. A high inventory turnover, for example, does not necessarily mean that the manufacturer would have enough cash or margin to fulfil its current obligations: the worst case scenario is not being able to fulfil its long term obligations, whether this consists of equity or long-term debt, due to pricing strategies such as offering lower-end products with much smaller profit margins than the manufacturer’s premium product. In the literature, Dawar (2014) uses a similar measure—cash to current liabilities—and found a positive relationship between it and the capital structure of Indian firms; Hong (2017) uses the same liquidity measure for his study in South Korea firms, while Mirza et al. (2017) found a mixed relationship of liquidity in China firms, depending on the definition of capital structure. Authors have different views on what proxies best measure firm growth: for example, Rajan & Zingales (1995) and Abdeljawad & Nor (2017) use the market-to-book ratio to capture future growth opportunity. This paper, however, uses the quarterly growth of revenue as a proxy for firm growth. We posit that a firm’s growth should be straightforwardly observable in the financial statements, and not bound by market expectations of the firm, as thus is captured in the market-to-book ratio. Dawar (2014) and Chancharat (2015) found no 6 significance relationship between firm growth and the capital structure of Indian and Thai firms, respectively; whereas Ahmad & Abdullah (2013), Zeitun & Saleh (2015), Kodongo (2014), Sheikh & Wang (2013), and Hong (2017) found positive relationships in Malaysia, GCC countries, Kenya, Pakistan, and South Korea, respectively. Fluctuation in a national currency can affect the pricing of products in the automotive industry, as seen in recent years: as the Malaysian currency has weakened, firms in its automotive industry have had to increase prices. This is probably due to the nature of the automotive industry in Malaysia, which is a net import industry with the majority of firm costs being denominated in foreign currency. For example, research done by a Malaysian financial service company, Kenanga Research and reported on the Malaysian news portal The Star Business in 2015, reveal that Tan Chong Motor Holding’s bottom line is said to be affected by 6% for every 1% fluctuation in the Ringgit–USD rate, while UMW’s bottom line could be affected by 3%. But does this variable affect a net export country such as Thailand? Intuitively, it could have an indirect effect on firm profitability (see Jong et al., 2008; Gungoraydinoglu & Öztekin, 2011 for their definition of direct and indirect effects of country-specific determinants). We here use the quarterly growth rate of the currency exchange rate provided by the IMF metadata, by country. We take the US dollar as an anchor currency due to the easily available historical data provided by the IMF metadata. Gross domestic product (GDP) is measured here using the quarterly growth of the country’s gross domestic product. The values of GDP, nominal, and domestic currency are taken from the IMF metadata for each country; overall, thus data could be seen as an indicator of the economic health of the country (Mirza et al., 2017), and it could strengthen the growth of the cyclically sensitive automotive industry. We would expect firms to be willingly to borrow at higher debt ratios during boom periods in order to increase their capacity and capture more market share, and to borrow at a lower debt ratio during bust periods. However, we use a long fifteen-year period in this study, and so we suspect that the effect of the GDP on firm’s behavior could be averaged out. We follow the common use of GDP as a control variable (Haron, 2014; Alves & Ferreira, 2011; Jong et al., 2008). Inflation is important determinant of capital structure (Alves & Ferreira, 2011) which may affect the debt ratio through the interest rate. Central banks often adjust their monetary policy by targeting inflation. Referring to the so-called term structure expectation hypothesis (Mishkin 2016, pp. 172), all things being equal, at a repeatedly high short-term interest rate, we could expect the long-term interest rate to also be equally high, and vice versa. At higher inflation (or expected future higher interest rate), this provides motivation for firms to borrow less long-term debt (bonds). An alternative view is that higher inflation decreases the benefit of leverage because of the higher bankruptcy costs of debt imposed on firms (Gungoraydinoglu & Oztekin 2011). In the case of higher inflation rates, firms choose more short-term debts over equity (Abzari et al., 2012). We make use of the quarterly growth rate of the consumer prices index provided by the IMF metadata by country as measure of inflation growth in this paper. There are four ways to measure the financial development of a country: financial depth, accessibility, efficiency, and stability (Cihak et al., 2012). We could expect the debt ratio to differ between countries with different development of the depth of financial institutions. For example, Alves & Ferreira (2011), assert that a firm might have an incentive to choose bank debt over equity on account of the higher rate of return required by shareholders in a country with an illiquid or underdeveloped capital market. This could cause 7 a greater preference for debt by firms in such countries. One way to measure the financial depth of the country is to use bank size, and this paper uses the definition of financial depth from World Bank data, which is the total size of claims of domestic banks on the domestic private sector as a percentage of the country’s GDP. This is provided by the IMF metadata for each country. 3.2 Empirical model and descriptive statistics The primary motivation for using the panel data is the ability to control for unobservable heterogeneity (Arvanitis et al., 2013; Dougherty, 2011). This is because, if the explanatory variables in our regression model are comprehensive, this will capture all the relevant characteristics of the population, meaning that there would not be any unobservable characteristics. If we were to leave unobserved effects untreated (even if they do not correlate with any of the explanatory variables), their presence alone will generally cause the ordinary least squares method to give an inefficient estimate and an invalid standard error (Dougherty, 2011). We thus employ a fixed effect model with a robust standard error estimated using the least squares method so as study the impact of firm performances on the choice of capital structure mix. Our unbalanced panel data is yi,t = β0 + Ʃ(j=1 to k)βjxi,j,t + μi + εi,t, where β0 is the intercept; βjxi,j,t is all the explanatory variables we have included, and k is 9 in both Equation 1 and 2; μi is the unobserved effect; and εi,t is the disturbance. We use the Breusch–Pagan Lagrangian Multiplier, BPLM test to decide whether the pooled ordinary least square estimation can be applied. Its null hypothesis implies homoscedasticity, where Var(μi) = 0, and thus the rejection of the LM test null hypotheses shows the existence of heterogeneity in the variables in our panel data. From the BPLM test result, the application of the pooled least squares estimation is consistently rejected due to violation of the least squares assumption in favor of random effect. The Hausman test was then perform to identify whether there is a correlation between an unobservable heterogeneity with the variables employed in our regression model. EViews was used to compute both the random effect and fixed effect so as to compare the estimates of coefficient, Var(βRandom– βFixed). The rejection of the null hypotheses favors the selection of a fixed effect instead of a random effect. From our Hausman test result, the fixed effect model is accepted when the pvalue of the Hausman test is < 0.05, while the random effect model is accepted when the pvalue is > 0.05. We then further employ the coefficient-of-covariance method for the White crosssection with robust standard error on account of our concern over heteroscedasticity, given our small sample size. According to Cameron & Miller (2015), failure to control for withincluster error correlations can lead to very misleadingly small standard errors, and consequently to a misleading narrow confidence interval, large t-statistic, and low p-values. The specification with both firm-specific and country-specific determinants is shown here in Equations 1 and 2. TDAi,t = β0 + β1ROAi,t + β2TANi,t + β3RGRi,t + β4LIQi,t + β5SIZi,t + β6FXFj,t + β7GDPj,t + β8INFj,t + β9BANj,t … Equation 1 TDAi,t = β0 + β1ROEi,t + β2TANi,t + β3RGRi,t + β4LIQi,t + β5SIZi,t + β6FXFj,t + β7GDPj,t + β8INFj,t + β9BANj,t … Equation 2 8 where TDAi,t is the total debt ratio, ROAi,t is the ratio of earnings before interest and tax to the total assets, and ROEi,t is the ratio of earnings before interest and tax to the total equity; TANi,t is the ratio of net fixed asset to total asset; RGRi,t is the revenue growth; LIQi,t is the ratio of operating free cash flow to the current liabilities; SIZi,t is the natural logarithm of the total assets; FXFj,t is the fluctuation of the currency against the US dollar; GDPj,t is the gross domestic product growth; INFi,t is the quarterly growth of the consumer price index; BANj,t is the banking depth as a percentage of the gross domestic product; the subscripts i, j, and t indicate firm i in country j at time t. Table 1: Descriptive statistic of firm- and country-specific variables Malaysia Singapore Thailand Indonesia N 1132 N 223 N 1010 N 637 μ 0.163 μ 0.252 μ 0.269 μ 0.307 Total debt ratio = total TDA ñ 0.108 ñ 0.230 ñ 0.260 ñ 0.294 debt / total asset ơ 0.155 ơ 0.128 ơ 0.230 ơ 0.197 Return-on-asset = μ 0.018 μ 0.013 μ 0.018 μ 0.017 ROA earnings before interest ñ 0.016 ñ 0.013 ñ 0.017 ñ 0.017 and tax / total asset ơ 0.022 ơ 0.019 ơ 0.022 ơ 0.019 Return-on-equity = μ 0.031 μ 0.051 μ 0.034 μ 0.043 ROE earnings before interest ñ 0.027 ñ 0.042 ñ 0.033 ñ 0.040 and tax / total equity ơ 0.035 ơ 0.069 ơ 0.062 ơ 0.068 μ 0.312 μ 0.226 μ 0.451 μ 0.343 Tangibility = net fixed TAN ñ 0.288 ñ 0.235 ñ 0.451 ñ 0.354 asset / total asset ơ 0.707 ơ 0.072 ơ 0.133 ơ 0.190 μ 0.021 μ 0.018 μ 0.023 μ 0.028 RGR Growth = Δ(revenue)t,t-1 ñ 0.016 ñ 0.013 ñ 0.016 ñ 0.033 ơ 0.233 ơ 0.179 ơ 0.180 ơ 0.206 Liquidity = operating free μ 0.201 μ 0.063 μ 0.252 μ 0.096 LIQ cash flow / current ñ 0.071 ñ 0.063 ñ 0.157 ñ 0.083 liabilities ơ 0.519 ơ 0.104 ơ 0.377 ơ 0.179 μ 2.678 μ 3.172 μ 3.452 μ 5.359 Size = natural logarithm SIZ ñ 2.476 ñ 3.212 ñ 3.452 ñ 5.771 of total asset ơ 0.710 ơ 0.663 ơ 0.452 ơ 1.911 Currency fluctuation μ 0.004 μ -0.002 μ -0.002 μ 0.007 FXF against US dollar = ñ 0.000 ñ -0.007 ñ -0.006 ñ 0.001 Δ(currency)t,t-1 ơ 0.032 ơ 0.024 ơ 0.025 ơ 0.041 μ 0.022 μ 0.012 μ 0.016 μ 0.038 Gross domestic product GDP ñ 0.027 ñ 0.008 ñ 0.013 ñ 0.015 = Δ(GDP)t,t-1 ơ 0.038 ơ 0.029 ơ 0.037 ơ 0.035 μ 0.006 μ 0.005 μ 0.006 μ 0.016 Inflation = Δ(consumer INF ñ 0.006 ñ 0.004 ñ 0.005 ñ 0.015 price)t,t-1 ơ 0.008 ơ 0.008 ơ 0.010 ơ 0.015 Banking depth = μ 4.384 μ 4.285 μ 3.896 μ 1.039 BAN ratio of domestic credit / ñ 4.390 ñ 4.149 ñ 3.752 ñ 0.960 GDP ơ 0.369 ơ 0.649 ơ 0.450 ơ 0.157 Note for Table 1: Notation μ is the mean, ñ is the median, ơ is the standard deviation, N is the number of observations in Malaysia. The descriptive statistic is calculated using Eviews 9 with the raw data obtained from IMF. Variable Description 9 4. Results and Discussion Table 2 present the least squares estimation results of the fixed effect model. Table 2: Summary of regression result using both firm- and country-specific variables shown in equation 1 and 2 Malaysia -0.15*** -0.12 (-3.26) (-4.23) -0.34*** (-2.84) 0.05 (0.66) 0.32*** 0.33*** (13.22) (13.56) 0.01 -0.003 (0.52) (-0.33) -0.01** -0.01*** (-2.08) (-2.90) 0.15*** 0.16*** (10.68) (11.07) -0.16*** -0.15*** (-3.20) (-3.36) -0.07 -0.07 (-1.45) (-1.36) -0.49** -0.49** (-2.38) (-2.41) -0.05*** -0.05*** (-8.57) (-9.28) 1,137 1,137 *** C ROA ROE TAN RGR LIQ SIZ FXF GDP INF BAN N Singapore -0.21*** -0.20** (-2.37) (-2.70) -0.38* (-1.87) -0.07 (-1.17) -0.58*** -0.58*** (-10.26) (-10.97) -0.04 -0.02 (-1.49) (-1.22) -0.05 -0.05 (-1.24) (-1.13) 0.23*** 0.23*** (6.84) (7.27) 0.08 0.08 (0.73) (0.63) -0.11 -0.11 (-0.94) (-0.91) -2.22*** -2.14*** (-4.96) (-4.83) -0.03*** -0.03*** (-3.43) (-3.14) 223 224 Thailand 0.26*** 0.32 (2.81) (2.91) -0.18 (-0.74) -0.01 (-0.09) 0.50*** 0.51*** (11.36) (10.72) 0.004 0.003 (0.14) (0.13) -0.06*** -0.04*** (-4.01) (-3.08) -0.03 -0.01 (-0.83) (-0.38) 0.29* 0.31** (1.84) (2.04) 0.08 0.04 (0.70) (0.37) 0.10 0.05 (0.33) (0.20) -0.04*** -0.04*** (-4.11) (-4.62) 1,018 1,020 *** Indonesia 0.23** 0.28 (2.76) (2.45) -1.22*** (-5.16) -0.01 (-0.13) -0.06 -0.04 (-1.06) (-0.65) -0.02 -0.03 (-1.07) (1.45) -0.01 -0.01 (-0.37) (-0.34) 0.10*** 0.10*** (3.76) (3.91) 0.17** 0.14* (2.38) (1.87) -0.34*** -0.29*** (-4.14) (-3.05) -0.13 0.02 (-1.06) (0.14) -0.44*** -0.41*** (-9.07) (-8.78) 647 653 *** Coefficient with White cross section standard error shown in bracket. Significance at *** 1%, ** 5% and * 10%. 4.1 Profitability and debt ratio Using Equation 1 and 2, we found that, other than for Thailand automotive firms, the return on assets (ROA) is significantly negatively correlated with the total debt ratio (TDA). Automotive firms from Indonesia, Malaysia, and Singapore thus seems to exhibit the behavior predicted by pecking order theory, with an inverse relationship between profitability and debt usage. The relationship between profitability and debt ratio is consistently as predicted by pecking order theory, implying that profitable automotive firms in these countries would tend to use less debt when they are profitable since they want to avoid the adverse selection problem that arise from asymmetrical information. Automotive firms in Thailand, on the other hand, show no significant negative correlation between the profitability and the total debt ratio. The greatest difference we see in Thailand’s automotive industry is the high volume of production for export, indicating that automotive firms in Thailand act as regional manufacturing hubs. In this capacity, Thai automotive policy is oriented toward foreign direct investment from multinational corporations. 10 4.2 Tangibility and debt ratio The tangibility of the automotive firms in the four countries shows results mixed between trade-off theory and pecking order theory. Hypothetically, we should be able to attribute higher tangibility to higher debt ratios, because tangible assets are easier to collateralize. We find this is true for the automotive firms in Malaysia and Thailand, where higher tangibility significantly affecting the higher debt ratio at the 1% significance level. In Malaysia for example, the consolidation of the banking sector in order to control the banks competition and the introduction of the policy that good quality collateral—generally in the form of commercial or residential real estate—be required from less well known businesses (Sufian & Habibullah, 2013). This kind of friction needed to be overcome with the use of tangible collateral. Trade-off theory suggests that profitable firms with high tangibility should have lower financial distress and lower bankruptcy costs (Gungoraydinoglu & Öztekin, 2011), and should borrow at higher debt ratios in order to gain extra benefit from the tax shield at the optimum debt ratio. We find this is somewhat different for the automotive firms in Singapore, where we suspect due to the capital funding and liquidity of banks are considered as key strength. The financial friction seems to be less than in the other countries. Although pecking order theory suggests that unprofitable firms that have exhausted their retained earnings would need to sell off some of their fixed assets (because they would prefer to avoid external funding as much as possible), we doubt that this happens in Singapore, because the automotive firms did not necessarily prefer to avoid bank borrowing in this case. In Indonesia, no significant correlation could be seen between liquidity and debt, although the sign of correlation is negative, as in Singapore. 4.3 Firm size and debt ratio In Singapore, the finding that firm size positively matters contradicts the finding that tangibility negatively matters. The only possible explanation of this finding is provided by trade-off theory. Firm size is found to be positively significant at 1% in all the four selected ASEAN countries, indicating that larger firms tend to exhibit higher debt ratios than smaller firms, as they have better economies of scale, diversification, and more information available, lowering the cost of bankruptcy and financial distress. Financial friction lessens and they are able to borrow more debt in order to gain higher tax shield benefits. 4.4 Growth and debt ratio Hypothetically, following the agency cost of debt theory or trade-off theory, higher revenue growth could cause a firm to incur more debt, while according to pecking order theory, higher growth could cause a firm to incur less debt. Higher growth opportunities indicate higher agency costs of debt, but lower agency costs of equity, leading to lower leverage, according to the agency view of trade-off theory (Gungoraydinoglu & Oztekin, 2011). Higher consistent growth would lead firms to expand their capacity, for which debt would a viable choice. Firms whose sales grow rapidly often need to expand their fixed assets (Pandey, 2001). We should thus expect a positive correlation between growth and debt. On the other hand, an alternative argument is that higher-growth firms tend to be smaller firms that also face higher distress. Growth would then be negatively correlated with debt, as more distressed firm would face higher friction when they needed to borrow. 11 However, this paper has shown no significant influence of realized revenue growth on the debt ratio in automotive firms in the four selected ASEAN countries. We posit that this is probably due to the measurement of this variable, indicating that the realized growth is not able to influence the automotive firms’ need for debt. Intuitively, durable goods manufacturers would not make any policies, such as debt policy, on the basis of variables that are sensitive to cycles, such as the realized revenue growth. We would suggest a measurement such as the market-to-book ratio, which is believed to proxy for the opportunity of growth. 4.5 Liquidity and debt ratio Higher liquidity could lead firm financing behavior, as trade-off theory suggests that liquid firms incur higher debt to take advantage of the reduced financial distress and to gain as much tax shield benefit as possible, maximizing firm value. Pecking order theory, on the other hand, would suggest using retained earnings and placing their excess retained earnings in safe short-term securities for cushioning the bad times. In Malaysia and Thailand, we see a significant negative correlation between firm liquidity and the debt ratio, indicating that firms may behave as predicted by the pecking order theory. Singapore and Indonesia, however, showed insignificant but similarly negative correlations between firm liquidity and debt. 4.6 Country-specific determinants and debt ratio The fluctuation of the local currency against the US dollar is seen to be a significant positive influence on the debt ratio in Thailand and Indonesia. When the currency of a country has a positive fluctuation, the currency is weakening (ΔFXt,t-1 where FX is the respective national currency rate against US dollar), and this leads firms to obtain more funds from banks in form of debt. In Malaysia, however, we showed a significant negative correlation with the total debt ratio, indicating that Malaysian automotive firm incur more debt when the Malaysian Ringgit is strong against the US dollar. For Singaporean automotive firms, there was no significant effect of national currency fluctuation on firms’ capital structure decisions. There is a significant negative influence of the country’s gross domestic product on the debt ratio of Indonesian firms. This indicates that automotive firms would obtain more external funds in form of debt to continue operations when the country’s economic activities are declining. We suspect that this is due to the automotive firms in Indonesia being able to cushion themselves against external factors using their own country’s domestic consumption. Thus, during economic downturns, the reduction in domestic consumption would trail behind the reduction in operating cash flow. At this time, firms would need external funds for working capital. However, we found no significant relationship between the country’s GDP and the debt ratio in the cases of Malaysia, Singapore, and Thailand. Borrowing more debt in the long term is preferred when inflation is consistently low for a few periods, because future inflation could be expected to be low when short-term inflation is consistently low. If monetary policy is adjusted automatically, low inflation means low future interest rates. Although we see this to be true in Malaysia and Singapore, we could not find any significant relationship between the inflation and debt ratio of automotive firms in Indonesia or Thailand. Lower inflation is significantly correlated with automotive firms in Malaysia and Singapore borrowing more. 12 Alves & Ferreira (2011) found that the bank claim on the private sector varies positively or negatively depending on the year in their cross-sectional data. On the other hand, we found that the bank domestic claim on the private sector in the countries studied here has a significant negative influence on the automotive firms’ debt ratio, using our panel data. This may indicates that when the banks had smaller claims on the domestic sector (lower lending, lower financial depth in the country), the total debt ratio of the automotive firms increased. The use of this measure is that it can proxy the financial depth of the country, and thus the negative relationship indicates that the country’s underdeveloped financial depth causes firms to rely more on the use of debt. 5. Conclusion This paper examines both the firm-specific and country-specific determinants of the capital structure of listed automotive firms in four selected ASEAN countries—Indonesia, Malaysia, Singapore, and Thailand—from 2001 to 2016. The initial intuition guiding this study was that the capital structure decision of automotive firms cannot be seen as the sole outcome of their idiosyncratic firm characteristics, but also as a reaction to the environment the business is operating in. We found the effects of the determinants varied between the countries. For example, the country’s GDP was found to significantly affect automotive firms’ total debt ratio in Indonesia, but not in the other countries, and the fluctuation in the national currency against the greenback was found to significantly affect automotive firm’s total debt ratio in Malaysia, Thailand, and Indonesia, though not in Singapore. One countryspecific determinant that was consistent exhibited in the four countries was country financial depth, which indicates the significant role of the financial institutions as intermediaries when automotive firms seek external funds. The relationships we have observed between the country-specific and firm-specific determinants of capital structure provide support for the applicability of pecking order theory and trade-off theory in these ASEAN automotive firms, even though some of the data was obtained from firms located within developed countries. Based on our empirical results, we are unable to decisively favor either theory over the other in explaining the financing behavior of automotive firms in the selected ASEAN countries. For example, the negative relationship between firm profitability and the liquidity-to-total-debt ratio follows the predictions of pecking order theory. The positive relationship between firm size and total debt ratio, on the other hand, follows the predictions of trade-off theory. The significant effect of tangibility differ between the studied countries. The automotive firms from Malaysia and Thailand showed positive relationships between tangibility and total debt ratio, Singapore showed a negative relationship, and Indonesia did not show any significant relationship. The interaction of each variable with the debt ratio has probably not been fully elucidated here. For example, the nature of the business, such as low liquidity required, causes automotive firms to borrow more, with the debt contract or the negotiated terms and conditions being imposed by the bank. In developing countries, where banks play a more focused role as financial intermediaries, an alternative reason for firm profitability being consistently negatively correlated with the debt ratio might be better explained in terms of the negotiated debt contract. We propose that more qualitative studies be performed, not only on nonfinancial firms, but also on financial institutions, paying special regard to their lending criteria. 13 References Abdeljawad, I., & Nor, F. M. (2017). The capital structure dynamics of Malaysian firms: timing behavior vs adjustment toward the target. International Journal of Managerial Finance, 13(3), 226-245. Abzari, M., Fathi. S., & Nematizadeh, F. (2012). Analyzing the impact of financial managers' perception of macroeconomic variables on capital structure of firms listed in Tehran Stock Exchange. Journal of Academic Research in Economics and Management Sciences, 1(3), 131-141. Ahmad, A. H., & Abdullah, N. A. H. (2016). Investigation of optimal capital structure in Malaysia: a panel threshold estimation. Studies in Economics and Finance, 30(2), 108 – 117. Alves, O. F. P., & Ferreira, M. A. (2011). Capital structure and law around the world. Journal of Multinational Finance Management. 21(2011), 119–150. Arellano, M., & Bond, S. (1991). Some test of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277-297. Arvanitis, S. H., Tzigkounaki, I. S., Stamatopoulos, T., & Thalassinos, E. (2012). Dynamic approach of capital structure of European shipping companies. International Journal of Business and Economic Sciences Applied Research, 5(3), 33-63. Baker, M., & Wurgler, J. (2002). Market timing and capital structure. The Journal of Finance. 57(1), 1-32. Booth, M. L., Aivazian, V., Demirguc-Kunt, A., & Maksimovic, V. (2001). Capital structure in developing countries. The Journal of Finance, 56(1), 87-130. Brealey, R. A., Myers, S. C., & Allen, F. 2014. Principle of Corporate Finance. 11th Global Edition. McGrawHill Education (UK) Limited. Cameron, A. C., & Miller, D. L. (2015). A practitioner’s guide to cluster-robust inference. The Journal of Human Resources. 53(3), 317-372. Cekrezi, A. (2013). Analyzing the impact of firm’s specific factors and macroeconomic factors on capital structure: a case of small non-listed firms in Albania. Journal of Finance and Accounting, 4(8), 90-95. Chaklader, B., & Chawla, D. (2016). A study of determinants of capital structure through panel data analysis of firms listed in NSE CNX 500. SAGE Publications. 20(4), 267–277. Chakraborty, I. (2010). Capital structure in an emerging stock market: The case of India. Research in International Business and Finance. 24(3), 295-314. Chancharat, N. (2015). Capital structure and corporate performance: evidence from Thailand. International Journal of Economic Research. 12(4), 1353-1370. Chang, J., Rynhart, G., & Huynh, P. (2016). ASEAN in transformation. Automotive and auto parts: shifting gears. Geneva, Switzerland: International Labor Organization. Cheng, H. (2014). Determinants of capital structure in Asian firms: new evidence on the role of firm level factors, industry characteristics and institutions. Leicester, England: Doctoral thesis, University of Leicester. Čihák, M., Demirgüç-Kunt, A., Feyen, E., & Levine, R. (2012). Benchmarking financial development around the world. World Bank Policy Research Working Paper 6175. Daskalakis, N., & Psillaki, M. (2008). Do country or firm factors explain capital structure? Evidence from SMEs in France and Greece. Applied Financial Economics, 18(2), 87–97. Dawar, V. (2017). Agency theory, capital structure and firm performance: some Indian evidence. Managerial Finance, 40(12), 1190-1206. Deesomsak, R., Paudyal, K. & Pescetto, G. (2004). The determinants of capital structure: evidence from the Asia Pacific region. Journal of multinational financial management, 14(4-5). 387-405. Demirguc-Kunt, A., & Maksimovic, V. (1999). Institutions, financial markets and firm debt maturity. Journal of Financial Economics. 54(3), 295-336. Dougherty, C. (2011). Introduction to Econometrics. 4th Edition. New York: Oxford University Press Inc. Fan, J. P. H., Titman, S., & Twite, G. (2012). An international comparison of capital structure and debt maturity choices. Journal of Financial and Quantitative Analysis, 47(1), 23-56. Frost & Sullivan. (2014). Advent of fuel efficient cars in ASEAN: executive briefing. Retrieved November 16, 2017 from https://www.smmt.co.uk/wp-content/uploads/sites/2/Advent-of-Fuel-Efficient-Cars-inASEAN_Frost-Sullivan.pdf. Gao, W. & Zhu, F. (2015). Information asymmetry and capital structure around the world. Pacific-Basin Finance Journal, 32(C), 131–159. Getzmann, A., Lang, S., & Spremann, K. (2014). Target capital structure and adjustment speed in Asia. AsiaPacific Journal of Financial Studies. 43(1), 1–30. Gitman, L. J., & Zutter, C. J. (2015). Principles of Managerial Finance. 14th Global Ed. Pearson Education Ltd. Gungoraydinoglu, A., & Öztekin, O. (2011). Firm- and country-level determinants of corporate leverage: some new international evidence. Journal of Corporate Finance, 17(5), 1457-1474. 14 Haron, R. (2014). Capital structure inconclusiveness: evidence from Malaysia, Thailand and Singapore. International Journal of Managerial Finance, 10(1), 23-38. Harris, M., & Raviv, A. (1991). The theory of capital structure. The Journal of Finance, 46(1), 297-355. Hong, S. (2017). The effect of debt choice on firm value. Journal of Applied Business Research, 33(1), 135-140 International Trade Administration. (2010). ASEAN Automotive Market. Retrieved November 24, 2017 from https://www.trade.gov/td/otm/assets/auto/ASEAN2010.pdf. Jani, R. R., & Bhatt, S. J. (2015). Capital structure determinants: a case study of automobile industry. International Journal of Research and Analytical Reviews. 2(1), 67-71. Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(1976), 305-360. Jensen, M. C. (1986). Agency cost of free cash flow, corporate finance and takeovers. American Economic Review, 76(2), 323-329. Jong, A. D., Kabir R., & Nguyen. T. T. (2008). Capital structure around the world: the roles of firm- and country-specific determinants. Journal of Banking and Finance, 32(9), 1954-1969. Kodongo, O., Mokoaleli-M, T., & Maina, L. (2014). Capital structure, profitability and firm value: panel evidence of listed firms in Kenya. Munich Personal RePEc Archive. Retrieved December 20, 2017 from https://mpra.ub.uni-muenchen.de/57116/. Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The Journal of Finance, 28(4), 911-922. Kumar, S., Colombage, S., & Rao, P. (2017). Research on capital structure determinants: a review and future directions. Journal of Managerial Finance, 13(2), 106-132. Lin, F. L., & Chang, T. (2009). Does debt affect firm value in Taiwan? A panel threshold regression analysis. Applied Economics, 43(1), 117-128. Mahalingam, E. (2015). TheStar news: Bumpy ride for auto business, including UMW and Tan Chong. Thestar Business News. Kuala Lumpur, Malaysia. Margaritis, D., & Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking and Finance. 34(3), 621-632. Masnoon, M., & Saeed, A. (2014). Capital structure determinants of KSE listed automobile companies. European Scientific Journal. 10(13), 451-461. Miglo, A. (2010). Chapter 10: The pecking order, trade-off, signaling and market-timing theories of capital structure: a review in H. Kent Baker, Gerald S. Martin, Capital Structure and Corporate Financing Decisions: Theory, Evidence, and Practice (pp. 171-191), Wiley and Sons. Miglo, A. (2017). Timing of earnings and capital structure. North American Journal of Economics and Finance, 40(C), 1-15. Mirza, S. S., Jebran, K., Yan, Y., & Iqbal, A. (2017). Financing behavior of firms in tranquil and crisis period: Evidence from China. Cogent Economics & Finance, 5: 1339770. Mishkin, F. S. (2015). The economics of money, banking and financial markets. Global 11th Edition. Harlow, United Kingdom: Pearson Education. Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297. Modigliani, F., & Miller, M. H. (1963). Corporate income tax and the cost of capital: a correction. The American Economic Review, 53(3), 433-443. Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221. Ong. T. S., & Teh, B. H. (2011). Capital structure and corporate performance of Malaysian construction sector. Journal of Humanities and Social Science, 1(2), 28-36. Pandey, I. M. (2001). Capital Structure and the firm characteristics: evidence from an emerging market. IIMA working paper no. 2001-10-04. Retrieved December 19, 2017 from http://dx.doi.org/10.2139/ssrn.300221. Pinková, P. (2012). Determinants of capital structure: evidence from the Czech automotive industry. Acta Univ. Agric. Silvic. Mendelianae Brun. 60, 217-224. Rafique, M. (2011). Effect of profitability and financial leverage on capital structure: a case of Pakistan’s automobile industry. Economics and Finance Review, 1(4), 50 – 58. Rajan, R. G., & Zingales, L. (1995). What we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421-1460. Ross, S. A. (1977). The determination of financial structure: the incentive-signaling approach. The Bell Journal of Economics, 8(1), 23-40. Salim, M., & Yadav, R. (2012). Capital structure and firm performance: evidence from Malaysia listed companies. Social and Behavioral Sciences, 65 (2012), 156-166. 15 Sheikh, N. A., & Wang, Z. (2013). The impact of capital structure on performance: an empirical study of nonfinancial listed firms in Pakistan. International Journal of Commerce and Management, 23(4), 354368. Startz, R. (2015). Eviews illustrated for version 9. Irvine, CA: IHS Global Inc. Sufian, F., & Habibullah, M. S. (2013). Financial sector consolidation and competition in Malaysia: an application of the Panzar-Rosse method. Journal of Economic Studies, 40(3), 390 – 410. Tai, W. P. (2016). The political economy of the automobile industry in ASEAN: a cross-country comparison. Journal of ASEAN Studies, 4(1), 34-60. Viverita, A. R. (2015). Capital structure, ownership concentration and firm performance: evidence of reverse causality hypotheses in ASEAN countries. Corporate Ownership & Control, 12(4), 451-461. Wad, P. (2009). The automobile industry of Southeast Asia: Malaysia and Thailand. Journal of the Asia Pacific Economy, 14(2), 172–193. Xu, J. (2012). Profitability and capital structure: evidence from import penetration. Journal of Financial Economics, 106(2), 427-446. Yazdanfar, D., & Öhman, P. (2015). Debt financing and firm performance: an empirical study based on Swedish data. Journal of Risk Finance, 16(1), 102-118. Zeitun, R., & Saleh, A. S. (2015). Dynamic performance, financial leverage and financial crisis: evidence from GCC countries. EuroMed Journal of Business, 10(2), 147-162. Zubairi, H. J. (2010). Impact of working capital management and capital structure on profitability of automobile firms in Pakistan (July 30, 2010). Finance and Corporate Governance Conference 2011 paper. Melbourne, Australia. Retrieved December 17, 2017 from http://dx.doi.org/10.2139/ssrn.1663354. 16 View publication stats