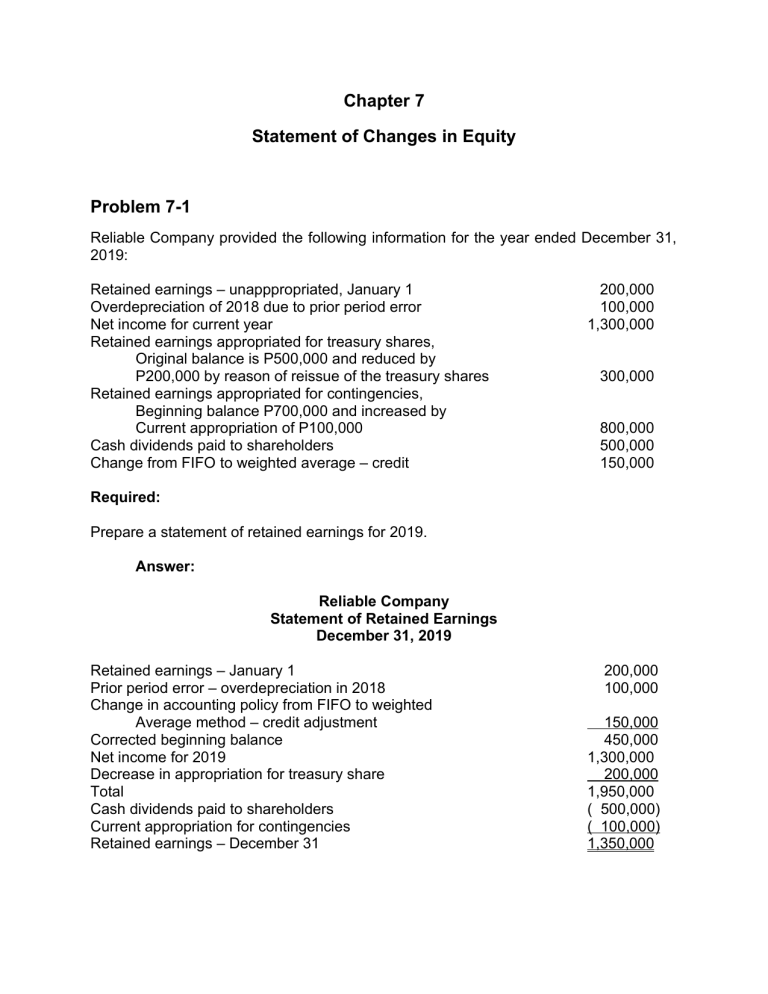

Chapter 7 Statement of Changes in Equity Problem 7-1 Reliable Company provided the following information for the year ended December 31, 2019: Retained earnings – unapppropriated, January 1 Overdepreciation of 2018 due to prior period error Net income for current year Retained earnings appropriated for treasury shares, Original balance is P500,000 and reduced by P200,000 by reason of reissue of the treasury shares Retained earnings appropriated for contingencies, Beginning balance P700,000 and increased by Current appropriation of P100,000 Cash dividends paid to shareholders Change from FIFO to weighted average – credit 200,000 100,000 1,300,000 300,000 800,000 500,000 150,000 Required: Prepare a statement of retained earnings for 2019. Answer: Reliable Company Statement of Retained Earnings December 31, 2019 Retained earnings – January 1 Prior period error – overdepreciation in 2018 Change in accounting policy from FIFO to weighted Average method – credit adjustment Corrected beginning balance Net income for 2019 Decrease in appropriation for treasury share Total Cash dividends paid to shareholders Current appropriation for contingencies Retained earnings – December 31 200,000 100,000 150,000 450,000 1,300,000 200,000 1,950,000 ( 500,000) ( 100,000) 1,350,000 Problem 7-2 Gondola Company showed the following charges and credits to retained earnings for 2019: Balance – January 1 Loss from fire Goodwill impairment Stock dividend Loss on sale of equipment Compensation of prior period not accrued Loss on retirement of preference share at more than Issue price Share premium Gain on early retirement of bonds payable Gain on life insurance settlement Correction of prior period error – credit Net income for the year Appropriated for treasury shares during the year 2,600,000 50,000 250,000 700,000 200,000 500,000 350,000 600,000 100,000 450,000 400,000 3,000,000 1,000,000 Required: Prepare a statement of retained earnings for 2019. Answer: Gondola Company Statement of Retained Earnings December 31, 2019 Balance – January 1 Compensation of prior period not accrued Correction of prior period error – credit Adjusted beginning balance Net income – adjusted Stock dividend Loss on retirement of preference share Appropriated for treasury share Balance – December 31 2,600,000 ( 500,000) 400,000 2,500,000 3,050,000 ( 700,000) ( 350,000) (1,000,000) 3,500,000 *computation of net income – adjusted Net income Loss from fire Goodwill impairment Loss on sale of equipment 3,000,000 ( 50,000) ( 250,000) ( 200,000) Gain on retirement of bonds payable Gain on life insurance settlement Adjusted net income 100,000 450,000 3,050,000 Problem 7-3 Angola Company reported the following comparative statement of income and retained earnings: 2020 2019 Sales Cost of goods sold 6,000,000 (2,800,000) 4,500,000 (2,400,000) Gross income Expenses 3,200,000 (1,500,000) 2,100,000 (1,800,000) Net income 1,700,000 300,000 Retained earnings – January 1 Net income Dividends paid 1,150,000 1,700,000 ( 500,000) 1,000,000 300,000 ( 150,000) Retained earnings – December 31 2,350,000 1,150,000 In 2020, the entity discovered that ending inventory for 2019 was understated by P100,000. In addition, the entity decided to change its method from double declining to straight line. The differences in the two depreciation methods are as follows: Double declining Straight line 2020 2019 350,000 340,000 450,000 400,000 Expenses in the income statements include depreciation based on double declining balance. Required: Prepare comparative statement of income and retained earnings. Answer: Angola Company Comparative Income statement December 31, 2020 and 2019 2020 6,000,000 (2,900,000) 3,100,000 (1,490,000) 1,610,000 Sales Cost of goods sold Gross income Expenses Net income 2019 4,500,000 (2,300,000) 2,200,000 (1,800,000) 400,000 Angola Company Comparative statement of Retained Earnings December 31, 2020 and 2019 Retained earnings – January 1 Net income Dividends paid Retained earnings – December 31 2020 1,250,000 1,610,000 ( 500,000) 2,360,000 2019 1,000,000 400,000 ( 150,000) 1,250,000 Problem 7-4 On January 1, 2019, Martha Company had 6,000,000 authorized ordinary shares of P5 par, of which 2,000,000 shares were issued and outstanding. The shareholders’ equity on same date showed the following balances: Ordinary share capital Share premium Retained earnings 10,000,000 7,500,000 3,250,000 On January 5, Martha issued at P54 per share, 100,000 shares of P50 par 9% cumulative, convertible preference share capital. Martha had 250,000 authorized preference shares. On February 1, Martha reacquired 20,000 ordinary shares for P16 per share. Martha uses the cost method. On April 30, Martha had completed an additional public offering of 500,000 ordinary shares with P5 par value. The shares were sold to the public at P12 per share. On June 17, Martha declared a cash dividend of P1 per ordinary share, payable on July 10 to shareholders of record on July 1. On November 6, Martha sold 10,000 shares of treasury for P21 per share. On December 7, Martha declared the yearly cash dividend on preferences share, payable on January 7, 2020, to shareholders of record on December 31,2019. On January 17, 2020, before the books were closed for 2019, Martha became aware that the ending inventory on December 31, 2018 was overstated by P200,000. The after-tax effect on 2018 net income was P140,000. The appropriate correcting entry was recorded. After correction of the beginning inventory, net income for 2019 was P2,250,000. Required: Prepare a statement of changes in equity for the year ended December 31, 2019. Answer: Martha Company Statement of Changes in Equity December 31, 2019 Ordinary Balance – January 1 Issuance of preference Purchase of treasury – ordinary Issuance of ordinary Dividend to ordinary Reissuance of TS Dividend to preference Overstatemen t of 2018 ending inventory Net income Balances – December 31 Preference 10,000,000 5,000,000 Share premium 7,500,000 RE TS 3,250,000 400,000 320,000 2,500,000 3,500,000 (2,480,000) 50,000 (160,000) (450,000) (140,000) 12,500,000 5,000,000 11,450,000 2,250,000 2,430,000 160,000 Problem 7-5 Carr Company reported the following shareholders’ equity on January 1, 2019. Preference share capital Share premium – preference Ordinary share capital Share premium – ordinary Retained earnings Treasury shares – ordinary 1,800,000 90,000 5,150,000 3,500,000 4,000,000 270,000 On January 1, 2019, Carr had 100,000 authorized shares of P100 par, 10% cumulative preference share capital and 3,000,000 authorized shares of no par ordinary share capital with a stated value of P5 per share. On January 10, 2019, Carr formally retired all the 30,000 ordinary shares of treasury. The treasury shares had been acquired in the previous year and were originally issued at P10 per share. Carr owned 10,000 ordinary shares of Bush Company purchased several years ago for P600,000. On February 15, Carr declared and paid a dividend in kind of one share of bush for every hundred ordinary shares of Carr held by a shareholder of record on February 28, 2019. The market price of bush share was P75 on February 15, 2017. On December 12, 2019, Carr declared the yearly cash dividend on preference share, payable on January 14, 2020, to shareholders of record on December 31, 2019. On January 15, 2020, before the accounting records were closed for 2019, Carr became aware that rent income for the year ended December 31, 2018 was overstated by P500,000. The after-tax effect on 2018 net income was P350,000. The appropriate correcting entry was recorded. After correcting the rent income, net income for 2019 was P2,600,000. Required: Prepare a statement of changes in equity for 2019. Answer: Balances – January 1 Retirement of TS Property dividend Dividend to preference Error Net income Balances December 31 Carr Company Statement of Changes in Equity December 31, 2019 Ordinary Preference Share RE premium 5,150,000 1,800,000 3,590,000 4,000,000 (150,000) TS 270,000 (120,000) (270,000) (750,000) (180,000) 5,000,000 1,800,000 3,470,000 (350,000) 2,600,000 5,320,000 - Problem 7-6 United Company reported the following unadjusted current assets and shareholders’ equity at year-end: Cash Financial assets at fair value, including cost of P300,000 of United Company shares Trade accounts receivable Inventory Share capital Share premium Retained earnings 600,000 1,000,000 3,500,000 1,500,000 5,000,000 2,000,000 500,000 What amount should be reported as total shareholders’ equity at year-end? a. b. c. d. 7,200,000 7,500,000 7,800,000 5,200,000 Answer: Problem 7-7 Bronze Company provided the following information at year-end: Share capital Share premium Cumulative translation adjustment – debit Treasury shares, at cost Retained earnings Cumulative unrealized gain on option contract Designated as cash flow hedge 6,000,000 3,500,000 2,000,000 700,000 1,500,000 600,000 What is the shareholders’ equity at year-end? a. b. c. d. 9,500,000 8,900,000 7,400,000 7,500,000 Answer: Share capital Share premium Retained earnings Cumulative unrealized gain on option contract Designated as cash flow hedge Cumulative translation adjustment – debit Treasury shares, at cost Total shareholders’ equity 6,000,000 3,500,000 1,500,000 600,000 (2,000,000) (700,000) 8,900,000 Problem 7-8 Silver Company provided the following information at year-end: Share premium Accounts payable Preference share capital, at par Ordinary share capital, at par Sales Total expenses Treasury shares – ordinary Dividends Retained earnings – beginning 1,000,000 1,100,000 2,000,000 3,000,000 10,000,000 7,800,000 500,000 700,000 1,000,000 What is the shareholders’ equity at year-end? a. b. c. d. 8,000,000 8,500,000 5,800,000 8,700,000 Answer: Sales Total expenses Net income Retained earnings – beginning Dividends Retained earnings – Ending Preference share capital Ordinary share capital Share premium Retained earnings Treasury shares Total shareholders’ equity 10,000,000 ( 7,800,000) 2,200,000 1,000,000 ( 700,000) 2,500,000 2,000,000 3,000,000 1,000,000 2,500,000 ( 500,000) 8,000,000 Problem 7-9 Kalinga Company reported the following adjusted accounts balances at year-end: Share capital Share premium Treasury shares, at cost Actuarial loss on defined benefit plan Retained earnings appropriated Retained earnings appropriated Revaluation surplus Cumulative translation adjustment – credit What amount should be reported as shareholders’ equity at year-end? a. b. c. d. 31,500,000 32,500,000 28,500,000 25,500,000 15,000,000 5,000,000 2,000,000 1,000,000 6,000,000 3,000,000 4,000,000 1,500,000 Answer: Share capital Share premium Retained earnings appropriated Retained earnings appropriated Revaluation surplus Cumulative translation adjustment – credit Treasury shares, at cost Actuarial loss on defined benefit plan Total shareholders’ equity 15,000,000 5,000,000 6,000,000 3,000,000 4,000,000 1,500,000 (2,000,000) (1,000,000) 31,500,000 Problem 7-10 1. In the statement of changes in equity, the effect of a change in accounting policy is presented a. Separately for each component of equity b. In aggregate for total equity. c. In total for the amount attribute to owners of the parent and the noncontrolling interest. d. Separately for the total amount attributable to owners of parent and the noncontrolling interest 2. In the statement of changes in equity, the effect of the correction of a prior period error is presented a. Separately for each component of equity b. In aggregate for total equity c. In total for the amount attributable to owners of the parent and the noncontrolling interest. d. Separately for the total amount attributable to owners of the parent and the noncontrolling interest. 3. Which of the following does not appear in the statement of retained earnings? a. b. c. d. Net loss Prior period error Preference share dividend Other comprehensive income 4. Which of the following would appear first in a statement of retained earnings? a. b. c. d. Net income Prior period error Chas dividend Share dividend 5. Corrections of errors in prior period are included in a. Retained earnings b. Other comprehensive income c. Net income d. Share premium