Partnership Test Bank: Formation, Operations, Ownership Changes

advertisement

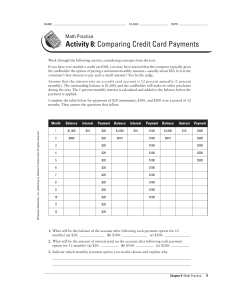

Chapter 15 Test Bank PARTNERSHIPS – FORMATION, OPERATIONS, AND CHANGES IN OWNERSHIP INTERESTS Multiple Choice Questions LO1 1. Under the Uniform Partnership Act, loans made by a partner to the partnership are treated as a. advances to the partnership for which interest shall be paid from the date of the advance. b. advances to the partnership that are carried in the partners' capital accounts. c. Accounts Payable of the partnership for which interest is paid. d. advances to the partnership for which interest does not have to be paid. LO1 2. A partner assigned his partnership interest to a third party. Which statement best describes the legal ramifications to the assignee? a. The assignment of the partnership interest does not entitle the assignee to partnership assets upon a liquidation. b. The assignment dissolves the partnership. c. The assignee has the right to share in the management of the partnership. d. The assignee does not become a partner but has the right to share in future partnership profits and to receive the proper share of partnership assets upon liquidation. LO1 3. In the Uniform Partnership Act, partners have I. mutual agency. II.unlimited liability. a. b. c. d. I only. II only. I and II. Neither I nor II. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-1 LO1 4. Partnerships a. are required to prepare annual reports. b. are required to file income tax returns but do not pay Federal taxes. c. are required to file income tax returns and pay Federal income taxes. d. are not required to file income tax returns or pay Federal income taxes. LO2 5. Langley invests his delivery van in partnership with McCurdy. What amount credited to Langley’s partnership capital? a. b. c. d. a computer repair should the van be The tax basis. The fair value at the date of contribution. Langley’s original cost. The assessed valuation for property tax purposes. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-2 Use the following information for questions 6, 7 and 8. A summary balance sheet for the McCune, Nall, and Oakley partnership appears below. McCune, Nall, and Oakley share profits and losses in a ratio of 2:3:5, respectively. Assets Cash Inventory Marketable securities Land Building-net Total assets $ 50,000 62,500 100,000 50,000 250,000 512,500 $ Equities McCune, capital Nall, capital Oakely, capital Total equities $ 212,500 200,000 100,000 512,500 $ The partners agree to admit Pavic for a one-fifth interest. The fair market value of partnership land is appraised at $100,000 and the fair market value of inventory is $87,500. The assets are to be revalued prior to the admission of Pavic and there is $15,000 of goodwill that attaches to the old partnership. LO2 6. By how much will the capital accounts of McCune, Nall, and Oakley increase, respectively, due to the revaluation of the assets and the recognition of goodwill? a. b. c. d. LO2 7. The capital accounts will increase by $25,000 each. The capital accounts will increase by $30,000 each. $18,000, $27,000, and $45,000. $20,000, $25,000, and $30,000. How much interest? a. b. c. d. cash must Pavic invest to acquire $117,500. $120,500. $146,875. $150,625. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-3 a one-fifth LO2 8. What will the profit and loss sharing ratios be after Pavic’s investment? a. b. c. d. 1:2:4:2. 2:3:5:2. 3:4:6:2. 4:6:10:5. Use the following information for questions 9, 10 and 11. Albion and Blaze share profits and losses equally. Albion and Blaze receive salary allowances of $20,000 and $30,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month balance regardless of when additional capital contributions or permanent withdrawals are made subsequently within the month. Partners’ drawings are not used in determining the average capital balances. Total net income for 2006 is $120,000. January 1 capital balances Yearly drawings ($1,500 a month) Permanent withdrawals of capital: June 3 May 2 Additional investments of capital: July 3 October 2 LO3 9. $ ( $ Blaze 120,000 18,000 12,000 ) ( 15,000 ) 40,000 50,000 What is the weighted-average capital for Albion and Blaze in 2006? a. b. c. d. LO3 10. Albion 100,000 18,000 $100,000 $105,333 $110,667 $126,667 and and and and $120,000. $126,667. $119,583. $105,333. If the average capital for Albion and Blaze from the above information is $112,000 and $119,000, respectively, what will be the total amount of profit allocated after the salary and interest distributions are completed? a. $70,000. b. $73,100. c. $75,000. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-4 d. $80,000. LO3 11. If the average capital balances for Albion and Blaze are $100,000 and $120,000, what will the final profit allocations for Albion and Blaze in 2006? a. b. c. d. $50,000 $54,000 $70,000 $75,000 and and and and $70,000. $66,000. $50,000. $45,000. Use the following information for questions 12 and 13. Bloom and Carnes share profits and losses in a ratio of 2:3, respectively. Bloom and Carnes receive salary allowances of $10,000 and $20,000, also respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners’ drawings are not used in determining the average capital balances. Total net income for 2006 is $60,000. If net income after deducting the interest and salary allocations is greater than $20,000, Carnes receives a bonus of 5% of the original amount of net income. January 1 capital balances Yearly drawings ($1,500 a month) LO3 12. $ Carnes 300,000 18,000 What are the total amounts for the allocation of interest, salary, and bonus, and, how much over-allocation is present? a. b. c. d. LO3 13. $ Bloom 200,000 18,000 $60,000 $80,000 $83,000 $83,000 and and and and $0. $20,000. $0. $23,000. If the partnership experiences a net loss of $20,000 for the year, what will be the final amount of profit or (loss) closed to each partner’s capital account? a. b. c. d. ($30,000) to Bloom and $10,000 to Carnes. ($10,000) to Bloom and ($10,000) to Carnes. ($8,000) to Bloom and ($12,000) to Carnes. $10,000 to Bloom and ($30,000) to Carnes. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-5 LO3 14. The XYZ partnership provides a 10% bonus to Partner Y that is based upon partnership income, after deduction of the bonus. If the partnership's income is $121,000, how much is Partner Y's bonus allocation? a. b. c. d. LO3 15. Drawings a. b. c. d. LO4 16. $11,000. $11,450. $11,650. $12,100. are advances to a partnership. are loans to a partnership. are a function of interest on partnership average capital. *are the same nature as withdrawals. If the partnership agreement provides a formula for the computation of a bonus to the partners, the bonus would be computed a. next to last, because the final allocation is distribution of the profit residual. b. before income tax allocations are made. c. after the salary and interest allocations are made. d. in any manner agreed to by the partners. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-6 the Use the following information for questions 17, 18 and 19. Davis has decided to retire from the partnership of Davis, Eiser, and Foreman. The partnership will pay Davis $200,000. Goodwill is to be recorded in the transaction as implied by the excess payment to Davis. A summary balance sheet for the Davis, Eiser, and Foreman partnership appears below. Davis, Eiser, and Foreman share profits and losses in a ratio of 1:1:3, respectively. Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Davis, capital Eiser, capital Foreman, capital Total equities LO5 17. $ 160,000 140,000 300,000 600,000 $40,000. $120,000. $160,000. $200,000. What partnership capital will Eiser have after Davis retires? a. b. c. d. LO5 19. $ 75,000 82,000 38,000 150,000 255,000 600,000 What goodwill will be recorded? a. b. c. d. LO5 18. $ $100,000. $140,000. $180,000. $220,000. What partnership capital will Foreman have after Davis retires? a. $240,000. b. $300,000. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-7 c. $360,000. d. $420,000. LO6 20. In a limited partnership, a general partner a. b. c. d. is excluded from management. is not entitled to a bonus at the end of the year. has limited liability for partnership debit. has unlimited liability for partnership debit. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-8 LO2 Exercise 1 Cesar and Damon share partnership profits and losses at 60% and 40%, respectively. The partners agree to admit Egan into the partnership for a 50% interest in capital and earnings. Capital accounts immediately before the admission of Egan are: Cesar (60%) Damon (40%) Total $ $ 300,000 300,000 600,000 Required: 1. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $400,000 for the ownership interest. Egan paid the money directly to Cesar and to Damon for 50% of each of their respective capital interests. The partnership records goodwill. 2. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $500,000 for the ownership interest. Egan paid the money to the partnership for a 50% interest in capital and earnings. The partnership records goodwill. 3. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $700,000 for the ownership interest. Egan paid the money to the partnership for a 50% interest in capital and earnings. The partnership records goodwill. LO3 Exercise 2 On February 1, 2005, Flores, Gilroy, and Hansen began a partnership in which Flores and Hansen contributed cash of $25,000; Gilroy contribute property with a fair value of $50,000 and a tax basis $40,000. Gilroy receives a 5% bonus of partnership income. Flores and Hansen receive salaries of $10,000 each. The partnership agreement of Flores, Gilroy, and Hansen provides all partners to receive a 5% interest on capital and that profits and losses be divided of the remaining income be distributed to Flores, Gilroy, and Hansen by a 1:3:1 ratio. Required: Prepare a schedule to distribute $25,000 of partnership net income to the partners. LO3 Exercise 3 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-9 The profit and loss sharing agreement for the Quade, Reid, and Scott partnership provides for a $15,000 salary allowance to Reid. Residual profits and losses are allocated 5:3:2 to Quade, Reid, and Scott, respectively. In 2006, the partnership recorded $120,000 of net income that was properly allocated to the partner's capital accounts. On January 25, 2007, after the books were closed for 2006, Quade discovered that office equipment, purchased for $12,000 on December 29, 2006, was recorded as office expense by the company bookkeeper. Required: Prepare the necessary correcting entry(s) for the partnership. LO3 Exercise 4 Evans, Fitch, and Gault operate a partnership with a complex profit and loss sharing agreement. The average capital balance for each partner on December 31, 2006 is $300,000 for Evans, $250,000 for Fitch, and $325,000 for Gault. An 8% interest allocation is provided to each partner. Evans and Fitch receive salary allocations of $10,000 and $15,000, respectively. If partnership net income is above $25,000, after the salary allocations are considered (but before the interest allocations are considered), Gault will receive a bonus of 10% of the original amount of net income. All residual income is allocated in the ratios of 2:3:5 to Evans, Fitch, and Gault, respectively. Required: 1. Prepare a schedule to allocate income to the partners assuming that partnership net income is $250,000. 2. Prepare a journal entry to distribute the partnership's income to the partners (assume that an Income Summary account is used by the partnership). ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-10 LO3 Exercise 5 Required: Using the information from Exercise 4 above: 1. Prepare a schedule to allocate income or loss to the partners assuming that the partnership incurs a net loss of $36,000. 2. Prepare a journal entry to distribute the partnership's loss to the partners (assume that an Income Summary account is used by the partnership). LO3 Exercise 6 Grech, Harris, and Ivers have a retail partnership business selling personal computers. The partners are allowed an interest allocation of 8% on their average capital. Capital account balances on the first day of each month are used in determining weighted average capital, regardless of additional partner investment or withdrawal transactions during any given month. Drawings are disregarded in computing average capital, but temporary withdrawals of capital that are debited to the capital account are used in the average calculation. Partner capital activity for the year was: Capital accounts Jan 1 balance Feb 2 investment Mar 6 investment Apr 20 withdrawal Jul 3 withdrawal and investment Sep 29 investment Nov 5 investment Required: Grech 200,000 50,000 10,000 $ $ Harris 300,000 $ 20,000 ( ( 7,000 ) 5,000 Ivers 250,000 10,000 4,000 10,000 ) 5,000 5,000 Calculate weighted average capital for each partner, and determine the amount of interest that each partner will be allocated. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-11 LO3 Exercise 7 The profit and loss sharing agreement for the Sealy, Teske, and Ubank partnership provides that each partner receive a bonus of 5% on the original amount of partnership net income if net income is above $25,000. Sealy and Teske receive a salary allowance of $7,500 and $10,500, respectively. Ubank has an average capital balance of $260,000, and receives a 10% interest allocation on the amount by which his average capital account balance exceeds $200,000. Residual profits and losses are allocated to Sealy, Teske, and Ubank in their respective ratios of 7:5:8. Required: Prepare a schedule to allocate $88,000 of partnership net income to the partners. LO5 Exercise 8 A summary balance sheet for the partnership of Ivory, Jacoby and Kato on December 31, 2006 is shown below. Partners Ivory, Jacoby and Kato allocate profit and loss in their respective ratios of 9:6:10. Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Ivory, capital Jacoby, capital Kato, capital Total equities $ $ $ $ 50,000 75,000 120,000 80,000 400,000 725,000 425,000 225,000 75,000 725,000 The partners agree to admit Lange for a one-tenth interest. The fair market value for partnership land is $180,000, and the fair market value of the inventory is $150,000. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-12 Required: 1. Record the entry to revalue the partnership assets prior to the admission of Lange. 2. Calculate how much Lange will have to invest to acquire a 10% interest. 3. If Lange paid $200,000 to the partnership in exchange for a 10% interest, what would be the bonus that is allocated to each partner's capital account? LO5 Exercise 9 A summary balance sheet for the Vail, Wacker Yang partnership on December 31, 2006 is shown below. Partners Vail, Wacker, and Yang allocate profit and loss in their respective ratios of 4:5:7. The partnership agreed to pay partner Yang $227,500 for his partnership interest upon his retirement from the partnership on January 1, 2007. Any payments exceeding Yang’s capital balance are treated as a bonus from partners Vail and Wacker. Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Vail, capital Wacker, capital Yang, capital Total equities $ $ $ $ 75,000 87,500 60,000 90,000 150,000 462,500 212,500 112,500 137,500 462,500 Required: Prepare the journal entry to reflect Yang’s retirement from the partnership. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-13 LO5 Exercise 10 A summary balance sheet for the Almond, Brandt, and Clack partnership on December 31, 2006 is shown below. Partners Almond, Brandt, and Clack allocate profit and loss in their respective ratios of 2:1:1. The partnership agreed to pay partner Brandt $135,000 for his partnership interest upon his retirement from the partnership on January 1, 2007. The partnership financials on January 1, 2007 are: Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Almond, capital Brandt, capital Clack, capital Total equities $ $ $ $ 75,000 85,000 60,000 90,000 150,000 420,000 210,000 105,000 105,000 420,000 Required: Prepare the journal entry to reflect Brandt’s retirement from the partnership: 1. Assuming a bonus to Brandt. 2. Assuming a revaluation of total partnership capital based on excess payment. 3. Assuming goodwill to excess payment is recorded. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-14 SOLUTIONS Multiple Choice Questions 1. a 2. d 3. c 4. b 5. b 6. c The assets will be valued upward by $90,000 which, allocated on a 2:3:5 basis, yields $18,000 to McCune, $27,000 to Nall, and $45,000 to Oakely. 7. d After the revaluation, the assets will be recorded at $602,500. If Pavic is admitted for a one-fifth interest, the $602,500 represents 80% of the total implied capital. Dividing $602,500 by 80% gives a total capitalization of $753,150 for which $150,625 is required from Pavic for a 20% interest. 8. d Each of the original partners has given up 20% of their interest to Pavic. Their profit and loss sharing ratios will therefore be 80% of what they were before the admission of Pavic. McCune Nall Oakely Pavic 20% x 80% = 30% x 80% = 50% x 80% = = 16% 24% 40% 20% Expressed as: 4:6:10:5 9. c Albion: [($100,000 x 6) + ($88,000 x 1) + ($128,000 x 5)]/12 = $110,667 Blaze: 10. b [($120,000 x 5) + ($105,000 x 5) + ($155,000 x 2)]/12 = $119,583 Capital: ($112,000 + $119,000)x(10%) = $23,100 Salary: ($20,000 + $30,000) = $50,000 Total: $23,100 + $50,000 = $73,100 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-15 11. b Albion: ($100,000 x 10%) + $20,000 + $24,000 = $54,000 Blaze: ($120,000 x 10%) + $30,000 + $24,000 = $66,000 12. b Interest: ($500,000 x 10%) Salary: ($10,000 + $20,000) Bonus: Condition not met = $50,000 = $30,000 = $0 Total allocations = $80,000 and over-allocations = $80,000 - $60,000 = $20,000 13. b Bloom: Interest allocation: Salary allocation: $20,000 $10,000 Carnes: Interest allocation: Salary allocation: $30,000 $20,000 There is a total of $80,000 for positive allocations. To bring them down to a $20,000 loss, a residual adjustment of ($100,000) is needed which is allocated ($40,000) to Bloom and ($60,000) to Carnes. After these amounts are assigned to the partners, each partner’s capital account will be reduced by a net $10,000. 14. a 15. d 16. d 17. d 18. c 19. c 20. d B = .1x($121,000 - B) B = $12,100 - .1B 1.1B = $12,100 B = $11,000 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-16 Exercise 1 Requirement 1 Goodwill Cesar, capital Damon, capital 200,000 Cesar, capital Damon, capital Egan, capital 210,000 190,000 120,000 80,000 400,000 If a $400,000 payment represents 50% of total capital, then twice that amount, or $800,000, is the implied total capital including goodwill. If the present total capital is $600,000, and the implied total capital is $800,000, the amount of goodwill to record is $200,000. This goodwill is allocated 60% to Cesar and 40% to Damon. After the first entry is posted, the balances in the Cesar and Damon capital accounts will be $420,000 and $380,000, respectively. If onehalf of each partner’s interest is given to Egan, Cesar’s capital account is reduced by $210,000, and Damon’ capital account is reduced by $190,000. Requirement 2 Goodwill Cash Egan, capital 100,000 500,000 600,000 If we focus on the current capital of the partnership, $600,000, and say that it is fairly valued, then, if it represents 50% of final capital after Egan’s investment, final capital should be $1,200,000. Egan’s share of final capital will be $600,000, and, if Egan invests $500,000 for this interest, there must be $100,000 of goodwill that is allocated to Egan. Requirement 3 Goodwill Cesar, capital Damon, capital 100,000 Cash 700,000 60,000 40,000 Egan, capital 700,000 If Egan invests $700,000 for a 50% interest, it implies that total partnership capital should be $1,400,000. After Egan’s investment, total ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-17 capital will be $1,300,000, and goodwill is therefore $100,000. The goodwill is allocated to Cesar and Damon. Exercise 2 Net income $ Bonus to Gilroy ( Salaries ( Interest ( Residual loss ( Loss allocation Allocation $ Income 25,000 1,250 20,000 5,000 1,250 1,250 0 Flores ) ) ) ) Gilroy $ $ $( $ Hansen 1,250 10,000 1,250 2,500 $ 10,000 1,250 250 ) ( 11,000 $ 750 ) ( 3,000 $ 250 ) 11,000 Exercise 3 1/25/07 Office Equipment Quade, capital Reid, capital Scott, capital 12,000 6,000 3,600 2,400 Correction of journal entry error from 12/29/03. To record office equipment and to adjust partner capital accounts. Exercise 4 Requirement 1 Net income Bonus to Gault Salary allocation Interest allocation Residual Final allocation $ ( ( ( ( $ Income 250,000 25,000 25,000 70,000 130,000 0 Evans ) ) $ ) ) $ 10,000 24,000 26,000 60,000 Fitch $ $ 15,000 20,000 39,000 74,000 Gault $ 25,000 $ 26,000 65,000 116,000 Requirement 2 Income summary Evans, capital Fitch, capital Gault, capital 250,000 60,000 74,000 116,000 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-18 Exercise 5 Requirement 1 Net loss Bonus to Gault Salary allocation Interest allocation Subtotal Residual allocation Totals Loss $ ( 36,000 ( 0 ( 25,000 ( 70,000 ( 131,000 131,000 $ 0 ) ) ) $ ) ) ( $ Evans Fitch Gault 10,000 $ 24,000 34,000 26,200 ) ( 7,800 $( $ 15,000 20,000 $ 35,000 39,300 ) ( 4,300 ) $( 0 26,000 26,000 65,500 ) 39,500 ) Requirement 2 Fitch, capital Gault, capital Evans, capital Income summary 4,300 39,500 7,800 36,000 Exercise 6 Jan, Feb Mar Apr, May, Jun, Jul Aug, Sep Oct, Nov, Dec Total capital Average capital Interest allocation Jan, Feb, Mar Apr, May, Jun, Jul Aug, Sep Oct, Nov, Dec Total capital Average capital Interest allocation $ 200,000 250,000 260,000 253,000 258,000 $ 300,000 320,000 330,000 334,000 x x x x x x x x x 2 1 4 2 3 3 4 2 3 = $ = = = = $ $ $ = = = = $ $ $ $ ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-19 Grech 400,000 250,000 1,040,000 506,000 774,000 2,970,000 247,500 19,800 Harris 900,000 1,280,000 660,000 1,002,000 3,842,000 320,167 25,613 Jan, Feb, Mar, Apr May, Jun, Jul, Aug, Sep Oct, Nov Dec Total capital Average capital Interest allocation $ 250,000 240,000 245,000 250,000 x x x x 4 5 2 1 = = = = $ $ $ $ Ivers 1,000,000 1,200,000 490,000 250,000 2,940,000 245,000 19,600 Exercise 7 Net income Bonus Salary Interest Subtotal Balance Totals $ ( ( ( ( $ Income 88,000 13,200 18,000 6,000 50,800 50,800 0 Sealy ) $ ) ) ) $ 4,400 7,500 11,900 17,780 29,680 Teske $ $ 4,400 10,500 14,900 12,700 27,600 Ubank $ 4,400 $ 6,000 10,400 20,320 30,720 Exercise 8 Requirement 1 The assets of the partnership must be adjusted to fair market value. Land will increase by $100,000, and Inventory by $75,000. The profit and loss ratio elements add up to 25. Partner Ivory will then be allocated 9/25 of the $175,000, etc. Land Inventory Ivory, capital Jacoby, capital Kato, capital 100,000 75,000 63,000 42,000 70,000 Requirement 2 The partnership's total assets after revaluation are $900,000. If Lange acquires a 10% interest, it implies that the $900,000 represents 90% of the partnership’s value after Lange's investment. Therefore, $900,000/90% = $1,000,000, and $1,000,000 x 10% = $100,000. The entry to record Lange’s investment would be: Cash 100,000 Lange, capital 100,000 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-20 Requirement 3 Cash 200,000 Lange, capital Ivory, capital Jacoby, capital Kato, capital 100,000 36,000 24,000 40,000 Exercise 9 1/1/04 Yang, capital Vail, capital ($90,000 x 4/9) Wacker, capital ($90,000 x 5/9) Cash 137,500 40,000 50,000 227,500 Exercise 10 Requirement 1 Almond and Clack give a bonus to Brand which reduces their capital in a 2 to 1 ratio. Brandt, capital Almond, capital Clack, capital Cash 105,000 20,000 10,000 135,000 Requirement 2 Revalue the total partnership capital to reflect Brandt’s retirement’s excess payment of $30,000. the Goodwill Almond, capital Clack, capital Brandt, capital 60,000 Brandt, capital Cash 135,000 value at 20,000 10,000 30,000 135,000 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-21 Requirement 3 Add goodwill equal to the excess payment Brandt, capital Goodwill Cash 105,000 30,000 135,000 ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-22