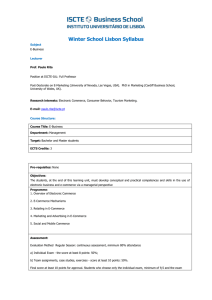

E-Commerce Coursebook: Introduction, Framework, and Applications

advertisement