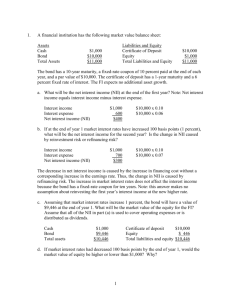

True/ False questions (Each worth 1 point) Problems (Total 23 points) 1. A financial institution has the following balance sheet structure: Assets Cash Bond Total Assets Liabilities and Equity Certificate of Deposit Equity Total Liabilities and Equity $1,000 $10,000 $11,000 $10,000 $1,000 $11,000 The bond has a 10-year maturity and a fixed-rate coupon of 10 percent. The certificate of deposit has a 1-year maturity and a 6 percent fixed rate of interest. The FI expects no additional asset growth. a. What will be the net interest income (NII) at the end of the first year? Note: Net interest income equals interest income minus interest expense. 2. A bank invested $50 million in a two-year asset paying 10 percent interest per annum and simultaneously issued a $50 million, one-year liability paying 8 percent interest per annum. What will be the bank’s net interest income each year if at the end of the first year all interest rates have increased by 1 percent (100 basis points)? 3. Consider the following balance sheet for Watchover U Savings, Inc. (in millions): Assets Floating-rate mortgages (currently 10% annually) 30-year fixed-rate loans (currently 7% annually) Total Assets $50 $50 $100 Liabilities and Equity Demand deposits (currently 6% annually) Time deposits (currently 6% annually Equity Total Liabilities & Equity $70 $20 $10 $100 a. What is WatchoverU’s expected net interest income at year-end? 4. A one-year, $100,000 loan carries a market interest rate of 12 percent. The loan requires payment of accrued interest and one-half of the principal at the end of six months. The remaining principal and accrued interest are due at the end of the year. What is the duration of this loan? 5. What is the duration of a consol bond that sells at a YTM of 8 percent? 10 percent? 12 percent? What is a consol bond? 6. Hedge Row Bank has the following balance sheet (in millions): Assets $150 Total $150 Liabilities Equity Total $135 $15 $150 The duration of the assets is six years, and the duration of the liabilities is four years. The bank is expecting interest rates to fall from 10 percent to 9 percent over the next year. a. What is the duration gap for Hedge Row Bank? b. What is the expected change in net worth for Hedge Row Bank if the forecast is accurate? 7. Use the following information about a hypothetical government security dealer named M.P. Jorgan. Market yields are in parenthesis, and amounts are in millions. Assets Cash 1-month T-bills (7.05%) 3-month T-bills (7.25%) 2-year T-notes (7.50%) 8-year T-notes (8.96%) 5-year munis (floating rate) (8.20% reset every 6 months) Total assets $10 75 75 50 100 25 $335 Liabilities and Equity Overnight repos Subordinated debt 7-year fixed rate (8.55%) Equity Total liabilities & equity $170 150 15 $335 a. What is the repricing gap if the planning period is 30 days? 3 months? 2 years? Recall that cash is a noninterest-earning asset. Repricing gap using a 30-day planning period = $75 - $170 = -$95 million. Repricing gap using a 3-month planning period = ($75 + $75) - $170 = -$20 million. Reprising gap using a 2-year planning period = ($75 + $75 + $50 + $25) - $170 = +$55 million. b. What is the impact over the next 30 days on net interest income if interest rates increase 50 basis points? Decrease 75 basis points? If interest rates increase 50 basis points, net interest income will decrease by $475,000. NII = CGAP(R) = -$95m.(.005) = -$0.475m. If interest rates decrease by 75 basis points, net interest income will increase by $712,500. NII = CGAP(R) = -$95m.(-.0075) = $0.7125m. c. The following one-year runoffs are expected: $10 million for two-year T-notes and $20 million for eight-year T-notes. What is the one-year repricing gap? The repricing gap over the 1-year planning period = ($75m. + $75m. + $10m. + $20m. + $25m.) - $170m. = +$35 million. d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise 50 basis points? Decrease 75 basis points? If interest rates increase 50 basis points, net interest income will increase by $175,000. NII = CGAP(R) = $35m.(0.005) = $0.175m. If interest rates decrease 75 basis points, net interest income will decrease by $262,500. NII = CGAP(R) = $35m.(-0.0075) = -$0.2625m. 8. The duration of a 20-year, 8 percent coupon Treasury bond selling at par is 10.292 years. The bond’s interest is paid semiannually, and the bond qualifies for delivery against the Treasury bond futures contract. a. What is the modified duration of this bond? The modified duration is 10.292/1.04 = 9.896 years. b. What is the impact on the Treasury bond price if market interest rates increase 50 bps? P = -MD(R)$100,000 = -9.896 x 0.005 x $100,000 = -$4,948.08. c. If you sold a Treasury bond futures contract at 95 and interest rates rose 50 basis points, what would be the change in the value of your futures position? P = - MD (R) P = - 9.896(0.005)$95,000 = - $4,700.70 d. If you purchased the bond at par and sold the futures contract, what would be the net value of your hedge after the increase in interest rates? Decrease in market value of the bond purchase Gain in value from the sale of futures contract Net gain or loss from hedge -$4,948.08 $4,700.70 -$247.38 9.This example is to estimate both the duration and convexity of a 6-year bond paying 5 percent coupon annually and the annual yield to maturity is 6 percent. Using the textbook method: CX = 108 [(950.3506-950.8268)/950.8268 + (951.3032-950.8268)/950.8268] = 108[-0.0005007559 + 0.0005501073] = 31.70 What is the effect of a 2 percent increase in interest rates, from 6 percent to 8 percent? Using Present Values, the percentage change is: = ($950.8268 - $861.3136)/ $950.8268 = -9.41% MVA = -D*R/(1 + R) + 0.5CX(R)2 = -5.3097*[(0.02)/1.06] + 0.5(31.7)(0.02)2 = -0.1002 + .0063 = -9.38% Adding convexity adds more precision. Duration alone would have given the answer of 10.02%. Using the duration formula: 10. Estimate the convexity for each of the following three bonds all of which trade at YTM of 8 percent and have face values of $1,000. A 7-year, zero-coupon bond. A 7-year, 10 percent annual coupon bond. A 10-year, 10 percent annual coupon bond that has a duration value of 6.994 ( 7) years. Market Value Market Value Capital Loss + Capital at 8.01 percent -0.37804819 -0.55606169 -0.73121585 at 7.99 percent 0.37832833 0.55643682 0.73186329 Divided by Original Price 0.00000048 0.00000034 0.00000057 Gain 7-year zero 7-year coupon 10-year coupon Convexity = 108 * (Capital Loss + Capital Gain) ÷ Original Price at 8.00 percent 7-year zero 7-year coupon 10-year coupon CX = 100,000,000*0.00000048 = 48 CX = 100,000,000*0.00000034 = 34 CX = 100,000,000*0.00000057 = 57