Accounting Class Packet: Journal Entries & Financial Statements

advertisement

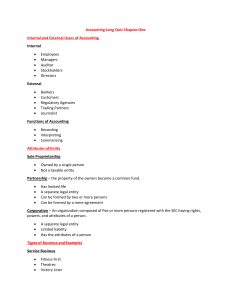

Unit 1 2 Chapter Chapter Chapter Packet 3 4 Chapter 5 © 2020 forLittleLion. All rights reser ved. Visit forLittleLion © forLittleLion Unit 1 Packet © forLittleLion ACCT 3110 – Marquardt – Adapted from Hanlon et al., Intermediate Accounting 3e Unit 1 Continuing Class Packet 1. Marco Polo Company has been in operation for a few years and has a fiscal year of August 1 to July 31. The following transactions occurred during the fiscal year beginning August 1, 2018. Prepare a journal entry for each transaction below and post it to the general a- ledger. (All amounts in $ thousands.) financing a. 8/1/18: Owners invest an additional $50,000 cash in the corporation in exchange for 5,000 shares of common stock. investing b. 10/1/18: The Company purchases equipment for $20,000 cash. c. 10/15/18: The Company purchases inventory for $13,000 on account. N/A financing d. 12/1/18: The Company borrows $30,000 from a local bank and signs a note payable. e. 12/10/18: The Company sells inventory for $40,000 on account. The cost of inventory N/ A sold is $22,000. operating f. 2/1/19: The Company collects $15,000 of accounts receivable from customers. operating g. 2/15/19: The Company pays $20,000 of accounts payable to its inventory supplier. financing h. 6/20/19: The Company pays its shareholders a cash dividend of $1,000. operating i. 7/31/19: The Company pays salaries of $8,000 for work performed during the year. 2. Prepare an unadjusted trial balance as of July 31, 2019. ( 3. Prepare any necessary adjusting journal entries at July 31, 2019 and post them to the *☆ → ads s * affect ledger. The following information is also available. a. Depreciation on the equipment is $500 for the year. b. Marco Polo estimates that bad debt expense for the year is $1,000. c. The note payable requires the principal plus interest at 10% to be paid on 12/1/22. 10% annually , $301000 , 8 months = $2,000 4. Prepare an adjusted trial balance as of July 31, 2019. 5. Prepare Marco Polo’s financial statements for the fiscal year. 6. Prepare the necessary closing journal entries and post them to the ledger. 7. Prepare a post-close trial balance as of July 31, 2019. 1 General Journal Date 08-01-18 Account Title Cash Debit $ 50,000 Common stock 10-01-18 $ Equipment $ Inventory $ Cash A /R $ $ COGS $ Cash A /P $ Dividend $ salaries Expense $ $ Depreciation Expense 07-31-19 $ Bad Debt Expense Allowance 40,000 $ 22,000 $ 151000 $ 20,000 $ 11000 $ for $ Interest payable $ 500 $ 1,000 $ 2.000 1,000 Bad Debt Interest Expense 8,000 500 Accumulated Depreciation 07-31-19 $ 8,000 cash 07-31-19 30,000 1,000 cash 07-31-19 $ 201000 cash 06-20-19 13,000 151000 AIR 02-15-19 $ 22,000 Inventory 02-01-19 20,000 40,000 sales Revenue 12-10-18 $ 30,000 NIP 12-10-18 50,000 13,000 A /P 12-01-18 $ 20,000 Cash 10-15-18 Credit 2,000 2 General Ledger Cash BB 5,000 50,000 A/R 13,000 BB 201000 10,000 Allowance for Bad Debts 1,000 15,000 40,000 1,000 351000 2,000 1,000 30100.0 81000 15,000 BB 58,000 Inventory BB 20,000 Accumulated Depreciation Equipment 22,000 BB 13,000 6,000 1,000 BB 500 20,000 1,500 20,000 16,000 BB 0 13,000 BB BB 2. °O° 30,000 R/E 0 21000 30,000 191000 3,000 Interest Payable N/P A/P C/S BB 20,000 BB 50,000 ¥ 3 General Ledger Sales Revenue 0 Salaries Expense COGS BB 40,000 BB 0 BB 221000 8,0002 ¥ Depreciation Expense BB 0 500 500 Dividends BB 0 0 8,000 Interest Expense Bad Debt Expense BB BB 0 / ' °O° 0 2,000 1,000 2,000 Income Summary 0 BB 1,000 1,000 4 Unadjusted Trial Balance 7/31/2019 Debit Credit Cash Accounts Receivable Allowance for Bad Debts Inventory Equipment Accumulated Depreciation Accounts Payable Notes Payable Interest Payable Retained Earnings Common Stock Sales Revenue Cost of Goods Sold Wages Expense Depreciation Expense Bad Debt Expense Interest Expense Dividends TOTAL Adjusted Trial Balance 7/31/2019 Debit Credit 511000 51,000 35,000 35,000 2,000 1,000 11,000 11,000 261000 261000 1,500 11000 9,000 9,000 30,000 30,000 2,000 0 3,000 3,000 70,000 70,000 401000 401000 22,000 22000 8,000 81000 0 500 0 1,000 0 2,000 11000 1541000 Post-close Trial Balance 7/31/2019 Debit Credit 1,000 1541000 5 Marco Polo Company Income Statement multiple step For the year ended July 31, 2019 $ sales Revenue $ (COGS) 40,000 ( 22,0003 Gross Profit 18,000 Operating Expenses (8/000) Wages Exp Depreciation Exp Bad Debt Total operating operating (500) 11,000) Exp (9,500) F- xp 8,500 Income Non-operating Income / Exp Interest (2,000) Exp 61500 Net Income Marco Polo Company Statement of Shareholders Equity For the year ended July 31, 2019 Common Stock Beginning 08/01/18 : issue common 20,000 stock paid dividends 07/31/19 Earnings 3,000 501000 net income Ending Retained : 701000 Total Stockholder's Entity 23,000 50,000 61500 6,500 ( 1,000) ( 1,000) 8,500 78,500 Marco Polo Company Balance Sheet classified As of July 31, 2019 Current July 31,2018 AIR net of , * use bb of T operating Assets Cash allowance of $2,000 Inventory Current Assets Total As of $511000 5000 $33 9000 , 000 $11,000 20000 $95,000 34000 ↑ Non Current Assets - Property Total Non , Plant , É Equip net of ace . Current Assets - . dep $1,500 . $24,500 5000 $24,500 5000 " $119,500 Assets Total 39000 Current liabilities A /P $9,000 - Noles Total Non Total liabilities Payable Interest - Payable Current 0 $2,000 0 liabilities 16000 Equity 45 $70 , ME $8,500 Total shareholder's Total $30,000 liabilities Shareholder's ↓ 7,000 16000 Total current liabilities Non Current 16000 liabilities + Equity Shareholder's ooo 20000 3000 23000 Equity 39000 ↑ as in Accts 24,000 ↓ 9,000 2,000 account Marco Polo Company Statement of Cash Flows For the year ended July 31, 2019 Direct Method Cash operating Flows from Collection from customers Payment for Payment for Inventory salaries Activities Indirect Method Cash Flows from Net Income $6,500 ($20,000) Depreciation Expense $500 ( $8,000) Accounts Receivable ($24,000) Inventory $9,000 Interest Cash Flows from cash Flows from Purchase ($131000) Operations Activities Investing Total Cash Flows from Investing ($20,000) Received Notes Payable Paid Dividend * all pos cash flows . Received $1,000) Paid Dividend ↳ might be newer $461000 from company as Investing Activities Investing common stock $30,000 coming ( $13,000) Equipment Notes ($20,000) ($20 000) financing they tripled AIR Payable $50,000 $30,000 $1,000) $79000 $79,000 Total Cash Flows $2.000 operations Total Cash Flows from Issued $50,000 Common Stock Payable Total cash Flows from Purchase ( $7,000) Cash Flows from Financing Activities Cash Flows from Financing Activities Issued Payable Cash Flows from ($20,000) Equipment Activities $15,000 Accounts Total Operating Total Cash Flows $ 46,000 Chapter © forLittleLion 2 Chapter 1. incurred but not paid Utility costs Deist [ utility expense xx utility payable santfntility payable xx ✗✗ cash xx 2. equipment purchased ( Dec 31 3. a deep . $365K deposit [ senile for service for next a. ( prepaid ins [ e. I. $14.6k / 14.6k a r 9.6k b. cash 9.6k defsewrev UP $401.5k ( salaries exp [ ins $36.5k . c. $3.6k g. $36.5k cash $21.9K K . $21.9K cash $60k cash [ $21.9K supplies / d- $21.9k a p nlp prepaid b2 4.8k # . 4.8k [ alp [ dividends [ c. $60K a2.fi#Eex-p $3.6k cash $36.5k [ now ( cash prepaid f. xx cash $438k equipment [ $21.9K cash $73k cash d2[ closing 5. . $40K $3.6K interest exp $32k interest credits to payable incsum $5.5K ver $100K Inc sum . BB $100 $220K s 7 . $325.5k $225.5k ( Inc sum $1641670 Linc exp $132K intexp $6.6K tax exp $26.07K op sum RIE 60830 yggz, [ Salary 3.000 200,000 3,000 1,400 - 200,0001-11 = 1,400 3000 + ✗ = 201,400 ✗ = 198,400 © forLittleLion d- $40K cash $100 interest vev sew new int r.ec - I. $7.3k equipment ins h $21.9K . interest [ At [ cash 29.2K service 29.2k rev month ✗✗ deferred i. ( b. $365K cash e. 4. xx . cash Wfeatendofyear xx Cls relieved useful xx dep exp Acc ; CR cash Cash [ . equipment cash in DR Jun30[ 2 Homework HE "K Div 11k c.2. [ ( service $36.5k $36.5k ur rent exp $36.5k cash / n r $36.5k $12k cash dep [ accdep exp $12k $2k $2k ACCT 3110 – Marquardt – Adapted from Hanlon et al., Intermediate Accounting 3e Chapter 2 Class Packet: Accounting Information System Learning Objective 2-1: Analyze the effects of economic transactions using the accounting equation. • The Accounting Equation: creditors assets = owners liabilities -1 stockholder's equity o All of a company’s economic resources are claimed by either its: creditors or owners assets o Every transaction recorded will affect at least two accounts so the equation stays in balance. • Practice: How does each event affect the accounting equation? Transaction Assets A local business person invested $45,000 to open A Cash A cash liability Equity Ads a hardware store. $25,000 was borrowed from a bank. $15,000 was paid for one A notes payable to cash year’s rent of a retail location. A prepaid hent Inventory costing $10,000 was purchased on account. Inventory costing $6,000 was sold on account for $12,000. lhinuentoy MAIR d inv A Alp a sales 4 COGS revenue >> a faulty ← due to expenses sub from revenue 1 ↑ Credit ↑ Credit ↑ Debit ↑ Debit Revenues Gains Expenses Losses ↑ Debit Net Income Dividends paid to shareholders from RIE Breaking down the Accounting Equation ↑ Credit ↑ Credit Common Stock Preferred Stock Paid-in Capital (“Amounts invested”) Retained Earnings (“Amounts earned”) ↑ Debit Assets ↑ Credit = Liabilities ↑ Credit + Shareholders’ Equity 2 Learning Objective 2-2: Identify, record, and post transactions. Learning Objective 2-3: Prepare an unadjusted trial balance. • Key attributes of an accounting information system: Listing of all accounts: their names, reference numbers, and Chart of Accounts corresponding FS element (asset, liability, etc.) Detailed record of all account, their beginning balances, General Ledger bunch of T - accounts a transactions over a period, and ending balances. Ex: T-account Chronological record of transactions over a period. Might also have General Journal special subsidiary journals for routine or repetitive transactions. Listing of all accounts and their ending balances (debits or credits) = Trial Balance • as of a certain point in time. All accounts can either be classified as Permanent or Temporary: Temporary Account Permanent Account Balances carried over from one period to the Balances closed out (start over at zero) at next. the beginning of each new period. Measured at a point in time. Measured for a period of time. Balance Sheet Accounts Dividends Income Statement Accounts you don't revenues • " have or " dividends just like don't you , " have " expenses Practice: Classify the following as permanent or temporary: Salaries expense T Sales revenue T T Accounts payable P Dividends Cost of goods sold T Gain on sale of investment Cash P Common stock on incstmt T P 3 • The Accounting Cycle: o The process of recording economic events, eventually leading to the preparation of the financial statements. • We record transactions for economic events that directly affect the financial position of the company. • Might be external or internal: o External: exchanges • ' exchange resources goods /services paying vendors do not third , o Internal: recorded at • Adjusted ' - Ex a third involve a or - party , recorded throughout the period employees party but , Smith is still earned or owed period end Journal Entries Depreciation : / obligations with a¥rer party with Ex : sales of of , Prep aids , interest , bad debt external economic I , & impairments events 1 ] Hanlon et al., Intermediate Accounting 3e Exhibit 2-6 4 intend economic events | • During the accounting period: o Identify, record, and post transactions. o Primarily external economic events. • accounting a g. End of accounting period: o Identify, record, and post adjusting journal entries. o Primarily internal economic events. o Prepare the financial statements. • Before opening the next accounting period: o Close out the temporary accounts. • Review: Review the journal entry to record the gain or loss on the sale of an asset: 1. Debit the consideration received (usually cash). 2. Credit the book value of the asset sold. 3. Plug the difference to a gain or loss. put in → after assets: cash [ d cash Loss ( ping) c 100 zo asset 120 what we received is less than what we have on our books Yash 14% ) gain (plug asset 20 120 • In your own words: Explain the purpose of adjusting journal entries. • Practice recording external economic events and preparing an unadjusted trial balance in the Unit 1 Continuing Class Packet. Learning Objective 2-4: Identify, record, and post adjusting journal entries. Learning Objective 2-5: Prepare an adjusted trial balance. • Adjusting Journal Entries: o Result from the use of accrual accounting. We don’t just record transactions when cash exchanges hands! 5 o Some revenues/expenses are earned/incurred over time. We may owe someone (or they may owe us) even if no new event has passed between us lately. • Deferrals: Cash exchanges hands first, then earning/incurring of revenue/expense. o Examples: FYE 7 , cash flow • AJE Accruals: Revenue/expense has been earned/incurred, even though cash won’t exchange hands until the future. o Examples: Interest , taxes , YE accruals for utilities and wages FYE A µ cashflow AJE • Review: How to record simple interest. o Interest rates given to you in this class will always be stated annually. o Accrue interest expense or interest revenue at period end for the portion of the year the loan has been outstanding. o For now, focus on simple interest. Compound interest is discussed in Ch 6. principle ✗ Annual Interest Rate ✗ Time = Interest Accrued 6 • Practice: Employee salaries for the month of June for Charles Company were $65,000. Employees are always paid on the first day of the next month for a given month’s work. Prepare Charles’ adjusting journal entry on June 30, the company’s fiscal year end. ¥→ record , gne.ws when 6/30 : salaries salaries (accrued , : gaian.es payayu Ñ they paid • Expense cash 65,000 65,000 Payable salaries) 65,000 65,000 Practice: Mathis Company borrowed $30,000 at 6% (annual) interest on May 1, 2022, with / principal and interest due on April 30, 2023. The company’s fiscal year ends December 31. Prepare the adjusting journal entry to record interest expense on December 31, 2022. SKIP If Mathis failed to record the adjusting journal entry, what would be the impact on the income statement for 2022? 7 • Practice: Every year on August 1, Cork Company pays for a one-year flood insurance policy. On August •31, 2022, Cork renewed the policy for the upcoming year for $24,000. Using the information below, prepare journal entry to record the payment on August 1, plus the adjusting journal entry needed on December 31, the company’s fiscal year end. Prepaid insurance BB 10,800 Angl 24,000 101000 Dec 31 :(repaid Cash :( 24,000 Expense 20,800 Prepaid 1ns old balance (Jahl + new balance DR 24,000 insurance insurance 24,800 CR ( Angl 20,800 - - Jul-31) Dec 31) 20,800 • Practice recording adjusting journal entries and preparing an adjusted trial balance in the Unit 1 Continuing Class Packet. Learning Objective 2-6: Prepare financial statements from an adjusted trial balance. • Five financial statements: o Income Statement – primary FS for communicating performance (profit/loss) o Balance Sheet – accounting equation at FYE o Statement of Cash Flows – explains the change in cash year-over-year o Statement of Shareholders’ Equity – explains the change in SE year-over-year o Statement of Comprehensive Income – net income plus other comprehensive income o Example: Nordstrom • Financial statements are the company’s primary method for communicating financial information to external users. • We will learn the details on each of these in Chapters 3-5. 8 Learning Objective 2-7: Prepare and post closing entries and prepare a post-closing trial balance. • Close out temporary accounts o First to an intermediary account o Second to : Summary Income Retained Earnings • Allows temporary accounts to “start over” at zero at the beginning of the next period • Ensures ending retained earnings account reflects net income • Practice: On December 31, 2021, the partial adjusted trial balance of the Hoffmeister Company included the following. Prepare Hoffmeister’s closing journal entries. Debit close) P Accounts receivable T Dividends T Cost of goods sold 450,000 T Commission expense 120,000 T Sales revenue 700,000 p Retained earnings 245,000 (Bait : nothing to 10,000 ! ④ ① Closeout Income Summary 0 5,000 Credit BB 700,000 "" 10,000 ③ yd 120,000 corona ' [ Revenue Inc "" " ( Inc CR summary 570,000 COGS . 450,000 Exp 120,000 Closeout Dividends ( summary DR CR 1201000 120,000 RYE 700,000 """ Com RIE summary 7001000 summary Inc [ Inc DR Revenue move to 10,000 Dividends / "" °o° revenue COGS exp Dividends COM R/E 450,000 1201000 101000 120,000 we 000 / What is the beginning balance of Retained Earnings on January 1, 2022? $365,000 9 • We will practice closing entries and preparing a post-close trial balance again at the conclusion of the Unit 1 Continuing Class Packet. Learning Objective 2-8: Describe the use of special purpose frameworks and the conversion from cash basis income to accrual basis income (Appendix 2A). • US GAAP is required for the financial reporting of US public companies. • The only generally accepted accrual-basis standard for private entities too. • But sometimes a company might not Khotan file US GAAP if its users do not demand it: - - • very small lenders entities might not care Common alternate financial reporting bases: o Cash basis or modified cash basis instead € o Tax basis used for filing tax returns of GAAP o Reminder: PCC issues US GAAP simplifications for private companies. But these are still approved by FASB and still considered US GAAP! • If a company uses a financial reporting framework other than US GAAP: o It must make this clear in its financial statements. o Disclose the basis used and how it differs from US GAAP. o Do not use financial statement titles similar to US GAAP. Hanlon et al., Intermediate Accounting 3e • Converting between cash basis and accrual basis: o Useful when a company operates on a cash basis, but reports on an accrual basis. o Helps demonstrate the relationship between accounts and transactions. 10 • Practice: Banks Company paid $12,000 cash for insurance premiums during the fiscal year. There was $3,000 in prepaid insurance at the beginning of the year and $6,000 at the end of the year. What was insurance expense for the year? Prepaid insurance 3000 [Prpqiadsh " # É 12000 9000 [ DR insexp Ck 9000 prepaid ins 9000 6000 • Practice (E-2-44): The balance sheets for Experts Inc. reported salaries payable of $3,000 and year end $1,400 on its December 31, 2019 and 2020 balance sheets, respectively. If salaries paid during 2020 were $200,000, what was salaries expense for the current year? DR Salaries payable 3000 2001000 [ Salaries expense salaries payable ok 198,400 198,400 198,400 1400 • Practice: The balance sheets for the Denton Times reported deferred subscription revenue of $16,000 and $18,400 on its December 31, 2020 and 2021 balance sheets, respectively. Its 2021 income statement reported subscription revenue of $70,200. How much cash was received from customers for subscriptions during 2021? Deferred subscr. revenue 11 I. Company Company A: A received $32,000 B a credit starting next to 3. The purposes of A: from month . Company B on company A 's as prepayment books , a closing [ AIR [ COGS Inv on entries are to Company will d- will provide include service to : : RIE & Update the Account to cast ← xx Rev . JE for this transaction dividends declared inventory service Deferred Revenue transfer balances of temporary accounts to 4. Sold for xx ← inc asset inc equity ← dec xx xx ← equity die asset © forLittleLion balance of RIE for the effect of net income loss and Chapter © forLittleLion 3 ACCT 3110 – Marquardt – Adapted from Hanlon et al., Intermediate Accounting 3e Chapter 3 Class Packet: Income Statement and Comprehensive Income Learning Objective 3-1: Prepare an income statement using single-step and multiple-step formats, focusing on income from continuing operations. Learning Objective 3-2: Report the impact of unusual or infrequent items. • The Income Statement: o Reports a company’s profits for a period of time. o Primary financial statement communicating performance o Revenues, expenses, gains, and losses o Elements of the income statement can be relatively more: permanent (continue transient OR ( in future ) ▪ Why would investors/creditors want to know if something is permanent or transitory? predictive value • not to in : to better predict future performance Income from Continuing Operations: o Profit or loss from segments of the business that are expected to continue in the future. ▪ As opposed to segments that have been discontinued (discussed later) o Companies have discretion in how they organize this section. In real life, it’s a spectrum, but we’ll talk about two extremes: Single step and multiple step. Single Step Multiple Step subcategories I. list Revenues & Gains for : I. Gross profit 2. list Expenses & Losses 2. operating 3. Non • Unusual or Infrequent items: not a lot of discretion allowed o If the company has a material - Income operating Income from FASB unusual or infrequent item in Income from Continuing Operations, it must be reported as its own line item or disclosed in footnotes. o Ex: Natural disasters, impairment losses, litigation/settlements, restructuring o Why? transient items not a , continual / income loss 1 continue future ) Multiple Step Single Step f- Cost of Goods Sold Gross Profit Operating Expenses Examples (Exhibit 3-1): Selling, general, and administrative (advertising, wages, bad debts, rent, utilities, depreciation/amortization) - Research and development - + _ Gain or loss on sale of operating assets - Expenses and Losses Nonoperating Income Income from Continuing Operations Sales Revenue : Restructuring costs (ex: employee termination, relocation) cutting costs Impairment losses Operating Income Examples (Exhibit 3-1): Investment or peripheral revenues ✓ Interest expense + - Gain or loss on sale of investments - Losses on litigation or disaster Income from Continuing Operations before Tax Income Tax on Continuing Operations Income from Continuing Operations Discontinued Ops. Net Income Operating Income Gross Profit Revenues and Gains Income from Discontinued Operations, net of Tax Net Income 2 • Practice: What are permanent earnings? a. Earnings from transactions that are likely to generate similar profits in the future b. Earnings from transactions that are either not likely to occur again or likely to have a different impact on income in the future c. Balance sheet accounts that are not closed out at the end of each fiscal period • Practice: Belle Co. had the following results for the year ended December 31, 2020. All data are before tax, and Belle Co. has a tax rate of 25%. o For each item, state which subcategory of the income statement it belongs in (gross profit, operating expense, nonoperating income/expense, or discontinued operations). Income Category Sales revenue $8,200 Cost of goods sold 4,800 Selling, general, and administrative expenses 2,000 gross profit gross profit operating expense Gain on sale of investments 300 Non Loss on discontinued operations 500 Discontinued Restructuring costs 280 Research and development expense 250 Interest revenue 25 Loss on sale of PP&E 100 - Operating Income Operating Operating Expense Operating Expense Non Operating - Income Operating Expense o What is Belle’s gross profit for 2020? $ 8,200 - $4,800 $-3,400 o What is Belle’s operating income for 2020? 2,000 280 250 31400 -493¥ -10€ 2 , 630 3 o What is Belle’s income from continuing operations for 2020? Operation income $770 = 81325-4 1- Inc from cont beforetax:$ . non - op Inc 1095 tax in from cont after tax :$%2° o What is Belle’s net income for 2020? in from cont loss on . disc op . after tax . before tax tax benefit (tux from loss on :($ 821 500 ) $ 125 ← :($375 ) loss) disc op aftertax : net income : • $ : used to offset not receiving money from IRS , $446 In your own words: If you were an investor, would you prefer to see a single step or multiple step income statement? Learning Objective 3-3: Prepare an income statement to include discontinued operations. • What is a discontinued operation? o A major strategic shift away from a certain line of business, component, or segment. ▪ More significant than a restructuring. Involves shutting down an entire segment. o Reported separate from continuing operations on the income statement. Why? disc op • are transient so , would be beneficial for investors to see disc op separate Two parts to Income from Discontinued Operations: o Always: Income or loss from the segment’s operations during the period until shut down o Maybe: Gain or loss related to disposition of assets in the segment ▪ Depends on whether the segment has been sold or is still held for sale o If both apply, they can be listed separately or combined (and disclosed separately). o Intraperiod tax allocation: Reported net of tax dividing taxes btwn disc ops & op . . . inc . 4 Decision Tree for Discontinued Operations: What is included in Income (Loss) from Discontinued Operations? 1. ALWAYS Income or Loss from Operations of the discontinued component over the period 2. Gain or Loss on the actual disposal of the component’s assets Book Value vs. Consideration Received " cash " Maybe Has the component been sold by the period end? Fair Value = Market value 2a. BV < FV* Compare: Book Value vs. Fair Value* Do Nothing! No additional gain (until we actually sell it). Good News *Less Expected Cost to Sell 2b. BV > FV* diff btwn BV & FV Record an Impairment Loss for the excess. Bad News 5 • Practice: In October 2021, Michael Company decided to sell one of its divisions. The fiscal year end is December 31, 2021, and the tax rate is 25%. For each of the following cases, what is Michael’s income (loss) from discontinued operations for 2021? o The division was sold on December 18, 2021. From January 1, 2021 through disposal, the division had a pre-tax loss from operations of $7,000,000. The assets of the division had a net selling price of $11,000,000 and a book value of $10,000,000. operations gain before on loss ( 7. sale ooo , ooo Book value ) 10M < Price um 1,000,000 [ ( 6,000,000 ) tax 0.75 after tax cash gdii n 11m iii. ( 41500,000 ) o On December 31, 2021, the division had not yet been sold. For the year, the division reported a pre-tax loss from operations of $7,000,000. On December 31, 2021, assets of the division had a book value of $10,000,000 and a fair value, minus anticipated cost to sell, of $9,000,000. operations impairment before taxes loss loss ( 7,000,000 ) ( 1,000,000 ) ( 8,000,000) 0.75 after taxes BV FV 10M > 9m impairment [ loss loss 1M department 1M ( 6,000,000 ) 6 o On December 31, 2021, the division had not yet been sold. For the year, the division reported a pre-tax loss from operations of $7,000,000. On December 31, 2021, assets of the division had a book value of $10,000,000 and a fair value, minus anticipated cost to sell, of $12,000,000. BV Operating before (7,000 loss 10M , TV < 12M ) ooo ( 7,000,000) tax 0.75 after tax ( 5,250,000 ) Learning Objective 3-4: Disclose earnings per share on the income statement. • EPS: A company’s profits expressed on a per share basis ( earnings per • Reported for: share) o Continuing operations, discontinued operations, and net income " hypothetical " o Basic and diluted shares outstanding ▪ Diluted includes securities/compensation convertible into common shares. referring to commonshares pretend shares dividends get paid first 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑆𝑡𝑜𝑐𝑘 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 = 𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 ᵗ#É • In your own words: Why might it be helpful to have information about profit expressed per share outstanding? - helps ↳ - - important for comparability investors ex account for firm size : price know their to earnings ROI ratio 7 Demonstration of a Weighted Average: Earnings Per Share This example demonstrates how to calculate a weighted average. The calculation of EPS requires a weighted average for the denominator. For demonstration, we first calculate a simple average, which will allow us to easily transition to a weighted average. Sandy Corp. reports net income of $5,000,000 for the year ended 12/31/20. The company declared preferred stock dividends of $400,000. As of 1/1/20, there were 2 million shares outstanding. The company issued another 1 million shares on 4/1/20. • Identify each unique level of shares outstanding that existed during the year. Each unique value is an element in the average. • • 1/1/20 – 3/30/20 (3 months): 2 million • 4/1/20 – 12/31/20 (9 months): 3 million Simple average: Weight each element equally. 2,000,000 + 3,000,000 = 2,500,000 2 Equal weights Or stated differently… 2,000,000 3,000,000 + = (2,000,000 × 6⁄12 ) + (3,000,000 × 6⁄12) = 2,500,000 2 2 • Weighted average: Assign different weights for each element. Weights are based on relative degree of importance/influence. Here, that is the proportion of time that element existed. • 1/1/20 – 3/30/20: 2 million outstanding for 3/12 months of the year • 4/1/20 – 12/31/20: 3 million outstanding for 9/12 months of the year (2,000,000 × 3⁄12 ) + (3,000,000 × 9⁄12) = (500,000) + (2,250,000) = 𝟐, 𝟕𝟓𝟎, 𝟎𝟎𝟎 Weighted average shares outstanding • Practice: Calculate earnings per share. 𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑊𝑡. 𝐴𝑣𝑔. 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 5,000,000 - 400,000 = 21750 , ooo $1.67 / share 8 Learning Objective 3-5: Report other comprehensive income. • Comprehensive Income: Includes net income plus other changes in shareholders’ equity that are not transactions with owners • Other Comprehensive Income (OCI) examples: o Unrealized holding gains and losses on some investments o Gains and losses from postretirement benefit plans o Deferred gains and losses from derivatives o Foreign currency translation o These are advanced accounting topics. We will not study how these amounts are calculated. You should just be aware that they are typical OCI items. • Just like net income accumulates on the balance sheet in retained earnings, OCI accumulates in Accumulated Other Comprehensive Income (AOCI). • If a company has OCI, it must report Comprehensive Income either: o As one continuous statement, including both net income and OCI or o An income statement immediately followed by a statement of comprehensive income (which lists the OCI items) ▪ • Example: Alphabet Practice: Which of the following is not an example of other comprehensive income? a. Unrealized gains and loss on postretirement benefit plans b. Foreign currency translation adjustments c. Deferred gains from derivatives d. Salaries expense 9 Learning Objective 3-6: Describe the statement of stockholders’ equity. • Statement of stockholders’ equity: o Shows the changes in the components of stockholders’ equity over the period. ▪ Ex: Retained earnings, common stock, preferred stock, AOCI ▪ Beginning balances tie to last year’s balance sheet ▪ Ending balances tie to current year’s balance sheet o Example: Alphabet • Practice: Prepare an income statement and statement of stockholders’ equity in the Unit 1 Continuing Class Packet. Learning Objective 3-7: Report changes in accounting estimate, changes in accounting principle, and error corrections. • We will focus on concepts only for this learning objective for now. We’ll see numerical examples throughout the remainder of the semester. • Error Corrections: o Errors are common. Most are caught and corrected before the financial statements are issued. But what do we do when we discover a material misstatement that wasn’t corrected before financial statement issuance? o Three steps: 1. Record Prior Period Adjustment (JE) a. Adjust balance sheet accounts, possibly including the beginning balance of retained earnings if the error affected prior period net income. 2. Restate prior financial 3. Disclose the statements that were affected by if error is JES , then from prior to closing Fmust include R / error correction • Example: WeWork restatement first disclosed in an 8-K December 2021 • Changes to financial accounting (other than errors) could be addressed one of three ways, depending on the circumstances: 10 – Determine cumulative impact of change and record prior Retrospective period adjustment to beginning retained earnings. Implementation – Restate all prior periods presented comparatively. old years need to be using – Essentially as if we’ve used the new method all along. updated new – Determine cumulative impact of change and record prior Modified Retrospective Implementation – Like retrospective, but not required to restate comparative periods. – Use the new method going forward only Prospective – No adjustment to prior periods Implementation • period adjustment to beginning retained earnings Change in Accounting Principle: Voluntary change FASB update to ASC Ex: Switching inventory costing methods LIFO , FIFO - - Retrospective , weighted away implementation g. asingleupdate (ASU) Ex: Standard updates to revenue recognition Varies , dictated by FASB Disclose reason o In your own words: Why might FASB require retrospective implementation for voluntary changes to accounting principles? - - • disinutivire keep changing comparability Change in Accounting Estimate: o Update of estimate or its assumptions due to new information o Ex: Allowance for bad debts, fair values, future warranty expenses, depreciation inputs (useful life, residual value) or method (straight line, etc.) o Accounted for prospectively o Disclose in a footnote if material 11 method Chapter © forLittleLion 4 ACCT 3110 – Marquardt – Adapted from Hanlon et al., Intermediate Accounting 3e Chapter 4 Class Packet: Balance Sheet and Financial Reporting Learning Objective 4-1: Describe classification of asset, liability, and equity accounts on the balance sheet. Learning Objective 4-2: Prepare a classified balance sheet. • The Balance Sheet: o Reports a company’s financial position at a point in time. o Accounting equation. o A “snapshot” of: ▪ What the company owns (A) ▪ What it owes (L) ▪ What’s left over for shareholders (SE) o Primary financial statement for communicating: financial health ↳ • liquidity , solvency , flexibility , constrain Classifying Assets and Liabilities into Current and Noncurrent: o For most companies: ▪ Current assets = Cash and assets expected to be consumed or converted to cash within one year. ▪ Current liabilities = Liabilities expected to be satisfied within one year. o Unless the company’s operating cycle is greater than one year. Then we designate current/noncurrent based on the length of the operating cycle. o What is the operating cycle? 1. Use cash to acquire inventory • The period of time in which cash turns over for the sale of goods or services (from outlay 4. Collect cash from customer 2. Prepare inventory for sale to customer to receipt). • Not many industries have operating cycles greater than one year. Examples? 3. Deliver inventory to customer alcohol , tobacco , construction 1 • Typical examples of Current Assets (Exhibit 4-4): o Listed in order of decreasing liquid Most Short-term investments 1 least • Cash and cash equivalents Accounts receivable (i.e., trade receivables) Contra-asset: Allowance for doubtful accounts Notes and nontrade receivables Inventories (raw materials, WIP, finished goods) liquid Prepaid expenses Typical examples of Noncurrent Assets (Exhibit 4-5): Long-term investments i assets held for Property, plant, and equipment used speculation in ( sinking funds ) operations Contra-account: Accumulated depreciation Intangible assets Leased assets Other noncurrent assets • deferred taxes , restricted cash Classifying Investments: o A security or asset where we expect to earn a return (appreciation, interest, or dividends). o Ex: Stocks or bonds of other companies, other securities, real estate, assets held for speculation, nonconsolidated subsidiaries. cash equivalent Short Term Investment Why Tom Investment Highly liquid, low-risk security Original maturity of 3 months or less Ex: Commercial paper, money markets, Treasury bills (if ≤ 3 mo.) Any investment that management has the intent and ability to sell the “current” window (one year) Any investment that management does not intend to sell within the “current” window (one year) 2 • Typical examples of Current Liabilities (Exhibit 4-6): o No required ordering; usually by materiality or relevance to the company. Accounts payable (i.e., trade payables) Accrued liabilities Some formal debt contracts: Short-term notes payable Current portion of long-term debt and leases (e.g., installments or interest) Callable debt tender call can repayment of anytime Deferred revenues • Typical examples of Noncurrent Liabilities (Exhibit 4-7): Bonds or notes payable Pension or other post-retirement benefit liabilities Leases Other noncurrent liabilities • Practice: Marble Company took out a $1,000,000 note payable with its local bank on March 1, 2021. For each of the following scenarios, how should Marble present the note payable on its balance sheet as of December 31, 2021? Ignore interest. due within year of one this Current Noncurrent Liability Liability The full amount of the loan is due on December 31, 2027. 0 1M The full amount of the loan is due on September 30, 2022. IM The loan must be repaid in installments. Marble must pay $100,000 on February 28 of each year 100K 900K for 10 years. 3 • Typical examples of Stockholders’ Equity (Exhibit 4-8): o Listed in order of permanence o Sometimes called Net Assets or the company’s Book Value. Paid in capital move phnmnant 4s , Pls , Par value, excess of par Number of shares outstanding at FYE § Retained earnings Accumulated other comprehensive income Treasury stock contra account Noncontrolling interest less If the company owns enough of a subsidiary to consolidate FS (>50%), but not 100%. permanent • Practice: Prepare a classified balance sheet in the Unit 1 Continuing Class Packet. • In your own words: What is the purpose of the balance sheet? For example, what can we learn from analyzing the balance sheet? Learning Objective 4-3: Explain notes to financial statements. • Full disclosure principle: Disclosure notes (i.e., footnotes) to the financial statements provide important detail and context to the summary information on the financial statements. • The major footnotes: disiloswher o Summary of significant accounting policies: ▪ Financial accounting involves judgment and can be complex. This footnote aims to explain to readers the accounting treatment of material activities or accounts. ▪ Especially important when: 4 ▪ Ex: Revenue recognition, inventory costing (LIFO, FIFO), depreciation, fair value ▪ Fair value: An estimate of the hypothetical price we would expect today to receive to sell an asset or pay to transfer a liability. • Might be based on observable market prices, similar transactions, estimated replacement cost, or discounted cash flow models. • Categorized into “levels” based on degree of management subjectivity involved: Level 3: Significant unobservable inputs (ex: discounted cash flows) Level 2: Significant observable inputs (ex: similar assets) Level 1: Quoted prices for identical assets in active markets • US GAAP requires fair value measurement for some financial assets and liabilities. It gives companies the option to measure some other assets and liabilities at fair value. o Subsequent events: ▪ A major event that occurs after a company’s fiscal year-end but before the financial statements are issued ▪ Ex: Issuance of debt or equity, merger or acquisition, update on contingencies Fiscal Mr End 10 Team we want o Related party transactions: ▪ Transactions between the company and its owners, management, their families, affiliate companies (parent, subsidiary, sister), etc. ▪ Concern whether it was an “arm’s-length transaction.” Did the other party get special terms? ▪ It is not prohibited to engage in these activities. But we need to disclose them so there is transparency about their terms. 5 o Additional details on material accounts (varies by company) o Errors, fraud, and illegal acts o Segments and major customers (LO 4-5) • Practice (E5-54 adapted): The following selected normal balances are from a partial trial balance as of December 31. The following additional information is also available. Cash 150,000 Investments 196,000 Accounts receivable 150,000 Allowance for bad debts ? Inventory Note receivable * we gave money to someone else $ 56,000 $150,000 c 200,000 NC ? ; $50,000 current ; $ non - current 140.000 Nc C 160,000 Interest receivable Equipment $ 100,000 Current $200,000 160,000 NC Accumulated depreciation 30,000 NC Franchise 30,000 ( ✗ 0.05 ✗ 0.06 contra = × $7,500 3/12 C ( Contra AR) $3,000 C = equipment) NC o Included in Cash is $50,000 of cash restricted for 18 months due to a debt agreement. o Included in Investments is $56,000 of short-term investments, and the remaining is longterm. Both are recognized at fair value. o 5% of Accounts Receivable is estimated to be uncollectible. allowance for bad debt o The Note Receivable is due in 21 months. The interest rate is 6%, and the note originated on September 30 of the current year. Interest is paid annually with the first payment due September 30 of next year. o What are total current assets? $ 100,000 + $56 , 000 - $7,500 + 160,000 t $3,000 + $1501000 = $461 , soo o What are total noncurrent assets? $50,000T $140,000 +$200 , 000 + $160 , ooo - $30,000T $30 ooo , = $550,000 o What are some significant accounting policies the company would likely include in its summary of significant accounting policies footnote? - depreciation / amortization method - - - - - possibly how note receivable debt they estimate bad restricted cash - investment @ fair value inventory accounting revenue method * recognition always want to explain 6 I • In your own words: Why are the disclosure notes an important element of the annual report? Learning Objective 4-4: Describe SEC filings of publicly traded companies in the US. • Most common required SEC financial filings: Full financial statements and disclosures. Audited. Due 60-90 days after FYE. Financial statements and some condensed disclosures. Not audited. Due 40-45 days after FQE. As applicable, reports specific material events like M&A or changes in auditors or directors. • Audit Report: o Management is ultimately responsible for following US GAAP. Why is an audit valuable? increase credibility of statements o SEC requires a financial statement audit for all US public companies (and an audit of internal controls for most of them). o Four types of opinions the auditor can issue: unqualified qualified adverse disclaimer FS are presented in conformity with GAAP Misstatement in FS contained to specific area or scope limitation Pervasive misstatements. FS should not be relied upon. Auditor was unable to gather sufficient evidence to issue an opinion. o Which opinion do you think is most common? o Example: Lululemon Athletica ▪ What type of opinion was issued here? o Report also defines the critical audit matters. o Report might also contain an explanatory paragraph providing more context. o Memory hint: Think of a qualifier like an exception. So “unqualified” means “without exception” (good), and “qualified” means “with exception” (bad). 7 • So far, we’ve discussed the financial statements and footnotes, both of which are audited. The rest of the 10-K is unaudited. Some major components include: o Management discussion and analysis (MD&A) ▪ Management explains their views and opinions on the financial results, operations, trends, risks, and future plans. o Business risks o Supplementary data, e.g., quarterly highlights o Management certifications of controls and financial statements o Other corporate governance details ▪ Often referenced to the proxy statement (DEF 14-A) o Although these sections are unaudited, the auditor is still likely to review them for overall reasonableness. • Practice (R4-04): Match each of the following 10-K excerpts of real companies with one of the following four sections where we are most likely to find it: MD&A, audit report, or management certification. Answers may be used more than once. Based on the assessment, management concluded that, as of December 31, 2020, the Company’s internal control over financial reporting is effective. (Source: 3M Company 10-K) In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2020, in conformity with audit MPF.wgwalopinion ifo.ec accounting principles generally accepted in the United States of America. (Source: The Boeing Company 10-K) Our net sales for fiscal 2020 decreased $2.6 billion, or 16 percent, compared with fiscal 2019, reflecting a 39 percent decline in store sales, partially offset by a 54 percent increase in online sales. (Source: Gap Inc. 10-K) 8 Learning Objective 4-5: Identify segment reporting requirements. • US GAAP requires companies to disclose some financial highlights for its segments. o Segment income and total assets. o Other data points if available. • Operating segments: o Management approach: Follow how management defines operating segments internally. o Report if the segment comprises at least 10% of total assets, total revenues, or absolute profit or loss. o Keep adding segments until at least 75% of revenue is captured. • Also required to disclose geographic segments (US and material non-US) and major customers (individually provide 10% of revenues) • In your own words: Why might an investor want to know how assets or income are divided across segments or major customers? 9 5 Chapter © forLittleLion ACCT 3110 – Marquardt – Adapted from Hanlon et al., Intermediate Accounting 3e Chapter 5 Class Packet: Statement of Cash Flows and Financial Analysis Learning Objective 5-1: Identify operating, investing, and financing activities. • The Statement of Cash Flows: o Explains the year-over-year change in cash → sources of cash inflows and outflows. o Includes cash, cash equivalents, and restricted cash. o Organized into three categories: operating, investing, and financing. o Why is this helpful? solvency - liquidity acknowledge that - - - • & must make if no - we more cash flows : ability have lots pay debts get paid to cash than and to you of to survive spend accusals , could be Grand Operating Cash Flows: o Inflows and outflows that result from core operations. o Approximates net income on a cash basis. ▪ Study tip: If there is a related accrual-basis revenue, expense, gain, or loss on the income statement, that cash flow belongs in operating activities! o Companies can choose to report using either the direct or indirect method. o Common examples (Exhibit 5-1): Inflows Dividend → Renner interest → Revenue Outflows From customers for the sale of goods/services To suppliers for inventory, supplies. Refunds received from suppliers Payment of salaries, rent, utilities, etc. Dividend received on investments * Payment of income taxes Interest received on receivables * Interest paid on debt * * might be tricky ← interest expense Classifying Interest and Dividends on the Statement of Cash Flow: Received Paid operating operating Interest • " Dividends theres • operating financing no dividends expense paid directly out of THE Investing Cash Flows: o Inflows and outflows related to the acquisition and disposition of long-term fixed assets and investments. o Common examples (Exhibit 5-2): Inflows Outflows Sale of fixed assets (ex: PP&E) and intangibles Purchase of fixed assets or intangibles Sale of investments (ex: stocks/bonds of other Purchase of investments entities) Collection of the principal on a loan to another Loans made to another entity entity • Financing Cash Flows: o Inflows and outflows related to external financing transactions with the company’s owners and creditors. o Common examples (Exhibit 5-3): Inflows Outflows Issuing stock (or resale of treasury stock) Share repurchases (treasury stock) Issuing bonds or taking out a loan Payment of the principal on a loan paying b% bonds given to us Retirement of bonds or other debt Payment of dividends " , • What if we have an investing or financing activity that doesn’t involve cash (or only partially)? o Disclose at the bottom of SCF or in the footnotes. Ex : 100,000 Building 10,000 Cash NIP • 90,000 Practice: Which of the following items would not be included as a cash flow from operating activities in a statement of cash flows? a. r Collection of cash from customers b. Purchase of machinery Inv . c. Purchase of inventory d. Collection of interest on a note receivable / • Practice (BE 5-24 & 25): Gomez Corp. reported the following cash flows for the year. Calculate net cash provided (used) by investing activities and financing activities. Purchased an investment in debt securities for cash Sold equipment previously used in operations for cash Paid cash for dividends Issued common stock for cash ($ 30,000) investing / outflow 25,000 investing / inflow (10,000) financing / outflow 100,000 financing /inflow ( 80,000/ / outflow Retired a 10-year bond payable financing Sold investment in equity securities Borrowed cash by signing a nine-month note payable 11,000 investing/ inflow 15,000 / inflow Extended a loan to a customer for a building expansion (8,000) investing = financing investing / outflow (30/000)+25,000+11,000 + (8,0003--12,000) financing = (10/000)+100,000 + (80/000)+151000 = 25,000 Learning Objective 5-2: Prepare a statement of cash flows using the indirect method to present cash flows from operating activities. Learning Objective 5-8: Prepare a statement of cash flows using the direct method to present cash flows from operating activities. • The distinction of direct vs. indirect method only matters for operating activities. o Investing and financing activities only use direct method. • Net cash flows from operating activities are the same regardless of method. The two methods just organize the information differently. • Summarizing the direct method: * pretty rare o Directly lists each type of cash inflow or outflow. ▪ Cash received from customers, Cash paid to suppliers, etc. ▪ Example: CVS o If you use the direct method, you must also reconcile net income to OCF in a : supplementary schedule (effectively reporting both methods!). • Practice: All of Castro Company’s sales are made on account. It had sales revenue of $5,000,000 for the year ended June 30, 2031. The balances of accounts receivable on June 30, 2020 and 2021 were $450,000 and $375,000, respectively. What would Castro report as cash collected from customers in its statement of cash flows, using the direct method? AR 450,000 450,000 * [AIR 5M → 5,000,000 sales Rev 5M ✗ 5,000,000 5,450,000 51075,000 375,000 - = = ✗ 375 ✗ 3751000 = , on + × Summarizing the indirect method: recon net income with OCF (operating cash to- s ) o Used by the majority of public companies. Example: Walgreens o If you use the indirect method, you must also disclose the cash paid for interest and taxes. o Three step process: 1. Start with net income 2. Adjust for noncash items a. Add back noncash expenses and losses ex : depreciation / amortizationFadd b. Subtract noncash revenues and gains already in investing #:geim on back to doesn't loss on sale essentially it reverse since actually happen ) sale c. Why? These items affected net income, but they don’t affect cash. So, when calculating operating cash flows, we basically reverse them. 3. Adjust for changes in operating accounts Assets o Classifying changes in operating accounts under the indirect method: Liabilities • Increase Decrease subtract add add subtract o Explaining why: ▪ If assets increase, we had less cash available to us (e.g., still waiting on A/R, paid more into a prepaid asset). That feels like an outflow, so we subtract. * we gained inventory AYR , to pay for ▪ If assets decrease, we had more cash available. That feels like an inflow, so we add. * sold ▪ If liabilities increase, we had more cash available to us (e.g., got to delay paying a bill and hold onto the cash). That feels like an inflow, so we add. * ▪ we haven't paid the etc we had . assets liabilities yet If liabilities decrease, we must have paid them off. That feels like an outflow, so we * subtract. , it we paid the liabilities • indirect method - Practice: Marvin Co. reported net income of $530,000 for the year ended December 31, 2019. begs end Accounts payable balances at the beginning and end of the year were $72,000 and $64,000, beg end respectively. Beginning and ending inventory balances were $80,000 and $95,000, respectively. Purchases of inventory were $180,000. What would Marvin Co. would report as ↑ operating cash flows? . Inc . AP ( $8,000) Inventory ( $15,000) operating • CF method indirect $530,000 Net Income Dec not included in = ← we ← we paid paid A / P with cash (neg cash fww) for inventory with cash ( neg cash flow) $507,000 Practice (adapted from E5-42): Calex had the following selected balance sheet information Sales as of December 31. Assume there were no dispositions of equipment in the current year. Based on these account balances, what can we infer related to operating and/or investing activities? Prior Year 10,000 15,000 Accumulated Depreciation (1,000) (2,000) - Equipment increased by Accumulated $5k ( Investment activity Depreciation increased by ↳ we recorded • Current Year Equipment - depreciation expense $1k = used to add back to operating activity Practice: Prepare a statement of cash flows under the direct and indirect methods in the Unit 1 Continuing Class Packet. Learning Objective 5-3: Describe the interrelations of the financial statements. • ↓ 8K We address this LO by examining the relationships in the Unit 1 Continuing Class Packet. ↑ 15K Learning Objective 5-4: Perform an investment analysis using the DuPont framework. • Financial Statement Analysis: Investors and other intermediaries use the financial statements to make investment decisions/recommendations. The financial statements can provide insights on the amount, timing, and risk of expected future cash flows. o Although individual data points can be informative, we can often gain richer insights by examining their relationships. o Exhibit 5-7 has a full list of ratios described by this textbook. We’ll discuss the most important ones in class. o Practical tips: ▪ Ratios and metrics can be modified as needed to fit a given situation. The ratios we study in this class are in their simplest, most common form. ▪ Each ratio or data point is just one piece of the puzzle. Never make an investment decision based on a single one! Context is important. ▪ In order to analyze a ratio or data point, you usually need a benchmark of comparison. Ex: Trends over time, industry averages, debt covenant requirements, numerical thresholds. • Profitability Ratios: Generally better if… Return on Equity 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐴𝑣𝑔. 𝑆𝐸 Profit Margin 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 Gross Profit Percentage Higher Higher Higher • Activity Ratios: Generally better if… Accounts Receivable Turnover 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑔. 𝐴𝑅 Average Days to Collect Receivables 365 𝐴𝑅 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝐶𝑂𝐺𝑆 𝐴𝑣𝑔. 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 Inventory Turnover Average Days in Inventory • Higher Lower Higher 365 𝐼𝑛𝑣. 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 lower Practice: Mabel Inc. began the year with inventory of $320,000. At year-end, inventory was $250,000. Cost of goods sold was $1,400,000, and sales revenue was $2,500,000 for the year. Calculate the average days in inventory (rounded). 1-41 COI • 4.91 = = ( 320k -1250k) /z avg.tw?wIwnan- 3Y.a- 74dayrNetlnc.DuPont Framework: o Three drivers to shareholders’ return on equity: Return on Equity = Profit Margin × Asset Turnover × Leverage Nlt Netsaus_ avg.Assetsn-vg.se Arg Equity = Net sales Shareholders earn a higher return when… higher profit per unit sold × × . Arg sell . Assets more units or bemoeeltieient financing growth wwsownes other than equity o Another visual depiction of the DuPont Framework: Hanlon et al., Intermediate Accounting 3e Exhibit 5-5 Learning Objective 5-5: Perform a credit analysis using key ratios. • Creditors (i.e., lenders) care about profitability. However, their “upside” is limited to a full return of principal and interest. So above all else, they care about default risk. • Default risk: The risk that the borrower will be unable to repay its debts (principal and interest), either in the short or long-term. • Liquidity Ratios: o Focused on short-term default risk. Generally better if… Current Ratio Working Capital Quick Ratio 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 higher 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 higher 𝐶𝑎𝑠ℎ + 𝑆𝑇 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡𝑠 + 𝐴𝑅 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 higher o Why might the quick ratio be a superior measure of liquidity than the current ratio? takes into account liquid assets not • Practice: Calculate the current ratio and quick ratio of Barton Springs Bikes based on the following information: current o Cash of $6,000 = 6ᵗ'%I = 2 o Accounts receivable of $10,000 quick o Inventory of $20,000 = 6+,- = 0.89 o Accounts payable of $18,000 o Long-term note payable of $25,000 • Solvency Ratios: o Focused on long-term default risk. Generally better if… Total Liabilities to Equity Times Interest Earned • 𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑆𝐸 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑇𝑎𝑥𝑒𝑠 (𝐸𝐵𝐼𝑇) 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 Practice: Garner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The average debt-to-equity ratio in its industry is 1.20. Calculate Garner’s debt-to-equity ratio and indicate how the company’s default risk compares to its industry. a. 0.60; Higher default risk b. 0.60; Lower default risk c. 1.50; Higher default risk d. 1.50; Lower default risk • Practice: Which of the following transactions would increase a company’s liquidity ratios (current ratio and quick ratio)? a. Receive cash from customers on accounts receivable b. Purchase office supplies with cash c. Pay dividends to shareholders d. Borrow cash by signing a three-year note Learning Objective 5-6: Perform horizontal and vertical analysis. • Horizontal analysis: Examining trends across time. Net Income • 2015 1,000 2016 1,500 2017 1,200 2000 1000 0 2015 2016 2017 Vertical analysis: Examining the distribution of categories within a broader amount. Current Assets 2,500 25% Noncurrent Assets 7,500 75% Total Assets 10,000 Learning Objective 5-7: Recognize non-GAAP financial measures. • Management may voluntarily disclose some metrics that don’t fully comply with GAAP. If so, the SEC requires they also report the GAAP-based measure, as well as a reconciliation. o Common examples: EBIT, EBITDA, free cash flow Pros to reporting non-GAAP • Example: Ford Cons to reporting non-GAAP