Aboura and Arisoy Can Exposure to Aggregate Tail Risk Explain Size, Book-to-Market and Idiosyncratic Volatility Anomalies

advertisement

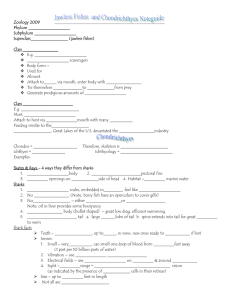

Can Exposure to Aggregate Tail Risk Explain Size, Book-to-Market, and Idiosyncratic Volatility Anomalies? Sofiane Aboura Y. Eser Arisoy‡ May 9, 2016 Abstract We examine the impact of aggregate tail risk on return dynamics of size, book-to-market ratio, and idiosyncratic volatility sorted portfolios. Using changes in VIX Tail Hedge Index (ΔVXTH) as a proxy for aggregate tail risk, and controlling for market, size, book-to-market, and aggregate volatility risk, we document significant portfolio return exposures to tail risk. In particular, portfolios that contain small, value and volatile stocks exhibit consistently positive and statistically significant tail risk betas, whereas portfolios of big, growth and non-volatile stocks exhibit negative tail risk betas. We posit that due to their positive tail risk exposures, tail riskaverse investors demand extra compensation to hold small, value, and high idiosyncratic volatility stocks. Our results offer a tail risk-based explanation to size, value, and idiosyncratic volatility anomalies. Keywords: Tail risk, Implied volatility, Idiosyncratic volatility, Size, Value, Anomalies JEL Classification: C4, G13, G32. Department of Economics, CEPN (UMR-CNRS 7234), Université de Paris XIII, Sorbonne Paris Cité, 99 avenue Jean-Baptiste Clément, 93430 Villetaneuse, France. Phone: +33149403323, E-mail: sofiane.aboura@univ-paris13.fr ‡ Department of Finance, DRM-Finance, Université Paris-Dauphine, Place du Maréchal de Lattre de Tassigny, 75775 Paris cedex 16, France. Phone: +33144054360, Email: eser.arisoy@dauphine.fr Electronic copy available at: http://ssrn.com/abstract=2832893 1. Introduction Tail risk hedging has gained considerable interest among market participants following the aftermath of the 2008 financial crisis. It is now widely acknowledged that market returns have much fatter tails than presumed by a Normal distribution and tail events occur much frequently than a Normal curve would predict. Therefore, understanding the dynamics of aggregate tail risk and its relation to portfolio returns is of crucial importance in investment decision making and has implications for portfolio management. In this paper, we investigate the role of aggregate tail risk in three well-documented asset pricing anomalies – size, value vs. growth, and idiosyncratic volatility puzzle. Keynes (1921) seems to have been the first economist to recognize that a decision maker has to minimize the probability of obtaining an outcome below the mean. 1 In the same spirit, Roy (1952) explains how the portfolio manager should minimize the chance of disaster based on the “safety first” principle. Similarly, the recent revival of the rare-disasters literature in the wake of the financial crisis is critically based on several concepts studied in the extreme value theory literature to measure the tail risk and in particular the left tail risk (Embrechts, 1997). On the other hand, it is well known from the option pricing literature that assets like deep out-ofthe money put contracts can become highly valuable during stress periods. For example, Rubinstein (1994) argues that “the market's pricing of index options since the crash seems to indicate an increasing “crash-o-phobia” among investors”. One would expect naturally a similar sensitivity to tail risk in the stock market.2 For example, Bloom (2009) offers an uncertainty based explanation in which economic uncertainty affects negatively firms’ investment decision and firms’ employment decision. The author explains that firm-level tail uncertainty is a channel through which tail risk impacts the equity premium and shows that the tail exponent, which measures the tail heaviness, is an important determinant of asset prices and find that crashsensitive stocks bear a premium. Bollerslev and Todorov (2011) show that compensation for rare events accounts for a large fraction of the U.S. equity risk premium. Gabaix (2012) reaches similar findings by showing that a time-varying rare disaster risk framework can explain the equity premium puzzle.3 Chollete and Lu (2011) suggest that tail risk should induce a monotonic pattern in the sense that stocks that are more sensitive to tail risk should receive higher returns. 1 See Brady (1996) for a detailed discussion of "safety first" approach in decision making under risk. For example, Yuen (2015) documents that the option-implied left tail risk of the market is priced in the crosssection of stock returns, even after controlling for risk during normal times. 3 See also Tsai and Wachter (2015) who survey recent models of disaster risk that provide explanations for the equity premium puzzle. 2 1 Electronic copy available at: http://ssrn.com/abstract=2832893 They argue that these stocks, which tend to co-move with systemic risk, should to be unattractive for risk-averse investors as it will be more difficult to sell them during stress periods. For that reason, these stocks should carry a “tail risk premium”. Similarly, Chabi-Yo et al. (2015) note that U.S. stocks that are likely to perform badly when the market crashes earn significantly higher average returns than stocks that offer some protection against market downturns. Bollerslev et al. (2015) confirm these results by explaining that market fear plays an important role in understanding the return predictability since investors demand a special compensation for bearing tail risk. In a recent work, Kelly and Jiang (2014) use monthly firm-level price crashes to identify common fluctuations in tail risk among individual stocks. The authors find that the tail measure is significantly correlated with tail risk measures extracted from S&P 500 index options and negatively predicts real economic activity. Furthermore, they show that tail risk has strong predictive power for aggregate market returns. Despite a growing body of literature, it is still not known whether portfolios based on different stock characteristics have different exposures to aggregate tail risk, and if yes, whether their differential exposure can help explain several stock market anomalies documented in the literature. Our study is an attempt to fill this gap. In particular, our paper examines the sensitivity of size, book-to-market (B/M) and idiosyncratic volatility sorted portfolios to aggregate tail risk. There are several studies which document that small and value stocks are prone to risk factors such as aggregate volatility risk (Barinov, 2012), market jump risk (Arisoy, 2014; Cremers et al., 2014), financial distress risk (Avramov et al., 2013), and liquidity risk (Asness et al., 2013). Furthermore, Herskovic, et al. (2016) document strong comovement of individual stock return volatilities and find that idiosyncratic risk has important implications of this behavior for asset prices. Given the difficulty in pricing smallvalue and big-growth stocks using linear factor models, and the continuing debate over why stocks with high idiosyncratic volatility earn lower returns than low idiosyncratic volatility, tail risk seems to be an ideal candidate as an explanatory factor as it can capture nonlinearities in the left tail of the stock return distribution which can help improve the performance of the proposed linear factor models. That’s why in this paper we revisit size, value and idiosyncratic volatility anomalies, and study if and how aggregate tail risk relates to returns on small vs. big, and value vs. growth, and high vs. low idiosyncratic volatility portfolios. To operationalize our research framework and test our aggregate tail risk-based hypotheses, one needs to come up with a measure of aggregate implied tail risk. We argue that VIX Tail Hedge Index (VXTH) computed by the Chicago Board Options Exchange (CBOE) is a suitable measure to proxy aggregate risk-neutral tail risk. In particular, VXTH deals with extreme downward 2 movements in S&P 500 stock index by tracking the performance of a hypothetical portfolio that buys and holds the S&P 500 index and buys one-month 30-delta call options on the CBOE VIX Index.4 Our choice of VXTH as a proxy for aggregate tail risk has several reasons. First, prices formed in options market are forward looking, and contain valuable information about investors' expectations about the return process of the underlying. Known as the “investor fear gauge” VIX measures the market’s expectations of short-term volatility and extreme market events. The power of the VXTH index comes from the exceptionally high returns earned by VIX call options in times of extreme downward moves in the stock market. Second, VXTH is a tradable tail risk strategy which can be implemented by market participants. Third, market completeness assumption might also break down at times of high stress as investors are not able to associate probabilities to states of the economy. When markets are incomplete, there should be a general interaction between option and stock markets; hence we expect an option-implied measure of aggregate tail risk to have implications on stock returns. Fourth, one can observe direct measures of volatility and tail risk from options markets, which can help market participants to build up more efficient hedging strategies against different sources of risk by disentangling volatility risk from tail risk. Fifth, it is model-free as it is not derived from a particular setting. Hence, an option-implied measure of aggregate tail risk has certain advantages over statistical measures, which makes VXTH an ideal tool to summarize market sentiment about the evolution of aggregate tail risk and study the implications of tail risk on asset returns.5 Using VXTH as a proxy for aggregate tail risk our findings can be summarized as follows. First, the extreme portfolios (containing smallest and biggest stocks) are more sensitive to the tail risk factor than mid-cap stocks. Especially small stocks and the SMB strategy exhibit a positive and statistically significant aggregate tail risk exposure both during the full sample period and 4 Most measures of tail risk proposed in the literature have been based on statistical metrics that model power laws. Chapman and Gallmeyer (2014) mitigate the information content (at least on the short run) of the Kelly and Jiang (2014) tail risk measure, based on the Hill (1975) estimator, concerning the average cross section of stock returns. This estimator, as usually the case in extreme value theory, does not require knowing the whole distribution, but only the form of behavior in the tail to draw statistical inference. Moore et al. (2013) discuss how downside tail risk of stock returns can be differentiated cross-sectionally by including in the analysis not only the tail risk but also the corresponding scale parameter. Andersen et al. (2016) find a clear separation between the left tail factor that is predictive of the future equity tail risk premium and the spot variance factor that is predictive of the actual future return variation. Chabi-Yo et al. (2013) and Weigert (2015) compute tail risk estimator on the basis of a copula to feature the tail dependence. 5 Despite its short history beginning from 2007, it covers the biggest financial turmoil period that the markets have witnessed for decades, i.e. the subprime crisis of 2007-2008, making it ideal to study the effects of aggregate tail risk on stock returns and financial market anomalies. Hence the sample period that we examine, i.e. January 2007 to February 2016, has the advantage of covering a period of extreme aggregate uncertainty, and a period with less uncertainty about aggregate market conditions following interventions by the U.S. government and the FED to address the issue of tail risk management. 3 the subprime and Eurozone crises period. Second, value (growth) stocks are positively (negatively) and significantly exposed to aggregate tail risk factor and tail risk betas monotonically increase from growth to value portfolios. This relation is in general robust during the two sub-periods studied. Third, stocks with high idiosyncratic volatility and the strategy that is long in high IVOL stocks and short in low IVOL stocks exhibit positive and significant aggregate tail risk betas, with tail risk betas increasing almost monotonically from low to high idiosyncratic volatility stocks. The positive exposure of high IVOL stocks and the High-Lo IVOL strategy remains robust during the two subsamples. Overall, small, value and high IVOL stocks are much riskier than their big, growth and low IVOL counterparts as they are much heavily (positively) exposed to aggregate tail risk. Hence, tail risk-averse investors will ask for extra compensation to hold these particular stocks in their portfolios. Our results offer an aggregate tail risk based explanation to size, value vs. growth, and idiosyncratic volatility anomalies. The remainder of the paper is organized as follows. Section 2 presents data and methodology used in our analysis. Section 3 presents the empirical results. Section 4 summarizes the main findings and concludes. 2. Data and Methodology In this section, we first describe the data and test assets used in our analyses. Next, we present empirical methodology that forms the basis of our tests. 2.1. Data Data on VIX Tail Hedge Index (VXTH) are from Chicago Board Options Exchange (CBOE). 6 CBOE has introduced this benchmark index designed to cope with extreme downward movements in American premier stock index. VXTH index tracks the performance of a hypothetical portfolio that buys and holds the performance of the S&P 500 index and buys onemonth 30-delta call options on the CBOE VIX Index. The power of the VXTH index comes from the very high level of returns yielded by VIX call options in times of stock market crash like so-called black swan events. To reduce hedging costs and monetize VIX option profits when volatility levels peak, the weight of the VIX calls in the portfolio varies according to the forward value of VIX to capture the likelihood of a black swan event. More precisely, the amount in percentage allocated to VIX calls varies as follows: 6 www.cboe.com/VXTH 4 VIX futures ≤ 15%, 0% of portfolio in VIX calls, 15 < VIX ≤ 30%, 1% of portfolio in VIX calls, 30 < VIX ≤ 50%, 0.5% of portfolio in VIX calls, VIX > 50%, 0% of portfolio in VIX calls. This tail risk hedging strategy protects the investor from extreme market variations while reducing the transaction costs by limiting the number of VIX calls that are purchased during periods of expected low volatility. The test assets are five portfolios sorted with respect to size, book-to market ratio, and idiosyncratic volatility, as well as 6 (2x3) portfolios sorted with respect to size and book-tomarket ratio. Monthly returns of tests assets, market returns, SMB and HML factors, and Treasury bill rates are downloaded from Ken French’s data library. 7 We further use change in VIX index to proxy for aggregate volatility risk. The full period is from 1st January 2007 to 29th February 2016 with a total of 110 months. The first subsample is from 1st January 2007 to 31st July 2011 and the second subsample is from August 1st 2011 to29th February 2016, both of which are 55 months long. Table 1 presents the summary statistics of market returns, the VIX index, and the VXTH index for the full sample (Panel A), the first sub-sample (Panel B), and the second sub-sample (Panel C). Panel D documents correlations between the five factors used in our study. We use change in VIX and VXTH rather than their levels as investors ultimately care about innovations in risk factors rather than their levels. The correlation between ΔVXTH and ΔVIX is relatively moderate at -0.51, which is not surprising given the aggregate tail index is built on a small fraction of VIX options and a big fraction of stock market index, hence, the negative sign comes from the socalled leverage effect. The correlation between ΔVXTH and market returns (-0.11) is also slightly lower than the correlation between change in ΔVIX and market returns (-0.16). Figure 1 illustrates the level of the VIX and VXTH indices during our sample period. As can be seen, when aggregate tail risk increases (for example during the subprime crisis period) VXTH index goes down and when tail risk decreases (post March 2009 period) the tail risk index goes up. One can also see an increase in tail risk after the second half of 2015. 7 http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html 5 2.2. Methodology We start with the time-series analysis of excess returns on selected portfolios to examine whether they have different exposure to aggregate tail risk. Our experimental setting builds on the Fama and French (1993) three-factor model.8 The seminal articles by Fama and French (1992, 1993), show that a combination of size and book-to-market ratio captures more adequately the crosssection of stock returns than the market beta set alone. Indeed, the Fama and French (1993) model includes the market factor, the size and the book-to-market factors as they are mainly interpreted as proxies for risk factors such as systematic risk, liquidity risk and market distress risk. We augment the Fama and French (1993) three-factor model by adding aggregate volatility risk factor and aggregate tail risk factor. Thus, the workhorse model that forms the basis of our time-series regressions is the following five-factor model: 𝑟𝑖𝑡 = 𝛼𝑖 + 𝛽𝑖,𝑀𝐾𝑇 𝑀𝐾𝑇𝑡 + 𝛽𝑖,𝑆𝑀𝐵 𝑆𝑀𝐵𝑡 + 𝛽𝑖,𝐻𝑀𝐿 𝐻𝑀𝐿𝑡 + 𝛽𝑖,∆𝑉𝐼𝑋 ∆𝑉𝐼𝑋𝑡 + 𝛽𝑖,𝑉𝑋𝑇𝐻 ∆𝑉𝑋𝑇𝐻𝑡 + 𝜀𝑖𝑡 (1) where rit is the monthly return on portfolio i in excess of the T-bill rate, 𝑀𝐾𝑇𝑡 is the market factor, 𝑆𝑀𝐵𝑡 (Small minus Big) is the size factor that measures the return difference between the average small cap and the average big cap portfolios, 𝐻𝑀𝐿𝑡 (High minus Low) is the book-tomarket factor that measures the return difference between the average value and the average growth portfolios, ∆𝑉𝐼𝑋𝑡 is the proxy for aggregate volatility risk factor and ∆𝑉𝑋𝑇𝐻𝑡 is the proxy for aggregate tail risk factor. Section 3 presents results of time-series regressions in Equation (1), using either 5 portfolios sorted with respect to stocks’ market capitalizations, 5 portfolios sorted with respect to book-to market ratios, 5 portfolios sorted with respect to idiosyncratic volatility and 6 portfolios sorted both with respect to 2 size (small and big) and 3 book-to-market (small, medium and big) as test assets. 3. Empirical Results This section presents results of time-series regressions in Equation (1) that form the basis of our tests to examine the relationship between aggregate tail risk and empirically documented size and value anomalies, and the idiosyncratic volatility puzzle. 8 We also made robustness checks using the Fama and French (2015) five-factor model and the results are qualitatively similar although the power of the tests is slightly reduced given the over-parametrization of the model. Results are given upon request. 6 3.1. Aggregate tail risk and size anomaly It is well documented that stocks with small market capitalizations tend to earn higher returns on average than stocks with higher market capitalizations, an important phenomenon that cannot be explained by the CAPM alone (Banz, 1981; Reinganum, 1981). The literature has come up with several explanations including rational risk-based explanations arguing that small stocks are more prone to certain risk factors than large stocks and the return differential is a compensation to investors who bear these risks (Fama and French, 1993, 1996). Among potential explanations are the liquidity explanation highlighting the higher transaction costs associated with small stocks (Amihud and Mendelson, 1986), behavioral explanations arguing that investors do not behave optimally and make consistent pricing errors while valuing stocks, and once these errors are corrected for the size anomaly is less significant (Lakonishok et al., 1994; La Porta, 1996; La Porta et al., 1997), and time-varying risk and business cycle explanations arguing that small stocks are especially more prone to business downturns with limited capacity to cope with increased deterioration in investment opportunities (Lettau and Ludvigson, 2001; Petkova and Zhang, 2005). Given the increase in frequency of extreme events during the subprime crisis, we explore whether portfolios differing in their market capitalizations have different exposures to aggregate tail risk. Table 2 presents results of time-series regressions presented in Equation (1), using excess returns on 5 size-sorted portfolios as test assets. Consistent with earlier studies, there is not a clear relationship between market betas and size, and betas follow an inverse U-shaped pattern from the smallest quintile to the highest quintile. As expected SMB factor is a strong determinant of size-sorted portfolio returns by construction. The significance of HML factor is weaker than SMB factor. We further document that change in the VIX index loads negatively with returns on portfolios of small stocks and positively with returns on the portfolio of big stocks, however none of the coefficients are significantly different from zero. Looking at tail betas, we document that ΔVXTH betas are positive and statistically significant for small stocks and for the long-short portfolio while they are negative and very close to being significant for big stocks. The results imply that size-sorted portfolios are exposed to aggregate tail risk in a very distinct way than aggregate volatility risk. The positive tail risk loadings of small stocks and the SMB portfolio implies that small stocks and the SMB strategy are much riskier during times of extreme downward market moves. These findings, if persistent, can offer an alternative tail-based explanation to the well-documented size anomaly. 7 3.2. Aggregate tail risk and value vs. growth anomaly One of the well-established features of asset returns is that firms with high book-to-market ratios (value firms) deliver, on average, higher returns than firms with low book-to-market ratios (growth firms). The value premium, computed as the difference in average returns between value (high B/M) firms and growth (low B/M) firms, was first identified by Graham and Dodd (1934) and deeply investigated by Fama and French (1992) and is viewed as a proxy for distress risk (Fama and French, 1996).9 We investigate whether return dynamics of B/M sorted portfolios are sensitive to aggregate tail risk. Table 3 presents the slope coefficients of time-series regressions using excess returns on 5 B/M sorted portfolios as test assets. We test if portfolios of stocks sorted with respect to their book-tomarket ratios (B/M) have different sensitivities with respect to the aggregate tail risk factor, VXTH. One can see that market and HML factors have strong explanatory power on the returns of B/M sorted portfolios. SMB factor has almost no explanatory power with the exception of the value portfolio. Furthermore, aggregate volatility risk factor has a negative and significant loading for the growth portfolio and a positive loading for the second lowest B/M ratio quintile. Regarding the tail risk factor, we document significant aggregate tail risk exposures for portfolios that contain the lowest and highest B/M stocks as well as the HML portfolio. Most importantly, growth stocks exhibit negative tail risk betas whereas value stocks and the HML portfolio exhibit positive tail risk betas. Furthermore, the tail index betas increase monotonically from growth to value stocks. The results imply that value stocks and the HML strategy are risky strategies given their positive exposure to aggregate tail risk. On the other hand, growth stocks (with their negative exposure to aggregate tail risk) offer a potential hedge against increases in aggregate tail risk. However, book-to-market ratio and size are two closely related variables as the firm’s size also displayed in the denominator of its book-to-market ratio. Because of this mechanical relationship, it is possible to find small stocks in high B/M portfolio and likewise big stocks might be the dominant stocks in low B/M portfolio. Therefore, it becomes crucial to disentangle the effect of size and B/M ratios to understand the real effect of aggregate tail risk on more refined portfolio returns. 9 Liew and Vassalou (2000) show that HML factor correlates positively with GDP growth, even after controlling for market factor. Lettau and Ludvigson (2001) and Petkova and Zhang (2005) argue that the value premium is closely related to business cycles, and show that the consumption and market betas of value stocks increases in bad times in conditional CCAPM and conditional CAPM settings, respectively. Arisoy (2010, 2014) argue that value stocks are much riskier at times of increased aggregate volatility risk. 8 3.3. Six portfolios (2x3) sorted with respect to size and book-to-market ratios In this section, we further refine size and B/M sorted portfolios and disentangle the size and book-to-market effects by examining returns of 6 portfolios, where stocks are first sorted with respect to 2 size portfolios (small and big), and then within each size portfolio, stocks are sorted with respect to their book-to-market ratios. In this manner, we can have a better understanding about the impact of aggregate tail risk factor on the return dynamics of size and B/M sorted portfolios, where the potential confounding effects of size and B/M are minimized as a result of a more refined sample. Table 4 presents the slope coefficients of time-series regressions outlined in Equation (1), using excess returns on 6 portfolios sorted with respect to 2 size-based portfolios (small vs. big), and then 3 B/M tertiles within each two size-based portfolios. Based on this more refined sample of portfolios, we observe several interesting features about how aggregate tail risk impacts size and book-to-market sorted portfolios when the effect of size on book-to-market is disentangled. First of all, 4 out 6 portfolios document statistically significant tail risk loadings. Across small stocks, we observe that only the small-value portfolio exhibit a positive and significant tail risk beta. Therefore, the positive coefficient observed for small stocks documented in Table 2 is mostly due to the presence of value stocks in this portfolio. Furthermore, there is an interesting pattern across big stocks. It is only the portfolio of big and growth stocks which exhibit a negative and significant tail risk beta, while the two other portfolios which contain medium and high B/M stocks exhibit positive and significant betas. Therefore, with their negative tail risk loadings, it is only the big and growth stocks (not small and growth stocks) which provide a hedge against increases in tail risk. Value stocks on the other hand exhibit positive tail risk loadings regardless of their size, hence they are viewed much riskier by tail risk averse investors. As documented previously, the sensitivity to tail risk increases monotonically from growth to value stocks, which implies that investors require a higher compensation to hold value stocks in their portfolios. 3.4. Aggregate tail risk and idiosyncratic volatility anomaly Ang et al. (2006a, 2006b, 2009) document that stocks with high idiosyncratic volatility earn lower returns than stocks with low idiosyncratic volatility in the cross-section of US and international stock returns, respectively. This puzzling finding is at odds with the capital asset pricing models which posit that investors should not care about idiosyncratic volatility as they should optimally hold the market portfolio in which idiosyncratic volatility risk is already diversified away. However Goetzmann and Kumar (2008) show that US investors hold 9 underdiversified portfolios. In the case of underdiversdification, investors could demand a premium for bearing idiosyncratic risk. Therefore idiosyncratic risk should either not be priced (due to diversification) or if it is priced, it should command a positive premium, not negative. Studies attribute this puzzling negative relationship between idiosyncratic volatility and returns to several factors ranging from illiquidity (Bali and Cakici, 2008), one-month return reversal (Fu, 2009; Huang et al. 2009), earnings surprises (Jiang, Xu, and Yao, 2009), idiosyncratic skewness (Boyer, Mitton and Vorkink (2010), non-systematic coskewness (Chabi-Yo 2011), MAX effect (Bali, Cakici and Whitelaw, 2011), average variance beta (Chen and Petkova, 2012), retail trading proportion (Han and Kumar, 2013), incomplete information (Berrada and Hugonnier, 2013), and prospect theory (Bhootra and Hur, 2015).10 Given these wide range of potential explanations, it is worth examining whether portfolios of stocks sorted with respect to idiosyncratic volatility (IVOL) exhibit different sensitivity to aggregate tail risk. Table 5 presents the slope coefficients of time-series regressions using excess returns on 5 IVOL sorted portfolios to test if such portfolios of stocks sorted with respect to their idiosyncratic volatility (IVOL) have different sensitivities with respect to innovations in the aggregate tail risk factor, ΔVXTH. Once again, the MKT and SMB factors have significant loadings on IVOL sorted portfolios whereas the HML factor is never significant. Aggregate volatility risk is significant only for one portfolio. On the other hand, aggregate tail risk betas are positive and statistically significant for the highest IVOL stocks and the long-short IVOL portfolio. Moreover, the betas are negatively exposed to tail risk factor for low IVOL stocks and almost monotonically increasing to positive values for high IVOL stocks. The findings imply that due to their positive exposure to aggregate tail risk high idiosyncratic volatility stocks should be considered riskier at times of increased tail risk. Furthermore, a strategy that is long in high IVOL stocks and low IVOL stocks is risky as it is positively exposed to aggregate tail risk. Our findings offer a tail risk-based alternative explanation to the idiosyncratic volatility puzzle. 3.5. Financial crisis, aggregate tail risk, size, value effects and idiosyncratic risk This sub-section examines the impact of aggregate uncertainty on size, B/M and idiosyncratic volatility sorted portfolios in two sub-periods, January 2007 - July 2011, and August 2011 - 10 In addition, several papers show that the idiosyncratic volatility puzzle is stronger among stocks with high leverage (Johnson, 2004), low institutional ownership (Nagel, 2005), non-NYSE listings (Bali and Cakici, 2008), low analyst coverage (Ang, Hodrick, Xing, and Zhang, 2009), prices of at least five dollars (George and Hwang, 2013), low credit ratings (Avramov et al. 2013), high short-sale constraints (Boehme et al. 2009; George and Hwang, 2013; Stambaugh, Yu, and Yuan, 2015), low book-to-market ratio (Barinov, 2013), and for non-January months (George and Hwang, 2013; Doran, Jiang, and Peterson, 2012). 10 February 2016. The subsample analysis provides us with a quasi-natural experimental setting to test the impact of recent financial crisis, which we associate with extreme increase in aggregate tail risk. In particular, we investigate if return dynamics of size, B/M and idiosyncratic volatility sorted portfolios were different between a period where VXTH was more exposed to tail risk (pre- August 2011), and a sideways market where the aggregate tail risk easing down and heat of financial markets cooling down as the Eurozone countries, the ECB, US government and the FED intervening and reassuring the markets, with equity markets picking up and investors becoming relatively less tail risk-averse about macro-financial conditions (post-August 2011). Tables 6, 7 and 8 report the slope coefficients of our 5-factor model as outlined in Equation (1), for the 5 size, B/M, IVOL sorted portfolios during January 2007 - July 2011 for Panel A, and during August 2011 - January 2016 for Panel B. In fact, Panel A covers both contraction and recession period in the US and Eurozone countries, while Panel B is characterized by the recovery and expansion period. Looking at Panel A in Table 6, one can see that the results for the whole sample are mainly driven by the first subsample with small stocks and the SMB portfolio being positively and significantly exposed to aggregate tail risk. As one could expect, Panel B shows almost no significant exposure to aggregate tail risk during the recovery phase. The findings imply that the sensitivity of small stocks and SMB portfolio to aggregate tail risk is most prominent during the first sub–period (when aggregate tail risk was at its highest) and it disappears during the second sub-period. Looking at Panel A in Table 7, one can see very similar results to those presented in Table 3. During the recession period, growth stocks exhibit negative and statistically significant aggregate tail risk loadings, whereas value stocks exhibit positive and significant tail risk loadings. In addition, tail index beta is negative for growth stocks and positive for value stocks while increasing monotonically from growth to value stocks, a finding similar to what we observe over the whole sample period. More generally, significant aggregate tail index betas concerns portfolios that contain lowest and highest B/M stocks as well as the HML portfolio. They are significant in 4 out of 6 portfolios in Panel A and 3 out of 6 in Panel B. While the sensitivity of size and B/M sorted portfolios to aggregate tail risk is generally stronger during the first half of the sample period, IVOL sorted portfolios present a different pattern. The positive exposure of high IVOL portfolio together with the long-short IVOL strategy persists during both sample periods implying that the relationship between aggregate tail risk and returns 11 on high IVOL stocks is persistently positive, therefore high IVOL stocks would be deemed riskier as a result of their positive and significant exposure to aggregate tail risk. 4. Conclusion We examine the relation between return dynamics of size, book-to-market, and idiosyncratic volatility sorted portfolios and aggregate tail risk. We propose a novel proxy to measure a stock’s return sensitivity to aggregate tail risk – VIX Tail Hedge Index (VXTH). Our proposed measure has the advantage of being forward-looking and investable, which can better summarize a portfolio’s exposure to aggregate tail risk. Using changes in VXTH as a measure of aggregate tail risk we document the following. We find that small, value and high idiosyncratic volatility stocks exhibit consistently positive and statistically significant aggregate tail risk betas during January 2007 ‒ February 2016 period. In particular, small stocks are positively and significantly exposed to the tail risk factor and this positive exposure is mainly driven by the recession period. Meanwhile, value (growth) stocks are positively (negatively) and significantly exposed to aggregate tail risk with tail risk betas monotonically increasing from growth to value stocks. A detailed analysis reveals that smallvalue portfolio is the portfolio which is exposed most positively to aggregate tail risk across small stocks. On the other hand, big-growth portfolio is the only portfolio that offers a hedge against aggregate tail risk with its negative tail risk exposure. We further revisit the idiosyncratic volatility puzzle and find that stocks with high IVOL and a strategy that is long in high IVOL stocks and short in low IVOL stocks exhibit a positive aggregate tail risk exposure. 12 References Amihud, Y. and H. Mendelson, 1986, “Asset pricing and the bid-ask spread”, Journal of Financial Economics 17, 223-249. Amihud, Y., 2002, “Illiquidity and stock returns: Cross-section and time-series Effects”, Journal of Financial Markets 5, 31-56. Andersen, T., N., Fusari, and V., Todorov, 2016, “The pricing of tail risk and the equity premium: Evidence from international option markets”, Northwestern University Working paper. Ang, A., R. Hodrick, Y., Xing, and X., Zhang, 2006a, “The cross-section of volatility and expected returns”, Journal of Finance 61, 259-299. Ang, A., J., Chen, Y., Xing, 2006b, “Downside risk”, Review of Financial Studies 19, 11911239. Ang, A., R., Hodrick, Y., Xing, X., Zhang, 2009, “High idiosyncratic volatility and low returns: International and further U.S. evidence”, Journal of Financial Economics 91, 1-23. Arisoy, Y. E., 2010, “Volatility risk and the value premium: Evidence from the French stock market”, Journal of Banking and Finance 34, 975-983. Arisoy, Y. E., 2014, “Aggregate volatility and market jump risk: An option-based explanation to size and value premia”, Journal of Futures Markets 34, 34-55. Asness, C., T., Moskowitz, and L.H., Pedersen, 2013, “Value and momentum everywhere”, Journal of Finance 68, 929-985. Avramov, D., T., Chordia, G., Jostova, and A., Philipov, 2013, “Anomalies and financial distress” Journal of Financial Economics 108, 139-159. Banz, R., 1981, “The relation between return and market value of common stocks, Journal of Financial Economics 9, 3-18. Bali, T. G. and N, Cakici, 2008, “Idiosyncratic volatility and the cross section of expected returns”, Journal of Financial and Quantitative Analysis 43, 29-58. Bali T., and N., Cakici, R.F., Whitelaw, 2011, “Maxing out: stocks as lotteries and the crosssection of expected returns”, Journal of Financial Economics 99, 427-446. Banz, R.W., 1981,” The relationship between return and market value of common stocks”, Journal of Financial Economics 9, 3-18. Barinov, A., 2012, “Aggregate volatility risk: Explaining the small growth anomaly and the new issues puzzle”, Journal of Corporate Finance 18,763-781. Barinov, A. 2013, “Analyst disagreement and aggregate volatility risk”, Journal of Financial and Quantitative Analysis 48, 1877-1900. Berrada, T., and J., Hugonnier, 2013. "Incomplete information, idiosyncratic volatility and stock returns," Journal of Banking and Finance 37, 448-462. 13 Bhootra, A., and J., Hur, 2015, “High idiosyncratic volatility and low returns: A prospect theory explanation”, Financial Management 44, 295-322. Bloom, N., 2009, “The impact of uncertainty shocks”, Econometrica 77, 623–685. Boehme, R., B., Danielsen, P., Kumar, and S., Sorescu, 2009, “Idiosyncratic risk and the cross section of stock returns: Merton (1987) meets Miller (1977), Journal of Financial Markets 12, 438-468. Bollerslev, T., and V., Todorov, 2011, “Tails, fears, and risk premia”, Journal of Finance 66, 2165-2211. Bollerslev, T., V., Todorov, and L., Xu, 2015, “Tail risk premia and return predictability”, Journal of Financial Economics 118, 113-134. Boyer, B.H., T. Mitton, and K. Vorkink, 2010, “Expected idiosyncratic skewness”, Review of Financial Studies 23, 169-202. Brady, M.E., 1996, “J.M. Keynes "Safety First" approach, decision making under risk in the Treatise on Probability (1921)”, California State University Working paper. Chabi-Yo, 2011, “Explaining the idiosyncratic volatility puzzle using stochastic discount factors”, Journal of Banking and Finance 35, 1971-1983. Chabi-Yo, F., S., Ruenzi, and F., Weigert, 2015, “Crash sensitivity and the cross-section of expected stock returns, Ohio State University Working paper. Chapman, D., and M., Gallmeyer, 2014, “Aggregate tail risk, economic disasters, and the crosssection of expected returns”, University of Virginia Working paper. Chen, Z., and R., Petkova, 2012, “Does idiosyncratic volatility proxy for risk exposure?” Review of Financial Studies 25, 2745-2787. Cholette, L., C.-C., Lu, 2011, “The market premium for dynamic tail risk”, University of Stavanger Working Paper. Cremers, M., M., Halling, and D., Weinbaum, 2014, “Aggregate jump and volatility risk in the cross-section of stock returns”, Journal of Finance 70, 577-614. Doran, J., D. Jiang, and D. Peterson, 2012, “Gambling preference and the New Year effect of assets with lottery features”, Review of Finance 16, 685-731. Embrechts, P., C., Klüppelberg, and T., Mikosch, 1997, “Modelling extremal events for insurance and finance”, Springer: New York. Fama, E., and K., French, 1992, “The cross-section of expected returns”, Journal of Finance 47, 427-465. Fama, E. F., and K.R., French, 1993, “Common risk factors in the returns on stocks and bonds”, Journal of Financial Economics 33, 3-56. 14 Fama, E. F., and K.R., French, 1996, “Multifactor explanations of asset pricing anomalies”, Journal of Finance 51, 55-84. Fama, E.F., and K.R., French, 2015. “A five factor model”, Journal of Financial Economics 116, 1-22. Fu, F., 2009, “Idiosyncratic risk and the cross-section of expected stock returns”, Journal of Financial Economics 91, 24-37. Gabaix, X., 2012, “Variable rare disasters: an exactly solved framework for ten puzzles in macro-finance”, Quarterly Journal of Economics 127, 645-700. George, T.J., and C.-Y., Hwang, 2013 “Analyst coverage and two Puzzles in the cross section of returns,” Bauer College of Business Working paper. Goetzmann, W., and A., Kumar, 2008, “Equity portfolio diversification”, Review of Finance 12, 433-463. Graham, B., and D. Dodd, 1934, Security Analysis, McGraw-Hill: New York. Han, B., and A., Kumar, 2013, “Speculative retail trading and asset prices”, Journal of Financial and Quantitative Analysis 48, 377-404. Herskovic, B., B., Kelly, H., Lustig, and S., Van Nieuwerburg, 2016, “The common factor in idiosyncratic volatility: Quantitative asset pricing implications”, Journal of Financial Economics 119, 249-283 Hill, B., 1975, “A simple general approach to inference about the tail of a distribution”, Annals of Statistics 3, 1163-1164. Huang, W., Liu, Q., Rhee, S. G., and Zhang, L., 2009, “Return reversals, idiosyncratic risk, and expected returns”, Review of Financial Studies 23, 147−168. Jiang, G. J., D. Xu, and T. Yao, 2009, “The information content of idiosyncratic volatility”, Journal of Financial and Quantitative Analysis 44, 1-28. Johnson, T. C., 2004, “Forecast dispersion and the cross-section of expected returns”, Journal of Finance 59, 1957-1978. Kelly, B., and H., Jiang, 2014, “Tail risk and asset prices”, Review of Financial Studies 27, 2841-2871. Keynes, J. M., 1921, Treatise on probability, London: Macmillan. Lakonishok, J., A., Shleifer, R., Vishny, 1994, “Contrarian investment, extrapolation, and risk”, Journal of Finance 49, 1541-1578. Lettau, M., and S.C., Ludvigson, 2001, “Resurrecting the (C)CAPM: A cross-sectional test when risk premia are time-varying”, Journal of Political Economy, 109, 1238-1287. Liew, J., and M., Vassalou, 2000,” Can book-to-market, size and momentum be risk factors that predict economic growth?”, Journal of Financial Economics 57, 221-245. 15 La Porta, R. 1996, “Expectations and the cross-section of stock returns”, Journal of Finance 51, 1715-1742. La Porta, R., J., Lakonishok, A., Shleifer, and R.W., Vishny, 1997, “Good news for value stocks: Further evidence on market efficiency”, Journal of Finance 52, 859-874. Moore, K., P., Sun, C., de Vries, and C., Zhou, 2013, “The cross-section of tail risks in stock returns”, Erasmus University Working paper. Nagel, S., 2005, Short sales, institutional investors and the cross-section of stock returns, Journal of Financial Economics 78, 277–309. Petkova, R., L., Zhang, 2005, “Is value riskier than growth?”, Journal of Financial Economics 78, 187-202. Reinganum, R., 1981, “Misspecification of capital asset pricing: Empirical anomalies based on earnings' yields and market values”, Journal of Financial Economics 9, 19-46. Roy, A.D., 1952, “Safety first and the holding of assets”, Econometrica 20, 413-449. Rubinstein, M., 1994, “Implied binomial trees”, Journal of Finance 49, 771-813. Stambaugh, R., J., Yu, and Y., Yuan, 2015, “Arbitrage asymmetry and the idiosyncratic volatility puzzle”, Journal of Finance 70, 1903-1948. Tsai, J., and J., Wachter, 2015, “Disaster risk and its implications for asset pricing”, Annual Review of Financial Economics 7, 219-252. Weigert, F., 2015, “Crash aversion and the cross-section of expected stock returns worldwide”, Review of Asset Pricing Financial Studies, forthcoming. Yuen, S., 2015, “The fear factor and the cross-section of stock returns”, Northwestern University Working paper. 16 Table 1 Summary Statistics and Correlations Panel A: Descriptive Statistics (Full Sample) MKT VIX VXTH Mean 0.58 21.46 140.69 Std. Dev. 4.65 9.72 34.22 Skewness -0.63 2.12 0.28 Kurtosis 4.18 8.61 1.98 Min -17.15 10.31 74.36 Max 11.35 68.51 204.79 Kurtosis 3.59 6.63 2.90 Min -17.15 10.31 74.36 Max 10.20 68.51 146.37 Kurtosis 3.33 8.79 1.72 Min -7.59 11.15 126.91 Max 11.35 45.45 204.79 Panel B: Descriptive Statistics (Jan 2007 - Jul 2011) MKT VIX VXTH Mean 0.22 25.09 112.41 Std. Dev. 5.45 11.11 15.60 Skewness -0.67 1.80 0.14 Panel C: Descriptive Statistics (Aug 2011 - Feb 2016) MKT VIX VXTH Mean 0.94 17.82 168.98 Std. Dev. 3.69 6.37 22.16 Skewness -0.07 2.26 0.08 Panel D: Pearson Correlation Among Factors MKT SMB HML ΔVIX ΔVXTH MKT 1.0000 0.4152 0.3145 -0.1632 -0.1111 SMB HML ΔVIX 1.0000 0.3119 -0.0813 -0.0958 1.0000 -0.0340 -0.0592 1.0000 -0.5137 ΔVXTH 1.0000 Note: Panel A presents descriptive statistics of daily levels of MKT, VIX and VXTH for the full sample period in Panel A (January 3, 2007 to July 31, 2011), first sub-sample period in Panel B (January 3, 2007 to July 31, 2011) and second sub-sample period in Panel C (August 1, 2011 to February 29, 2016). Panel D presents correlations between factors used in the study expressed in average daily returns (in %). 17 Table 2 Size portfolios Portfolios Small Size2 Size3 Size4 Big SMB MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 0.9794*** 1.0697*** 0.1148*** -0.0023 0.0305* -0.2491*** 97.95% [45.84] [26.48] [3.02] [-0.14] [1.73] [-2.81] 1.0148*** 0.9600*** 0.0013 0.0058 0.0045 -0.0019 [80.91] [40.49] [0.06] [0.59] [0.43] [-0.04] 1.0379*** 0.6677*** -0.0673* -0.0066 -0.0094 0.1661** [52.08] [17.72] [-1.90] [-0.42] [-0.57] [2.01] 1.0685*** 0.3433*** -0.0812** -0.0229 0.0174 0.0091 [46.09] [7.83] [-1.97] [-1.26] [0.91] [0.09] 0.9830*** -0.1824*** 0.0024 0.0004 -0.0055 0.0075 [236.18] [-23.18] [0.33] [0.11] [-1.59] [0.44] -0.0007 1.2526*** 0.1131*** -0.0033 0.0369** -0.3140*** [-0.03] [31.08] [2.98] [-0.20] [2.09] [-3.55] 99.25% 97.86% 96.78% 99.84% 92.29% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to February 29, 2016. Small is the portfolio of stocks that are in the lowest market capitalization decile, and Big is the portfolio of stocks that are in the largest market capitalization decile. SMB is the portfolio that is long in Small and short in Big portfolios. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 18 Table 3 B/M portfolios Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low BM 0.9969*** -0.0140 -0.3542*** -0.0257*** -0.0222* 0.1159* 97.91% [63.91] [-0.47] [-12.77] [-2.11] [-1.72] [1.79] 0.9529*** -0.0523 0.0013 0.0280* 0.0026 0.1179 [51.91] [-1.51] [0.04] [1.95] [0.17] [1.55] 1.0479*** -0.0253 0.1570*** 0.0250 0.0245 -0.1399 [44.19] [-0.56] [3.72] [1.34] [1.25] [-1.42] 0.9781*** -0.0097 0.4667*** -0.0061 0.0229 -0.1215 [47.62] [-0.25] [12.78] [-0.38] [1.35] [-1.43] 1.0758*** 0.2938*** 0.5934*** 0.0262 0.0517* -0.0563 [31.34] [4.53] [9.72] [0.97] [1.82] [-0.40] 0.0818** [0.31]*** 0.9482*** 0.0513* 0.0748** -0.2295 [2.27] [4.53] [14.81] [1.82] [2.51] [-1.54] BM2 BM3 BM4 High BM HML 96.98% 96.13% 97.14% 94.44% 77.01% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to February 29, 2016. Low is the portfolio of stocks that are in the lowest book-to-market ratio decile (growth portfolio), and High is the portfolio of stocks that are in the highest book-to-market decile (value portfolio). HML is the portfolio that is long in High and short in Low portfolios. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 19 Table 4 2x3 portfolios sorted with respect to size and book-to-market Portfolios Size B/M S L S M MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 1.0612*** 1.0495*** -0.4252*** 0.0078 -0.0112 -0.1890** 98.38% [57.01] [29.83] [-12.85] [0.54] [-0.98] [-2.45] 0.9738*** 0.8674*** 0.0961*** -0.0007 -0.0116 0.0900 [72.47] [34.15] [4.02] [-0.07] [-1.04] [1.62] 0.8817*** 0.6111*** 0.0030 0.0392** 0.0332 S H 0.9842*** [71.19] [33.74] [24.86] [0.28] [2.54] [0.58] B L 0.9618*** -0.1063*** -0.2700*** -0.0064 -0.0185** 0.1414*** [86.13] [-5.03] [-13.60] [-0.73] [-2.00] [3.06] -0.1323*** 0.1592*** 0.0230 0.0276* -0.1377* B M 1.0456*** [58.36] [-3.91] [5.00] [1.64] [1.86] [-1.85] B H 1.0387*** 0.0613 0.6941*** -0.0018 0.0321* -0.0796 [44.63] [1.39] [16.78] [-0.10] [1.66] [-0.82] 99.08% 99.21% 98.80% 97.65% 97.12% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to February 29, 2016. The test assets are 6 portfolios sorted with respect to 2 size and 3 B/M. S and B stand for portfolio of stocks that the smallest market capitalization and largest market capitalization, respectively. L, M and H stand for portfolio of stocks that are in the lowest book-to-market ratio tertile, medium lowest tertile and highest book-tomarket tertile, respectively. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 20 Table 5 5 portfolios sorted with respect to idiosyncratic volatility Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low IVOL 0.8029*** -0.1770*** 0.0063 0.0097 -0.0128 0.1652* 93.52% [35.64] [-4.16] [0.16] [0.55] [-0.68] [1.77] IVOL2 1.0560*** 0.0653* 0.0476 0.0366** 0.0103 0.0482 [52.19] [1.71] [1.32] [2.31] [0.62] [0.58] IVOL3 1.1538*** 0.1304** -0.0068 -0.0381 -0.0125 -0.1503 [35.53] [2.12] [-0.12] [-1.50] [-0.46] [-1.12] IVOL4 1.3824*** 0.1899** -0.0891 -0.0236 0.0300 -0.1830 [28.54] [2.07] [-1.04] [-0.62] [0.75] [-0.91] High IVOL 1.4058*** 0.7081*** 0.1110 -0.0415 0.0994* -0.6118** [19.88] [5.30] [0.88] [-0.75] [1.70] [-2.09] Hi-Lo IVOL 0.6058*** 0.8855*** 0.1054 -0.0518 0.1131* -0.8345** [6.97] [5.39] [0.68] [-0.76] [1.77] [-2.32] 97.19% 94.34% 91.30% 86.52% 57.90% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to February 29, 2016. The test assets are 5 portfolios sorted with respect to 5 IVOL quintiles within each size quintile. Low IVOL, IVOL 2, IVOL 3, IVOL 4, High IVOL and Hi-Lo IVOL stand for portfolio of stocks that correspond to the lowest idiosyncratic volatility, second smallest IVOL quintile, third smallest IVOL quintile, fourth smallest IVOL quintile, highest IVOL quintile, respectively and Hi-Lo IVOL is the portfolio that is long in low idiosyncratic volatility and short in high idiosyncratic volatility. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 21 Table 6 Subperiod analysis - 5 size portfolios Panel A: January 2007 - July 2011 Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 0.9838*** 1.0092*** 0.1342*** 0.0112 0.0593** -0.3608*** 98.51% [36.51] [16.95] [2.67] [0.50] [2.10] [-2.86] Size2 1.0027*** 0.9164*** 0.0414 0.0046 -0.0050 0.0460 [56.26] [23.27] [1.25] [0.99] [-0.88] [0.55] Size3 1.0465*** 0.6276*** -0.0814 -0.0100 -0.0090 0.3389*** [37.48] [10.17] [-1.56] [-0.43] [-0.31] [2.59] Size4 1.0645*** 0.3593*** -0.1013* -0.0483* 0.0035 0.0636 [32.41] [4.95] [-1.65] [-1.77] [0.10] [0.41] Big 0.9835*** -0.1878*** 0.0032 -0.0104 -0.0302 0.0034 [179.03] [-15.48] [0.31] [-0.70] [-1.62] [0.13] 0.0014 1.2081*** 0.1280** 0.0208 0.0860** -0.4797*** [0.05] [19.90] [2.50] [0.25] [2.30] [-3.73] Small SMB 99.31% 98.07% 97.13% 99.88% 92.84% Panel B: August 2011 - February 2016 Portfolios Small Size2 Size3 Size4 Big SMB MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 0.9467*** 1.1717*** 0.1186* -0.0213 0.0020 -0.0562 97.10% [24.63] [20.11] [1.75] [-0.82] [0.09] [-0.43] 1.0399*** 0.9664*** -0.0350 0.0122 0.0279** -0.0439 [55.70] [34.15] [-1.06] [0.97] [2.45] [-0.69] 1.0539*** 0.6905*** 0.0133 0.0036 -0.0057 0.0009 [32.79] [14.17] [0.23] [0.17] [-0.29] [0.01] 1.0895*** 0.3126*** -0.0254 0.0196 0.0347 -0.0810 [28.61] [5.42] [-0.38] [0.77] [1.49] [-0.63] 0.9842*** -0.1753*** 0.0043 -0.0068 -0.0062 0.0149 [132.34] [-15.55] [0.33] [-1.36] [-1.37] [0.59] -0.0370 1.3468*** 0.1139* -0.0144 0.0086 -0.0739 [-0.99] [23.89] [1.73] [-0.58] [0.38] [-0.59] 99.28% 97.60% 95.96% 99.76% 92.38% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to July 31, 2011 (Panel A), and for the sample period of August 1, 2011 to February 29, 2016 (Panel B). Small is the portfolio of stocks that are in the lowest market capitalization quintile, and Big is the portfolio of stocks that are in the largest market capitalization quntile. SMB is the portfolio that is long in Small and short in Big portfolios. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 22 Table 7 Subperiod analysis - 5 B/M portfolios Panel A: January 2007 - July 2011 Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low BM 1.0136*** -0.0204 -0.3522*** -0.0582*** -0.0818*** 0.2143** 98.55% [52.33] [-0.48] [-9.75] [-3.61] [-4.04] [2.36] BM2 0.9341*** -0.0155 0.0287 -0.0021 0.0259 0.0809 [32.55] [-0.24] [0.54] [-0.09] [0.90] [0.60] BM3 1.0337*** -0.0171 0.1556*** 0.0142 0.0323 -0.2258 [29.06] [-0.22] [2.35] [0.34] [0.61] [-1.36] BM4 1.0061*** -0.0237 0.4493*** 0.0506** 0.0563* -0.1535 [36.53] [-0.39] [8.75] [2.12] [1.88] [-1.19] High BM 1.0360*** 0.2954*** 0.6226*** 0.0551* 0.0689* -0.0245 [20.57] [2.66] [6.63] [1.86] [1.85] [-0.10] 0.0235 0.3269*** 0.9718*** 0.1116* 0.1507*** -0.3543 [0.47] [2.98] [10.50] [1.73] [3.23] [-1.53] HML 96.70% 96.14% 97.96% 94.97% 81.24% Panel B: August 2011 - February 2016 Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low BM 0.9740*** -0.0519 -0.4097*** 0.0031 0.0103 0.0386 97.69% [39.92] [-1.40] [-9.50] [0.19] [0.69] [0.47] 0.9582*** -0.0743** -0.0549 0.0092 -0.0295** 0.1271* [42.87] [-2.19] [-1.39] [0.61] [-2.16] [1.68] 1.0709*** 0.0006 0.1970*** -0.0061 0.0009 -0.0774 [31.24] [0.01] [3.25] [-0.26] [0.04] [-0.67] 0.9155*** 0.0289 0.4508*** -0.0128 0.0075 -0.0183 [25.15] [0.52] [7.00] [-0.52] [0.34] [-0.15] 1.1670*** 0.2531*** 0.6188*** 0.0384 0.0825** -0.1782 [21.52] [3.08] [6.45] [1.05] [2.49] [-0.97] 0.1936*** 0.3049*** 1.0281*** 0.0354 0.0725** -0.2196 [3.28] [3.41] [9.85] [0.89] [2.01] [-1.10] BM2 BM3 BM4 High BM HML 97.92% 96.11% 94.30% 92.67% 69.23% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to July 31, 2011 (Panel A), and for the sample period of August 1, 2011 to February 29, 2016 (Panel B). Low is the portfolio of stocks that are in the lowest book-to-market ratio quintile (growth portfolio), and High is the portfolio of stocks that are in the highest book-to-market quintile (value portfolio). HML is the portfolio that is long in High and short in Low portfolios. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 23 Table 8 Subperiod analysis - 5 IVOL portfolios Panel A: January 2007 - July 2011 Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low IVOL 0.8000*** -0.1775*** 0.0056 0.0103 -0.0137 0.2226** 93.45% [35.46] [-4.16] [0.14] [0.58] [-0.73] [2.38] 1.0531*** 0.0648* 0.0470 0.0372** 0.0094 0.1056 [51.63] [1.68] [1.29] [2.33] [0.56] [1.25] 1.1509*** 0.1299** -0.0074 -0.0374 -0.0134 -0.0929 [35.01] [2.09] [-0.13] [-1.45] [-0.49] [-0.68] 1.3795*** 0.1894** -0.0898 -0.0230 0.0290 -0.1256 [28.45] [2.07] [-1.04] [-0.60] [0.72] [-0.63] 1.4028*** 0.7076*** 0.1103 -0.0409 0.0985* -0.5545* [19.79] [5.28] [0.88] [-0.74] [1.68] [-1.89] 0.6029*** 0.8851*** 0.1047 -0.0512 0.1122* -0.7771** [6,93] [5,38] [0,68] [-0.75] [1.76] [-2.15] IVOL2 IVOL3 IVOL4 High IVOL Hi-Lo IVOL 97.13% 94.18% 91.25% 86.41% 57.67% Panel B: August 2011 - February 2016 Portfolios MKT SMB HML ΔVIX ΔVXTH Alpha Adj. R2 Low IVOL 0.8029*** -0.1770*** 0.0063 0.0097 -0.0128 0.1652* 93.52% [35.64] [-4.16] [0.16] [0.55] [-0.68] [1.77] 1.0560*** 0.0653* 0.0476 0.0366** 0.0103 0.0482 [52.19] [1.71] [1.32] [2.31] [0.62] [0.58] 1.1538*** 0.1304** -0.0068 -0.0381 -0.0125 -0.1503 [35.53] [2.12] [-0.12] [-1.50] [-0.46] [-1.12] 1.3824*** 0.1899** -0.0891 -0.0236 0.0300 -0.1830 [28.54] [2.07] [-1.04] [-0.62] [0.75] [-0.91] 1.4058*** 0.7081*** 0.1110 -0.0415 0.0994* -0.6118** [19.88] [5.30] [0.88] [-0.75] [1.70] [-2.09] 0.6058*** 0.8855*** 0.1054 -0.0518 0.1131* -0.8345** [6.97] [5.39] [0.68] [-0.76] [1.77] [-2.32] IVOL2 IVOL3 IVOL4 High IVOL Hi-Lo IVOL 97.19% 94.34% 91.30% 86.52% 57.90% Note: This table presents slope coefficients of the regressions of the five-factor model as outlined in Equation (1) for the sample period of January 3, 2007 to July 31, 2011 (Panel A), and for the sample period of August 1, 2011 to February 29, 2016 (Panel B). The test assets are 5 portfolios sorted with respect to 5 IVOL quintiles within each size quintile. Low IVOL, IVOL 2, IVOL 3, IVOL 4, High IVOL and Hi-Lo IVOL stand for portfolio of stocks that correspond to the lowest idiosyncratic volatility, second smallest IVOL quintile, third smallest IVOL quintile, fourth smallest IVOL quintile, highest IVOL quintile, respectively and Hi-Lo IVOL is the portfolio that is long in low idiosyncratic volatility and short in high idiosyncratic volatility. The numbers in square brackets are Newey-West adjusted t-statistics and *, ** and *** denote respectively significance at the 10%, 5% and 1% level. 24 Figure 1 This figure displays the VXTH and VIX indexes for the sample period of January 3, 2007 to February 29, 2016. 25